Global Intelligent Completion Market

Market Size in USD Billion

CAGR :

%

USD

3.98 Billion

USD

14.78 Billion

2024

2032

USD

3.98 Billion

USD

14.78 Billion

2024

2032

| 2025 –2032 | |

| USD 3.98 Billion | |

| USD 14.78 Billion | |

|

|

|

|

What is the Global Intelligent Completion Market Size and Growth Rate?

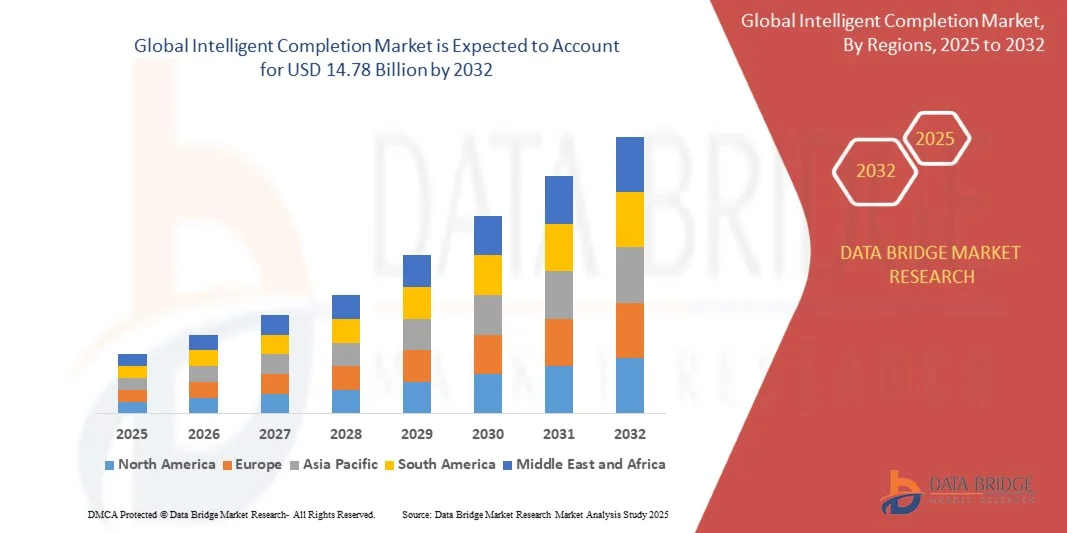

- The global intelligent completion market size was valued at USD 3.98 billion in 2024 and is expected to reach USD 14.78 billion by 2032, at a CAGR of 17.8% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected home devices and smart home technology, leading to increased digitalization in both residential and commercial settings

- Furthermore, rising consumer demand for secure, user-friendly, and integrated solutions for their homes and businesses is establishing Intelligent Completions as the modern access control system of choice. These converging factors are accelerating the uptake of Intelligent Completion solutions, thereby significantly boosting the industry's growth

What are the Major Takeaways of Intelligent Completion Market?

- Intelligent Completions, offering electronic or digital access control for doors and gates, are increasingly vital components of modern home security and automation systems in both residential and commercial settings due to their enhanced convenience, remote access capabilities, and seamless integration with smart home ecosystems

- The escalating demand for Intelligent Completions is primarily fueled by the widespread adoption of smart home technologies, growing security concerns among consumers, and a rising preference for the convenience of keyless entry

- Asia-Pacific dominated the Intelligent Completion market with the largest revenue share of 41.31% in 2024, driven by rapid industrialization, increasing investments in upstream oil and gas projects, and growing adoption of advanced well technologies

- North America is poised to grow at the fastest CAGR of 7.69% from 2025 to 2032, driven by increasing offshore deepwater activities, higher adoption of digital oilfield technologies, and modernization of aging wells

- The Complex Intelligent Well Completion segment dominated the market with the largest revenue share of 57.8% in 2024, driven by its capability to optimize reservoir performance, provide real-time monitoring, and allow remote intervention in challenging well environments

Report Scope and Intelligent Completion Market Segmentation

|

Attributes |

Intelligent Completion Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Intelligent Completion Market?

