Global Integrated Cardiology Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.21 Billion

USD

4.81 Billion

2025

2033

USD

2.21 Billion

USD

4.81 Billion

2025

2033

| 2026 –2033 | |

| USD 2.21 Billion | |

| USD 4.81 Billion | |

|

|

|

|

Integrated Cardiology Devices Market Size

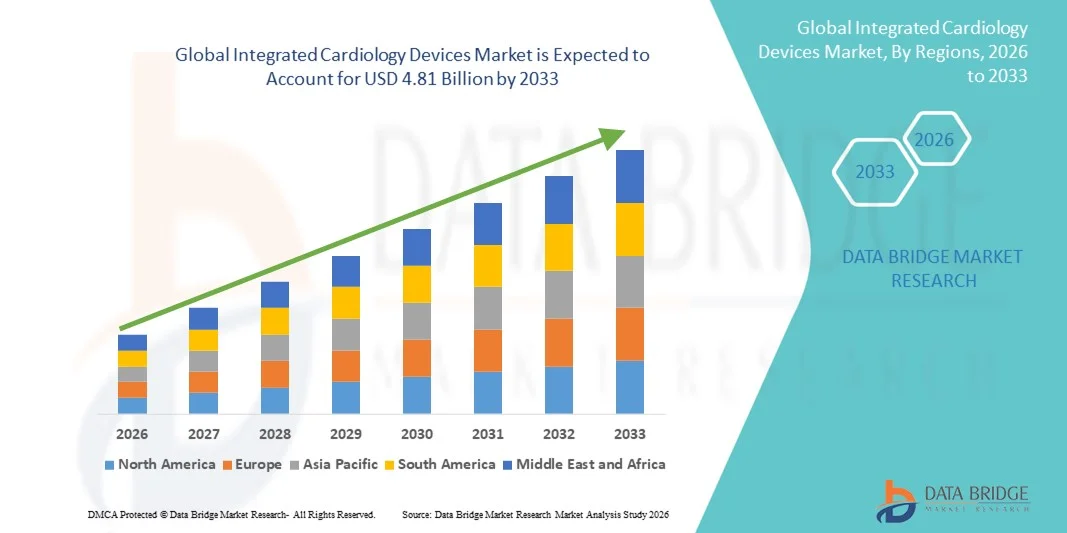

- The global integrated cardiology devices market size was valued at USD 2.21 billion in 2025 and is expected to reach USD 4.81 billion by 2033, at a CAGR of 10.21% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular diseases, rising adoption of minimally invasive procedures, and rapid technological advancements in cardiology diagnostic and therapeutic devices, which are enhancing clinical efficiency and patient outcomes

- Furthermore, growing healthcare expenditure, expanding healthcare infrastructure in emerging economies, and rising demand for integrated and interoperable cardiology solutions are driving the uptake of advanced devices across hospitals and cardiac care centers worldwide. These converging factors are accelerating the adoption of integrated cardiology solutions, thereby significantly boosting the industry’s growth

Integrated Cardiology Devices Market Analysis

- Integrated cardiology devices, including cardiology EMR software, FFR, HER, and optical coherence tomography systems, are increasingly vital components of modern cardiac care in hospitals and catheterization laboratories due to their ability to provide real-time monitoring, accurate diagnostics, and seamless integration across cardiac care workflows

- The escalating demand for integrated cardiology devices is primarily fueled by the rising prevalence of cardiovascular diseases, growing adoption of advanced cardiac imaging and monitoring technologies, and the need for interoperable solutions that enhance clinical efficiency and patient outcomes

- North America dominated the integrated cardiology devices market with the largest revenue share of 42.3% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of leading medical device companies, with the U.S. witnessing substantial adoption of cardiology EMR software, FFR systems, and optical coherence tomography devices in hospitals and catheterization laboratories

- Asia-Pacific is expected to be the fastest-growing region in the integrated cardiology devices market during the forecast period due to increasing healthcare investments, rising incidence of cardiac disorders, and expanding access to advanced cardiac care technologies in emerging economies

