Global Insertable Cardiac Monitors Icm Market

Market Size in USD Million

CAGR :

%

USD

910.40 Million

USD

3,710.58 Million

2025

2033

USD

910.40 Million

USD

3,710.58 Million

2025

2033

| 2026 –2033 | |

| USD 910.40 Million | |

| USD 3,710.58 Million | |

|

|

|

|

Insertable Cardiac Monitors (ICM) Market Size

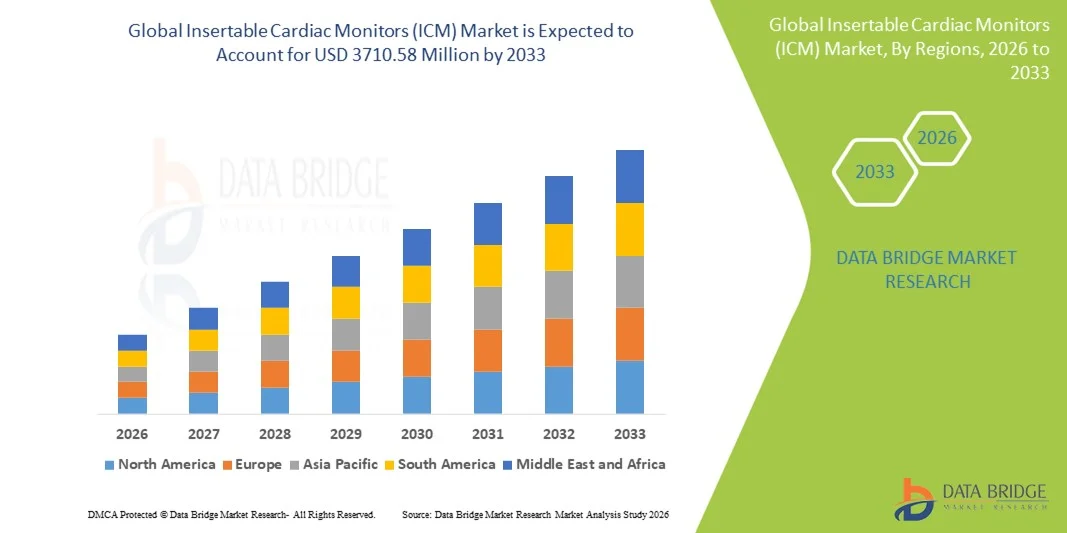

- The global insertable cardiac monitors (ICM) market size was valued at USD 910.40 Million in 2025 and is expected to reach USD 3710.58 Million by 2033, at a CAGR of 19.20% during the forecast period

- The market growth is largely driven by the rising prevalence of cardiac arrhythmias, unexplained syncope, and atrial fibrillation, along with continuous technological advancements in minimally invasive cardiac monitoring devices, leading to increased adoption of insertable cardiac monitors across hospitals and cardiac care centers

- Furthermore, growing demand for long-term, accurate, and remote cardiac rhythm monitoring solutions, supported by advancements in wireless data transmission, extended battery life, and improved diagnostic accuracy, is accelerating the uptake of Insertable Cardiac Monitors (ICM), thereby significantly boosting overall market growth

Insertable Cardiac Monitors (ICM) Market Analysis

- Insertable Cardiac Monitors (ICMs), designed for long-term, continuous monitoring of cardiac rhythms, are increasingly vital tools in modern cardiac care due to their ability to detect infrequent arrhythmias, atrial fibrillation, and unexplained syncope with high diagnostic accuracy in both hospital and outpatient settings

- The escalating demand for ICMs is primarily fueled by the rising prevalence of cardiovascular diseases, growing incidence of atrial fibrillation and cryptogenic stroke, and increasing preference for minimally invasive, long-term monitoring solutions that enable early diagnosis and timely clinical intervention

- North America dominated the insertable cardiac monitors (ICM) market with the largest revenue share of approximately 41.8% in 2025, supported by advanced healthcare infrastructure, high adoption of remote cardiac monitoring technologies, favorable reimbursement policies, and a strong presence of leading medical device manufacturers. The U.S. accounted for the majority of regional demand due to widespread use of ICMs in stroke evaluation programs and integrated cardiac care networks

