Global Intumescent Coatings For Fireproofing And Spray Applied Fire Resistive Materials Market

Market Size in USD Billion

CAGR :

%

USD

2.07 Billion

USD

3.18 Billion

2024

2032

USD

2.07 Billion

USD

3.18 Billion

2024

2032

| 2025 –2032 | |

| USD 2.07 Billion | |

| USD 3.18 Billion | |

|

|

|

|

Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market Size

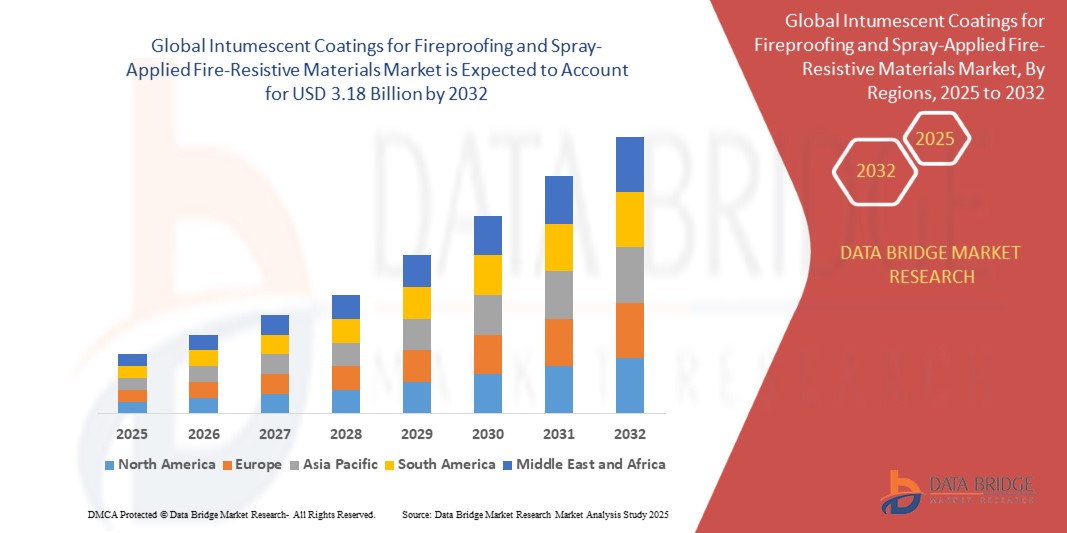

- The global intumescent coatings for fireproofing and spray-applied fire-resistive materials market size was valued at USD 2.07 billion in 2024 and is expected to reach USD 3.18 billion by 2032, at a CAGR of 5.5% during the forecast period

- The market growth is largely fueled by rising infrastructure development and stringent fire safety regulations across residential, commercial, and industrial sectors, driving the demand for passive fire protection solutions such as intumescent coatings and spray-applied fire-resistive materials

- Furthermore, increasing awareness of structural fire safety, combined with advancements in water-based and eco-friendly coating technologies, is accelerating the adoption of these materials in construction and manufacturing, thereby significantly boosting the market’s expansion

Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market Analysis

- Intumescent coatings and spray-applied fire-resistive materials are passive fire protection solutions applied to structural elements to enhance fire resistance by forming an insulating char layer when exposed to high temperatures, helping maintain structural integrity during fire events

- Growing implementation of fire safety codes, especially in high-rise buildings, oil & gas facilities, and public infrastructure, coupled with increasing use of steel and composite materials in construction, is propelling the demand for these coatings globally

- Asia-Pacific dominated the intumescent coatings for fireproofing and spray-applied fire-resistive materials market with a share of 36.1% in 2024, due to rapid infrastructure development, industrial expansion, and strict fire safety regulations

- Europe is expected to be the fastest growing region in the intumescent coatings for fireproofing and spray-applied fire-resistive materials market during the forecast period due to rigorous fire safety regulations, energy-efficient building mandates, and heightened awareness of passive fire protection

- Epoxy segment dominated the market with a market share of 59% in 2024, due to its exceptional adhesion, corrosion resistance, and mechanical strength. Epoxy-based fireproof coatings are extensively used in oil & gas, marine, and industrial sectors where durability and chemical resistance are crucial. Their ability to perform under extreme environmental conditions supports their leadership in high-risk installations

