Global Insect Based Animal Feed Market

Market Size in USD Billion

CAGR :

%

USD

1.79 Billion

USD

2.72 Billion

2024

2032

USD

1.79 Billion

USD

2.72 Billion

2024

2032

| 2025 –2032 | |

| USD 1.79 Billion | |

| USD 2.72 Billion | |

|

|

|

|

Insect-based Animal Feed Market Size

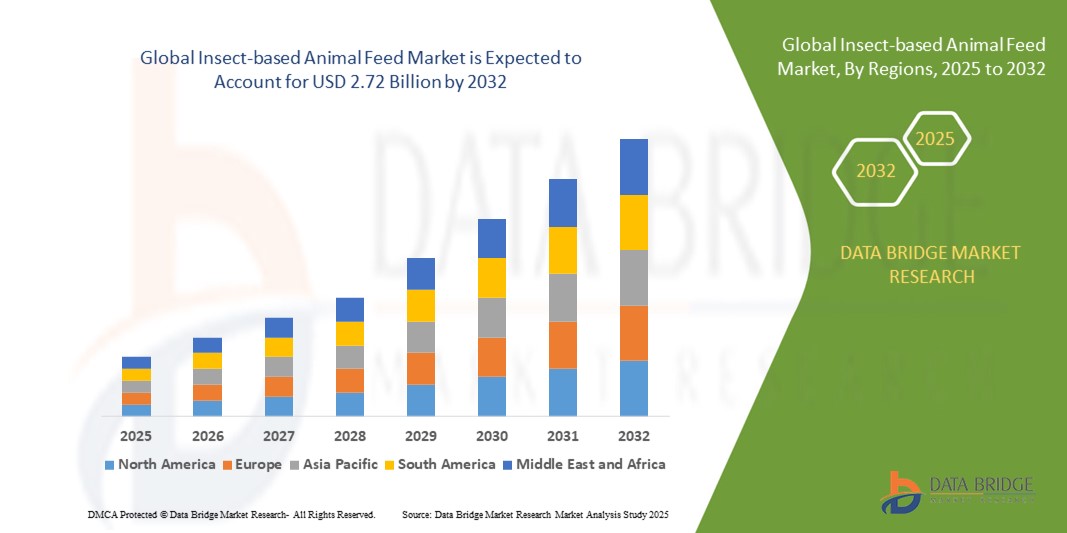

- The global insect-based animal feed market size was valued at USD 1.79 billion in 2024 and is expected to reach USD 2.72 billion by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is largely fuelled by the rising demand for sustainable and protein-rich feed alternatives, coupled with the environmental benefits of insect farming compared to traditional feed sources

- Increasing adoption of insect-based feed in aquaculture, poultry, and pet food industries is further accelerating the market growth

Insect-based Animal Feed Market Analysis

- The market is witnessing strong momentum as global feed manufacturers increasingly explore eco-friendly and cost-effective alternatives to soy and fishmeal.

- Insect-based feed offers higher protein digestibility, essential amino acids, and a reduced ecological footprint, making it a preferred choice in sustainable animal nutrition

- Europe dominated the insect-based animal feed market with the largest revenue share of 41% in 2024, driven by strong regulatory support, technological innovation, and the European Union’s commitment to sustainable and circular economy practices

- Asia-Pacific region is expected to witness the highest growth rate in the global insect-based animal feed market, driven by increasing population, rising meat consumption, and growing emphasis on sustainable and cost-effective feed solutions

- The fly larvae segment held the largest market revenue share in 2024, driven by its high protein content, rapid reproduction cycle, and cost-effectiveness in mass production. Fly larvae-based feed is widely used in aquaculture and poultry due to its balanced nutritional profile and sustainable cultivation methods

Report Scope and Insect-based Animal Feed Market Segmentation

|

Attributes |

Insect-based Animal Feed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion Into Aquaculture And Poultry Feed |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Insect-based Animal Feed Market Trends

Rising Adoption Of Insect Protein As A Sustainable Feed Alternative

• The growing use of insect protein in animal feed is transforming the livestock and aquaculture industries by providing a sustainable, nutrient-rich alternative to traditional feed ingredients such as soy and fishmeal. Insects offer high protein content, essential amino acids, and better digestibility, helping improve animal growth and health

• The rising demand for sustainable feed in regions facing environmental challenges is accelerating the adoption of insect-based proteins. These solutions reduce dependency on overexploited natural resources such as fishmeal, aligning with global sustainability goals

• The cost-effectiveness and scalability of insect farming make it attractive for feed producers, as it requires less land, water, and energy compared to conventional feed sources. Farmers benefit from improved productivity and reduced reliance on volatile feed markets

• For instance, in 2023, several European aquaculture firms reported reduced feed costs and improved fish survival rates after incorporating black soldier fly larvae into fish diets. This shift highlighted insect protein’s potential to enhance food security while cutting operational expenses

