Global Intravenous Immunoglobulin Market

Market Size in USD Million

CAGR :

%

USD

11.97 Million

USD

21.83 Million

2022

2030

USD

11.97 Million

USD

21.83 Million

2022

2030

| 2023 –2030 | |

| USD 11.97 Million | |

| USD 21.83 Million | |

|

|

|

|

Intravenous Immunoglobulin Market Analysis and Size

Immunoglobulin are manufactured from a huge pool of human plasma that is collected from at least 100 donors or more. The intramuscular route of administration is a conventional method and is not preferred currently, as it is painful. Intravenous immunoglobulin has developed as a boon in the last few years for patients with compromised immune systems. The increasing burden of target diseases such as primary immunodeficiency diseases is projected to boost the growth of the market.

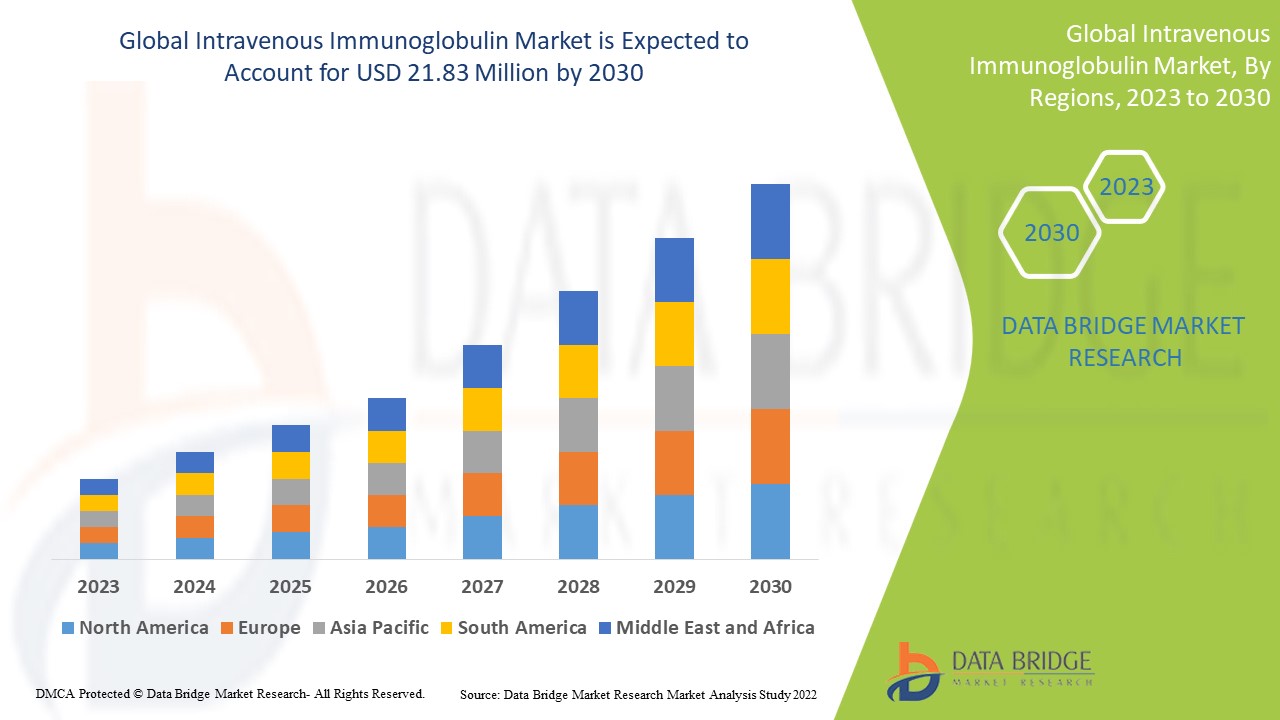

Data Bridge Market Research analyses a growth rate in the intravenous immunoglobulin market in the forecast period 2023-2030. The expected CAGR of intravenous immunoglobulin market is tend to be around 7.80% in the mentioned forecast period. The market was valued at USD 11.97 million in 2022, and it would grow upto USD 21.83 million by 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Intravenous Immunoglobulin Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Application (Hypogammaglobulinemia, CIDP, Congential AIDS), Route of Administration (Intravenous and Subcutaneous), End-Users (Hospitals, Homecare, Specialty Clinics, Others), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, online Pharmacies and Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Baxter (U.S.), Bayer AG (Germany), Merck & Co., Inc. (U.S.), Biotest AG (Germany), Top Bio Group Co., Ltd. (China), CSL Limited (Australia), Octapharma AG (Switzerland), Grifols, S.A (Spain), Kedrion S.p.A (Italy) |

|

Market Opportunities |

|

Market Definition

Immunoglobulin is the product breakdown of blood plasma that contains antibody. Immunoglobulin is a blood product which is generally administered through intravenous route. It consists of polyvalent IgG antibodies extracted from blood donors' plasma. Many patients are suffering from disorders such Wiskott Aldrich Syndrome, X-linked agammaglobulinemia who are unable to produce enough antibodies. Thus they benefit from intravenous immunoglobulin to maintain the sufficient level of antibodies in the body.

Global Intravenous Immunoglobulin Market Dynamics

Drivers

- Growing Incidences of Primary Immune Deficiencies (PIDs)

As per W.H.O, at present, there are more than 50 different Primary Immune Deficiencies (PIDs) such as specific antibody deficiency and X-lined hypo-gamma-globulinemia. This deficiences include 176 different types of rare hereditary disorders. As per the U.S. National Library of Medicine and National Institute of Health, around 6 million patients are suffering from PID globally. Increasing occurrences of these diseases are anticipated to boost the demand for immunoglobulin therapies during the forecast period.

