Global Insect Repellent Market

Market Size in USD Billion

CAGR :

%

USD

7,095.21 Billion

USD

11,308.69 Billion

2022

2030

USD

7,095.21 Billion

USD

11,308.69 Billion

2022

2030

| 2023 –2030 | |

| USD 7,095.21 Billion | |

| USD 11,308.69 Billion | |

|

|

|

|

Insect Repellent Market Analysis and Sizes

The insect repellent market is driven by various factors, including increasing awareness about insect-borne diseases, and growing concerns about insect-related allergies. Insect repellents are used to protect individuals from mosquito bites, ticks, flies, and other insects that can transmit diseases such as malaria, dengue, Zika virus, and Lyme disease.

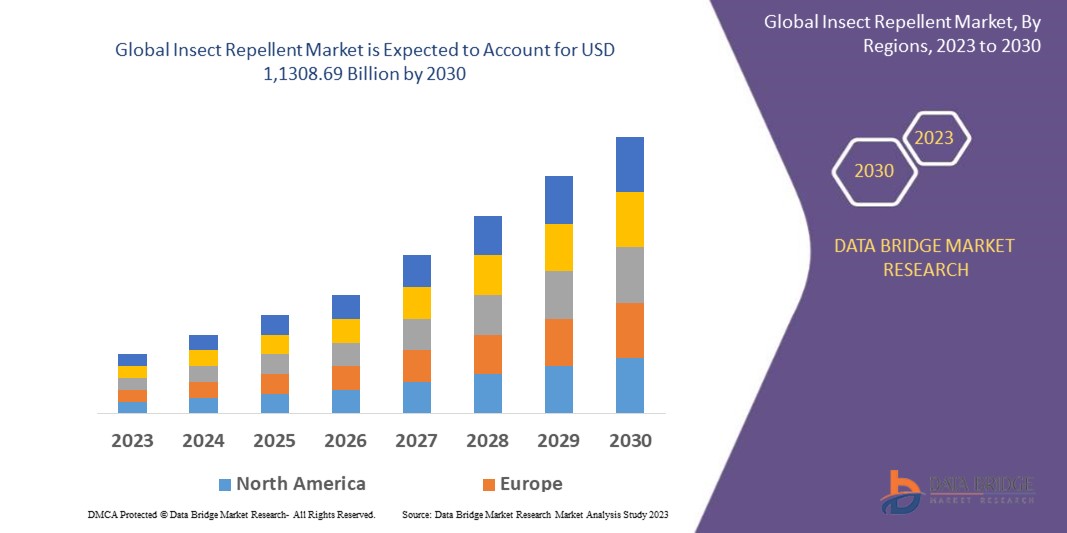

Data Bridge Market Research analyses that the insect repellent market which was USD 7,095.21 million in 2022, would boost up to USD 1,1308.69 billion by 2030, and is expected to undergo a CAGR of 6.00% during the forecast period. This indicates that the market value In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and consumer behavior.

Insect Repellent Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Body Worn, Non-Body Worn), Insect Type (Mosquito Repellent, Bugs Repellent, Fly Repellent, Others), Distribution Channel (Online, Offline) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Spectrum Brands, Inc., (U.S.), S.C. Johnson & Son Inc., (U.S.), Henkel AG & Co. KGaA (Germany), Reckitt Benckiser Group PLC (U.K.), Dabur (India), Godrej Consumer Products Limited (India), Jyothy Laboratories Ltd (India), Johnson & Johnson Private Limited (U.S.), Himalaya Wellness Company (India) |

|

Market Opportunities |

|

Market Definition

Insect repellent refers to a substance or product that is designed to repel or deter insects from landing on or biting humans, animals, or surfaces. The primary purpose of insect repellents is to protect against insect bites, which can transmit diseases and cause irritation or allergic reactions. Insect repellents work by creating a barrier that insects find unpleasant or by masking the human or animal scents that attract insects. They typically contain active ingredients that repel insects, such as DEET (N,N-Diethyl-meta-toluamide), picaridin, IR3535 (Ethyl butylacetylaminopropionate), permethrin, or natural ingredients like citronella, eucalyptus oil, or lemon eucalyptus oil.

Global Insect Repellent Market Dynamics

Drivers

- Rising Awareness of Insect-Borne Diseases

Increasing awareness about the risks associated with insect-borne diseases is a significant driver for the insect repellent market. Diseases such as malaria, dengue fever, Zika virus, West Nile virus, Lyme disease, and chikungunya are transmitted by insects such as mosquitoes and ticks. As people become more aware about these diseases and their potential health consequences, the demand for insect repellents as a preventive measure increases.