Report Scope and Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market Segmentation

|

Attributes |

Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market Trends

“Increasing Fire Safety Regulations”

- Rising fire safety regulations worldwide are a principal driver for growth in intumescent coatings and spray-applied fire-resistive materials (SFRMs). New building codes for high-rises, industrial structures, and public infrastructure increasingly mandate the use of advanced passive fire protection, spurring demand in both new construction and refurbishment projects

- For instance, regulatory regimes in Asia-Pacific, such as recent high-rise fire codes in China and India, now require thin-film intumescent coatings for towers above 24m, making third-party certification and compliance a prerequisite for market access. The push for low-VOC formulations and sustainability in the EU has further accelerated the shift from traditional materials to modern, environment-friendly intumescent coatings

- Fire safety authorities, such as the National Fire Protection Association (NFPA) in the U.S., have documented a persistent rise in fire incidents, adding urgency to the implementation of stricter fire safety standards and inspection regimes for commercial, industrial, and residential buildings

- The advancement of intumescent coatings—such as nano-enhanced, graphene-infused, and water-based formulations—enables higher fire resistance with thinner layers, supporting modern architectural designs and compliance with evolving codes

- Sustainability goals, including the use of bio-based resins and recyclable fireproofing systems, are shaping product innovation as environmental impact becomes a factor in regulatory frameworks and developer decisions

- Hybrid solutions that blend passive coatings with active monitoring (IoT sensors, smart coatings) are emerging, ensuring maintenance and performance tracking throughout the building lifecycle

Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market Dynamics

Driver

“Rising Incidence of Wildfires Prompts Fireproofing Needs”

- The increasing frequency and severity of wildfires worldwide are visibly accelerating investments in fireproofing solutions. Wildland-urban interface (WUI) areas, critical infrastructure, and industrial facilities in at-risk regions are prioritizing advanced fire-resistive materials to protect assets and meet insurance and regulatory mandates

- For instance, after record-breaking wildfires in the western U.S. and Australia, both government and private sector operators have increased fireproofing budgets, specifying intumescent coatings and SFRMs for perimeter structures, emergency response facilities, and transportation infrastructure to minimize loss and damage

- Technological innovations—such as AI-powered risk modeling, drone-based inspections, and real-time detection—play a key role in targeting and optimizing fireproofing investments in high-risk zones

- Fireproofing is now recognized as a necessary requirement for new construction and also for retrofitting existing buildings, especially where fire events have created pressure for more robust disaster resilience and preparedness strategies

- Policy incentives, stricter insurance coverage requirements, and funding for disaster mitigation are further fueling the market's expansion beyond traditional industrial sectors

Restraint/Challenge

“Competition from Traditional Fireproofing Materials”

- Despite the advantages of intumescent coatings and SFRMs—including lighter weight, aesthetic flexibility, and superior performance for complex steel structures—traditional fireproofing materials such as cementitious sprays and mineral-fiber boards continue to pose significant competition, especially in price-sensitive and industrial-scale applications

- For instance, cementitious fireproofing is often preferred for large structural steel projects due to its lower upfront cost, ease of bulk application, and well-established regulatory acceptance—even though it can be bulky and may compromise space or design elegance

- Intumescent coatings typically require more specialized application techniques and can carry higher initial costs, which can deter adoption among budget-constrained projects or regions with less rigorous fire safety codes

- The established supply chains, contractor familiarity, and legacy specifications tied to traditional products make it challenging for newer formulations to gain rapid acceptance in conservative construction markets

- In some industrial and commercial settings, maintenance and environmental exposure concerns (such as humidity or impact damage) may tip the scales in favor of older, more robust—if less elegant—fireproofing solutions, despite innovation in intumescent technology. Addressing price sensitivity and improving awareness of lifecycle benefits remain key for advancing intumescent and spray-applied material adoption over legacy alternatives

Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market Scope

The market is segmented on the basis of product type, type, resin, substrate, technology, application, and end-user.

