Global Institutional Cleaning Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

1.75 Billion

USD

2.14 Billion

2024

2032

USD

1.75 Billion

USD

2.14 Billion

2024

2032

| 2025 –2032 | |

| USD 1.75 Billion | |

| USD 2.14 Billion | |

|

|

|

|

Institutional Cleaning Ingredients Market Size

Institutional Cleaning Ingredients Market Size

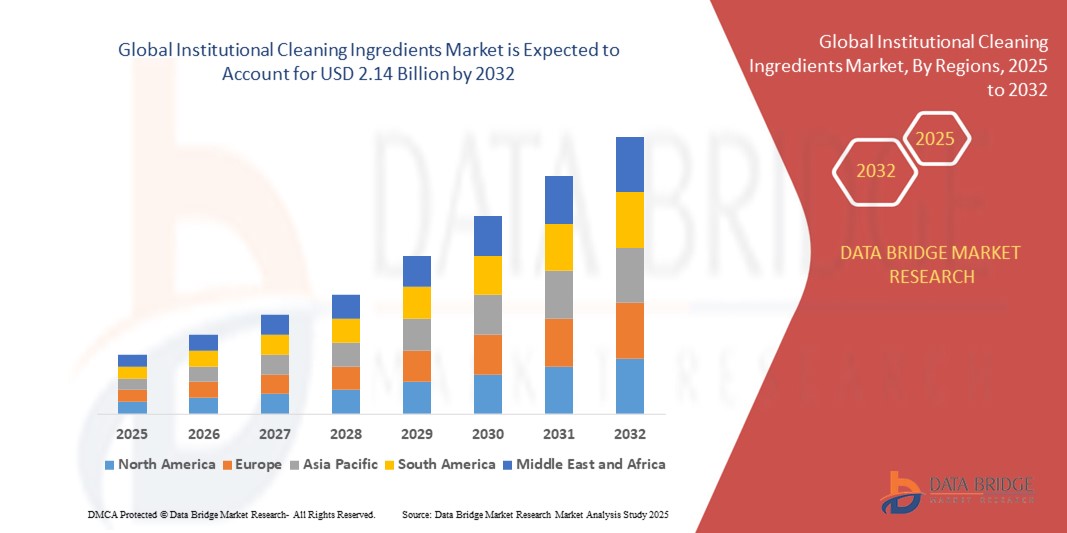

- The global institutional cleaning ingredients market size was valued at USD 1.75 billion in 2024 and is expected to reach USD 2.14 billion by 2032, at a CAGR of 4.1% during the forecast period

- The market growth is largely fuelled by the increasing demand for hygienic and sanitized environments in healthcare, hospitality, and educational institutions

- Rising awareness of infectious disease prevention and government regulations on sanitation standards are also driving adoption of advanced cleaning ingredients

Institutional Cleaning Ingredients Market Analysis

- The market is witnessing a shift toward eco-friendly and sustainable cleaning ingredients, with institutions preferring biodegradable and low-toxicity formulations to comply with environmental norms

- Technological advancements in formulation chemistry are enabling highly effective, multi-purpose, and surface-specific cleaning agents, improving efficiency while reducing labor and operational costs

- Asia-Pacific dominated the institutional cleaning ingredients market with the largest revenue share of 39.2% in 2024, driven by rapid urbanization, increasing hygiene awareness, and the expansion of healthcare, hospitality, and educational sectors across countries such as China, India, and Japan

- North America region is expected to witness the highest growth rate in the global institutional cleaning ingredients market, driven by technological advancements in cleaning formulations, stringent regulatory standards, and widespread adoption of green-certified and high-efficiency cleaning products

- The Surfactants segment held the largest market revenue share in 2024, driven by their high cleaning efficiency, versatility across different surfaces, and ability to enhance the performance of other chemical formulations. Surfactants are widely used in both automated and manual cleaning applications in hospitals, hotels, and commercial facilities due to their cost-effectiveness and broad-spectrum efficacy

Report Scope and Institutional Cleaning Ingredients Market Segmentation

|

Attributes |

Institutional Cleaning Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand For Eco-Friendly And Sustainable Cleaning Ingredients |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Institutional Cleaning Ingredients Market Trends

Increasing Adoption of Eco-Friendly And High-Performance Cleaning Ingredients

- The growing focus on hygiene, sanitation, and sustainability is transforming the institutional cleaning ingredients market by driving the adoption of eco-friendly and high-performance chemical formulations. These ingredients improve cleaning efficacy, reduce environmental impact, ensure compliance with regulatory standards, and contribute to corporate social responsibility goals. Institutions are increasingly emphasizing sustainable practices while maintaining high sanitation standards across diverse facilities

