Global Internal Gear Pump Market

Market Size in USD Million

CAGR :

%

USD

741.41 Million

USD

1,377.38 Million

2024

2032

USD

741.41 Million

USD

1,377.38 Million

2024

2032

| 2025 –2032 | |

| USD 741.41 Million | |

| USD 1,377.38 Million | |

|

|

|

|

Internal Gear Pump Market Size

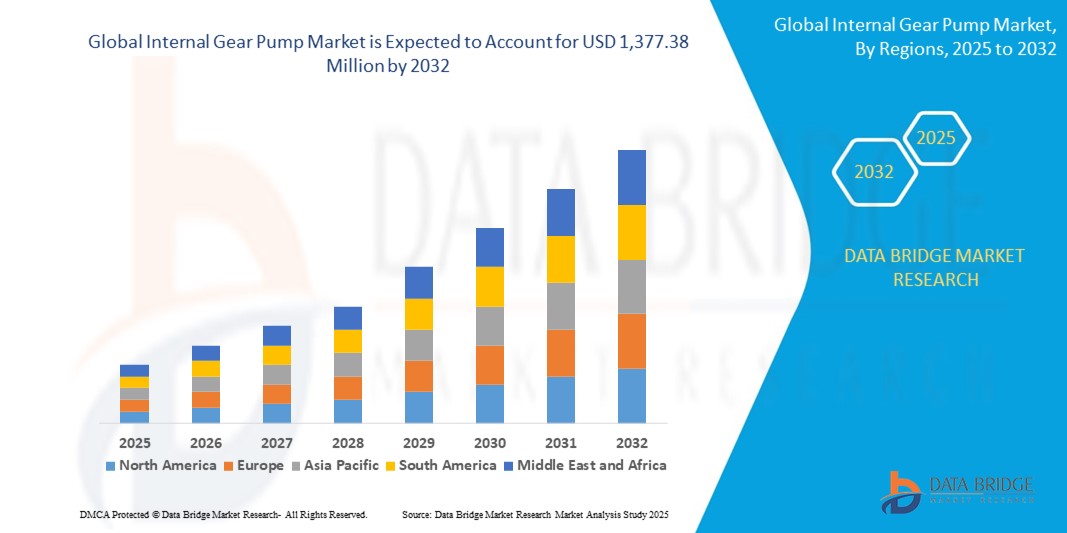

- The global internal gear pump market size was valued at USD 741.41 million in 2024 and is expected to reach USD 1,377.38 million by 2032, at a CAGR of 8.05% during the forecast period

- The market growth is primarily driven by increasing demand for efficient fluid transfer solutions, rising industrialization, and the need for reliable pumps in critical applications such as oil & gas and chemical processing

- Growing awareness of energy-efficient and low-maintenance pump solutions is further boosting the demand for internal gear pumps across various industrial sectors

Internal Gear Pump Market Analysis

- The internal gear pump market is experiencing consistent growth due to the rising need for precise and reliable fluid handling in industries such as oil & gas, chemical, and food & beverage

- The demand for durable and corrosion-resistant pumps, particularly in harsh environments, is encouraging manufacturers to innovate with advanced materials and designs

- North America dominated the internal gear pump market with the largest revenue share of 39.2% in 2024, driven by a well-established industrial base, high adoption of advanced pump technologies, and significant demand from the oil & gas sector

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid industrialization, increasing investments in manufacturing, and growing demand for efficient pumping solutions in countries such as China, India, and Southeast Asian nations

- The steel pumps segment dominated the largest market revenue share of 40% in 2024, driven by their superior chemical resistance, mechanical strength, and suitability for handling aggressive and viscous fluids. Steel pumps are widely favored in industries such as chemical, oil & gas, and food & beverage due to their durability and ability to operate under demanding conditions, reducing maintenance costs and ensuring reliable performance.

Report Scope and Internal Gear Pump Market Segmentation

|

Attributes |

Internal Gear Pump Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Internal Gear Pump Market Trends

Increasing Adoption of Automation and Smart Technologies

- The global internal gear pump market is experiencing a notable trend toward the integration of automation and smart technologies

- These advancements enable enhanced monitoring and control of pump operations, optimizing performance, energy efficiency, and maintenance schedules

- Smart internal gear pumps equipped with IoT sensors and predictive analytics can detect anomalies and predict maintenance needs, reducing downtime and operational costs

- For instances, companies are developing smart pump systems that provide real-time data on flow rates, pressure, and wear, enabling proactive adjustments for applications in industries such as oil & gas and chemical processing

- This trend is increasing the appeal of internal gear pumps for industries seeking reliable, high-efficiency solutions for fluid transfer

- Automation technologies also support precise control of pump operations, improving consistency in applications such as food & beverage processing and marine systems

Internal Gear Pump Market Dynamics

Driver

Growing Demand in Oil & Gas and Chemical Industries

- The rising demand for efficient fluid handling in the oil & gas and chemical sectors is a key driver for the global internal gear pump market

- Internal gear pumps, known for their reliability and ability to handle viscous fluids, are increasingly used in applications such as crude oil transfer, chemical processing, and lubricant circulation

