Global Insect Growth Regulators Igrs Market

Market Size in USD Billion

CAGR :

%

USD

11.79 Billion

USD

19.22 Billion

2024

2032

USD

11.79 Billion

USD

19.22 Billion

2024

2032

| 2025 –2032 | |

| USD 11.79 Billion | |

| USD 19.22 Billion | |

|

|

|

|

Insect Growth Regulators Market Size

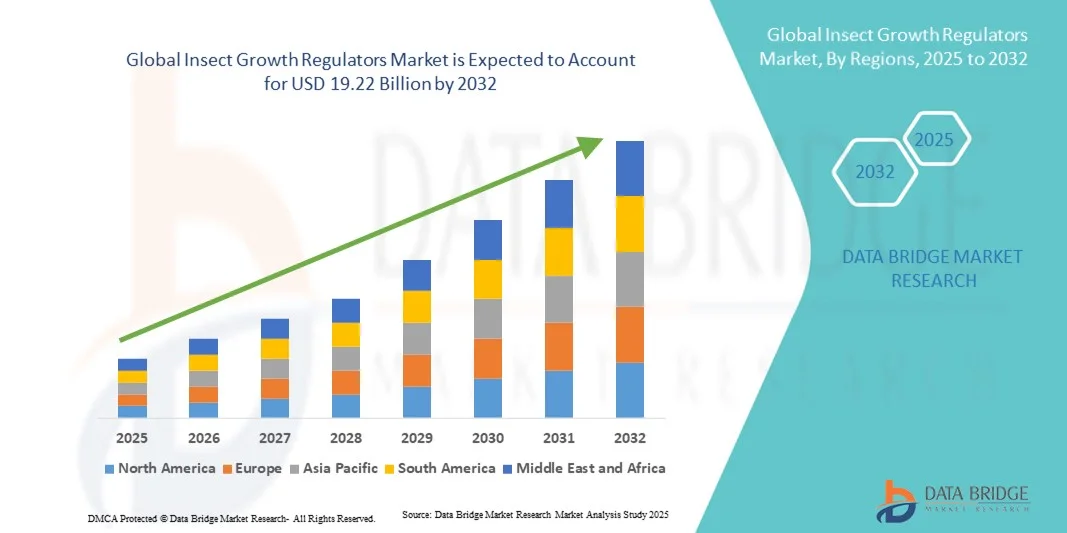

- The global insect growth regulators market size was valued at USD 11.79 billion in 2024 and is expected to reach USD 19.22 billion by 2032, at a CAGR of 6.30% during the forecast period

- The market growth is largely fueled by the increasing adoption of sustainable pest control solutions in agriculture, livestock, and commercial pest management, driven by the need to reduce chemical pesticide usage and minimize environmental impact

- Furthermore, rising awareness of integrated pest management practices and regulatory support for eco-friendly crop protection products are establishing insect growth regulators as a preferred solution for long-term and targeted pest control. These converging factors are accelerating the adoption of IGRs, thereby significantly boosting the market's expansion

Insect Growth Regulators Market Analysis

- Insect growth regulators, which disrupt the growth, development, or reproduction of insects, are increasingly important in modern agriculture, livestock management, and commercial pest control due to their targeted action, reduced toxicity, and compatibility with integrated pest management programs

- The escalating demand for IGRs is primarily fueled by the growing emphasis on sustainable and environmentally safe pest control solutions, increasing pest resistance to conventional insecticides, and the rising need to protect high-value crops and livestock from pest-related losses

- North America dominated the insect growth regulators market with a share of 40.1% in 2024, due to high adoption of sustainable agricultural practices, advanced livestock farming, and stringent regulatory standards for chemical pesticide use

- Asia-Pacific is expected to be the fastest growing region in the insect growth regulators market during the forecast period due to rapid urbanization, increasing agricultural production, and rising awareness of environmentally safe pest control in countries such as China, India, and Japan

- Agriculture applications segment dominated the market with a market share of 50.6% in 2024, due to the critical need to protect crops from insect infestations and ensure high yields. The use of IGRs in agriculture is favored due to their selective action, reduced toxicity, and compatibility with integrated pest management practices. Farmers increasingly prefer IGRs to manage pests sustainably while adhering to regulatory standards on chemical residues

Report Scope and Insect Growth Regulators Market Segmentation

|

Attributes |

Insect Growth Regulators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Insect Growth Regulators Market Trends

