Global Medical Remote Patient Monitoring And Care Market

Market Size in USD Billion

CAGR :

%

USD

12.70 Billion

USD

32.58 Billion

2024

2032

USD

12.70 Billion

USD

32.58 Billion

2024

2032

| 2025 –2032 | |

| USD 12.70 Billion | |

| USD 32.58 Billion | |

|

|

|

|

Medical Remote Patient Monitoring and Care Market Size

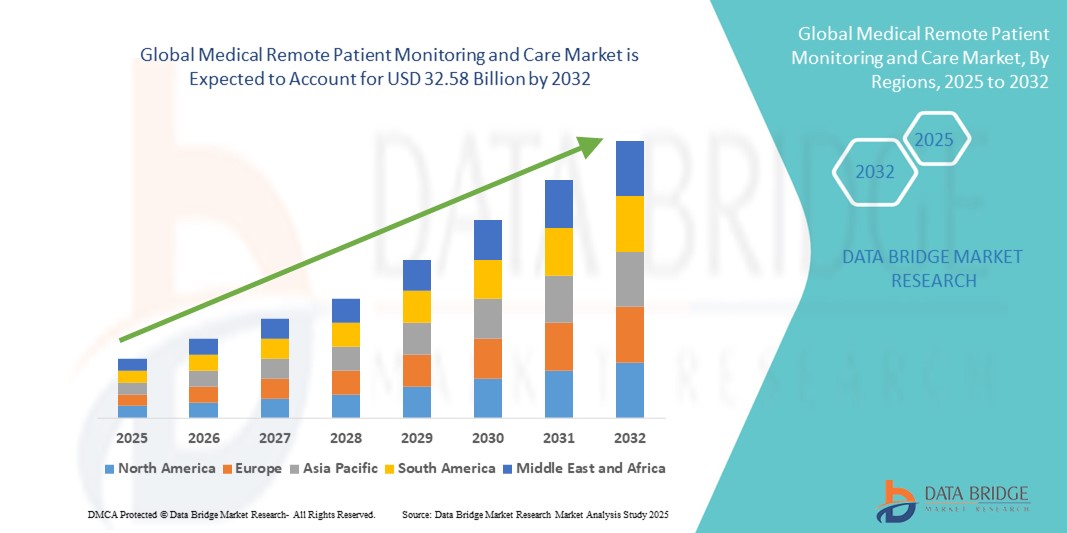

- The global medical remote patient monitoring and care market size was valued at USD 12.70 billion in 2024 and is expected to reach USD 32.58 billion by 2032, at a CAGR of 12.50% during the forecast period

- The market growth is largely driven by increasing chronic disease prevalence, rising healthcare costs, and a growing shift toward value-based care, which has prompted healthcare providers to adopt remote monitoring technologies for improved outcomes and cost-efficiency

- Furthermore, advancements in wearable devices, mobile health apps, and telehealth platforms are empowering patients and clinicians likely as with real-time health insights. These dynamics are accelerating the integration of remote patient monitoring into standard care models, thereby significantly boosting the industry's growth

Medical Remote Patient Monitoring and Care Market Analysis

- Medical remote patient monitoring and care systems, which enable real-time tracking of patients' health data outside traditional clinical environments, are becoming indispensable in modern healthcare due to their ability to enhance patient outcomes, reduce hospitalization rates, and support chronic disease management across both inpatient and outpatient settings

- The escalating demand for remote monitoring is primarily fueled by the global rise in chronic diseases such as diabetes and cardiovascular conditions, increased healthcare digitalization, and a growing preference for home-based care supported by wearable technologies and telehealth integration

- North America dominated the medical remote patient monitoring and care market with the largest revenue share of 39% in 2024, driven by robust healthcare infrastructure, strong adoption of connected health solutions, and supportive reimbursement policies, with the U.S. leading due to its high penetration of digital health platforms and regulatory backing for remote care reimbursement

- Asia-Pacific is expected to be the fastest growing region in the medical remote patient monitoring and care market during the forecast period due to increasing healthcare investments, growing mobile connectivity, and government initiatives to enhance care delivery in remote and underserved areas

- Blood glucose monitoring devices segment dominated the medical remote patient monitoring and care market with a market share of 29.9% in 2024, owing to the widespread prevalence of diabetes, increased adoption of continuous glucose monitoring systems, and integration with smartphones and cloud-based platforms for real-time data sharing and analysis

Report Scope and Medical Remote Patient Monitoring and Care Market Segmentation

|

Attributes |

Medical Remote Patient Monitoring and Care Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Remote Patient Monitoring and Care Market Trends

