Global Insoluble Sulfur Market

Market Size in USD Billion

CAGR :

%

USD

1.91 Billion

USD

2.51 Billion

2024

2032

USD

1.91 Billion

USD

2.51 Billion

2024

2032

| 2025 –2032 | |

| USD 1.91 Billion | |

| USD 2.51 Billion | |

|

|

|

|

Insoluble Sulfur Market Size

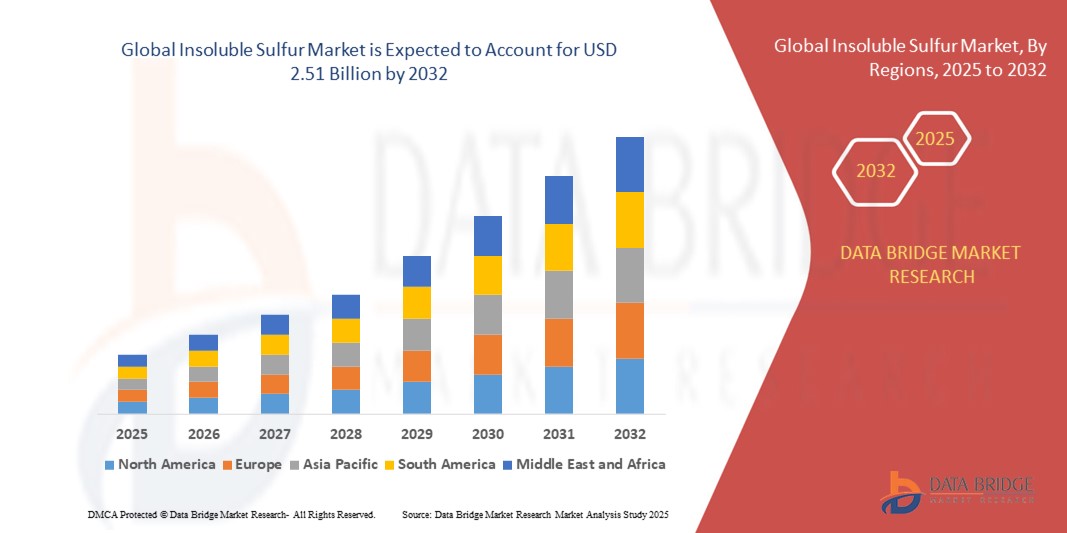

- The global insoluble sulfur market size was valued at USD 1.91 billion in 2024 and is expected to reach USD 2.51 billion by 2032, at a CAGR of 3.50% during the forecast period

- The market growth is primarily driven by increasing demand for high-performance tires in the automotive industry, coupled with the rising need for durable rubber products in industrial applications

- Growing awareness of the benefits of insoluble sulfur, such as improved heat resistance and enhanced rubber compound stability, is further boosting demand across tire manufacturing and other industrial sectors

Insoluble Sulfur Market Analysis

- The insoluble sulfur market is experiencing robust growth due to the rising adoption of high-performance rubber compounds in tire manufacturing, driven by the global automotive industry's expansion

- The tire manufacturing segment holds the largest market revenue share of 65% in 2024, supported by the increasing use of high dispersion and high stability grades of insoluble sulfur for superior tire durability and performance

- Asia-Pacific dominates the insoluble sulfur market with the largest revenue share of 55.5% in 2024, driven by the presence of major tire manufacturing hubs in countries such as China, India, and Japan

- North America is expected to be the fastest-growing region during the forecast period, propelled by advancements in tire technology, increasing vehicle production, and growing demand for high-quality rubber products in industrial applications

- The Regular Grades segment dominated the largest market revenue share of 59.8% in 2024, driven by its widespread use as a vulcanizing agent in the rubber industry, particularly in tire manufacturing, due to its cost-effectiveness and ease of procurement

Report Scope and Insoluble Sulfur Market Segmentation

|

Attributes |

Insoluble Sulfur Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Insoluble Sulfur Market Trends

Increasing Adoption of Advanced Manufacturing Technologies

- The global insoluble sulfur market is experiencing a notable trend toward the integration of advanced manufacturing technologies to enhance production efficiency and product quality

- Technologies such as automated production processes and precision chemical engineering are being utilized to improve the consistency and performance of insoluble sulfur grades, particularly high dispersion and high stability grades

- These advancements enable manufacturers to produce insoluble sulfur with enhanced thermal stability and dispersibility, catering to the specific needs of high-performance tire manufacturing and other rubber applications

- For instances, companies are investing in automated systems to optimize the production of oil-filled insoluble sulfur, which offers superior performance in tire manufacturing by preventing sulfur bloom and improving rubber durability

- This trend is increasing the appeal of insoluble sulfur for industrial applications, as it meets the growing demand for high-quality, durable rubber products in automotive and footwear sectors

- Advanced analytics and real-time monitoring systems are also being employed to track production parameters, ensuring consistent quality across regular, high dispersion, high stability, and special grades

Insoluble Sulfur Market Dynamics

Driver

Growing Demand for High-Performance Tires and Rubber Products

- The rising demand for high-performance tires, driven by the global expansion of the automotive industry, particularly in Asia-Pacific, is a key driver for the insoluble sulfur market

