Global Intravascular Ultrasound Ivus Market

Market Size in USD Million

CAGR :

%

USD

490.77 Million

USD

785.17 Million

2025

2033

USD

490.77 Million

USD

785.17 Million

2025

2033

| 2026 –2033 | |

| USD 490.77 Million | |

| USD 785.17 Million | |

|

|

|

|

Intravascular Ultrasound (IVUS) Market Size

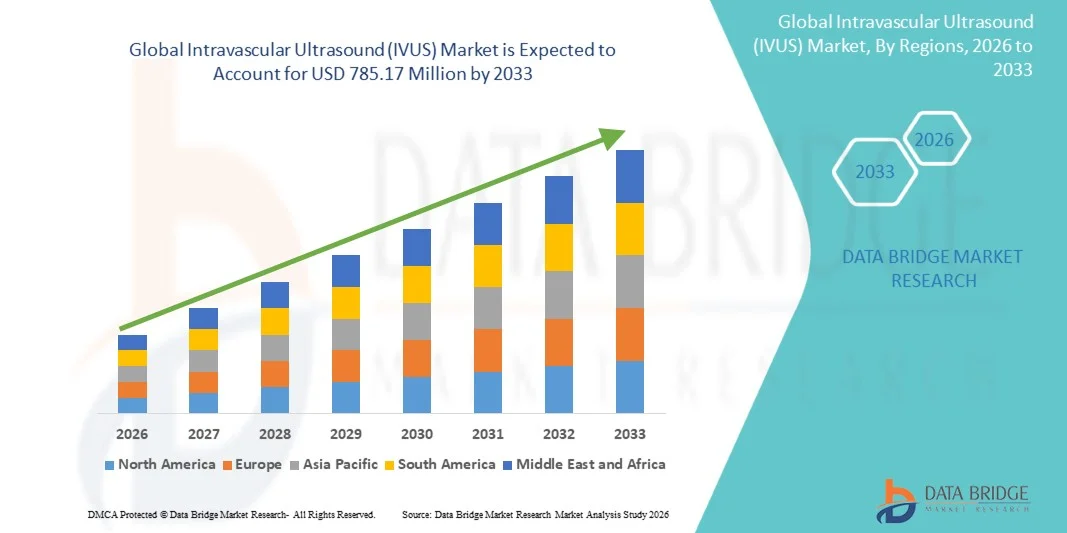

- The global Intravascular Ultrasound (IVUS) market size was valued at USD 490.77 million in 2025 and is expected to reach USD 785.17 million by 2033, at a CAGR of 6.05% during the forecast period

- The market growth is primarily driven by the increasing prevalence of cardiovascular diseases, rising adoption of minimally invasive diagnostic procedures, and technological advancements in imaging systems, enabling more precise and real-time visualization of vascular structures

- In addition, growing awareness among cardiologists and healthcare providers regarding the benefits of IVUS in improving procedural outcomes and patient safety is fueling its adoption across hospitals and specialized cardiac care centers. These converging trends are propelling the demand for IVUS systems, thereby significantly enhancing the market’s growth

Intravascular Ultrasound (IVUS) Market Analysis

- Intravascular Ultrasound (IVUS), providing high-resolution imaging of blood vessels from within the lumen, is increasingly critical in modern cardiovascular diagnostics and interventions due to its ability to guide percutaneous coronary procedures, assess plaque morphology, and improve procedural outcomes

- The rising adoption of Intravascular Ultrasound (IVUS) is primarily driven by the growing prevalence of cardiovascular diseases, increased demand for minimally invasive diagnostic tools, and technological advancements in imaging catheters and software for precise vessel assessment

- North America dominated the Intravascular Ultrasound (IVUS) market with the largest revenue share of 38.7% in 2025, supported by high awareness among cardiologists, advanced healthcare infrastructure, and strong adoption of interventional cardiology procedures, with the U.S. witnessing significant utilization of Intravascular Ultrasound (IVUS) in complex coronary interventions and research-led hospitals investing in next-generation imaging systems

- Asia-Pacific is expected to be the fastest-growing region in the Intravascular Ultrasound (IVUS) market during the forecast period due to increasing incidence of cardiovascular diseases, rising healthcare expenditure, and expansion of cardiac care facilities across emerging economies such as China and India

