Global Iot Based Cold Chain Management Market

Market Size in USD Billion

CAGR :

%

USD

7.21 Billion

USD

18.85 Billion

2024

2032

USD

7.21 Billion

USD

18.85 Billion

2024

2032

| 2025 –2032 | |

| USD 7.21 Billion | |

| USD 18.85 Billion | |

|

|

|

|

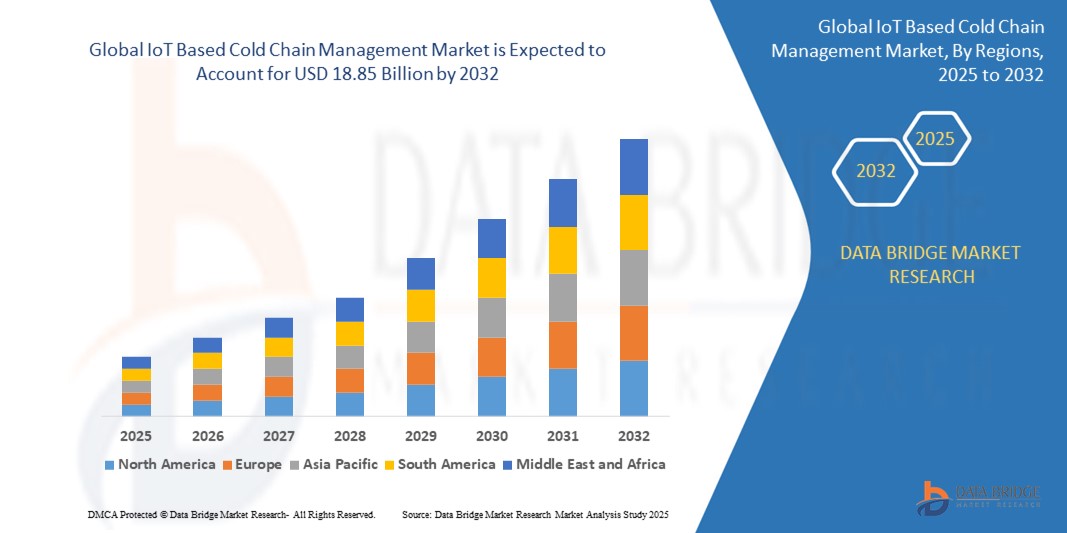

What is the Global IoT Based Cold Chain Management Market Size and Growth Rate?

- The global IoT based cold chain management market size was valued at USD 7.21 billion in 2024 and is expected to reach USD 18.85 billion by 2032, at a CAGR of 12.77% during the forecast period

- Market growth is driven by the increasing need for real-time monitoring, temperature-sensitive logistics, and food and pharmaceutical safety compliance across global supply chains

- The integration of IoT sensors, cloud analytics, and automation tools enables end-to-end visibility and efficiency, making cold chain processes more reliable and cost-effective

What are the Major Takeaways of IoT Based Cold Chain Management Market?

- IoT based cold chain management systems enable continuous tracking of temperature, humidity, and location for perishable goods, ensuring regulatory compliance and minimizing spoilage

- Increasing demand from pharmaceutical, food & beverage, and chemical industries, alongside stricter government regulations, is fueling the widespread adoption of these smart logistics solutions

- The shift toward predictive analytics, energy-efficient systems, and AI-powered alerts is enhancing operational precision, ultimately driving the growth of intelligent cold chain ecosystems

- North America dominated the IoT based cold chain management market with the largest revenue share of 42.58% in 2024, driven by stringent regulatory frameworks, the presence of leading cold chain technology providers, and advanced infrastructure for temperature-sensitive logistics

- Asia-Pacific IoT based cold chain management market is projected to grow at the fastest CAGR of 11.59% from 2025 to 2032, fueled by rising population, urbanization, and increasing demand for secure food and vaccine distribution

- The hardware segment dominated the market with the largest revenue share of 54.6% in 2024, driven by the increasing deployment of IoT-enabled sensors, data loggers, gateways, and RFID tags in temperature-sensitive logistics

Report Scope and IoT Based Cold Chain Management Market Segmentation

|

Attributes |

IoT Based Cold Chain Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the IoT Based Cold Chain Management Market?

“Enhanced Efficiency through AI-Driven Predictive Analytics”

- A leading trend in the global IoT based cold chain management market is the integration of artificial intelligence (AI) and machine learning to optimize temperature control, route efficiency, and asset tracking in real time. This technological advancement enhances operational visibility, minimizes product spoilage, and ensures regulatory compliance across global supply chains

- For instance, Controlant uses AI-powered predictive insights to identify potential temperature excursions before they occur, enabling preventive action in pharmaceutical logistics

- AI systems also analyze historical shipment data to optimize cold chain routes and delivery schedules, ensuring perishable goods arrive in ideal condition. The fusion of AI and IoT is transforming traditional cold chain models into proactive and responsive ecosystems.