- Insoluble sulfur, used as a vulcanizing agent, enhances the mechanical properties, durability, and heat resistance of rubber, making it essential for tire manufacturing, industrial applications, and footwear

- Government regulations in regions such as Europe, mandating improved tire safety and fuel efficiency, are further accelerating the adoption of insoluble sulfur in tire production

- The proliferation of electric vehicles (EVs) and the development of 5G-enabled smart manufacturing are enabling faster and more efficient production processes, supporting the growth of insoluble sulfur applications

- Major automakers and rubber product manufacturers are increasingly incorporating high stability and high dispersion grades of insoluble sulfur to meet consumer expectations for durable, eco-friendly, and high-performance products

Restraint/Challenge

High Production Costs and Environmental Concerns

- The high cost of producing insoluble sulfur, particularly specialized grades such as high dispersion and high stability, poses a significant barrier to market growth, especially in cost-sensitive emerging markets

- The complex manufacturing processes, requiring advanced equipment and precise control, contribute to elevated production costs, which can deter smaller manufacturers or limit adoption in certain regions

- Environmental concerns related to sulfur production, including emissions and waste management, are a major challenge. The extraction and processing of sulfur can have significant environmental impacts, raising concerns about compliance with stringent environmental regulations

- The fragmented regulatory landscape across countries, particularly regarding emissions and waste disposal, complicates operations for global manufacturers and increases compliance costs

- These factors can limit market expansion, particularly in regions such as North America and Europe, where environmental awareness and regulatory scrutiny are high, despite North America being the fastest-growing region due to demand for premium tires and sustainable practices

Insoluble Sulfur market Scope

The market is segmented on the basis of grade, application, distribution channel, and product.

- By Grade

On the basis of grade, the global insoluble sulfur market is segmented into Regular Grades, High Dispersion Grades, High Stability Grades, and Special Grades. The Regular Grades segment dominated the largest market revenue share of 59.8% in 2024, driven by its widespread use as a vulcanizing agent in the rubber industry, particularly in tire manufacturing, due to its cost-effectiveness and ease of procurement.

The High Dispersion Grades segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its excellent dispersibility and thermal stability, which are critical for advanced tire production and high-performance rubber applications.

- By Application

On the basis of application, the global insoluble sulfur market is segmented into Tire Manufacturing, Industrial Application, Footwear, Cable and Wire, Pipe, and Others. The Tire Manufacturing segment dominated the market with a revenue share of 89.5% in 2024, driven by the substantial demand from the globally expanding automotive industry, where insoluble sulfur enhances tire durability, strength, and resistance to wear and aging.

The Industrial Application segment is anticipated to experience robust growth from 2025 to 2032, fueled by increasing demand for high-quality rubber components in industries such as construction and manufacturing, supported by advancements in rubber processing technologies.

- By Distribution Channel

On the basis of distribution channel, the global insoluble sulfur market is segmented into Direct/Institutional Sales, Retail Sales, and Others. The Direct/Institutional Sales segment accounted for the largest market revenue share of 62.3% in 2024, driven by strong relationships between manufacturers and large-scale buyers, such as tire and rubber product producers, ensuring consistent supply and customized solutions.

The Retail Sales segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand from small-scale rubber product manufacturers and aftermarket suppliers, facilitated by improved global distribution networks.

- By Product

On the basis of product, the global insoluble sulfur market is segmented into Non-Oil-Filled Insoluble Sulfur and Oil-Filled Insoluble Sulfur. The Oil-Filled Insoluble Sulfur segment held the largest market revenue share of 58.7% in 2024, attributed to its enhanced dispersibility and compatibility in rubber compounds, making it a preferred choice for tire manufacturing and other high-performance rubber applications.

The Non-Oil-Filled Insoluble Sulfur segment is expected to witness significant growth from 2025 to 2032, driven by its use in specialized applications requiring high purity and minimal additives, such as in medical and consumer goods industries.

Insoluble Sulfur Market Regional Analysis

- Asia-Pacific dominates the insoluble sulfur market with the largest revenue share of 55.5% in 2024, driven by the presence of major tire manufacturing hubs in countries such as China, India, and Japan

- Consumers prioritize insoluble sulfur for its superior thermal stability and enhanced vulcanization properties, particularly in tire production and industrial applications across diverse climatic conditions

- Growth is supported by advancements in sulfur grades, including high dispersion and high stability grades, alongside rising adoption in both OEM and aftermarket segments

Japan Insoluble Sulfur Market Insight

Japan’s insoluble sulfur market is expected to witness significant growth due to strong consumer preference for high-quality, technologically advanced insoluble sulfur grades that enhance tire performance and safety. The presence of major tire manufacturers and the integration of insoluble sulfur in OEM tire production accelerate market penetration. Rising interest in aftermarket rubber customization also contributes to growth.

