Global Intimate Wear Market

Market Size in USD Billion

CAGR :

%

USD

90.30 Billion

USD

118.40 Billion

2025

2033

USD

90.30 Billion

USD

118.40 Billion

2025

2033

| 2026 –2033 | |

| USD 90.30 Billion | |

| USD 118.40 Billion | |

|

|

|

|

Intimate Wear Market Size

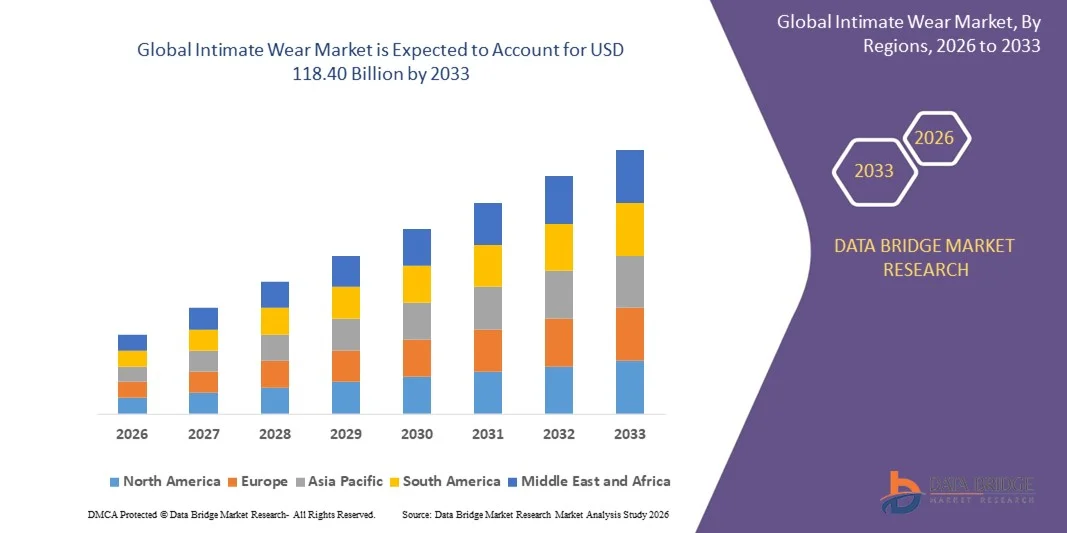

- The global intimate wear market size was valued at USD 90.30 billion in 2025 and is expected to reach USD 118.40 billion by 2033, at a CAGR of 6.20% during the forecast period

- The market growth is largely fuelled by the rising consumer preference for comfort-driven and fashion-forward intimate apparel, increasing awareness about body positivity, and growing adoption of online retail channels

- Increasing demand for innovative fabrics, seamless designs, and multifunctional products such as shapewear and maternity wear is further supporting market expansion

Intimate Wear Market Analysis

- Growth in lifestyle-oriented fashion trends, increasing working population, and the influence of social media are driving consumer inclination towards premium and stylish intimate apparel

- Rising focus on inclusivity, gender-neutral designs, and sustainable fabrics is fostering innovation and encouraging manufacturers to offer diverse product ranges

- North America dominated the intimate wear market with the largest revenue share of 35.72% in 2025, driven by rising awareness of comfort, fashion, and health, as well as increased adoption of online and offline retail channels

- Asia-Pacific region is expected to witness the highest growth rate in the global intimate wear market, driven by large young population, expanding middle-class base, and rapid growth of online retail platforms

- The bras segment held the largest market revenue share in 2025, driven by high consumer demand for comfort, support, and multifunctional designs. Bras with seamless construction, adjustable fits, and innovative fabrics have become increasingly popular among various age groups, contributing to the segment’s dominant position

Report Scope and Intimate Wear Market Segmentation

|

Attributes |

Intimate Wear Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Victoria’s Secret (U.S.) • Spanx, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Intimate Wear Market Trends

Rise of Comfortable and Functional Intimate Wear

- The growing shift toward comfortable, multifunctional intimate wear is transforming the global intimate wear market by enabling garments that combine style, support, and health benefits. Innovations in fabric technology, seamless designs, and moisture-wicking materials allow consumers to enjoy enhanced comfort and fit, resulting in higher adoption across different age groups and lifestyles. Increased awareness of wellness and body positivity is also contributing to higher demand for inclusive, supportive designs

