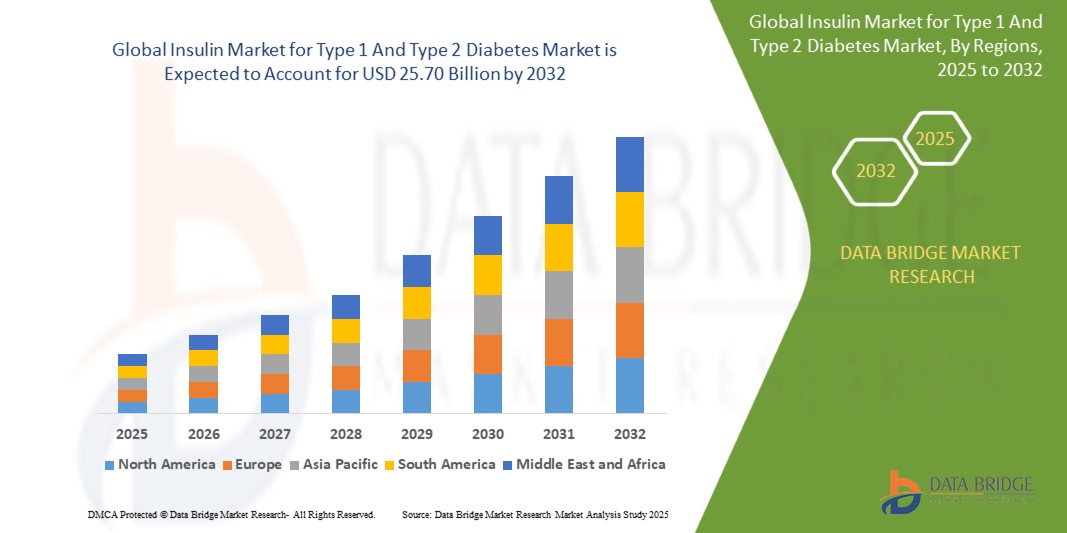

Global Insulin Market For Type 1 And Type 2 Diabetes Market

Market Size in USD Billion

CAGR :

