Global Insulated Gate Bipolar Transistor Igbt Market

Market Size in USD Billion

CAGR :

%

USD

9.16 Billion

USD

21.93 Billion

2024

2032

USD

9.16 Billion

USD

21.93 Billion

2024

2032

| 2025 –2032 | |

| USD 9.16 Billion | |

| USD 21.93 Billion | |

|

|

|

|

Global Insulated Gate Bipolar Transistor (IGBT) Market Size

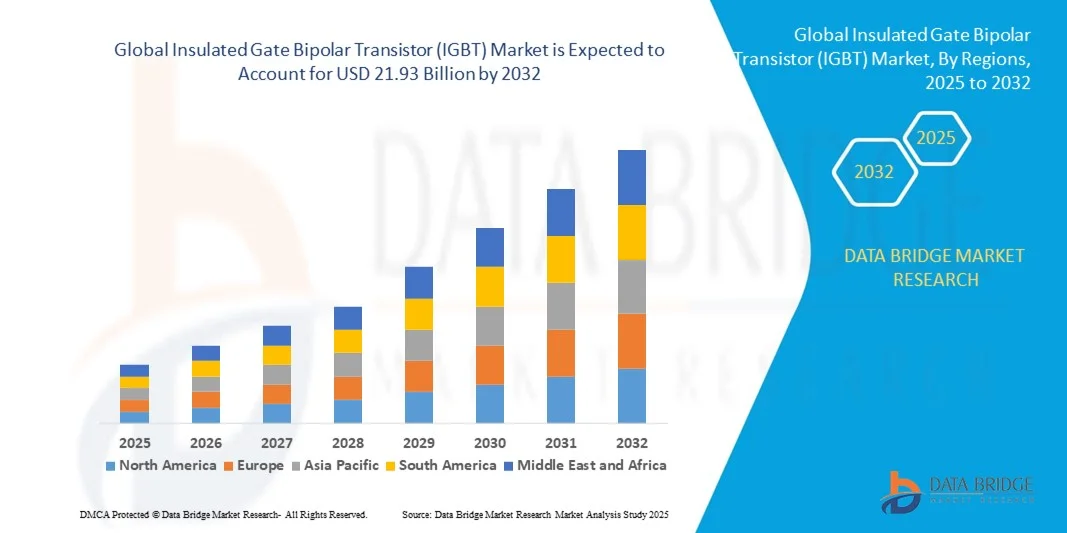

- The global Insulated Gate Bipolar Transistor (IGBT) Market size was valued at USD 9.16 billion in 2024 and is expected to reach USD 21.93 billion by 2032, growing at a CAGR of 11.52% during the forecast period.

- The market's expansion is primarily driven by the rising demand for energy-efficient electronic devices and the increasing deployment of electric vehicles (EVs), renewable energy systems, and high-voltage industrial applications.

- Additionally, advancements in power semiconductor technologies and the push for sustainable energy infrastructure are fueling IGBT adoption across sectors, positioning it as a critical component in modern power management systems and contributing substantially to market growth.

Global Insulated Gate Bipolar Transistor (IGBT) Market Analysis

- Insulated Gate Bipolar Transistors (IGBTs), which combine the high-efficiency and fast-switching features of MOSFETs with the high-current and low-saturation-voltage capabilities of bipolar transistors, are becoming critical components in power electronics across automotive, industrial, and renewable energy sectors due to their role in improving energy efficiency and system performance.

- The accelerating demand for IGBTs is largely driven by the global shift toward electric vehicles (EVs), expansion of renewable energy installations like solar and wind, and the need for efficient power management in industrial automation and consumer electronics.

- Europe dominated the global IGBT market with the largest revenue share of 34.6% in 2024, supported by rapid industrialization, government EV subsidies, and the presence of major semiconductor manufacturers in countries like China, Japan, and South Korea, all contributing to high-volume IGBT production and consumption.

- Asia-Pacific is projected to be the fastest-growing region in the IGBT market during the forecast period, propelled by stringent environmental regulations, strong EV adoption, and ongoing investments in green energy infrastructure.

