Global Insurtech Market

Market Size in USD Billion

CAGR :

%

USD

7.19 Billion

USD

27.21 Billion

2025

2033

USD

7.19 Billion

USD

27.21 Billion

2025

2033

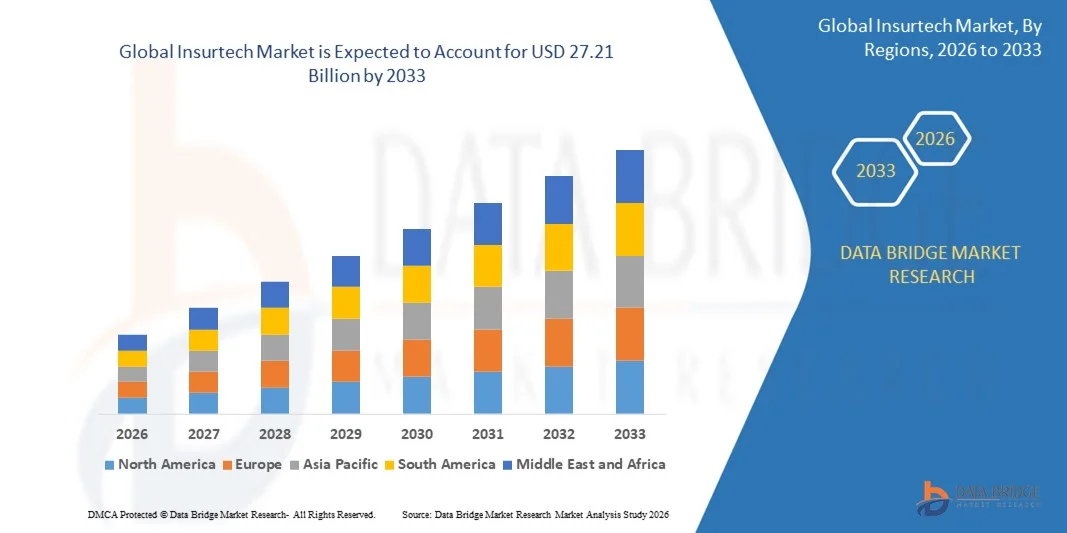

| 2026 –2033 | |

| USD 7.19 Billion | |

| USD 27.21 Billion | |

|

|

|

|

What is the Global Insurtech Market Size and Growth Rate?

- The global Insurtech market size was valued at USD 7.19 billion in 2025 and is expected to reach USD 27.21 billion by 2033, at a CAGR of 18.10% during the forecast period

- The insurtech market is experiencing rapid growth as technology-driven solutions transform the traditional insurance industry. This sector, which merges "insurance" and "technology," is driven by the increasing demand for digital innovation to enhance operational efficiency, customer experience, and risk management

- Key factors contributing to the market's expansion include advancements in artificial intelligence (AI), machine learning, big data analytics, and blockchain technology

What are the Major Takeaways of Insurtech Market?

- The integration of blockchain technology is also making significant strides in the insurtech sector. Blockchain offers a secure and transparent method for managing insurance transactions, reducing the risk of fraud, and ensuring data integrity

- This technology facilitates efficient contract management, claims processing, and regulatory compliance, contributing to increased trust and reliability in insurance operations

- North America dominated the global Insurtech market, accounting for the largest revenue share of 43.5% in 2025, driven by advanced digital infrastructure, high insurance penetration rates, and increased demand for personalized, tech-driven insurance solutions

- Asia-Pacific Insurtech market is anticipated to grow at the fastest CAGR of 16.7% during the forecast period of 2026 to 2033, propelled by rapid urbanization, increased smartphone penetration, and a rising middle-class population across countries such as China, India, Japan, and Southeast Asian nations

- The AI segment dominated the Insurtech market with the largest market revenue share of 48.6% in 2025, driven by its ability to automate claims processing, personalize insurance offerings, and enhance fraud detection

Report Scope and Insurtech Market Segmentation

|

Attributes |

Insurtech Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Insurtech Market?