- Cardiology EMR Software segment dominated the integrated cardiology devices market with a market share of 38.5% in 2025, driven by its critical role in managing patient records, supporting internal monitoring, and facilitating procedures such as cardiac resynchronization therapy and cardiothoracic surgery

Report Scope and Integrated Cardiology Devices Market Segmentation

|

Attributes |

Integrated Cardiology Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Integrated Cardiology Devices Market Trends

AI-Enabled Diagnostics and Remote Monitoring

- A significant and accelerating trend in the global integrated cardiology devices market is the adoption of AI-enabled diagnostic algorithms and remote patient monitoring solutions, enhancing the accuracy of cardiac assessments and improving patient outcomes

- For instance, AI-powered cardiology EMR software can automatically detect arrhythmias from ECG data, while FFR systems with embedded analytics assist clinicians in evaluating coronary lesions more efficiently

- AI integration enables predictive modeling to identify high-risk patients, optimize treatment plans, and provide intelligent alerts for abnormal cardiac events, while remote monitoring platforms allow continuous patient data collection and telecardiology consultations

- The seamless integration of cardiology devices with hospital information systems and mobile applications facilitates centralized patient management, allowing clinicians to track vitals, review imaging results, and coordinate therapies from a single interface

- This trend toward intelligent, data-driven, and interconnected cardiology solutions is transforming clinical workflows, prompting companies such as Philips and Siemens Healthineers to develop AI-powered devices with predictive analytics and remote monitoring functionalities

- The demand for integrated cardiology devices that offer AI and remote capabilities is growing rapidly across hospitals and catheterization laboratories, as healthcare providers increasingly prioritize early detection, continuous monitoring, and optimized cardiac care

- In addition, cloud-based cardiology platforms are gaining traction, allowing secure data storage, remote access, and collaborative decision-making among healthcare teams globally

Integrated Cardiology Devices Market Dynamics

Driver

Rising Cardiovascular Disease Burden and Technological Adoption

- The increasing prevalence of cardiovascular diseases worldwide, coupled with the accelerating adoption of advanced cardiology technologies, is a significant driver for the heightened demand for integrated cardiology devices

- For instance, in March 2025, GE Healthcare announced an AI-enabled cardiology EMR upgrade for its hospital clients, focusing on predictive diagnostics and workflow automation to improve patient outcomes

- As clinicians seek more precise diagnostics and effective treatment planning, integrated cardiology devices offer advanced features such as real-time imaging, FFR measurement, and comprehensive data consolidation, providing a compelling clinical advantage

- Furthermore, the growing adoption of minimally invasive cardiac procedures and demand for interoperable hospital systems are making integrated cardiology devices essential for improving procedural efficiency and patient safety

- The ability to remotely monitor patients, integrate with electronic health records, and support complex cardiothoracic surgeries are key factors propelling the adoption of integrated cardiology devices in both developed and emerging markets, while hospitals increasingly invest in AI-driven, connected solutions

- Rising government initiatives and reimbursement policies for advanced cardiac care in developed countries are further boosting adoption of integrated cardiology devices

- The increasing collaboration between medical device companies and hospitals to develop customized solutions is driving innovation and market growth

Restraint/Challenge

High Cost and Regulatory Compliance Complexity

- The high initial cost of integrated cardiology devices, particularly advanced AI-enabled EMR software and FFR systems, poses a significant challenge to broader market adoption, especially in price-sensitive or resource-constrained regions

- For instance, expensive multi-modality imaging systems or HER-integrated devices can limit adoption in smaller hospitals and clinics in emerging markets

- Regulatory hurdles, including stringent approvals from authorities such as the FDA and CE marking requirements, create delays in product launches and market entry, adding to the complexity for manufacturers

- While incremental cost reductions and leasing models are gradually improving accessibility, the perceived premium for advanced integrated cardiology devices can still hinder adoption for healthcare providers that prioritize immediate ROI over long-term clinical benefits

- Overcoming these challenges through cost-effective solutions, streamlined regulatory approvals, and clinician education on device utility and efficiency will be vital for sustained growth in the integrated cardiology devices market

- Interoperability issues between older hospital systems and new integrated devices can limit adoption and increase operational complexity for healthcare providers

- In addition, lack of trained personnel to operate sophisticated cardiology devices and interpret AI-driven analytics can slow market penetration in certain regions

Integrated Cardiology Devices Market Scope

The market is segmented on the basis of type, application, and end-user.