- Growing Demand For Hospitals For These Patients

The hospitals segment dominated the market due to increase in the number of patients opting for hospital treatment rather than standalone clinics. Furthermore, patients receiving IVIG infusions at home have improved the quality of life, as they get more comfortable in the daily activities. For instance, IVIG infusions at home care have minimized the scheduling clashes for multiple patients at a time.

Opportunities

- Increasing Healthcare Expenditure For Immunoglobulins

There has been increasing funding for several immunoglobulins that are helping to expand the market's growth. For instance, The National Institute of Allergy and Infectious Diseases (NIAID), part of the National Institutes of Health, sponsored and funded the phase III trial, known as Inpatient Treatment with Anti-Coronavirus Immunoglobulin, or ITAC. The antibody solution which was tested in the ITAC trial is anti-coronavirus hyperimmune intravenous immunoglobulin or hIVIG.

- Increasing Strategic Partnerships and Acquisitions between Organizations

Several market players are adopting numerous strategies such as mergers and acquisitions, distribution, and other collaborative agreements to gain a huge share by growing their market penetration. For instance, on 25 April 2022, Grifols S.A purchased Biotest, which is a significant and transformative deal that will boost growth and innovation. This deal will allow to accelerate and extend its product range, increase patient access to plasma medicines, operate the biggest private European network of plasma facilities, and increase revenue growth and margin development.

Restraints/Challenges

- High Cost of Treatment

The cost for diagnosis and treatment of demyelinating disease is very high. The increasing cost of IVIG therapy is estimated to be a major barrier to market expansion. Immunoglobulin infusions are typically given once every 3 to 4 weeks, and the therapy is ongoing about 12-16 sessions annually. The projected cost of IVIG is USD 73.89 per gram, with a total cost of USD 10,000, depending on the severity of the patient condition.

This intravenous immunoglobulin market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the intravenous immunoglobulin market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Global Intravenous Immunoglobulin Market

COVID-19 has caused significant issues for patients with mental and neurological disorders because of their increased susceptibility to infection. MIS-C (multi-system inflammatory syndrome) has been witnessed in several patients, especially among the younger population. Several medical professionals have been estimating the efficacy of IVIG injection for COVID-19 patients. For instance, in April 2021, Grifols, S.A. which is a key provider of plasma-derived medicines, contributed to a research study in collaboration with both the NIH and NIAID, to analyze an intravenous anti-SARS-CoV-2 hyperimmune globulin among outpatients, which is projected to boost the market growth during the forecast period.