- Consoles segment dominated the Intravascular Ultrasound (IVUS) market with a share of 52.3% in 2025, driven by their critical role in providing real-time imaging, seamless integration with catheter-based systems, and advanced features for accurate diagnosis and procedural guidance

Report Scope and Intravascular Ultrasound (IVUS) Market Segmentation

|

Attributes |

Intravascular Ultrasound (IVUS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Intravascular Ultrasound (IVUS) Market Trends

“Advanced Imaging and AI-Enhanced Diagnostic Guidance”

- A significant and accelerating trend in the global Intravascular Ultrasound (IVUS) market is the integration of artificial intelligence (AI) and advanced imaging software to improve diagnostic accuracy and procedural guidance during cardiovascular interventions

- For instance, AI-enabled IVUS systems can automatically detect and quantify plaque composition, lumen dimensions, and stent deployment accuracy, providing real-time decision support for interventional cardiologists

- AI integration in IVUS enables predictive analytics for patient outcomes, suggesting optimal stent sizing and placement while reducing procedural complications. For instance, some systems such as Volcano/Philips IVUS utilize AI to enhance image interpretation and guide intervention strategies

- The seamless combination of IVUS with other imaging modalities such as OCT or angiography facilitates comprehensive vessel assessment and procedural planning, allowing clinicians to visualize both lumen and vessel wall simultaneously for better clinical decisions

- This trend towards more intelligent, integrated, and real-time imaging solutions is reshaping clinical expectations for intravascular diagnostics. Consequently, companies such as Boston Scientific are developing AI-enhanced IVUS platforms with automated plaque analysis and predictive stent deployment features

- The demand for IVUS systems with AI and multimodal integration is growing rapidly across hospitals and specialized cardiac centers, as clinicians increasingly prioritize precision, safety, and outcome-driven interventions

- Increasing incorporation of cloud-based IVUS imaging and data storage is enabling remote consultation and second-opinion services, enhancing access to expert guidance for complex cardiovascular cases

Intravascular Ultrasound (IVUS) Market Dynamics

Driver

“Increasing Prevalence of Cardiovascular Diseases and Minimally Invasive Procedures”

- The growing incidence of coronary artery disease and other cardiovascular conditions, coupled with rising adoption of minimally invasive interventions, is a key driver for increased IVUS utilization

- For instance, in March 2025, Philips announced an expansion of its AI-powered IVUS solutions to improve procedural outcomes in complex coronary interventions, highlighting the growing clinical adoption

- As hospitals seek better imaging guidance for percutaneous coronary interventions, IVUS provides detailed vessel visualization, helping reduce complications and optimize stent placement

- Furthermore, the rising focus on patient safety and improved procedural success is making IVUS an essential tool in interventional cardiology, particularly in high-volume cardiac centers

- The increasing preference for advanced, real-time imaging solutions and integration with catheter-based procedures is boosting the adoption of IVUS across both developed and emerging healthcare markets

- Expanding awareness programs and clinical workshops by key players are educating cardiologists about IVUS benefits, accelerating adoption in previously untapped regions

- Increasing collaborations between IVUS system providers and hospitals for research and clinical trials are driving innovation, helping validate efficacy, and encouraging further market uptake

Restraint/Challenge

“High Cost and Technical Complexity Hindering Adoption”

- The relatively high cost of IVUS systems, including consoles and disposable catheters, can be a barrier to adoption, particularly in smaller hospitals or developing regions

- For instance, some mid-sized cardiac centers may hesitate to invest in IVUS due to budget constraints, despite its clinical advantages in complex interventions

- Technical complexity and the need for trained interventional cardiologists to operate and interpret IVUS imaging pose additional challenges for broader adoption

- While companies provide training and support programs, the learning curve for accurate image acquisition and analysis may limit initial usage in certain hospitals

- Addressing these challenges through cost reduction strategies, simplified imaging workflows, and enhanced clinician training programs will be crucial for sustained growth in the IVUS market

- Limited reimbursement policies for IVUS procedures in certain countries discourage hospitals from adopting the technology, restraining market penetration despite clinical benefits

- Competition from alternative imaging modalities such as OCT or high-resolution angiography can restrict adoption, as clinicians may prefer familiar or more cost-effective solutions for routine procedures

Intravascular Ultrasound (IVUS) Market Scope

The market is segmented on the basis of product type, modality, and end user.