- The high demand for versatile and inclusive designs is accelerating the introduction of products catering to diverse body types, maternity needs, and athleisure preferences. These garments are particularly popular among busy professionals, fitness enthusiasts, and fashion-conscious consumers seeking both aesthetic appeal and comfort. Brands are increasingly focusing on customizable and adaptive fits, which further drives consumer engagement and loyalty

- The affordability and widespread availability of modern intimate wear are making them attractive across multiple consumer segments. E-commerce platforms, department stores, and specialty boutiques are increasingly stocking these products to meet evolving consumer preferences and style demands. Social media influence and online reviews are also playing a key role in educating consumers and boosting adoption rates

- For instance, in 2023, several European and North American brands reported significant growth in sales after launching seamless, sustainable, and plus-size intimate wear collections, catering to comfort- and fashion-focused consumers. These launches were often accompanied by influencer campaigns and targeted digital marketing strategies, amplifying visibility and reach

- While product innovation and comfort-focused designs are driving market growth, long-term impact depends on consistent quality, inclusivity, and adapting to shifting fashion trends. Manufacturers are increasingly exploring sustainable materials and ethical production methods, which are becoming important factors in purchase decisions

Intimate Wear Market Dynamics

Driver

Growing Awareness of Comfort, Health, and Style

- Increasing consumer awareness of the importance of comfort, body positivity, and skin health is driving demand for innovative intimate wear. Products featuring breathable fabrics, ergonomic designs, and hypoallergenic materials are gaining traction among consumers seeking enhanced daily wear experiences. Brands are also leveraging educational campaigns to highlight health and wellness benefits, which supports higher adoption

- Rising focus on active lifestyles and wellness is accelerating the adoption of sports bras, shapewear, and multifunctional lingerie. Consumers prefer garments that provide support, flexibility, and style in one, boosting market penetration across urban and semi-urban areas. Integration of technology such as moisture-wicking or temperature-regulating fabrics is further enhancing product value

- Expansion of retail and e-commerce channels is further supporting market growth. Online marketplaces, department stores, and specialty fashion outlets are enhancing accessibility and visibility for a wide variety of intimate wear offerings. Omnichannel strategies and personalized recommendations are driving repeat purchases and brand loyalty

- For instance, in 2022, several U.S. and European brands launched inclusive size ranges and sustainable collections, resulting in higher category sales and stronger brand loyalty. Marketing campaigns emphasizing inclusivity and environmental responsibility have resonated with younger consumer demographics, accelerating adoption

- While fashion trends, comfort, and wellness awareness are driving the market, ensuring quality, sustainability, and innovation remains essential for sustained adoption. Companies investing in R&D and exploring innovative fabrics and designs are positioned to capture a larger share of the evolving market

Restraint/Challenge

Intense Competition and Price Sensitivity Among Consumers

- The high cost of premium and branded intimate wear compared to basic alternatives limits adoption among price-sensitive consumers. Cost remains a major barrier, particularly in emerging and developing markets. Seasonal price fluctuations and promotions also influence buying patterns and market dynamics

- Intense competition from established brands, fast fashion labels, and unbranded products reduces market penetration. Consumers often switch based on price, style, and perceived value, affecting brand loyalty. New entrants offering lower-cost alternatives further intensify competitive pressure in mature markets

- Supply chain fluctuations, including sourcing of specialized fabrics, lace, and sustainable materials, can impact production costs and product availability. Logistics delays may further affect timely delivery of seasonal or trend-driven collections. Global crises, raw material shortages, and trade restrictions can exacerbate supply chain vulnerabilities

- For instance, in 2024, several intimate wear brands in Europe reported supply chain disruptions and higher logistics costs due to geopolitical tensions, which led to delayed product launches and limited availability of premium collections. These challenges affected retailer margins and slowed expansion plans in key markets, ultimately impacting short-term revenue performance

- While product variety and innovation continue to expand, addressing price sensitivity, competitive pressure, and supply chain efficiency is crucial to unlock the full potential of the global intimate wear market. Companies investing in strategic partnerships, local sourcing, and production optimization are better positioned to mitigate risks and sustain market growth

Intimate Wear Market Scope

The global intimate wear market is segmented into four notable segments based on product type, gender, material type, and distribution channel.