- Growing Outdoor Activities

The popularity of outdoor activities such as camping, hiking, gardening, sports, and leisure travel has steadily increased. People engaging in these activities often encounter insects and pests, making the use of insect repellents essential for protection. As outdoor recreational pursuits continue to rise, so does the demand for insect repellent products, thus lifting the market growth from 2023 to 2030.

Opportunities

- Technological Advancements in Repellent Formulations

The insect repellent industry constantly evolves, with ongoing research and development efforts focused on creating more effective, longer-lasting formulations. Innovations such as microencapsulation, nanotechnology, and time-release technologies can potentially improve the efficacy and convenience of insect repellents, providing opportunities for companies that can bring these technologies to market.

- Expansion into Emerging Markets

Emerging markets, particularly in regions with high incidences of insect-borne diseases, present significant growth opportunities for insect repellent manufacturers. Companies can focus on expanding their distribution networks and increasing product availability in these regions to tap into the growing consumer base.

Restraints/Challenges

- Seasonal Demand of the Product

Insect repellents are often associated with outdoor activities and warmer seasons when insects are more prevalent. This seasonal demand can result in fluctuations in sales and revenue for companies operating in this market. They must carefully manage their inventory, production, and marketing strategies to ensure yearly profitability.

- Adverse Environmental Impact Concerns

Some chemical-based insect repellents have been associated with potential environmental and health risks. Consumer awareness and concerns about the environmental impact of certain repellent ingredients, such as DEET, have led to an increased demand for natural and eco-friendly alternatives. Companies must address these concerns and develop sustainable practices to meet consumer expectations.

Global Insect Repellent Market Scope

The insect repellent market is segmented on the basis of product type, insect type and distribution channel. The growth amongst these segments will help you analyses meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Body Worn

- Oils and Creams

- Stickers and Patches

- Apparels

- Aerosols

- Non-Body Worn

- Coils

- Mats and Sheet

- Liquid Vaporizer

Insect Type

- Mosquito Repellent

- Bugs Repellent

- Fly Repellent

- Others

Distribution Channel

- Online

- Offline

Global Insect Repellent Market Regional Analysis/Insights

The insect repellent market is analyzed and market size insights and trends are provided by country, product type, insect type and distribution channel as referenced above

The countries covered in the insect repellent market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the insect repellent market because of the introduction of new product variations and the high usage of insect repellent tools and kits in the Asia-Pacific region (APAC) is owed by insect-borne diseases and the malaria epidemic.

Middle East and Africa is expected to witness a significant growth rate from 2023 to 2030 due to the rising number of insect repellent manufacturers and the prevailing pathogens and vector-borne sickness.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Insect Repellent Market Share Analysis

The insect repellent market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to insect repellent market.

Some of the major players operating in the insect repellent market are:

- Spectrum Brands, Inc., (U.S.)

- S.C. Johnson & Son Inc., (U.S.)

- Henkel AG & Co. KGaA (Germany)

- Reckitt Benckiser Group PLC (U.K.)

- Dabur (India)

- Godrej Consumer Products Limited (India)

- Jyothy Laboratories Ltd (India)

- Johnson & Johnson Private Limited (U.S.)

- Himalaya Wellness Company (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL INSECT REPELLENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL INSECT REPELLENT MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL INSECT REPELLENT MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CONSUMER BUYING BEHAVIOUR

