Global Interventional Radiology Market

Market Size in USD Billion

CAGR :

%

USD

30.70 Billion

USD

53.26 Billion

2024

2032

USD

30.70 Billion

USD

53.26 Billion

2024

2032

| 2025 –2032 | |

| USD 30.70 Billion | |

| USD 53.26 Billion | |

|

|

|

|

Interventional Radiology Market Size

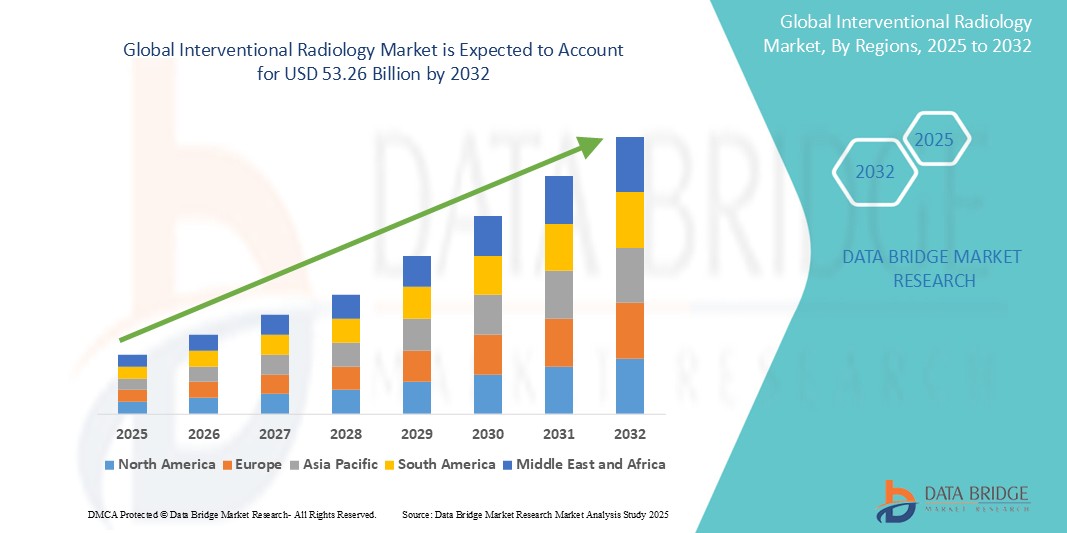

- The global interventional radiology market size was valued at USD 30.70 billion in 2024 and is expected to reach USD 53.26 billion by 2032, at a CAGR of 7.13% during the forecast period

- The market growth is largely fuelled by the rising prevalence of chronic diseases, increasing demand for minimally invasive procedures, and rapid advancements in imaging technologies.

- In addition, growing awareness among patients and healthcare providers about the benefits of interventional radiology, such as reduced hospital stays and lower healthcare costs, is further propelling market expansion

Interventional Radiology Market Analysis

- The interventional radiology market is witnessing steady growth, driven by the increasing adoption of image-guided procedures in modern healthcare

- The integration of advanced imaging technologies and artificial intelligence is enhancing procedural accuracy and expanding the scope of minimally invasive treatments

- North America dominates the interventional radiology market with the largest revenue share of 39% in 2025, driven by high healthcare expenditure, advanced infrastructure, and strong presence of key market players

- Asia-Pacific is expected to be the fastest growing region in the interventional radiology market during the forecast period due to rising healthcare investments, increasing awareness, and growing adoption of minimally invasive procedures in emerging economies

- The Catheters segment dominates the largest market revenue share in 2025, driven by their essential role in a wide range of diagnostic and therapeutic interventional radiology procedures. Their versatility in navigating complex vascular structures and delivering targeted treatments contributes to their widespread use. Catheters are fundamental in procedures such as angiography, embolization, and stent placement, which are commonly performed across multiple specialties. The continued refinement of catheter design, including features for improved flexibility, steerability, and biocompatibility, is enhancing procedural efficiency. Increased use in outpatient settings and rising demand for minimally invasive treatments are also supporting segment growth

