Global Instant Beverage Premix Market

Market Size in USD Billion

CAGR :

%

USD

60.44 Billion

USD

131.46 Billion

2025

2033

USD

60.44 Billion

USD

131.46 Billion

2025

2033

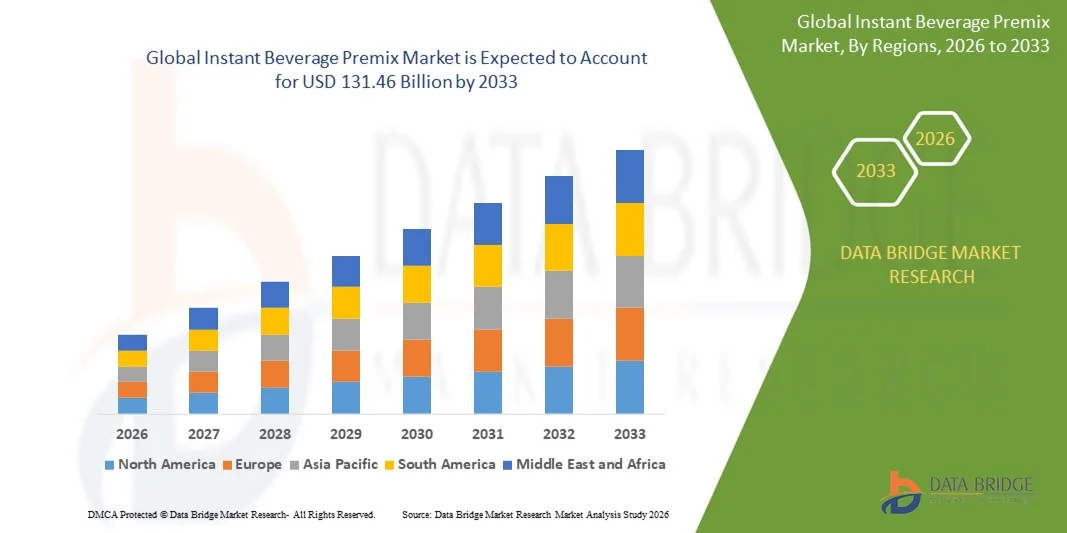

| 2026 –2033 | |

| USD 60.44 Billion | |

| USD 131.46 Billion | |

|

|

|

|

Instant Beverage Premix Market Size

- The global instant beverage premix market size was valued at USD 60.44 billion in 2025 and is expected to reach USD 131.46 billion by 2033, at a CAGR of 10.2% during the forecast period

- The market growth is largely fueled by rising consumer demand for convenient, ready-to-mix beverages that save time in preparation while offering consistent taste and quality across multiple beverage types

- Furthermore, increasing awareness of functional and health-oriented drinks, coupled with the expanding popularity of flavored, fortified, and probiotic premixes, is driving innovation and adoption in both household and commercial segments. These converging factors are accelerating the uptake of instant beverage premixes, thereby significantly boosting the industry's growth

Instant Beverage Premix Market Analysis

- Instant beverage premixes, including coffee, tea, health drinks, and flavored powders, are increasingly preferred due to their ease of preparation, portability, and versatility for home, office, and on-the-go consumption

- The escalating demand for these products is primarily fueled by growing urbanization, busy lifestyles, expanding retail and e-commerce channels, and rising consumer preference for functional, low-calorie, and convenient beverage solutions

- Asia-Pacific dominated the instant beverage premix market with a share of 41.72% in 2025, due to rising demand for convenient and ready-to-mix beverages, expanding retail and e-commerce channels, and a strong presence of beverage manufacturing hubs

- North America is expected to be the fastest growing region in the instant beverage premix market during the forecast period due to rising demand for convenient, flavored, and fortified instant beverages, expanding coffee and health drink culture, and strong e-commerce penetration

