Global Interactive Wound Dressing Market

Market Size in USD Billion

CAGR :

%

USD

17.16 Billion

USD

25.68 Billion

2025

2033

USD

17.16 Billion

USD

25.68 Billion

2025

2033

| 2026 –2033 | |

| USD 17.16 Billion | |

| USD 25.68 Billion | |

|

|

|

|

Interactive Wound Dressing Market Size

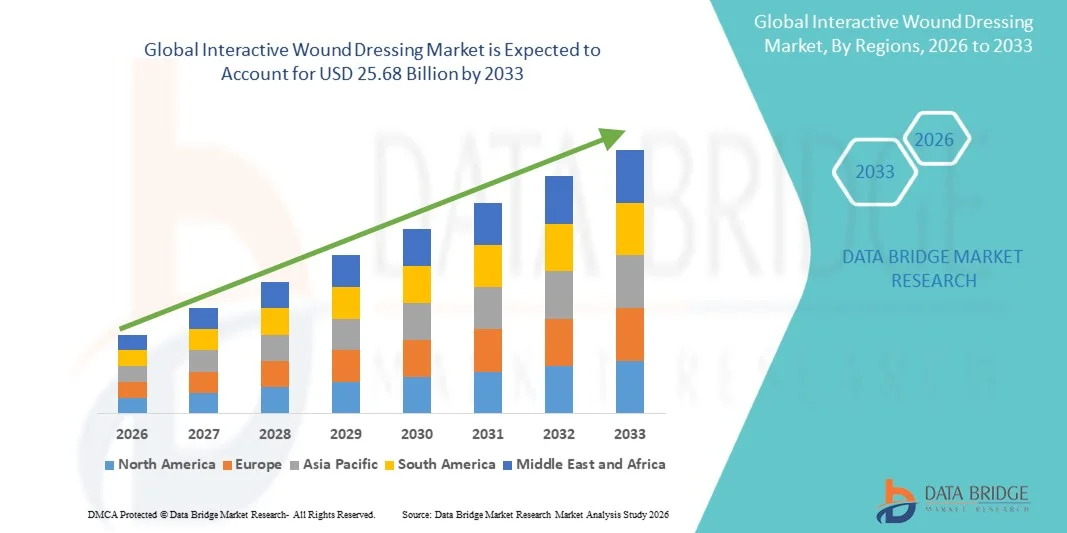

- The global Interactive Wound Dressing market size was valued at USD 17.16 billion in 2025 and is expected to reach USD 25.68 billion by 2033, at a CAGR of 5.17% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced wound care technologies and continuous innovation in interactive and smart dressing materials, leading to improved healing outcomes, real-time wound monitoring, and increased digitalization in hospital, home-care, and long-term care settings

- Furthermore, rising demand for effective, patient-friendly, and technologically integrated wound management solutions, along with the increasing prevalence of chronic wounds, diabetic ulcers, and pressure injuries, is establishing interactive wound dressings as a preferred choice in modern wound care. These converging factors are accelerating the uptake of Interactive Wound Dressing solutions, thereby significantly boosting the industry's growth

Interactive Wound Dressing Market Analysis

- Interactive wound dressings, including hydrocolloid, hydrogel, foam, and film-based advanced dressings, are increasingly vital components of modern wound care management due to their ability to provide moisture balance, protect against infection, and enable faster healing in hospital, home-care, and long-term care settings

- The escalating demand for interactive wound dressings is primarily fueled by rising prevalence of chronic wounds, diabetic foot ulcers, pressure injuries, and surgical wounds, combined with increasing adoption of advanced wound care technologies and integration of smart monitoring systems

- North America dominated the interactive wound dressing market with the largest revenue share of approximately 39.5% in 2025, supported by advanced healthcare infrastructure, high patient awareness, strong presence of leading wound care companies, and growing adoption of innovative dressing solutions in hospitals and specialized wound care centers

- Asia-Pacific is expected to be the fastest-growing region in the interactive wound dressing market during the forecast period due to rising healthcare spending, expanding hospital networks, growing awareness of advanced wound care, and increasing incidence of chronic wounds across countries such as China, India, and Japan