Report Scope and Interventional Radiology Market Segmentation

|

Attributes |

Interventional Radiology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Image-Guided and Minimally Invasive Procedures • Technological Integration of Artificial Intelligence and Robotics in Interventional Radiology |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Interventional Radiology Market Trends

“Integration of Artificial Intelligence in Interventional Radiology”

- Artificial intelligence is enhancing imaging precision, enabling real-time analysis during procedures for improved accuracy and efficiency

- For instance, Shimadzu Medical Systems introduced the Trinias angiography system with AI capabilities to assist in various interventional procedures

- AI-powered tools are streamlining workflow management by prioritizing critical cases and supporting clinical decision-making

- Viz.ai's Radiology Suite connects care teams in real-time, alerting radiologists about suspected illnesses to expedite diagnosis

- Machine learning algorithms are being utilized to detect patterns in imaging data, aiding in early disease detection and personalized treatment planning

- These advancements are contributing to more effective interventions and better patient outcomes

- The integration of AI is facilitating the development of hybrid operating rooms, combining surgical and interventional radiology capabilities for comprehensive patient care

- As AI technology continues to evolve, its application in interventional radiology is expected to expand, offering safer and more efficient alternatives to traditional surgical interventions

Interventional Radiology Market Dynamics

Driver

“Rising Preference for Minimally Invasive Procedures”

- The shift toward minimally invasive procedures is reshaping the interventional radiology market, as these treatments offer reduced pain, smaller incisions, and faster recovery for patients

- For instance, image-guided procedures such as tumor ablation and uterine fibroid embolization are increasingly replacing traditional surgeries

- Healthcare facilities benefit from shorter hospital stays and lower complication rates, improving patient flow and reducing overall treatment costs

- A study published in the Journal of Vascular and Interventional Radiology showed shorter post-operative recovery times for patients undergoing catheter-based interventions

- Interventional radiology techniques have expanded into multiple specialties such as cardiology, oncology, and neurology, increasing their clinical relevance

- Angioplasty is now commonly used to treat blocked arteries, while transarterial chemoembolization is used for liver cancer management

- Growing patient awareness and physician referrals are accelerating the adoption of image-guided procedures in both urban and non-urban healthcare settings

- Continuous innovation in imaging technologies such as computed tomography and magnetic resonance imaging is enhancing procedural precision and boosting confidence in clinical outcomes

Restraint/Challenge

“Shortage of Skilled Professionals”

- The shortage of skilled professionals is a key challenge in interventional radiology, as procedures require both advanced imaging knowledge and technical precision

- For instance, image-guided tumor ablations and complex vascular interventions need highly trained specialists for accurate execution

- Many healthcare systems, especially in underserved areas, face difficulty in recruiting interventional radiologists due to lack of training access and insufficient infrastructure

- In rural hospitals, general radiologists often fill the gap, which can compromise procedural outcomes due to limited expertise

- The rapid pace of technological innovation, including artificial intelligence and robotic assistance, requires ongoing education that not all professionals can access

- This skill gap can lead to delayed diagnoses, lower procedural success rates, and reduced patient trust in minimally invasive treatment options

- Workforce burnout from high demand and limited staff further decreases availability, making workforce development a priority to sustain market growth

Interventional Radiology Market Scope

The market is segmented on the basis of technology, product, procedure, applications, and end user.

- By Technology

On the basis of technology, the smart lock market is segmented into catheters, stents, inferior vena cava (IVC) filters, hemodynamic flow alteration (HFA) devices, angioplasty balloons, Thrombectomy Systems, Embolization Devices, Biopsy Needles, Accessories, and Others. The Catheters segment dominates the largest market revenue share in 2025, driven by their essential role in a wide range of diagnostic and therapeutic interventional radiology procedures. Their versatility in navigating complex vascular structures and delivering targeted treatments contributes to their widespread use. Catheters are fundamental in procedures such as angiography, embolization, and stent placement, which are commonly performed across multiple specialties. The continued refinement of catheter design, including features for improved flexibility, steerability, and biocompatibility, is enhancing procedural efficiency. Increased use in outpatient settings and rising demand for minimally invasive treatments are also supporting segment growth

