Global Interleukin Inhibitors Market

Market Size in USD Billion

CAGR :

%

USD

32.64 Billion

USD

85.51 Billion

2024

2032

USD

32.64 Billion

USD

85.51 Billion

2024

2032

| 2025 –2032 | |

| USD 32.64 Billion | |

| USD 85.51 Billion | |

|

|

|

|

Interleukin Inhibitors Market Size

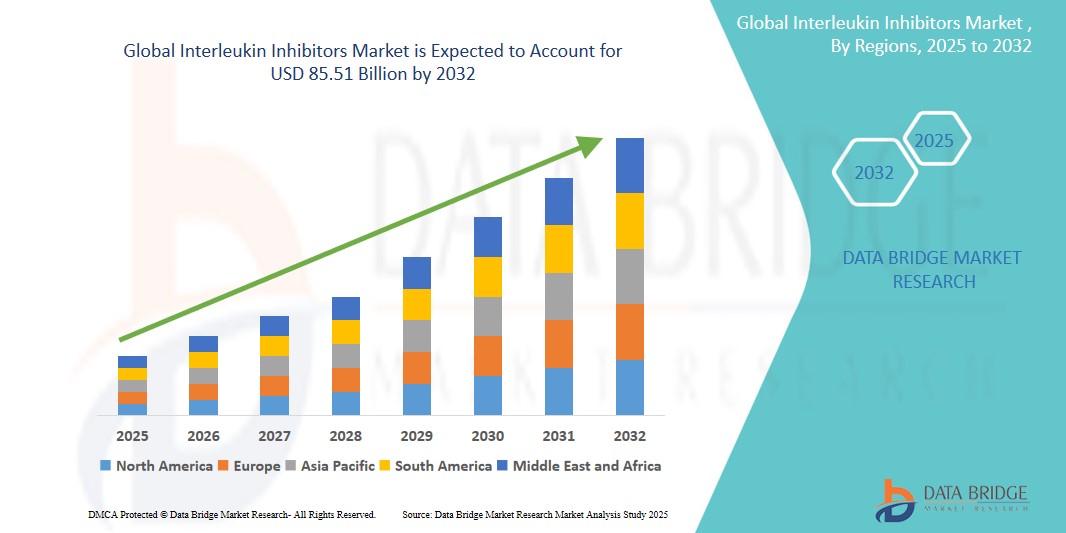

- The global interleukin inhibitors market size was valued at USD 32.64 billion in 2024 and is expected to reach USD 85.51 billion by 2032, growing at a CAGR of 13.4% during the forecast period.

- This growth is driven by factors such as the rising prevalence of autoimmune and chronic inflammatory diseases, increasing awareness and adoption of biologic therapies, and continuous advancements in targeted immunotherapy.

Interleukin Inhibitors Market Analysis

-

Interleukin inhibitors are biologic drugs designed to block the activity of specific interleukins involved in immune system signaling. These inhibitors play a crucial role in managing diseases such as psoriasis, psoriatic arthritis, rheumatoid arthritis, asthma, and inflammatory bowel disease.

-

The increasing burden of chronic inflammatory conditions and the demand for targeted, effective treatments are key drivers of market growth. Advances in monoclonal antibody therapies and supportive reimbursement policies further contribute to the expanding adoption of interleukin inhibitors.

- North America is expected to dominate the interleukin inhibitors market due to its well-established healthcare infrastructure, high treatment awareness, and strong presence of biopharmaceutical companies specializing in immunology.

- Asia-Pacific is expected to be the fastest-growing region in the interleukin inhibitors market during the forecast period, driven by rising healthcare investments, increased prevalence of autoimmune disorders, and growing access to biologics in emerging economies.

- The psoriasis segment is expected to dominate the market with 38.4% market share, attributed to the widespread use of IL-17 and IL-23 inhibitors that offer rapid and sustained skin clearance. High disease burden and favorable clinical outcomes have reinforced their first-line status in treatment guidelines.