- This intelligent automation allows logistics providers to reduce waste, lower energy usage, and cut costs, especially in food, vaccine, and biotech shipping

- As demand for real-time, data-driven supply chains grows, the trend toward AI-enabled IoT cold chain systems is accelerating and setting a new industry standard for efficiency, safety, and compliance

What are the Key Drivers of IoT Based Cold Chain Management Market?

- The rising need for real-time monitoring of temperature-sensitive goods across sectors such as food, pharma, and chemicals is significantly driving demand for IoT-based cold chain systems

- For instance, in April 2024, Onity Inc. (a Honeywell company) announced advancements in cold storage security using IoT sensors in its Passport solution, indicating growing R&D in this field

- Stricter lobal regulations and standards for product integrity and traceability are pushing companies to invest in connected cold chain infrastructure.

- Growth in e-commerce grocery and vaccine distribution, especially post-COVID-19, has amplified the demand for accurate, transparent, and traceable temperature-controlled logistics

- In addition, the shift toward sustainability, where IoT solutions help reduce energy waste and carbon footprint in cold storage, is gaining momentum across supply chain operations

Which Factor is challenging the Growth of the IoT Based Cold Chain Management Market?

- Cybersecurity concerns pose a major challenge, as IoT-based systems are vulnerable to hacking, malware, and data breaches, which can compromise shipment integrity and company data.

- For instance, several incidents involving unauthorized access to IoT networks have raised caution among logistics providers, particularly those transporting sensitive or high-value goods.

- Ensuring secure encryption, regular software updates, and multi-layered authentication protocols is essential to build trust and mitigate risk.

- Another hurdle is the high upfront cost of advanced IoT cold chain solutions, which may deter adoption among small logistics firms or in cost-sensitive emerging markets.

- Bridging these gaps through affordable, scalable solutions and stronger security frameworks will be essential for mass adoption and long-term market success

How is the IoT Based Cold Chain Management Market Segmented?

The market is segmented on the basis of component, enterprise size, and industry.

- By Component

On the basis of component, the IoT based cold chain management market is segmented into hardware, software, and services. The hardware segment dominated the market with the largest revenue share of 54.6% in 2024, driven by the increasing deployment of IoT-enabled sensors, data loggers, gateways, and RFID tags in temperature-sensitive logistics. The reliability of hardware components in providing real-time environmental monitoring and location tracking significantly contributes to their dominance.

The software segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by the growing need for advanced analytics, predictive maintenance, and real-time data visualization. Software platforms are enabling centralized control, alerts, and compliance reporting—critical elements for industries such as pharmaceuticals and food & beverage.

- By Enterprise Size

On the basis of enterprise size, the IoT based cold chain management market is segmented into SMEs and large enterprises. Large enterprises accounted for the largest market revenue share of 61.3% in 2024, owing to their broader logistics networks, regulatory compliance requirements, and higher investment capacity in end-to-end cold chain visibility and automation.

The SMEs segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the increased availability of cost-effective, scalable IoT solutions. Cloud-based platforms and subscription-based models are making it easier for SMEs to adopt cold chain monitoring tools without high upfront costs.

- By Industry

On the basis of industry, the IoT based cold chain management market is segmented into healthcare & pharma, retail & CPG, food & beverage, chemicals, and others. The healthcare & pharma segment dominated the market in 2024, holding the largest revenue share of 38.7%, attributed to the stringent temperature control requirements for vaccines, biologics, and other temperature-sensitive pharmaceuticals. Regulatory compliance such as GDP and FDA guidelines further boosts adoption.

The food & beverage segment is expected to register the fastest CAGR from 2025 to 2032, driven by increasing demand for fresh produce, dairy, meat, and seafood across global markets. The segment benefits from IoT-based solutions for minimizing spoilage, ensuring quality, and maintaining shelf life throughout distribution chains.

Which Region Holds the Largest Share of the IoT Based Cold Chain Management Market?

- North America dominated the IoT based cold chain management market with the largest revenue share of 42.58% in 2024, driven by stringent regulatory frameworks, the presence of leading cold chain technology providers, and advanced infrastructure for temperature-sensitive logistics

- The region benefits from a mature pharmaceutical and food supply chain that increasingly relies on real-time temperature and humidity monitoring using IoT-based systems to ensure product integrity

- The high adoption of connected logistics solutions, cloud computing, and AI-integrated platforms, coupled with growing demand for transparency and traceability, reinforces North America’s leadership in the cold chain IoT ecosystem

U.S. IoT Based Cold Chain Management Market Insight

The U.S. accounted for the largest market share in 2024 within North America, owing to strong government regulations for pharmaceutical and food safety, along with widespread deployment of real-time location systems (RTLS) and smart sensors. Major logistics and healthcare companies are increasingly leveraging IoT-based systems to reduce losses due to spoilage, ensure compliance, and improve supply chain efficiency. Ongoing investments in digital infrastructure and innovations in cold storage automation are also contributing significantly to the U.S. market's expansion.