The Thrombectomy Systems segment is anticipated to witness the fastest growth rate from 2025 to 2032, fuelled by the increasing prevalence of thrombotic diseases and advancements in minimally invasive clot removal techniques. The development of more effective and safer thrombectomy devices is expanding their application in treating conditions such as stroke and pulmonary embolism. Growing awareness about early intervention in acute ischemic events and supportive clinical guidelines are encouraging wider adoption. The integration of real-time imaging and mechanical retrieval systems is improving clinical outcomes, particularly in time-sensitive emergencies. This segment is also benefiting from ongoing clinical trials and regulatory approvals that are driving product innovation and availability

- By Product

On the basis of product, the interventional radiology market is segmented into magnetic resonance imaging (MRI), ultrasound imaging, computed tomography (CT) scanners, angiography systems, fluoroscopy systems, biopsy devices, and others. The Angiography Systems held the largest market revenue share in 2025, driven by their critical role in visualizing blood vessels and guiding vascular interventions. The increasing prevalence of cardiovascular diseases and the growing demand for minimally invasive vascular procedures contribute to the dominance of angiography systems. These systems are essential in diagnosing and treating conditions such as arterial blockages and aneurysms with high precision. Continuous innovations in digital imaging and integration with other interventional tools are enhancing their efficiency and clinical outcomes. The expansion of hybrid operating rooms is also supporting the adoption of advanced angiography systems across healthcare settings

The Biopsy Devices segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising incidence of cancer and the increasing adoption of minimally invasive diagnostic techniques. Technological advancements in biopsy needles and imaging guidance are improving the accuracy and safety of biopsy procedures. Image-guided biopsies using ultrasound, computed tomography, or magnetic resonance imaging are becoming the standard for detecting tumors and abnormal tissue. The growing preference for outpatient diagnostic care and early detection initiatives are further fueling demand. The development of targeted biopsy systems tailored for specific organs is expanding their application across multiple clinical areas

- By Procedure

On the basis of procedure, the interventional radiology market is segmented into angioplasty, angiography, biopsy and drainage, embolization, thrombolysis, vertebroplasty, nephrostomy, and others. The Angioplasty segment held the largest market revenue share in 2025, driven by the increasing prevalence of cardiovascular diseases and the effectiveness of angioplasty in treating arterial blockages. The shift towards minimally invasive cardiac interventions is fueling the growth of this segment. Angioplasty is widely used due to its ability to restore blood flow quickly with minimal recovery time, reducing the need for open-heart surgery. Ongoing improvements in balloon and stent technologies are enhancing procedural safety and success rates. The procedure’s growing adoption in emergency care and outpatient settings further supports its market leadership

The Thrombolysis segment is expected to witness the fastest growth rate from 2025 to 2032, favored for its ability to rapidly dissolve blood clots in critical conditions such as stroke and pulmonary embolism. Advancements in thrombolytic agents and delivery techniques are improving patient outcomes and expanding the use of this procedure. Targeted thrombolysis is becoming increasingly effective with image-guided catheters, reducing complications and treatment time. Its use in time-sensitive emergencies is gaining traction as clinical guidelines emphasize early intervention. Research into newer agents with fewer side effects is also contributing to increased confidence among practitioners

- By Applications

On the basis of applications, the interventional radiology market is segmented into cardiology, urology and nephrology, oncology, gastroenterology, and others. The Cardiology segment accounted for the largest market revenue share in 2024, driven by the high prevalence of cardiovascular diseases and the increasing use of minimally invasive techniques for their treatment. Interventional cardiology procedures such as angioplasty, stenting, and embolization are key drivers of this segment. These procedures offer quicker recovery, fewer complications, and have become standard in treating heart-related conditions. Technological advances in imaging and device design are further enhancing outcomes and procedural accuracy. The growing availability of catheter-based interventions in both acute and elective care settings is also supporting segment growth.