Integration of AI, Wearables, and Real-Time Data Analytics

- A significant and accelerating trend in the global medical remote patient monitoring and care market is the integration of artificial intelligence (AI), advanced wearables, and real-time data analytics. These technologies are enhancing the precision, responsiveness, and scalability of patient monitoring systems, allowing for early detection of health anomalies and timely medical intervention

- For instance, companies such as BioIntelliSense have developed wearables such as the BioSticker, which continuously monitors vital signs and uses AI to identify early indicators of deterioration. Similarly, Dexcom’s continuous glucose monitors (CGMs) leverage AI for predictive alerts and integration with smartphones for real-time data sharing

- AI integration enables personalized care pathways by analyzing patient-specific data trends, helping clinicians make proactive decisions and optimize treatment plans. These systems can detect subtle deviations in patient vitals that may precede critical events, enhancing preventive care capabilities

- In addition, wearables such as smartwatches and biosensors are increasingly being used in conjunction with telehealth platforms to facilitate remote diagnostics and continuous care. These devices not only provide convenience for patients but also significantly reduce the burden on healthcare infrastructure

- Cloud-based platforms and mobile apps have become central to this ecosystem, enabling centralized data access, patient engagement, and care coordination. Platforms such as Philips’ HealthSuite provide healthcare professionals with unified dashboards for monitoring patient data across multiple devices

- This trend toward intelligent, real-time, and patient-centric remote monitoring is transforming chronic disease management and post-acute care. As a result, companies such as Medtronic, GE HealthCare, and Abbott are expanding their portfolios to include AI-driven remote monitoring solutions integrated with electronic health record (EHR) systems

- The growing demand for predictive, personalized, and decentralized care models across both hospital and home settings is accelerating the adoption of intelligent remote monitoring systems globally

Medical Remote Patient Monitoring and Care Market Dynamics

Driver

Rising Chronic Disease Burden and Demand for Home-Based Care

- The global rise in chronic diseases such as diabetes, hypertension, heart disease, and respiratory disorders is a major driver propelling the demand for remote patient monitoring solutions

- For instance, in March 2024, Dexcom expanded its G7 CGM system to more global markets, enhancing diabetes monitoring capabilities across a wider patient base. Such initiatives reflect the market's move toward accessible and continuous care solutions

- The ability to monitor patients in real time outside of clinical environments reduces hospital readmissions, enables earlier interventions, and supports cost-effective care an increasingly important consideration for both public and private healthcare providers

- In addition, the aging population worldwide and the growing preference for aging-in-place care models are reinforcing the need for remote monitoring systems that support independence and reduce the need for frequent in-person consultations

- The convenience of wearable devices, smartphone-integrated apps, and 24/7 monitoring capabilities is attracting both healthcare providers and patients toward remote care solutions. Furthermore, supportive reimbursement frameworks and telehealth adoption in countries such as the U.S., Germany, and Japan are accelerating market growth

- The shift toward value-based care models and the emphasis on outcome-driven healthcare are also driving adoption of remote patient monitoring technologies, especially as they align with preventive care strategies

Restraint/Challenge

Data Privacy Concerns and Interoperability Barriers

- One of the major challenges facing the medical remote patient monitoring and care market is the concern over data privacy, security, and system interoperability. As patient health data is continuously collected, transmitted, and stored on cloud-based systems, the risk of data breaches and unauthorized access becomes a major issue

- For instance, breaches in healthcare data systems have raised alarms over the safeguarding of sensitive personal information, leading to hesitancy among both providers and patients in adopting digital monitoring tools

- Ensuring compliance with stringent regulations such as HIPAA (U.S.), GDPR (Europe), and similar data protection laws globally is essential for building and maintaining trust in remote care systems. Companies such as Medtronic and Philips have had to strengthen their data encryption protocols and introduce multi-layered cybersecurity frameworks to mitigate these concerns

- Another key challenge is the lack of standardized protocols and system interoperability, making it difficult for healthcare providers to integrate data from different remote monitoring devices into a unified electronic health record system

- In addition, the high initial cost of some monitoring devices, particularly those with advanced features, may limit their adoption in low- and middle-income countries. Despite price reductions over time, affordability remains a constraint for widespread deployment

- Addressing these challenges through secure data management solutions, interoperability standards, and cost-effective device innovation will be critical for sustaining market momentum and expanding access to remote patient care globally

Medical Remote Patient Monitoring and Care Market Scope

The market is segmented on the basis of device type, application, and end user.

- By Device Type

On the basis of device type, the medical remote patient monitoring and care market is segmented into cardiac monitoring devices, blood pressure monitoring devices, blood glucose monitoring devices, respiratory monitoring devices, neurological monitoring devices, multi-parameter monitoring devices, and others. The blood glucose monitoring devices segment dominated the market with the largest revenue share of 29.9% in 2024, driven by the growing global prevalence of diabetes and increasing adoption of continuous glucose monitoring (CGM) systems. These devices offer real-time glucose level tracking and are often integrated with mobile apps and cloud platforms, enhancing patient compliance and clinical decision-making.