Growing Use of Sustainable Pest Control Solutions

- The insect growth regulators (IGRs) market is steadily expanding as industries increasingly adopt sustainable and targeted pest control solutions that minimize environmental harm. Unlike conventional insecticides, IGRs disrupt insect development and reproduction rather than causing immediate toxicity, aligning with global trends toward eco-friendly pest management practices in agriculture, public health, and livestock sectors

- For instance, BASF SE has developed sustainable insect control solutions based on insect growth regulation technology aimed at reducing pest populations in stored grain and crop environments. The company’s advancements in selective pest control alternatives underscore the market’s transition toward safer and more environmentally responsible pest management strategies

- IGRs are being widely recognized for their effectiveness in integrated pest management programs, providing reliable control of mosquito, flea, and agricultural pests while preserving beneficial insect populations. Their targeted mode of action reduces ecosystem disruption and the risk of pesticide resistance common with traditional chemical agents

- In addition, growing pressure from regulatory bodies and consumers to reduce dependency on harmful insecticides has accelerated the use of IGR-based formulations. These products offer long-term pest suppression and residue-free outcomes, making them suitable for use in environmentally sensitive applications such as greenhouses and water bodies

- Growing awareness of sustainable farming and biological pest control approaches has led to increased adoption of IGRs in pest management systems for fruits, vegetables, and stored products. Their compatibility with other biocontrol agents enhances crop yield and reduces overall pesticide burden on soil and biodiversity

- The rising global focus on eco-efficient pest management is shaping the future of agricultural and public health pest control. As researchers improve formulations and delivery systems, IGRs are expected to play a critical role in transitioning to next-generation sustainable pest regulation techniques that support both productivity and environmental conservation

Insect Growth Regulators Market Dynamics

Driver

Supportive Regulations and Awareness of Integrated Pest Management

- Growing regulatory support for environmentally safe pest control measures and the rising acceptance of integrated pest management (IPM) practices are driving the demand for insect growth regulators. Governments and environmental agencies are actively promoting reduced reliance on synthetic insecticides by encouraging the use of targeted and residual-safe pest control solutions such as IGRs

- For instance, Sumitomo Chemical Co., Ltd. has expanded its portfolio of IGR-based products across pest control and vector management programs in Asia and Africa, supported by favorable regulatory initiatives. The company’s ongoing research collaborations with agricultural authorities illustrate strong alignment between industrial innovation and national IPM frameworks

- IGRs’ selective action and low toxicity to humans, animals, and beneficial insects make them suitable for use under regulations emphasizing sustainable agriculture and reduced chemical residues. They have become essential components in IPM programs seeking to balance crop productivity with ecological preservation

- In addition, agricultural extension programs and farmer education initiatives are raising awareness about integrated pest management and its advantages in minimizing environmental impact. These knowledge-driven campaigns are increasing field-level adoption of IGR-based solutions for long-term pest control efficiency

- As global agricultural policies continue to align with sustainability and safety standards, the market for IGRs is expected to benefit from supportive frameworks, collaborations, and funding for innovation. The integration of insect growth regulators within IPM structures underscores their importance in achieving effective pest control while maintaining environmental integrity

Restraint/Challenge

Insect Resistance Limiting Effectiveness

- The development of insect resistance to frequently used insect growth regulators presents a key challenge to market sustainability and long-term efficacy. Continuous exposure to specific active ingredients can lead to genetic adaptation among pest populations, reducing their susceptibility to the regulatory effects of these products over time

- For instance, Bayer AG has reported challenges in maintaining consistent performance of certain IGR-based mosquito and crop pest products due to the emergence of resistant insect strains. This has led to intensified investments in resistance management strategies and diversification of active substances to sustain market effectiveness

- Resistance issues often arise from overuse or inadequate rotation of IGRs, particularly in large-scale agricultural and vector control programs. Such occurrences undermine treatment reliability, increase pest survival rates, and demand additional intervention costs for farmers and pest management organizations

- In addition, variations in regional pest biology and environmental conditions complicate the formulation of globally effective resistance control strategies. The lack of awareness and implementation of resistance management protocols among smallholder farmers further exacerbates the issue, especially in developing markets

- Addressing this restraint requires comprehensive resistance monitoring, mode-of-action rotation, and development of new-generation IGRs with multi-target efficacy. Collaboration among regulators, researchers, and industry players will be crucial to ensuring that insect growth regulators remain effective and sustainable components of future pest management strategies

Insect Growth Regulators Market Scope

The market is segmented on the basis of product, form, and application.

