Global Insulin Secretagogue Market

Market Size in USD Billion

CAGR :

%

USD

2.83 Billion

USD

5.59 Billion

2024

2032

USD

2.83 Billion

USD

5.59 Billion

2024

2032

| 2025 –2032 | |

| USD 2.83 Billion | |

| USD 5.59 Billion | |

|

|

|

|

Insulin Secretagogue Market Size

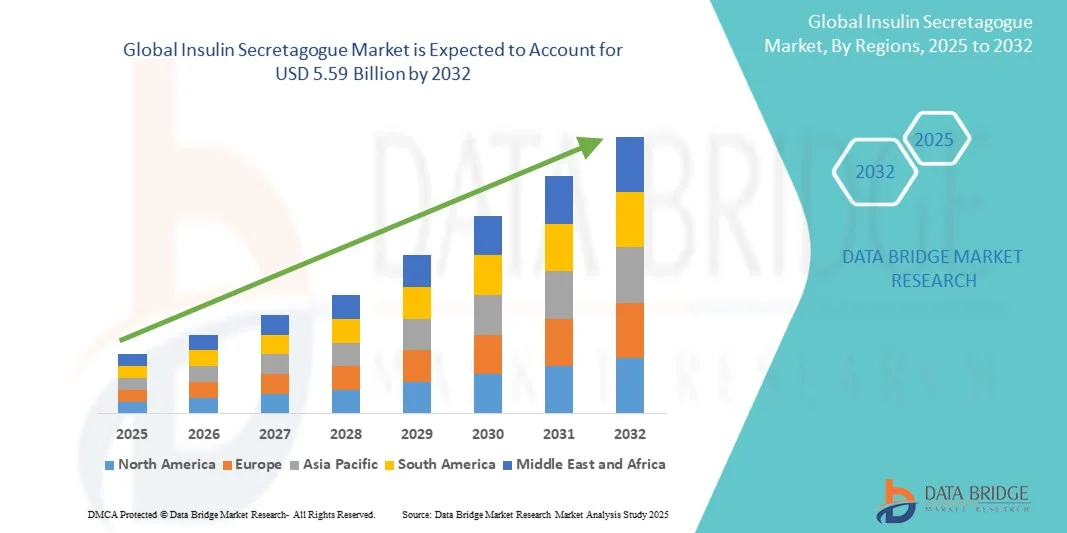

- The global insulin secretagogue market size was valued at USD 2.83 billion in 2024 and is expected to reach USD 5.59 billion by 2032, at a CAGR of 8.89% during the forecast period

- The market growth is largely driven by the increasing prevalence of diabetes worldwide and the rising adoption of oral antidiabetic therapies, particularly among patients seeking effective glycemic control

- Furthermore, advancements in drug formulations, the development of combination therapies, and growing awareness of diabetes management are enhancing the appeal of insulin secretagogues as an effective treatment option. These converging factors are accelerating market adoption, thereby significantly boosting the industry's growth

Insulin Secretagogue Market Analysis

- Insulin secretagogues, a class of oral antidiabetic drugs that stimulate pancreatic insulin secretion, are increasingly critical in the management of type 2 diabetes due to their efficacy in lowering blood glucose levels and convenience of oral administration compared with injectable therapies

- The rising prevalence of diabetes, increasing healthcare awareness, and a growing preference for non-invasive treatment options are primary factors driving the demand for insulin secretagogues

- North America dominated the insulin secretagogue market with the largest revenue share of 39.9% in 2024, supported by early adoption of advanced diabetes management therapies, high healthcare expenditure, and the presence of leading pharmaceutical companies, with the U.S. witnessing significant uptake of newer drug formulations and combination therapies tailored for glycemic control

- Asia-Pacific is expected to be the fastest-growing region in the insulin secretagogue market during the forecast period, driven by rapid urbanization, increasing incidence of type 2 diabetes, and expanding healthcare infrastructure

- Sulfonylurea segment dominated the insulin secretagogue market with a market share of 46.1% in 2024, owing to its long-standing clinical use, cost-effectiveness, and proven efficacy in reducing blood sugar levels in type 2 diabetes patients

Report Scope and Insulin Secretagogue Market Segmentation

|

Attributes |

Insulin Secretagogue Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Insulin Secretagogue Market Trends

“Rising Preference for Personalized and Combination Therapies”

- A significant and accelerating trend in the global insulin secretagogue market is the growing focus on personalized diabetes management and fixed-dose combination therapies that pair insulin secretagogues with other antidiabetic agents for enhanced efficacy and reduced side effects

- For instance, gliclazide-metformin combination tablets are being increasingly prescribed to provide effective glycemic control while improving patient adherence and minimizing hypoglycemia risk

- The integration of continuous glucose monitoring (CGM) data with insulin secretagogue treatment plans enables more precise dosing and tailored therapy adjustments, enhancing overall patient outcomes