%

USD

19.06 Billion

USD

25.70 Billion

2024

2032

USD

19.06 Billion

USD

25.70 Billion

2024

2032

| 2025 –2032 | |

| USD 19.06 Billion | |

| USD 25.70 Billion | |

|

|

|

|

Insulin Market for Type 1 And Type 2 Diabetes Market Size

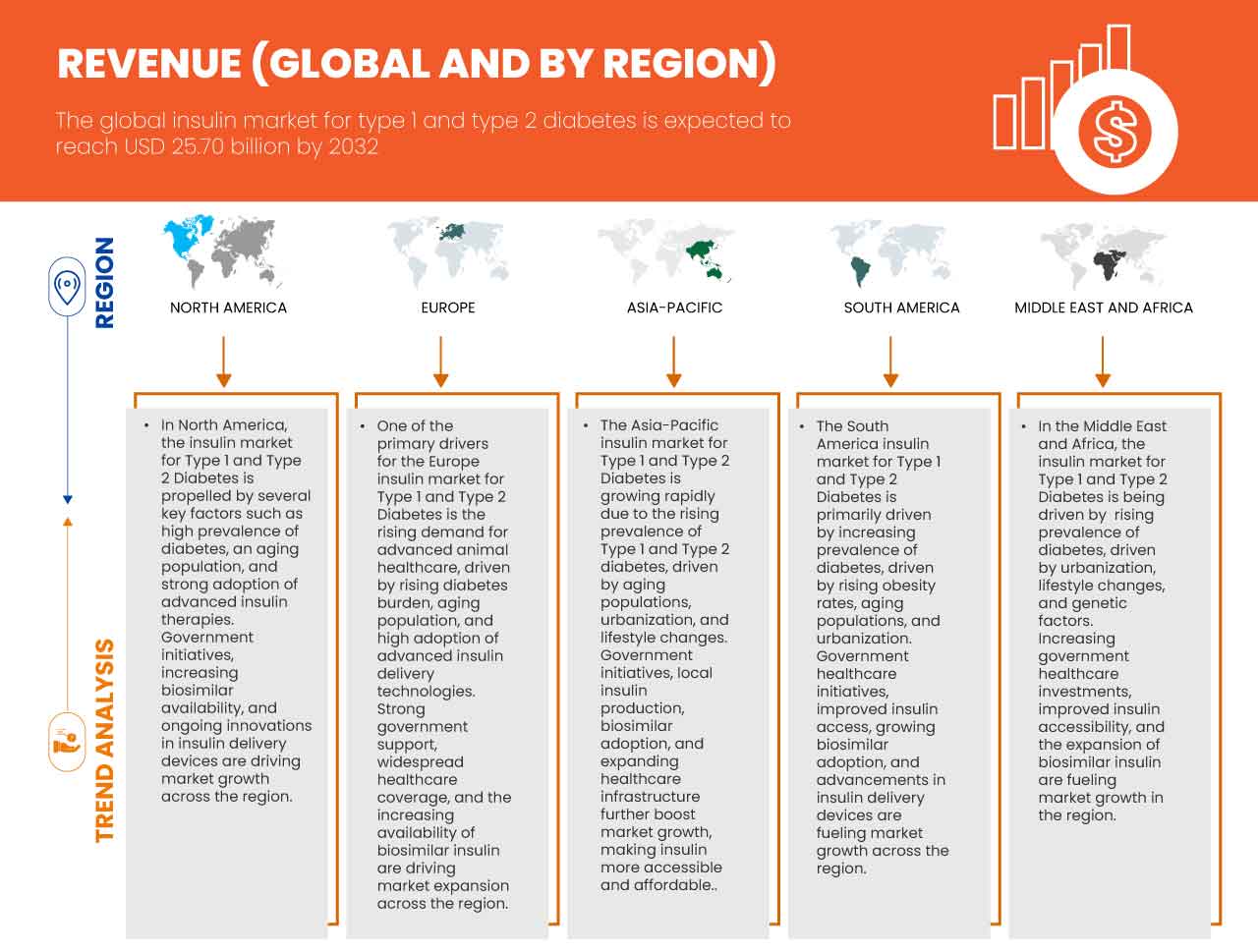

- The global insulin market for type 1 and type 2 diabetes market was valued at USD 19.06 billion in 2024 and is expected to reach USD 25.70 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.9%, primarily driven by the anticipated launch of therapies

- This growth is driven by factors such as the growing prevalence of diabetes, particularly Type 1 and Type 2, drives the demand for insulin. Additionally, advancements in insulin delivery systems and the increasing adoption of personalized diabetes care

Insulin Market for Type 1 And Type 2 Diabetes Market Analysis

- Type 1 diabetes is an autoimmune condition where the body’s immune system attacks and destroys insulin-producing beta cells in the pancreas, leading to an insulin deficiency. Type 2 diabetes occurs when the body becomes resistant to insulin or doesn't produce enough. Insulin therapy is used to regulate blood glucose levels in both conditions, improving glycemic control and preventing complications like cardiovascular diseases, kidney failure, and nerve damage

- Type 1 diabetes (T1D) is typically diagnosed in childhood or adolescence and requires lifelong insulin therapy, as the pancreas produces little to no insulin. It is an autoimmune disorder where the immune system mistakenly attacks insulin-producing beta cells. Type 2 Diabetes (T2D) is more common and primarily occurs in adults, although it is increasingly seen in children due to rising obesity rates. T2D is characterized by insulin resistance, where the body does not use insulin effectively. Over time, the pancreas cannot produce enough insulin to maintain normal blood glucose levels. Both types of diabetes require regular monitoring and insulin therapy to manage blood sugar levels effectively. Insulin treatment helps in preventing long-term complications like retinopathy, neuropathy, and cardiovascular diseases, improving the overall quality of life for patients

- The North America region stands out as one of the dominant region for Insulin Market for Type 1 And Type 2 Diabetes, driven by its advanced healthcare infrastructure and high adoption of innovative insulin delivery technologies

- For instance, U.S. continues to lead in the use of insulin pumps and continuous glucose monitoring systems, enabling better diabetes management

- With a growing focus on diabetes treatment and patient-centric solutions, the region drives significant advancements in insulin therapies, contributing greatly to global market growth

Report Scope and Insulin Market for Type 1 And Type 2 Diabetes Segmentation

|

Attributes |

Insulin Market for Type 1 And Type 2 Diabetes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Insulin Market for Type 1 And Type 2 Diabetes Market Trends

“Increased Adoption of Smart Insulin Delivery Systems”