- By Product

On the basis of product, the insect growth regulators market is segmented into chitin synthesis inhibitors, juvenile hormone analogs and mimics, and anti-juvenile hormone agents. The chitin synthesis inhibitors segment dominated the market with the largest market revenue share in 2024, driven by their proven efficacy in disrupting the molting process of insects, which helps in long-term pest population management. These inhibitors are widely preferred in both agriculture and commercial pest control due to their targeted action, minimal environmental impact, and compatibility with integrated pest management programs. Their consistent performance against a broad range of insect species further strengthens their market dominance.

The juvenile hormone analogs and mimics segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in livestock and agriculture sectors where controlled pest management is crucial. These products mimic natural hormones to prevent insect maturation and reproduction, offering an effective and environmentally safer alternative to conventional chemical pesticides. Rising awareness of sustainable pest control practices and regulatory support for eco-friendly solutions are accelerating their adoption.

- By Form

On the basis of form, the insect growth regulators market is segmented into aerosol, liquid, and bait. The liquid segment held the largest market revenue share in 2024, driven by its ease of application over large areas, higher coverage, and adaptability to different spraying equipment. Liquids are extensively used in agriculture and commercial pest control due to their quick action, efficient dispersal, and ability to penetrate insect breeding sites effectively. The flexibility of formulation and compatibility with other pest control agents further contribute to the segment’s dominance.

The bait segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by increasing demand for targeted and user-friendly pest control solutions. Baits offer precision in delivering active ingredients to specific pest populations, minimizing environmental exposure and reducing chemical wastage. Their convenience, safety, and effectiveness in both domestic and commercial applications are driving growth, especially in urban pest management programs.

- By Application

On the basis of application, the insect growth regulators market is segmented into agriculture applications, livestock pest control, and commercial pest control. The agriculture applications segment dominated the market with the largest revenue share of 50.6% in 2024, driven by the critical need to protect crops from insect infestations and ensure high yields. The use of IGRs in agriculture is favored due to their selective action, reduced toxicity, and compatibility with integrated pest management practices. Farmers increasingly prefer IGRs to manage pests sustainably while adhering to regulatory standards on chemical residues.

The livestock pest control segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising livestock farming activities and the need to prevent insect-borne diseases that impact animal health and productivity. IGRs in this segment help control pests such as flies and lice without harming animals, supporting better hygiene and improving overall yield in the livestock sector. Increasing awareness of animal welfare and eco-friendly pest control practices is further driving the adoption of IGRs in this application.

Insect Growth Regulators Market Regional Analysis

- North America dominated the insect growth regulators market with the largest revenue share of 40.1% in 2024, driven by high adoption of sustainable agricultural practices, advanced livestock farming, and stringent regulatory standards for chemical pesticide use

- Farmers and commercial pest control operators in the region prefer IGRs due to their targeted action, lower environmental impact, and compatibility with integrated pest management strategies

- This widespread adoption is further supported by strong research and development initiatives, technological advancements in formulation, and high awareness of eco-friendly pest control solutions, establishing IGRs as a preferred solution for both agriculture and commercial pest management

U.S. Insect Growth Regulators Market Insight

The U.S. IGR market captured the largest revenue share in North America in 2024, fueled by the increasing adoption of environmentally safe pest control solutions and government incentives for sustainable farming practices. The rising demand for controlling insect-borne diseases in livestock, along with the need to protect high-value crops, drives the market. Moreover, growing awareness of integrated pest management programs and the availability of innovative IGR formulations, such as chitin synthesis inhibitors and juvenile hormone analogs, are further accelerating market growth.

Europe Insect Growth Regulators Market Insight

The Europe IGR market is projected to expand at a substantial CAGR during the forecast period, primarily driven by strict regulations on chemical pesticides and increasing demand for organic and sustainable agriculture. Adoption is further supported by advanced farming practices, rising investments in crop protection technologies, and the growing preference for low-toxicity pest control solutions. The market is witnessing significant growth across agriculture, livestock, and commercial pest control applications.

U.K. Insect Growth Regulators Market Insight

The U.K. IGR market is expected to grow at a noteworthy CAGR, driven by the increasing focus on environmentally friendly pest control and regulatory compliance. Farmers and commercial pest operators are increasingly adopting IGRs to reduce pesticide residues and protect crops and livestock. The rise of urban agriculture and government-supported sustainable farming initiatives also contribute to the market expansion.

Germany Insect Growth Regulators Market Insight

The Germany IGR market is anticipated to expand at a considerable CAGR during the forecast period, fueled by growing awareness of sustainable farming practices and the adoption of eco-friendly pest management solutions. Germany’s emphasis on organic agriculture and technological innovations in crop protection enhances the demand for effective and low-toxicity IGR products. Commercial and livestock pest control sectors are increasingly integrating IGRs for long-term pest management.

