Global Iodine Market

Market Size in USD Billion

CAGR :

%

USD

1.15 Billion

USD

1.76 Billion

2024

2032

USD

1.15 Billion

USD

1.76 Billion

2024

2032

| 2025 –2032 | |

| USD 1.15 Billion | |

| USD 1.76 Billion | |

|

|

|

|

Iodine Market Size

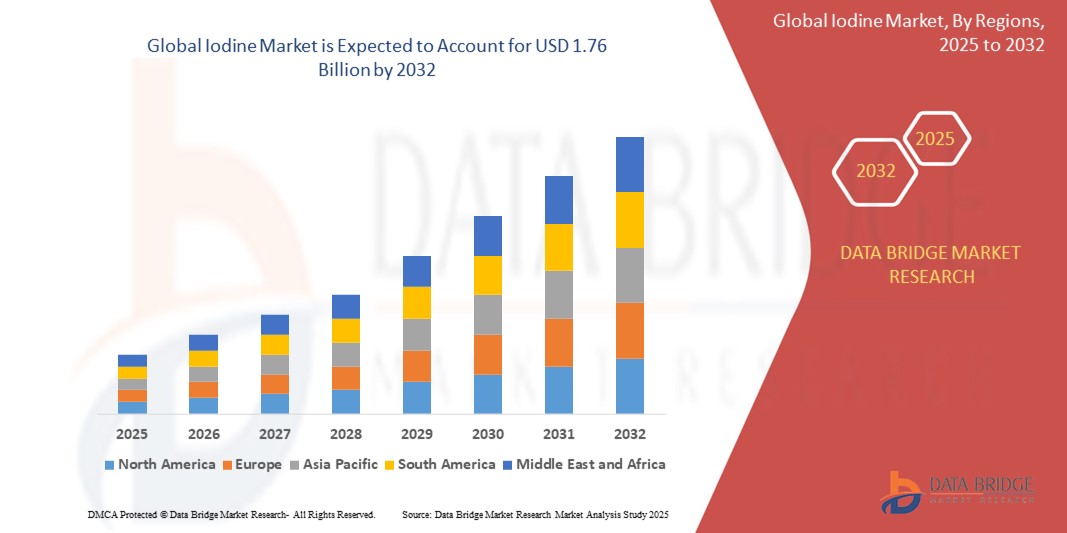

- The global Iodine market size was valued at USD 1.15 billion in 2024 and is expected to reach USD 1.76 billion by 2032, at a CAGR of 5.40% during the forecast period

- This growth is driven by advancements in extraction and purification technologies

Iodine Market Analysis

- Iodine is a vital trace element widely utilized in diverse industries such as pharmaceuticals, nutrition, animal feed, X-ray contrast media, and electronics, due to its unique chemical properties including high atomic number, antimicrobial activity, and reactivity with organic compounds

- The market demand for iodine is largely driven by increasing prevalence of iodine deficiency disorders (IDDs), the growing use of iodine-based contrast media in medical imaging, and rising applications in LCD polarizers and photovoltaic cells within the electronics and energy sectors

- Expanding usage in industrial catalysts, coupled with increased agricultural applications in animal feed and soil treatment, is reinforcing iodine’s strategic importance across both developed and emerging economies

- Europe is expected to dominate the iodine market, with the largest market share of 37.11%, due to its strong industrial base, especially in the pharmaceutical and chemical sectors, where iodine plays a crucial role in production processes

- Asia-Pacific is expected to witness the highest compound annual growth rate (CAGR) in the iodine market due to the region's rapidly expanding healthcare, chemical, and electronics industries

- The caliche ore segment is expected to dominate the Iodine market with the largest share of 49.32% in 2025 due to the sustainable and cost-effective extraction process associated with caliche ore, making it a preferred choice for iodine production

Report Scope and Iodine Market Segmentation

|

Attributes |

Iodine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Iodine Market Trends

“Rising Adoption of Iodine in Medical Imaging and Diagnostics”

- The use of iodine-based contrast agents is growing rapidly in radiology and nuclear medicine, owing to its high atomic number and superior X-ray attenuation properties