- Rising demand from hospitals, schools, hotels, and commercial establishments is accelerating the use of concentrated detergents, disinfectants, and surface sanitizers. These products enable faster, more effective cleaning while reducing labor and operational costs, supporting improved facility management, and minimizing chemical waste. In addition, automated cleaning systems are increasingly integrated with these ingredients for better efficiency and standardized hygiene protocols

- The versatility of modern cleaning ingredients allows institutions to address diverse surfaces, materials, and contamination risks, enhancing safety and hygiene across multiple sectors. Ingredients are now formulated to be effective on metals, plastics, textiles, and floors while minimizing corrosion or residue buildup. This flexibility supports specialized applications, from medical environments to food processing units, meeting sector-specific regulatory requirements

- For instance, in 2023, several large healthcare chains in Europe implemented biodegradable and non-toxic surface cleaners, leading to safer work environments, reduced chemical residues, and lower waste disposal costs. These initiatives also improved staff safety, decreased long-term environmental liability, and fostered patient and customer trust in facility sanitation practices

- While the trend toward high-performance and green cleaning solutions is strong, widespread adoption depends on cost, supply consistency, and product efficacy. Manufacturers are focusing on research, product innovation, and education to encourage broader usage, including training programs for staff and demonstration projects to highlight operational benefits. Adoption also relies on policy support and incentives promoting sustainable procurement in institutions

Institutional Cleaning Ingredients Market Dynamics

Driver

Rising Hygiene Standards And Regulatory Compliance Requirements

- Increasing awareness of infection control, hygiene, and environmental safety is pushing institutions to invest in high-quality cleaning ingredients. Regulatory standards and sanitation protocols in hospitals, schools, and food processing facilities are creating consistent demand for certified, high-performance products, while also encouraging transparent labeling and reporting

- Institutions are increasingly recognizing the cost benefits of effective cleaning, including reduced absenteeism, lower disease spread, and extended lifespan of equipment and facilities. This awareness drives consistent usage of advanced cleaning chemicals across sectors, while also lowering liability risks and enhancing operational productivity

- Government programs and industry initiatives promoting sustainability and safe chemical use are further boosting market growth, encouraging the adoption of eco-friendly and certified cleaning solutions. Incentives, certifications, and subsidies are supporting facility upgrades and procurement of high-quality, environmentally safe ingredients

- For instance, in 2022, several North American municipal authorities mandated green-certified cleaning products in public facilities, increasing demand for plant-based detergents and biodegradable disinfectants. This created standardized frameworks for product selection, improved regulatory compliance, and promoted a culture of sustainability in public service institutions

- While regulatory support and hygiene awareness are driving the market, consistent supply, formulation innovation, and cost-effective solutions are essential to maintain growth and adoption across institutions. Collaboration between manufacturers, distributors, and institutional buyers is key to meeting demand, ensuring timely deliveries, and scaling sustainable solutions globally

Restraint/Challenge

High Costs Of Advanced Cleaning Ingredients And Supply Chain Limitations

- Premium institutional cleaning ingredients, such as concentrated disinfectants and enzyme-based formulations, often come at higher price points, limiting adoption among budget-sensitive organizations. Small facilities and developing regions face affordability challenges that impede market penetration, while fluctuating raw material prices can further constrain procurement budgets

- Many institutions lack trained personnel to handle, store, and apply specialized cleaning chemicals safely and effectively. Improper usage can reduce product performance, increase health or environmental risks, and lead to regulatory non-compliance. Training programs and standardized usage protocols are necessary to overcome these operational barriers

- Supply chain disruptions, including limited availability of raw materials, packaging constraints, and transportation delays, further restrict consistent product delivery. These challenges can lead to inventory shortages, increased operational costs, and emergency procurement issues that affect cleaning schedules and facility hygiene standards

- For instance, in 2023, several educational institutions in Sub-Saharan Africa reported delays in acquiring certified disinfectants and detergents, affecting cleaning schedules and compliance with hygiene standards. These disruptions also highlighted the need for local production, regional warehouses, and diversified supply sources to ensure continuity

- While innovations in formulations and packaging continue, addressing high costs, supply reliability, and training gaps is crucial. Market participants are focusing on decentralized production, scalable ingredient solutions, digital inventory tracking, and capacity-building programs to enable wider adoption and long-term growth, ensuring both sustainability and operational efficiency

Institutional Cleaning Ingredients Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the institutional cleaning ingredients market is segmented into Surfactants, Enzymes, Bleaching Agents, Water Softeners, Emulsifiers, Binders and Antimicrobials, Chelating Agents, Preservatives, and Others. The Surfactants segment held the largest market revenue share in 2024, driven by their high cleaning efficiency, versatility across different surfaces, and ability to enhance the performance of other chemical formulations. Surfactants are widely used in both automated and manual cleaning applications in hospitals, hotels, and commercial facilities due to their cost-effectiveness and broad-spectrum efficacy.