Report Scope and Interleukin Inhibitors Market Segmentation

|

Attributes |

Interleukin Inhibitors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Interleukin Inhibitors Market Trends

“Advancements in Targeted Biologics and Personalized Immunotherapy”

- One prominent trend in the interleukin inhibitors market is the increasing focus on precision medicine and the development of targeted biologics tailored to specific interleukin pathways (e.g., IL-17, IL-23, IL-6)

- These biologics offer enhanced efficacy, faster symptom relief, and reduced systemic side effects by selectively blocking inflammatory cytokines involved in autoimmune and inflammatory diseases

- For instance, next-generation IL-23 inhibitors have shown promising results in clinical trials for plaque psoriasis, delivering long-term disease control with extended dosing intervals, improving patient adherence and quality of life.

- The rising adoption of personalized treatment approaches is driving innovation and expanding the interleukin inhibitors pipeline, transforming chronic disease management across multiple indications

Interleukin Inhibitors Market Dynamics

Driver

“Growing Burden of Autoimmune and Inflammatory Diseases”

- The increasing global incidence of autoimmune and chronic inflammatory conditions, including psoriasis, rheumatoid arthritis, inflammatory bowel disease, and asthma, is a major factor propelling demand for interleukin inhibitors

- These disorders significantly impair quality of life and productivity, leading to a greater need for effective, targeted immunotherapies that offer sustained symptom relief and disease modification

- The introduction of biologics with proven efficacy and safety profiles has transformed treatment protocols and raised expectations among both physicians and patients

For instance,

- According to the Global Burden of Disease Study 2021, autoimmune diseases affect over 4% of the global population, with a significant upward trend driven by lifestyle, genetic, and environmental factors. This creates a large patient pool requiring long-term immunomodulatory treatment

- Consequently, the surging prevalence of such conditions fuels the uptake of interleukin inhibitors, contributing to the market’s rapid growth

Opportunity

“Emergence of Subcutaneous and Oral Formulations Enhancing Patient Access”

- The shift toward convenient, self-administered formulations such as subcutaneous injectables and oral interleukin inhibitors presents a substantial growth opportunity

- These delivery methods improve treatment adherence, reduce the need for frequent hospital visits, and are especially beneficial for patients with limited mobility or those living in remote areas

- Additionally, the expansion of telehealth platforms and home-based care aligns with the rising demand for patient-centric treatment options

For instance,

- In September 2024, a new oral IL-1 inhibitor entered Phase III trials for gout and autoinflammatory syndromes, highlighting the pipeline's focus on expanding access and ease of use

- As these innovations reach the market, they are expected to broaden the eligible patient base and open new avenues for market penetration, especially in underserved regions

Restraint/Challenge

“High Cost and Reimbursement Barriers Limiting Accessibility”

- The high cost of interleukin inhibitors, often exceeding thousands of dollars per dose, poses a significant barrier to widespread adoption, especially in low- and middle-income countries

- Even in developed markets, reimbursement limitations and prior authorization hurdles can delay or restrict patient access to these therapies

- This financial burden affects both patients and healthcare systems, leading to disparities in access and outcomes

For instance,

- As noted in a 2024 Health Affairs report, the average annual treatment cost of IL-17 inhibitors for psoriasis ranges from USD 40,000 to USD 60,000, depending on dosage and market. Such high costs strain public and private insurance systems, particularly in countries with limited healthcare budgets

- These challenges may limit adoption in cost-sensitive regions, thereby slowing market expansion and affecting equity in biologic therapy access

Interleukin Inhibitors Market Scope

The market is segmented on the basis application, type, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By Distribution Channel |

|

In 2025, the psoriasis segment is projected to dominate the market with the largest share in the application segment

The psoriasis segment is expected to dominate the interleukin inhibitors market with the largest share of 38.4% in 2025 due to the widespread use of IL-17 and IL-23 inhibitors that offer rapid and sustained skin clearance. As a chronic autoimmune skin condition with a high global burden, psoriasis has benefited significantly from the inclusion of targeted biologics in clinical guidelines. Favorable clinical outcomes, longer dosing intervals, and enhanced patient quality of life continue to drive strong uptake. Increased awareness, earlier diagnosis, and rising treatment accessibility further contribute to this segment’s dominance.