- The increasing global burden of chronic diseases such as cardiovascular disorders, cancer, and neurological conditions is accelerating the number of diagnostic procedures, boosting iodine demand

- Technological advances in non-invasive imaging and personalized healthcare are encouraging the integration of iodine-based agents in CT scans, angiography, and interventional radiology

- For instance, in February 2024, GE HealthCare announced the launch of a next-generation low-osmolar iodine contrast agent for enhanced safety in cardiovascular imaging

- This trend underscores the growing relevance of iodine in precision diagnostics and positions the healthcare sector as a major end-user driving innovation and volume growth

Iodine Market Dynamics

Driver

“Rising Demand in Animal Nutrition and Feed Additives”

- The use of iodine-based contrast agents is growing rapidly in radiology and nuclear medicine, owing to its high atomic number and superior X-ray attenuation properties

- The increasing global burden of chronic diseases such as cardiovascular disorders, cancer, and neurological conditions is accelerating the number of diagnostic procedures, boosting iodine demand

- Technological advances in non-invasive imaging and personalized healthcare are encouraging the integration of iodine-based agents in CT scans, angiography, and interventional radiology

- For instance, in February 2024, GE HealthCare announced the launch of a next-generation low-osmolar iodine contrast agent for enhanced safety in cardiovascular imaging

- This trend underscores the growing relevance of iodine in precision diagnostics and positions the healthcare sector as a major end-user driving innovation and volume growth

Opportunity

“Expansion of Iodine Applications in the Electronics Industry”

- Iodine is increasingly being used in the manufacturing of LCD polarizers, semiconductor etching chemicals, and electrolytes for energy storage systems, driven by technological advancements in electronics

- The global shift toward smart devices, flat panel displays, and renewable energy systems is expanding the material demand for high-purity iodine compounds

- Growing investments in electric vehicles (EVs), photovoltaic cells, and 5G infrastructure are creating new revenue streams for iodine manufacturers

- In October 2023, Nippon Shokubai announced a partnership with a display technology firm to supply iodine-based compounds for OLED panel production

- The diversification of iodine’s industrial utility beyond traditional medical and nutritional domains presents a strong opportunity for long-term market expansion

Restraint/Challenge

“Volatility in Raw Material Supply and Price Fluctuations”

- Iodine is increasingly being used in the manufacturing of LCD polarizers, semiconductor etching chemicals, and electrolytes for energy storage systems, driven by technological advancements in electronics

- The global shift toward smart devices, flat panel displays, and renewable energy systems is expanding the material demand for high-purity iodine compounds

- Growing investments in electric vehicles (EVs), photovoltaic cells, and 5G infrastructure are creating new revenue streams for iodine manufacturers

- In October 2023, Nippon Shokubai announced a partnership with a display technology firm to supply iodine-based compounds for OLED panel production

- The diversification of iodine’s industrial utility beyond traditional medical and nutritional domains presents a strong opportunity for long-term market expansion

Iodine Market Scope

The market is segmented on the basis of source, form, and application.

|

Segmentation |

Sub-Segmentation |

|

By Source |

|

|

By Form |

|

|

By Application

|

|

In 2025, the caliche ore is projected to dominate the market with a largest share in source segment

The caliche ore segment is expected to dominate the Iodine market with the largest share of 49.32% in 2025 due to the sustainable and cost-effective extraction process associated with caliche ore, making it a preferred choice for iodine production.

The organic compounds is expected to account for the largest share during the forecast period in form segment

In 2025, the organic compounds segment is expected to dominate the market with the largest market share of 50.31% due to the growing demand for eco-friendly, biodegradable, and non-toxic solutions, driving the shift towards organic compounds in chemical production processes.