- The expansion of industrial activities in North America, the dominating region, is fueling the adoption of steel and cast iron pumps for heavy-duty applications

- The development of high-performance heavy-duty pumps is further supporting market growth by meeting the needs of demanding industrial environments

- The Asia-Pacific region, the fastest-growing market, is seeing increased investments in industrial infrastructure, boosting demand for internal gear pumps in chemical, marine, and food & beverage applications

- Manufacturers are focusing on offering customized pump solutions to cater to diverse industry requirements, enhancing market penetration

Restraint/Challenge

High Initial Costs and Maintenance Complexity

- The high upfront costs associated with the installation of internal gear pumps, particularly for heavy-duty and steel pump models, can be a barrier to adoption, especially for small and medium-sized enterprises in emerging markets

- The complexity of integrating these pumps into existing systems, particularly in retrofitting applications, adds to the overall cost and implementation challenges

- In addition, concerns about maintenance and operational reliability in harsh environments, such as marine and oil & gas applications, pose significant challenges

- The need for specialized maintenance expertise and spare parts for advanced pump systems can increase operational costs

- Regulatory requirements for environmental compliance and energy efficiency in regions such as North America and Asia-Pacific add further complexity, potentially limiting market growth in cost-sensitive regions

Internal Gear Pump market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the global internal gear pump market is segmented into steel pumps, cast iron pumps, heavy-duty pumps, and others. The steel pumps segment dominated the largest market revenue share of 40% in 2024, driven by their superior chemical resistance, mechanical strength, and suitability for handling aggressive and viscous fluids. Steel pumps are widely favored in industries such as chemical, oil & gas, and food & beverage due to their durability and ability to operate under demanding conditions, reducing maintenance costs and ensuring reliable performance. Their compatibility with corrosive and high-viscosity fluids further solidifies their preference among manufacturers seeking robust solutions.

The heavy-duty pumps segment is expected to register the fastest growth rate from 2025 to 2032, propelled by increasing demand from high-pressure applications such as offshore drilling, hydrogen refining, and chemical injection systems. These pumps are designed to withstand extreme conditions and deliver consistent performance in critical processes, making them essential for industries prioritizing operational efficiency and uptime. Advancements in materials and design, such as enhanced sealing technologies, further drive their adoption in specialized industrial applications.

- By Application

On the basis of application, the global internal gear pump market is segmented into chemical, marine, oil & gas, food & beverage, and others. The chemical segment held the largest revenue share in 2024, attributed to the critical role of internal gear pumps in handling viscous and corrosive fluids with precision. These pumps ensure consistent flow rates and minimize downtime in chemical manufacturing, where reliability and compliance with safety standards are paramount. The integration of smart sensors and automation technologies further enhances their appeal in this sector.

The food & beverage segment is projected to grow at the fastest rate from 2025 to 2032, driven by the increasing demand for hygienic, CIP-compliant, and regulation-compliant pumping solutions. The rise of digital transformation in food processing, coupled with growing consumer demand for packaged and processed foods, necessitates reliable and efficient fluid handling systems. Internal gear pumps support a variety of applications in this sector, including the transfer of viscous liquids such as syrups and oils, ensuring product integrity and compliance with strict safety certifications. The push for energy-efficient and sustainable solutions further amplifies demand in this segment.

Internal Gear Pump Market Regional Analysis

- North America dominated the internal gear pump market with the largest revenue share of 39.2% in 2024, driven by a well-established industrial base, high adoption of advanced pump technologies, and significant demand from the oil & gas sector

- Consumers and industries prioritize internal gear pumps for their reliability, precision in handling diverse fluids, and ability to operate under varying pressure conditions, particularly in regions with stringent industrial requirements

- Growth is supported by advancements in pump technology, including IoT-enabled and energy-efficient designs, alongside increasing adoption in both OEM and aftermarket segments

U.S. Internal Gear Pump Market Insight

The U.S. internal gear pump market captured the largest revenue share of 75.7% in 2024 within North America, fueled by strong demand in the oil & gas and chemical sectors, coupled with growing awareness of energy-efficient pumping solutions. The trend toward automation and smart manufacturing further boosts market expansion. The integration of internal gear pumps in industrial processes and adherence to regulatory standards such as OSHA and NFPA support sustained market growth.

Europe Internal Gear Pump Market Insight

The Europe internal gear pump market is expected to witness significant growth, supported by regulatory emphasis on energy efficiency and industrial safety. Industries seek pumps that provide consistent flow rates and handle high-viscosity fluids effectively. Growth is prominent in both new installations and retrofit projects, with countries such as Germany and France showing notable adoption due to advanced manufacturing sectors and environmental concerns.

U.K. Internal Gear Pump Market Insight

The U.K. market for internal gear pumps is expected to experience rapid growth, driven by demand for reliable fluid transfer solutions in chemical and food & beverage industries. Increasing focus on energy-efficient systems and compliance with CE and ATEX regulations encourages adoption. The rise in industrial automation and retrofit projects further contributes to market expansion.