- By Product Type

On the basis of product type, the intimate wear market is segmented into bras, panties, shapewear, loungewear, and sleepwear. The bras segment held the largest market revenue share in 2025, driven by high consumer demand for comfort, support, and multifunctional designs. Bras with seamless construction, adjustable fits, and innovative fabrics have become increasingly popular among various age groups, contributing to the segment’s dominant position.

The shapewear segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising interest in body-positive and figure-enhancing garments. Shapewear products offer versatility, support, and aesthetic appeal, making them increasingly preferred for both everyday wear and special occasions. Consumers are increasingly seeking shapewear that combines comfort, breathability, and style, driving rapid adoption.

- By Gender

On the basis of gender, the intimate wear market is segmented into female, male, and unisex. The female segment held the largest revenue share in 2025, attributed to higher product variety, targeted marketing, and growing focus on women’s fashion, comfort, and wellness. Female consumers are increasingly looking for multifunctional, supportive, and stylish garments that cater to both everyday wear and special occasions.

The unisex segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising demand for gender-neutral, inclusive, and versatile clothing options. Unisex products offer comfort, style, and adaptability, appealing to consumers seeking sustainable and multifunctional garments, accelerating market adoption.

- By Material Type

On the basis of material type, the intimate wear market is segmented into cotton, silk, lace, polyester, and nylon. The cotton segment held the largest market revenue share in 2025 due to its breathability, comfort, and suitability for daily wear. Cotton intimate wear products continue to be highly preferred across all age groups for both functional and casual applications.

The lace segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for premium, aesthetic, and occasion-specific intimate wear. Lace garments offer elegance, style, and sensual appeal, driving higher adoption among consumers seeking fashion-forward options alongside comfort.

- By Distribution Channel

On the basis of distribution channel, the intimate wear market is segmented into supermarkets, online retail, department stores, and specialty stores. The supermarkets segment held the largest market revenue share in 2025, driven by wide accessibility, brand visibility, and convenient availability of diverse product offerings for various consumer segments.

The online retail segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption of e-commerce platforms, easy home delivery, and personalized shopping experiences. Online channels provide consumers with a wide variety of options, competitive pricing, and convenience, boosting the market penetration of intimate wear globally.

Intimate Wear Market Regional Analysis

- North America dominated the intimate wear market with the largest revenue share of 35.72% in 2025, driven by rising awareness of comfort, fashion, and health, as well as increased adoption of online and offline retail channels

- Consumers in the region highly value versatility, inclusive sizing, and premium quality fabrics, along with seamless designs and multifunctional garments that combine support, style, and wellness benefits

- This widespread adoption is further supported by high disposable incomes, growing fitness and wellness trends, and a fashion-conscious population, establishing intimate wear as a must-have apparel segment for everyday and specialized use

U.S. Intimate Wear Market Insight

The U.S. intimate wear market captured the largest revenue share in 2025 within North America, fueled by rising consumer interest in comfort, inclusive sizing, and sustainable fabrics. The increasing preference for athleisure, multifunctional lingerie, and body-positive fashion is driving growth. In addition, the expansion of e-commerce and omnichannel retail strategies allows brands to reach diverse consumer segments efficiently, further propelling the market. Innovative product launches featuring breathable fabrics, ergonomic designs, and seamless construction are significantly contributing to the market's expansion.

Europe Intimate Wear Market Insight

The Europe intimate wear market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by evolving fashion trends, rising awareness of comfort and wellness, and the demand for sustainable fabrics. Urbanization, higher disposable incomes, and the presence of established fashion brands are fostering adoption. European consumers increasingly favor versatile, eco-conscious, and body-positive garments, leading to strong growth across retail and e-commerce channels. The region is witnessing growth across personal, lifestyle, and athleisure applications, with intimate wear incorporated into both daily use and specialized fashion collections.

U.K. Intimate Wear Market Insight

The U.K. intimate wear market is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising trend of home shopping, online retail adoption, and a growing focus on comfort, style, and health. Concerns regarding fit, inclusivity, and sustainable fabrics are encouraging both men and women to adopt premium and multifunctional intimate wear. The U.K.’s robust e-commerce infrastructure and growing consumer awareness of fashion and wellness are expected to continue stimulating market growth.

Germany Intimate Wear Market Insight

The Germany intimate wear market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for high-quality, sustainable fabrics and multifunctional designs. Germany’s strong retail and fashion infrastructure, combined with rising health and wellness awareness, promotes the adoption of innovative intimate wear products. Integration of comfort, style, and functionality in garments is becoming increasingly prevalent, with consumers favoring breathable, ergonomic, and eco-conscious materials that align with local lifestyle preferences.