- Asia-Pacific is expected to be the fastest-growing region in the insertable cardiac monitors (ICM) market, registering a CAGR of around 13.6% during the forecast period, driven by rising healthcare expenditure, increasing awareness of cardiac arrhythmias, expanding access to advanced cardiology services, and improving adoption of digital health technologies in countries such as China, India, and Japan

- The Multiple Lead Mobile Cardiac Telemetry Systems segment dominated the largest market revenue share of 45.1% in 2025, driven by its ability to provide comprehensive multi-lead ECG monitoring for accurate detection of cardiac abnormalities

Report Scope and Insertable Cardiac Monitors (ICM) Market Segmentation

|

Attributes |

Insertable Cardiac Monitors (ICM) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Medtronic (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Insertable Cardiac Monitors (ICM) Market Trends

Advancements in Miniaturization and Continuous Remote Cardiac Monitoring

- A significant and accelerating trend in the global insertable cardiac monitors (ICM) market is the advancement in device miniaturization combined with continuous remote cardiac monitoring capabilities. These technological improvements are enhancing patient comfort, long-term diagnostic accuracy, and physician efficiency in detecting arrhythmias and unexplained syncope

- For instance, Medtronic’s Reveal LINQ ICM, one of the smallest insertable cardiac monitors available, enables continuous heart rhythm monitoring for up to three years and supports remote data transmission to clinicians, reducing the need for frequent in-person visits

- Modern ICMs increasingly incorporate automated arrhythmia detection algorithms that can identify atrial fibrillation, bradycardia, tachycardia, and pauses with high sensitivity. These systems help clinicians receive actionable alerts in near real time, improving early diagnosis and timely intervention for high-risk cardiac patients

- The integration of remote patient monitoring platforms allows cardiac data from ICMs to be securely transmitted to healthcare providers, supporting proactive disease management and reducing hospital readmissions. This capability is particularly valuable for elderly patients and those living in remote or underserved regions

- This trend toward smaller, longer-lasting, and remotely managed cardiac monitors is reshaping clinical workflows and patient expectations for cardiac diagnostics. As a result, companies such as Abbott and BIOTRONIK are focusing on compact device designs, extended battery life, and improved sensing accuracy

- The growing demand for minimally invasive, long-term cardiac monitoring solutions across hospitals and ambulatory care settings is expected to further accelerate adoption of advanced ICM technologies globally

Insertable Cardiac Monitors (ICM) Market Dynamics

Driver

Rising Prevalence of Cardiac Arrhythmias and Demand for Long-Term Monitoring

- The increasing global prevalence of cardiovascular diseases, including atrial fibrillation and unexplained syncope, is a major driver fueling demand for insertable cardiac monitors

- For instance, in January 2024, Abbott announced expanded clinical adoption of its Confirm Rx ICM, emphasizing long-term rhythm monitoring and smartphone connectivity to enhance patient engagement and diagnostic outcomes

- ICMs provide continuous, long-duration cardiac rhythm monitoring, making them particularly useful when traditional external monitors fail to capture intermittent or asymptomatic arrhythmias

- Healthcare providers are increasingly adopting ICMs to support early diagnosis, personalized treatment planning, and improved long-term outcomes in patients with suspected cardiac rhythm disorders

- The rising adoption of remote patient monitoring programs and value-based healthcare models further supports the use of ICMs, as they help reduce emergency visits and hospital readmissions

- In addition, technological improvements in device longevity, wireless data transmission, and implantation procedures are making ICMs more accessible and clinically attractive across hospitals and cardiac centers

Restraint/Challenge

High Device Costs and Limited Awareness in Developing Regions

- The relatively high cost of insertable cardiac monitors and associated implantation procedures remains a key challenge limiting widespread adoption, particularly in cost-sensitive and developing markets