- The IGBT Module segment dominated the market with the largest revenue share of 62.4% in 2024, driven by its compact integration, higher efficiency, and widespread application in high-power industrial systems and electric vehicles.

Report Scope and Global Insulated Gate Bipolar Transistor (IGBT) Market Segmentation

|

Attributes |

Insulated Gate Bipolar Transistor (IGBT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Global Insulated Gate Bipolar Transistor (IGBT) Market Trends

Enhanced Efficiency Through AI-Driven Power Management

- A significant and accelerating trend in the global Insulated Gate Bipolar Transistor (IGBT) Market is the integration of artificial intelligence (AI) into power electronics systems, enabling smarter, more adaptive, and energy-efficient power management across electric vehicles (EVs), renewable energy systems, and industrial automation. This technological convergence is significantly improving system performance, reliability, and predictive maintenance capabilities.

- For instance, in EVs, AI-enhanced powertrain controllers utilize real-time data and machine learning algorithms to dynamically optimize the performance of IGBTs within inverters and motor drives, reducing energy loss and extending battery life. Similarly, AI is being used in solar inverters to forecast energy production and adjust power conversion in real time, enhancing overall grid stability.

- AI integration with IGBT modules allows for predictive diagnostics by continuously monitoring temperature, current, and voltage conditions, enabling early detection of performance degradation or potential faults. Companies like Infineon and STMicroelectronics are incorporating intelligent features into their IGBT solutions that support data analytics and thermal modeling for enhanced system uptime and reduced maintenance costs.

- The fusion of AI with power electronics also enables adaptive switching strategies and self-optimizing controls, where IGBT modules can automatically adjust their operation based on load requirements or environmental conditions, improving energy efficiency across a wide range of applications.

- This trend toward AI-enhanced, self-regulating IGBT systems is redefining the standards for energy management in sectors such as transportation, industrial automation, and grid infrastructure. Manufacturers like Fuji Electric and ON Semiconductor are investing in AI-compatible semiconductor designs to meet the growing demand for intelligent energy solutions.

- As energy systems become increasingly complex and distributed, the demand for AI-integrated IGBT solutions is growing rapidly. Both developed and emerging markets are prioritizing smart energy infrastructure, and the role of IGBTs as core components in intelligent power systems is expected to expand significantly during the forecast period.

Global Insulated Gate Bipolar Transistor (IGBT) Market Dynamics

Driver

Growing Demand Driven by Electrification and Energy Efficiency Goals

-

The surging global focus on energy efficiency, carbon reduction, and electrification across multiple sectors is a primary driver behind the increasing demand for Insulated Gate Bipolar Transistors (IGBTs). As industries transition from mechanical to electric systems, and governments push for cleaner energy, IGBTs are becoming essential components in high-power electronic systems.

- For Instance, in May 2024, Infineon Technologies AG introduced its next-generation IGBT7 technology optimized for electric vehicles and industrial drives, offering reduced power losses and improved thermal performance. Innovations like this are supporting the rapid expansion of electric mobility and smart energy infrastructure.

- The proliferation of electric vehicles (EVs), renewable energy installations (solar and wind), and industrial automation is accelerating the adoption of IGBT modules due to their efficiency in managing high voltage and current. In EVs, IGBTs serve as critical elements in inverters and onboard chargers, while in solar systems, they enable efficient DC-AC conversion for grid compatibility.

- Additionally, rising investments in modernizing power grids and industrial equipment—especially in emerging markets—are amplifying the need for robust and scalable power management solutions where IGBTs play a crucial role.

- The ability of IGBTs to reduce switching losses, enable compact system designs, and offer reliable performance under high-stress conditions makes them indispensable in mission-critical applications. As power demand grows and efficiency standards tighten globally, the IGBT market is poised for sustained, robust growth across automotive, energy, and industrial sectors.