Iodine Market Regional Analysis

“Europe Holds the Largest Share in the Iodine Market”

- Europe is expected to dominate the iodine market, with the largest market share of 37.11%, due to its strong industrial base, especially in the pharmaceutical and chemical sectors, where iodine plays a crucial role in production processes

- The growing demand for iodine in the healthcare industry, particularly in diagnostic imaging and antimicrobial applications, is contributing significantly to the region's market dominance

- Countries such as Germany and the U.K. are key drivers of this growth, as they are home to some of the world’s leading pharmaceutical and chemical companies, increasing the demand for iodine-based products

“Asia-Pacific is Projected to Register the Highest CAGR in the Iodine Market”

- Asia-Pacific is expected to witness the highest compound annual growth rate (CAGR) in the iodine market due to the region's rapidly expanding healthcare, chemical, and electronics industries

- China and India are significant contributors, with growing demand for iodine in medical applications, such as contrast agents for imaging, and in the production of biocides for water treatment and sanitation

- The increasing use of iodine in electronics, especially in the production of semiconductors and LCD screens, along with rising awareness of iodine's benefits in public health, is further driving demand in the region

Iodine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SQM S.A. (Chile)

- ISE CHEMIVALS CORPORATION (Philippines)

- IOCHEM (U.S.)

- Algorta Norte (Chile)

- NIPPOH CHEMICALS CO. LTD. (Japan)

- Kanto Natural Gas Development Co. Ltd. (Japan)

- GODO SHIGEN Co., Ltd. (Japan)

- TOHO EARTH TECH, INC. (Japan)

- Deep Water Chemicals, Inc. (U.S.)

- Toyota Tsusho Corporation (Japan)

- AJAY-SQM Group (India)

- AZER-YOD LLC (Azerbaijan)

- ACF Minera S.A. (Peru)

- Prachi Pharmaceuticals Private Limited (India)

- Salvi Chemicals Industries Ltd. (India)

Latest Developments in Global Iodine Market

- In October 2023, Iofina revealed its intention to build its 10th iodine extraction plant in a new location in Oklahoma. This strategic expansion marks a significant step in the company’s growth in the iodine extraction sector

- In June 2023, Iofina inaugurated its 6th iodine extraction plant in Oklahoma, utilizing its proprietary production technology. The company ramped up production soon after, capitalizing on high iodine prices throughout the year, which significantly enhanced its profitability in 2023

- In May 2023, REMONDIS SE & Co. KG, based in Germany, launched a new plant dedicated to the recovery of iodine from flue gas produced during hazardous waste incineration. This move aligns with the company's sustainability goals and its commitment to promoting the circular economy

- In August 2020, SQM S.A. outlined plans to cut brine extraction from the Salar de Atacama by 50% and reduce water consumption in its operations by 40%. This initiative is expected to support the production of carbon-neutral iodine alongside lithium and potassium

- In October 2022, SQM S.A. signed a multi-year agreement with GE Healthcare to supply iodine for contrast media. This agreement, which will bolster iodine supply year-on-year, underscores the importance of iodine in supporting Computed Tomography (CT) imaging and X-ray contrast media products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL IODINE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL IODINE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL IODINE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10 GLOBAL IODINE MARKET, BY SOURCE, 2018-2032 (USD MILLION) (KILO TONS)