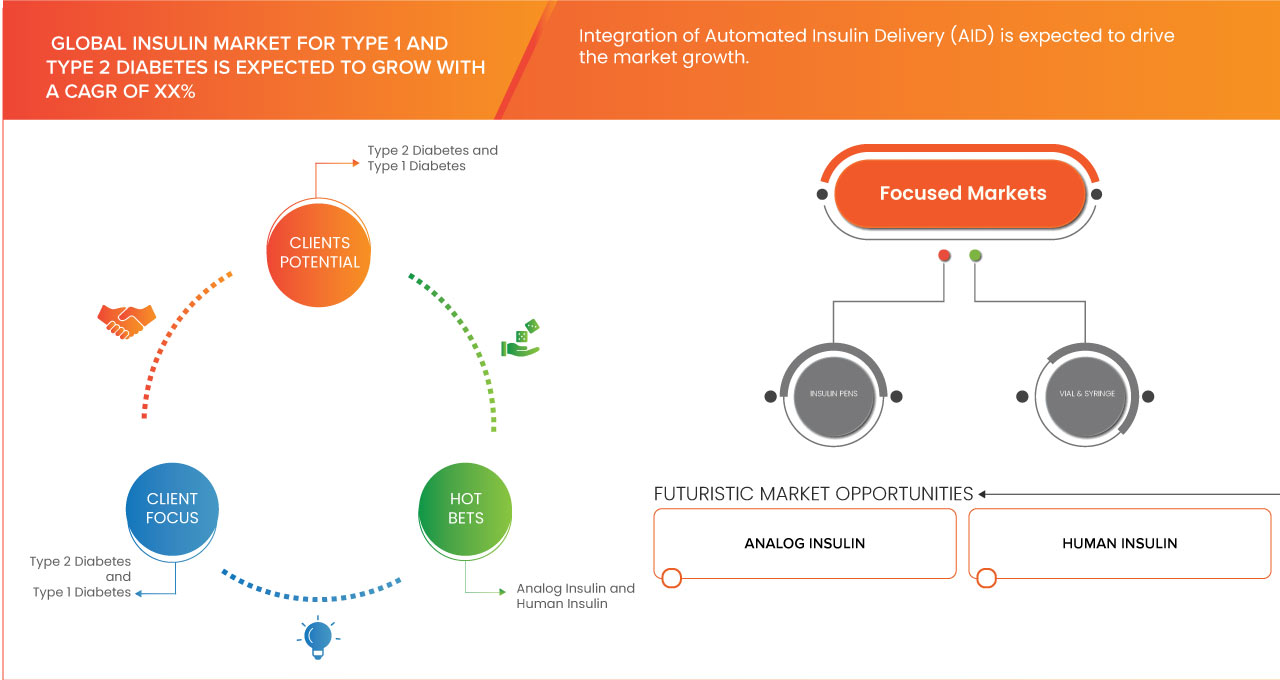

- One prominent trend in the global insulin market for type 1 and type 2 diabetes is the growing adoption of smart insulin delivery systems

- These advanced devices enhance diabetes management by offering real-time monitoring and insulin dose adjustments based on glucose levels, improving precision and overall treatment outcomes

- For instance, insulin pumps integrated with continuous glucose monitoring (CGM) systems allow for automated insulin delivery, adjusting doses based on real-time data, which helps maintain optimal glucose control with minimal manual intervention

- Digital platforms also facilitate seamless data tracking, enabling patients and healthcare providers to monitor trends, improve treatment plans, and prevent complications

- This trend is transforming diabetes care, promoting better patient compliance and outcomes, and driving the demand for advanced insulin delivery technologies in the market

Insulin Market for Type 1 And Type 2 Diabetes Market Dynamics

Driver

“Rising Prevalence of Diabetes”

- The increasing number of individuals diagnosed with diabetes creates a substantial demand for effective insulin therapies, which in turn drives growth in the global insulin market. Factors such as sedentary lifestyles, unhealthy diets, and an aging population contribute to this trend, resulting in a larger patient base requiring diabetes management solutions

- The heightened need for insulin products spurs innovation and competition among pharmaceutical companies, leading to the development of new formulations and delivery methods. This dynamic environment supports existing therapies and encourages the introduction of affordable biosimilars and improved technologies, further expanding market opportunities

For instance,

- In 2024, as per WHO, the number of people living with diabetes rose from 200 million in 1990 to 830 million in 2022. This rise was more rapid in low- and middle-income countries than in high-income countries. Diabetes caused over 2 million deaths in 2021, with significant complications like kidney failure and heart disease

- In March 2024, as per NCBI, diabetes prevalence has significantly increased, with 537 million adults affected in 2021, representing 10.5% of the population. By 2030, this number is projected to rise to 643 million (11.3%). Diabetes-related healthcare costs were $966 billion in 2021, expected to exceed $1054 billion by 2045

- The rising global prevalence of diabetes is fueling the need for innovative and convenient treatments, which can significantly improve patient quality of life and adherence to therapy. While challenges related to bioavailability and production costs remain, the market potential is vast, offering a promising solution for both Type 1 and Type 2 diabetes management.

Opportunity

“Advancements in Insulin Formulation and Delivery Technologies”

- Advancements in insulin drug formulation, including nanoparticle carriers, mucoadhesive agents, and pH-sensitive coatings, have significantly improved the bioavailability of oral insulin, making it a viable alternative to traditional injections. Innovations such as insulin analogs and smart drug delivery systems enhance absorption and enable real-time glucose monitoring. These breakthroughs address patient adherence, particularly in emerging markets with increasing diabetes prevalence, creating significant growth opportunities for the oral insulin market

For instance,

- A July 2020 article by NCBI highlighted that the urgent need for innovative treatments to address the growing diabetes burden. Key needs include improving patient adherence to treatment regimens, reducing healthcare costs, and providing effective, non-invasive solutions for diabetes management. Advancements like oral insulin and smart drug delivery systems present promising opportunities to meet these challenges and improve patient outcomes

- In August 2024, MDPI reported that advancements in drug delivery systems, such as nanoparticles and liposomes, to improve oral insulin bioavailability. These innovations offer a significant opportunity to enhance diabetes management by providing non-invasive, effective treatments. As global diabetes rates rise, such advancements meet the increasing demand for patient-centric solutions. As diabetes prevalence grows globally, these advancements in drug delivery systems cater to the need for more accessible, patient-focused treatments

- The ongoing advancements in drug formulation and technology are transforming the oral insulin landscape, providing significant opportunities for better management of diabetes. Innovations in bioavailability enhancement, novel drug delivery systems, and the integration of digital health tools pave the way for oral insulin to become a reliable, non-invasive alternative to injectable therapies. As the global diabetes epidemic continues to rise, these technological innovations not only boost patient adherence but also enable more efficient, tailored diabetes management, ultimately improving the quality of life