- Healthcare providers are increasingly leveraging patient-specific factors such as age, weight, comorbidities, and lifestyle patterns to recommend optimized therapy regimens that maximize efficacy and safety

- This trend towards more targeted, convenient, and combination-based insulin secretagogue therapies is reshaping prescriber and patient expectations for oral antidiabetic treatments

- The demand for insulin secretagogues in combination therapies and personalized treatment plans is growing rapidly across both developed and emerging markets, as healthcare systems prioritize better diabetes management and adherence

Insulin Secretagogue Market Dynamics

Driver

“Increasing Diabetes Prevalence and Growing Awareness of Oral Therapies”

- The rising prevalence of type 2 diabetes globally, combined with growing awareness of oral antidiabetic options, is a significant driver for the heightened demand for insulin secretagogues

- For instance, in March 2024, a report by the International Diabetes Federation highlighted a continued surge in adult diabetes cases, emphasizing the need for accessible oral treatment options such as sulfonylureas and meglitinides

- As patients and healthcare providers seek effective alternatives to injectable therapies, insulin secretagogues provide a convenient oral option that supports glycemic control and enhances patient compliance

- Furthermore, expanding public health initiatives and educational campaigns are increasing awareness of diabetes management options, encouraging early intervention and sustained therapy adherence

- The convenience of oral administration, cost-effectiveness, and proven efficacy in type 2 diabetes management are key factors propelling adoption in both outpatient and hospital settings

- The trend towards early diagnosis, patient education, and oral treatment preference continues to boost the insulin secretagogue market in both established and emerging healthcare systems

Restraint/Challenge

“Side Effects, Hypoglycemia Risk, and Regulatory Hurdles”

- Concerns regarding potential side effects, including hypoglycemia and weight gain, pose significant challenges to broader adoption of insulin secretagogues in some patient populations

- For instance, gliclazide and glipizide have reported cases of severe hypoglycemia in elderly patients or those with renal impairment, making prescribers cautious in selecting these therapies

- Stringent regulatory requirements and safety monitoring obligations across regions can delay product launches and increase development costs, affecting market expansion

- Addressing these challenges through improved drug formulations, risk mitigation strategies, and patient education is crucial to maintaining prescriber confidence and market growth

- In addition, competition from newer classes of antidiabetic drugs, such as GLP-1 receptor agonists and SGLT2 inhibitors, can limit the adoption of insulin secretagogues, particularly in patients seeking therapies with a lower risk of adverse effects

- Overcoming these challenges through safer formulations, regulatory compliance, and awareness campaigns will be vital for sustaining growth in the insulin secretagogue market

Insulin Secretagogue Market Scope

The market is segmented on the basis of type, route of administration, end users, and distribution channel.

- By Type

On the basis of type, the insulin secretagogue market is segmented into sulfonylurea, meglitinides, and others. The sulfonylurea segment dominated the market with the largest revenue share of 46.1% in 2024, owing to its long-standing clinical use, proven efficacy in lowering blood glucose levels, and cost-effectiveness. Physicians often prefer sulfonylureas for patients requiring reliable oral glycemic control, particularly in regions with established healthcare protocols. The segment also benefits from widespread availability and generic formulations, making it accessible across both developed and emerging markets. In addition, sulfonylureas are frequently prescribed in combination with metformin, further reinforcing their market dominance. Patient familiarity, prescriber confidence, and inclusion in standard treatment guidelines continue to drive steady adoption of sulfonylureas globally.

The meglitinides segment is anticipated to witness the fastest growth rate of 20.8% from 2025 to 2032, fueled by their rapid onset of action and flexible dosing schedule, which allows for improved postprandial glucose control. Meglitinides are increasingly preferred for elderly patients and those with irregular meal patterns due to reduced risk of prolonged hypoglycemia. The rising adoption of personalized diabetes therapy and combination regimens is accelerating the demand for meglitinides across both hospitals and outpatient care settings. In addition, ongoing research and development for newer meglitinide derivatives are expected to further boost growth.

- By Route of Administration

On the basis of route of administration, the insulin secretagogue market is segmented into oral, parenteral, and others. The oral segment dominated the market with the largest revenue share in 2024, driven by the convenience of non-invasive administration, higher patient adherence, and the widespread availability of oral formulations. Oral insulin secretagogues are particularly preferred in outpatient settings, where ease of use and adherence are critical for effective long-term diabetes management. Physicians and patients likely as favor oral therapies for their cost-effectiveness and integration into combination treatment plans. Furthermore, the oral route aligns with the rising trend of home-based diabetes care and telemedicine-driven monitoring. Increasing patient education and preference for less invasive treatment options continue to support this segment’s dominance.