- Powder segment dominated the market with a market share of 87.04% in 2025, due to its longer shelf life, ease of transportation, and convenient preparation for consumers. Powdered premixes are widely preferred in households and commercial establishments due to their versatility in hot and cold beverage preparation and compatibility with automated dispensing machines. The increasing demand for instant beverages in offices, cafes, and hotels further fuels the adoption of powdered forms. Manufacturers are continuously innovating in powder textures and solubility to enhance consumer experience and maintain flavor integrity. The convenience offered by powder premixes also supports their dominance in both urban and rural markets

Report Scope and Instant Beverage Premix Market Segmentation

|

Attributes |

Instant Beverage Premix Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Instant Beverage Premix Market Trends

Rising Demand for Functional and Flavored Instant Beverages

- The global instant beverage premix market is witnessing a rising demand for functional and flavored beverages as consumers increasingly seek convenient, ready-to-mix options that also offer health, wellness, and nutritional benefits. Consumers are gravitating towards beverages that provide probiotics, vitamins, antioxidants, and energy-boosting ingredients without compromising on taste or preparation convenience

- For instance, in July 2025, Good Enough Brands launched Good Enough Probiotics Reds Mix, Fruit Punch Flavored Drink Mix containing Anaerostipes caccae CLB101 to support gut health, highlighting the growing consumer preference for functional and fortified beverages. This launch demonstrates how brands are tapping into health-conscious consumer trends while offering flavorful, convenient solutions

- Flavored and functional premixes are gaining traction as they provide versatility in taste and nutritional benefits, catering to busy lifestyles and urban consumers who prefer quick preparation without compromising on flavor, texture, or dietary needs

- The trend towards health-conscious consumption is encouraging manufacturers to innovate with low-calorie, probiotic, vitamin-fortified, and antioxidant-enriched premixes, enhancing the overall product appeal. Such innovation also allows brands to differentiate their offerings in a highly competitive market

- The growing café culture, at-home beverage consumption, and adoption of ready-to-mix beverages in offices are supporting the demand for innovative and convenient premixes, creating opportunities for premium and niche product launches that target multiple demographics

- The market is expected to continue expanding as consumers increasingly prioritize both taste and functionality in instant beverages, encouraging brands to invest in R&D for unique flavors, innovative formulations, and health-focused enhancements that strengthen brand loyalty and market presence

Instant Beverage Premix Market Dynamics

Driver

Growing Consumer Preference for Convenient and Ready-to-Mix Drinks

- The increasing urbanization and busy lifestyles of consumers are driving demand for instant beverage premixes that offer easy preparation, consistent quality, and on-the-go convenience, making them an essential part of daily routines

- For instance, in June 2025, V8 Energy launched the V8 Energy Drink Mix powder with 80mg of natural caffeine and fruit-forward flavors such as Pomegranate Blueberry, Peach Mango, and Strawberry Lemonade, catering to on-the-go consumers seeking convenience, quick energy, and flavorful options. This launch illustrates how companies are addressing lifestyle-driven consumption trends

- Convenience, portability, and time-saving aspects of instant premixes are making them highly attractive in both household and commercial segments, fostering broader adoption across cafes, offices, and home kitchens where quick beverage solutions are needed

- Retail and e-commerce expansion are enabling easy access to a wide variety of premix products, supporting sales growth, facilitating trial of new flavors, and encouraging brand experimentation with functional and innovative ingredients

- The trend towards multifunctional beverages that combine taste, health benefits, and convenience continues to propel market growth, reinforcing the importance of instant beverage premixes in modern consumption habits and highlighting opportunities for product differentiation

Restraint/Challenge

High Competition and Price Sensitivity in the Market

- The instant beverage premix market faces high competition from both established global brands and emerging local players, which can limit profitability, market share, and create pressure to maintain competitive pricing without compromising quality

- For instance, multiple brands such as Nestlé, Continental Coffee, and Kaytea launched new premix products in 2025, intensifying competition, increasing the variety of choices available to consumers, and creating pressure on pricing strategies and marketing differentiation