• While insect-based feed is gaining momentum, its success depends on regulatory support, scaling production capacity, and consumer acceptance across different livestock segments. Industry players must focus on affordability, large-scale supply chains, and awareness campaigns to capitalize on this growing trend

Insect-based Animal Feed Market Dynamics

Driver

Growing Demand For Sustainable Protein And Rising Pressure On Conventional Feed Sources

• Increasing pressure on traditional feed ingredients such as soy and fishmeal is pushing both governments and producers to explore insect-based alternatives. Rising environmental concerns, land scarcity, and overfishing are forcing the industry to diversify feed sources, making insect protein a viable and sustainable solution

• Farmers and aquaculture operators are increasingly aware of the cost volatility and environmental impacts of conventional feed, driving a gradual shift toward insect protein to maintain productivity and profitability. By incorporating insects, producers can stabilize feed costs, reduce dependence on imports, and ensure consistent supply for livestock and aquaculture

• Government policies and international organizations are supporting insect-based feed production through funding programs, regulatory approvals, and pilot projects to strengthen feed security. These initiatives are also encouraging innovation in rearing and processing technologies to make insect farming more commercially viable

• For instance, in 2022, the European Union approved the use of insect protein in poultry and pig feed, boosting demand across the region and driving significant investment in insect farming facilities. This regulatory shift not only expanded market opportunities but also encouraged producers to scale operations across multiple livestock segments

• While awareness and supportive frameworks are expanding adoption, further efforts are needed to enhance processing technology, improve scalability, and reduce costs to make insect protein more accessible to mainstream feed producers. Expanding education among farmers and standardizing feed quality will also be crucial to build long-term trust in this protein source

Restraint/Challenge

High Production Costs And Limited Commercial-Scale Availability

• The high cost of large-scale insect farming and processing technologies limits widespread adoption, particularly among small and mid-sized feed producers. Investments in automated rearing systems, bio-secure facilities, and drying or extraction technologies make initial setup capital-intensive

• In many developing regions, the absence of large-scale insect production facilities and supply chain networks hinders access to insect-based feed. Farmers often lack the resources, technical knowledge, and infrastructure to integrate insect protein into daily operations, resulting in slower adoption rates

• Market penetration is also constrained by regulatory differences across countries, with approval for insect protein in feed still pending in several markets. This creates uncertainties for producers, restricts cross-border trade, and discourages investors from scaling operations globally

• For instance, in 2023, feed associations in Africa reported that fewer than 20% of livestock producers had access to insect-based protein due to high costs and lack of commercial suppliers. Limited awareness campaigns and weak government support further slowed the adoption of insect feed technologies in rural areas

• While technological advancements are gradually improving efficiency, addressing production costs, scalability, and regulatory harmonization is critical for unlocking the full potential of insect-based animal feed. Building public-private partnerships, incentivizing producers, and investing in R&D will be key to making insect protein a mainstream feed option

Insect-based Animal Feed Market Scope

The market is segmented on the basis of source and application.

- By Source

On the basis of source, the insect-based animal feed market is segmented into mealworms, fly larvae, and others. The fly larvae segment held the largest market revenue share in 2024, driven by its high protein content, rapid reproduction cycle, and cost-effectiveness in mass production. Fly larvae-based feed is widely used in aquaculture and poultry due to its balanced nutritional profile and sustainable cultivation methods.

The mealworms segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by their rich amino acid composition, ease of storage, and growing adoption in premium livestock feed. Mealworms are increasingly being utilized as an eco-friendly protein alternative, particularly in poultry and specialty animal diets.

- By Application

On the basis of application, the insect-based animal feed market is segmented into aquaculture, pig, poultry, and others. The aquaculture segment accounted for the largest revenue share in 2024, supported by the rising demand for fish protein and the growing substitution of fishmeal with insect-based alternatives to address overfishing concerns.

The poultry segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the affordability, digestibility, and immune-boosting properties of insect protein. Poultry farmers are increasingly adopting insect-based feed to improve bird health, enhance feed efficiency, and reduce reliance on conventional protein sources.

Insect-based Animal Feed Market Regional Analysis

• Europe dominated the insect-based animal feed market with the largest revenue share of 41% in 2024, driven by strong regulatory support, technological innovation, and the European Union’s commitment to sustainable and circular economy practices.

• The region’s early approval of insect protein for aquaculture, poultry, and pig feed has accelerated adoption among feed manufacturers.

• Growing consumer awareness of sustainability, combined with government-backed funding programs and advanced R&D infrastructure, is solidifying Europe’s leadership in the global market.