“Smart Automation and Remote Monitoring Integration”

- A prominent trend in the global intelligent completion market is the rising integration of smart automation and remote monitoring technologies. Operators are increasingly adopting real-time data-driven solutions that enhance operational efficiency, optimize production, and reduce downtime in oil and gas wells

- For instance, advanced Intelligent Completion systems now allow operators to adjust flow rates and control reservoir segments remotely, improving overall well performance. Systems from companies such as Schlumberger and Halliburton integrate seamlessly with SCADA and IoT platforms for enhanced visibility and control

- AI and machine learning algorithms are being used to predict well behavior, optimize reservoir management, and trigger alerts for maintenance or operational anomalies. These features improve safety and reduce the risk of costly errors

- The integration of Intelligent Completions with digital platforms enables centralized monitoring of multiple wells, facilitating efficient resource allocation and proactive operational planning

- This trend toward fully automated, connected, and intelligent well completions is reshaping operator expectations for field efficiency. Consequently, companies are increasingly offering AI-enabled solutions that allow remote intervention, predictive maintenance, and real-time optimization

- The demand for intelligent, connected, and automated well solutions is growing rapidly across upstream oil and gas operations as companies prioritize operational efficiency, safety, and cost-effectiveness

What are the Key Drivers of Intelligent Completion Market?

- The increasing need for optimized well performance, cost reduction, and enhanced reservoir management is a primary driver for the growth of Intelligent Completions

- For instance, in 2024, Schlumberger and Weatherford introduced advanced Intelligent Completion systems capable of autonomous monitoring and adjustment, improving production efficiency and reducing intervention costs

- The rising adoption of digital oilfield technologies and IoT-enabled operations further boosts the demand for Intelligent Completions, as these systems allow operators to make informed, real-time decisions

- Furthermore, the growing focus on operational safety, reduction of downtime, and predictive maintenance is encouraging companies to integrate AI and automation into well completions

- Intelligent Completions enable remote flow control, pressure monitoring, and real-time alerts, reducing the need for manual intervention and minimizing operational risks. These features are particularly valuable in deepwater, offshore, and complex onshore fields

- As the industry moves toward cost-efficient and technology-driven operations, the adoption of user-friendly and automated Intelligent Completion solutions continues to expand across the upstream oil and gas sector

Which Factor is Challenging the Growth of the Intelligent Completion Market?

- High initial capital expenditure and complex installation requirements for Intelligent Completion systems pose significant adoption challenges. These systems often require specialized equipment, skilled labor, and integration with existing field infrastructure

- For instance, operators in developing regions may face budget constraints and lack access to trained personnel, limiting the widespread deployment of advanced Intelligent Completions

- Cybersecurity and data integrity concerns are another critical challenge, as these systems rely on network connectivity and software, making them susceptible to cyber-attacks or data breaches. Companies such as Halliburton and Schlumberger are focusing on advanced encryption and secure data protocols to address these concerns

- In addition, variability in well conditions and reservoir characteristics can complicate system design and performance, requiring customized solutions for each project

- Overcoming these challenges through cost optimization, robust cybersecurity measures, training programs, and modular, scalable solutions will be crucial for sustained market growth in the intelligent completion segment

How is the Intelligent Completion Market Segmented?

The market is segmented on the basis of type, application, function, component, and services.

• By Type

On the basis of type, the INTELLIGENT COMPLETION market is segmented into Simple Intelligent Well Completion and Complex Intelligent Well Completion. The Complex Intelligent Well Completion segment dominated the market with the largest revenue share of 57.8% in 2024, driven by its capability to optimize reservoir performance, provide real-time monitoring, and allow remote intervention in challenging well environments. Operators increasingly prefer complex completions for deepwater, unconventional, and high-pressure reservoirs due to their ability to enhance production efficiency and reduce operational risk.