- The Semi-Permeable Films Dressing segment dominated the largest market revenue share of 41.5% in 2025, owing to its high breathability, water resistance, and protective barrier properties which prevent microbial infection

Report Scope and Interactive Wound Dressing Market Segmentation

|

Attributes |

Interactive Wound Dressing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Interactive Wound Dressing Market Trends

“Technological Advancements in Interactive Wound Dressing”

- A significant and accelerating trend in the global interactive wound dressing market is the growing adoption of advanced wound care technologies, including bioactive dressings, hydrocolloid-based systems, and smart moisture-regulating materials

- For instance, modern interactive wound dressings now incorporate features such as antimicrobial coatings, pH monitoring, and controlled exudate management, which enhance healing rates and reduce infection risk

- Manufacturers are increasingly focusing on the development of dressings that can adapt to different wound types, including diabetic ulcers, pressure sores, and post-surgical wounds, thereby improving clinical outcomes

- Furthermore, the use of biodegradable and skin-friendly materials in interactive wound dressings is improving patient comfort and compliance during treatment

- This trend toward more effective, adaptive, and patient-centered wound care solutions is driving hospitals, clinics, and home healthcare providers to replace traditional dressings with advanced interactive products

- Global adoption is supported by increasing awareness of wound management best practices and rising demand for faster recovery and reduced hospital stays

Interactive Wound Dressing Market Dynamics

Driver

“Rising Incidence of Chronic and Acute Wounds”

- The increasing prevalence of chronic wounds, such as diabetic foot ulcers, venous leg ulcers, and pressure injuries, is a key driver of demand for interactive wound dressings globally

- For instance, the World Health Organization reports a steady rise in diabetes and obesity cases worldwide, contributing to a growing population at risk of chronic wounds

- Interactive wound dressings offer enhanced moisture retention, infection control, and faster tissue regeneration, providing clear advantages over conventional dressings

- Furthermore, the expanding home healthcare sector and increasing adoption of outpatient wound care practices are supporting the demand for patient-friendly interactive dressings

- The focus on improving patient outcomes, reducing hospital readmissions, and lowering overall healthcare costs is encouraging healthcare providers to integrate interactive wound care solutions into standard treatment protocols

Restraint/Challenge

“High Costs and Limited Awareness in Emerging Markets”

- Despite growing demand, the high cost of advanced interactive wound dressings remains a major challenge for adoption, especially in price-sensitive regions

- For instance, some hydrocolloid and bioactive dressings can be several times more expensive than traditional gauze, limiting their use in low-resource settings

- In addition, lack of awareness and insufficient training among healthcare professionals in emerging markets can hinder the effective adoption and utilization of these products

- Other challenges include limited reimbursement policies in certain regions and the need for rigorous clinical validation to gain regulatory approvals

- Overcoming these barriers through cost-effective product development, educational initiatives, and expanded insurance coverage will be critical to sustaining global market growth in the Interactive Wound Dressing sector

Interactive Wound Dressing Market Scope

he market is segmented on the basis of type, application, and end user.

• By Type

On the basis of type, the Interactive Wound Dressing market is segmented into Semi-Permeable Films Dressing, Hydrogel, and Semi-Permeable Foams Dressing. The Semi-Permeable Films Dressing segment dominated the largest market revenue share of 41.5% in 2025, owing to its high breathability, water resistance, and protective barrier properties which prevent microbial infection. It is highly preferred in hospitals and clinics for treating superficial wounds and post-operative care. Its ease of use, cost-effectiveness, and compatibility with a wide range of wound types further bolster its adoption. The global adoption is also supported by increased awareness among healthcare professionals about wound management and patient comfort, driving steady demand across North America and Europe. Its ability to maintain a moist wound environment and transparency for wound inspection contributes to its leadership position. Increasing investments in advanced wound care research and the expanding chronic wound patient pool further enhance market revenue share.