Recent Development:

- In August 2021, Emergent BioSolutions, Inc., which is a multinational specialty biopharmaceutical company based in the U.S., stated the initiation of phase III clinical trial to assess its investigational SARS-CoV-2 Immune Globulin Intravenous (COVID-HIG) plasma-derived therapy as a capable outpatient treatment for patients with COVID-19 who are at higher risk of progression to severe disease. Therefore, the factors mentioned above are estimated to boost the growth of the global intravenous immunoglobulin market during the forecast period.

Global Intravenous Immunoglobulin Market Scope

The intravenous immunoglobulin market is segmented on the basis of application, route of administration, end-user, distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Application

- Hypogammaglobulinemia

- CIDP

- Congential AIDS

Route of Administration

- Intravenous

- Subcutaneous

End-Users

- Hospitals

- Homecare

- Specialty Clinics

- Others

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacies

- Others

Intravenous Immunoglobulin Market Regional Analysis/Insights

The intravenous immunoglobulin market is analyzed and market size insights and trends are provided by application, route of administration,end-user, distribution channel as referenced above.

The major countries covered in the intravenous immunoglobulin market report are the U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is considered to have the highest lucrative growth in the forecast period due to the presence of key manufacturers of the product is high and, increasing research and development activities, healthcare expenditure.

Asia-Pacific is dominating the market due to the growing awareness and potential opportunities for adopting immunoglobulin-based therapies for treating patients with primary immune deficiencies, along with a growing geriatric population.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Intravenous Immunoglobulin Market Share Analysis

The intravenous immunoglobulin market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to intravenous immunoglobulin market.

Key players operating in the intravenous immunoglobulin market include:

- Baxter (U.S.)

- Bayer AG (Germany)

- Merck & Co., Inc. (U.S.)

- Biotest AG (Germany)

- Top Bio Group Co., Ltd.(China)

- CSL Limited (Australia)

- Octapharma AG (Switzerland)

- Grifols, S.A (Spain)

- Kedrion S.p.A (Italy)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL INTRAVENOUS IMMUNOGLOBULIN MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL INTRAVENOUS IMMUNOGLOBULIN MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY MODELING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL INTRAVENOUS IMMUNOGLOBULIN MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S 5 FORCES