- By Product Type

On the basis of product type, the IVUS market is segmented into consoles and accessories. The consoles segment dominated the market with the largest revenue share of 52.3% in 2025, driven by their central role in high-resolution imaging and procedural guidance. Consoles act as the hub for IVUS procedures, enabling clinicians to evaluate vessel morphology, plaque characteristics, and stent deployment in real time. Hospitals and cardiac care centers prefer consoles due to their ability to enhance procedural accuracy, reduce complications, and integrate multiple catheter types. Technological advancements such as AI-assisted imaging and improved visualization software strengthen their market position. North America and Europe remain the largest adopters due to advanced healthcare infrastructure and high procedural volumes. The reliability, compatibility with multimodal imaging systems, and ability to support research and clinical trials further solidify the dominance of consoles.

The accessories segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand for disposable catheters, connectors, and specialized imaging tools. Accessories are essential for accurate image acquisition, procedural efficiency, and infection control. Growth is supported by the expansion of minimally invasive interventions and increasing procedural volume in emerging markets. Manufacturers are introducing innovative catheter designs, flexible connectors, and single-use imaging tools to improve operational efficiency. Hospitals and cardiac centers seek cost-effective solutions to complement consoles without large capital investment. Collaborations for clinical research and trials further drive the adoption of specialized accessories in the IVUS market.

- By Modality

On the basis of modality, the IVUS market is segmented into Histology IVUS, IMap IVUS, and Integrated Backscatter IVUS. The Histology IVUS segment dominated the market in 2025, driven by its high-resolution tissue characterization and ability to assess plaque morphology accurately. Histology IVUS allows cardiologists to distinguish fibrous, calcified, and lipid-rich plaques, supporting precise stent placement and optimal procedural outcomes. Its imaging quality is crucial for real-time vessel wall assessment during complex interventions. The segment benefits from strong adoption in North America and Europe, where healthcare facilities emphasize advanced diagnostic tools. Continuous software innovation, AI-assisted image interpretation, and compatibility with multimodal platforms further enhance its adoption. Histology IVUS also supports clinical trials and research on cardiovascular disease progression.

The IMap IVUS segment is anticipated to witness the fastest growth from 2026 to 2033, driven by automated tissue characterization and AI integration for predictive procedural outcomes. IMap IVUS provides quantitative plaque composition data, helping cardiologists plan personalized interventions. Rapid adoption is fueled by the increasing prevalence of coronary artery disease and minimally invasive procedures. Technological enhancements, including faster image processing and catheter compatibility, accelerate uptake. Emerging markets are witnessing adoption growth due to improved cardiac care infrastructure. In addition, IMap IVUS is widely used in clinical studies, reinforcing its utility in evidence-based cardiovascular treatment.

- By End User

On the basis of end user, the IVUS market is segmented into clinics, hospitals, mobile imaging centers, research and academic institutions, and others. The hospitals segment dominated the market in 2025, owing to high procedural volumes and availability of advanced cardiac care infrastructure. Hospitals are the primary adopters of IVUS due to complex coronary interventions, access to trained cardiologists, and the ability to invest in consoles and accessories. Strong demand in North America and Europe is driven by established cardiovascular treatment facilities and research programs. Hospitals benefit from integration of IVUS with multimodal imaging platforms and AI-assisted diagnostics. Large-scale adoption in tertiary and quaternary care centers reinforces their market dominance. Hospitals also participate in clinical trials, further increasing IVUS utilization and revenue contribution.

The research and academic institutions segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising focus on cardiovascular research, clinical studies, and technology validation. Academic hospitals and research centers utilize IVUS for studying plaque progression, testing new stent designs, and evaluating minimally invasive procedures. Adoption is growing as institutions increasingly integrate AI and multimodal imaging for research efficiency. Availability of grants and funding for cardiovascular research supports procurement of IVUS consoles and accessories. Collaborative studies with device manufacturers boost utilization and facilitate technology improvements. This segment also benefits from expansion in emerging markets, where research initiatives are rapidly increasing.