Restraint/Challenge

“Adverse Effects of High Dosage Of Insulin”

- High dosages of insulin can result in considerable adverse effects such as hypoglycemia, weight gain, and potential cardiovascular issues, which may discourage both patients and healthcare providers from embracing insulin therapies

- As a result, concerns over these complications can lead to greater caution in prescribing practices, ultimately hindering the expansion of the global insulin market for Type 1 and Type 2 diabetes, as patients increasingly turn to alternative treatments or management strategies

For instance,

- In July 2023, NCBI stated that Hypoglycemia is the most common adverse effect of insulin therapy. The other adverse effects of insulin therapy include weight gain and rarely electrolyte disturbances such as hypokalemia, especially when used along with other drugs causing hypokalemia. Moreover, pain at the injection site and lipodystrophy at the injection site are the most common adverse effects of daily subcutaneous injections

- Moreover, the fear of adverse reactions from high dosages can result in increased healthcare costs due to hospitalization or the need for additional medications to manage side effects. This financial burden can limit access to insulin therapies, particularly in developing regions where healthcare resources are constrained, further contributing to a restrained global insulin market. Increased awareness and education about these risks are essential, but they also underline the challenges the market faces in encouraging widespread adherence to insulin regimens

Global Insulin Market for Type 1 and Type 2 Diabetes Market Scope

The market is segmented on the basis type, product type, absorption site, age group, source, delivery method, gender, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Product Type |

|

|

By Absorption Site |

|

|

By Age Group

|

|

|

By Source |

|

|

By Delivery Method |

|

|

By Gender

|

|

|

By Distribution Channel

|

|

Insulin Market for Type 1 and Type 2 Diabetes Market Regional Analysis

“North America is the Dominant Region in the Insulin Market for Type 1 and Type 2 Diabetes”

- North America dominates the insulin market for Type 1 and Type 2 Diabetes, driven by advanced healthcare infrastructure, high adoption of innovative insulin therapies, and the strong presence of leading pharmaceutical companies

- The U.S. holds a significant share due to the rising prevalence of diabetes, increased demand for advanced insulin delivery systems, and continuous innovations in diabetes management technologies

- The availability of well-established healthcare policies and robust reimbursement structures, along with substantial investments in research & development by top insulin manufacturers, further strengthens the market.

- Additionally, the growing focus on personalized diabetes care, along with an increase in the adoption of insulin pumps and continuous glucose monitoring (CGM) systems, is fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the Insulin Market for Type 1 and Type 2 Diabetes, driven by rapid improvements in healthcare infrastructure, increasing awareness about diabetes management, and rising adoption of advanced insulin therapies

- Countries such as China, India, and Japan are emerging as key markets due to the growing aging population, which is more susceptible to diabetes-related complications

- Japan, with its advanced healthcare systems and increasing number of diabetes specialists, remains a crucial market for insulin therapies. The country continues to lead in the adoption of innovative insulin delivery devices, such as insulin pumps and continuous glucose monitoring (CGM) systems

- China and India, with their large diabetic populations and rising rates of diabetes-related health complications, are witnessing increased government and private sector investments in modern diabetes care solutions. The expanding presence of global insulin manufacturers and improving access to advanced diabetes treatment options further contribute to market growth

Insulin Market for Type 1 and Type 2 Diabetes Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Novo Nordisk A/S (Denmark)

- Eli Lilly and Company (U.S.)

- Sanofi (France)

- Biocon (India)

- Lupin (India)

- Shanghai Fosun Wanbang (Jiangsu) Pharmaceutical Group Co., Ltd. (China)

- Diasome Pharmaceuticals, Inc. (U.S.)

- SciGen Pte. Ltd. (Singapore)

- Wockhardt (India)

- MJ Biopharma Pvt. Ltd. (India)

- Oramed Pharmaceuticals (U.S.)

- Adocia (France)

- Nektar Therapeutics (U.S.)

Latest Developments in Global Insulin Market for Type 1 and Type 2 Diabetes

- In September 2024, Novo Nordisk has announced a new partnership to establish human insulin production in South Africa, strengthening its commitment to diabetes care in Africa. Currently reaching 500,000 people in Sub-Saharan Africa, this initiative aims to expand insulin access, with a goal of supplying 4.1 million people with type 1 and type 2 diabetes across the continent by 2026

- In August, Eli Lilly announced positive results from the SURMOUNT-1 study, showing that weekly tirzepatide (Zepbound/Mounjaro) reduced the risk of type 2 diabetes by 94% in adults with pre-diabetes and obesity or overweight. The 15 mg dose led to a 22.9% average weight loss over 176 weeks, demonstrating sustained efficacy

- In December 2022, Sanofi expanded its collaboration with Innate Pharma, focusing on natural killer (NK) cell engagers in oncology. Sanofi licensed the B7H3-targeting NK cell engager program from Innate's ANKET platform, with the option to add two more targets. This partnership aims to develop new cancer therapies, including treatments for solid tumors, enhancing Sanofi's immuno-oncology pipeline. The collaboration is expected to provide innovative cancer treatment options with a strong safety profile, benefiting patients by offering potential therapies for multiple cancer types. Sanofi will handle further development, manufacturing, and commercialization responsibilities