5.2 FACTORS AFFECTING BUYING DECISION

5.3 PRODUCT ADOPTION SCENARIO

5.4 PORTER’S FIVE FORCES

5.5 REGULATION COVERAGE

5.6 RAW MATERIAL SOURCING ANALYSIS

5.7 IMPORT EXPORT SCENARIO

6 PRODUCTION CAPACITY OUTLOOK

7 PRICE INDEX

8 BRAND OUTLOOK

8.1 BRAND COMPARATIVE ANALYSIS

8.2 PRODUCT VS BRAND OVERVIEW

9 IMPACT OF ECONOMIC SLOWDOWN

9.1 IMPACT ON PRICES

9.2 IMPACT ON SUPPLY CHAIN

9.3 IMPACT ON SHIPMENT

9.4 IMPACT ON DEMAND

9.5 IMPACT ON STRATEGIC DECISIONS

10 SUPPLY CHAIN ANALYSIS

10.1 OVERVIEW

10.2 LOGISTIC COST SCENARIO

10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

11 GLOBAL INSECT REPELLENT MARKET, BY REPELLENTS TYPE

11.1 OVERVIEW

11.2 BODY WORN REPELLENTS

11.2.1 OILS

11.2.2 CREAMS AND LOTIONS

11.2.3 STOCKERS AND PATCHES

11.2.4 ROLL-ONS

11.2.5 WIPES

11.2.6 APPARELS

11.2.6.1. TROUSERS

11.2.6.2. SHIRTS

11.2.6.3. JACKETS

11.2.6.4. HEAD NETS

11.2.6.5. OTHERS

11.2.7 SPRAYS

11.2.8 OTHERS

11.3 NON-BODY WORN REPELLENTS

11.3.1 COILS

11.3.2 BEDNETS

11.3.3 MATS AND SHEETS

11.3.4 LIQUID VAPORIZER

11.3.5 AEROSOLS

11.3.6 STICKS

11.3.7 CANDLES

11.3.8 TORCHES

11.3.9 OTHERS

12 GLOBAL INSECT REPELLENT MARKET, BY INGREDIENT TYPE

12.1 OVERVIEW

12.2 CITRONELLA OIL

12.3 OIL OF LEMON EUCALYPTUS

12.4 CLOVE

12.5 LEMONGRASS

12.6 BASIL

12.7 NEEM

12.8 LAVENDER

12.9 SOYBEAN OIL

12.1 CATNIP OIL

12.11 GERNANIUM OIL

12.12 CEDARWOOD OIL

12.13 SURFACTANTS

12.14 FATTY ALCOHOL

12.15 DIMETHYL PHTHALATE

12.16 OTHERS

13 GLOBAL INSECT REPELLENT MARKET, BY INSECT TYPE

13.1 OVERVIEW

13.2 MOSQUITO

13.3 BUGS

13.4 FLY

13.5 ANTS

13.6 WASPS

13.7 OTHERS

14 GLOBAL INSECT REPELLENT MARKET, BY PACKAGING TYPE

14.1 OVERVIEW

14.2 TUBES

14.3 CANS

14.4 POUCHES

14.5 BOXES

14.6 BOTTLES

14.7 OTHERS

15 GLOBAL INSECT REPELLENT MARKET, BY PACKAGING MATERIAL TYPE

15.1 OVERVIEW

15.2 PLASTIC

15.2.1 POLYETHYLENE (PE)

15.2.2 POLYETHYLENE TERAPHTHALATE (PET)

15.2.3 POLYVINYL CHLORIDE (PVC)

15.2.4 POLYCARBONATE (PC)

15.2.5 OTHERS

15.3 PAPER

15.4 METAL

15.5 OTHERS

16 GLOBAL INSECT REPELLENT MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 SUPERMARKETS/HYPERMARKETS

16.3 CONVENIENCE STORES

16.4 SPECIALTY STORES

16.5 E-COMMERCE

16.6 OTHERS

17 GLOBAL INSECT REPELLENT MARKET, BY END-USER

17.1 OVERVIEW

17.2 RESIDENTIAL

17.2.1 RESIDENTIAL, BY END-USER

17.2.1.1. MULTIFAMILY BUILDINGS

17.2.1.2. INDEPENDENT HOUSES

17.2.2 RESIDENTIAL, BY TYPE

17.2.2.1. CITRONELLA OIL

17.2.2.2. OIL OF LEMON EUCALYPTUS

17.2.2.3. CLOVE

17.2.2.4. LEMONGRASS

17.2.2.5. BASIL

17.2.2.6. NEEM

17.2.2.7. LAVENDER

17.2.2.8. SOYBEAN OIL

17.2.2.9. CATNIP

17.2.2.10. GERNANIUM OIL

17.2.2.11. CEDARWOOD OIL

17.2.2.12. OTHERS

17.3 COMMERCIAL

17.3.1 COMMERCIAL, BY END-USER

17.3.1.1. COMMERCIAL BUILDINGS

17.3.1.2. SUPERMARKETS/HYPERMARKETS

17.3.1.3. MALLS

17.3.1.4. CORPORATE OFFICES

17.3.1.5. SCHOOLS/UNIVERSITY

17.3.1.6. HOSPITALS

17.3.1.7. BANKS

17.3.1.8. HOTELS AND RESTAURANTS

17.3.1.9. GOVERNMENT BUILDINGS

17.3.1.10. OTHERS

17.3.2 COMMERCIAL, BY TYPE

17.3.2.1. CITRONELLA OIL

17.3.2.2. OIL OF LEMON EUCALYPTUS

17.3.2.3. CLOVE

17.3.2.4. LEMONGRASS

17.3.2.5. BASIL

17.3.2.6. NEEM

17.3.2.7. LAVENDER

17.3.2.8. SOYBEAN OIL

17.3.2.9. CATNIP

17.3.2.10. GERNANIUM OIL

17.3.2.11. CEDARWOOD OIL

17.3.2.12. OTHERS

17.4 RECREATIONAL ACTIVITIES

17.4.1 RECREATIONAL ACTIVITIES, BY END-USER

17.4.1.1. CAMPING

17.4.1.2. TREKKING

17.4.1.3. ADVENTUROUS SPORTS

17.4.1.4. CLIMBING

