Global Intralogistics Market

Market Size in USD Billion

CAGR :

%

USD

29.14 Billion

USD

75.84 Billion

2025

2033

USD

29.14 Billion

USD

75.84 Billion

2025

2033

| 2026 –2033 | |

| USD 29.14 Billion | |

| USD 75.84 Billion | |

|

|

|

|

Global Intralogistics Market Size

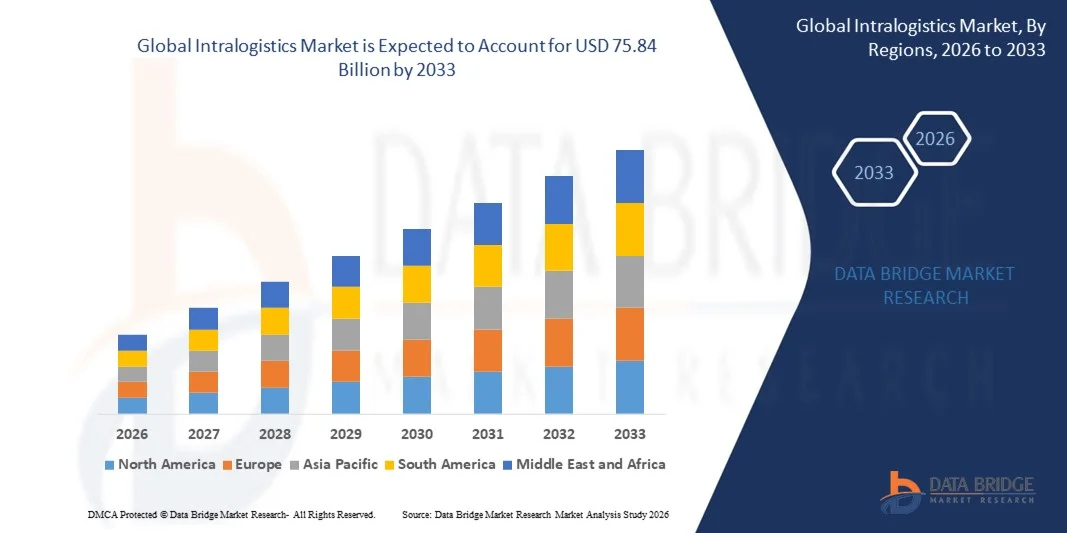

- The global Intralogistics Market size was valued at USD 29.14 billion in 2025 and is expected to reach USD 75.84 billion by 2033, growing at a CAGR of 12.70% during the forecast period.

- The market growth is primarily driven by the increasing adoption of automation, robotics, and AI-driven solutions across warehouses and distribution centers, enhancing operational efficiency and reducing labor costs.

- Additionally, rising demand for real-time inventory management, faster order fulfillment, and seamless supply chain integration is propelling the deployment of advanced intralogistics systems. These factors are collectively driving the accelerated adoption of automated material handling solutions, thereby significantly boosting market expansion.

Global Intralogistics Market Analysis

- Intralogistics solutions, encompassing automated material handling, robotics, and warehouse management systems, are increasingly essential for modern supply chain operations in both industrial and commercial settings due to their efficiency, scalability, and ability to integrate with digital logistics platforms.

- The growing demand for intralogistics solutions is primarily driven by the rapid rise of e-commerce, increasing pressure for faster order fulfillment, and the need for cost-effective and automated warehouse operations.

- North America dominated the Global Intralogistics Market with the largest revenue share of 33.1% in 2025, attributed to early adoption of warehouse automation, high investment in logistics infrastructure, and a strong presence of leading intralogistics solution providers, with the U.S. witnessing significant deployment of automated storage and retrieval systems and robotics in distribution centers, driven by innovations from both established industrial automation firms and emerging tech startups.

- Asia-Pacific is expected to be the fastest-growing region in the Global Intralogistics Market during the forecast period due to rapid industrialization, expansion of e-commerce, and increasing investments in smart warehouse technologies.

- The hardware segment dominated the market with the largest revenue share of 52.6% in 2025, driven by the widespread deployment of automated storage and retrieval systems (AS/RS), conveyors, robotic arms, and autonomous mobile robots (AMRs) in warehouses and distribution centers.

