Global Intelligent Power Distribution Unit Pdu Market

Market Size in USD Billion

CAGR :

%

USD

4.81 Billion

USD

9.46 Billion

2024

2032

USD

4.81 Billion

USD

9.46 Billion

2024

2032

| 2025 –2032 | |

| USD 4.81 Billion | |

| USD 9.46 Billion | |

|

|

|

|

Intelligent Power Distribution Unit (PDU) Market Size

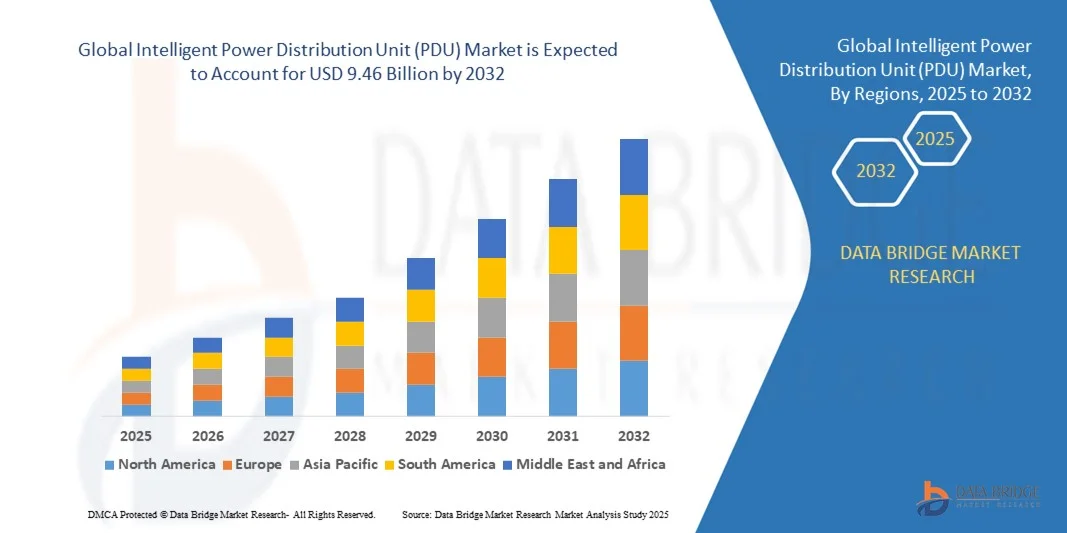

- The global intelligent power distribution unit (PDU) market size was valued at USD 4.81 billion in 2024 and is expected to reach USD 9.46 billion by 2032, at a CAGR of 8.83% during the forecast period

- The market growth is largely fuelled by increasing demand for reliable and efficient power management solutions across data centers, industrial facilities, and commercial buildings

- Rising adoption of cloud computing, edge data centers, and IoT-enabled devices is further driving the need for intelligent PDUs that provide real-time monitoring, load balancing, and energy optimization

Intelligent Power Distribution Unit (PDU) Market Analysis

- The growing integration of smart technologies and remote monitoring systems is transforming the PDU market, enabling predictive maintenance, energy efficiency, and improved operational reliability

- Increasing focus on reducing energy costs and carbon footprint is accelerating the adoption of intelligent PDUs, particularly in regions with high electricity expenses and stringent energy regulations

- North America dominated the intelligent PDU market with the largest revenue share of 37.5% in 2024, driven by the growing adoption of cloud computing, data centers, and industrial automation

- Asia-Pacific region is expected to witness the highest growth rate in the global intelligent power distribution unit (PDU) market, driven by rapid urbanization, growing adoption of smart and automated

- The Switched segment held the largest market revenue share in 2024, driven by its ability to provide remote control of individual outlets, enhanced load management, and improved operational flexibility. Switched PDUs are widely adopted in data centers and industrial facilities for efficient power distribution and monitoring

Report Scope and Intelligent Power Distribution Unit (PDU) Market Segmentation

|

Attributes |

Intelligent Power Distribution Unit (PDU) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Intelligent Power Distribution Unit (PDU) Market Trends

Rise of Smart and IoT-Enabled Power Distribution Solutions

- The growing adoption of smart and IoT-enabled PDUs is transforming the power distribution landscape by enabling real-time monitoring, predictive maintenance, and automated load management. These systems improve energy efficiency and operational reliability, particularly in data centers and industrial facilities. The integration of AI and advanced analytics allows operators to identify inefficiencies, predict faults before they occur, and optimize power usage across multiple devices and zones

- Increasing demand for remote monitoring and control capabilities is accelerating the deployment of networked PDUs. These solutions allow facility managers to track power usage, detect faults, and optimize energy consumption without on-site intervention, enhancing operational efficiency. Remote access capabilities also facilitate rapid response to anomalies and reduce downtime risks, improving overall facility performance and reliability