The parenteral segment is expected to witness the fastest CAGR from 2025 to 2032, largely driven by the development of injectable secretagogues with modified-release formulations and improved pharmacokinetics. Parenteral therapies are increasingly being explored in hospital and specialty clinic settings for patients with severe or uncontrolled diabetes requiring precise dosing. The growing availability of pen-based and prefilled devices enhances convenience and encourages adoption. In addition, combination therapies that integrate parenteral secretagogues with other injectable antidiabetics are contributing to faster market growth.

- By End Users

On the basis of end users, the insulin secretagogue market is segmented into hospitals, specialty clinics, and others. The hospital segment dominated the market with the largest revenue share in 2024, driven by high patient volumes, advanced diabetes care facilities, and the presence of trained healthcare professionals capable of monitoring therapy. Hospitals often prescribe insulin secretagogues as part of structured treatment regimens for inpatient and outpatient diabetes management programs. The segment also benefits from hospital formularies and bulk procurement practices, ensuring steady supply and adoption. In addition, hospitals are central to clinical trials and post-marketing studies, further solidifying their role in market dominance. Continuous training for physicians and diabetes educators contributes to the sustained preference for insulin secretagogues in hospital settings.

The specialty clinics segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing numbers of diabetes-focused clinics and endocrinology centers in both developed and emerging markets. Specialty clinics provide personalized care, patient education, and therapy monitoring, which encourages the adoption of tailored insulin secretagogue regimens. The expansion of outpatient diabetes management programs and telemedicine-enabled clinics also contributes to rapid growth in this segment. Rising patient awareness of treatment options and specialized consultation services further accelerates adoption.

- By Distribution Channel

On the basis of distribution channel, the insulin secretagogue market is segmented into hospital pharmacy, retail pharmacy, and others. The hospital pharmacy segment dominated the market with the largest revenue share in 2024, driven by centralized procurement, bulk purchasing agreements, and direct physician prescription channels. Hospital pharmacies ensure consistent availability of insulin secretagogues for both inpatient and outpatient care, supporting adherence to treatment protocols. The segment also benefits from partnerships with pharmaceutical companies for education and awareness programs targeting prescribers and patients. Furthermore, hospital pharmacies often stock combination therapies and newer formulations, reinforcing their market dominance.

The retail pharmacy segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing patient preference for convenient access to medications, expansion of pharmacy chains in urban and semi-urban areas, and the rise of e-pharmacies. Retail pharmacies provide ease of purchase, timely refills, and counseling services, making them attractive for chronic diabetes management. Growing awareness campaigns and insurance coverage for outpatient medications further contribute to the rapid growth of this distribution channel.

Insulin Secretagogue Market Regional Analysis

- North America dominated the insulin secretagogue market with the largest revenue share of 39.9% in 2024, supported by early adoption of advanced diabetes management therapies, high healthcare expenditure, and the presence of leading pharmaceutical companies

- Patients and healthcare providers in the region increasingly prefer insulin secretagogues for effective glycemic control, ease of oral administration, and integration into combination treatment regimens

- This widespread adoption is further supported by high healthcare expenditure, well-established distribution networks, and the presence of leading pharmaceutical companies conducting research and development, establishing insulin secretagogues as a preferred treatment option in both hospitals and outpatient clinics

U.S. Insulin Secretagogue Market Insight

The U.S. insulin secretagogue market captured the largest revenue share of 42% in 2024 within North America, driven by the high prevalence of type 2 diabetes and the well-established healthcare infrastructure. Patients and healthcare providers increasingly prefer oral antidiabetic therapies, including insulin secretagogues, for effective glycemic control and ease of administration. The growing adoption of combination therapies and personalized treatment plans further supports market growth. In addition, rising awareness of diabetes management, widespread insurance coverage, and strong presence of leading pharmaceutical companies contribute to the market’s expansion.

Europe Insulin Secretagogue Market Insight

The Europe insulin secretagogue market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing prevalence of diabetes and strong emphasis on effective disease management. The region’s healthcare systems encourage early intervention and the use of oral therapies, boosting adoption. Rising urbanization and healthcare accessibility, coupled with increasing patient awareness, are fostering demand for insulin secretagogues. Europe is witnessing growth across hospitals, specialty clinics, and outpatient care, with both newly diagnosed and long-term diabetes patients benefiting from oral therapy options.

U.K. Insulin Secretagogue Market Insight

The U.K. insulin secretagogue market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the rising incidence of type 2 diabetes and the adoption of oral antidiabetic medications. Patients and physicians increasingly favor convenient, cost-effective therapies that support long-term glycemic control. In addition, government health programs and initiatives promoting diabetes awareness encourage the use of insulin secretagogues. The U.K.’s well-developed healthcare infrastructure, robust pharmacy network, and growing emphasis on outpatient care continue to stimulate market growth.