17.4.1.5. OTHERS

17.4.2 RECREATIONAL ACTIVITIES, BY TYPE

17.4.2.1. CITRONELLA OIL

17.4.2.2. OIL OF LEMON EUCALYPTUS

17.4.2.3. CLOVE

17.4.2.4. LEMONGRASS

17.4.2.5. BASIL

17.4.2.6. NEEM

17.4.2.7. LAVENDER

17.4.2.8. SOYBEAN OIL

17.4.2.9. CATNIP

17.4.2.10. GERNANIUM OIL

17.4.2.11. CEDARWOOD OIL

17.4.2.12. OTHERS

17.5 INDUSTRIAL

17.5.1 INDUSTRIAL, BY TYPE

17.5.1.1. CITRONELLA OIL

17.5.1.2. OIL OF LEMON EUCALYPTUS

17.5.1.3. CLOVE

17.5.1.4. LEMONGRASS

17.5.1.5. BASIL

17.5.1.6. NEEM

17.5.1.7. LAVENDER

17.5.1.8. SOYBEAN OIL

17.5.1.9. CATNIP

17.5.1.10. GERNANIUM OIL

17.5.1.11. CEDARWOOD OIL

17.5.1.12. OTHERS

17.6 OTHERS

18 GLOBAL INSECT REPELLENT MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.5 MERGERS & ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT & APPROVALS

18.7 EXPANSIONS & PARTNERSHIP

18.8 REGULATORY CHANGES

19 GLOBAL INSECT REPELLENT MARKET, BY GEOGRAPHY (VALUE & VOLUME)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

19.1 NORTH AMERICA

19.1.1 U.S.

19.1.2 CANADA

19.1.3 MEXICO

19.2 EUROPE

19.2.1 GERMANY

19.2.2 U.K.

19.2.3 ITALY

19.2.4 FRANCE

19.2.5 SPAIN

19.2.6 SWITZERLAND

19.2.7 NETHERLANDS

19.2.8 BELGIUM

19.2.9 RUSSIA

19.2.10 TURKEY

19.2.11 REST OF EUROPE

19.3 ASIA-PACIFIC

19.3.1 JAPAN

19.3.2 CHINA

19.3.3 SOUTH KOREA

19.3.4 INDIA

19.3.5 AUSTRALIA

19.3.6 SINGAPORE

19.3.7 THAILAND

19.3.8 INDONESIA

19.3.9 MALAYSIA

19.3.10 PHILIPPINES

19.3.11 REST OF ASIA-PACIFIC

19.4 SOUTH AMERICA

19.4.1 BRAZIL

19.4.2 ARGENTINA

19.4.3 REST OF SOUTH AMERICA

19.5 MIDDLE EAST AND AFRICA

19.5.1 SOUTH AFRICA

19.5.2 EGYPT

19.5.3 ISRAEL

19.5.4 UAE

19.5.5 SAUDI ARABIA

19.5.6 KUWAIT

19.5.7 REST OF MIDDLE EAST AND AFRICA

20 GLOBAL INSECT REPELLENT MARKET – COMPANY PROFILE

(NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST)

20.1 MERCK KGAA

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT UPDATES

20.2 SC JOHNSON PROFESSIONAL USA, INC

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT UPDATES

20.3 RECKITT BENCKISER GROUP PLC

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT UPDATES

20.4 ADVENTURE READY BRANDS

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT UPDATES

20.5 GODREJ CONSUMER PRODUCTS LTD

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT UPDATES

20.6 SPECTRUM BRANDS HOLDINGS INC.

20.6.1 COMPANY SNAPSHOT

20.6.2 REVENUE ANALYSIS

20.6.3 PRODUCT PORTFOLIO

20.6.4 RECENT UPDATES

20.7 DABUR INTERNATIONAL

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT UPDATES

20.8 BULLFROG

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT UPDATES

20.9 ENESIS GROUP

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT UPDATES

20.1 MURPHY'S NATURALS

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT UPDATES

20.11 QUANTUM HEALTH

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT UPDATES

20.12 AUNT FANNIE, INC

20.12.1 COMPANY SNAPSHOT

20.12.2 REVENUE ANALYSIS

20.12.3 PRODUCT PORTFOLIO

20.12.4 RECENT UPDATES

20.13 BABYGANICS

20.13.1 COMPANY SNAPSHOT

20.13.2 REVENUE ANALYSIS

20.13.3 PRODUCT PORTFOLIO

20.13.4 RECENT UPDATES

20.14 QUANTUM, INC

20.14.1 COMPANY SNAPSHOT

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT UPDATES

20.15 3M

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANALYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT UPDATES

21 QUESTIONNAIRE

22 RELATED REPORTS

23 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.