- For instance, budget constraints in public healthcare systems and limited reimbursement coverage in certain regions have slowed the penetration of ICM technology despite demonstrated clinical benefits

- Lack of awareness among patients and primary care providers regarding the long-term benefits of ICMs compared to short-term external monitors also restrains market growth

- Concerns related to procedural risks, although minimal, and follow-up requirements may further contribute to hesitation among some patients and healthcare providers

- Addressing these challenges through broader reimbursement policies, clinician education, cost optimization, and expanded clinical evidence will be essential to support market expansion

- Overcoming pricing barriers while improving accessibility and awareness will be critical for sustained growth of the Insertable Cardiac Monitors (ICM) market over the forecast period

Insertable Cardiac Monitors (ICM) Market Scope

The market is segmented on the basis of type, disease, and end-user.

- By Type

On the basis of type, the Insertable Cardiac Monitors (ICM) market is segmented into Multiple Lead Mobile Cardiac Telemetry Systems, Mobile Cardiac Telemetry Patch, and Others. The Multiple Lead Mobile Cardiac Telemetry Systems segment dominated the largest market revenue share of 45.1% in 2025, driven by its ability to provide comprehensive multi-lead ECG monitoring for accurate detection of cardiac abnormalities. These systems are widely adopted in hospitals and specialty clinics for continuous monitoring of patients with arrhythmias, atrial fibrillation, and syncope. The segment benefits from well-established clinical protocols, real-time data transmission, and integration with electronic health records (EHRs), enabling timely interventions. High reliability, robust performance, and suitability for high-risk patients further reinforce its market dominance. Moreover, increasing prevalence of cardiovascular disorders, growing remote patient monitoring programs, and rising awareness among healthcare providers support strong adoption. The ability to provide extended monitoring periods and automated alerts for abnormal heart rhythms strengthens clinical utility. Growing investments in advanced telemetry systems and technological innovations also contribute to the segment’s leadership position.

The Mobile Cardiac Telemetry Patch segment is expected to witness the fastest CAGR of 13.8% from 2026 to 2033, owing to its non-invasive design, ease of use, and patient comfort. These wearable patches allow continuous monitoring in outpatient or home settings and are increasingly preferred by patients for discreet and long-term ECG tracking. Advancements in wireless data transmission, battery life, and sensor technology enhance performance and convenience. Rising adoption in preventive care, clinical trials, and remote monitoring programs drives growth. Healthcare providers appreciate patch-based systems for their portability, cost-effectiveness, and ability to integrate with mobile platforms for real-time alerts. Expanding awareness among patients and clinicians regarding the benefits of continuous cardiac monitoring further supports market growth. The segment is also witnessing adoption in emerging markets due to increasing availability and affordability.

- By Disease

On the basis of disease, the Insertable Cardiac Monitors (ICM) market is segmented into Renal Disease, Cardiac Arrhythmias, Atrial Fibrillation, Stroke, Syncope, and Others. The Cardiac Arrhythmias segment held the largest market share of 38.7% in 2025, driven by the high prevalence of arrhythmias globally and the critical role of continuous monitoring in early detection. ICMs are widely used in hospitals, diagnostic centers, and specialty clinics to detect abnormal heart rhythms and prevent severe complications. The segment benefits from growing awareness among healthcare providers, integration with clinical decision-making systems, and increasing cardiovascular disease incidence. Continuous data collection, automated alerts, and remote monitoring enhance patient care. Additionally, the segment is supported by research initiatives and increasing government funding for cardiovascular disease management. Hospitals prefer ICMs for post-operative monitoring, syncope evaluation, and high-risk patient surveillance. The segment’s reliability, accuracy, and clinical validation reinforce its leading position. Rising focus on preventive cardiology and remote patient management strengthens adoption across developed markets.

