Global Intercontinental Ballistic Missile Market

Market Size in USD Billion

CAGR :

%

USD

7.78 Billion

USD

11.85 Billion

2024

2032

USD

7.78 Billion

USD

11.85 Billion

2024

2032

| 2025 –2032 | |

| USD 7.78 Billion | |

| USD 11.85 Billion | |

|

|

|

|

What is the Global Intercontinental Ballistic Missile Market Size and Growth Rate?

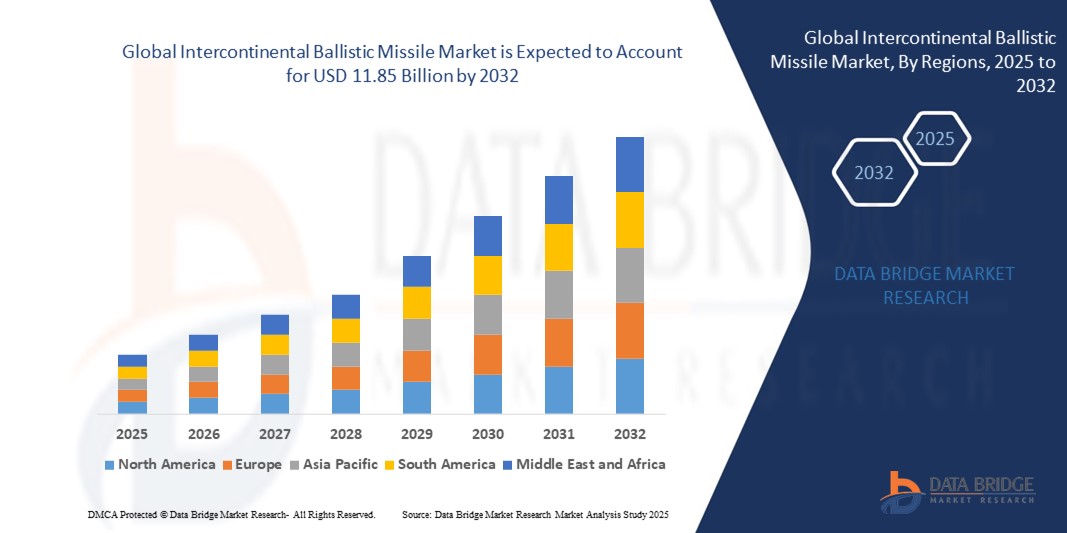

- The global intercontinental ballistic missile market size was valued at USD 7.78 billion in 2024 and is expected to reach USD 11.85 billion by 2032, at a CAGR of 5.10% during the forecast period

- Growth in the number of border threats across the globe and rising national security concerns have resulted in growth in the intercontinental ballistic missile market value. The global focus to free the world of terrorism coupled with rising number of terrorist activities especially in the Middle East will also create lucrative growth opportunities for the intercontinental ballistic missile market

What are the Major Takeaways of Intercontinental Ballistic Missile Market?

- Increased government investments in the state-owned companies for the development of advanced ballistic missiles and rising technological advancements in the security and surveillance systems will also foster the intercontinental ballistic missile market growth

- Rising geo-political tensions around the world and increasing partnerships between players in various fields such propulsion systems will further carve the way for the growth of the intercontinental ballistic missile market

- North America dominated the intercontinental ballistic missile (ICBM) market with the largest revenue share of 55.69% in 2024, driven by significant investments in nuclear modernization programs and the need to maintain strategic deterrence capabilities

- The Asia-Pacific intercontinental ballistic missile market is poised to grow at the fastest CAGR of 11.23% during 2025–2032, driven by rising geopolitical tensions, regional arms races, and increasing investments in indigenous missile development

- The land-based segment dominated the market with the largest revenue share of 59.4% in 2024, supported by established silo and mobile launcher systems operated by nuclear powers such as the U.S., Russia, and China

Report Scope and Intercontinental Ballistic Missile Market Segmentation

|

Attributes |

Intercontinental Ballistic Missile Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Intercontinental Ballistic Missile Market?