4.2 PESTEL ANALYSIS

4.3 ANALYSIS OF TRADITIONAL AND NOVEL PRODUCTS

5 INDUSTRY INSIGHTS

5.1 PATENT ANALYSIS

5.1.1 PATENT LANDSCAPE

5.1.2 USPTO NUMBER

5.1.3 PATENT EXPIRY

5.1.4 EPIO NUMBER

5.1.5 PATENT STRENGTH AND QUALITY

5.1.6 PATENT CLAIMS

5.1.7 PATENT CITATIONS

5.1.8 PATENT LITIGATION AND LICENSING

5.1.9 FILE OF PATENT

5.1.10 PATENT RECEIVED CONTRIES

5.1.11 TECHNOLOGY BACKGROUND

5.2 DRUG TREATMENT RATE BY MATURED MARKETS

5.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

5.4 PATIENT FLOW DIAGRAM

5.5 KEY PRICING STRATEGIES

5.6 KEY PATIENT ENROLLMENT STRATEGIES

5.7 INTERVIEWS WITH SPECIALIST

5.8 OTHER KOL SNAPSHOTS

6 EPIDEMOLOGY

6.1 INCIDENCE RATE

6.2 TREATMENT RATE

6.3 MORTALITY RATE

6.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

6.5 PATIENT TREATMENT SUCCESS RATES

7 MERGERS AND ACQUISITION

7.1 LICENSING

7.2 COMMERCIALIZATION AGREEMENTS

8 REGULATORY FRAMEWORK

8.1 REGULATORY APPROVAL PROCESS

8.2 GEOGRAPHIES' EASE OF REGULATORY APPROVAL

8.3 REGULATORY APPROVAL PATHWAYS

8.4 LICENSING AND REGISTRATION

8.5 POST-MARKETING SURVEILLANCE

8.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

9 PIPELINE ANALYSIS

9.1 CLINICAL TRIALS AND PHASE ANALYSIS

9.2 DRUG THERAPY PIPELINE

9.3 PHASE III CANDIDATES

9.4 PHASE II CANDIDATES

9.5 PHASE I CANDIDATES

9.6 OTHERS (PRE-CLINICAL AND RESEARCH)

10 MARKETED DRUG ANALYSIS

10.1 DRUG

10.1.1 BRAND NAME

10.1.2 GENERICS NAME

10.2 THERAPEUTIC INDIACTION

10.3 PHARACOLOGICAL CLASS OD THE DRUG

10.4 DRUG PRIMARY INDICATION

10.5 MARKET STATUS

10.6 MEDICATION TYPE

10.7 DRUG DOSAGES FORM

10.8 DOSAGES AVAILABILITY

10.9 PACKAGING TYPE

10.1 DRUG ROUTE OF ADMINISTRATION

10.11 DOSING FREQUENCY

10.12 DRUG INSIGHT

10.13 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

10.13.1 FORECAST MARKET OUTLOOK

10.13.2 CROSS COMPETITION

10.13.3 THERAPEUTIC PORTFOLIO

10.14 CURRENT DEVELOPMENT SCENARIO

11 MARKET OVERVIEW

11.1 DRIVERS

11.2 RESTRAINS

11.3 OPPURTUNITY

11.4 CHALLENGES

12 MARKET ACCESS

12.1 10-YEAR MARKET FORECAST

12.2 CLINICAL TRIAL RECENT UPDATES

12.3 ANNUAL NEW FDA APPROVED DRUGS

12.4 DRUGS MANUFACTURER AND DEALS

12.5 MAJOR DRUG UPTAKE

12.6 CURRENT TREATMENT PRACTICES

12.7 IMPACT OF UPCOMING THERAPY

13 R & D ANALYSIS

13.1 COMPARATIVE ANALYSIS

13.2 DRUG DEVELOPMENTAL LANDSCAPE

13.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

13.4 THERAPEUTIC ASSESSMENT

13.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

14 GLOBAL INTRAVENOUS IMMUNOGLOBULIN MARKET, BY TYPE

(NOTE: MARKET VALUE, VOLUME AND ASP ANALYSIS WOULD BE PROVIDED FOR ALL SEGMENTS AND SUB-SEGMENTS OF PRODUCT)