Germany Insect-Based Animal Feed Market Insight

The Germany insect-based animal feed market held the largest market revenue share in 2024, driven by the country’s emphasis on innovation, sustainability, and eco-friendly farming practices. Germany is home to several pioneering insect farming companies, supported by strong R&D and favorable policies. The increasing integration of insect protein into pig and poultry feed, coupled with the country’s robust agricultural infrastructure, is fostering long-term growth.

U.K. Insect-Based Animal Feed Market Insight

The U.K. insect-based animal feed market is expected to witness the fastest growth rate from 2025 to 2032, supported by the nation’s rising interest in sustainable protein sources and the push for self-sufficiency in feed production. Increasing concerns over climate change, coupled with regulatory encouragement for alternative feed ingredients, are boosting adoption. The aquaculture and poultry sectors are key drivers, with expanding investments in commercial insect farming facilities fueling industry growth.

Asia-Pacific Insect-Based Animal Feed Market Insight

The Asia-Pacific insect-based animal feed market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rapid urbanization, rising meat and seafood consumption, and government-backed initiatives promoting alternative protein sources. Countries such as China, India, and Japan are leading adoption, with aquaculture serving as a key growth driver. In addition, the region’s favorable climatic conditions and cost-efficient production models are accelerating large-scale insect farming.

China Insect-Based Animal Feed Market Insight

The China insect-based animal feed market captured the largest revenue share in Asia-Pacific in 2024, driven by the country’s massive aquaculture industry, rising demand for livestock feed, and strong government support for food security. China’s middle class and urban population are fueling demand for protein-rich diets, creating opportunities for insect-based feed. In addition, the presence of innovative insect farming startups and large-scale pilot projects is strengthening the market outlook.

Japan Insect-Based Animal Feed Market Insight

The Japan insect-based animal feed market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s advanced technological capabilities, high protein demand, and strong focus on sustainability. The aquaculture sector, particularly shrimp and fish farming, is a primary driver of adoption, with insect protein increasingly being integrated as a replacement for fishmeal. Japan’s commitment to circular economy practices and its investment in high-tech insect farming facilities are further accelerating market growth. In addition, the growing demand for eco-friendly feed solutions in both livestock and aquaculture sectors is shaping the long-term expansion of insect-based animal feed in the country.

North America Insect-Based Animal Feed Market Insight

The North America insect-based animal feed market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising awareness of sustainable farming, technological advancements, and increasing investment in insect protein production. Aquaculture and poultry sectors are leading adoption, supported by consumer demand for eco-friendly and traceable food production. Strong regulatory developments and the presence of advanced insect farming facilities are fostering long-term industry growth.

U.S. Insect-Based Animal Feed Market Insight

The U.S. insect-based animal feed market is expected to witness the fastest growth rate from 2025 to 2032, propelled by rising feed cost volatility and demand for sustainable protein solutions. The aquaculture sector, along with growing poultry and livestock industries, is driving insect protein adoption. The presence of innovative startups, favorable investment climate, and expanding regulatory approvals are accelerating commercialization and scaling of insect-based feed.

Insect-based Animal Feed Market Share

The Insect-based Animal Feed industry is primarily led by well-established companies, including:

- NextProtein (France)

- Bühler AG (Switzerland)

- Entofood (Thailand)

- EnviroFlight (U.S.)

- Coppens International BV (Netherlands)

- Agriprotein (South Africa)

- Protix (Netherlands)

- InnovaFeed (France)

- Beta Hatch (U.S.)

- Entomo Farms (Canada)

- Unique (China)

- Hexafly (Ireland)

- Enterra Feed (Canada)

- Better Origin (U.K.)

- Nutrition Technologies (Malaysia)

Latest Developments in Global Insect-based Animal Feed Market

- In May 2022, HiProMine entered into a strategic partnership with WEDA Dammann & Westerkamp GmbH, a leading supplier of feeding technology solutions. Through this collaboration, WEDA provides HiProMine with Black Soldier Fly (BSFL) insects, supporting the development of advanced pet and animal nutrition products. This move is expected to enhance sustainable feed solutions and strengthen HiProMine’s position in the insect-based animal feed market

- In February 2022, Protix, a pioneering insect farming company, secured EUR 50 million (USD 51.4 million) in funding to drive international expansion and accelerate research and development. The investment will boost the production of insect-based proteins for aquaculture, livestock, and pets, reinforcing the company’s role in promoting sustainable and resource-efficient feed alternatives in the global market

- In February 2021, Innovafeed, in collaboration with Auchan, launched its third insect-fed animal feed line by introducing pork fed with insect oil-enriched diets. This innovation significantly reduces carbon footprint and supports sustainability goals, showcasing the potential of insect-based feed to reshape traditional animal farming practices and meet consumer demand for eco-friendly food production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Insect Based Animal Feed Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Insect Based Animal Feed Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Insect Based Animal Feed Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.