The Oncology segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising incidence of cancer and the growing application of interventional radiology in cancer diagnosis and treatment. Minimally invasive tumor ablation, chemoembolization, and radioembolization are expanding the role of interventional radiology in oncology care. These procedures enable targeted treatment with reduced systemic side effects, improving patient quality of life. Integration with advanced imaging is increasing the precision of tumor localization and therapy delivery. The demand for personalized and outpatient cancer treatments is also contributing to the segment’s rapid expansion.

- By End User

On the basis of end user, the interventional radiology market is segmented into Hospitals, clinics, and home care settings. The Hospitals segment accounted for the largest market revenue share in 2024, driven by the concentration of advanced interventional radiology facilities and specialized medical professionals in hospitals. Hospitals remain the primary setting for complex interventional procedures due to their comprehensive infrastructure and multidisciplinary care capabilities. High patient volumes and access to emergency care services make hospitals essential hubs for procedures such as angiography, thrombectomy, and tumor ablation. In addition, integration with diagnostic departments ensures timely intervention and better clinical outcomes. Investment in hybrid operating rooms and advanced imaging systems further strengthens the dominance of this segment.

The Clinics segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing shift towards outpatient procedures and the development of specialized interventional radiology clinics. The convenience and cost-effectiveness of clinic-based interventional radiology procedures are contributing to their rapid growth. Clinics offer shorter wait times, personalized care, and reduced hospital-associated costs, making them attractive to both patients and providers. The availability of compact and mobile imaging systems is enabling the expansion of services in ambulatory settings. This trend is supported by healthcare policies encouraging decentralized and preventive care delivery models.

Interventional Radiology Market Regional Analysis

- North America dominates the interventional radiology market with the largest revenue share of 39% 2025, driven by a growing demand for minimally invasive procedures and advanced healthcare infrastructure, as well as increased awareness of the benefits of interventional radiology.

- Consumers in the region highly value the reduced recovery times, lower risks, and greater precision offered by interventional radiology compared to traditional surgery

- This widespread adoption is further supported by high healthcare spending, a well-established network of hospitals and clinics, and continuous technological advancements, establishing interventional radiology as a preferred treatment option for a wide range of conditions

U.S. Interventional Radiology Market Insight

The U.S. interventional radiology market captured the largest revenue share of 90% within North America in 2025, fueled by the rapid adoption of minimally invasive techniques and the increasing prevalence of chronic diseases. Consumers are increasingly prioritizing less invasive procedures that offer faster recovery and reduced complications. The growing preference for advanced imaging technologies and innovative treatment options further propels the interventional radiology industry. Moreover, the increasing focus on research and development, coupled with favorable reimbursement policies, is significantly contributing to the market's expansion.

Europe Interventional Radiology Market Insight

The European interventional radiology market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by aging populations and the rising incidence of chronic diseases, coupled with strong healthcare systems. The increase in patient awareness, combined with the demand for minimally invasive procedures, is fostering the adoption of interventional radiology. European healthcare providers are also drawn to the cost-effectiveness and efficiency these procedures offer. The region is experiencing significant growth across various medical specialties, with interventional radiology becoming an integral part of standard care.

U.K. Interventional Radiology Market Insight

The U.K. interventional radiology market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of minimally invasive surgeries and a desire for improved patient outcomes. In addition, concerns regarding long hospital stays and surgical complications are encouraging both patients and healthcare providers to choose interventional radiology solutions. The UK's focus on healthcare innovation, alongside its robust healthcare infrastructure, is expected to continue to stimulate market growth.

Germany Interventional Radiology Market Insight

The German interventional radiology market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing investment in healthcare technology and a strong emphasis on high-quality medical care. Germany's well-developed healthcare infrastructure, combined with its focus on innovation and patient safety, promotes the adoption of interventional radiology, particularly in hospitals and specialized clinics. The integration of advanced imaging and minimally invasive techniques is also becoming increasingly prevalent, with a strong preference for evidence-based medicine aligning with local healthcare practices.

