Global Intent Based Networking Ibn Market

Market Size in USD Billion

CAGR :

%

USD

2.05 Billion

USD

11.09 Billion

2024

2032

USD

2.05 Billion

USD

11.09 Billion

2024

2032

| 2025 –2032 | |

| USD 2.05 Billion | |

| USD 11.09 Billion | |

|

|

|

|

Intent-based Networking (IBN) Market Size

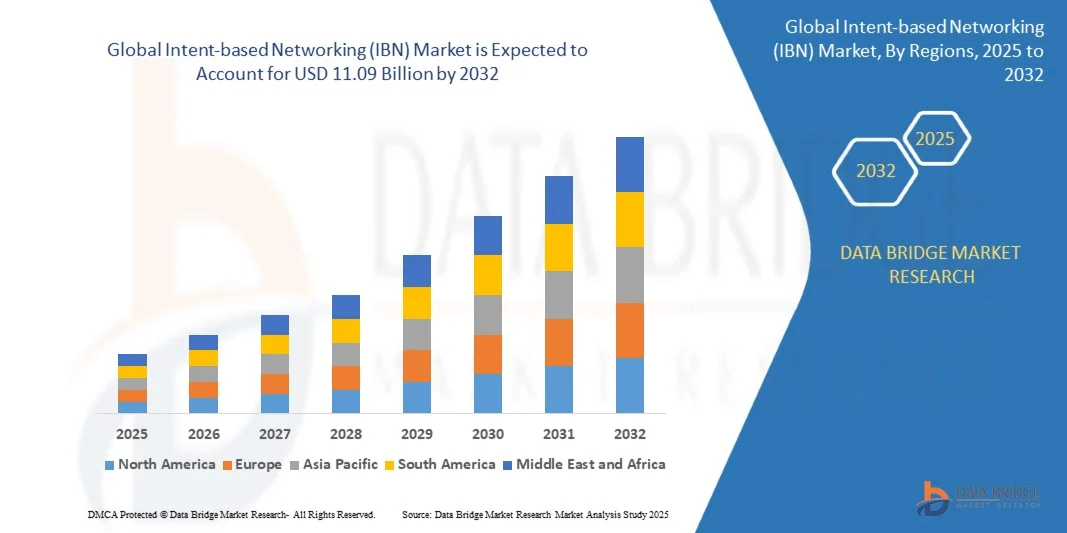

- The global intent-based networking (IBN) market size was valued at USD 2.05 billion in 2024 and is expected to reach USD 11.09 billion by 2032, at a CAGR of 23.50% during the forecast period

- The market growth is largely fuelled by the increasing adoption of automation in enterprise networks, growing complexity of network infrastructures, and rising demand for intelligent, self-managing network solutions that reduce operational costs and improve efficiency

- The surge in cloud adoption, remote work trends, and the need for advanced cybersecurity solutions are also driving IBN deployment across various industries, enhancing network agility, scalability, and performance

Intent-based Networking (IBN) Market Analysis

- IBN is transforming traditional network management by enabling automated policy enforcement, real-time monitoring, and predictive analytics, which support proactive issue resolution and optimized performance

- The market is witnessing significant investments from technology vendors and enterprises in AI-driven network solutions, reflecting the strategic importance of IBN in modern digital transformation initiatives

- North America dominated the IBN market with the largest revenue share of 35.50% in 2024, driven by rapid digital transformation, high adoption of AI-driven network solutions, and the increasing need for automated, self-managing networks

- Asia-Pacific region is expected to witness the highest growth rate in the global intent-based networking (IBN) market, driven by expanding industrial digitalization, rising cloud adoption, and growing IT spending across emerging economies

- The Software segment held the largest market revenue share in 2024, driven by the rising adoption of AI-driven network automation, predictive monitoring, and policy-based configuration. Software solutions enable centralized management, real-time analytics, and automated issue resolution, making them essential for enterprises seeking operational efficiency and network reliability

Report Scope and Intent-based Networking (IBN) Market Segmentation

|

Attributes |

Intent-based Networking (IBN) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Intent-based Networking (IBN) Market Trends

“Increasing Adoption of AI-Driven Network Automation”

- The growing integration of AI-driven intent-based networking solutions is transforming enterprise network management by enabling real-time monitoring, automated configuration, and predictive issue resolution. Organizations benefit from reduced downtime, improved network performance, and streamlined operations. These solutions also support dynamic traffic management and automatic anomaly detection, enhancing network reliability and operational efficiency