Germany Insulin Secretagogue Market Insight

The Germany insulin secretagogue market is expected to expand at a considerable CAGR during the forecast period, driven by increasing awareness of diabetes management and the preference for technologically advanced, safe, and effective oral therapies. Germany’s strong healthcare system, combined with a focus on research and innovation, promotes the adoption of insulin secretagogues in both hospitals and specialty clinics. The integration of diabetes management programs, including patient monitoring and education, further enhances adoption. Patients increasingly prefer therapies that balance efficacy with minimized risk of hypoglycemia, supporting market growth.

Asia-Pacific Insulin Secretagogue Market Insight

The Asia-Pacific insulin secretagogue market is poised to grow at the fastest CAGR of 22% during the forecast period of 2025 to 2032, driven by rising prevalence of diabetes, urbanization, and improving healthcare infrastructure in countries such as China, India, and Japan. The region’s increasing focus on outpatient care and patient education is promoting oral antidiabetic therapy adoption. Furthermore, growing awareness of cost-effective treatment options and expansion of domestic pharmaceutical manufacturers enhance market accessibility. Rising disposable incomes and government initiatives for diabetes care further drive adoption across both urban and semi-urban populations.

Japan Insulin Secretagogue Market Insight

The Japan insulin secretagogue market is gaining momentum due to the country’s aging population, high awareness of diabetes management, and preference for convenient oral therapies. Patients increasingly rely on insulin secretagogues to manage postprandial glucose levels effectively. Integration of advanced treatment protocols and monitoring technologies in specialty clinics and hospitals is further boosting adoption. The emphasis on preventive care and patient-centric approaches, combined with high healthcare expenditure, is supporting sustained growth in both residential and clinical settings.

India Insulin Secretagogue Market Insight

The India insulin secretagogue market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly rising diabetes prevalence, expanding middle class, and growing healthcare awareness. Oral antidiabetic therapies, including sulfonylureas and meglitinides, are increasingly preferred due to affordability, convenience, and accessibility. The expansion of hospitals, specialty clinics, and pharmacy networks facilitates wider adoption. In addition, government initiatives promoting diabetes management and the availability of generic formulations from domestic manufacturers are key factors driving market growth.

Insulin Secretagogue Market Share

The Insulin Secretagogue industry is primarily led by well-established companies, including:

- Lilly USA, LLC. (U.S.)

- Novo Nordisk A/S (Denmark)

- Sanofi (France)

- Merck & Co., Inc. (U.S.)

- AstraZeneca (U.K.)

- Takeda Pharmaceutical Company Limited (Japan)

- Biocon Ltd. (India)

- Abbott (U.S.)

- Pfizer Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Dr. Reddy’s Laboratories Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Sandoz International GmbH (Switzerland)

- Cadila Pharmaceuticals Ltd. (India)

- MannKind Corporation (U.S.)

- Oramed Pharmaceuticals Inc. (Israel)

- Bigfoot Biomedical, Inc. (U.S.)

- Hanmi Pharmaceutical Co., Ltd. (South Korea)

- Kissei Pharmaceutical Co., Ltd. (Japan)

- Ace Therapeutics (U.S.)

What are the Recent Developments in Insulin Secretagogue Market?

- In October 2023, A study presented at the European Association for the Study of Diabetes (EASD) annual meeting revealed that food insecurity significantly increases the risk of severe hypoglycemia in adults with diabetes, especially among those using insulin and/or secretagogues. This underscores the importance of addressing social determinants in diabetes management

- In May 2023, the FDA approved Inpefa (sotagliflozin), a dual sodium-glucose co-transporter 1 and 2 (SGLT1/2) inhibitor, for the treatment of heart failure. While primarily indicated for heart failure, Inpefa's approval is noteworthy as it may influence the broader landscape of diabetes management, given the interconnectedness of cardiovascular health and diabetes

- In January 2023, Researchers at the University of Alberta discovered that certain older antipsychotic drugs could target enzymes involved in lowering blood sugar, presenting a potential new therapeutic avenue for type 2 diabetes. This finding opens up possibilities for repurposing existing medications in diabetes treatment

- In January 2023, the U.S. Food and Drug Administration (FDA) approved Brenzavvy (bexagliflozin), a sodium-glucose cotransporter 2 (SGLT2) inhibitor, as an adjunct to diet and exercise to improve glycemic control in adults with type 2 diabetes. This approval marked Brenzavvy as the fifth SGLT2 inhibitor to receive FDA approval, expanding treatment options for patients managing type 2 diabetes

- In May 2022, Eli Lilly and Company received FDA approval for Mounjaro (tirzepatide), a dual GIP and GLP-1 receptor agonist, for the treatment of type 2 diabetes. This approval marked a significant advancement in diabetes care, offering a new therapeutic option for patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.