Global Integrated Traffic Systems Market

Market Size in USD Billion

CAGR :

%

USD

34.97 Billion

USD

69.83 Billion

2024

2032

USD

34.97 Billion

USD

69.83 Billion

2024

2032

| 2025 –2032 | |

| USD 34.97 Billion | |

| USD 69.83 Billion | |

|

|

|

|

Integrated Traffic Systems Market Size

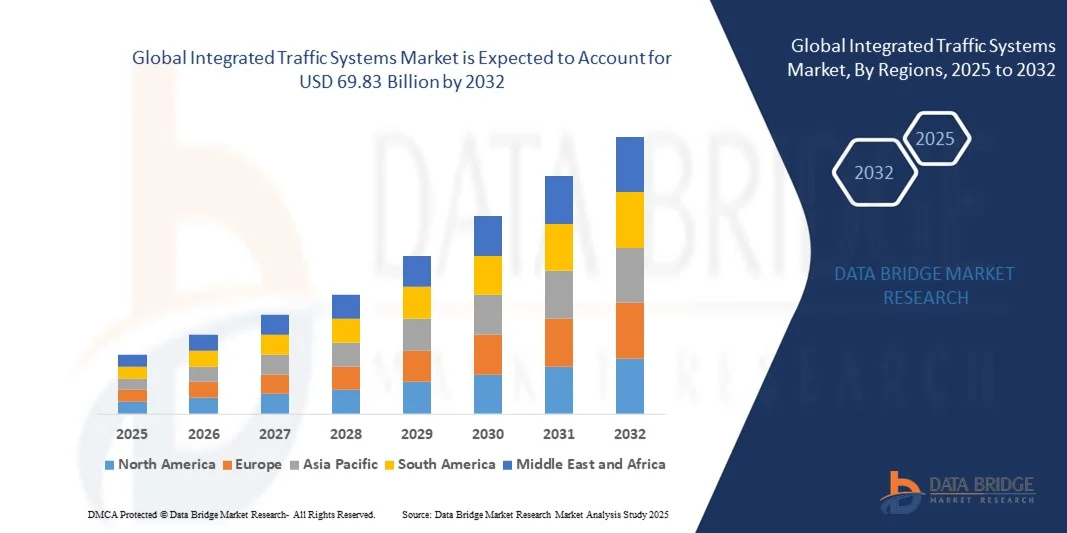

- The global integrated traffic systems market size was valued at USD 34.97 billion in 2024 and is expected to reach USD 69.83 billion by 2032, at a CAGR of 9.03% during the forecast period

- The market growth is largely fuelled by the rising demand for smart mobility solutions, increasing urbanization, adoption of advanced traffic management technologies, and the growing focus on reducing traffic congestion and enhancing road safety

- Continuous investments in smart city projects and digital transportation infrastructure are expected to create significant growth opportunities for integrated traffic systems in the coming years.

Integrated Traffic Systems Market Analysis

- Rising adoption of smart mobility solutions to manage growing urban traffic congestion effectively

- Increasing integration of IoT, AI, and data analytics in traffic management systems for real-time monitoring and decision-making

- North America dominated the integrated traffic systems market with the largest revenue share of 38.5% in 2024, driven by rising investments in smart city projects, urban infrastructure modernization, and the increasing adoption of AI- and IoT-enabled traffic management solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global integrated traffic systems market, driven by increasing urban populations, government-backed smart transport projects, and the rapid integration of AI and IoT technologies in traffic monitoring and control systems

- The Weigh-In-Motion (WIM) sensors segment held the largest market revenue share in 2024, driven by their ability to measure vehicle weight and classify traffic in real-time without disrupting traffic flow. WIM sensors are widely adopted for highway monitoring, toll collection, and infrastructure management, making them a key component of modern traffic systems

Report Scope and Integrated Traffic Systems Market Segmentation

|

Attributes |

Integrated Traffic Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Integrated Traffic Systems Market Trends

Adoption of AI-Enabled and IoT-Driven Traffic Management Solutions

- The rapid adoption of AI and IoT technologies is reshaping integrated traffic systems by enabling real-time monitoring, predictive analytics, and adaptive signal control. These smart capabilities allow cities to manage congestion more efficiently, reduce travel time, and improve overall traffic safety

- The rising demand for connected mobility is accelerating the deployment of intelligent infrastructure such as adaptive traffic lights, smart sensors, and cloud-based traffic control centers. These systems enhance data-driven decision-making and support seamless integration with emerging mobility platforms