- Rising demand for self-managing, adaptive networks is accelerating the adoption of IBN platforms in large-scale data centers, cloud environments, and hybrid IT infrastructures. These solutions allow IT teams to focus on strategic initiatives while reducing manual intervention. In addition, IBN helps in proactive capacity planning and rapid fault mitigation, reducing service disruptions and operational costs

- The scalability, reliability, and ease of deployment of modern IBN solutions are making them attractive for businesses across industries. Companies can optimize resource allocation, enforce consistent policies, and enhance cybersecurity posture without extensive manual oversight. Furthermore, the integration of AI analytics enables predictive maintenance and continuous performance optimization, driving long-term value

- For instance, in 2023, several global financial institutions implemented AI-powered IBN solutions across multi-branch networks, improving service availability, reducing configuration errors, and enhancing compliance with IT policies. This deployment also facilitated better network segmentation and risk management, contributing to improved regulatory adherence and operational resilience

- While AI-driven automation is accelerating network efficiency, the market growth depends on continued innovation, seamless integration with legacy systems, and IT staff training. Vendors must focus on customizable, secure, and scalable solutions to maximize adoption. In addition, increasing demand for hybrid and multi-cloud support further positions IBN as a critical enabler of digital transformation

Intent-based Networking (IBN) Market Dynamics

Driver

“Rising Demand for Automated and Self-Managing Networks”

- Enterprises are increasingly adopting automated network solutions to manage growing data traffic, IoT devices, and multi-cloud environments. IBN platforms provide policy-driven automation, reducing human error and operational complexity. They also improve network visibility and provide actionable insights, helping IT teams proactively manage network performance

- Organizations prioritize agility, reliability, and security in network operations. IBN solutions facilitate rapid deployment of new services, predictive maintenance, and real-time network optimization, driving enterprise adoption. Moreover, automated compliance reporting and anomaly detection help mitigate cybersecurity risks and operational bottlenecks

- Regulatory compliance and data privacy requirements encourage enterprises to implement centralized, AI-driven network monitoring and policy enforcement, further boosting IBN deployment. These solutions assist in maintaining audit readiness, ensuring data protection standards, and minimizing compliance-related risks while reducing operational workload

- For instance, in 2022, several telecom operators deployed IBN solutions to automate configuration and monitoring across regional networks, enhancing service uptime and reducing operational costs. The deployment also enabled advanced traffic prioritization and real-time SLA monitoring, strengthening customer experience and service reliability

- While adoption is increasing, consistent innovation, seamless integration, and cost-effectiveness remain essential for sustained market growth. In addition, the need for hybrid network orchestration and enhanced AI capabilities continues to push market participants to evolve their offerings to meet growing enterprise demands

Restraint/Challenge

“High Implementation Costs and Technical Complexity”

- The high cost of IBN deployment, including software licenses, hardware upgrades, and skilled personnel, limits adoption among small and medium-sized enterprises. Implementation budgets and ROI considerations remain critical factors. Organizations also face recurring costs for software updates, support services, and AI model tuning, which can impact long-term affordability

- Complex integration with legacy network infrastructure requires technical expertise and careful planning. Lack of trained personnel and established frameworks in many organizations can hinder seamless adoption. In addition, inadequate IT governance and fragmented network architectures can prolong deployment timelines and reduce anticipated efficiency gains

- Market growth is also constrained by concerns over vendor lock-in, interoperability challenges, and cybersecurity risks associated with automated networks. Enterprises may face difficulties integrating multi-vendor environments, which can lead to increased operational risks and higher maintenance complexity

- For instance, in 2023, several regional enterprises delayed IBN implementation due to high upfront costs and compatibility issues with existing network equipment, affecting project timelines and investment decisions. These delays often led to increased reliance on manual network management and reduced overall network performance

- While technology is evolving rapidly, addressing cost, technical integration, and workforce readiness is crucial. Market participants must focus on scalable, user-friendly solutions and robust training programs to ensure long-term adoption. Continuous enhancement of AI algorithms, automation capabilities, and multi-cloud orchestration is also critical to unlock full market potential

Intent-based Networking (IBN) Market Scope

The market is segmented on the basis of component type, deployment model, application, and vertical

• By Component Type

On the basis of component type, the IBN market is segmented into Networking Hardware Components, Software, and Service. The Software segment held the largest market revenue share in 2024, driven by the rising adoption of AI-driven network automation, predictive monitoring, and policy-based configuration. Software solutions enable centralized management, real-time analytics, and automated issue resolution, making them essential for enterprises seeking operational efficiency and network reliability.