• By Product Type

On the basis of product type, the market is segmented into intumescent coatings for fireproofing and spray-applied fire-resistive materials. The intumescent coatings for fireproofing segment accounted for the largest market share in 2024 due to its superior aesthetics, ease of application, and ability to provide passive fire protection without compromising the visual appearance of structures. Widely preferred in commercial and high-rise buildings, these coatings expand under heat to form a char layer that insulates the underlying material, thereby delaying structural collapse during a fire. Their growing use in steel-framed constructions and increasing regulatory compliance regarding fire safety standards are driving segment dominance.

The spray-applied fire-resistive materials (SFRM) segment is projected to witness the fastest growth from 2025 to 2032, spurred by its cost-effectiveness and extensive application in industrial and large-scale infrastructure projects. SFRMs are preferred for their quick installation and strong thermal insulation properties, especially in settings where fire protection must cover complex geometries or wide surface areas. Their growing use in retrofitting older buildings and in oil & gas facilities enhances their growth outlook.

• By Type

On the basis of type, the market is segmented into thick-film and thin-film coatings. The thick-film segment led the market with the highest revenue share in 2024, driven by its widespread application in hydrocarbon fire protection, particularly in high-risk environments such as petrochemical and energy plants. Thick-film coatings offer higher durability, superior thermal insulation, and longer fire-resistance duration, making them a critical choice for heavy-duty infrastructure.

The thin-film segment is expected to exhibit the fastest growth from 2025 to 2032, primarily due to its rising adoption in architectural applications where aesthetics are paramount. Thin-film coatings are favored in commercial buildings and offices for their smooth finish, low weight, and reliable performance under cellulosic fire conditions. Their compatibility with decorative topcoats and lower application thickness contribute to their growing preference among architects and contractors.

• By Resin

On the basis of resin type, the market is segmented into epoxy, acrylic, alkyd, polyurethane, and others. The epoxy segment held the largest market share of 59% in 2024 owing to its exceptional adhesion, corrosion resistance, and mechanical strength. Epoxy-based fireproof coatings are extensively used in oil & gas, marine, and industrial sectors where durability and chemical resistance are crucial. Their ability to perform under extreme environmental conditions supports their leadership in high-risk installations.

The acrylic segment is anticipated to grow at the highest CAGR from 2025 to 2032, fueled by demand for water-based, low-VOC coatings in green building projects. Acrylic resins offer rapid drying, cost-effectiveness, and environmental compliance, making them ideal for residential and light-commercial fireproofing applications. Their increasing use in thin-film systems and decorative coatings further boosts segment growth.

• By Substrate

On the basis of substrate, the market is segmented into structural cast iron and cast iron, wood, composite elements, and others. Structural cast iron and cast iron dominated the market in 2024, supported by their widespread use in large-scale steel frameworks and the urgent need for fire protection in such load-bearing components. The strong thermal conductivity of metal substrates necessitates advanced fire-resistive coatings to maintain structural integrity in fire scenarios.

The wood segment is expected to register the fastest growth rate from 2025 to 2032, driven by increasing applications in modular construction, residential buildings, and interior design. As wooden structures become more prominent in sustainable architecture, the need for fire retardant solutions that preserve aesthetics while ensuring safety is driving demand for specialized intumescent coatings compatible with wood.

• By Technology

On the basis of technology, the market is divided into epoxy-based, water-based, solvent-based, and powder-based. Epoxy-based coatings dominated the market in 2024 due to their exceptional performance in offshore and oil & gas applications. These coatings resist moisture, chemicals, and mechanical stress, making them ideal for harsh environments where fire hazards are combined with corrosive exposure.

Water-based coatings are projected to witness the highest growth from 2025 to 2032, supported by environmental regulations and the push for low-VOC and non-toxic fireproofing materials. Their user-friendly application, fast drying times, and minimal odor make them increasingly suitable for occupied buildings, schools, and healthcare settings.

• By Application

On the basis of application, the market is segmented into hydrocarbon and cellulosic fire protection. Hydrocarbon fire protection led the market in 2024 due to stringent safety norms in oil & gas, chemical processing, and offshore industries where high-temperature fires caused by fuel combustion pose severe structural risks. Coatings used in these applications are designed to withstand rapid temperature rise and maintain integrity under explosive conditions.