Restraint/Challenge

Thermal Management Complexities and High Initial Costs

- One of the primary challenges facing the global Insulated Gate Bipolar Transistor (IGBT) market is the issue of thermal management and the relatively high initial costs associated with advanced IGBT modules. IGBTs operate under high voltage and current conditions, which leads to significant heat generation that must be efficiently dissipated to ensure long-term performance and reliability.

- For Instance, high-power applications in electric vehicles (EVs), renewable energy systems, and industrial drives require sophisticated thermal solutions—such as heat sinks, liquid cooling systems, and thermal interface materials—that can add complexity and cost to the overall system. Improper heat dissipation can result in thermal stress, reduced efficiency, or even device failure, particularly in demanding environments.

- Additionally, the initial cost of high-performance IGBT modules, especially those designed for EVs or heavy industrial use, can be a barrier to entry for small and medium enterprises or for adoption in cost-sensitive regions. These modules often incorporate advanced features such as fast switching, higher voltage ratings, and robust packaging, all of which contribute to their premium pricing.

- For instance, emerging economies looking to implement smart grids or electrify transportation may struggle with the upfront investment required for IGBT-based systems compared to cheaper, less efficient alternatives. While long-term energy savings and system performance justify the investment, the initial expenditure remains a key concern.

- Addressing these issues through innovations in IGBT packaging (such as silicon carbide-based solutions), integrated thermal sensors, and more cost-effective manufacturing processes will be crucial. Furthermore, industry-wide efforts to educate system designers on best practices for thermal design and to promote the long-term cost benefits of IGBT-based solutions are essential to overcoming adoption barriers.

- As the market matures, the development of standardized, compact, and thermally optimized IGBT solutions—along with continued price reductions—will be instrumental in driving broader adoption across automotive, industrial, and energy sectors.

Global Insulated Gate Bipolar Transistor (IGBT) Market Scope

The market is segmented on the basis of type, power rating, application.

- By Type

On the basis of type, the IGBT market is segmented into Discrete IGBT and IGBT Module. The IGBT Module segment dominated the market with the largest revenue share of 62.4% in 2024, driven by its compact integration, higher efficiency, and widespread application in high-power industrial systems and electric vehicles. IGBT modules are preferred for their ability to handle high voltages and currents with lower switching losses, making them ideal for renewable energy systems, motor drives, and EV powertrains. Their modular design also simplifies installation and thermal management, which enhances reliability in demanding environments.

The Discrete IGBT segment is expected to witness the fastest CAGR of 18.9% from 2025 to 2032, fueled by increasing adoption in low- to medium-power applications such as inverters, UPS systems, and consumer electronics. Discrete IGBTs are cost-effective and offer design flexibility for compact systems where space, performance, and affordability are critical.

- By Power Rating

Based on power rating, the market is segmented into High Power, Medium Power, and Low Power IGBTs. The High Power segment accounted for the largest market share of 48.1% in 2024, owing to the growing deployment of IGBTs in utility-scale renewable energy projects, HVDC systems, and high-speed rail applications. These IGBTs are essential in scenarios where high voltage and current handling is critical, and performance under extreme thermal and electrical stress is necessary.

The Medium Power segment is projected to grow at the fastest CAGR of 19.6% from 2025 to 2032, driven by increasing integration in industrial drives, electric vehicle powertrains, and mid-scale solar inverters. These applications demand reliable switching capabilities with a balance of cost-efficiency and performance. As industrial automation and EV adoption rise globally, medium power IGBTs are becoming a preferred choice for manufacturers aiming for scalable and robust power solutions.

- By Application

On the basis of application, the IGBT market is segmented into Energy & Power, Consumer Electronics, Inverter & UPS, Electric Vehicle, Industrial System, and Others. The Electric Vehicle segment held the largest revenue share of 36.7% in 2024, propelled by the global transition to e-mobility and the vital role of IGBTs in managing EV powertrains, charging systems, and regenerative braking. With governments offering EV subsidies and automakers scaling production, demand for automotive-grade IGBTs continues to rise.