The Hydrogel segment is expected to witness the fastest CAGR of 9.8% from 2026 to 2033, due to its superior hydration properties, pain-relieving effects, and suitability for dry and necrotic wounds. Hydrogels facilitate autolytic debridement and are increasingly adopted in home care settings and surgical centers for both acute and chronic wounds. Rising diabetic populations and an increasing prevalence of burns, abrasions, and pressure ulcers drive the hydrogel segment. Their ease of incorporation with bioactive compounds, growth factors, and antimicrobial agents makes them highly attractive to clinicians. Additionally, ongoing product innovations and formulation improvements targeting patient comfort and faster healing further boost growth prospects. The Asia-Pacific region is emerging as a high-growth market due to increasing healthcare infrastructure investments and awareness campaigns.

• By Application

On the basis of application, the Interactive Wound Dressing market is segmented into Chronic Wounds, Leg Ulcers, Mechanical Stress Wounds, Lacerations, Grazes, Burns, Skin Tears, Diabetic Wounds, and Acute Wounds. The Chronic Wounds segment accounted for the largest market revenue share of 38.7% in 2025, driven by the rising prevalence of diabetes, pressure ulcers, and venous leg ulcers in aging populations globally. Chronic wounds require advanced dressings that provide sustained moisture balance, infection control, and ease of monitoring, making interactive dressings highly suitable. Adoption is particularly strong in hospitals and clinics in North America and Europe, where reimbursement policies and standardized wound care protocols support their use. Increasing government initiatives to improve chronic wound management and awareness among caregivers further consolidate the segment’s dominance.

The Diabetic Wounds application segment is expected to witness the fastest CAGR of 10.3% from 2026 to 2033, fueled by the growing global diabetic population, which is projected to reach over 700 million by 2030. Interactive dressings that support autolytic debridement, antimicrobial protection, and moisture retention are increasingly preferred for diabetic foot ulcers. Rising patient awareness, the adoption of telemedicine for remote wound monitoring, and the integration of novel biomaterials in dressings are driving this segment. The Asia-Pacific region, particularly India and China, is emerging as a high-growth market due to increasing diabetes prevalence, rising healthcare spending, and improved access to modern wound care technologies.

• By End User

On the basis of end user, the Interactive Wound Dressing market is segmented into Hospitals and Clinics, and Ambulatory Surgical Centers. The Hospitals and Clinics segment held the largest market revenue share of 62% in 2025, driven by the high volume of wound care procedures, presence of trained medical professionals, and structured wound care protocols. Hospitals invest in advanced interactive dressing solutions to reduce healing time, prevent infections, and minimize hospital stays. Increasing hospitalization for chronic wounds, surgical interventions, and burns further strengthens demand. North America leads in adoption due to advanced healthcare infrastructure and favorable reimbursement policies.

The Ambulatory Surgical Centers segment is expected to witness the fastest CAGR of 8.9% from 2026 to 2033, owing to the rising trend of outpatient wound management, minimally invasive procedures, and cost-effective care delivery. These centers increasingly prefer interactive wound dressings for post-operative wound healing, chronic wound follow-ups, and patient convenience. The growth is supported by increasing outpatient surgeries globally, rising awareness among surgeons about dressing efficacy, and the integration of telehealth for follow-up care. Asia-Pacific and Latin America are emerging as key growth regions due to expansion of surgical centers and increased access to advanced wound care products.

Interactive Wound Dressing Market Regional Analysis

- North America dominated the interactive wound dressing market with the largest revenue share of approximately 39.5% in 2025

- Supported by advanced healthcare infrastructure, high patient awareness, strong presence of leading wound care companies

- Growing adoption of innovative dressing solutions in hospitals and specialized wound care centers

U.S. Interactive Wound Dressing Market Insight

The U.S. interactive wound dressing market captured the largest revenue share within North America in 2025, fueled by rising demand for advanced wound care products, increasing prevalence of chronic wounds, and adoption of technologically advanced dressing solutions in hospitals, clinics, and home care settings. The market growth is further supported by favorable reimbursement policies and the strong presence of global wound care product manufacturers.

Europe Interactive Wound Dressing Market Insight

The Europe interactive wound dressing market is projected to expand at a substantial CAGR during the forecast period, driven by rising awareness of advanced wound care products, increasing geriatric population, and growth in hospital and specialized wound care facilities. Countries such as Germany, the U.K., and France are witnessing strong adoption of interactive and advanced dressings in both hospital and home care settings.