The Atrial Fibrillation segment is expected to witness the fastest CAGR of 12.9% from 2026 to 2033, owing to the rising incidence of atrial fibrillation and the need for continuous monitoring to prevent stroke and other complications. ICMs detect asymptomatic episodes that conventional monitoring might miss. Increasing geriatric population, growing awareness about stroke prevention, and healthcare initiatives targeting arrhythmia management drive adoption. Technological improvements in data analytics, remote access, and wireless connectivity further enhance clinical applicability. Pharmaceutical and research institutions also adopt ICMs for clinical trials and drug evaluation. Rising demand for patient-friendly, non-invasive solutions accelerates growth in both developed and emerging markets. Government initiatives and reimbursement support in key regions further boost adoption.

- By End-User

On the basis of end-user, the Insertable Cardiac Monitors (ICM) market is segmented into Hospitals, Diagnostic Centres, Specialty Clinics, and Others. The Hospitals segment dominated the largest market revenue share of 41.5% in 2025, driven by the adoption of ICMs for in-patient and outpatient cardiac monitoring. Hospitals leverage ICMs for continuous ECG tracking, post-operative care, arrhythmia diagnosis, and remote patient management programs. The segment benefits from high patient volumes, robust healthcare infrastructure, and availability of skilled professionals. Integration with EHRs, automated alert systems, and reliable data transmission further reinforce adoption. Hospitals use ICMs to improve clinical outcomes, reduce readmission rates, and optimize treatment protocols. Government support, increasing cardiovascular disease prevalence, and hospital-led research programs also contribute to segment dominance.

The Specialty Clinics segment is expected to witness the fastest CAGR of 13.4% from 2026 to 2033, driven by focused outpatient cardiac care and the rising popularity of remote monitoring services. Specialty clinics adopt ICMs for targeted populations, including high-risk cardiac patients and individuals with unexplained syncope. Ease of use, compact design, and integration with mobile monitoring platforms support adoption. Clinics benefit from cost-effectiveness compared to hospital monitoring, better patient compliance, and ability to provide long-term outpatient care. Expanding cardiac research, growing clinic networks, and increasing awareness about preventive cardiology fuel growth. The segment is also gaining traction in emerging economies due to increasing healthcare accessibility.

Insertable Cardiac Monitors (ICM) Market Regional Analysis

- North America dominated the insertable cardiac monitors (ICM) market with the largest revenue share of approximately 41.8% in 2025

- Supported by advanced healthcare infrastructure, high adoption of remote cardiac monitoring technologies, favorable reimbursement policies, and a strong presence of leading medical device manufacturers

- The market accounted for the majority of regional demand due to widespread use of ICMs in stroke evaluation programs and integrated cardiac care networks

U.S. Insertable Cardiac Monitors (ICM) Market Insight

The U.S. insertable cardiac monitors (ICM) market captured the largest revenue share within North America in 2025. Growth is fueled by the adoption of remote cardiac monitoring solutions, integrated cardiac care networks, and robust reimbursement policies. Hospitals and specialty clinics increasingly implement ICMs for continuous monitoring of arrhythmias and syncope evaluation, supporting early diagnosis and improved patient outcomes. Collaborative initiatives between hospitals, diagnostic centers, and device manufacturers are further propelling market expansion.

Europe Insertable Cardiac Monitors (ICM) Market Insight

The Europe insertable cardiac monitors (ICM) market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing prevalence of cardiac disorders, growing geriatric population, and the rising need for advanced cardiac monitoring solutions. Countries such as Germany, France, and the U.K. are witnessing growing adoption of ICMs across hospitals and diagnostic centers due to favorable healthcare infrastructure and rising awareness of arrhythmia management.

U.K. Insertable Cardiac Monitors (ICM) Market Insight

The U.K. insertable cardiac monitors (ICM) market is anticipated to grow steadily during the forecast period, driven by increasing incidence of cardiac arrhythmias and stroke, along with government initiatives promoting preventive healthcare. Rising adoption of remote monitoring systems in both hospital and outpatient settings is further accelerating growth.

Germany Insertable Cardiac Monitors (ICM) Market Insight

Germany’s insertable cardiac monitors (ICM) market is expected to expand at a significant CAGR, fueled by strong healthcare infrastructure, advanced diagnostic facilities, and high awareness of cardiovascular health. Hospitals and specialized cardiac centers are increasingly integrating ICMs for continuous patient monitoring, supporting early intervention and personalized treatment plans.