Asia-Pacific Intimate Wear Market Insight

The Asia-Pacific intimate wear market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and growing fashion consciousness in countries such as China, India, Japan, and South Korea. The region’s increasing inclination towards health, comfort, and wellness, supported by digital retail channels, is driving the adoption of multifunctional and body-positive intimate wear. Moreover, the growing manufacturing capabilities and competitive pricing of local brands are expanding accessibility, making intimate wear more affordable to a wider consumer base.

Japan Intimate Wear Market Insight

The Japan intimate wear market is expected to witness the fastest growth rate from 2026 to 2033 due to high consumer focus on comfort, health, and premium design. Japanese consumers prioritize garments that combine ergonomic design, seamless construction, and multifunctional benefits. The adoption of intimate wear is further fueled by increasing interest in wellness, athleisure, and sustainable fashion, along with the growth of e-commerce and digital marketing strategies targeting diverse age groups.

China Intimate Wear Market Insight

The China intimate wear market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s expanding middle class, growing fashion awareness, and high rates of digital adoption. China stands as one of the largest markets for intimate wear, with consumers increasingly seeking comfortable, multifunctional, and body-positive garments. The rapid growth of e-commerce platforms, online retail, and domestic brands offering innovative products are key factors propelling market expansion in China.

Intimate Wear Market Share

The Intimate Wear industry is primarily led by well-established companies, including:

• Victoria’s Secret (U.S.)

• Hanesbrands Inc. (U.S.)

• PVH Corp. (U.S.)

• American Eagle Outfitters (Aerie) (U.S.)

• Calvin Klein (U.S.)

• Marks & Spencer Group plc (U.K.)

• Triumph International (Switzerland)

• Jockey International, Inc. (U.S.)

• MAS Holdings (Sri Lanka)

• Zivame (India)

• Spanx, Inc. (U.S.)

• L Brands, Inc. (U.S.)

• Boux Avenue Ltd. (U.K.)

• Lounge Underwear Ltd. (U.K.)

• Ann Summers Ltd. (U.K.)

Latest Developments in Global Intimate Wear Market

- In August 2025, Victoria’s Secret (U.S.) entered into a strategic technology partnership to introduce a virtual fitting room powered by augmented reality. This development aims to enhance customer engagement, improve size and fit accuracy, and reduce product return rates. The initiative highlights the growing integration of digital tools in intimate wear retail and is expected to set new benchmarks for personalized shopping experiences across the market

- In September 2025, Hanesbrands (U.S.) launched an eco-friendly intimate wear line using recycled materials and sustainable manufacturing practices. This product development focuses on meeting rising consumer demand for environmentally responsible apparel while strengthening the company’s sustainability positioning. The move is expected to attract eco-conscious consumers and encourage wider adoption of sustainable practices within the intimate wear industry

- In July 2025, Savage X Fenty (U.S.) expanded its portfolio with the launch of adaptive intimate wear designed for individuals with disabilities. This product innovation addresses inclusivity and accessibility, targeting an underserved consumer segment. The development enhances brand perception, broadens the customer base, and is expected to influence other players to prioritize inclusive design in the global intimate wear market

- In November 2023, PVH Corp., strategic divestment, announced the cash acquisition of its Warners, Olga, and True & Co. businesses by Basic Resources for USD 160 million. This move allows PVH to sharpen its focus on core global brands while enabling Basic Resources to strengthen its portfolio in the intimates segment. The transaction is expected to enhance operational efficiency, improve brand positioning, and intensify competition in the value and mid-range intimate wear market

- In June 2023, Victoria’s Secret, strategic partnership, collaborated with Amazon Fashion to expand digital reach and elevate the customer shopping experience. The partnership offers access to over 4,000 products across intimate wear, sleepwear, and loungewear, including participation in Amazon Prime’s Try Before You Buy program. This initiative improves product accessibility, boosts online sales potential, and accelerates omnichannel growth in the global intimate wear market

- In February 2023, HanesBrands Inc., product launch, introduced the Hanes Originals collection featuring colorful, modern innerwear for women, men, and children. The launch emphasizes innovative fabrics, comfort, and youthful designs aimed at attracting younger demographics. This development strengthens brand relevance, supports portfolio diversification, and contributes to heightened product innovation across the competitive intimate apparel landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.