14.1 OVERVIEW

14.2 IGG

14.2.1 IGG1

14.2.2 IGG2

14.2.3 IGG3

14.2.4 IGG4

14.3 IGA

14.3.1 IGA1

14.3.2 IGA2

14.4 IGM

14.5 IGE

14.6 IGD

15 GLOBAL INTRAVENOUS IMMUNOGLOBULIN MARKET, BY INDICATION

15.1 OVERVIEW

15.2 PRIMARY HUMORAL IMMUNODEFICIENCY DISEASE (PIDD)

15.2.1 COMMON VARIABLE IMMUNODEFICIENCY (CVID)

15.2.2 X-LINKED AGAMMAGLOBULINEMIA

15.2.3 CONGENITAL AGAMMAGLOBULINEMIA

15.2.4 WISKOTT-ALDRICH SYNDROME

15.2.5 SEVERE COMBINED IMMUNODEFICIENCIES (SCID)

15.3 IDIOPATHIC THROMBOCYTOPENIC PURPURA (ITP)

15.4 CHRONIC INFLAMMATORY DEMYELINATING POLYNEUROPATHY (CIDP)

15.5 KAWASAKI’S VASCULITIS

15.6 MYASTHENIA GRAVIS

15.6.1 GENERALIZED MYASTHENIA GRAVIS

15.6.2 OCULAR MYASTHENIA GRAVIS

15.6.3 TRANSIENT NEONATAL MYASTHENIA GRAVIS

15.7 LUPUS

15.8 MYOSITIS

15.9 MULTIFOCAL MOTOR NEUROPATHY

15.1 GUILLAIN BARRÉ SYNDROME

15.11 HYPOPLASMINOGENEMIA

15.11.1 HEREDITARY

15.11.2 NONFAMILIAL

15.12 ACQUIRED IMMUNODIFICIENCY DISORDERS

15.13 CANCER

15.13.1 CHRONIC LYMPHOCYTIC LYMPHOMA

15.13.2 MULTIPLE MYELOMA

15.14 OTHER INDICATIONS

16 GLOBAL INTRAVENOUS IMMUNOGLOBULIN MARKET, BY CONCENTRATION

16.1 OVERVIEW

16.2 IVIG 5%

16.3 IVIG 10%

17 GLOBAL INTRAVENOUS IMMUNOGLOBULIN MARKET, BY AGE GROUP

17.1 OVERVIEW

17.2 PEDIATRIC

17.3 ADULT

17.4 GERIATRIC

18 GLOBAL INTRAVENOUS IMMUNOGLOBULIN MARKET, BY DRUG TYPE

18.1 OVERVIEW

18.2 BRANDED DRUGS

18.2.1 GAMUNEX

18.2.2 FLEBOGAMMA DIF

18.2.3 GAMMAGARD S/D

18.2.4 GAMMAGARD LIQUID

18.2.5 GAMMAKED

18.2.6 GAMMAPLEX

18.2.7 GAMUNEX-C

18.2.8 OCTAGAM

18.2.9 PRIVIGEN

18.3 GENERIC

19 GLOBAL INTRAVENOUS IMMUNOGLOBULIN MARKET, BY END USER

19.1 OVERVIEW

19.2 HOSPITALS

19.3 SPECIALTY CLINIC

19.4 HOMECARE

19.5 OTHERS

20 GLOBAL INTRAVENOUS IMMUNOGLOBULIN MARKET, BY DISTRIBUTION CHANNEL

20.1 OVERVIEW

20.2 HOSPITAL PHARMACY

20.3 RETAIL PHARMACY

20.4 OTHERS

21 GLOBAL INTRAVENOUS IMMUNOGLOBULIN MARKET, SWOT AND DBMR ANALYSIS

22 GLOBAL INTRAVENOUS IMMUNOGLOBULIN MARKET, COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

22.2 COMPANY SHARE ANALYSIS: EUROPE

22.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

22.4 MERGERS & ACQUISITIONS

22.5 NEW PRODUCT DEVELOPMENT & APPROVALS

22.6 EXPANSIONS

22.7 REGULATORY CHANGES

22.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

23 GLOBAL INTRAVENOUS IMMUNOGLOBULIN MARKET, BY GEOGRAPHY

GLOBAL INTRAVENOUS IMMUNOGLOBULIN MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