- Price-sensitive consumers in developing markets may prefer lower-cost alternatives, which can constrain the adoption of premium or functional premix products despite their added health, convenience, and nutritional benefits

- Maintaining consistent quality, taste, solubility, and nutritional profile across regions while keeping costs competitive is a persistent challenge for manufacturers, requiring continuous innovation, efficient production processes, and robust supply chain management

- Overcoming intense market rivalry, balancing affordability with product innovation, and meeting evolving consumer expectations is crucial for sustained growth in the instant beverage premix market, emphasizing the need for strong brand positioning, flavor and functionality differentiation, and strategic marketing efforts

Instant Beverage Premix Market Scope

The market is segmented on the basis of form, type, function, and distribution channel.

- By Form

On the basis of form, the Instant Beverage Premix market is segmented into powder, paste, and granules. The powder segment dominated the market with the largest market revenue share of 87.04% in 2025, driven by its longer shelf life, ease of transportation, and convenient preparation for consumers. Powdered premixes are widely preferred in households and commercial establishments due to their versatility in hot and cold beverage preparation and compatibility with automated dispensing machines. The increasing demand for instant beverages in offices, cafes, and hotels further fuels the adoption of powdered forms. Manufacturers are continuously innovating in powder textures and solubility to enhance consumer experience and maintain flavor integrity. The convenience offered by powder premixes also supports their dominance in both urban and rural markets.

The paste segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand in ready-to-use formats for cafes, restaurants, and food service providers. Paste forms provide consistent taste and texture, reducing preparation time and ensuring uniform quality. For instance, companies such as Nestlé have introduced paste-based coffee and tea premixes targeted at commercial outlets to streamline beverage preparation. The paste format also allows for innovative flavor blends and fortified beverages, meeting consumer demand for both convenience and functional ingredients.

- By Type

On the basis of type, the Instant Beverage Premix market is segmented into instant coffee, instant tea, instant milk, instant health drinks, instant soup, and others. The instant coffee segment held the largest market revenue share in 2025, driven by its global popularity, strong consumer preference for quick caffeine intake, and availability in diverse flavors and blends. Instant coffee provides convenience in preparation, consistent taste, and compatibility with multiple beverage formats such as lattes and cappuccinos. Growing café culture and at-home coffee consumption further bolster the dominance of instant coffee premixes. Manufacturers are focusing on premiumization with specialty blends and functional coffee options to capture high-value segments. The segment also benefits from strong distribution networks in retail and online channels.

The instant health drinks segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising health consciousness and demand for functional beverages enriched with vitamins, minerals, and plant extracts. For instance, companies such as Amul and Horlicks have launched fortified health drink premixes catering to children, adults, and elderly consumers. These products are increasingly adopted in schools, offices, and households for daily nutrition supplementation. The growth is also supported by innovative flavor options and fortified blends that combine taste with health benefits.

- By Function

On the basis of function, the Instant Beverage Premix market is segmented into plain and flavored. The plain segment dominated the market with the largest market revenue share in 2025, driven by its widespread adoption in households and commercial setups where consumers prefer customizable beverage preparation. Plain premixes offer versatility to combine with milk, water, or sweeteners according to taste preference and dietary requirements. The segment is favored for traditional beverages such as plain tea, coffee, and milk-based drinks. Manufacturers continue to focus on improving solubility, aroma retention, and shelf stability to maintain consumer satisfaction. Plain premixes also serve as a base for multiple functional and flavored variants, supporting broad market demand.

The flavored segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing consumer preference for unique and indulgent taste experiences. For instance, companies such as Nestlé and Tata Consumer Products have launched flavored coffee, tea, and health premixes with variants such as vanilla, chocolate, and masala. Flavored premixes cater to millennials and urban consumers seeking convenience with enjoyable taste profiles. The segment is also driven by innovation in limited-edition flavors, seasonal offerings, and functional flavor blends, enhancing appeal across age groups.