China Insoluble Sulfur Market Insight

China holds the largest share of the Asia-Pacific insoluble sulfur market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for high-performance tire solutions. The country’s growing middle class and focus on advanced manufacturing support the adoption of high dispersion and high stability insoluble sulfur grades. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

U.S. Insoluble Sulfur Market Insight

The U.S. insoluble sulfur is expected to witness significant growth, fueled by strong demand in tire manufacturing and growing awareness of the benefits of high-performance insoluble sulfur grades. The trend toward advanced rubber compounding and stringent environmental regulations promoting sustainable materials further boost market expansion. The integration of insoluble sulfur in premium tire production and industrial applications complements aftermarket sales, creating a diverse product ecosystem.

Europe Insoluble Sulfur Market Insight

The Europe insoluble sulfur market is expected to witness significant growth, supported by regulatory emphasis on sustainable tire production and high-quality rubber products. Consumers seek grades that enhance tire durability and performance while meeting environmental standards. Growth is prominent in both OEM tire installations and industrial retrofit projects, with countries such as Germany and France showing significant uptake due to rising environmental concerns and advanced manufacturing capabilities.

U.K. Insoluble Sulfur Market Insight

The U.K. market for insoluble sulfur is expected to experience notable growth, driven by demand for high-quality tire manufacturing and industrial applications in urban and suburban settings. Increased interest in sustainable rubber products and rising awareness of performance benefits encourage adoption. Evolving environmental and safety regulations influence consumer choices, balancing performance with compliance.

Germany Insoluble Sulfur Market Insight

Germany is expected to witness strong growth in the insoluble sulfur market, attributed to its advanced tire manufacturing sector and high consumer focus on durability and energy efficiency. German consumers prefer technologically advanced grades, such as high dispersion and high stability insoluble sulfur that enhance tire performance and contribute to lower fuel consumption. The integration of these grades in premium tires and industrial applications supports sustained market growth.

Insoluble Sulfur Market Share

The insoluble sulfur industry is primarily led by well-established companies, including:

- Eastman Chemical Company (U.S.)

- Oriental Carbon & Chemicals Ltd. (India)

- Shikoku Chemicals Corporation (Japan)

- Grupa Azoty (Poland)

- China Sunsine Chemical Holdings Ltd. (China)

- Nynas AB (Sweden)

- LANXESS (Germany)

- Solvay (Belgium)

- Flexsys (U.S.)

- Henan Kailun Chemical Co., Ltd. (China)

- Sanshin Chemical Industry Co., Ltd. (Japan)

- Lion Copolymer Holdings, LLC (U.S.)

- Willing New Materials Technology Co., Ltd. (China)

What are the Recent Developments in Global Insoluble Sulfur Market?

- In June 2025, the Government of India imposed anti-dumping duties on imports of insoluble sulphur from China and Japan, and vitamin-A palmitate from China, the European Union, and Switzerland. Acting on recommendations from the Directorate General of Trade Remedies (DGTR), the Ministry of Finance announced that these duties—effective immediately—will remain in force for five years. The move aims to protect domestic industries from unfairly priced imports that were found to cause material injury to local manufacturers

- In June 2025, Flexsys announced a $0.25/kg price increase for its Insoluble Sulfur products in India, effective July 1, 2025, or as per individual customer contracts. The price adjustment is driven by rising raw material costs, volatile feedstock pricing, and increased R&D investments in sustainable, high-performance vulcanization technologies. This move aligns with Flexsys’s broader strategy to support the growing demand for premium grades in EV tires and green manufacturing, while maintaining product quality and innovation leadership in the rubber and tire industry

- In January 2025, Apna Wholesale Inc. issued a recall of its Paras Premium Golden Raisins due to the presence of undeclared sulfur dioxide (sulfites). The recall affects 7 oz and 14 oz packages sold in New York and Massachusetts, and was prompted by routine sampling conducted by the New York State Department of Agriculture and Markets, which revealed 56.8 mg of sulfites per serving—far exceeding safe levels for sensitive individuals. While no illnesses were reported, 29 injuries including bone bruises, sprains, and temporary hearing loss were linked to the product. This incident underscores the importance of regulatory oversight and sulfur compound safety in both food and industrial sectors

- In March 2024, the Government of India, through the Directorate General of Trade Remedies (DGTR), initiated an anti-dumping investigation into imports of insoluble sulfur originating from China and Japan. The probe was launched in response to concerns that these imports were being dumped at prices below normal value, causing material injury to the domestic industry. Insoluble sulfur is a critical additive in the rubber and tire manufacturing sector, and the investigation aims to ensure fair trade practices and protect Indian manufacturers from unfair pricing strategies

- In July 2022, Shikoku Chemicals Corporation announced plans to construct new facilities for insoluble sulfur at its Marugame Plant in Kagawa, Japan. The project, valued at 4.5 billion yen (approximately $32.8 million), was scheduled to begin construction in April 2023 and conclude by October 2024, with production expected to commence in December 2024. This expansion aims to significantly enhance Shikoku’s manufacturing capacity to meet the rising global demand for insoluble sulfur, a key vulcanizing agent used in radial tire production and other industrial rubber applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Insoluble Sulfur Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Insoluble Sulfur Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Insoluble Sulfur Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.