- The affordability and scalability of cloud-based solutions make them attractive for both developed and developing regions, enabling municipal authorities to manage traffic efficiently without heavy upfront costs. This supports smarter allocation of resources and reduces infrastructure pressure

- For instance, in 2024, several metropolitan cities in Europe deployed AI-enabled adaptive traffic signal systems that reduced average vehicle idling time by 20%, cutting down fuel consumption and improving air quality across urban zones

- While the adoption of AI and IoT is driving innovation, the long-term impact depends on cybersecurity readiness, interoperability standards, and adequate training for operators. Manufacturers must focus on scalable, secure, and localized solutions to maximize the benefits of integrated traffic systems

Integrated Traffic Systems Market Dynamics

Driver

Rising Urbanization and Growing Demand for Smart Mobility Solutions

- The surge in urban populations worldwide is creating significant pressure on existing transportation infrastructure, compelling authorities to adopt advanced traffic management solutions. Integrated systems help optimize traffic flow, reduce congestion, and enhance commuter safety

- Increasing awareness of economic losses linked to traffic jams, including reduced productivity, fuel wastage, and higher emissions, is pushing governments and private operators to invest in intelligent traffic solutions

- Supportive government initiatives and large-scale smart city programs are accelerating the adoption of integrated traffic systems. Public–private partnerships are further enabling innovation and rapid deployment in both developed and emerging economies

- For instance, in 2023, the U.S. Department of Transportation launched a smart corridor project featuring AI-powered traffic signals and IoT-based vehicle detection systems, significantly improving travel efficiency along major routes

- While rising urbanization and supportive frameworks are driving adoption, consistent funding, data integration, and stakeholder collaboration remain essential to achieving widespread and sustainable traffic management improvements

Restraint/Challenge

High Deployment Cost and Complex Integration With Legacy Infrastructure

- The significant upfront investment required for advanced traffic management systems, including sensors, communication networks, and AI platforms, remains a major barrier for resource-constrained municipalities and smaller cities

- Integration challenges with existing legacy infrastructure further complicate deployment. Many cities face difficulties in harmonizing outdated traffic lights and road networks with advanced digital systems

- Limited technical expertise among local operators and municipal staff reduces system efficiency and increases dependence on specialized vendors. This hinders seamless adoption and long-term sustainability of integrated traffic projects

- For instance, in 2024, several developing nations in Asia reported delays in implementing smart traffic programs due to compatibility issues between modern adaptive systems and existing analog traffic signals

- Although technological advancements are addressing cost and integration hurdles, expanding access will require modular systems, financing support, and stronger collaboration between governments, technology providers, and infrastructure developers

Integrated Traffic Systems Market Scope

The market is segmented on the basis of sensor type, function, and hardware.

- By Sensor Type

On the basis of sensor type, the integrated traffic systems market is segmented into Weigh-In-Motion Sensors and Acoustic Sensors. The Weigh-In-Motion (WIM) sensors segment held the largest market revenue share in 2024, driven by their ability to measure vehicle weight and classify traffic in real-time without disrupting traffic flow. WIM sensors are widely adopted for highway monitoring, toll collection, and infrastructure management, making them a key component of modern traffic systems.

The Acoustic Sensors segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their high accuracy in detecting vehicle presence, speed, and traffic density in urban environments. Acoustic sensors are particularly effective in areas where traditional detection methods are difficult to deploy, providing reliable, real-time traffic data for adaptive traffic management and congestion reduction.

- By Function

On the basis of function, the market is segmented into Traffic Monitoring, Traffic Control, and Information Provision. The Traffic Monitoring segment held the largest market revenue share in 2024, owing to increasing demand for real-time data collection, vehicle tracking, and congestion analysis to improve traffic flow and road safety.

The Traffic Control segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising adoption of AI-enabled adaptive traffic lights and automated signal management systems. These solutions help optimize traffic flow, reduce waiting times, and enhance overall commuter safety.

- By Hardware

On the basis of hardware, the market is segmented into Display Boards, Sensors, Surveillance Cameras, Radar, Smart Traffic Lights, Interface Boards, and Others. The Smart Traffic Lights segment held the largest market share in 2024 due to their increasing deployment in smart city projects and urban traffic management initiatives. Smart traffic lights enable adaptive signaling, reducing congestion and fuel consumption while improving road safety.

The Sensors segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising use of IoT and AI-based detection systems for accurate vehicle monitoring and real-time traffic data collection. Sensors play a crucial role in enabling automated traffic management, predictive analytics, and seamless integration with intelligent transportation platforms.