The Networking Hardware Components segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing demand for advanced routers, switches, and controllers that support automated orchestration. Hardware innovation ensures seamless software integration, improved scalability, lower latency, and enhanced security, which is vital for large-scale, multi-cloud enterprise environments.

• By Deployment Model

On the basis of deployment model, the market is segmented into On-Premise and On Cloud. The On Cloud segment held the largest share in 2024, driven by the growing shift toward cloud-based IT infrastructure and the need for remote network management. Cloud deployment offers scalability, flexibility, lower upfront investment, and simplified maintenance, making it highly attractive for dynamic enterprise operations.

The On-Premise segment is expected to witness the fastest growth rate from 2025 to 2032, driven by enterprises seeking complete control over network infrastructure, enhanced security, and compliance with strict data regulations. On-premise IBN allows customization, integration with existing systems, and minimal dependency on external connectivity.

• By Application

On the basis of application, the market is segmented into Healthcare, Government, Manufacturing, Telecom, Defense, and BFSI. The BFSI segment held the largest market share in 2024, driven by the sector’s need for secure, reliable, and automated network operations. IBN solutions help BFSI enterprises reduce downtime, enforce compliance, and maintain uninterrupted service delivery.

The Telecom segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the adoption of automated, AI-driven network solutions across 5G infrastructure and large-scale telecom networks. IBN enhances traffic management, ensures service uptime, and supports complex multi-branch operations.

• By Vertical

On the basis of vertical, the market is segmented into Construction, Building, Telecomm, and Healthcare. The Telecomm vertical held the largest share in 2024, driven by growing demand for automated network management in service provider infrastructure, IoT deployments, and cloud connectivity. IBN ensures high availability, streamlined operations, and optimized resource allocation.

The Healthcare vertical is expected to witness the fastest growth rate from 2025 to 2032, driven by hospitals, clinics, and research facilities adopting automated network solutions for real-time patient data management and secure communication. IBN improves network reliability, enhances cybersecurity, and supports the growing demand for connected medical devices.

Intent-based Networking (IBN) Market Regional Analysis

- North America dominated the IBN market with the largest revenue share of 35.50% in 2024, driven by rapid digital transformation, high adoption of AI-driven network solutions, and the increasing need for automated, self-managing networks

- Enterprises in the region highly value predictive network analytics, real-time monitoring, and policy-based automation offered by IBN solutions, enabling reduced downtime and improved operational efficiency

- This widespread adoption is further supported by robust IT infrastructure, high technological readiness, and strong investment in cloud and hybrid networks, establishing IBN as a preferred solution for enterprises across BFSI, telecom, and government sectors

U.S. IBN Market Insight

The U.S. IBN market captured the largest revenue share in 2024 within North America, fueled by rapid enterprise adoption of AI-enabled network automation and cloud-based network management. Organizations are increasingly prioritizing operational agility, network reliability, and cybersecurity. The growing deployment of multi-cloud environments, coupled with demand for predictive maintenance and automated policy enforcement, further propels the IBN market. In addition, continuous integration with legacy infrastructure and focus on IT staff upskilling supports market expansion.

Europe IBN Market Insight

The Europe IBN market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent regulatory requirements, digital transformation initiatives, and rising demand for automated network operations. Increasing enterprise reliance on connected devices and cloud services fosters IBN adoption. European organizations are also motivated by efficiency gains, reduced operational complexity, and compliance with GDPR and other network security regulations. The market is expanding across healthcare, telecom, and manufacturing sectors.

U.K. IBN Market Insight

The U.K. IBN market is expected to witness the fastest growth rate from 2025 to 2032, driven by the accelerating adoption of AI-driven networks in enterprise and public sectors. Concerns regarding cybersecurity, operational efficiency, and compliance are encouraging organizations to implement policy-based automated network solutions. The UK’s advanced IT infrastructure, emphasis on digital innovation, and strong telecom sector further stimulate market growth.

Germany IBN Market Insight

The Germany IBN market is expected to witness significant growth from 2025 to 2032, fueled by the increasing demand for intelligent, automated networks across manufacturing, government, and BFSI sectors. Germany’s focus on Industry 4.0 initiatives, cybersecurity, and sustainable IT infrastructure promotes IBN adoption. Integration of IBN with existing enterprise networks ensures reliable, secure, and high-performance network operations, aligning with local industrial and technological expectations.