Intravascular Ultrasound (IVUS) Market Regional Analysis

- North America dominated the Intravascular Ultrasound (IVUS) market with the largest revenue share of 38.7% in 2025, supported by high awareness among cardiologists, advanced healthcare infrastructure, and strong adoption of interventional cardiology procedures

- Hospitals and cardiac care centers in the region prioritize IVUS for complex coronary interventions due to its ability to provide high-resolution vessel imaging, guide stent placement, and improve procedural outcomes

- This strong adoption is further supported by well-trained interventional cardiologists, research-led hospitals, and early integration of AI-assisted imaging and multimodal platforms, establishing IVUS as a standard diagnostic and procedural tool in North American cardiac care

U.S. Intravascular Ultrasound (IVUS) Market Insight

The U.S. IVUS market captured the largest revenue share of 81% in 2025 within North America, fueled by the high prevalence of cardiovascular diseases and increasing adoption of minimally invasive interventional procedures. Hospitals and specialized cardiac centers are prioritizing IVUS for its ability to provide high-resolution vessel imaging and guide precise stent deployment. Growing awareness among cardiologists about improved procedural outcomes, combined with AI-assisted imaging platforms and multimodal integration, further propels the IVUS market. The rising volume of percutaneous coronary interventions (PCI) and complex coronary cases drives consistent demand. Moreover, U.S. hospitals actively participate in clinical trials and research studies, which boosts IVUS adoption. Advanced healthcare infrastructure and a well-trained interventional workforce continue to strengthen market growth.

Europe Intravascular Ultrasound (IVUS) Market Insight

The Europe IVUS market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of cardiovascular disease management and growing adoption of minimally invasive procedures. Stringent healthcare regulations, advanced hospital infrastructure, and rising government initiatives to improve cardiac care are fostering IVUS adoption. European clinicians are increasingly using IVUS to enhance procedural accuracy, reduce complications, and guide stent placement. The market is witnessing growth across both private and public hospitals, as well as academic research centers. Integration with AI and multimodal imaging platforms is contributing to enhanced clinical outcomes. Rising patient preference for safer, less invasive interventions is also supporting market expansion.

U.K. Intravascular Ultrasound (IVUS) Market Insight

The U.K. IVUS market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing demand for accurate coronary imaging and improved interventional outcomes. Concerns regarding cardiovascular disease complications are encouraging hospitals and specialty cardiac centers to adopt IVUS for precise procedural guidance. The U.K.’s advanced healthcare system, strong cardiology research programs, and availability of AI-assisted IVUS platforms are expected to continue stimulating market growth. The adoption of minimally invasive procedures and rising PCI volumes are further supporting demand. Moreover, the integration of IVUS with other imaging modalities is enhancing clinical efficiency and accuracy. Growing awareness among clinicians about patient-specific interventions also drives uptake.

Germany Intravascular Ultrasound (IVUS) Market Insight

The Germany IVUS market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s emphasis on advanced healthcare technology and cardiovascular disease management. Germany’s well-developed hospital infrastructure and focus on research and innovation promote IVUS adoption. Hospitals are increasingly integrating IVUS with AI-assisted imaging and multimodal platforms to improve procedural accuracy and patient outcomes. Rising demand for minimally invasive interventions and stent optimization procedures is further boosting the market. Strong government initiatives supporting cardiac care and clinical studies contribute to expansion. In addition, Germany’s focus on high-quality, evidence-based treatments aligns with the adoption of advanced IVUS systems.

Asia-Pacific Intravascular Ultrasound (IVUS) Market Insight

The Asia-Pacific IVUS market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, driven by increasing prevalence of cardiovascular diseases, rapid urbanization, and expansion of advanced cardiac care facilities. Countries such as China, Japan, and India are witnessing rising adoption of minimally invasive procedures and PCI interventions. The growing inclination toward technologically advanced imaging systems and AI-assisted diagnostics is driving market growth. Moreover, expanding healthcare infrastructure and government initiatives promoting cardiovascular health contribute to adoption. Emerging hospitals and specialty cardiac centers are investing in IVUS to enhance procedural accuracy and patient outcomes. Increasing clinical research and collaborations with global IVUS providers further accelerate market growth.