AI-Powered Personalization and Automation Revolutionizing Insurance Delivery

- A prominent and accelerating trend in the global Insurtech market is the deeper integration of Artificial Intelligence (AI) and automation, transforming the way insurance products are underwritten, distributed, and serviced. AI is enabling personalized insurance solutions, dynamic pricing models, and faster claims processing, enhancing both customer experience and operational efficiency

- For instance, companies such as Lemonade leverage AI-powered chatbots and algorithms to automate policy issuance and claims settlements within minutes, reshaping customer expectations around speed and transparency in insurance services

- AI is also fueling advanced risk assessment, with Insurtech firms utilizing predictive analytics, real-time data, and machine learning to offer hyper-personalized insurance plans tailored to individual lifestyles or behaviors, such as usage-based auto insurance or on-demand travel coverage

- Moreover, the integration of AI with voice technology and mobile apps is streamlining customer interactions, allowing policyholders to access services, file claims, or seek support via voice commands through platforms such as Amazon Alexa or chatbots embedded within insurers' apps

- This trend towards AI-driven, user-friendly insurance services is reshaping the competitive landscape, pushing traditional insurers to adopt digital tools and collaborate with Insurtech firms to remain relevant

- As digital-native consumers increasingly demand personalized, seamless, and instant insurance solutions, AI and automation are becoming central pillars of innovation across the Insurtech ecosystem, driving market expansion globally

What are the Key Drivers of Insurtech Market?

- The rising demand for digitally accessible, affordable, and flexible insurance products, coupled with advancements in technology, is a primary driver fueling the Insurtech market's growth

- For instance, in November 2025, Fedo.ai collaborated with Canara HSBC Life Insurance to introduce AI-powered non-invasive health assessments, aiming to improve underwriting processes and enhance the customer experience in life insurance applications

- The growing adoption of smartphones, mobile applications, and digital platforms is making insurance more accessible to underinsured and tech-savvy populations, especially in emerging markets. Insurtech firms are leveraging digital channels to reach new customers, particularly in sectors such as microinsurance and embedded insurance

- In addition, the rise of usage-based insurance models, such as pay-as-you-drive motor policies or on-demand travel coverage, is transforming product offerings to better align with consumer preferences for flexibility and cost-effectiveness

- Regulatory reforms in favor of digital innovation, along with increased investment in Insurtech startups by venture capital firms and established insurers, are accelerating technological advancements and market growth

- The convenience of instant policy issuance, automated claims management, and data-driven risk evaluation is attracting both individuals and businesses, making Insurtech solutions a preferred choice over conventional insurance processes

Which Factor is Challenging the Growth of the Insurtech Market?

- The concerns over data privacy, cybersecurity vulnerabilities, and regulatory compliance remain significant challenges restraining the broader adoption of Insurtech solutions. As Insurtech platforms rely heavily on collecting, storing, and analyzing personal data, they become prime targets for cyberattacks

- For instance, high-profile incidents of data breaches in financial services have raised consumer skepticism around sharing sensitive information with digital platforms, including Insurtech providers

- Ensuring robust data protection measures, secure cloud infrastructures, and compliance with evolving regulations such as GDPR or regional data localization laws is critical for building consumer trust and safeguarding market growth

- Furthermore, the digital divide in emerging markets, where internet penetration and digital literacy remain limited, can hinder the scalability of Insurtech solutions among rural or underserved populations

- The integration of complex technologies such as AI, blockchain, and IoT also poses challenges for traditional insurers lacking the technical expertise or infrastructure to collaborate effectively with Insurtech firms

- Overcoming these challenges will require investments in cybersecurity, partnerships between Insurtechs and incumbent insurers, regulatory clarity, and efforts to bridge the digital inclusion gap, all of which are essential for the sustainable expansion of the Insurtech market

How is the Insurtech Market Segmented?

The market is segmented on the basis of product, application, and type.

- By Product

On the basis of product, the insurtech market is segmented into AI, Hadoop, and Blockchain. The AI segment dominated the Insurtech market with the largest market revenue share of 48.6% in 2025, driven by its ability to automate claims processing, personalize insurance offerings, and enhance fraud detection. AI-powered chatbots and predictive analytics are increasingly being deployed by Insurtech companies to improve operational efficiency and deliver seamless customer experiences. The rapid development of generative AI tools and their integration into insurance platforms is further fueling AI's dominance in the market.