Integration of Advanced Guidance and Hypersonic Technologies

- A significant and accelerating trend in the global intercontinental ballistic missile (ICBM) market is the adoption of hypersonic glide vehicles (HGVs) and precision guidance systems to enhance strike capabilities and evade missile defenses

- For instance, Russia’s Avangard system has demonstrated hypersonic maneuverability, while China’s DF-41 ICBM integrates multiple independently targetable reentry vehicles (MIRVs), highlighting rapid technological advancements

- The integration of artificial intelligence (AI) in targeting and trajectory prediction is also emerging, enabling intercontinental ballistic missile to optimize flight paths and improve accuracy against hardened or mobile targets

- Furthermore, AI-driven command-and-control systems are enhancing early-warning, launch decisions, and missile defense countermeasures, strengthening deterrence credibility

- This trend towards hypersonic speed, AI integration, and improved maneuverability is fundamentally reshaping the strategic balance among major powers

- Consequently, nations such as the U.S., China, and Russia are heavily investing in next-generation intercontinental ballistic missile systems, ensuring their survivability and relevance in modern warfare

- The demand for advanced intercontinental ballistic missile is rapidly growing across nuclear powers as they prioritize modernization of their deterrence capabilities amid rising geopolitical tensions

What are the Key Drivers of Intercontinental Ballistic Missile Market?

- The rising geopolitical tensions and renewed focus on nuclear deterrence are primary drivers of the global intercontinental ballistic missile market, with major powers modernizing their arsenals to maintain strategic parity

- For instance, in 2023, the U.S. Air Force advanced the LGM-35A Sentinel intercontinental ballistic missile program, replacing the aging Minuteman III fleet to ensure credible deterrence

- Nations are investing in intercontinental ballistic missile as part of their nuclear triad modernization, ensuring second-strike capability and survivability against evolving missile defense systems

- The proliferation of missile defense technologies, such as THAAD and Aegis systems, is pushing countries to enhance penetration aids, MIRVs, and hypersonic vehicles, driving ICBM upgrades

- Furthermore, the increasing availability of indigenous missile technology, especially in Asia-Pacific, is fueling domestic development programs to reduce reliance on imports

- The strategic importance of intercontinental ballistic missile in maintaining national security and power projection continues to propel global investments, with modernization programs expanding across established and emerging nuclear states

Which Factor is Challenging the Growth of the Intercontinental Ballistic Missile Market?

- Arms control treaties, cost constraints, and global security concerns remain major challenges for the intercontinental ballistic missile market. High R&D and production costs restrict participation to a few nuclear powers

- For instance, the collapse of arms control frameworks such as the INF Treaty and uncertainty around the New START Treaty raise concerns about unchecked intercontinental ballistic missile proliferation

- Cybersecurity vulnerabilities in digital guidance and command systems also pose risks, as intercontinental ballistic missile increasingly depend on advanced software for targeting and launch control

- Moreover, the high political sensitivity surrounding ICBM development invites international pressure, sanctions, and non-proliferation measures, hindering market expansion for some nations

- The enormous costs—estimated at hundreds of billions for modernization programs—create challenges for budget-constrained countries, especially amid competing defense priorities

- Addressing these issues through multilateral agreements, cost-efficient modernization strategies, and cybersecurity safeguards will be crucial to sustaining intercontinental ballistic missile market growth

How is the Intercontinental Ballistic Missile Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Type

On the basis of type, the intercontinental ballistic missile (ICBM) market is segmented into land-based and submarine-based. The land-based segment dominated the market with the largest revenue share of 59.4% in 2024, supported by established silo and mobile launcher systems operated by nuclear powers such as the U.S., Russia, and China. These systems offer cost advantages, rapid deployment, and long-standing operational reliability. Countries continue to invest in upgrading silo-based fleets, such as the U.S. LGM-35A Sentinel program, to ensure strategic deterrence.

The submarine-based segment is projected to witness the fastest CAGR of 6.7% from 2025 to 2032, driven by its survivability, stealth, and assured second-strike capability. Submarine-launched ballistic missiles (SLBMs), such as the U.S. Trident II and India’s K-4, remain critical in nuclear triad modernization programs. Increasing investments in nuclear submarines by emerging powers will accelerate the growth of submarine-based ICBMs.

- By Launch Mode

On the basis of launch mode, the market is segmented into surface-to-surface, surface-to-air, air-to-air, air-to-surface, and subsea-to-air. The surface-to-surface category held the dominant revenue share of 71.8% in 2024, reflecting its role as the primary mode for ICBM deployment from silos, mobile ground vehicles, and naval platforms. These missiles form the backbone of strategic deterrence and are widely deployed by nuclear states.

The subsea-to-air segment is projected to grow at the fastest CAGR of 7.1% during 2025–2032, as SLBMs launched from stealth submarines provide unparalleled survivability and are less vulnerable to first-strike attacks. Increasing emphasis on undersea deterrence in national defense strategies, coupled with advancements in submarine technology, is fueling this growth. While other modes such as air-to-air and surface-to-air are limited in ICBM applications, the focus on survivability and global reach ensures surface-to-surface and subsea-to-air modes dominate the market landscape.