Japan Intravascular Ultrasound (IVUS) Market Insight

The Japan IVUS market is gaining momentum due to the country’s high incidence of cardiovascular diseases, rapid adoption of minimally invasive procedures, and focus on high-precision cardiac care. Hospitals and specialized cardiac centers prioritize IVUS for its ability to provide detailed vessel imaging and guide complex PCI interventions. Integration with AI-enabled platforms and multimodal imaging systems enhances procedural accuracy and outcomes. The growing elderly population is likely to further spur demand for accurate, less invasive imaging solutions. In addition, Japan’s advanced healthcare infrastructure and well-trained interventional cardiologists support rapid adoption. Clinical trials and research initiatives leveraging IVUS systems contribute to technological advancements and market growth.

India Intravascular Ultrasound (IVUS) Market Insight

The India IVUS market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding healthcare infrastructure, rising prevalence of cardiovascular diseases, and growing awareness of minimally invasive procedures. Hospitals and specialty cardiac centers increasingly adopt IVUS for PCI guidance, stent optimization, and patient-specific interventions. The push towards advanced cardiac care and government initiatives supporting cardiovascular health are key factors propelling the market. Availability of cost-effective IVUS consoles and disposable accessories also supports wider adoption. Rising clinical research and collaborations with global IVUS providers facilitate technology transfer and skill development. Growing urban populations and increasing disposable incomes further enhance market potential in India.

Intravascular Ultrasound (IVUS) Market Share

The Intravascular Ultrasound (IVUS) industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V. (Netherlands)

- Boston Scientific Corporation (U.S.)

- Terumo Corporation (Japan)

- Medtronic (Ireland)

- Conavi Medical Inc. (Canada)

- ACIST Medical Systems, Inc. (U.S.)

- Cordis (U.S.)

- Siemens Healthineers AG (Germany)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- GE Healthcare (U.S.)

- Hitachi, Ltd. (Japan)

- FUJIFILM Healthcare (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- BD (U.S.)

- Abbott (U.S.)

- Biotronik SE & Co. KG (Germany)

- Olympus Corporation (Japan)

What are the Recent Developments in Global Intravascular Ultrasound (IVUS) Market?

- In October 2025, Royal Philips launched the AI‑powered IVUS Mentor platform at TCT 2025, an adaptive learning tool designed to expand access to IVUS image‑guided therapy education worldwide, helping clinicians build interpretation skills with personalized, case‑based training. This development addresses the training gap limiting broader IVUS adoption and supports clinical proficiency globally

- In September 2025, Boston Scientific received FDA clearance for the AVVIGO+ Multi‑Modality Guidance System, a next‑generation IVUS and FFR system with advanced software and AI‑based automated lesion assessment designed to improve vessel imaging quality and procedural decision‑making during PCI. This approval marks a significant advancement in multifunctional intravascular imaging technologies

- In September 2025, Conavi Medical submitted its next‑generation Novasight Hybrid IVUS/OCT intravascular imaging system to the U.S. Food and Drug Administration for 510(k) clearance, aiming to combine IVUS and OCT into a single dual‑modality platform with enhanced image quality, improved workflow, and simplified user interface for coronary applications

- In March 2025, Evident Vascular successfully closed its Series B financing round to advance its next‑generation AI‑powered Intravascular Ultrasound platform, securing new investments to accelerate development of enhanced vascular imaging technology and support FDA 510(k) clearance for U.S. market launch. This funding underscores growing investor confidence in AI‑integrated IVUS solutions and signals strong momentum toward innovation and clinical adoption in vascular imaging

- In October 2021, clinical experts convened under Philips’ leadership to establish the first‑ever global consensus for the appropriate use of IVUS in peripheral vascular disease interventions, setting evidence‑based recommendations to standardize practice and improve quality of care using IVUS guidance. This consensus helped build clinical confidence and guideline support for IVUS in broader vascular applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.