The Blockchain segment is expected to witness the fastest CAGR from 2025 to 2033, propelled by its ability to offer secure, transparent, and tamper-proof insurance processes. Blockchain technology is being leveraged to streamline claims settlement, enable smart contracts, and reduce fraud, making it a critical enabler for trust and efficiency in digital insurance ecosystems.

- By Application

On the basis of application, the insurtech market is segmented into Products and Services. The Products segment held the largest market revenue share in 2025, driven by the widespread demand for digital insurance products such as on-demand, usage-based, and microinsurance solutions. Insurtech platforms are transforming product design by leveraging real-time data and AI to deliver hyper-personalized policies that meet evolving consumer needs.

The Services segment is projected to witness the fastest CAGR during the forecast period, fueled by growing demand for technology-driven claims management, underwriting automation, and AI-powered customer support. Insurtech service providers are playing a vital role in modernizing legacy insurance processes, thereby enhancing speed, transparency, and customer satisfaction.

- By Type

On the basis of type, the insurtech market is segmented into Auto, Business, Health, Home, Specialty, and Travel. The Health segment dominated the Insurtech market with the largest market revenue share of 34.7% in 2025, driven by increasing demand for personalized health insurance products, remote health monitoring, and digital health assessments. The growing emphasis on preventive care, wellness programs, and AI-enabled underwriting is further enhancing the growth of digital health insurance solutions.

The Travel segment is expected to register the fastest CAGR from 2025 to 2033, supported by the rising demand for flexible, on-demand, and instant travel insurance coverage. Insurtech companies are offering seamless mobile-based solutions for travelers, enabling quick policy issuance, real-time claims processing, and integration with booking platforms, contributing to strong growth in this segment.

Which Region Holds the Largest Share of the Insurtech Market?

- North America dominated the global Insurtech market, accounting for the largest revenue share of 43.5% in 2025, driven by advanced digital infrastructure, high insurance penetration rates, and increased demand for personalized, tech-driven insurance solutions

- Consumers across the region prioritize real-time access, AI-driven underwriting, and seamless digital claims processes offered by Insurtech platforms, fostering widespread adoption among both individuals and businesses

- This regional dominance is further reinforced by a strong startup ecosystem, significant venture capital investments, and partnerships between traditional insurers and Insurtech firms, positioning North America as the leading hub for Insurtech innovation and market expansion

U.S. Insurtech Market Insight

The U.S. Insurtech market captured the largest revenue share within North America, in 2025, fueled by the rising consumer demand for affordable, accessible, and flexible insurance products. The country's highly competitive insurance sector is increasingly embracing AI, automation, and mobile platforms to streamline operations, improve customer experience, and deliver tailored insurance offerings. The prevalence of digital-savvy consumers and supportive regulatory frameworks continues to accelerate the adoption of Insurtech solutions across health, auto, property, and life insurance segments.

Europe Insurtech Market Insight

The Europe Insurtech market is expected to witness robust growth throughout the forecast period, driven by stringent regulatory standards, growing digital literacy, and consumer demand for transparent, tech-enabled insurance services. Insurtech companies in Europe are focusing on microinsurance, embedded insurance, and usage-based models, catering to evolving consumer expectations. The region's emphasis on data privacy, combined with innovation in insurance distribution and claims automation, is encouraging greater Insurtech adoption across both mature and emerging markets in Europe.

U.K. Insurtech Market Insight

The U.K. Insurtech market is projected to expand at a significant CAGR during the forecast period, fueled by the country’s thriving FinTech ecosystem and growing demand for customized, on-demand insurance solutions. Rising awareness of digital insurance platforms, combined with the need for convenient, mobile-first policy management, is driving the Insurtech sector. The U.K. also serves as a strategic gateway for Insurtech firms expanding into European markets, supported by a strong regulatory environment and consumer openness to digital financial services.

