Global Internet Of Things Iot Insuretech Market

Market Size in USD Billion

CAGR :

%

USD

381.92 Billion

USD

819.87 Billion

2024

2032

USD

381.92 Billion

USD

819.87 Billion

2024

2032

| 2025 –2032 | |

| USD 381.92 Billion | |

| USD 819.87 Billion | |

|

|

|

|

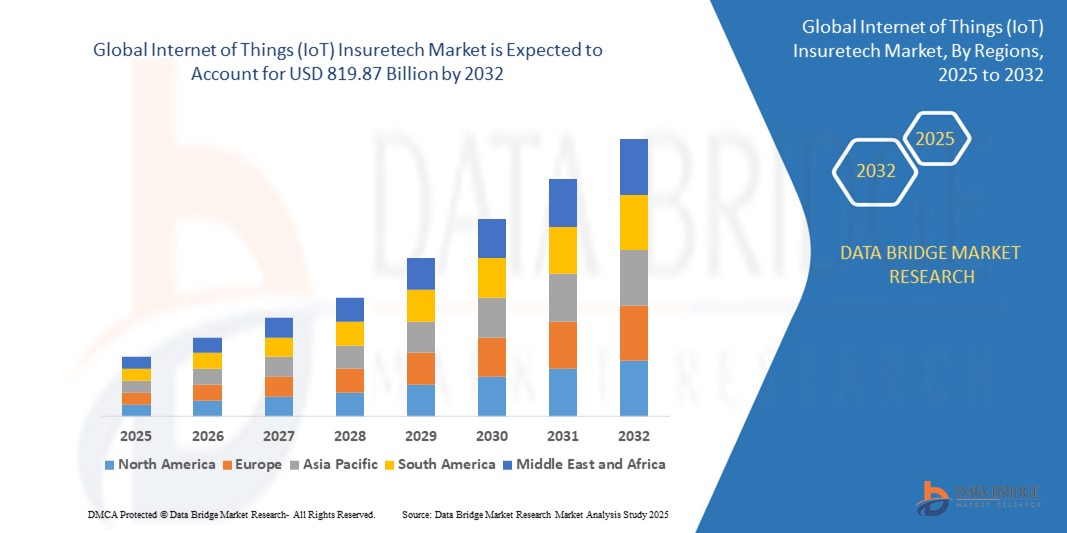

What is the Global Internet of Things (IoT) Insuretech Market Size and Growth Rate?

- The global Internet of Things (IoT) Insuretech market size was valued at USD 381.92 billion in 2024 and is expected to reach USD 819.87 billion by 2032, at a CAGR of 10.02% during the forecast period

- The Internet of Things (IoT) insurtech market is experiencing rapid growth, driven by advancements in data analytics, machine learning, and sensor technology. The latest method involves using IoT devices, such as smart home sensors, wearables, and connected vehicles, to gather real-time data. This data allows insurance companies to personalize policies, improve risk assessments, and offer usage-based insurance (UBI) models, aligning premiums with actual usage and behavior

- Telematics in auto insurance is a prominent instance, leveraging vehicle data to optimize premium calculations. Machine learning algorithms analyze this data, enabling insurers to predict risks more accurately, reduce fraud, and improve claim management. Blockchain technology is also being adopted to enhance transparency and reduce the administrative burden of policy processing

What are the Major Takeaways of Internet of Things (IoT) Insuretech Market?

- Growth in the market is being fueled by rising IoT adoption, with connected devices projected to exceed 30 billion by 2025. Insurtech companies are capitalizing on the increasing consumer demand for personalized services and cost-saving solutions. These technologies enhance customer experience and help insurers reduce operational costs and enhance profitability, contributing to significant market expansion

- North America dominated the Internet of Things (IoT) Insuretech market with the largest revenue share of 39.47% in 2024, driven by the rapid adoption of connected insurance solutions across auto, health, and home sectors

- Asia-Pacific region is forecast to grow at the fastest CAGR of 11.05% from 2025 to 2032, due to rapid urbanization, insurance digitization, and increasing smartphone penetration

- The Auto insurance segment dominated the Internet of Things (IoT) Insuretech market with the largest market revenue share of 34.5% in 2024, primarily due to the widespread integration of telematics devices and usage-based insurance models

Report Scope and Internet of Things (IoT) Insuretech Market Segmentation

|

Attributes |

Internet of Things (IoT) Insuretech Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Internet of Things (IoT) Insuretech Market?