- By Distribution Channel

On the basis of distribution channel, the Instant Beverage Premix market is segmented into store-based and non-store-based channels. The store-based segment dominated the market with the largest market revenue share in 2025, driven by the extensive reach of supermarkets, hypermarkets, and convenience stores where consumers can access a wide variety of products in a single trip. Physical retail allows consumers to compare brands, examine packaging, and take advantage of in-store promotions and loyalty programs. Manufacturers also leverage store-based channels for product visibility and brand recognition. The segment is strengthened by organized retail expansion in urban and semi-urban areas, contributing to sustained dominance in sales.

The non-store-based segment is expected to witness the fastest growth from 2026 to 2033, fueled by the rise of e-commerce platforms, direct-to-consumer subscriptions, and online grocery delivery services. For instance, companies such as Amazon and BigBasket have facilitated easy access to premium and niche instant beverage premixes through digital channels. Non-store-based distribution offers convenience, doorstep delivery, and personalized subscription options for frequent consumers. The growth is further driven by increasing smartphone penetration, digital payments, and targeted online marketing campaigns.

Instant Beverage Premix Market Regional Analysis

- Asia-Pacific dominated the instant beverage premix market with the largest revenue share of 41.72% in 2025, driven by rising demand for convenient and ready-to-mix beverages, expanding retail and e-commerce channels, and a strong presence of beverage manufacturing hubs

- The region’s cost-effective production landscape, increasing investments in flavor innovations, and growing exports of instant beverage premixes are accelerating market expansion

- The availability of skilled labor, supportive government policies, and rapid urbanization across developing economies are contributing to increased consumption of instant beverage premixes in both household and commercial sectors

China Instant Beverage Premix Market Insight

China held the largest share in the Asia-Pacific Instant Beverage Premix market in 2025, owing to its strong manufacturing base, high consumption of coffee, tea, and health drinks, and expanding e-commerce infrastructure. The country’s investment in flavor innovation, modern production facilities, and distribution networks is a major growth driver. Demand is further supported by rising urban middle-class consumers, growing café culture, and increasing adoption of ready-to-drink and instant beverage formats.

India Instant Beverage Premix Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly growing urban population, increasing awareness of health and wellness beverages, and rising investments in manufacturing of instant drinks. Government initiatives promoting food processing and local production are strengthening the demand for premixes. In addition, expanding retail penetration, surge in online sales, and rising consumption of coffee, tea, and health drinks are contributing to robust market expansion.

Europe Instant Beverage Premix Market Insight

The Europe Instant Beverage Premix market is expanding steadily, supported by high demand for convenience beverages, strong preference for flavored and fortified drinks, and growing investments in sustainable and high-quality production. The region emphasizes quality, hygiene standards, and innovative product development, particularly in functional and health-focused premixes. Rising adoption of premium and organic beverage options is further enhancing market growth.

Germany Instant Beverage Premix Market Insight

Germany’s Instant Beverage Premix market is driven by a mature coffee and tea culture, strong retail networks, and rising demand for functional and specialty beverages. The country has well-established R&D capabilities for beverage innovation, fostering the development of novel flavors and fortified products. Demand is particularly strong in urban households, offices, and foodservice establishments seeking convenient yet high-quality instant beverages.

U.K. Instant Beverage Premix Market Insight

The U.K. market is supported by high consumer preference for instant coffee, tea, and health drinks, growing focus on functional beverages, and increasing adoption of e-commerce for convenient purchase. Investments in product innovation, flavor diversification, and fortified premixes are supporting market growth. The U.K.’s strong retail presence and rising demand for on-the-go beverages contribute significantly to market expansion.

North America Instant Beverage Premix Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for convenient, flavored, and fortified instant beverages, expanding coffee and health drink culture, and strong e-commerce penetration. Consumers’ focus on time-saving solutions, functional nutrition, and premium beverage experiences is boosting demand. Growing partnerships between beverage manufacturers and retail or online channels are further supporting market growth.

