Global Insulated Concrete Form Market

Market Size in USD Billion

CAGR :

%

USD

1.41 Billion

USD

2.53 Billion

2024

2032

USD

1.41 Billion

USD

2.53 Billion

2024

2032

| 2025 –2032 | |

| USD 1.41 Billion | |

| USD 2.53 Billion | |

|

|

|

|

Insulated Concrete Form Market Size

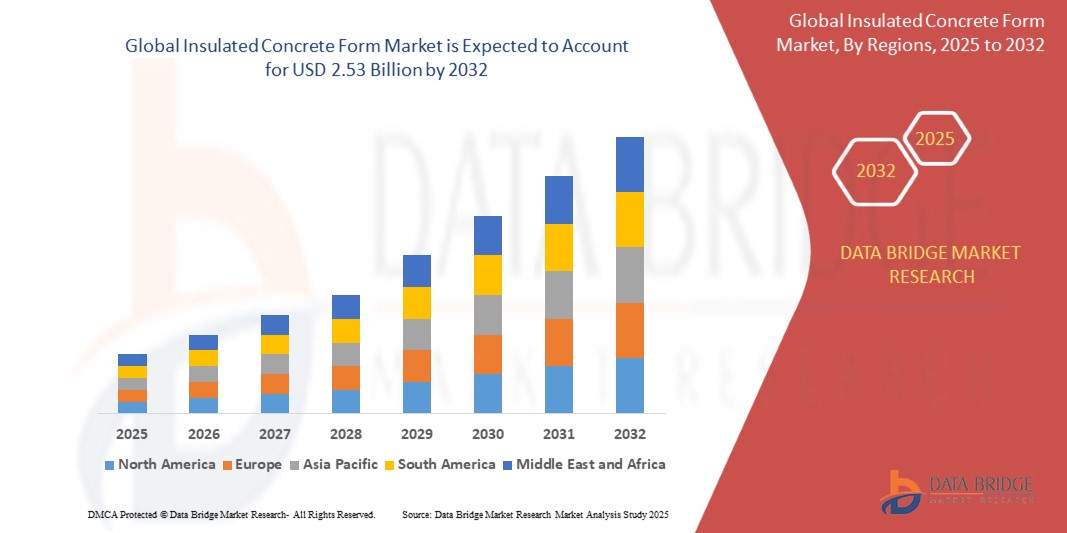

- The global insulated concrete form market size was valued at USD 1.41 billion in 2024 and is expected to reach USD 2.53 billion by 2032, at a CAGR of 7.50% during the forecast period

- The market growth is largely fuelled by the rising demand for energy-efficient and sustainable construction solutions, particularly in residential and commercial building sectors

- The increasing focus on reducing carbon footprints and improving thermal insulation in buildings is also contributing significantly to market expansion

Insulated Concrete Form Market Analysis

- The insulated concrete form (ICF) market is gaining strong momentum owing to growing awareness regarding energy conservation and disaster-resistant construction

- ICFs offer advantages such as superior energy efficiency, soundproofing, and durability, which are increasingly valued by builders and homeowners alike

- North America dominated the insulated concrete form market with the largest revenue share in 2024, driven by rising demand for energy-efficient building materials and the adoption of sustainable construction practices

- Asia-Pacific region is expected to witness the highest growth rate in the global insulated concrete form market, driven by expanding infrastructure development, rising population, increasing energy efficiency awareness, and government initiatives promoting sustainable building technologies across emerging economies such as China, India, and Southeast Asian nations

- The flat wall system segment dominated the market with the largest revenue share in 2024, driven by its structural efficiency and wide adoption in both residential and commercial buildings. This system offers superior strength, load-bearing capacity, and thermal performance, making it a preferred choice for builders aiming for energy-efficient construction. The consistent and uniform wall surface it provides also makes finishing easier, thereby reducing project timelines and costs

Report Scope and Insulated Concrete Form Market Segmentation

|

Attributes |

Insulated Concrete Form Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Insulated Concrete Form Market Trends

“Rising Popularity of Disaster-Resilient Construction”

- Growing concerns over natural disasters such as hurricanes, wildfires, and earthquakes are leading to higher demand for resilient construction materials

- ICFs offer superior strength and impact resistance, making them ideal for disaster-prone regions and helping minimize property damage

- Governments and municipal authorities are incorporating disaster-resilient construction codes that increasingly recommend or mandate the use of materials such as ICFs

- Real estate developers are promoting ICF-based housing as a premium, safety-oriented offering for families in vulnerable areas

- Insurance companies are beginning to offer incentives, such as premium discounts, for properties built using ICFs due to their proven durability

- For instance, in hurricane-prone areas of Florida, several housing communities have adopted ICF construction to reduce rebuilding costs after storms