- By Type

On the basis of type, the integrated cardiology devices market is segmented into Cardiology EMR Software, HER, FFR, and Optical Coherence Tomography (OCT). Cardiology EMR Software segment dominated the market with the largest revenue share of 38.5% in 2025, driven by its critical role in managing comprehensive patient records, supporting internal monitoring, and facilitating decision-making for cardiologists. Hospitals and cardiac centers prioritize EMR software for its ability to consolidate patient histories, diagnostic results, and treatment plans in a single platform, enhancing workflow efficiency. Its integration with AI algorithms allows predictive analysis of cardiac events, improving early detection and patient management. In addition, EMR solutions support interoperability with other cardiology devices, enabling seamless coordination during cardiothoracic surgeries and cardiac resynchronization therapy procedures. The robust adoption of cardiology EMR software in developed regions, combined with increasing healthcare digitization globally, further strengthens its market dominance.

HER (Hybrid Electronic Record) segment is anticipated to witness the fastest growth rate of 21.3% CAGR from 2026 to 2033, fueled by rising demand for real-time patient monitoring, centralized data access, and interoperability across hospital systems. HER platforms allow clinicians to track patient vitals, imaging results, and procedural data remotely, supporting telecardiology initiatives and home-based cardiac care. Hospitals in emerging economies are increasingly investing in HER solutions to reduce readmission rates and optimize clinical workflows. The scalability of HER systems, combined with the growing prevalence of cardiovascular diseases, contributes to their rapid adoption. Furthermore, HER adoption is accelerated by integration with mobile applications, enabling secure, cloud-based access to cardiac records for multi-disciplinary teams.

- By Application

On the basis of application, the integrated cardiology devices market is segmented into sudden cardiac arrest, internal monitoring, cardiac resynchronization therapy, cardiothoracic surgery, and others. Internal Monitoring segment dominated the market with the largest revenue share of 35.8% in 2025, driven by its essential role in continuous patient monitoring and early detection of cardiac anomalies. Devices such as implantable FFR systems and wearable sensors provide real-time hemodynamic data to cardiologists, allowing timely intervention. Hospitals and catheterization laboratories increasingly rely on internal monitoring to enhance patient safety during high-risk procedures. Integration with EMR and HER platforms ensures that the collected data is securely stored and easily accessible for treatment planning. In addition, internal monitoring supports telecardiology programs, enabling remote supervision of critical patients. The segment’s dominance is strengthened by the growing incidence of heart failure, arrhythmias, and other chronic cardiovascular conditions globally.

Cardiac Resynchronization Therapy (CRT) segment is expected to witness the fastest growth rate of 22.5% CAGR from 2026 to 2033, driven by the increasing prevalence of heart failure and advancements in implantable devices that improve cardiac function. CRT adoption is rising due to its ability to restore synchronized ventricular contraction, enhancing quality of life and reducing hospitalizations. Technological innovations, such as remote programming and integration with AI-enabled monitoring systems, further increase clinician confidence and patient acceptance. CRT devices are also benefiting from government initiatives and reimbursement policies promoting advanced cardiac therapies. The combination of improved outcomes, patient-centric care, and technological advancements supports rapid growth of the CRT segment.

- By End-User

On the basis of end-user, the integrated cardiology devices market is segmented into hospital pharmacies, catheterization laboratories, and others. Catheterization Laboratories segment dominated the market with the largest revenue share of 40.2% in 2025, driven by the critical need for precision cardiac procedures and real-time hemodynamic monitoring. Catheterization labs utilize integrated cardiology devices such as FFR systems, OCT imaging, and EMR software to enhance procedural efficiency, improve clinical decision-making, and minimize complications. Adoption is further accelerated in large hospitals and cardiac centers, where complex interventions such as PCI and CRT are frequently performed. Integration with hospital information systems ensures secure and accessible patient data during interventions. In addition, continuous training programs and increasing clinician familiarity with advanced cardiology devices support widespread adoption.