23.1 NORTH AMERICA

23.1.1 U.S.

23.1.1.1. U.S. INTRAVENOUS IMMUNOGLOBULIN MARKET, BY TYPE

23.1.1.2. U.S. INTRAVENOUS IMMUNOGLOBULIN MARKET, BY INDICATION

23.1.1.3. U.S. INTRAVENOUS IMMUNOGLOBULIN MARKET, BY CONCENTRATION

23.1.1.4. U.S. INTRAVENOUS IMMUNOGLOBULIN MARKET, BY AGE GROUP

23.1.1.5. U.S. INTRAVENOUS IMMUNOGLOBULIN MARKET, BY DRUG TYPE

23.1.1.6. U.S. INTRAVENOUS IMMUNOGLOBULIN MARKET, BY END USER

23.1.1.7. U.S. INTRAVENOUS IMMUNOGLOBULIN MARKET, BY DISTRUBUTION CHANNEL

23.1.2 CANADA

23.1.3 MEXICO

23.2 EUROPE

23.2.1 GERMANY

23.2.2 FRANCE

23.2.3 U.K.

23.2.4 HUNGARY

23.2.5 LITHUANIA

23.2.6 AUSTRIA

23.2.7 IRELAND

23.2.8 NORWAY

23.2.9 POLAND

23.2.10 ITALY

23.2.11 SPAIN

23.2.12 RUSSIA

23.2.13 TURKEY

23.2.14 NETHERLANDS

23.2.15 SWITZERLAND

23.2.16 REST OF EUROPE

23.3 ASIA-PACIFIC

23.3.1 JAPAN

23.3.2 CHINA

23.3.3 SOUTH KOREA

23.3.4 INDIA

23.3.5 AUSTRALIA

23.3.6 SINGAPORE

23.3.7 THAILAND

23.3.8 MALAYSIA

23.3.9 INDONESIA

23.3.10 PHILIPPINES

23.3.11 VIETNAM

23.3.12 REST OF ASIA-PACIFIC

23.4 SOUTH AMERICA

23.4.1 BRAZIL

23.4.2 ARGENTINA

23.4.3 PERU

23.4.4 COLOMBIA

23.4.5 VENEZUELA

23.4.6 REST OF SOUTH AMERICA

23.5 MIDDLE EAST AND AFRICA

23.5.1 SOUTH AFRICA

23.5.2 SAUDI ARABIA

23.5.3 UAE

23.5.4 EGYPT

23.5.5 KUWAIT

23.5.6 ISRAEL

23.5.7 REST OF MIDDLE EAST AND AFRICA

23.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

24 GLOBAL INTRAVENOUS IMMUNOGLOBULIN MARKET, COMPANY PROFILE

24.1 OCTAPHARMA AG

24.1.1 COMPANY OVERVIEW

24.1.2 REVENUE ANALYSIS

24.1.3 GEOGRAPHIC PRESENCE

24.1.4 PRODUCT PORTFOLIO

24.1.5 RECENT DEVELOPMENTS

24.2 GRIFOLS

24.2.1 COMPANY OVERVIEW

24.2.2 REVENUE ANALYSIS

24.2.3 GEOGRAPHIC PRESENCE

24.2.4 PRODUCT PORTFOLIO

24.2.5 RECENT DEVELOPMENTS

24.3 TAKEDA PHARMACEUTICALS U.S.A., INC.

24.3.1 COMPANY OVERVIEW

24.3.2 REVENUE ANALYSIS

24.3.3 GEOGRAPHIC PRESENCE

24.3.4 PRODUCT PORTFOLIO

24.3.5 RECENT DEVELOPMENTS

24.4 ADMA BIOLOGICS.

24.4.1 COMPANY OVERVIEW

24.4.2 REVENUE ANALYSIS

24.4.3 GEOGRAPHIC PRESENCE

24.4.4 PRODUCT PORTFOLIO

24.4.5 RECENT DEVELOPMENTS

24.5 BIOTEST UK.

24.5.1 COMPANY OVERVIEW

24.5.2 REVENUE ANALYSIS

24.5.3 GEOGRAPHIC PRESENCE

24.5.4 PRODUCT PORTFOLIO

24.5.5 RECENT DEVELOPMENTS

24.6 CSL

24.6.1 COMPANY OVERVIEW

24.6.2 REVENUE ANALYSIS

24.6.3 GEOGRAPHIC PRESENCE

24.6.4 PRODUCT PORTFOLIO

24.6.5 RECENT DEVELOPMENTS

24.7 KEDRION BIOPHARMA INC.

24.7.1 COMPANY OVERVIEW

24.7.2 REVENUE ANALYSIS

24.7.3 GEOGRAPHIC PRESENCE