Report Scope and Global Intralogistics Market Segmentation

|

Attributes |

Intralogistics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Dematic (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Global Intralogistics Market Trends

Enhanced Efficiency Through AI and Robotics Integration

- A significant and accelerating trend in the Global Intralogistics Market is the deepening integration of artificial intelligence (AI) and advanced robotics into warehouse and distribution operations. This fusion of technologies is significantly enhancing operational efficiency, accuracy, and scalability across supply chains.

- For instance, autonomous mobile robots (AMRs) equipped with AI-driven navigation systems can dynamically optimize routes in warehouses, reducing travel time and increasing throughput. Similarly, robotic picking systems powered by computer vision and machine learning can identify and handle a wide range of products with minimal human intervention.

- AI integration in intralogistics enables predictive maintenance, inventory optimization, and intelligent workflow management. For example, some systems utilize AI to forecast demand, prioritize orders, and adjust material handling processes in real time. Robotics integration further supports automated sorting, packing, and transportation, reducing labor costs and errors.

- The seamless integration of AI and robotics with warehouse management systems (WMS) and enterprise resource planning (ERP) platforms facilitates centralized monitoring and control over entire supply chain operations. Through a single interface, operators can manage inventory, track shipments, and coordinate automated systems, creating a fully connected and intelligent logistics environment.

- This trend towards more intelligent, adaptive, and interconnected intralogistics solutions is fundamentally transforming operational standards and expectations in supply chain management. Consequently, companies such as Dematic, GreyOrange, and Swisslog are developing AI-enabled robotics and automation solutions that enhance speed, accuracy, and flexibility in warehouses and distribution centers.

- The demand for intralogistics systems with seamless AI and robotics integration is growing rapidly across manufacturing, e-commerce, and retail sectors, as businesses increasingly prioritize efficiency, scalability, and data-driven decision-making.

Global Intralogistics Market Dynamics

Driver

Growing Need Due to E-commerce Expansion and Demand for Operational Efficiency

- The rapid growth of e-commerce, increasing consumer expectations for faster delivery, and the need for highly efficient warehouse operations are significant drivers for the heightened demand for advanced intralogistics solutions.

- For instance, in 2025, GreyOrange introduced an AI-powered warehouse automation system capable of optimizing order fulfillment in real time, demonstrating how key companies are driving innovation and adoption in the intralogistics market. Such advancements are expected to accelerate market growth throughout the forecast period.

- As businesses face increasing pressure to reduce labor costs, improve accuracy, and speed up order processing, intralogistics solutions such as automated storage and retrieval systems (AS/RS), autonomous mobile robots (AMRs), and conveyor systems provide compelling advantages over traditional manual operations.

- Furthermore, the growing adoption of smart warehouses and digital supply chain platforms is making intralogistics systems an integral part of modern logistics ecosystems, offering seamless integration with warehouse management systems (WMS) and enterprise resource planning (ERP) software.

- The demand for real-time inventory management, predictive analytics, and automated material handling is driving widespread deployment of intralogistics solutions across e-commerce, manufacturing, and retail sectors. Investments in scalable, modular, and user-friendly automation systems further contribute to market expansion.

Restraint/Challenge

High Implementation Costs and Integration Complexity

- The relatively high initial investment required for advanced intralogistics systems, including robotics, AI-driven software, and automated storage solutions, poses a significant challenge to market adoption, particularly for small- and medium-sized enterprises (SMEs).

- For instance, some high-capacity AS/RS implementations can cost millions of dollars, deterring smaller businesses from adopting full-scale automation despite its operational benefits.

- Additionally, integrating intralogistics solutions with existing warehouse layouts, legacy systems, and supply chain processes can be complex, requiring skilled personnel, time, and additional investment. Companies such as Dematic and Vanderlande emphasize modular and scalable solutions to mitigate these challenges.

- While the long-term operational savings and efficiency gains often justify the upfront costs, the perceived financial and technical barriers can slow adoption, especially in developing regions or for companies with limited automation expertise.

- Overcoming these challenges through cost-effective solutions, modular deployment options, comprehensive training, and seamless system integration will be vital for sustained market growth.

Global Intralogistics Market Scope

The market is segmented on the basis of Component and end use.