10.1 OVERVIEW

10.2 UNDERGROUND BRINES

10.3 CALICHE ORE

10.4 SEAWEED

11 GLOBAL IODINE MARKET, BY TYPE, 2018-2032 (USD MILLION)

11.1 OVERVIEW

11.2 FLAKE IODINE

11.3 PRILL IODINE

11.4 RESUBLIMED IODINE

11.5 RECYCLED IODINE

12 GLOBAL IODINE MARKET, BY METHOD, 2018-2032 (USD MILLION)

12.1 OVERVIEW

12.2 BLOWING OUT METHOD

12.3 ION-EXCHANGE METHOD

13 GLOBAL IODINE MARKET, BY FORM, 2018-2032 (USD MILLION)

13.1 OVERVIEW

13.2 ORGANIC COMPOUND

13.3 INORGANIC COMPOUNDS

13.4 ELEMENTAL & ISOTOPES

14 GLOBAL IODINE MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

14.1 OVERVIEW

14.2 X-RAY CONTRAST MEDIA

14.3 OPTICAL POLARIZING FILM

14.4 DISINFECTANTS

14.5 CATALYSTS

14.6 STABILIZERS

14.7 PHARMACEUTICALS

14.8 SODIUM ADDITIVES

14.9 FEED ADDITIVES

14.1 BIOCIDES

14.11 FLUOROCHEMICALS

14.12 NYLON

14.13 OTHERS

15 GLOBAL IODINE MARKET, BY REGION, 2018-2032 (USD MILLION) (KILO TONS)

15.1 GLOBAL IODINE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.2 NORTH AMERICA

15.2.1 U.S.

15.2.2 CANADA

15.2.3 MEXICO

15.3 EUROPE

15.3.1 GERMANY

15.3.2 U.K.

15.3.3 ITALY

15.3.4 FRANCE

15.3.5 SPAIN

15.3.6 SWITZERLAND

15.3.7 NETHERLANDS

15.3.8 BELGIUM

15.3.9 RUSSIA

15.3.10 DENMARK

15.3.11 SWEDEN

15.3.12 POLAND

15.3.13 TURKEY

15.3.14 REST OF EUROPE

15.4 ASIA-PACIFIC

15.4.1 JAPAN

15.4.2 CHINA

15.4.3 SOUTH KOREA

15.4.4 INDIA

15.4.5 AUSTRALIA

15.4.6 SINGAPORE

15.4.7 THAILAND

15.4.8 INDONESIA

15.4.9 MALAYSIA

15.4.10 PHILIPPINES

15.4.11 NEW ZEALAND

15.4.12 VIETNAM

15.4.13 REST OF ASIA-PACIFIC

15.5 SOUTH AMERICA

15.5.1 BRAZIL

15.5.2 ARGENTINA

15.5.3 REST OF SOUTH AMERICA

15.6 MIDDLE EAST AND AFRICA

15.6.1 SOUTH AFRICA

15.6.2 UAE

15.6.3 SAUDI ARABIA

15.6.4 OMAN

15.6.5 QATAR

15.6.6 KUWAIT

15.6.7 REST OF MIDDLE EAST AND AFRICA

16 GLOBAL IODINE MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

16.6 MERGERS & ACQUISITIONS

16.7 NEW PRODUCT DEVELOPMENT & APPROVALS

16.8 EXPANSIONS & PARTNERSHIP

16.9 REGULATORY CHANGES

17 GLOBAL IODINE MARKET, SWOT & DBMR ANALYSIS

18 GLOBAL IODINE MARKET, COMPANY PROFILES

18.1 NIPPOH CHEMICALS CO., LTD.

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENTS

18.2 ISE CHEMICALS CORPORATION

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.3 SQM S.A.

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 GODO SHIGEN CO., LTD.

18.4.1 COMPANY OVERVIEW

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 TOYOTA TSUSHO CORPORATION

18.5.1 COMPANY OVERVIEW

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 ALGORTA NORTE

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 IOCHEM

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 TOHO EARTHTECH CO., LTD.

18.8.1 COMPANY OVERVIEW

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 IOFINA PLC

18.9.1 COMPANY OVERVIEW

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 CALIBRE CHEMICALS PVT. LTD

18.10.1 COMPANY OVERVIEW

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENTS

18.11 MERCK KGAA

18.11.1 COMPANY OVERVIEW

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 RB ENERGY INC.

18.12.1 COMPANY OVERVIEW

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 DEEP WATER CHEMICALS

18.13.1 COMPANY OVERVIEW

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 KANTO NATURAL GAS DEVELOPMENT CO., LTD.

18.14.1 COMPANY OVERVIEW

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 COSAYACH

18.15.1 COMPANY OVERVIEW

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 ACF MINERA SA

18.16.1 COMPANY OVERVIEW

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.17 PROTOCHEM

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENTS

18.18 COSAYACH COMPAÑÍA DE SALITRE Y YODO

18.18.1 COMPANY OVERVIEW

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENTS

18.19 ESKAY IODINE

18.19.1 COMPANY OVERVIEW

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 ITOCHU CHEMICAL FRONTIER CORPORATION

18.20.1 COMPANY OVERVIEW

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 RELATED REPORTS

20 QUESTIONNAIRE

21 ABOUT DATA BRIDGE MARKET RESEARCH

Global Iodine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Iodine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Iodine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.