Europe IoT Based Cold Chain Management Market Insight

The Europe market is projected to grow steadily, supported by regulatory mandates such as GDP (Good Distribution Practices) and growing demand for safe and efficient delivery of vaccines, biologics, and perishable food items. IoT solutions are being integrated into both centralized and decentralized cold storage facilities to enhance data logging and route optimization. Countries such as Germany, the U.K., and France are at the forefront of deploying digital cold chain systems to address food security and public health concerns.

U.K. IoT Based Cold Chain Management Market Insight

In the U.K., the market is witnessing strong growth due to increasing adoption in pharma, food retail, and grocery delivery services. The rise in online grocery shopping and meal delivery platforms is encouraging businesses to invest in robust, end-to-end cold chain visibility. The government’s emphasis on sustainable logistics and temperature monitoring compliance is also spurring IoT solution deployment across the supply chain ecosystem.

Germany IoT Based Cold Chain Management Market Insight

Germany is experiencing significant demand growth for IoT-based cold chain systems, driven by the country’s precision-focused approach to manufacturing and logistics. The integration of real-time analytics, wireless monitoring devices, and blockchain-based traceability tools is gaining traction. Germany’s leadership in industrial automation and its well-established export-driven food and pharma sectors make it a strategic market for cold chain innovation.

Which Region is the Fastest Growing in the IoT Based Cold Chain Management Market?

Asia-Pacific IoT based cold chain management market is projected to grow at the fastest CAGR of 11.59% from 2025 to 2032, fueled by rising population, urbanization, and increasing demand for secure food and vaccine distribution. Nations such as China, Japan, and India are leading adoption, supported by government-led smart infrastructure initiatives and rapid growth in organized retail and e-commerce. Low-cost IoT device manufacturing in the region, along with strong domestic consumption and evolving healthcare logistics, is making cold chain digitization more accessible and scalable for both SMEs and large enterprises.

Japan IoT Based Cold Chain Management Market Insight

In Japan, the market is gaining momentum due to the country’s advanced logistics network, rising elderly population, and strong emphasis on product quality and safety. High demand for integrated cold chain solutions in vaccine distribution, convenience stores, and supermarkets is driving adoption. Moreover, the incorporation of AI and robotics into logistics chains is further accelerating the implementation of intelligent cold chain systems.

China IoT Based Cold Chain Management Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, driven by massive investments in smart city development, 5G infrastructure, and cold chain logistics. The country’s strong manufacturing capabilities, government support for food safety, and booming e-commerce grocery delivery ecosystem are powering rapid adoption of IoT-based cold chain systems. Local tech giants and startups asuch as are advancing low-cost, high-efficiency solutions to meet surging domestic and export demand.

Which are the Top Companies in IoT Based Cold Chain Management Market?

The IoT based cold chain management industry is primarily led by well-established companies, including:

- Sensitech Inc. (U.S.)

- Berlinger & Co. AG (Switzerland)

- Elpro-Buchs AG (Switzerland)

- Controlant (Iceland)

- Emerson Electric Co. (U.S.)

- Digi International Inc. (U.S.)

- Monnit Corporation (U.S.)

- ORBCOMM Inc. (U.S.)

- Daikin Industries Ltd. (Japan)

- Zest Labs Inc. (U.S.)

- Infratab Inc. (U.S.)

- SecureRF Corporation (U.S.)

- TagBox Solutions Pvt. Ltd. (India)

- FreshSurety Corporation (U.S.)

- BT9 Ltd. (Israel)

- Huawei Technologies (China)

- HC Technologies (U.S.)

- Aeris Communication (U.S.)

- SenseGiz Inc. (India)

- TE Connectivity (Switzerland)

What are the Recent Developments in Global IoT Based Cold Chain Management Market?

- In September 2024, ELPRO launched elproPREDICT, a cutting-edge real-time predictive analytics solution aimed at transforming cold chain logistics. Developed in collaboration with SmartCAE, the solution integrates real-time data from ELPRO’s monitoring devices to provide actionable insights, allowing proactive risk management and consistent product quality throughout the supply chain. This initiative reflects ELPRO’s commitment to innovation and digital transformation in cold chain operations

- In August 2023, Emergent Cold Latin America announced the acquisition of the cold storage operations of Frigorifico Modelo in Montevideo, Uruguay. The company also unveiled immediate plans to construct a 17,000-pallet expansion at its newly acquired facility in Polo Oeste, with completion expected by mid-2024. This move significantly strengthens Emergent Cold's infrastructure and presence in the Latin American cold chain market

- In December 2020, Laird Connectivity unveiled the Sentrius BT610 IoT sensor, a next-generation device leveraging Laird’s proven capabilities in long-range IoT sensor development. Designed for extended coverage and reliable performance, the sensor supports smart, connected operations across various industries. This product launch highlights Laird Connectivity’s expertise in robust IoT sensor innovation

- In August 2020, Roambee Corporation formed a strategic partnership with Rogers to empower businesses with advanced IoT capabilities, enhancing supply chain intelligence and operational agility. The collaboration aimed to deliver connected solutions that improve visibility, efficiency, and responsiveness. This partnership marked a significant step toward more dynamic and data-driven supply chains

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.