- By Component

On the basis of component, the Global Intralogistics Market is segmented into hardware, software, and services. The hardware segment dominated the market with the largest revenue share of 52.6% in 2025, driven by the widespread deployment of automated storage and retrieval systems (AS/RS), conveyors, robotic arms, and autonomous mobile robots (AMRs) in warehouses and distribution centers. Hardware investments form the backbone of intralogistics operations, providing the tangible infrastructure necessary for automation, material handling, and operational efficiency.

The software segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, fueled by the increasing adoption of warehouse management systems (WMS), AI-driven predictive analytics, and cloud-based platforms. Software solutions optimize inventory management, workflow scheduling, and predictive maintenance, enabling businesses to gain real-time visibility and efficiency without necessarily increasing physical infrastructure. The services segment, including installation, maintenance, and consulting, also supports overall adoption but contributes a smaller share relative to hardware and software.

- By End-Use

On the basis of end-use, the Global Intralogistics Market is segmented into food & beverages, logistics, retail & e-commerce, automotive, industrial manufacturing, airports, chemicals, and other end-uses. The logistics segment accounted for the largest market revenue share of 36.8% in 2025, driven by the rapid growth of e-commerce, the need for fast and accurate order fulfillment, and the increasing complexity of supply chains requiring automated storage, sorting, and distribution solutions. Companies in the logistics sector are increasingly implementing intralogistics technologies to optimize warehouse operations, reduce labor dependency, and minimize order processing times.

The retail & e-commerce segment is expected to witness the fastest CAGR of 24.1% from 2026 to 2033, fueled by rising online shopping, omnichannel distribution requirements, and the need for scalable, automated warehouse solutions to manage fluctuating inventory and demand peaks. Other sectors such as automotive and industrial manufacturing also contribute to growth due to automation of material transport and assembly line integration, but their adoption rates are comparatively moderate.

Global Intralogistics Market Regional Analysis

- North America dominated the Global Intralogistics Market with the largest revenue share of 33.1% in 2025, driven by the early adoption of warehouse automation, advanced robotics, and AI-powered material handling solutions.

- Businesses in the region prioritize operational efficiency, faster order fulfillment, and cost optimization, making automated intralogistics systems a critical investment in manufacturing, e-commerce, and distribution sectors.

- This widespread adoption is further supported by high technological readiness, strong infrastructure, and the presence of major intralogistics solution providers. The increasing integration of AI, robotics, and warehouse management software enables real-time inventory tracking, predictive maintenance, and seamless supply chain coordination, establishing North America as the leading market for intralogistics solutions across both industrial and commercial applications.

U.S. Intralogistics Market Insight

The U.S. intralogistics market captured the largest revenue share of 81% in 2025 within North America, fueled by rapid adoption of warehouse automation, AI-driven robotics, and advanced material handling systems. Businesses are increasingly prioritizing operational efficiency, faster order fulfillment, and cost optimization across e-commerce, manufacturing, and distribution sectors. The growing preference for modular and scalable automation solutions, combined with the integration of warehouse management systems (WMS) and predictive analytics, is further propelling market growth. Moreover, the presence of leading intralogistics solution providers and robust infrastructure supports the deployment of sophisticated automated systems across both industrial and commercial applications.

Europe Intralogistics Market Insight

The Europe intralogistics market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent regulations on supply chain efficiency, labor optimization, and safety standards. The increasing demand for automation in warehouses, coupled with the need for real-time inventory management and efficient material handling, is fostering the adoption of intralogistics solutions. Countries such as Germany, the Netherlands, and France are witnessing significant growth in automated storage systems, robotic picking solutions, and AI-driven warehouse software, particularly in the manufacturing, retail, and e-commerce sectors.

U.K. Intralogistics Market Insight

The U.K. intralogistics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of warehouse automation and the need for faster order processing in e-commerce and retail sectors. Additionally, labor cost pressures and the demand for centralized warehouse monitoring are encouraging businesses to adopt automated storage, retrieval, and sorting systems. The country’s robust e-commerce infrastructure and growing investment in smart warehouse technologies are expected to continue stimulating market growth.

Germany Intralogistics Market Insight

The Germany intralogistics market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of automation, digitalization, and Industry 4.0 practices. Germany’s advanced industrial infrastructure and focus on sustainable, energy-efficient solutions promote the adoption of AI-driven robotics, automated guided vehicles (AGVs), and warehouse management software. The integration of intralogistics systems with smart factory operations is becoming increasingly prevalent, particularly in manufacturing and logistics facilities seeking to enhance productivity and operational accuracy.