Integrated Traffic Systems Market Regional Analysis

- North America dominated the integrated traffic systems market with the largest revenue share of 38.5% in 2024, driven by rising investments in smart city projects, urban infrastructure modernization, and the increasing adoption of AI- and IoT-enabled traffic management solutions

- Cities in the region prioritize reducing congestion, improving road safety, and integrating connected vehicle technologies, which has accelerated the deployment of intelligent traffic systems

- This widespread adoption is further supported by government initiatives, high urbanization rates, and advanced digital infrastructure, establishing integrated traffic systems as a key solution for both metropolitan and suburban areas

U.S. Integrated Traffic Systems Market Insight

The U.S. market captured the largest revenue share in North America in 2024, fueled by extensive investments in intelligent transportation systems (ITS) and smart city initiatives. Municipal authorities are focusing on reducing traffic congestion, improving commuter safety, and implementing AI-driven adaptive traffic lights. The growing preference for data-driven traffic management and real-time monitoring further propels market growth. In addition, the integration of IoT, cloud-based platforms, and connected vehicles is significantly contributing to the market’s expansion.

Europe Integrated Traffic Systems Market Insight

The Europe market is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent urban planning regulations, increased vehicle density, and government incentives for smart city projects. Countries such as Germany, France, and the U.K. are witnessing growing adoption of traffic monitoring, adaptive signaling, and predictive congestion management. European cities are leveraging integrated traffic systems to optimize traffic flow, reduce emissions, and enhance commuter convenience, with both new urban developments and infrastructure upgrades supporting market growth.

U.K. Integrated Traffic Systems Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising urbanization, a push for smart mobility solutions, and increasing government support for ITS deployment. Traffic congestion and road safety concerns are encouraging the adoption of adaptive signaling, surveillance systems, and data-driven traffic control solutions. The country’s advanced digital infrastructure and connected transport ecosystem further drive market adoption across both metropolitan and regional transport networks.

Germany Integrated Traffic Systems Market Insight

The Germany market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s focus on innovation, sustainable urban development, and efficient traffic management. Germany’s well-developed road networks, combined with governmental smart city initiatives and investment in AI-based traffic solutions, are promoting the adoption of integrated traffic systems. Integration with connected vehicle technologies and environmental monitoring is further boosting the deployment of advanced traffic infrastructure in residential, commercial, and industrial zones.

Asia-Pacific Integrated Traffic Systems Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, government investment in smart city projects, and increasing adoption of AI and IoT technologies in traffic management. Countries such as China, Japan, and India are witnessing growing deployment of adaptive traffic signals, real-time traffic monitoring, and connected vehicle infrastructure. The region’s focus on sustainable urban mobility and smart transport solutions is supporting market expansion, alongside the availability of cost-effective systems and local manufacturing capabilities.

Japan Integrated Traffic Systems Market Insight

The Japan market is expected to witness the fastest growth rate from 2025 to 2032 due to high urban density, technological advancement, and government initiatives supporting intelligent transport infrastructure. The adoption of AI-enabled adaptive traffic systems, sensors, and real-time monitoring platforms is driven by the need to reduce congestion, improve commuter safety, and integrate transport networks. Japan’s focus on connected vehicles and smart city projects further fuels demand for advanced integrated traffic solutions.

China Integrated Traffic Systems Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, significant investments in smart city initiatives, and high adoption of IoT-based traffic solutions. The country is implementing AI-enabled traffic management, adaptive signaling, and real-time congestion monitoring across major cities. Strong government support, domestic manufacturing of traffic system components, and the push toward connected mobility solutions are key factors driving market growth in China.

Integrated Traffic Systems Market Share

The Integrated Traffic Systems industry is primarily led by well-established companies, including:

- Cisco Systems, Inc. (U.S.)

- Teledyne FLIR LLC (U.S.)

- Sumitomo Electric Industries, Ltd. (Japan)

- Siemens AG (Germany)

- SWARCO AG (Austria)

- LG CNS Co., Ltd. (South Korea)

- Kapsch TrafficCom AG (Austria)

- Cubic Corporation (U.S.)

- Iteris, Inc. (U.S.)

- JENOPTIK AG (Germany)

- Q-Free ASA (Norway)

- EFKON India Pvt. Ltd. (India)

- HARMAN International (U.S.)

- SNC-Lavalin Group Inc. (Canada)

- Citilog (France)

- imtac (UAE)

- TransCore (U.S.)

- PTV AG (Germany)

- Global Traffic Technologies, LLC (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.