The Enzymes segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their ability to break down complex organic stains, reduce chemical usage, and improve eco-friendliness. Enzyme-based cleaning ingredients are particularly popular in healthcare and food-service sectors, where regulatory compliance and hygiene standards are stringent. Their adoption is supported by ongoing R&D and the increasing preference for green cleaning solutions across institutions.

- By Application

On the basis of application, the market is segmented into Dishwashing Machine and Dishwashing Manual. The Dishwashing Machine segment held the largest market revenue share in 2024, fueled by the growing use of automated cleaning systems in restaurants, hotels, and large institutions for improved efficiency, reduced labor costs, and consistent sanitation.

The Dishwashing Manual segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its widespread use in smaller establishments, schools, and remote facilities where automated dishwashing systems are not feasible. Manual cleaning solutions, supported by concentrated and high-performance ingredients, provide effective hygiene and flexibility for diverse institutional settings while maintaining cost efficiency.

Institutional Cleaning Ingredients Market Regional Analysis

- Asia-Pacific dominated the institutional cleaning ingredients market with the largest revenue share of 39.2% in 2024, driven by rapid urbanization, increasing hygiene awareness, and the expansion of healthcare, hospitality, and educational sectors across countries such as China, India, and Japan

- Institutions in the region are increasingly adopting eco-friendly, high-performance, and certified cleaning ingredients that ensure regulatory compliance, improve sanitation, and reduce environmental impact

- Widespread adoption is further supported by government-led sanitation initiatives, rising disposable incomes, and growing institutional focus on safety and efficiency, establishing advanced cleaning ingredients as a preferred solution across sectors

China Institutional Cleaning Ingredients Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, fueled by stringent hygiene regulations, rapid urbanization, and increasing adoption of certified cleaning solutions in hospitals, hotels, and schools. Government sanitation programs, combined with the growing availability of cost-effective enzyme-based and eco-friendly ingredients, are driving market expansion.

Japan Institutional Cleaning Ingredients Market Insight

Japan’s market is expected to witness the fastest growth rate from 2025 to 2032 due to high hygiene standards, rising institutional demand for non-toxic and biodegradable cleaning chemicals, and the integration of advanced cleaning systems in commercial and healthcare facilities. The country’s focus on sustainability and safe chemical usage is further boosting market adoption.

North America Institutional Cleaning Ingredients Market Insight

The North America market is expected to witness the fastest growth rate from 2025 to 2032 due to strict hygiene regulations, strong institutional frameworks, and growing adoption of green-certified and high-performance cleaning ingredients in hospitals, schools, and commercial establishments. The U.S. leads the region with widespread adoption of enzyme-based detergents, disinfectants, and advanced cleaning solutions.

Europe Institutional Cleaning Ingredients Market Insight

Europe’s market is expected to witness the fastest growth rate from 2025 to 2032, driven by regulatory compliance, increasing focus on environmental sustainability, and demand for versatile cleaning solutions across healthcare, hospitality, and educational sectors. Countries such as Germany and the U.K. are witnessing strong adoption of biodegradable and high-efficiency chemical formulations.

U.K. Institutional Cleaning Ingredients Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, supported by high institutional hygiene standards, adoption of sustainable cleaning products, and growing concerns regarding infection control and operational efficiency. Strong retail and e-commerce channels further facilitate access to certified cleaning ingredients.

Germany Institutional Cleaning Ingredients Market Insight

Germany’s market is expected to witness the fastest growth rate from 2025 to 2032 due to increasing regulatory enforcement, sustainability initiatives, and adoption of enzyme-based and non-toxic cleaning solutions in healthcare and industrial institutions. Emphasis on environmental protection and efficient facility management promotes market penetration.

Institutional Cleaning Ingredients Market Share

The Institutional Cleaning Ingredients industry is primarily led by well-established companies, including:

- Diversey, Inc. (U.S.)

- Evonik Industries AG (Germany)

- Dow (U.S.)

- BASF SE (Germany)

- Clariant AG (Switzerland)

- Ashland Global Holdings Inc. (U.S.)

- Stepan Company (U.S.)

- Spartan Chemical Company, Inc. (U.S.)

- Ecolab (U.S.)

- Solvay (Belgium)

- Croda International Plc (U.K.)

- 3M (U.S.)

- Unilever (U.K.)

- NEOS COMPANY LIMITED (Japan)

- Kao Corporation (Japan)

- WVT Industries NV (Belgium)

- Mitsubishi Chemical Holdings Corporation (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Institutional Cleaning Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Institutional Cleaning Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Institutional Cleaning Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.