The Simple Intelligent Well Completion segment is expected to witness the fastest CAGR of 19.5% from 2025 to 2032, fueled by the growing adoption in conventional onshore wells where cost-efficiency and ease of installation are prioritized. Simple completions are particularly attractive for smaller operators seeking reliable performance without the need for advanced monitoring infrastructure.

• By Application

On the basis of application, the market is segmented into Onshore and Offshore Applications. The Offshore Applications segment accounted for the largest market revenue share of 61.3% in 2024, owing to the growing number of deepwater exploration projects and the critical need for automated and remotely controlled well systems in challenging offshore environments. Advanced offshore completions provide operators with enhanced safety, improved flow management, and reduced intervention costs, which are crucial for high-capex projects.

Conversely, the Onshore Applications segment is expected to register the fastest CAGR of 18.7% from 2025 to 2032, driven by rising shale and tight oil production activities, increasing investments in unconventional reservoirs, and the demand for cost-effective yet technologically reliable solutions for onshore operations.

• By Function

On the basis of function, the market is segmented into Downhole Monitoring System, Communication System, Surface Control System, and Downhole Control System. The Downhole Monitoring System segment held the largest market revenue share of 54.5% in 2024, driven by the increasing requirement for real-time data on pressure, temperature, and flow to optimize reservoir performance and ensure safety. Downhole monitoring allows operators to make informed production decisions and prevents potential operational failures.

The Communication System segment is projected to witness the fastest CAGR of 20.2% from 2025 to 2032, supported by the growing deployment of advanced telemetry and IoT-enabled solutions for real-time information transfer between the downhole and surface systems, ensuring faster decision-making and automated interventions.

• By Component

On the basis of component, the market is segmented into Software and Hardware. The Software segment dominated the market with the largest revenue share of 56.1% in 2024, fueled by the integration of advanced analytics, AI-driven optimization, and predictive maintenance solutions in Intelligent Completions. Software platforms enable operators to remotely monitor and control wells, analyze production data, and optimize reservoir management.

Meanwhile, the Hardware segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, driven by rising demand for sensors, valves, control modules, and robust downhole equipment required for high-performance and automated well completions, especially in complex and deepwater environments.

• By Services

On the basis of services, the market is segmented into End-To-End Solution and Point Solution. The End-To-End Solution segment held the largest market revenue share of 62.4% in 2024, supported by operators seeking comprehensive solutions that include design, engineering, installation, monitoring, and maintenance of intelligent completions. These turnkey offerings reduce operational risks and provide optimized production outcomes.

The Point Solution segment is expected to witness the fastest CAGR of 18.3% from 2025 to 2032, driven by operators preferring modular or targeted upgrades, such as installation of specific monitoring or control modules, to enhance existing wells without incurring full-scale completion system costs.

Which Region Holds the Largest Share of the Intelligent Completion Market?

- Asia-Pacific dominated the intelligent completion market with the largest revenue share of 41.31% in 2024, driven by rapid industrialization, increasing investments in upstream oil and gas projects, and growing adoption of advanced well technologies

- Consumers and operators in the region highly value Intelligent Completions for real-time monitoring, remote control, and optimization of production across complex reservoirs

- This widespread adoption is further supported by rising energy demand, government incentives for technological modernization, and the presence of emerging local manufacturers, establishing Intelligent Completions as a preferred solution for both onshore and offshore operations

China Intelligent Completion Market Insight

The China intelligent completion market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s growing upstream oil and gas exploration activities, including shale, tight oil, and offshore operations. Rising investments in intelligent well systems are driven by the need to optimize production, reduce downtime, and enhance reservoir management. Technological advancements, supportive government policies, and domestic manufacturing capabilities have accelerated the adoption of Intelligent Completions across both onshore and offshore projects. Furthermore, operators increasingly deploy digital solutions for predictive maintenance, remote monitoring, and real-time data analysis, establishing China as the dominant market in the region.