Hospital Pharmacies segment is expected to witness the fastest growth rate of 20.8% CAGR from 2026 to 2033, fueled by the rising demand for integrated medication management and cardiac therapy optimization. Hospital pharmacies leverage EMR and HER platforms to track prescriptions, manage drug interactions, and ensure timely delivery of medications for cardiac patients. Integration with internal monitoring and AI-enabled analytics enhances patient safety and supports personalized treatment plans. Growth is also driven by expanding hospital infrastructure in emerging economies and increasing adoption of digital solutions for efficient healthcare delivery. Furthermore, collaboration between pharmacy teams and cardiology departments improves overall patient outcomes, driving rapid market adoption.

Integrated Cardiology Devices Market Regional Analysis

- North America dominated the integrated cardiology devices market with the largest revenue share of 42.3% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of leading medical device companies

- Healthcare providers in the region highly value the accuracy, real-time monitoring, and seamless integration offered by integrated cardiology devices such as cardiology EMR software, FFR systems, and optical coherence tomography with hospital information systems

- This widespread adoption is further supported by government initiatives, well-established reimbursement policies, and the growing preference for AI-enabled diagnostics and remote monitoring solutions, establishing integrated cardiology devices as a critical component of modern cardiac care in hospitals and catheterization laboratories

U.S. Integrated Cardiology Devices Market Insight

The U.S. integrated cardiology devices market captured the largest revenue share of 81% in 2025 within North America, fueled by the widespread adoption of advanced cardiac care technologies and hospital digitalization initiatives. Healthcare providers are increasingly prioritizing AI-enabled EMR systems, FFR devices, and optical coherence tomography for accurate diagnostics and improved patient outcomes. The growing demand for minimally invasive procedures, telecardiology solutions, and remote patient monitoring further propels market growth. Moreover, integration with hospital information systems and mobile applications allows seamless coordination across cardiology departments, enhancing procedural efficiency. The U.S. market continues to benefit from robust healthcare infrastructure, government reimbursement policies, and a strong presence of leading medical device manufacturers.

Europe Integrated Cardiology Devices Market Insight

The Europe integrated cardiology devices market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent healthcare regulations, rising cardiovascular disease prevalence, and growing adoption of advanced cardiac technologies. Increased urbanization and investment in hospital infrastructure are fostering the integration of AI-enabled cardiology devices and remote monitoring platforms. European hospitals and cardiac centers are also adopting cardiology EMR software and FFR systems to improve workflow efficiency and patient management. The market growth is supported by the increasing focus on preventive cardiac care, technological innovation, and government initiatives promoting digital healthcare solutions.

U.K. Integrated Cardiology Devices Market Insight

The U.K. integrated cardiology devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of hospital digitalization, advanced cardiac care programs, and increasing awareness of cardiovascular diseases. The adoption of cardiology EMR systems, FFR, and OCT devices is accelerating due to a focus on improving patient outcomes and minimizing procedural risks. In addition, government policies supporting healthcare technology adoption and telecardiology initiatives are encouraging hospitals and clinics to implement integrated cardiology solutions. The robust healthcare infrastructure and increasing investments in AI-powered monitoring systems continue to stimulate market growth in the U.K.

Germany Integrated Cardiology Devices Market Insight

The Germany integrated cardiology devices market is expected to expand at a considerable CAGR during the forecast period, fueled by strong healthcare infrastructure, growing cardiac patient population, and technological advancements in cardiology diagnostics. Hospitals and catheterization laboratories are increasingly integrating cardiology EMR software, FFR, and optical coherence tomography systems to enhance procedural precision and clinical decision-making. Germany’s emphasis on innovation, quality care, and patient safety promotes adoption of advanced integrated cardiology devices. In addition, the country’s focus on digital health solutions and interoperability supports market expansion across both public and private healthcare sectors.