Asia-Pacific Intralogistics Market Insight

The Asia-Pacific intralogistics market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, driven by rapid industrialization, e-commerce expansion, and rising demand for automated supply chain solutions in countries such as China, Japan, and India. Government initiatives supporting smart manufacturing and digitalization are accelerating adoption, while the region’s emergence as a manufacturing hub for robotics and automation systems is improving affordability and accessibility of intralogistics solutions.

Japan Intralogistics Market Insight

The Japan intralogistics market is gaining momentum due to the country’s advanced technological ecosystem, high labor costs, and increasing need for operational efficiency. Japanese companies are rapidly adopting automated guided vehicles, robotic picking systems, and AI-powered warehouse management solutions to optimize inventory management and reduce reliance on manual labor. The integration of intralogistics systems with broader smart factory and IoT-enabled platforms is fueling growth, particularly in manufacturing and distribution facilities.

China Intralogistics Market Insight

The China intralogistics market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, expanding e-commerce, and growing industrial automation adoption. China is one of the largest markets for automated warehouse systems, AGVs, and robotic picking solutions, driven by high demand from retail, logistics, and manufacturing sectors. The government’s push towards smart logistics, increasing investment in AI-enabled automation, and the availability of cost-effective domestic intralogistics solutions are key factors propelling market growth in China.

Global Intralogistics Market Share

The Intralogistics industry is primarily led by well-established companies, including:

• Dematic (U.S.)

• KION Group / Dematic (Germany)

• Swisslog (Switzerland)

• Vanderlande (Netherlands)

• Hikrobot (China)

• Bastian Solutions (U.S.)

• Toyota Material Handling (Japan)

• Fives Group (France)

• Cisco-Eagle (U.S.)

• SSI Schäfer (Germany)

• Muratec / Murata Machinery (Japan)

• Knapp AG (Austria)

• Daifuku (Japan)

• Geek+ (China)

• Raymond Handling Concepts (U.S.)

• Jungheinrich AG (Germany)

• Magazino (Germany)

• OTTO Motors (Canada)

• Elettric80 (Italy)

• GrayOrange (U.S.)

What are the Recent Developments in Global Intralogistics Market?

- In April 2024, Dematic, a global leader in intralogistics and automation solutions, launched a strategic initiative in South Africa to modernize warehouse operations through its advanced automated storage and retrieval systems (AS/RS) and robotics solutions. This initiative emphasizes the company’s commitment to delivering efficient, scalable, and technology-driven supply chain solutions tailored to regional logistics challenges, reinforcing its position in the rapidly growing Global Intralogistics Market.

- In March 2024, GreyOrange, a robotics and AI-based intralogistics provider, deployed its next-generation Sortation and Picking System in major e-commerce fulfillment centers across the U.S. Designed to optimize order accuracy and processing speed, this system highlights GreyOrange’s dedication to enhancing operational efficiency and enabling businesses to meet increasing consumer demand with precision and reliability.

- In March 2024, Honeywell International Inc. successfully implemented an AI-powered warehouse automation project in Bengaluru, India, aimed at improving urban logistics and industrial supply chain efficiency. The project leverages advanced robotics, AI algorithms, and warehouse management software to enhance throughput and minimize operational downtime, demonstrating the growing role of smart intralogistics technologies in creating more efficient and resilient logistics networks.

- In February 2024, SSI Schäfer announced a strategic partnership with a leading European e-commerce company to deploy fully automated warehouse systems, including conveyor solutions and robotic picking stations. This collaboration is designed to streamline order fulfillment, reduce labor dependency, and improve supply chain responsiveness, underscoring SSI Schäfer’s focus on driving innovation and operational excellence in the intralogistics sector.

- In January 2024, Vanderlande, a prominent provider of automated material handling systems, unveiled its next-generation high-speed sortation system at LogiMAT 2024. Equipped with AI-driven predictive analytics and modular design, the system enables warehouses and distribution centers to handle peak order volumes with greater efficiency and accuracy, reflecting Vanderlande’s commitment to integrating advanced technology into intralogistics operations to meet evolving market demands.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.