Asia-Pacific Insertable Cardiac Monitors (ICM) Market Insight

The Asia-Pacific insertable cardiac monitors (ICM) market is projected to grow at the fastest CAGR of 13.6% from 2026 to 2033, driven by rising healthcare investments, expanding cardiology services, growing prevalence of cardiac arrhythmias, and increasing adoption of digital health technologies in countries such as China, India, and Japan.

Japan Insertable Cardiac Monitors (ICM) Market Insight

The Japan insertable cardiac monitors (ICM) market is gaining momentum due to advanced healthcare infrastructure, increasing awareness of cardiovascular diseases, and adoption of remote patient monitoring solutions. The aging population is expected to further drive demand for ICM devices in both hospital and outpatient settings.

China Insertable Cardiac Monitors (ICM) Market Insight

China insertable cardiac monitors (ICM) market accounted for the largest market revenue share in Asia-Pacific in 2025. Growth is attributed to rising healthcare expenditure, increasing awareness of arrhythmias, expanding access to specialized cardiac care, and adoption of remote cardiac monitoring systems in hospitals and clinics. Government initiatives promoting digital health technologies and cardiac care infrastructure are key factors driving market expansion.

Insertable Cardiac Monitors (ICM) Market Share

The Insertable Cardiac Monitors (ICM) industry is primarily led by well-established companies, including:

• Medtronic (U.S.)

• Abbott (U.S.)

• BIOTRONIK SE & Co. KG (Germany)

• Boston Scientific Corporation (U.S.)

• MicroPort Scientific Corporation (China)

• iRhythm Technologies, Inc. (U.S.)

• Philips Healthcare (Netherlands)

• CardioComm Solutions, Ltd. (Canada)

• Preventice Solutions, Inc. (U.S.)

• AliveCor, Inc. (U.S.)

• Medicover Healthcare (Sweden)

• Becton Dickinson (U.S.)

• Shenzhen Comen Medical Instruments Co., Ltd. (China)

• Zhejiang Sanyou Medical Co., Ltd. (China)

• Nihon Kohden Corporation (Japan)

• GE Healthcare (U.S.)

• Samsung Medison (South Korea)

• Omron Healthcare (Japan)

• WELCH ALLYN (U.S.)

• Neurosoft (Russia)

Latest Developments in Global Insertable Cardiac Monitors (ICM) Market

- In July 2021, Medtronic announced that its AI‑algorithm package AccuRhythm received regulatory clearance for its LINQ II ICM, enhancing heart‑rhythm event data accuracy and reducing false‑alerts for atrial fibrillation (AF) and asystole

- In September 2022, Medtronic disclosed that LINQ II ICM had become the first continuous, long‑term ICM cleared by the U.S. Food and Drug Administration (FDA) for pediatric patients (age ≥ 2 years) — opening ICM use to younger populations with suspected rhythm disorders

- In May 2023, Abbott announced that its new Assert‑IQ ICM secured FDA clearance, offering a long‑life ICM option with remote‑monitoring features and improved arrhythmia detection for long‑term monitoring of irregular heartbeats

- In May 2023, Medtronic’s AccuRhythm AI technology was recognized with the MedTech Breakthrough Award for “Best New Monitoring Solution,” highlighting how its AI‑powered ICMs (both LINQ II and predecessor models) significantly improve diagnostic accuracy and reduce clinical workload

- In November 2023, clinical data presented from over 16,000 LINQ II ICM patients showed that use of the AccuRhythm AI algorithms reduced false alerts by more than 91% (for AF/pause), cutting review burden for clinics by hundreds of hours annually and boosting confidence in continuous monitoring reliability

- In May 2025, the first implant of a next‑generation ICM from Boston Scientific — the Lux-Dx II+ ICM — was completed, indicating intensifying competition and innovation in ICM technology as the company enters the long-term cardiac monitoring space

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.