U.S. Instant Beverage Premix Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its high consumption of instant coffee, tea, and health drink premixes, strong retail and online distribution networks, and investments in product innovation. The country’s focus on flavored and fortified beverages, convenience, and premium formats is driving growth. Presence of key players, increasing consumer awareness of functional and wellness beverages, and expanding café culture further solidify the U.S.'s leading position in the region.

Instant Beverage Premix Market Share

The instant beverage premix industry is primarily led by well-established companies, including:

- Keurig Green Mountain, Inc. (U.S.)

- Nestlé (Switzerland)

- Cargill Incorporated (U.S.)

- The Coca-Cola Company (U.S.)

- PepsiCo (U.S.)

- Monster Energy Company (U.S.)

- Starbucks Coffee Company (U.S.)

- SUNTORY BEVERAGE & FOOD LIMITED (Japan)

- Panama Foods (India)

- Neel Beverages Pvt Ltd. (India)

- Tweak Beverages (India)

- The Republic of Tea (U.S.)

- Omsai Foods (India)

- Carlsberg Breweries A/S (Denmark)

- Diageo (U.K.)

- Kartin (India)

- Mothercafe (India)

- Ken Global (India)

- SK Café Brooke Hots Pvt. Ltd. (India)

- Chai Kapi (India)

Latest Developments in Global Instant Beverage Premix Market

- In July 2025, Good Enough Brands launched its functional beverage, Good Enough Probiotics Reds Mix, Fruit Punch Flavored Drink Mix. Each serving contained the probiotic strain Anaerostipes caccae CLB101 to support gut health. This launch reinforced the growing consumer preference for functional and wellness-oriented instant beverage premixes, highlighting opportunities for products that combine convenience with digestive health benefits. The introduction of a low-calorie, gut-friendly drink enhanced the market’s focus on health-conscious options and encouraged other players to innovate in the probiotic and functional segment

- In June 2025, the V8 Energy team introduced the V8 Energy Drink Mix, a powder formulation designed to deliver a steady energy boost with 80mg of natural caffeine sourced from black and green tea. Available in Pomegranate Blueberry, Peach Mango, and Strawberry Lemonade flavors, the launch expanded the on-the-go energy drink category within instant beverage premixes. By providing a convenient, fruit-forward, and caffeinated option, V8 Energy Drink Mix addressed the rising demand for portable, functional beverages among active and urban consumers, strengthening the market for energy-focused premixes

- In May 2025, RTD tea brand Kaytea unveiled a new range of instant iced tea powders in the United Kingdom, available in Peach and Mango, Lemon, and Classic Milk Tea flavors. Designed for effortless preparation with hot or cold water, the launch capitalized on the trend of convenient, ready-to-mix tea beverages. This development is significant for the UK market as it expands consumer choice in instant tea formats, enhances at-home beverage consumption, and positions Kaytea as a competitive player in the growing functional and flavored tea premix segment

- In May 2025, Continental Coffee, a leading Indian beverage brand and subsidiary of CCL Products (India) Limited, launched Continental THIS Lemon Iced Tea Premix pan-India. Offered in both a 400g pouch and 140g stick packs, the product catered to individual and family consumption. This launch strengthened the brand’s presence in the Indian instant beverage premix market and highlighted the increasing consumer demand for convenient, ready-to-serve flavored tea options. The introduction of versatile pack sizes also supports broader market penetration across retail and e-commerce channels

- In April 2025, Nestlé introduced Nescafé Ready-to-Blend Instant Coffee Mix in select Asian markets, offering a versatile powder format that could be mixed with hot or cold milk for customized beverages. This launch is poised to impact the market by addressing the growing preference for flexible, premium coffee solutions that combine convenience and quality. The product reinforces the trend toward multifunctional instant premixes and supports Nestlé’s strategy to capture a larger share in the expanding ready-to-mix coffee and functional beverage segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Instant Beverage Premix Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Instant Beverage Premix Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Instant Beverage Premix Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.