Germany Internal Gear Pump Market Insight

Germany is expected to witness significant growth in the internal gear pump market, attributed to its advanced industrial manufacturing sector and strong emphasis on energy efficiency. German industries prefer technologically advanced pumps, such as steel and heavy-duty pumps, that enhance operational efficiency and reduce maintenance costs. The integration of these pumps in premium industrial applications and aftermarket solutions supports sustained market growth.

Asia-Pacific Internal Gear Pump Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid industrialization, expanding manufacturing sectors, and rising demand for internal gear pumps in countries such as China, India, and Japan. Increasing awareness of efficient fluid handling and energy-saving solutions boosts demand across chemical, marine, oil & gas, and food & beverage applications. Government initiatives promoting industrial automation and sustainability further encourage adoption of advanced internal gear pumps.

Japan Internal Gear Pump Market Insight

Japan’s internal gear pump market is expected to experience rapid growth due to strong consumer and industrial preference for high-quality, technologically advanced pumps that enhance operational efficiency and reliability. The presence of major industrial manufacturers and the integration of internal gear pumps in OEM applications accelerate market penetration. Rising interest in aftermarket solutions for customized industrial processes also contributes to growth.

China Internal Gear Pump Market Insight

China holds the largest share of the Asia-Pacific internal gear pump market, propelled by rapid industrial growth, increasing manufacturing output, and high demand for fluid transfer solutions in chemical and oil & gas sectors. The country’s expanding industrial base and focus on automation support the adoption of advanced internal gear pumps, including steel and cast iron variants. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Internal Gear Pump Market Share

The internal gear pump industry is primarily led by well-established companies, including:

- Haight Pumps (U.S.)

- Bosch Rexroth (Germany)

- Daido Machinery (Japan)

- NOP (Japan)

- Shanghai Heshan Pump (China)

- Sumitomo Precision (Japan)

- Viking Pump (U.S.)

- Chongqing Huanzhou Pumps (China)

- Hannuo Pump (China)

- Hydac International (Germany)

- Bucher Hydraulics (Switzerland)

- Tuthill (U.S.)

- Taibang (China)

- Yuken (India)

- Dover (U.S.)

- Voith (Germany)

- HSP (China)

- SPX FLOW (U.S.)

What are the Recent Developments in Global Internal Gear Pump Market?

- In October 2024, Moog Inc., a U.S.-based leader in precision motion and fluid control systems, introduced the EPU-G, a next-generation electrohydrostatic pump unit. This innovative product combines a newly developed 4-quadrant internal gear pump with a high-dynamic servomotor, delivering flow rates from 20 to 85 l/min and pressures up to 345 bar. Engineered for energy efficiency, low noise, and compact integration, the EPU-G supports direct manifold connection and reduces oil volume by up to 90%. It’s ideal for self-contained hydrostatic transmissions and was unveiled at EuroBLECH 2024 in Hannover, Germany

- In January 2024, SPX FLOW’s Waukesha Cherry-Burrell brand launched the Universal® 2 ND (U2 ND) Series of positive displacement pumps, engineered to deliver superior reliability and performance across a wide range of industrial applications. Designed as a direct competitor to industrial gear and progressive cavity pumps, the U2 ND Series features pressure ratings up to 500 psi, Clean-in-Place (CIP) capability, and free-draining vertical ports. Its robust construction supports dry-run operation and protects shear-sensitive products, while offering pulsation-free flow and long-life components. This makes it ideal for handling chemicals, adhesives, slurries, and other demanding fluids

- In October 2023, Viking Pump, a global leader in positive displacement pump technology, unveiled its iHS Series of internal gear pumps. This new series is engineered for exceptional durability and high performance, tailored to meet the rigorous demands of industrial applications such as chemical processing, petroleum handling, and polymer production. The iHS Series features Viking’s proven internal gear design, offering smooth, low-pulsation flow, robust construction, and versatile sealing options. With a focus on reliability and efficiency, these pumps are built to handle a wide range of viscosities and operating conditions, making them ideal for continuous-duty environments

- In March 2023, KSB SE & Co. KGaA, through its Indian subsidiary KSB Limited, acquired the technology portfolio of Bharat Pumps and Compressors Ltd. (BP&CL), based in Prayagraj. This strategic acquisition granted KSB exclusive rights to BP&CL’s products, including reciprocating and centrifugal pumps, compressors, and high-pressure gas cylinders. It enabled KSB to expand its product line in both new pump solutions and aftermarket services, enhancing its ability to serve industries such as oil and gas, refineries, and nuclear power. The move also supports India’s “Make in India” initiative and strengthens KSB’s SupremeServ service network

- In December 2022, Dover Corporation, a U.S.-based industrial products manufacturer, completed its acquisition of Witte Pumps & Technology GmbH, a German specialist in precision gear pumps. Witte was integrated into Dover’s Maag business unit within the Pumps & Process Solutions segment. This strategic move significantly strengthened Dover’s gear pump portfolio, expanded its geographic reach, and enhanced its ability to serve a broader range of industries including chemical, polymer processing, food and beverage, and pharmaceuticals. The acquisition also positioned Dover to deliver more comprehensive solutions and drive growth through technological leadership and operational scale

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Internal Gear Pump Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Internal Gear Pump Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Internal Gear Pump Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.