- In December 2024, Lupin Acquired Huminsulin from Lilly to Enhance Diabetes Portfolio. It was performed in the aim to expand diabetes portfolio and provide high-quality, affordable health care to our patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 COMPETITIVE INTELLIGENCE

4.4 GLOBAL AND REGIONAL PREVALENCE:

4.5 INDUSTRY INSIGHTS

4.6 KEY MARKETING STRATEGIES FOR THE GLOBAL INSULIN MARKET TYPE 1 & TYPE 2 DIABETES

4.7 MARKETED DRUG ANALYSIS

5 PIPELINE ANALYSIS

6 REGULATORY FRAMEWORK

6.1 REGULATORY FRAMEWORK FOR THE ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.1.1 REGULATORY APPROVAL PROCESS

6.1.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.1.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.1.4 LICENSING AND REGISTRATION

6.1.5 POST-MARKETING SURVEILLANCE

6.1.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6.2 REGULATORY FRAMEWORK FOR THE NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.2.1 REGULATORY APPROVAL PROCESS

6.2.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.2.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.2.4 LICENSING AND REGISTRATION

6.2.5 POST-MARKETING SURVEILLANCE

6.2.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6.3 REGULATORY FRAMEWORK FOR THE SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.3.1 REGULATORY APPROVAL PROCESS

6.3.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.3.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.3.4 LICENSING AND REGISTRATION

6.3.5 POST-MARKETING SURVEILLANCE

6.3.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6.4 REGULATORY FRAMEWORK FOR THE EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.4.1 REGULATORY APPROVAL PROCESS

6.4.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.4.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.4.4 LICENSING AND REGISTRATION

6.4.5 POST-MARKETING SURVEILLANCE

6.4.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6.5 REGULATORY FRAMEWORK FOR THE MIDDLE EAST & AFRICA (MEA) INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

6.5.1 REGULATORY APPROVAL PROCESS

6.5.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

6.5.3 REGULATORY APPROVAL PATHWAYS (COUNTRY-WISE)

6.5.4 LICENSING AND REGISTRATION

6.5.5 POST-MARKETING SURVEILLANCE

6.5.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING PREVALENCE OF DIABETES