“Enhanced Convenience Through AI and Voice Integration”

- A key trend shaping the Internet of Things (IoT) Insuretech market is the rapid integration of AI and voice assistants such as Amazon Alexa, Google Assistant, and Apple HomeKit, providing users with seamless control and heightened convenience

- Smart insurance solutions are being designed to allow voice-controlled policy management, claim processing, and real-time risk monitoring, enabling customers to engage with insurers through intuitive interfaces

- For instance, Lemonade has embedded AI and voice tech into its platform to automate claims via chatbots, while other startups are integrating with virtual assistants to enable quick coverage checks or premium payments through simple voice commands

- AI algorithms are also being utilized to analyze connected device data (such as telematics and smart home sensors) to offer dynamic policy pricing, automate underwriting, and detect fraud

- The growing synergy between AI, IoT devices, and voice interaction is reshaping how insurers engage with clients, creating frictionless, real-time insurance experiences

- This evolution is setting new standards in customer expectations, pushing insurers to adopt smarter, voice-enabled, and AI-integrated systems for competitive differentiation

What are the Key Drivers of Internet of Things (IoT) Insuretech Market?

- Increasing adoption of smart devices and sensors in homes, vehicles, and industries is generating vast streams of data, driving insurers to utilize IoT for real-time risk assessment and proactive engagement

- For instance, in April 2024, Zurich Insurance Group partnered with Roost Inc. to deploy smart water leak detectors and smoke alarms, reducing claims and offering usage-based insurance (UBI)

- Rising consumer demand for personalized insurance policies, faster claim settlements, and improved transparency is pushing insurers to embed IoT in their offerings

- Businesses are increasingly leveraging IoT-based insuretech to monitor fleet performance, employee safety, and equipment health, especially in logistics, manufacturing, and construction sectors

- In addition, advancements in cloud computing and 5G networks are enabling low-latency data transmission from IoT devices, making real-time underwriting and dynamic pricing more feasible across a broader range of insurance products

- Together, these factors are transforming traditional insurance into a data-driven, preventative, and customer-centric model

Which Factor is challenging the Growth of the Internet of Things (IoT) Insuretech Market?

- Cybersecurity vulnerabilities associated with connected devices remain one of the most pressing challenges in the IoT Insuretech landscape, potentially hampering user trust and broader adoption

- IoT devices used for insurance data collection can become entry points for hackers, exposing sensitive personal and financial information, which raises regulatory and ethical concerns

- High-profile cyberattacks and breaches involving IoT infrastructure have made both insurers and policyholders cautious. For instance, past vulnerabilities in smart car telematics and home sensors have highlighted the risk of manipulation or surveillance

- Regulatory compliance, especially in regions with strict data privacy laws such as GDPR in Europe, adds complexity and cost for insuretech firms adopting IoT

- Moreover, high implementation costs and technological fragmentation among IoT platforms can deter small insurers and limit deployment in emerging economies

- To overcome these barriers, stakeholders must invest in end-to-end encryption, standardization protocols, and user education, while also focusing on cost-effective and scalable IoT solutions to drive mass adoption across diverse user segments

How is the Internet of Things (IoT) Insuretech Market Segmented?

The market is segmented on the basis of type and service.

- By Type

On the basis of type, the Internet of Things (IoT) Insuretech market is segmented into Auto, Business, Health, Home, Specialty, Travel, and Others. The Auto insurance segment dominated the Internet of Things (IoT) Insuretech market with the largest market revenue share of 34.5% in 2024, primarily due to the widespread integration of telematics devices and usage-based insurance models. Insurers increasingly use connected car data to monitor driving behavior, offer dynamic premium pricing, and provide real-time alerts, contributing to reduced claim risks and improved customer satisfaction.

The Health insurance segment is anticipated to witness the fastest growth rate of 22.8% from 2025 to 2032, driven by the growing adoption of wearable devices and IoT-enabled health monitoring systems. These technologies allow insurers to personalize health plans, encourage wellness programs, and proactively detect health risks, fostering a shift from reactive to preventive care. The rise in chronic diseases and demand for remote patient monitoring is further fueling this growth.

- By Service

On the basis of service, the Internet of Things (IoT) Insuretech market is segmented into Consulting, Support and Maintenance, and Managed Services. The Managed Services segment held the largest market revenue share of 41.2% in 2024, driven by the increasing demand from insurers for outsourced IoT infrastructure management, analytics, and device integration. Managed services enable insurance companies to focus on core business operations while leveraging third-party expertise to manage complex IoT ecosystems, data security, and performance optimization.

The Support and Maintenance segment is expected to witness the fastest CAGR from 2025 to 2032, as insurers seek ongoing technical assistance, software upgrades, and proactive issue resolution to ensure uninterrupted IoT functionality. The growing complexity of connected devices and networks further underlines the need for robust support structures to ensure high system availability and data accuracy.

Which Region Holds the Largest Share of the Internet of Things (IoT) Insuretech Market?