The multi-parameter monitoring devices segment is expected to witness the fastest growth rate of 20.6% from 2025 to 2032, as healthcare systems shift toward comprehensive patient surveillance tools that monitor multiple vital signs simultaneously. These devices are increasingly used in post-acute care and home settings to provide a holistic view of patient health, improve chronic disease management, and reduce hospitalization rates.

- By Application

On the basis of application, the medical remote patient monitoring and care market is segmented into oncology, diabetes, cardiovascular diseases, and others. The diabetes segment accounted for the largest market revenue share of 34.7% in 2024, due to the high global burden of diabetes and increasing reliance on digital and wearable technologies for continuous glucose tracking. The growing availability of AI-integrated CGMs and insulin management systems supports proactive patient engagement and remote care coordination, making diabetes monitoring the dominant application area.

The cardiovascular diseases segment is anticipated to witness the fastest CAGR of 19.3% during the forecast period, propelled by increasing incidence of heart-related conditions and the growing demand for ECG monitoring and real-time arrhythmia detection devices. These tools are particularly valuable for elderly patients and post-surgical monitoring, enhancing early intervention and reducing emergency hospital visits.

- By End User

On the basis of end user, the medical remote patient monitoring and care market is segmented into hospital-based patients, ambulatory patients, and home healthcare patients. The home healthcare patients segment held the largest revenue share of 42.1% in 2024, supported by a global shift toward home-based care, rising healthcare costs, and the increased availability of user-friendly, wearable remote monitoring devices. Patients and providers asuch as prefer the flexibility, cost savings, and comfort of managing chronic conditions in home environments, a trend further accelerated by the COVID-19 pandemic and digital health reforms.

The ambulatory patients segment is projected to register the highest growth rate of 21.9% from 2025 to 2032, driven by the growing use of outpatient care models and remote monitoring in specialty clinics and diagnostic centers. These solutions allow for efficient patient triaging, post-discharge monitoring, and chronic disease follow-up, aligning with value-based healthcare delivery models focused on improved outcomes and lower readmission rates.

Medical Remote Patient Monitoring and Care Market Regional Analysis

- North America dominated the medical remote patient monitoring and care market with the largest revenue share of 39% in 2024, driven by robust healthcare infrastructure, strong adoption of connected health solutions, and supportive reimbursement policies, with the U.S. leading due to its high penetration of digital health platforms and regulatory backing for remote care reimbursement

- Patients and providers in the region highly value the ability of remote monitoring technologies to deliver real-time insights, reduce hospital visits, and support personalized care, especially for aging populations and those with long-term health conditions

- This high level of adoption is further supported by favorable reimbursement policies, rising healthcare costs, and a tech-savvy population, making remote patient monitoring a critical component of digital health strategies across both hospital and home care settings

U.S. Medical Remote Patient Monitoring and Care Market Insight

The U.S. medical remote patient monitoring and care market captured the largest revenue share of 82% in 2024 within North America, driven by widespread adoption of telehealth, robust healthcare infrastructure, and favorable reimbursement policies. Patients and providers are increasingly relying on remote monitoring solutions to manage chronic conditions and reduce hospital readmissions. The rapid integration of wearable technologies, mobile apps, and AI-enabled analytics platforms further accelerates adoption, particularly within value-based care models and home healthcare settings.

Europe Medical Remote Patient Monitoring and Care Market Insight

The Europe medical remote patient monitoring and care market is projected to expand at a substantial CAGR throughout the forecast period, fueled by aging populations, increased prevalence of chronic diseases, and growing emphasis on digital health innovation. Stringent regulatory frameworks supporting remote care, combined with investments in healthcare IT infrastructure, are fostering adoption. Applications in post-acute and long-term care settings are driving demand, especially in Germany, France, and the Nordic countries, where patient-centric digital care is gaining strong momentum.

U.K. Medical Remote Patient Monitoring and Care Market Insight

The U.K. medical remote patient monitoring and care market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by NHS initiatives to decentralize care, reduce in-person hospital visits, and increase digital health adoption. Rising chronic disease incidence, coupled with strong support for remote and AI-assisted monitoring, is boosting demand. The UK’s tech-forward healthcare system, combined with government backing for integrated digital care pathways, continues to stimulate market growth across home and outpatient settings.