U.K. Interactive Wound Dressing Market Insight

The U.K. interactive wound dressing market is expected to grow steadily during the forecast period, fueled by increased adoption of advanced wound care technologies, rising incidence of chronic wounds, and expanding hospital and clinical infrastructure.

Germany Interactive Wound Dressing Market Insight

The Germany interactive wound dressing market is anticipated to register notable growth, supported by high patient awareness, adoption of innovative wound care solutions, and strong healthcare infrastructure across hospitals and specialized centers.

Asia-Pacific Interactive Wound Dressing Market Insight

The Asia-Pacific interactive wound dressing market is poised to grow at the fastest CAGR during the forecast period, driven by rising healthcare spending, expanding hospital networks, growing awareness of advanced wound care, and increasing incidence of chronic wounds across countries such as China, India, and Japan.

Japan Interactive Wound Dressing Market Insight

The Japan interactive wound dressing market is gaining momentum due to increasing patient awareness, technological advancements in wound care products, and the growing elderly population, which drives demand for advanced dressing solutions in both hospitals and home care settings.

China Interactive Wound Dressing Market Insight

The China interactive wound dressing market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising incidence of chronic wounds, expanding healthcare infrastructure, increasing patient awareness, and growing adoption of technologically advanced dressing solutions in hospitals and specialized wound care centers.

Interactive Wound Dressing Market Share

The Interactive Wound Dressing industry is primarily led by well-established companies, including:

- Smith & Nephew plc (U.K.)

- 3M Company (U.S.)

- Mölnlycke Health Care AB (Sweden)

- ConvaTec Group PLC (U.K.)

- Coloplast A/S (Denmark)

- Hartmann Group (Germany)

- Medtronic plc (Ireland)

- Johnson & Johnson (U.S.)

- Derma Sciences, Inc. (U.S.)

- Acelity L.P., Inc. (U.S.)

- BioMed Skin Solutions (U.S.)

- ActiMaris GmbH (Germany)

- Systagenix Wound Management (U.K.)

- Healionics Inc. (U.S.)

- Arch Therapeutics, Inc. (U.S.)

- Cramer Products Inc. (U.S.)

- Medline Industries, Inc. (U.S.)

- Beiersdorf AG (Germany)

- B Braun SE (Germany)

- Integra LifeSciences Corporation (U.S.)

Latest Developments in Global Interactive Wound Dressing Market

- In January 2024, Medline introduced the OptiView Transparent Dressing with HydroCore Technology, a first‑of‑its‑kind interactive wound dressing that allows caregivers to visually inspect wounds without removing the dressing, improving monitoring and reducing disruption to healing. This dressing features an innovative transparent design with a gel core that helps redistribute pressure and draw heat away from the skin, supporting pressure injury prevention and enhanced patient care

- In September 2024, 3M announced the commercial launch of the V.A.C. Peel and Place Dressing, an extended‑wear interactive wound dressing integrated with negative‑pressure wound therapy (NPWT) systems, aimed at simplifying clinical workflows and enhancing wound healing in surgical and chronic care settings. This launch broadened treatment options tied to interactive technologies for wound management

- In April 2023, 3M (U.S.) received U.S. FDA approval for two wound care dressings under its 3M Veraflo Therapy line — the 3M Veraflo Cleanse Choice Complete Dressing and the 3M V.A.C. Veraflo Cleanse Choice Dressing — expanding its portfolio of advanced interactive wound care products designed to support complex and chronic wound treatment protocols. This regulatory milestone strengthened 3M’s presence in the advanced wound care segment and supported clinical adoption of improved therapy combinations

- In May 2023, Smith & Nephew (U.K.) announced that its PICO Single Use Negative Pressure Wound Therapy System was awarded an innovative technology contract by Vizient, Inc., enhancing access to advanced wound care and interactive dressing options in U.S. hospitals. This contract highlighted the adoption of advanced and interactive wound management modalities in mainstream clinical care

- In September 2023, MiMedx Group, Inc. (U.S.) launched EPIEFFECT, an advanced wound care solution designed for enhanced repair in chronic wounds, adding to the interactive dressing landscape with a product focused on biological wound healing technologies. This launch reflected a broader trend toward bioactive and interactive modalities in wound management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.