The IL-17 inhibitors segment is expected to account for the largest share during the forecast period in the type segment

In 2025, the IL-17 inhibitors segment is expected to dominate the market with the largest market share of 34.60% due to its strong clinical efficacy in treating moderate to severe plaque psoriasis, psoriatic arthritis, and ankylosing spondylitis. IL-17 inhibitors such as secukinumab and ixekizumab have become frontline treatments, offering quick symptom relief and high rates of skin clearance. Continued regulatory approvals for expanded indications, improved safety profiles, and rising demand in emerging markets further support the segment’s leading position in the global interleukin inhibitors market.

Interleukin Inhibitors Market Regional Analysis

“North America Holds the Largest Share in the Interleukin Inhibitors Market”

-

North America dominates the interleukin inhibitors market due to advanced healthcare systems, high biologics adoption rates, and extensive use of targeted therapies in the treatment of autoimmune and inflammatory diseases

- The United States holds a major share of the regional market owing to the widespread prevalence of conditions such as psoriasis, rheumatoid arthritis, inflammatory bowel disease, and asthma, all of which are increasingly treated using IL inhibitors

- Favorable reimbursement policies for biologics, a well-established regulatory framework, and continuous research and development investments by key pharmaceutical companies are key factors reinforcing the region's dominance

- Additionally, the availability of advanced diagnostic capabilities and early adoption of innovative therapies, supported by strategic collaborations between biotech firms and healthcare providers, further fuels the growth of the interleukin inhibitors market in North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Interleukin Inhibitors Market”

-

The Asia-Pacific region is expected to grow at the highest CAGR in the global interleukin inhibitors market, driven by increasing healthcare expenditures, expansion of biologics manufacturing, and rising prevalence of chronic inflammatory diseases

- India, China, and Japan are emerging as key contributors due to growing awareness, rising diagnosis rates, and a large pool of untreated patients suffering from diseases such as psoriasis, ankylosing spondylitis, and ulcerative colitis

- Japan leads the region in terms of biologic approvals and adoption due to its highly developed medical infrastructure, aging population, and strong clinical trial activity involving interleukin-targeting therapies

- China and India are experiencing a rise in biologics use supported by regulatory reforms, public-private partnerships, and increased local manufacturing capabilities, which are collectively enhancing accessibility and affordability. These dynamics position Asia-Pacific as a high-growth market over the forecast period

Interleukin Inhibitors Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Novartis AG (Switzerland)

- AbbVie Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Regeneron Pharmaceuticals Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- AstraZeneca (United Kingdom)

- Bausch Health Companies Inc. (Canada)

- GlaxoSmithKline plc (United Kingdom)

- Teva Pharmaceuticals Industries Ltd. (Israel)

- Sanofi (France)

- Sun Pharmaceutical Industries Ltd. (India)

- Genentech, Inc. (U.S.)

- Merck KGaA (Germany)

Latest Developments in Global Interleukin Inhibitors Market

- In June 2024, AbbVie Inc. has developed and marketed IL inhibitors, including Skyrizi (risankizumab), targeting IL-23 for autoimmune conditions such as psoriasis and Crohn’s disease. The company has emphasized innovation through rigorous research and development to improve patient outcomes and address unmet medical needs in chronic inflammatory diseases.

- In June 2020, Eli Lilly and Company has established a reputation for products such as Taltz (ixekizumab) and Mirikizumab, targeting IL-17 and IL-23, respectively. The company is focused on advancing therapeutic options for autoimmune diseases through strategic partnerships and clinical trials to improve treatment efficacy and safety profiles.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.