Japan Intelligent Completion Market Insight

The Japan intelligent completion market is witnessing steady growth due to increasing offshore deepwater projects and the modernization of aging wells. Operators prioritize intelligent completion systems to achieve operational efficiency, enhance safety, and improve production monitoring in challenging offshore environments. Government initiatives supporting technological innovation and automation further drive adoption. In addition, Japan’s focus on predictive maintenance, energy efficiency, and integration of digital oilfield technologies encourages the deployment of advanced Intelligent Completion solutions. The rising need for secure and efficient reservoir management in both mature and new fields positions Japan as a key growth market in the Asia-Pacific Intelligent Completion industry.

India Intelligent Completion Market Insight

The India intelligent completion market is projected to expand significantly, driven by growing onshore exploration, increasing enhanced oil recovery (EOR) projects, and government-backed energy initiatives. Operators are adopting intelligent completion systems to maximize production, reduce operational risks, and improve reservoir management efficiency. The demand for technologically advanced yet cost-effective solutions is rising across both mature and new fields. Furthermore, the integration of digital monitoring, remote control systems, and predictive analytics enhances operational productivity. Rising private and public sector investments in upstream infrastructure, combined with strategic partnerships with global technology providers, are accelerating market adoption, establishing India as a rapidly expanding Intelligent Completion market.

Which Region is the Fastest Growing Region in the Intelligent Completion Market?

North America is poised to grow at the fastest CAGR of 7.69% from 2025 to 2032, driven by increasing offshore deepwater activities, higher adoption of digital oilfield technologies, and modernization of aging wells. The region’s technological sophistication, skilled workforce, and presence of key market players are accelerating Intelligent Completion adoption in both onshore and offshore projects.

U.S. Intelligent Completion Market Insight

The U.S. intelligent completion market captured the largest revenue share in North America in 2024, fueled by ongoing shale production, offshore deepwater projects in the Gulf of Mexico, and modernization of aging wells. Operators increasingly implement intelligent completion systems to optimize production, reduce downtime, and enhance reservoir management using real-time monitoring and predictive analytics. Technological innovation, a skilled workforce, and early adoption of digital oilfield solutions contribute to rapid market growth. Furthermore, government support for energy efficiency and digital transformation in upstream operations strengthens adoption. North America, led by the U.S., is emerging as the fastest-growing region for Intelligent Completions globally.

Canada Intelligent Completion Market Insight

The Canada intelligent completion market is growing steadily, driven by unconventional oil and gas operations, including tight oil and heavy oil fields. Operators are increasingly deploying intelligent completion systems to enhance production efficiency, enable remote monitoring, and reduce operational costs. Technological advancements, coupled with supportive government regulations and investments in digital oilfield initiatives, are accelerating adoption. The growing demand for reliable and automated well completions in onshore fields, combined with partnerships between domestic and international service providers, fosters market expansion. Canada’s focus on energy security and operational efficiency positions it as a key contributor to North America’s Intelligent Completion market growth.

Which are the Top Companies in Intelligent Completion Market?

The Intelligent Completion industry is primarily led by well-established companies, including:

- Schlumberger (U.S.)

- Weatherford (U.S.)

- Halliburton (U.S.)

- National Oilwell Varco (NOV) (U.S.)

- Baker Hughes (BHGE) (U.S.)

- Praxis (U.K.)

- Tendeka (U.K.)

- Ciscon Nigeria (Nigeria)

- Vantage Energy (U.S.)

- Omega Well Intervention Ltd (U.K.)

What are the Recent Developments in Intelligent Completion Market?

- In February 2023, Baker Hughes launched advanced software aimed at improving efficiency and performance in well-completion operations while simultaneously reducing emissions, strengthening the company’s commitment to sustainable and optimized well-completion solutions

- In April 2022, Halliburton introduced StrataSta, an innovative deep azimuthal resistivity service that provides multilayer visualization to optimize well contact with reservoirs and enhance real-time reserve evaluation, further expanding its iStar intelligent drilling and logging platform to deliver more precise and efficient well completions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.