- North America dominated the Internet of Things (IoT) Insuretech market with the largest revenue share of 39.47% in 2024, driven by the rapid adoption of connected insurance solutions across auto, health, and home sectors

- Insurers in the region are leveraging IoT to gather real-time data, enabling dynamic risk assessment, personalized pricing, and fraud detection

- A robust tech ecosystem, early adoption of smart devices, and supportive regulatory frameworks have further strengthened market penetration, making the region a global hub for IoT-based insurance innovation

U.S. Internet of Things (IoT) Insuretech Market Insight

The U.S. market dominated North America’s revenue share in 2024, backed by a surge in demand for usage-based auto and health insurance models. The proliferation of wearable devices, smart home sensors, and connected vehicles has transformed how insurers assess and mitigate risks. Strategic partnerships between InsurTech startups and major insurance firms are accelerating product innovations and policy customization, further driving adoption.

Europe Internet of Things (IoT) Insuretech Market Insight

Europe is projected to witness substantial CAGR through 2032, fueled by increasing focus on customer-centric insurance models and regulatory mandates promoting digital transformation. IoT-based underwriting is gaining traction in auto and property insurance. Enhanced risk visibility and data-driven claims management are compelling traditional insurers to digitize offerings. Environmental sustainability and smart building initiatives are also playing a key role in driving IoT deployment in insurance.

U.K. Internet of Things (IoT) Insuretech Market Insight

The U.K. market is expected to grow notably, supported by rising adoption of IoT in motor, health, and home insurance. Increasing consumer awareness of pay-as-you-drive policies and smart home-based risk mitigation is transforming the insurance landscape. Government support for innovation, a thriving startup ecosystem, and the push for digital claims processing are propelling the U.K. as a key growth market within Europe.

Germany Internet of Things (IoT) Insuretech Market Insight

Germany is projected to expand significantly, driven by strong demand for precision risk assessment and data-backed underwriting. High insurance penetration, a tech-savvy population, and emphasis on smart infrastructure are boosting IoT integration in policies. German insurers are increasingly focusing on automating claims and leveraging telematics to reduce operational costs and enhance customer experience.

Which Region is the Fastest Growing in the Internet of Things (IoT) Insuretech Market?

Asia-Pacific region is forecast to grow at the fastest CAGR of 11.05% from 2025 to 2032, due to rapid urbanization, insurance digitization, and increasing smartphone penetration. The growing middle class and government-backed smart city projects are fostering IoT adoption in insurance. Local insurers are embracing connected devices to tap into underserved markets and offer real-time, usage-based policies.

Japan Internet of Things (IoT) Insuretech Market Insight

Japan’s market is gaining strong traction, driven by advanced IoT infrastructure and a focus on elder care solutions. Insurers are leveraging smart health monitors and home safety sensors to deliver personalized insurance services. Integration of AI and IoT in policy issuance and claims is creating highly efficient systems, attracting both consumers and regulators toward next-gen insurance models.

China Internet of Things (IoT) Insuretech Market Insight

China led the Asia-Pacific IoT Insuretech market in 2024, fueled by rising tech adoption and increasing consumer demand for smart insurance solutions. From connected cars to wearable tech, Chinese insurers are aggressively rolling out usage-based and on-demand policies. Strong domestic manufacturing and digital ecosystems are facilitating cost-effective IoT implementation, positioning China as a global leader in IoT-based insurance innovation.

Which are the Top Companies in Internet of Things (IoT) Insuretech Market?

The Internet of Things (IoT) Insuretech industry is primarily led by well-established companies, including:

- Google LLC (U.S.)

- Lemonade Inc. (U.S.)

- SAP SE (Germany)

- IBM Corp. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Oracle (U.S.)

- Accenture (Ireland)

- LexisNexis (U.S.)

- Capgemini (France)

- Allianz (Germany)

- Microsoft (U.S.)

- Zurich Insurance Group Ltd. (Switzerland)

- Hippo (U.S.)

- Concirrus (U.K.)

- Wipro Limited (India)

- Telit (U.K.)

- Aeris Group Ltd (U.S.)

- Damco International A/S (Denmark)

What are the Recent Developments in Global Internet of Things (IoT) Insuretech Market?

- In November 2022, IBM Corporation announced a partnership with Ablera and Bulgaria to enhance ABACUS, an AI-powered solution for insurance pricing and rating. This upgrade improves speed and accuracy, reducing manual errors and expanding usability. The enhanced ABACUS leverages advanced mathematical sophistication, allowing a broader range of users to benefit from its capabilities

- In August 2022, Telit, a leader in the Internet of Things (IoT), acquired assets from Mobilogix. This acquisition boosts Telit’s device engineering expertise, optimizing specifications for handoff to electronic manufacturing services, original device manufacturing, and achieving regulatory approvals and carrier certifications. The move strengthens Telit’s position in IoT and enhances its service offerings

- In May 2020, The Verisk Data Exchange Add-In became available on the Geotab Marketplace, integrating with Geotab’s connected car solutions. This allows Geotab’s fleet clients to share telematics data directly with insurers in the Verisk Data Exchange. This data exchange aims to enhance underwriting, rating, and other IoT-driven insurance services by providing detailed fleet risk insights

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.