Asia-Pacific Insect Growth Regulators Market Insight

The Asia-Pacific IGR market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, increasing agricultural production, and rising awareness of environmentally safe pest control in countries such as China, India, and Japan. The region’s expanding agriculture and livestock sectors, coupled with government initiatives promoting sustainable practices, are fueling adoption. Affordable and locally manufactured IGR products are further accelerating market penetration across both rural and urban areas.

Japan Insect Growth Regulators Market Insight

The Japan IGR market is gaining momentum due to advanced farming techniques, strong emphasis on food safety, and rising urban livestock operations. Japanese farmers increasingly prefer IGRs for their low environmental impact, precise action on pests, and compatibility with integrated pest management. In addition, technological integration in agriculture, such as precision spraying systems, supports the effective use of IGRs across crops and commercial pest control.

China Insect Growth Regulators Market Insight

The China IGR market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by the country’s extensive agricultural base, rapid adoption of modern farming techniques, and growing awareness of sustainable pest control. Increasing government support for environmentally safe agricultural practices, coupled with the availability of cost-effective IGR products, is propelling market growth. Both crop protection and livestock pest control applications are witnessing robust adoption, supported by domestic manufacturing capabilities and distribution networks.

Insect Growth Regulators Market Share

The insect growth regulators industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- Central Life Sciences (U.S.)

- Syngenta AG (Switzerland)

- Dow AgroSciences (U.S.)

- HELM Agro US, Inc. (U.S.)

- Nufarm (Australia)

- Russell IPM (U.S.)

- Valent U.S.A. LLC (U.S.)

- McLaughlin Gormley King Co., Inc. (U.S.)

- Sumitomo Chemical Co., Ltd. (Japan)

- Control Solutions, Inc. (U.S.)

- Central Garden & Pet Company (U.S.)

- ADAMA India Private Limited (India)

Latest Developments in Global Insect Growth Regulators Market

- In March 2025, Bayer unveiled Plenexos insecticide, a next-generation ketoenol capable of systemic movement through leaves and roots, protecting crops such as cotton, tomatoes, and lettuce from sap-feeding pests. The product addresses growing demand for sustainable and environmentally compliant pest control solutions. By offering enhanced efficacy combined with reduced environmental impact, Bayer strengthens its competitive position in both developed and emerging markets. The launch is expected to drive adoption among large-scale agricultural operations seeking compliance with stricter sustainability regulations and integrated pest management practices. This rollout also sets the stage for Bayer’s multi-country introduction in 2026, potentially expanding its regional market share

- In March 2024, Syngenta introduced Advion Trio cockroach gel bait, the first gel formulation to combine pyriproxyfen, novaluron, and indoxacarb. This innovative product allows pest-management professionals to target multiple stages of cockroach development with a single application, delivering both growth disruption and rapid knock-down effects. The launch enhances Syngenta’s leadership in urban and commercial pest control, providing a solution that reduces labor costs and increases operational efficiency for service providers. Its adoption is expected to accelerate in residential, hospitality, and food service sectors, where effective and safe pest control is critical

- In 2024, BASF launched a new insect growth regulator targeting mosquito larvae in several Asia-Pacific countries, designed for public health applications. The product supports integrated vector management programs by addressing resistance issues with conventional insecticides and promoting safer, environmentally sustainable alternatives. Its introduction strengthens BASF’s portfolio in the public health pest control segment, meeting rising government and NGO demand for effective mosquito management solutions. The launch is likely to boost market penetration of IGRs in densely populated urban areas and regions prone to vector-borne diseases

- In 2024, Sumitomo Chemical received regulatory approval in Brazil for its latest insect growth regulator, aimed at enhancing agricultural pest management across Latin America. This approval enables the company to offer advanced pest control solutions to major crop sectors such as soy, corn, and sugarcane. By addressing the challenge of pest resistance and promoting sustainable pest management practices, the launch is expected to strengthen Sumitomo Chemical’s position in the rapidly growing Latin American IGR market. In addition, it provides farmers with safer alternatives to conventional chemical pesticides, supporting long-term environmental compliance

- In 2024, ADAMA launched a next-generation insect growth regulator for horticulture in Europe, focusing on both greenhouse and open-field crops. The product delivers improved efficacy against resistant pest populations, ensuring higher crop protection and yield stability. This launch reinforces ADAMA’s commitment to innovation and sustainable agriculture, catering to European growers seeking environmentally friendly and regulatory-compliant pest control solutions. By offering precise, effective, and low-toxicity IGRs, ADAMA strengthens its market share in the European horticulture segment, particularly among high-value crops

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.