Cellulosic fire protection is anticipated to grow fastest over the forecast period as it finds rising usage in commercial and residential buildings. These fires, driven by wood, paper, and furniture, require effective and visually acceptable fireproofing solutions, making intumescent coatings a favorable choice for architects and developers.

• By End-User

On the basis of end-user, the market is segmented into building and constructions, oil and gas, industrial, automotive, aerospace, and others. The building and construction segment dominated the market in 2024, underpinned by expanding urban infrastructure, increasing focus on occupant safety, and rising adoption of fire safety codes across developed and developing regions. Fireproofing of steel and wooden structures in high-rise residential and commercial projects continues to propel demand.

The oil and gas segment is forecasted to experience the highest growth from 2025 to 2032, driven by heightened safety regulations, ongoing investments in refining and exploration, and the critical need to prevent catastrophic damage during fire incidents. Fire-resistive coatings in these settings protect lives and also ensure the continuity of operations in high-risk environments.

Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market Regional Analysis

- Asia-Pacific dominated the intumescent coatings for fireproofing and spray-applied fire-resistive materials market with the largest revenue share of 36.1% in 2024, driven by rapid infrastructure development, industrial expansion, and strict fire safety regulations

- The region's construction boom across emerging economies such as China, India, and Southeast Asia has led to heightened demand for fire protection in commercial, industrial, and residential projects

- Growing awareness of fire safety standards, increased foreign investment in infrastructure, and government mandates for fire-resistant materials in buildings are further bolstering market expansion across APAC

China Market Insight

China held the largest revenue share in the Asia-Pacific region in 2024, driven by an expanding construction industry, stringent fire safety enforcement, and significant investments in oil & gas and industrial infrastructure. The country’s extensive urban development and smart city initiatives are leading to a surge in demand for both intumescent coatings and spray-applied fire-resistive materials. With a robust domestic manufacturing base and increasing emphasis on sustainable and compliant construction practices, China continues to set the pace for regional market growth.

India Market Insight

India is emerging as one of the fastest-growing markets in Asia-Pacific, fueled by growing commercial real estate development, rising demand for residential high-rises, and the government’s focus on urban infrastructure. The introduction of stricter fire safety codes and growing awareness among builders and developers about fire protection technologies are significantly driving the adoption of intumescent coatings. In addition, increasing foreign direct investments and public-private partnerships in construction and industrial sectors are strengthening the market outlook.

Europe Market Overview

Europe is projected to experience the fastest CAGR from 2025 to 2032 in the intumescent coatings and spray-applied fire-resistive materials market, primarily due to rigorous fire safety regulations, energy-efficient building mandates, and heightened awareness of passive fire protection. The enforcement of the EU Construction Products Regulation (CPR) and increasing emphasis on sustainable construction practices are prompting developers to adopt high-performance, low-emission fire-resistive materials. Both new builds and renovations across commercial, institutional, and residential spaces are increasingly incorporating intumescent coatings to meet fire resistance and environmental compliance standards. The region’s technological advancement and regulatory focus make it a key growth hotspot for advanced fireproofing solutions.

Germany Market Insight

Germany is showing consistent growth in this market due to its strong industrial base, focus on innovation, and a deep-rooted culture of regulatory compliance in construction and safety. As energy-efficient and sustainable building standards become more prevalent, demand for low-VOC, high-performance fire-resistive coatings is rising. Germany’s extensive refurbishment of older structures and new infrastructure projects are contributing significantly to the rising use of intumescent coatings and SFRMs.

U.K. Market Insight

The U.K. market is expected to grow rapidly, propelled by increasingly stringent fire safety standards, particularly in the wake of high-profile incidents that have spurred regulatory reform. Builders and developers are under growing pressure to implement passive fire protection in both new construction and renovations, especially in high-rise residential and commercial buildings. The U.K.’s mature construction sector, combined with heightened safety awareness and regulatory compliance, is fostering substantial growth in demand for intumescent coatings and fire-resistive materials.