Insulated Concrete Form Market Dynamics

Driver

“Increasing Demand for Energy-Efficient and Sustainable Building Solutions”

- ICFs are gaining popularity for their superior thermal insulation, which can cut heating and cooling costs by 40–50% compared to traditional materials

- Sustainability trends and green certification programs such as LEED and BREEAM are accelerating the shift toward ICFs in both residential and commercial projects

- The structure of ICFs inherently supports airtight building envelopes, enhancing indoor comfort while reducing energy leakage

- Builders and developers are increasingly using ICFs to meet zero-energy building requirements in cold or hot climates

- Recycled materials used in ICF foam panels are aligned with circular economy goals, helping reduce environmental impact

- For instance, several zero-energy housing developments in Ontario, Canada, now require ICF usage to meet provincial energy efficiency targets

Restraint/Challenge

“High Initial Cost and Limited Awareness in Developing Regions”

- The upfront cost of ICFs remains significantly higher than conventional construction materials such as wood or brick, deterring budget-conscious builders

- Many contractors and builders lack familiarity with ICF construction techniques, leading to reluctance in adoption and risk-averse decision-making

- The shortage of skilled labor trained in ICF installation in many regions increases construction time and labor expenses

- Educational outreach and demonstration projects are limited in emerging markets, reducing visibility of the long-term benefits of ICF systems

- Governments in developing countries often lack incentives or regulations supporting advanced sustainable construction, slowing down market penetration

- For instance, in Indonesia, traditional concrete block construction continues to dominate due to its affordability and broad workforce familiarity, despite ICFs offering better energy efficiency

Insulated Concrete Form Market Scope

The market is segmented on the basis of concrete shape, material, and application.

• By Concrete Shape

On the basis of concrete shape, the insulated concrete form (ICF) market is segmented into flat wall system, screen grid system, waffle grid system, and post and lintel system. The flat wall system segment dominated the market with the largest revenue share in 2024, driven by its structural efficiency and wide adoption in both residential and commercial buildings. This system offers superior strength, load-bearing capacity, and thermal performance, making it a preferred choice for builders aiming for energy-efficient construction. The consistent and uniform wall surface it provides also makes finishing easier, thereby reducing project timelines and costs.

The screen grid system segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand in low-rise construction and energy-efficient homebuilding. This system reduces the volume of concrete needed while still offering substantial strength and insulation, appealing to cost-sensitive and eco-conscious developers. Its lighter structure and faster assembly make it ideal for single-family homes and light commercial applications.

• By Material

On the basis of material, the market is segmented into polystyrene foam, polyurethane foam, cement-bonded wood fiber, cement-bonded polystyrene beads, and others. The polystyrene foam segment held the largest market share in 2024, attributed to its superior insulation properties, lightweight structure, and ease of handling on-site. It supports high thermal resistance, which helps reduce energy consumption in buildings, aligning with global green building standards.

The polyurethane foam segment is expected to witness the fastest growth rate from 2025 to 2032, due to its higher R-value per inch, offering enhanced insulation with thinner wall sections. Its use is gaining traction in commercial and high-performance residential buildings aiming for net-zero energy use or passive house certifications.

• By Application

On the basis of application, the ICF market is segmented into residential, commercial, and industrial. The residential segment captured the largest revenue share in 2024, driven by rising demand for sustainable housing, stringent building energy codes, and homeowner interest in energy cost savings and disaster resilience.

The commercial segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increased usage in hotels, schools, hospitals, and office buildings. Developers and architects prefer ICFs for their thermal efficiency, noise reduction, and faster construction timelines, which contribute to long-term operational cost savings and green building certifications.

Insulated Concrete Form Market Regional Analysis

- North America dominated the insulated concrete form market with the largest revenue share in 2024, driven by rising demand for energy-efficient building materials and the adoption of sustainable construction practices

- The region’s preference for high-performance thermal insulation systems and stringent building codes supporting green construction significantly contribute to market growth

- Advancements in construction technologies, increased awareness regarding disaster-resilient structures, and the widespread use of ICFs in residential and commercial construction continue to support market expansion across North America

U.S. Insulated Concrete Form Market Insight

The U.S. insulated concrete form market held the largest revenue share within North America in 2024, fuelled by growing residential construction activities and rising demand for energy-efficient housing. The U.S. government’s initiatives promoting green building standards, along with consumer preference for durable and cost-effective insulation solutions, are key growth drivers. Increased investments in infrastructure and the widespread use of ICFs in multi-family and low-rise buildings further support the market. For instance, the use of ICFs in disaster-prone zones such as Florida and California is gaining traction due to their structural strength and resistance to natural calamities.