7.1.2 GROWING ADOPTION OF INSULIN THERAPIES FOR TYPE 1 AND TYPE 2 DIABETES

7.1.3 INTEGRATION OF AUTOMATED INSULIN DELIVERY (AID)

7.1.4 INCREASING TECHNOLOGICAL INNOVATIONS FOR INSULIN

7.2 RESTRAINTS

7.2.1 ADVERSE EFFECTS OF HIGH DOSAGE OF INSULIN

7.2.2 HIGH PRODUCTION AND DEVELOPMENT COSTS ASSOCIATED WITH INSULIN

7.3 OPPORTUNITIES

7.3.1 ADVANCEMENTS IN INSULIN FORMULATION AND DELIVERY TECHNOLOGIES

7.3.2 REVOLUTIONIZING DIABETES MANAGEMENT WITH NEEDLE-FREE INSULIN

7.3.3 INCREASING PHARMACEUTICAL INVESTMENTS AND STRATEGIC COLLABORATIONS

7.4 CHALLENGES

7.4.1 INSULIN ACCESSIBILITY CHALLENGES IN RURAL AND UNDERSERVED REGIONS

7.4.2 LIMITED SHELF LIFE ASSOCIATED WITH ORAL INSULIN

8 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE

8.1 OVERVIEW

8.2 TYPE 2 DIABETES

8.3 TYPE 1 DIABETES

9 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE

9.1 OVERVIEW

9.2 ANALOG INSULIN

9.3 HUMAN INSULIN

9.4 OTHERS

10 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE

10.1 OVERVIEW

10.2 LONG ACTING INSULIN

10.3 RAPID-ACTING INSULIN

10.4 SHORT ACTING INSULIN

10.5 OTHERS

11 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER

11.1 OVERVIEW

11.2 MALE

11.3 FEMALE

12 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD

12.1 OVERVIEW

12.2 INSULIN PENS

12.3 VIAL & SYRINGE

12.4 INSULIN PUMPS

12.5 INHALABLE INSULIN

12.6 IMPLANTABLE INSULIN DELIVERY SYSTEMS

13 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP

13.1 OVERVIEW

13.2 ADULT PATIENTS

13.3 GERIATRIC PATIENTS

13.4 PEDIATRIC PATIENTS

14 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE

14.1 OVERVIEW

14.2 BASAL

14.3 BOLUS

14.4 OTHERS

15 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 RETAIL PHARMACIES

15.3 HOSPITAL PHARMACIES

15.4 ONLINE PHARMACIES

15.5 DIABETES CLINICS & SPECIALTY PHARMACIES

16 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES MARKET, BY REGION

16.1 OVERVIEW

16.2 NORTH AMERICA

16.2.1 U.S

16.2.2 CANADA

16.2.3 MEXICO

16.3 EUROPE

16.3.1 GERMANY

16.3.2 FRANCE

16.3.3 U.K

16.3.4 ITALY

16.3.5 RUSSIA

16.3.6 SPAIN

16.3.7 TURKEY

16.3.8 NETHERLANDS

16.3.9 SWITZERLAND

16.3.10 AUSTRIA

16.3.11 IRELAND

16.3.12 NORWAY

16.3.13 POLAND

16.3.14 REST OF EUROPE

16.4 ASIA-PACIFIC

16.4.1 CHINA

16.4.2 INDIA

16.4.3 JAPAN

16.4.4 SOUTH KOREA

16.4.5 AUSTRALIA

16.4.6 INDONESIA

16.4.7 THAILAND

16.4.8 MALAYSIA

16.4.9 VIETNAM

16.4.10 PHILIPPINES

16.4.11 TAIWAN

16.4.12 SINGAPORE

16.4.13 REST OF ASIA-PACIFIC

16.5 SOUTH AMERICA

16.5.1 BRAZIL

16.5.2 ARGENTINA

16.5.3 CHILE

16.5.4 PERU

16.5.5 REST OF SOUTH AMERICA

16.6 MIDDLE EAST AND AFRICA

16.6.1 SAUDI ARABIA

16.6.2 SOUTH AFRICA

16.6.3 EGYPT

16.6.4 U.A.E

16.6.5 ISRAEL

16.6.6 KUWAIT

16.6.7 REST OF MIDDLE EAST AND AFRICA

17 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 NOVO NORDISK A/S

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 SWOT ANALYSIS

19.1.5 PIPELINE PORTFOLIO

19.1.6 RECENT DEVELOPMENT/ NEWS

19.2 LILLY

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 SWOT ANALYSIS

19.2.5 PRODUCT PORTFOLIO

19.2.6 RECENT DEVELOPMENT

19.3 SANOFI

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 SWOT ANALYSIS

19.3.5 PRODUCT PORTFOLIO

19.3.6 RECENT DEVELOPMENT

19.4 BIOCON

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 SWOT ANALYSIS

19.4.5 PIPELINE PRODUCT PORTFOLIO

19.4.6 RECENT DEVELOPMENT

19.5 LUPIN

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 SWOT ANALYSIS

19.5.5 PRODUCT PORTFOLIO

19.5.6 RECENT DEVELOPMENT

19.6 ADOCIA

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 SWOT ANALYSIS

19.6.4 PRODUCT PORTFOLIO

19.6.5 RECENT DEVELOPMENT

19.7 DIASOME PHARMACEUTICALS, INC.

19.7.1 COMPANY SNAPSHOT

19.7.2 SWOT ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENT

19.8 MJ BIOPHARM PVT LTD.

19.8.1 COMPANY SNAPSHOT

19.8.2 SWOT ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENT

19.9 NEKTAR

19.9.1 COMPANY SNAPSHOT

19.9.2 SWOT ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT NEWS

19.1 ORAMED

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 SWOT ANALYSIS

19.10.4 PIPELINE PRODUCT PORTFOLIO

19.10.5 RECENT DEVELOPMENT

19.11 SCIGEN PTE. LTD.

19.11.1 COMPANY SNAPSHOT

19.11.2 SWOT ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENT

19.12 SHANGHAI FOSUN PHARMACEUTICAL(GROUP)CO., LTD.

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 SWOT ANALYSIS

19.12.4 PRODUCT PORTFOLIO

19.12.5 RECENT DEVELOPMENT

19.13 WOCKHARDT

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 SWOT ANALYSIS

19.13.4 PRODUCT PORTFOLIO

19.13.5 RECENT DEVELOPMENT

20 QUESTIONNAIRE

List of Table

TABLE 1 THE TOP 10 COUNTRIES BY THE NUMBER OF ADULTS WITH DIABETES IN 2021

TABLE 2 DISTRIBUTION OF EXPENDITURE ACROSS REGIONS:

TABLE 3 NUMBER OF ADULTS WITH DIABETES IS EXPECTED TO INCREASE SIGNIFICANTLY IN SEVERAL COUNTRIES:

TABLE 4 REGIONAL DIABETES STATISTICS: PREVALENCE, TREATMENT, AND OUTCOMES

TABLE 5 GLOBAL CLINICAL TRIAL MARKET FOR ORAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

TABLE 6 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE GLOBAL ORAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

TABLE 7 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE GLOBAL ORAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES

TABLE 8 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 GLOBAL TYPE 2 DIABETES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL TYPE 1 DIABETES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL ANALOG INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL HUMAN INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL OTHERS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL LONG ACTING INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL RAPID-ACTING INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL SHORT ACTING INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL OTHERS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL MALE IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL FEMALE IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL INSULIN PENS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL VIAL & SYRINGE IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL INSULIN PUMPS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL INHALABLE INSULIN IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL IMPLANTABLE INSULIN DELIVERY SYSTEMS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 30 GLOBAL ADULT PATIENTS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 GLOBAL GERIATRIC PATIENTS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 GLOBAL PEDIATRIC PATIENTS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 34 GLOBAL BASAL IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 GLOBAL BOLUS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 GLOBAL OTHERS IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 GLOBAL RETAIL PHARMACIES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 GLOBAL HOSPITAL PHARMACIES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 GLOBAL ONLINE PHARMACIES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 GLOBAL DIABETES CLINICS & SPECIALTY PHARMACIES IN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES MARKET, BY REGION, 2021-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 52 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 55 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 56 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 59 U.S. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 60 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 63 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 64 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 65 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 66 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 67 CANADA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 68 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 71 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 72 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 73 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 74 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 75 MEXICO INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 76 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 80 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 83 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 84 EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 85 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 88 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 89 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 90 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 91 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 92 GERMANY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 93 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 96 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 97 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 98 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 99 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 100 FRANCE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 101 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 104 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 105 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 106 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 107 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 108 U.K. INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 109 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 112 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 113 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 114 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 115 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 116 ITALY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 117 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 120 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 121 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 122 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 123 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 124 RUSSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 125 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 128 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 129 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 130 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 131 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 132 SPAIN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 133 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 136 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 137 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 138 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 139 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 140 TURKEY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 141 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 144 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 145 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 146 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 147 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 148 NETHERLANDS INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 149 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 152 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 153 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 154 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 155 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 156 SWITZERLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 157 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 160 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 161 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 162 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 163 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 164 AUSTRIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 165 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 168 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 169 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 170 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 171 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 172 IRELAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 173 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 176 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 177 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 178 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 179 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 180 NORWAY INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 181 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 184 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 185 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 186 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 187 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 188 POLAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 189 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 192 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 193 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 194 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 195 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 196 REST OF EUROPE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 197 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 198 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 201 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 202 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 203 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 204 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 205 ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 206 CHINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 CHINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 CHINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 209 CHINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 210 CHINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 211 CHINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 212 CHINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 213 CHINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 214 INDIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 INDIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 INDIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 217 INDIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 218 INDIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 219 INDIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 220 INDIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 221 INDIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 222 JAPAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 JAPAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 JAPAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 225 JAPAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 226 JAPAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 227 JAPAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 228 JAPAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 229 JAPAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 230 SOUTH KOREA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 SOUTH KOREA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 SOUTH KOREA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 233 SOUTH KOREA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 234 SOUTH KOREA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 235 SOUTH KOREA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 236 SOUTH KOREA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 237 SOUTH KOREA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 238 AUSTRALIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 AUSTRALIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 AUSTRALIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 241 AUSTRALIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 242 AUSTRALIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 243 AUSTRALIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 244 AUSTRALIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 245 AUSTRALIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 246 INDONESIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 INDONESIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 INDONESIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 249 INDONESIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 250 INDONESIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 251 INDONESIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 252 INDONESIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 253 INDONESIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 254 THAILAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 THAILAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 THAILAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 257 THAILAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 258 THAILAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 259 THAILAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 260 THAILAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 261 THAILAND INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 262 MALAYSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 MALAYSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 MALAYSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 265 MALAYSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 266 MALAYSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 267 MALAYSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 268 MALAYSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 269 MALAYSIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 270 VIETNAM INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 VIETNAM INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 VIETNAM INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 273 VIETNAM INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 274 VIETNAM INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 275 VIETNAM INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 276 VIETNAM INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 277 VIETNAM INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 278 PHILIPPINES INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 PHILIPPINES INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 PHILIPPINES INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 281 PHILIPPINES INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 282 PHILIPPINES INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 283 PHILIPPINES INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 284 PHILIPPINES INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 285 PHILIPPINES INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 286 TAIWAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 TAIWAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 TAIWAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 289 TAIWAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 290 TAIWAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 291 TAIWAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 292 TAIWAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 293 TAIWAN INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 294 SINGAPORE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 SINGAPORE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 SINGAPORE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 297 SINGAPORE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 298 SINGAPORE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 299 SINGAPORE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 300 SINGAPORE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 301 SINGAPORE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 302 REST OF ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 REST OF ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 REST OF ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 305 REST OF ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 306 REST OF ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 307 REST OF ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 308 REST OF ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 309 REST OF ASIA-PACIFIC INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 310 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 311 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 314 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 315 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 316 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 317 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 318 SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 319 BRAZIL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 BRAZIL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 BRAZIL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 322 BRAZIL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 323 BRAZIL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 324 BRAZIL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 325 BRAZIL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 326 BRAZIL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 327 ARGENTINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 ARGENTINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 ARGENTINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 330 ARGENTINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 331 ARGENTINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 332 ARGENTINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 333 ARGENTINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 334 ARGENTINA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 335 CHILE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 CHILE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 CHILE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 338 CHILE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 339 CHILE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 340 CHILE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 341 CHILE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 342 CHILE INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 343 PERU INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 PERU INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 PERU INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 346 PERU INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 347 PERU INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 348 PERU INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 349 PERU INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 350 PERU INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 351 REST OF SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 REST OF SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 REST OF SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 354 REST OF SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 355 REST OF SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 356 REST OF SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 357 REST OF SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 358 REST OF SOUTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 359 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 360 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 363 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 364 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 365 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 366 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 367 MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 368 SAUDI ARABIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 SAUDI ARABIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 370 SAUDI ARABIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 371 SAUDI ARABIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 372 SAUDI ARABIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 373 SAUDI ARABIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 374 SAUDI ARABIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 375 SAUDI ARABIA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 376 SOUTH AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 SOUTH AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 378 SOUTH AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 379 SOUTH AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 380 SOUTH AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 381 SOUTH AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 382 SOUTH AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 383 SOUTH AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 384 EGYPT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 EGYPT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 EGYPT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 387 EGYPT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 388 EGYPT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 389 EGYPT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 390 EGYPT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 391 EGYPT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 392 U.A.E INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 393 U.A.E INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 394 U.A.E INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 395 U.A.E INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 396 U.A.E INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 397 U.A.E INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 398 U.A.E INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 399 U.A.E INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 400 ISRAEL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 401 ISRAEL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 402 ISRAEL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 403 ISRAEL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 404 ISRAEL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 405 ISRAEL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 406 ISRAEL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 407 ISRAEL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 408 KUWAIT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 409 KUWAIT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 KUWAIT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 411 KUWAIT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 412 KUWAIT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 413 KUWAIT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 414 KUWAIT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 415 KUWAIT INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 416 REST OF MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 417 REST OF MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 418 REST OF MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY ABSORPTION SITE, 2018-2032 (USD THOUSAND)