Germany Medical Remote Patient Monitoring and Care Market Insight

The Germany medical remote patient monitoring and care market is expected to expand at a considerable CAGR during the forecast period, supported by government-led digital health reforms and increasing demand for efficient chronic care management. With a strong focus on data privacy, Germany leads in developing secure, interoperable platforms for remote monitoring. The adoption of RPM tools is particularly strong in cardiology and diabetes management, where real-time patient data is critical to improving treatment outcomes and reducing emergency interventions.

Asia-Pacific Medical Remote Patient Monitoring and Care Market Insight

The Asia-Pacific medical remote patient monitoring and care market is poised to grow at the fastest CAGR of 24.6% during 2025 to 2032, propelled by rapid urbanization, expanding healthcare infrastructure, and increased access to smartphones and digital health platforms. Countries such as China, Japan, and India are experiencing surging demand for RPM solutions, particularly in managing chronic diseases among aging populations. Government-backed digital health initiatives and the rising affordability of wearable medical devices are broadening access across both urban and rural areas.

Japan Medical Remote Patient Monitoring and Care Market Insight

The Japan medical remote patient monitoring and care market is gaining momentum due to the country’s aging population, advanced technological infrastructure, and rising healthcare demands. Japan's healthcare system increasingly emphasizes home-based care and preventive health, with strong support for telemedicine and connected devices. The integration of RPM with AI-powered analytics and hospital IT systems is driving efficiency in chronic care delivery and ensuring continuous monitoring for high-risk patients.

India Medical Remote Patient Monitoring and Care Market Insight

The India medical remote patient monitoring and care market accounted for the largest market revenue share in Asia Pacific in 2024, driven by growing investments in healthcare digitization, high smartphone penetration, and a rising middle class. The country's efforts to expand access to healthcare through initiatives such as Ayushman Bharat and the push for smart hospitals are fostering adoption. Affordable RPM devices and increasing awareness among healthcare providers are accelerating the use of remote monitoring for chronic disease management, maternal health, and post-operative care.

Medical Remote Patient Monitoring and Care Market Share

The medical remote patient monitoring and care industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- VitalConnect (U.S.)

- Biobeat (Israel)

- General Electric (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- OMRON Corporation (Japan)

- Abbott (U.S.)

- Nihon Kohden Corporation (Japan)

- Vivify Health, Inc. (U.S.)

- Aerotel Medical Systems (Israel)

- BIOTRONIK SE & Co. KG (Germany)

- A&D Company, Limited (Japan)

- AliveCor, Inc. (U.S.)

- Masimo (U.S.)

- Dexcom, Inc. (U.S.)

- Senseonics, Inc. (U.S.)

- ResMed (U.S.)

- 100Plus (U.S.)

- ChroniSense Medical, Ltd. (Israel)

- Vitls (U.S.)

- Cardiomo (U.S.)

- CoachCare (U.S.)

What are the Recent Developments in Global Medical Remote Patient Monitoring and Care Market?

- In May 2024, Philips expanded its HealthSuite Remote Patient Monitoring (RPM) platform with enhanced AI capabilities to support early detection of patient deterioration in home settings. This update allows healthcare providers to proactively intervene by integrating predictive analytics and real-time data from wearable biosensors. The development reinforces Philips’ commitment to improving patient outcomes through advanced remote care solutions and scalable digital health ecosystems

- In April 2024, Dexcom, Inc. announced the global rollout of its Dexcom G7 Continuous Glucose Monitoring System, targeting broader diabetic populations across Europe and Asia-Pacific. With faster sensor warm-up times and improved integration with mobile devices, the G7 supports greater patient adherence and real-time monitoring. The move illustrates Dexcom’s strategy to enhance diabetes care through innovative, user-friendly remote monitoring technologies

- In March 2024, BioIntelliSense introduced the BioButton Rechargeable, a next-generation wearable device for continuous remote vital sign monitoring. The device supports extended multi-parameter data capture, making it ideal for post-discharge care and chronic disease management. This advancement underscores the growing demand for scalable and cost-efficient RPM tools in both inpatient and outpatient settings

- In February 2024, GE HealthCare partnered with Masimo to integrate the Masimo W1 advanced wearable into GE’s digital care continuum solutions. The collaboration aims to expand the use of continuous remote monitoring for both hospital and home environments, enhancing clinical decision-making through real-time physiological data. This initiative highlights the industry’s focus on interoperability and comprehensive patient monitoring

- In January 2024, Medtronic plc launched its CareLink SmartSync platform upgrade, enabling enhanced data transmission from cardiac implantable devices for remote patient follow-up. This update strengthens Medtronic’s remote care capabilities, ensuring timely clinician access to actionable cardiac data and improving long-term outcomes for patients with chronic heart conditions. The development reflects the company’s dedication to advancing connected health and remote patient engagement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.