- The modularity, scalability, and ease of integration of modern intelligent PDUs are making them attractive for both new installations and retrofits. Organizations can deploy advanced PDUs without significant infrastructure changes, ensuring cost-effective upgrades. The flexibility of modular PDUs also supports gradual expansion and future-proofing of data centers and industrial facilities, accommodating evolving energy demands

- For instance, in 2023, several large-scale data centers in North America implemented IoT-enabled intelligent PDUs that provided real-time energy analytics and automated load balancing. This resulted in reduced downtime, optimized energy consumption, and lower operational costs. The deployment also helped these facilities meet sustainability targets and improve overall energy efficiency compliance

- While intelligent PDUs are accelerating energy efficiency and reliability, their impact depends on continuous technological innovation, cybersecurity, and interoperability with existing systems. Manufacturers must focus on robust, scalable, and cost-effective solutions to fully capitalize on market demand. Ensuring seamless integration with legacy infrastructure and adherence to international standards remains a critical factor for adoption

Intelligent Power Distribution Unit (PDU) Market Dynamics

Driver

Increasing Demand For Energy Efficiency And Reliable Power Management

- The growing focus on reducing operational costs and carbon footprint is driving the adoption of intelligent PDUs across data centers, commercial buildings, and industrial facilities. These systems enable better energy utilization and load management. By providing actionable insights and real-time alerts, PDUs also support proactive maintenance and extend equipment life cycles

- Organizations are increasingly aware of the financial and operational risks associated with unmonitored power distribution, such as equipment downtime, energy wastage, and overloading. This awareness is accelerating investments in intelligent PDUs. The ability to prevent unexpected outages and reduce electricity consumption directly improves operational efficiency and cost-effectiveness

- Government incentives, energy regulations, and sustainability initiatives are encouraging companies to deploy energy-efficient power distribution solutions. These supportive frameworks are enhancing adoption rates globally. Regulations related to energy efficiency and green building certifications are further motivating organizations to adopt IoT-enabled PDUs as part of their compliance strategy

- For instance, in 2022, several European industrial complexes integrated intelligent PDUs with automated load balancing and monitoring features, improving energy efficiency and reducing operational interruptions. These deployments also helped organizations optimize resource utilization and reduce maintenance overheads while supporting sustainability goals

- While awareness and regulatory support are driving the market, adoption depends on technological compatibility, cost-effectiveness, and ease of deployment for different facility types. Facilities with outdated electrical infrastructure face additional challenges, making proper planning and integration strategies essential for successful implementation

Restraint/Challenge

High Initial Cost And Integration Complexity

- The high upfront investment for intelligent PDUs, especially those with advanced monitoring and IoT capabilities, limits adoption among small and mid-sized facilities. Cost remains a major barrier for widespread deployment. The ROI is often realized over a longer period, which can discourage short-term investments despite operational benefits

- Integration with existing electrical infrastructure can be complex, requiring skilled personnel and specialized tools. This challenge often delays installations and limits market penetration. Retrofitting older systems may require additional upgrades to ensure safety, compatibility, and optimal performance of intelligent PDUs

- Supply chain constraints, including component shortages and price volatility, can impact availability and deployment timelines of intelligent PDUs. This restricts growth, particularly in emerging regions. Fluctuating raw material costs and limited access to specialized electronic components may further delay project timelines and increase overall implementation costs

- For instance, in 2023, several commercial facilities in Asia-Pacific faced delays in implementing intelligent PDUs due to high costs and integration challenges, impacting operational efficiency plans. These delays highlighted the need for standardized, cost-effective solutions and localized manufacturing support

- While technology continues to advance, addressing cost, integration complexity, and supply chain reliability is critical for broader adoption and long-term market growth. Companies focusing on scalable, modular, and easy-to-install PDUs are likely to gain a competitive advantage in the evolving global market

Intelligent Power Distribution Unit (PDU) Market Scope

The market is segmented on the basis of type, power phase, application, and end user.

- By Type

On the basis of type, the intelligent PDU market is segmented into Metered, Monitored, Dual Circuit, Automatic Transfer Switch, Basic PDU, Switched, and Hot Swap. The Switched segment held the largest market revenue share in 2024, driven by its ability to provide remote control of individual outlets, enhanced load management, and improved operational flexibility. Switched PDUs are widely adopted in data centers and industrial facilities for efficient power distribution and monitoring.

The Monitored segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by real-time energy usage tracking, proactive alert generation, and predictive maintenance capabilities. Monitored PDUs are increasingly preferred for their ability to optimize energy efficiency and reduce downtime across critical facilities.

- By Power Phase

On the basis of power phase, the intelligent PDU market is segmented into Single Phase and Three Phase. The Three Phase segment held the largest market revenue share in 2024, driven by its suitability for high-capacity power distribution in data centers, industrial environments, and commercial facilities. Three Phase PDUs provide reliable performance, reduce energy losses, and support scalable infrastructure.

The Single Phase segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in small- and medium-sized enterprises, edge data centers, and localized power distribution applications. Single Phase PDUs are appreciated for their cost-effectiveness, ease of installation, and suitability for lower power requirements.