TABLE 419 REST OF MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 420 REST OF MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 421 REST OF MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DELIVERY METHOD, 2018-2032 (USD THOUSAND)

TABLE 422 REST OF MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 423 REST OF MIDDLE EAST AND AFRICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: SEGMENTATION

FIGURE 2 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: DATA TRIANGULATION

FIGURE 3 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: DROC ANALYSIS

FIGURE 4 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: SEGMENTATION

FIGURE 10 TWO SEGMENTS COMPRISE THE GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES, BY TYPE

FIGURE 11 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISING PREVALENCE OF DIABETES IS EXPECTED TO DRIVE THE GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 TYPE 2 DIABETES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES IN THE FORECAST PERIOD OF 2025 & 2032

FIGURE 15 NORTH AMERICA IS EXPECTED TO DOMINATE THE MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 ASIA-PACIFIC IS THE FASTEST-GROWING REGION FOR GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 TOP 10 COUNTRIES BY THE NUMBER OF ADULTS WITH DIABETES IN 2021

FIGURE 18 GLOBAL HEALTHCARE EXPENDITURE FOR DIABETES

FIGURE 19 NUMBER OF PEOPLE WITH DIABETES IN 2045 (MILLIONS)

FIGURE 20 DROC ANALYSIS

FIGURE 21 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY TYPE, 2024

FIGURE 22 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 23 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY TYPE, CAGR (2025-2032)

FIGURE 24 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY TYPE, LIFELINE CURVE

FIGURE 25 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY SOURCE, 2024

FIGURE 26 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY SOURCE, 2025 TO 2032 (USD THOUSAND)

FIGURE 27 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY SOURCE, CAGR (2025-2032)

FIGURE 28 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY SOURCE, LIFELINE CURVE

FIGURE 29 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY PRODUCT TYPE, 2024

FIGURE 30 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY PRODUCT TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 31 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY PRODUCT TYPE, CAGR (2025-2032)

FIGURE 32 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 33 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY GENDER, 2024

FIGURE 34 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY GENDER, 2025 TO 2032 (USD THOUSAND)

FIGURE 35 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY GENDER, CAGR (2025-2032)

FIGURE 36 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY GENDER, LIFELINE CURVE

FIGURE 37 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DELIVERY METHOD, 2024

FIGURE 38 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DELIVERY METHOD, 2025 TO 2032 (USD THOUSAND)

FIGURE 39 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DELIVERY METHOD, CAGR (2025-2032)

FIGURE 40 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DELIVERY METHOD, LIFELINE CURVE

FIGURE 41 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY AGE GROUP, 2024

FIGURE 42 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY AGE GROUP, 2025 TO 2032 (USD THOUSAND)

FIGURE 43 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY AGE GROUP, CAGR (2025-2032)

FIGURE 44 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY AGE GROUP, LIFELINE CURVE

FIGURE 45 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY ABSORPTION SITE, 2024

FIGURE 46 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY ABSORPTION SITE, 2025 TO 2032 (USD THOUSAND)

FIGURE 47 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY ABSORPTION SITE, CAGR (2025-2032)

FIGURE 48 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY ABSORPTION SITE, LIFELINE CURVE

FIGURE 49 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DISTRIBUTION CHANNEL, 2024

FIGURE 50 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 51 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 52 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 53 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: SNAPSHOT (2024)

FIGURE 54 GLOBAL INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: COMPANY SHARE 2024 (%)

FIGURE 55 NORTH AMERICA INSULIN MARKET FOR TYPE 1 AND TYPE 2 DIABETES: COMPANY SHARE 2024 (%)