24.7.4 PRODUCT PORTFOLIO

24.7.5 RECENT DEVELOPMENTS

24.8 PROTHYA BIOSOLUTION

24.8.1 COMPANY OVERVIEW

24.8.2 REVENUE ANALYSIS

24.8.3 GEOGRAPHIC PRESENCE

24.8.4 PRODUCT PORTFOLIO

24.8.5 RECENT DEVELOPMENTS

24.9 MERCK & CO., INC.

24.9.1 COMPANY OVERVIEW

24.9.2 REVENUE ANALYSIS

24.9.3 GEOGRAPHIC PRESENCE

24.9.4 PRODUCT PORTFOLIO

24.9.5 RECENT DEVELOPMENTS

24.1 KAMADA PHARMACEUTICALS.

24.10.1 COMPANY OVERVIEW

24.10.2 REVENUE ANALYSIS

24.10.3 GEOGRAPHIC PRESENCE

24.10.4 PRODUCT PORTFOLIO

24.10.5 RECENT DEVELOPMENTS

24.11 EMERGENT

24.11.1 COMPANY OVERVIEW

24.11.2 REVENUE ANALYSIS

24.11.3 GEOGRAPHIC PRESENCE

24.11.4 PRODUCT PORTFOLIO

24.11.5 RECENT DEVELOPMENTS

24.12 LFB ( LABORATOIRE FRANÇAIS DU FRACTIONNEMENT DES BIOTECHNOLOGIES )

24.12.1 COMPANY OVERVIEW

24.12.2 REVENUE ANALYSIS

24.12.3 GEOGRAPHIC PRESENCE

24.12.4 PRODUCT PORTFOLIO

24.12.5 RECENT DEVELOPMENTS

24.13 BIO PRODUCTS LABORATORY LTD.

24.13.1 COMPANY OVERVIEW

24.13.2 REVENUE ANALYSIS

24.13.3 GEOGRAPHIC PRESENCE

24.13.4 PRODUCT PORTFOLIO

24.13.5 RECENT DEVELOPMENTS

24.14 CHINA BIOLOGIC PRODUCTS HOLDINGS, INC.

24.14.1 COMPANY OVERVIEW

24.14.2 REVENUE ANALYSIS

24.14.3 GEOGRAPHIC PRESENCE

24.14.4 PRODUCT PORTFOLIO

24.14.5 RECENT DEVELOPMENTS

24.15 JOHNSON AND JOHNSON

24.15.1 COMPANY OVERVIEW

24.15.2 REVENUE ANALYSIS

24.15.3 GEOGRAPHIC PRESENCE

24.15.4 PRODUCT PORTFOLIO

24.15.5 RECENT DEVELOPMENTS

24.16 GC BIOPHARMA CORP.

24.16.1 COMPANY OVERVIEW

24.16.2 REVENUE ANALYSIS

24.16.3 GEOGRAPHIC PRESENCE

24.16.4 PRODUCT PORTFOLIO

24.16.5 RECENT DEVELOPMENTS

24.17 NOVARTIS AG

24.17.1 COMPANY OVERVIEW

24.17.2 REVENUE ANALYSIS

24.17.3 GEOGRAPHIC PRESENCE

24.17.4 PRODUCT PORTFOLIO

24.17.5 RECENT DEVELOPMENTS

24.18 BIOPHARMA PLASMA

24.18.1 COMPANY OVERVIEW

24.18.2 REVENUE ANALYSIS

24.18.3 GEOGRAPHIC PRESENCE

24.18.4 PRODUCT PORTFOLIO

24.18.5 RECENT DEVELOPMENTS

24.19 SYNERMORE BIOLOGICS

24.19.1 COMPANY OVERVIEW

24.19.2 REVENUE ANALYSIS

24.19.3 GEOGRAPHIC PRESENCE

24.19.4 PRODUCT PORTFOLIO

24.19.5 RECENT DEVELOPMENTS

24.2 RELIANCE LIFE SCIENCES

24.20.1 COMPANY OVERVIEW

24.20.2 REVENUE ANALYSIS

24.20.3 GEOGRAPHIC PRESENCE

24.20.4 PRODUCT PORTFOLIO

24.20.5 RECENT DEVELOPMENTS

24.21 TAJ PHARMA GROUP

24.21.1 COMPANY OVERVIEW

24.21.2 REVENUE ANALYSIS

24.21.3 GEOGRAPHIC PRESENCE

24.21.4 PRODUCT PORTFOLIO

24.21.5 RECENT DEVELOPMENTS

25 RELATED REPORTS

26 CONCLUSION

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.