Asia-Pacific Integrated Cardiology Devices Market Insight

The Asia-Pacific integrated cardiology devices market is poised to grow at the fastest CAGR of 24% during 2026–2033, driven by increasing cardiovascular disease prevalence, rising healthcare expenditure, and expanding hospital infrastructure in countries such as China, Japan, and India. The region’s growing focus on digital healthcare solutions, telecardiology, and AI-enabled diagnostics is boosting adoption. Moreover, government initiatives promoting healthcare modernization and preventive care, along with improved affordability of integrated cardiology devices, are expanding the market to a wider patient base. Emerging economies in APAC are also witnessing rapid adoption of minimally invasive cardiac procedures, further propelling market growth.

Japan Integrated Cardiology Devices Market Insight

The Japan integrated cardiology devices market is gaining momentum due to the country’s advanced healthcare infrastructure, high technological adoption, and aging population. Hospitals and cardiac centers are increasingly implementing cardiology EMR software, FFR, and OCT systems to enable efficient patient management and remote monitoring. Integration with other hospital IT systems and IoT-based solutions enhances workflow efficiency and clinical decision-making. The market is also driven by government support for digital healthcare initiatives and growing awareness of cardiovascular disease prevention, fueling adoption across both residential and institutional care settings.

India Integrated Cardiology Devices Market Insight

The India integrated cardiology devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rising prevalence of cardiovascular diseases, expanding hospital infrastructure, and growing adoption of digital healthcare solutions. Hospitals and catheterization laboratories are increasingly deploying cardiology EMR systems, FFR, and OCT devices to improve diagnosis, monitoring, and treatment efficiency. Government programs promoting digital healthcare and preventive cardiac care, coupled with increasing affordability of advanced devices, are key factors driving the market. Strong domestic manufacturing and growing awareness among healthcare providers further support market expansion in India.

Integrated Cardiology Devices Market Share

The Integrated Cardiology Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Abbott (U.S.)

- Edwards Lifesciences Corporation (U.S.)

- GE Healthcare (U.S.)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Terumo Corporation (Japan)

- BIOTRONIK SE & Co. KG (Germany)

- LivaNova PLC (U.K.)

- Cardinal Health (U.S.)

- B. Braun SE (Germany)

- MicroPort Scientific Corporation (China)

- NIHON KOHDEN CORPORATION (Japan)

- Getinge AB (Sweden)

- ZOLL Medical Corporation (U.S.)

- Acrostak AG (Switzerland)

- Lepu Medical Technology (Beijing) Co., Ltd. (China)

- iVascular, S.L.U. (Spain)

What are the Recent Developments in Global Integrated Cardiology Devices Market?

- In December 2025, Royal Philips announced it agreed to acquire SpectraWAVE, Inc., adding its HyperVue intravascular imaging system and X1‑FFR AI‑enabled coronary physiology assessment technology to Philips’ portfolio, expanding AI‑powered coronary imaging and physiological assessment capabilities within integrated cardiac care platforms

- In September 2025, the U.S. Food and Drug Administration (FDA) granted pre‑market approval (PMA) and 510(k) clearances for Kardium’s Globe® Pulsed Field Ablation System, a fully integrated cardiac mapping and ablation platform that combines high‑density mapping and pulsed field ablation in a single device to treat atrial fibrillation, marking a significant milestone in integrated cardiology treatment technologies

- In July 2025, Boston Scientific received FDA approval for expanded labeling of its FARAPULSE™ Pulsed Field Ablation (PFA) System, extending its indication to include treatment of persistent atrial fibrillation and enhancing the integrated use of pulsed field ablation technologies in electrophysiology and interventional cardiology

- In March 2025, GE HealthCare launched new AI‑powered cardiology innovations including Flyrcado™ (flurpiridaz F‑18) injection at the ACC 2025 conference, emphasizing seamless data integration across the cardiology care pathway and showcasing the company’s push to transform diagnostics and treatment workflows in cardiology

- In January 2024, Boston Scientific’s FARAPULSE™ Pulsed Field Ablation System received its initial FDA approval for isolation of pulmonary veins in the treatment of drug‑refractory atrial fibrillation, representing a key regulatory milestone for pulsed field ablation technology in integrated cardiac intervention

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.