North America Market Overview

North America captured a substantial share of the market in 2024, supported by strong fire protection regulations and well-established safety protocols across commercial, industrial, and energy sectors. The region continues to emphasize the use of fire-resistive coatings to protect structural steel in buildings and critical infrastructure. Growth is particularly evident in sectors such as oil & gas, manufacturing, and public infrastructure, where fireproofing is essential to mitigate risk and meet legal safety obligations. The combination of stringent standards from bodies such as the NFPA and a preference for durable, high-performance coatings drives steady adoption across North America.

U.S. Market Insight

The U.S. dominated the North American market due to widespread use of intumescent coatings in both private and public sector projects. The country's extensive commercial real estate activity, coupled with regulatory enforcement by agencies such as OSHA and the NFPA, ensures sustained demand for fire-resistive solutions. Increasing construction of warehouses, data centers, and high-rise buildings—alongside growing awareness of sustainable and energy-efficient coatings—is reinforcing the role of intumescent technologies in maintaining structural integrity and safety.

Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market Share

The intumescent coatings for fireproofing and spray-applied fire-resistive materials industry is primarily led by well-established companies, including:

- Jotun (Norway)

- PPG Industries, Inc. (U.S.)

- Akzo Nobel N.V. (Netherlands)

- The Sherwin-Williams Company (U.S.)

- Hempel A/S (Denmark)

- 3M (U.S.)

- GCP Applied Technologies Inc. (U.S.)

- MBCC Deutschland GmbH (Germany)

- No-Burn, Inc. (U.S.)

- Contego International Inc. (U.S.)

- Teknos Group (Finland)

- Arabian Vermiculite Industries (Saudi Arabia)

- Sika AG (Switzerland)

- Etex Group (Belgium)

- Albi Protective Coatings (U.S.)

- Flame Control (U.S.)

- CPG EUROPE (U.K.)

- Rudolf Hensel GmbH (Germany)

- Isolatek International (U.S.)

Latest Developments in Global Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Materials Market

- In June 2025, Huntsman introduced the POLYRESYST EV5005 polyurethane-based intumescent coating system, designed specifically for automotive applications. This innovation addresses a critical fire safety challenge in electric vehicles by enhancing passive fire protection for metal and composite battery components without compromising design flexibility. The launch is expected to expand the application of intumescent coatings in the automotive sector, particularly in EV battery safety, reinforcing market growth in transportation-related fireproofing solutions

- In June 2023, Jotun expanded its Global Intumescent R&D Laboratory to boost product innovation and technology advancement. This expansion aims to enhance product development and fire testing capacity, accelerating the creation of innovations and advanced products. In addition, it provides certification support for Jotun's existing product range, strengthening its position in the intumescent coatings market

- In January 2022, PPG Industries unveiled the PPG AMERCOAT range of passive fire protection coatings tailored for steel structures. As water-based intumescent solutions, these coatings contribute to enhanced safety standards while aligning with growing environmental and regulatory expectations. The launch reinforced PPG’s role in supporting industrial and infrastructure fire safety, further advancing market adoption of sustainable fire-resistive materials

- In 2021, AkzoNobel launched Interchar 931, a waterborne, single-component intumescent coating for structural steel that provides up to 120 minutes of fire resistance. The product’s ease of application and quick-drying characteristics cater to the fast-paced demands of modern construction. This development strengthens AkzoNobel’s position in the fire protection market and supports the increasing demand for environmentally friendly, high-performance coatings

- In May 2020, Sherwin-Williams introduced Firetex M90/03, an intumescent coating capable of providing up to 90 minutes of fire resistance for both onsite and offsite applications. The product's adaptability to different construction environments supports the growing trend of modular and prefabricated building practices. This innovation helped broaden the use of fire-resistive coatings in versatile construction settings, supporting market expansion across both traditional and modern construction methods.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Intumescent Coatings For Fireproofing And Spray Applied Fire Resistive Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Intumescent Coatings For Fireproofing And Spray Applied Fire Resistive Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Intumescent Coatings For Fireproofing And Spray Applied Fire Resistive Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.