Europe Insulated Concrete Form Market Insight

The Europe insulated concrete form market is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent energy efficiency regulations and growing interest in zero-energy buildings. Countries such as Germany, France, and the U.K. are actively implementing sustainable construction policies that encourage the use of ICFs. In addition, the market benefits from increasing renovation activities and heightened consumer awareness about long-term energy savings. European construction companies are steadily integrating ICF systems into both residential and commercial developments to meet carbon-neutral goals and thermal performance standards.

Germany Insulated Concrete Form Market Insight

The Germany insulated concrete form market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country's leadership in energy-efficient construction and environmental regulations. The government's commitment to reduce building emissions and the popularity of passive houses are fostering the adoption of ICFs. Moreover, Germany's robust construction industry and demand for noise-insulating, thermally efficient wall systems contribute to market expansion. Local innovations in construction technology and the use of eco-friendly building materials also enhance Germany’s role in driving ICF demand across Europe.

U.K. Insulated Concrete Form Market Insight

The U.K. insulated concrete form market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for energy-efficient construction and alignment with net-zero carbon targets. Government initiatives, such as the Future Homes Standard and support for sustainable housing, are encouraging the use of ICFs in both new builds and retrofits. The growing popularity of eco-conscious residential developments and the need for durable, thermally insulated wall systems are also accelerating market adoption. Furthermore, the U.K.'s emphasis on improving building performance and reducing long-term energy costs supports the integration of ICFs in modern construction practices.

Asia-Pacific Insulated Concrete Form Market Insight

The Asia-Pacific insulated concrete form market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, growing infrastructure development, and rising demand for sustainable building practices. Emerging economies such as China, India, and Indonesia are increasingly adopting ICFs to meet green building codes and reduce energy consumption in buildings. Government support for eco-friendly construction and the growing presence of global manufacturers in the region are accelerating the availability and affordability of ICF systems.

China Insulated Concrete Form Market Insight

The China insulated concrete form market dominated the Asia-Pacific region in 2024, backed by massive construction activities, government mandates on energy-efficient buildings, and rising adoption of green materials. The demand for sustainable urban housing and high-rise developments has fueled the uptake of ICF systems. The integration of ICFs in public infrastructure projects and the increasing influence of environmental policies such as China's “Dual Carbon” goal are reinforcing the market’s growth trajectory. Domestic players are also enhancing product availability through cost-effective innovations tailored to regional construction needs.

Japan Insulated Concrete Form Market Insight

The Japan insulated concrete form market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s focus on disaster-resilient infrastructure and energy-efficient building methods. Japan’s susceptibility to earthquakes has led to a rising preference for reinforced, durable materials such as ICFs that offer both structural integrity and thermal efficiency. The government’s initiatives promoting sustainable urban development and energy conservation further support market growth. In addition, the shrinking availability of skilled labor has made ICFs an attractive choice due to their ease of installation and reduced construction time, especially in residential and small-scale commercial projects.

Insulated Concrete Form Market Share

The Insulated Concrete Form industry is primarily led by well-established companies, including:

- Tremco CPG (India)

- RPM INTERNATIONAL INC. (U.S.)

- Quad-Lock Building Systems (Canada)

- Airlite Plastics Company & Fox Blocks (U.S.)

- BASF SE (Germany)

- Logix Brands Ltd. (Canada)

- Polycrete International (Canada)

- LiteForm (U.S.)

- Rastra (U.S.)

- SuperForm (Denmark)

- ROCKWOOL A/S (Australia)

- Beco Products Ltd (U.K.)

- Mikey Block’s (U.S.)

Latest Developments in Global Insulated Concrete Form Market

- In November 2022, Foam Holdings, a Wynnchurch Capital, L.P. company, completed the acquisition of Amvic Inc. and Concrete Block Insulating Systems Inc. This acquisition positions Foam Holdings as a leader in the insulated concrete form (ICF) market in North America, leveraging Amvic's expertise in expanded polystyrene (EPS) ICF technology

- In September 2022, Amvic Inc. introduced the Amvic ICF system, featuring modular interlocking expanded polystyrene (EPS) building blocks with enhanced graphite properties. Notable for its flame retardant capabilities, the system enhances construction efficiency and sustainability in building projects across North America

- In April 2021, The Insulating Concrete Forms Manufacturers Association (ICFMA) partnered with the National Ready Mixed Concrete Association (NRMCA) for the Build with Strength 2.0 program. Collaborating with Habitat for Humanity International, the initiative focuses on providing affordable and sustainable housing solutions in the U.S. through concrete donations for Habitat homes

- In August 2021, Graven Hill, U.K.'s largest self and custom build community, joined forces with Iconic Development Group to introduce insulated concrete form (ICF)-constructed homes. Iconic Development Group initiated construction of six homes at Graven Hill, with plans for an additional 20 homes, marking a significant expansion of sustainable housing options in the U.K

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Insulated Concrete Form Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Insulated Concrete Form Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Insulated Concrete Form Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.