Asia-Pacific Interventional Radiology Market Insight

The Asia-Pacific interventional radiology market is poised to grow at the fastest CAGR in 2025, driven by increasing urbanization, rising disposable incomes, and the growing prevalence of chronic diseases in countries such as China, Japan, and India. The region's expanding healthcare infrastructure, supported by government initiatives promoting advanced medical treatments, is driving the adoption of interventional radiology. Furthermore, as APAC emerges as a key growth hub for the medical device industry, the accessibility and affordability of interventional radiology procedures are expanding to a larger patient population.

Japan Interventional Radiology Market Insight

The Japan interventional radiology market is gaining momentum due to the country’s focus on high-quality healthcare, an aging population, and the increasing demand for advanced medical technologies. The Japanese market places a significant emphasis on precision and patient safety, and the adoption of interventional radiology is driven by the increasing need for minimally invasive treatments for various age-related conditions. The integration of cutting-edge imaging with robotic assistance is fueling growth. Moreover, Japan's healthcare system is well-equipped to integrate new technologies, further driving market expansion.

China Interventional Radiology Market Insight

The China interventional radiology market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country's large population, rapid economic growth, and increasing healthcare expenditure. China is one of the largest markets for medical devices, and interventional radiology is becoming increasingly popular in hospitals and specialized treatment centers. The push towards improving healthcare access and the availability of a growing number of trained interventional radiologists are key factors propelling the market in China.

Interventional Radiology Market Share

The Interventional Radiology industry is primarily led by well-established companies, including:

- General Electric (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Carestream Health (U.S.)

- ESAOTE SPA (Italy)

- Hitachi, Ltd. (Japan)

- Hologic, Inc. (U.S.)

- Shimadzu Corporation (Japan)

- Siemens Healthcare GmbH (Germany)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Samsung Medison Co., Ltd. (South Korea)

- Medtronic (Ireland)

- Agfa-Gevaert Group (Belgium)

- Teleflex Incorporated (U.S.)

- Cook (U.S.)

- Analogic Corporation (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Trivitron Healthcare (India)

Latest Developments in Global Interventional Radiology Market

- In November 2024, In November 2024, Philips India launched the Azurion interventional radiology system to enhance procedural capabilities across cardiology, neurology, vascular, and surgical specialties. The system features advanced C-arm rotation, smooth 2D to 3D imaging transitions, and intuitive table-side control, improving workflow efficiency. Integrated AI-powered remote monitoring via the Philips Service Hub helps maintain system performance and minimize downtime. This launch strengthens Philips’ presence in the high-demand interventional radiology segment. It aligns with the growing market preference for precision, speed, and minimally invasive procedures. The system is expected to support faster patient recovery and better outcomes

- In October 2024, the VA Boston Healthcare System unveiled a cutting-edge interventional radiology suite at its West Roxbury campus. The facility is designed to support minimally invasive, image-guided treatments aimed at reducing recovery times and hospital stays for veterans. It features advanced imaging capabilities to ensure precision in diagnosis and therapeutic interventions. The suite marks a strategic upgrade to veteran healthcare, focusing on faster, safer procedures. It also helps reduce procedural complications, aligning with value-based care initiatives. This development underscores the increasing adoption of interventional radiology in public healthcare infrastructure

- In June 2024, GE HealthCare and MediView XR Inc. installed the world’s first OmnifyXR interventional suite at North Star Vascular and Interventional. The system integrates augmented reality and 3D visualization to support minimally invasive procedures with greater accuracy. This innovation improves physician guidance during interventions, enhancing procedural safety and outcomes. It represents a major leap in interventional radiology technology, blending real-time imaging with immersive navigation. The launch aims to appeal to facilities seeking next-gen radiology solutions. It also highlights GE HealthCare’s push to lead in digital transformation within the interventional space

- In June 2024, Royal Philips completed the first implantation of the Duo Venous Stent System to treat venous outflow obstruction in patients with chronic venous insufficiency. The procedure followed U.S. FDA premarket approval and represents a significant advancement in vascular interventional care. The device is designed for durability and flexibility, improving long-term vein patency. This launch enhances Philips’ vascular portfolio and affirms its innovation leadership in minimally invasive solutions. The new stent system is expected to improve patient outcomes and reduce the need for repeat interventions. Its entry into the market supports Philips’ strategic expansion in therapeutic radiology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.