The Inverter & UPS segment is expected to witness the fastest CAGR of 21.3% from 2025 to 2032, due to increasing reliance on uninterrupted power supplies and the growing demand for solar and wind energy inverters. These systems require efficient power conversion, which IGBTs facilitate with minimal energy loss and high switching frequency. The expanding commercial and residential adoption of backup and off-grid power systems is further boosting this segment’s growth.

Global Insulated Gate Bipolar Transistor (IGBT) Market Regional Analysis

- Europe dominated the global Insulated Gate Bipolar Transistor (IGBT) market with the largest revenue share of 34.6% in 2024, driven by rapid industrialization, expansion of electric vehicle (EV) production, and large-scale investments in renewable energy infrastructure across countries like China, Japan, and South Korea.

- The region’s strong manufacturing base, combined with government support for energy-efficient technologies and electrification initiatives, has led to high adoption of IGBTs in sectors such as transportation, power generation, and industrial automation.

- Additionally, the presence of key semiconductor manufacturers and the growing demand for high-performance power electronics in emerging economies contribute significantly to market growth. Rising consumer demand for electric vehicles, alongside the region's leadership in solar and wind energy capacity additions, continues to establish Asia-Pacific as the primary hub for IGBT innovation, production, and deployment.

U.S. IGBT Market Insight

The U.S. IGBT market captured the largest revenue share of 38% in 2024 within North America, driven by increasing adoption of electric vehicles (EVs), renewable energy projects, and industrial automation. The country’s emphasis on clean energy policies and technological advancements in power electronics is fueling demand for high-efficiency IGBT modules. Growing investments in smart grids, EV infrastructure, and advanced manufacturing processes are also significant growth drivers. Furthermore, the strong presence of key semiconductor companies and R&D initiatives in silicon carbide (SiC) based IGBTs are accelerating market expansion in the U.S.

Europe IGBT Market Insight

The Europe IGBT market is projected to expand at a robust CAGR throughout the forecast period, supported by stringent environmental regulations and the transition towards sustainable energy systems. Countries like Germany, France, and the UK are witnessing strong demand for IGBTs in renewable energy installations, electric mobility, and industrial automation. The increasing focus on reducing carbon emissions and enhancing energy efficiency in manufacturing facilities is propelling the adoption of advanced power semiconductor devices. Europe’s commitment to innovation and the growth of smart grid infrastructure also bolster the market’s long-term outlook.

U.K. IGBT Market Insight

The U.K. IGBT market is expected to grow at a significant CAGR during the forecast period, fueled by the nation’s growing emphasis on electric vehicle adoption and renewable energy integration. The government's supportive policies promoting zero-emission transportation and energy-efficient industrial solutions are driving investments in IGBT technology. Moreover, the expanding manufacturing sector and smart infrastructure developments in the U.K. are boosting demand for power electronics that enhance operational efficiency and reduce energy loss, making IGBTs a critical component across various applications.

Germany IGBT Market Insight

The Germany IGBT market is anticipated to witness considerable growth, driven by the country’s leadership in industrial automation, electric mobility, and renewable energy sectors. Germany’s advanced manufacturing ecosystem, strong R&D capabilities, and focus on sustainability contribute to the rising adoption of high-performance IGBT modules. The country’s push towards Industry 4.0 and the transition to clean energy sources necessitate efficient power semiconductor devices, positioning IGBTs as a key enabler of smart and green technologies in both commercial and residential applications.

Asia-Pacific IGBT Market Insight

The Asia-Pacific IGBT market is poised to grow at the fastest CAGR of 22.5% from 2025 to 2032, led by rapid industrialization, urbanization, and electrification initiatives in China, Japan, South Korea, and India. The region’s dominance in electric vehicle production, renewable energy deployment, and consumer electronics manufacturing is driving significant demand for advanced IGBT modules. Government incentives supporting smart grid development and green energy transitions further accelerate growth. Additionally, the presence of major semiconductor manufacturers and expanding local supply chains make Asia-Pacific the global hub for IGBT innovation and production.