- By Range

On the basis range, the intercontinental ballistic missile market is categorized into above 10,000 km and below 10,000 km. The above 10,000 km segment dominated the market with a revenue share of 62.5% in 2024, owing to its ability to deliver warheads across continents, ensuring global strike capability. Nations such as Russia (RS-28 Sarmat) and the U.S. (Sentinel) prioritize ultra-long-range missiles to maintain credible deterrence against adversaries worldwide.

Meanwhile, the below 10,000 km segment is expected to expand at the fastest CAGR of 6.3% during 2025–2032, as regional powers and emerging nuclear states increasingly focus on medium-to-long-range ICBMs that balance cost, flexibility, and sufficient reach to deter adversaries within regional theaters. Such systems offer rapid deployment and reduced complexity compared to their ultra-long-range counterparts. Rising demand from countries such as India and North Korea for regional deterrence is fueling this segment’s growth.

- By Payload

On the basis of payload, the market is segmented into multiple warheads and single warhead. The multiple warheads (MIRVs) segment accounted for the dominant market share of 68.1% in 2024, reflecting their ability to overwhelm missile defense systems and strike multiple targets simultaneously. Nations such as China, Russia, and the U.S. continue to develop MIRV-enabled ICBMs such as the DF-41 and Minuteman III upgrades, ensuring deterrence credibility against advanced missile defense shields.

The single warhead segment is forecast to register the fastest CAGR of 5.9% from 2025 to 2032, supported by its cost-effectiveness, simplicity, and continued adoption by nations with smaller nuclear arsenals or limited deterrence strategies. Single-warhead intercontinental ballistic missile remain essential for countries emphasizing minimum deterrence policies, such as India. While MIRVs dominate due to their advanced capability, the need for reliable and affordable systems sustains growth in the single warhead segment.

- By Application

The intercontinental ballistic missile market by application is segmented into ocean military defense and land military defense. The land military defense segment dominated with the largest market share of 57.6% in 2024, as silo-based and mobile ground-launched ICBMs remain the most deployed systems globally. Their extensive use in nuclear doctrines, supported by decades of infrastructure investment, ensures their dominance.

However, the ocean military defense segment is projected to grow at the fastest CAGR of 7.4% during 2025–2032, driven by the strategic importance of submarine-launched ICBMs (SLBMs) for assured second-strike capability. Nations such as the U.S., U.K., China, and India are modernizing or expanding their ballistic missile submarine fleets, making undersea deterrence a cornerstone of nuclear strategies. With rising geopolitical tensions and the demand for survivable platforms, ocean-based ICBMs are expected to play an increasingly critical role in shaping future deterrence postures.

Which Region Holds the Largest Share of the Intercontinental Ballistic Missile Market?

- North America dominated the intercontinental ballistic missile (ICBM) market with the largest revenue share of 55.69% in 2024, driven by significant investments in nuclear modernization programs and the need to maintain strategic deterrence capabilities

- The region’s leadership is underpinned by the U.S. nuclear triad, where ICBMs play a crucial role alongside submarine-launched and air-delivered weapons

- Strong defense budgets, advanced missile defense systems, and continuous research in hypersonic technologies reinforce North America’s dominance in this segment. Modernization programs such as the U.S. LGM-35A Sentinel ICBM ensure the region sustains its strategic edge

U.S. Intercontinental Ballistic Missile Market Insight

The U.S. captured the largest share of 81% in 2024 within North America, fueled by the replacement of aging Minuteman III missiles and new contracts supporting ICBM modernization. The U.S. Department of Defense’s consistent funding, coupled with innovations in hypersonic glide vehicles and AI-based targeting, strengthens the domestic market. Growing emphasis on maintaining second-strike capability and countering rising threats from peer competitors ensures strong demand.

Europe Intercontinental Ballistic Missile Market Insight

The European intercontinental ballistic missile market is projected to expand at a substantial CAGR during the forecast period, driven by NATO’s modernization priorities and the need for credible deterrence in response to evolving geopolitical threats. France and the U.K. remain the primary contributors, with active development and maintenance of submarine-launched ballistic missile (SLBM) programs, such as the U.K.’s Trident system and France’s M51 missiles. Rising defense budgets, urban security demands, and modernization of nuclear forces are expected to foster market expansion across the region.

U.K. Intercontinental Ballistic Missile Market Insight

The U.K. is anticipated to grow at a noteworthy CAGR, supported by its Dreadnought-class submarine program, which will extend the life and capabilities of its SLBM fleet. Concerns over emerging global security threats, coupled with the U.K.’s focus on strategic deterrence, are driving demand for next-generation intercontinental ballistic missile capabilities. The strong role of defense contractors and government initiatives sustains long-term market momentum.