Asia-Pacific IBN Market Insight

The Asia-Pacific IBN market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, increasing cloud adoption, and growing IT investments in countries such as China, Japan, and India. Enterprises are adopting AI-based network automation to improve efficiency, reduce operational costs, and ensure scalability. In addition, regional government initiatives supporting digital infrastructure and smart city projects are accelerating market penetration across telecom, healthcare, and manufacturing sectors.

Japan IBN Market Insight

The Japan IBN market is expected to witness strong growth from 2025 to 2032 due to high technology adoption, smart city initiatives, and a focus on network reliability. Enterprises prioritize predictive network monitoring, automated configuration, and enhanced cybersecurity. Integration of IBN solutions with IoT, cloud, and AI-driven analytics supports efficient, self-managing networks. The market is further driven by rising IT budgets, innovation in AI networking platforms, and government support for digital infrastructure.

China IBN Market Insight

The China IBN market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid digital transformation, high adoption of cloud and enterprise networks, and AI-driven automation. The country’s growing enterprise sector, increasing focus on network security, and government-backed smart city programs are key factors driving IBN adoption. Affordable AI-enabled network solutions and strong local vendor presence further support market growth across BFSI, telecom, and industrial sectors.

Intent-based Networking (IBN) Market Share

The Intent-based Networking (IBN) industry is primarily led by well-established companies, including:

- Cisco Systems, Inc. (U.S.)

- Juniper Networks, Inc. (U.S.)

- Hewlett Packard Enterprise (U.S.)

- IBM Corporation (U.S.)

- Extreme Networks, Inc. (U.S.)

- Nokia Corporation (Finland)

- Arista Networks, Inc. (U.S.)

- Huawei Technologies Co., Ltd. (China)

- VMware, Inc. (U.S.)

- Ciena Corporation (U.S.)

Latest Developments in Intent-based Networking (IBN) Market

- In May 2025, Forward Networks entered a strategic partnership with IBM to integrate its intent-based networking (IBN) platform with IBM’s hybrid cloud solutions. This collaboration enhances interoperability, enabling enterprises to achieve greater automation efficiency and visibility across complex network infrastructures

- In April 2025, Nokia opened a new research and development facility in Finland dedicated to advancing intent-based networking technologies. The center focuses on innovation for telecom and enterprise networks, reinforcing Nokia’s commitment to automation and global technological leadership

- In February 2025, IBM appointed a new head for its intent-based networking division to strengthen strategic direction and innovation. This move highlights IBM’s focus on expanding AI-powered automation and scaling intelligent networking solutions for global enterprises

- In January 2025, Cisco acquired an intent-based networking startup to enhance its AI-driven network automation capabilities. The acquisition is expected to accelerate the integration of predictive analytics and self-healing network features, boosting Cisco’s position in intelligent infrastructure solutions

- In November 2024, Gluware raised USD 30 million in Series C funding to expand its intent-based networking automation platform and accelerate enterprise adoption. The investment aims to enhance low-code automation and strengthen Gluware’s market presence among global enterprises

- In October 2024, Juniper Networks secured a major contract from a leading European financial institution to deploy its intent-based networking solutions. The project supports digital transformation initiatives and strengthens automation within Europe’s financial sector

- In September 2024, Huawei launched its next-generation intent-based networking system featuring advanced AI capabilities and real-time analytics. The solution optimizes enterprise network performance and positions Huawei as a strong competitor in AI-driven network management

- In August 2024, Nokia partnered with Hewlett Packard Enterprise (HPE) to co-develop intent-based networking solutions tailored for telecom operators. The collaboration focuses on network automation, scalability, and intelligence, enhancing operational agility across global telecom networks

- In July 2024, IBM introduced an AI-powered intent-based networking platform for hybrid cloud environments. The platform automates network configuration and management, helping enterprises achieve improved efficiency, security, and scalability in complex IT infrastructures

- In May 2024, Forward Networks raised USD 50 million in Series D funding to accelerate development of its intent-based networking platform and expand globally. This funding supports innovation in intent verification and real-time network analysis, intensifying competition in enterprise automation

- In May 2024, Juniper Networks expanded its intent-based networking portfolio with a new release of its Apstra software, incorporating advanced analytics and multi-vendor support. The update enhances operational efficiency and flexibility for modern data center environments

- In April 2024, Cisco announced major advancements in its intent-based networking portfolio, introducing AI-driven automation and enhanced security features. These innovations simplify enterprise network management and reinforce Cisco’s leadership in the global IBN market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.