Japan IGBT Market Insight

Japan’s IGBT market is gaining momentum due to the country’s strong focus on energy efficiency, automation, and electric vehicle technology. The nation’s leadership in semiconductor research and precision manufacturing supports continuous advancements in IGBT performance and reliability. Increasing integration of IGBTs in industrial machinery, automotive electronics, and renewable energy projects is driving market growth. Japan’s aging population also indirectly boosts demand for automation and energy-efficient solutions, reinforcing the adoption of IGBT technology in both consumer and commercial sectors.

China IGBT Market Insight

China accounted for the largest revenue share in the Asia-Pacific IGBT market in 2024, driven by extensive investments in electric vehicles, renewable energy capacity, and smart manufacturing. As the world’s largest EV market and a leader in solar and wind power installations, China’s demand for high-performance, cost-effective IGBT modules remains strong. The government’s aggressive push towards electrification and carbon neutrality targets fuels continuous market expansion. Additionally, China’s robust semiconductor manufacturing ecosystem and increasing R&D investments ensure sustained innovation and production capacity growth in the IGBT sector.

Global Insulated Gate Bipolar Transistor (IGBT) Market Share

The Insulated Gate Bipolar Transistor (IGBT) industry is primarily led by well-established companies, including:

• Infineon Technologies AG (Germany)

• ABB Ltd (Switzerland)

• Danfoss Group (Denmark)

• Fuji Electric Co., Ltd. (Japan)

• Hitachi, Ltd. (Japan)

• Toshiba Corporation (Japan)

• ROHM CO., LTD (Japan)

• Littelfuse, Inc. (U.S.)

• StarPower Semiconductor Ltd. (China)

• Renesas Electronics Corporation (Japan)

• ON Semiconductor Corporation (U.S.)

• STMicroelectronics (Switzerland)

• IPG Photonics Corporation (U.S.)

• Texas Instruments Incorporated (U.S.)

• Analog Devices Inc. (U.S.)

• Microchip Technology Inc. (U.S.)

• Alpha & Omega Semiconductor (U.S.)

• SEMIKRON (Germany)

What are the Recent Developments in Global Insulated Gate Bipolar Transistor (IGBT) Market?

- In April 2023, Infineon Technologies AG, a global leader in semiconductor solutions, announced a strategic expansion of its IGBT manufacturing capabilities in Malaysia to meet rising demand from electric vehicle and renewable energy sectors. This initiative highlights Infineon's commitment to delivering high-performance power semiconductor devices tailored to regional market needs while reinforcing its leadership position in the rapidly growing global IGBT market.

- In March 2023, ON Semiconductor Corporation, headquartered in the USA, launched its latest high-power IGBT module designed specifically for industrial motor drives and electric vehicle applications. The new module offers improved efficiency and thermal performance, underlining ON Semiconductor’s dedication to advancing power electronics technology to support sustainable industrial growth and electric mobility.

- In March 2023, Toshiba Corporation successfully implemented a smart grid pilot project in Japan using its advanced IGBT modules to optimize energy distribution and reduce power losses. This project demonstrates Toshiba’s focus on leveraging cutting-edge IGBT technology to enhance energy efficiency and support the development of resilient, sustainable urban infrastructure.

- In February 2023, ABB Ltd, a key player in power and automation technologies, announced a strategic partnership with a leading European renewable energy firm to supply high-efficiency IGBT modules for wind turbine inverters. This collaboration aims to improve grid integration of renewable power and underscores ABB’s commitment to innovation and sustainable energy solutions in the IGBT market.

- In January 2023, Danfoss Group unveiled its next-generation IGBT power modules at the Hannover Messe industrial trade fair. These modules, designed for electric vehicles and industrial automation, offer enhanced switching speeds and thermal management capabilities. Danfoss’ launch reflects the company’s focus on driving performance improvements and reliability in power semiconductor components for global markets.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Insulated Gate Bipolar Transistor Igbt Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Insulated Gate Bipolar Transistor Igbt Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Insulated Gate Bipolar Transistor Igbt Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.