Germany Insurtech Market Insight

The Germany Insurtech market is expected to grow steadily, supported by the country’s reputation for technological innovation, data protection awareness, and increasing preference for digital insurance channels. German consumers and businesses are adopting Insurtech platforms for their simplicity, efficiency, and ability to provide transparent policy management and claims processing. Collaborations between Insurtech startups and established insurance companies are further enhancing product offerings, particularly in areas such as cyber insurance, health insurance, and AI-driven risk assessments.

Which Region is the Fastest Growing Region in the Insurtech Market?

Asia-Pacific Insurtech market is anticipated to grow at the fastest CAGR of 16.7% during the forecast period of 2025 to 2033, propelled by rapid urbanization, increased smartphone penetration, and a rising middle-class population across countries such as China, India, Japan, and Southeast Asian nations. The region's underpenetrated insurance markets, coupled with a surge in digital adoption, present significant opportunities for Insurtech firms offering affordable, mobile-based, and microinsurance solutions. Government-led initiatives promoting financial inclusion and digital transformation are further accelerating Insurtech growth across APAC.

Japan Insurtech Market Insight

The Japan Insurtech market is experiencing steady expansion, driven by the country’s technological advancement, aging population, and increasing demand for health-focused, digitally accessible insurance products. Insurtech platforms are being integrated with smart health monitoring devices and mobile apps to provide real-time, personalized coverage solutions. Japan's highly regulated insurance sector is also opening up to innovation through partnerships between traditional insurers and Insurtech startups, particularly in health, life, and travel insurance segments.

China Insurtech Market Insight

The China Insurtech market accounted for the largest revenue share within Asia Pacific in 2025, fueled by high internet penetration, the rise of digital payment ecosystems, and the growing demand for affordable insurance products among the expanding middle class. China is witnessing strong growth in areas such as mobile-first health insurance, digital claims platforms, and usage-based auto insurance. The push for smart cities, coupled with the presence of leading domestic tech giants and favorable regulatory developments, is accelerating the Insurtech sector's growth across urban and rural areas.

Which are the Top Companies in Insurtech Market?

The insurtech industry is primarily led by well-established companies, including:

- DXC Technology Company (U.S.)

- Trov, Inc. (U.S.)

- Wipro Limited (India)

- ZhongAn (China)

- TCS (India)

- Cognizant (U.S.)

- Infosys (India)

- Pegasystems (U.S.)

- Appian (U.S.)

- Mindtree (India)

- Prima Solutions (India)

- Fineos (Ireland)

- Bolt Solutions (U.S.)

- Majesco (U.S.)

- EIS Group (U.S.)

- Oscar Insurance (U.S.)

- Quantemplate (U.K.)

- Shift Technology (India)

What are the Recent Developments in Global Insurtech Market?

- In December 2025, Sure collaborated with CU Financial Group, LLC to introduce SimpleQuote, a cutting-edge digital insurance solution designed to provide credit union members with effortless access to insurance products, marking a key step toward digitalizing insurance services for the credit union sector. This initiative is expected to enhance member engagement and streamline the insurance purchasing process

- In November 2025, Fedo.ai partnered with Canara HSBC Life Insurance to roll out AI-powered, non-invasive health assessments, aiming to transform the health insurance customer experience through advanced technology. This partnership underscores the growing role of AI in simplifying health assessments and enhancing service delivery

- In March 2025, Zego, a U.K.-based insurtech firm, announced the expansion of its fleet insurance services to Southeast Asia, reflecting the increasing globalization of digital insurance solutions. This move highlights Zego's strategic efforts to tap into high-growth markets in the region

- In March 2025, CNB Bank & Trust (CIBC) joined forces with Insuritas to integrate a full-scale digital insurance agency into CIBC's platform, leveraging Insuritas' BUNDLE platform to offer comprehensive insurance solutions for retail and commercial clients. This partnership strengthens CIBC’s position in providing embedded, seamless insurance experiences

- In June 2023, Clover Health Investments Corp., known for its physician enablement services improving Medicare access, announced a preliminary settlement agreement to resolve seven derivative lawsuits pending across courts in Delaware, New York, and Tennessee. This resolution marks a significant legal milestone, helping Clover Health focus on its core mission of enhancing healthcare accessibility

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.