- By Application

On the basis of application, the intelligent PDU market is segmented into Datacenters, Educational Labs, Commercial Applications/Network Closets, Industrial Power Solutions, and VoIP Phone Systems. The Datacenters segment held the largest market revenue share in 2024, driven by the need for reliable, scalable, and energy-efficient power distribution solutions to support cloud computing, IoT, and high-density server environments.

The Industrial Power Solutions segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by growing automation, adoption of smart manufacturing solutions, and the need for real-time energy monitoring and load management in factories and production facilities.

- By End User

On the basis of end user, the intelligent PDU market is segmented into Energy, Telecom and IT, BFSI, Transportation, Industrial Manufacturing, Government, and Healthcare. The Telecom and IT segment held the largest market revenue share in 2024, driven by the proliferation of data centers, network operations centers, and high-density IT infrastructure requiring reliable and intelligent power distribution.

The Healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing digitization of healthcare facilities, adoption of smart medical equipment, and the need for uninterrupted and monitored power supply to critical hospital operations.

Intelligent Power Distribution Unit (PDU) Market Regional Analysis

- North America dominated the intelligent PDU market with the largest revenue share of 37.5% in 2024, driven by the growing adoption of cloud computing, data centers, and industrial automation

- Organizations in the region highly value real-time energy monitoring, automated load management, and predictive maintenance capabilities offered by intelligent PDUs

- This widespread adoption is further supported by well-established IT infrastructure, high technological awareness, and the increasing emphasis on energy efficiency and operational reliability across commercial and industrial facilities

U.S. Intelligent PDU Market Insight

The U.S. intelligent PDU market captured the largest revenue share of 82% in 2024 within North America, fueled by rapid expansion of data centers, edge computing, and IoT-enabled facilities. Companies are increasingly investing in intelligent PDUs to ensure uninterrupted power, optimize energy consumption, and reduce operational costs. Furthermore, government energy efficiency initiatives and sustainability programs are accelerating the deployment of smart and remotely monitored PDUs across various sectors.

Europe Intelligent PDU Market Insight

The Europe intelligent PDU market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent energy efficiency regulations and rising adoption of automated industrial and commercial infrastructures. Increased urbanization and digitalization are fostering the deployment of intelligent PDUs. European organizations are also leveraging PDUs for enhanced operational reliability and reduced energy costs.

U.K. Intelligent PDU Market Insight

The U.K. intelligent PDU market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for energy-efficient infrastructure and smart data center solutions. The emphasis on reducing power outages, optimizing operational costs, and integrating advanced monitoring technologies is encouraging organizations to adopt intelligent PDUs.

Germany Intelligent PDU Market Insight

The Germany intelligent PDU market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s focus on energy efficiency, industrial automation, and sustainability initiatives. Germany’s advanced infrastructure and strong industrial base promote the adoption of intelligent PDUs in both commercial and industrial sectors. Integration with smart energy management systems is becoming increasingly common to enhance operational reliability.

Asia-Pacific Intelligent PDU Market Insight

The Asia-Pacific intelligent PDU market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rapid urbanization, rising IT and telecom infrastructure investments, and industrial automation in countries such as China, Japan, and India. The region's inclination towards smart and connected facilities, supported by government initiatives for digitalization, is driving adoption. In addition, APAC’s emergence as a manufacturing hub for PDUs is improving affordability and accessibility for a wider customer base.

Japan Intelligent PDU Market Insight

The Japan intelligent PDU market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high-tech industrial ecosystem, increasing urbanization, and growing demand for reliable and monitored power distribution. Japanese organizations prioritize minimizing downtime, energy optimization, and integrating PDUs with IoT-enabled facility management systems. The aging workforce and emphasis on automated monitoring systems further accelerate demand.

China Intelligent PDU Market Insight

The China intelligent PDU market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid expansion of data centers, cloud computing facilities, and industrial automation. China is among the largest markets for intelligent power distribution solutions, with high adoption in commercial, industrial, and telecom sectors. Government-backed smart city projects, availability of cost-effective PDU solutions, and strong local manufacturing capabilities are major factors propelling market growth.

Intelligent Power Distribution Unit (PDU) Market Share

The Intelligent Power Distribution Unit (PDU) industry is primarily led by well-established companies, including:

- Eaton (U.S.)

- ABB (Switzerland)

- Raritan Inc. (U.S.)

- Rittal GmbH & Co. KG (Germany)

- Cyber Power Systems (U.S.) Inc. (U.S.)

- Schneider Electric (France)

- Leviton Manufacturing Co. Inc. (U.S.)

- Elcom International (Australia)

- Geist (U.S.)

- Black Box Corporation (U.S.)

- Chatsworth Products (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Enlogic (U.S.)

- Anord Mardix (U.K.)

- Cisco Systems, Inc. (U.S.)

- Vertiv Group Corp (U.S.)

- PDU Expert UK (U.K.)

- Legrand (France)

- Siemon (U.S.)

- Tripp Lite (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.