Germany Intercontinental Ballistic Missile Market Insight

Germany’s role in the intercontinental ballistic missile market is indirect, but its growing defense spending and leadership in European missile defense initiatives are expected to impact regional dynamics. While Germany does not maintain its own intercontinental ballistic missile force, its investments in missile defense technologies and contributions to NATO security frameworks are shaping allied modernization efforts. Emphasis on digital security, innovation, and transatlantic defense cooperation supports its participation in Europe’s strategic missile ecosystem.

Which Region is the Fastest Growing Region in the Intercontinental Ballistic Missile Market?

The Asia-Pacific intercontinental ballistic missile market is poised to grow at the fastest CAGR of 11.23% during 2025–2032, driven by rising geopolitical tensions, regional arms races, and increasing investments in indigenous missile development. Countries such as China, India, and North Korea are expanding their ICBM arsenals to strengthen deterrence and enhance global strategic standing. Rapid modernization programs, combined with advancements in hypersonic technologies and MIRV capabilities, are fueling strong growth across the region.

Japan Intercontinental Ballistic Missile Market Insight

Japan, while not possessing intercontinental ballistic missile due to treaty obligations, is increasingly investing in missile defense systems to counter growing regional threats. Its advanced technological base and defense cooperation with the U.S. support innovation in long-range strike and defense systems, indirectly impacting the intercontinental ballistic missile ecosystem. Rising security concerns and defense reforms are expected to further shape Japan’s role in the broader regional missile landscape.

China Intercontinental Ballistic Missile Market Insight

China accounted for the largest share of the Asia-Pacific intercontinental ballistic missile market in 2024, supported by the expansion of its DF-41 ICBM program and the deployment of mobile and silo-based systems. The country’s focus on survivable second-strike capability, rapid urbanization, and technological innovation makes it a central player in global ICBM development. Strong domestic manufacturing capacity and the push for hypersonic glide vehicles are further propelling China’s leadership in this market.

Which are the Top Companies in Intercontinental Ballistic Missile Market?

The Intercontinental Ballistic Missile industry is primarily led by well-established companies, including:

- Lockheed Martin Corporation (U.S.)

- Raytheon Technologies Corporation (U.S.)

- General Dynamics Corporation (U.S.)

- BAE Systems (U.K.)

- Boeing (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Thales Group (France)

- Textron Inc. (U.S.)

- Rheinmetall AG (Germany)

- Alliant Techsystems (U.S.)

- IAI – Israel Aerospace Industries (Israel)

- Denel Dynamics (South Africa)

- Northrop Grumman (U.S.)

- Saab (Sweden)

- Airbus S.A.S. (Netherlands – HQ, operational in France)

- Aselsan (Turkey)

- Rafael Advanced Defense Systems Ltd. (Israel)

- Diehl Stiftung & Co. KG (Germany)

- Leonardo S.p.A. (Italy)

What are the Recent Developments in Global Intercontinental Ballistic Missile Market?

- In May 2024, Raytheon Technologies formed a strategic alliance with South Korea's Agency for Defense Development (ADD), focusing on co-developing advanced missile defense systems designed to intercept sophisticated ballistic threats. This collaboration is expected to significantly strengthen South Korea's regional defense posture

- In April 2024, North Korea unveiled a new hypersonic missile, highlighting its growing advancements in missile technologies, while domestic defense manufacturers were tasked to accelerate indigenous hypersonic and intercontinental missile programs to address regional security challenges. This move further escalates tensions and emphasizes North Korea's determination to expand its strike capabilities

- In March 2024, India’s Defense Research and Development Organisation (DRDO) announced the successful testing of the Agni-VI missile, equipped with stealth technology and a range surpassing 12,000 km, aimed at boosting nuclear deterrence and extending strategic reach across Asia and beyond. This achievement marks a critical milestone in India’s long-term defense modernization efforts

- In February 2024, the China Aerospace Corporation (CASC) partnered with the China Academy of Launch Vehicle Technology to develop a new solid-fuel intercontinental ballistic missile (ICBM), designed to increase payload capacity and extend operational range. This initiative is expected to reinforce China’s strategic missile arsenal

- In January 2024, Lockheed Martin secured a USD 3 billion contract with the U.S. Air Force to modernize the Minuteman III ICBM system, aiming to enhance missile range, accuracy, and cybersecurity defenses. This modernization ensures that the U.S. maintains a reliable strategic deterrence capability amid evolving global threats

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.