Global Iot Connectivity Market

Market Size in USD Billion

CAGR :

%

USD

663.38 Billion

USD

2,295.57 Billion

2024

2032

USD

663.38 Billion

USD

2,295.57 Billion

2024

2032

| 2025 –2032 | |

| USD 663.38 Billion | |

| USD 2,295.57 Billion | |

|

|

|

|

Global Internet of Things (IoT) Connectivity Market Size

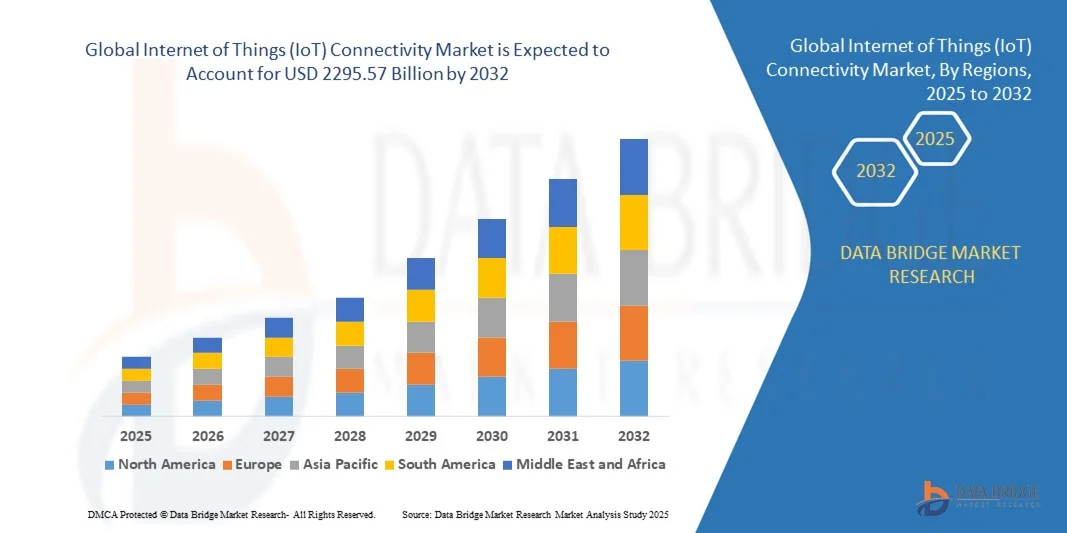

- The global Internet of Things (IoT) connectivity market was valued at USD 663.38 billion in 2024 and is projected to reach USD 2295.57 billion by 2032, growing at a CAGR of 19.10% during the forecast period.

- The surge in demand is primarily driven by the rapid expansion of connected home devices and smart home technologies, which are facilitating widespread digital transformation across both residential and commercial sectors.

- Additionally, growing consumer preference for secure, intuitive, and interoperable solutions is positioning IoT connectivity as a foundational component of modern infrastructure. This convergence is fueling adoption across industries, significantly propelling overall market growth.

Global Internet of Things (IoT) Connectivity Market Analysis

- The Global Internet of Things (IoT) Connectivity Market, which enables digital communication between interconnected devices and systems, is becoming increasingly essential across residential, commercial, and industrial environments due to its role in enabling automation, data sharing, and intelligent decision-making

- The growing demand for IoT connectivity is primarily driven by the widespread adoption of smart technologies, the expansion of 5G infrastructure, and increasing consumer and enterprise reliance on real-time data and connected solutions for enhanced efficiency and productivity

- North America dominated the IoT connectivity market with the largest revenue share of 39.5% in 2024, supported by strong technological infrastructure, early adoption of smart devices, and heavy investments in IoT platforms by leading tech giants, with the U.S. witnessing robust deployment across industries including healthcare, manufacturing, and smart cities

- Asia-Pacific is expected to emerge as the fastest-growing region in the IoT connectivity market during the forecast period, driven by rapid urban development, increasing internet penetration, and government-backed initiatives promoting digital transformation and smart infrastructure

- The platform and solution segment dominated the market in 2024, accounting for approximately 64% of the revenue share, owing to its central role in enabling seamless device communication, data integration, real-time monitoring, and remote control

Report Scope and Global Internet of Things (IoT) Connectivity Market Segmentation

|

Attributes |

Internet of Things (IoT) Connectivity Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Internet of Things (IoT) Connectivity Market Trends

Enhanced Intelligence Through AI and Voice-Enabled IoT Integration

- A major and accelerating trend in the Global Internet of Things (IoT) Connectivity Market is the growing integration of artificial intelligence (AI) and voice-enabled platforms like Amazon Alexa, Google Assistant, and Apple Siri. This convergence is elevating the capabilities of connected devices, enabling more intuitive control, automation, and data-driven insights across smart homes, industries, and enterprises.

- For Instance, smart thermostats and lighting systems now integrate with AI-powered assistants to automatically adjust settings based on user behavior and environmental data. Devices like the Ecobee SmartThermostat use AI to optimize energy consumption while offering voice control through Alexa and Siri, showcasing the power of this interconnected ecosystem.

- In industrial IoT, AI enhances machine-to-machine communication by enabling predictive maintenance, anomaly detection, and real-time decision-making. Meanwhile, voice-enabled interfaces allow field workers to access critical data hands-free via connected wearables or smart devices, improving productivity and safety.

- By combining AI-driven analytics with IoT connectivity, organizations can unlock smarter automation, such as adaptive traffic management systems, energy-efficient building controls, and intelligent healthcare monitoring. The voice assistant integration also enables seamless interaction across devices, creating unified control hubs for homes and businesses alike.

- Companies such as Cisco, Microsoft, and IBM are developing AI-IoT solutions that incorporate natural language processing and machine learning to offer personalized experiences, optimize workflows, and enhance system responsiveness based on user input and real-time data streams.

- This ongoing fusion of AI and IoT connectivity is rapidly reshaping market expectations. As consumers and enterprises alike seek more intelligent, responsive, and voice-interactive ecosystems, demand is surging for solutions that deliver automated insights, hands-free control, and seamless integration across multiple platforms and devices.

Global Internet of Things (IoT) Connectivity Market Dynamics

Driver

Growing Demand Driven by Digital Transformation and Smart Ecosystem Expansion

-

The surge in digital transformation initiatives across sectors such as manufacturing, healthcare, logistics, and smart cities is a primary driver for the increased demand in the Global Internet of Things (IoT) Connectivity Market. Organizations are increasingly seeking real-time data, automation, and remote monitoring capabilities to enhance efficiency, productivity, and decision-making.

- For instance, in March 2024, Siemens AG expanded its industrial IoT platform, MindSphere, to offer deeper integration with edge computing and AI-based analytics. This move is part of a broader trend among leading companies to provide end-to-end IoT solutions that support scalable connectivity and intelligent data processing.

- In the consumer space, the continued rise in smart home adoption is fueling the demand for connected devices—such as smart thermostats, lighting, security cameras, and appliances—that rely on reliable IoT connectivity. Seamless integration across platforms like Amazon Alexa, Google Home, and Apple HomeKit is pushing the market forward.

- Moreover, the growing need for interconnected systems in healthcare, such as remote patient monitoring and smart medical devices, is driving investment in secure and scalable IoT infrastructure. Enterprises are also deploying IoT solutions to monitor supply chains, optimize energy consumption, and manage assets in real-time.

- The proliferation of DIY IoT platforms, increased availability of plug-and-play connectivity modules, and advancements in low-power wide-area networks (LPWAN) are making IoT adoption more accessible for startups, SMEs, and consumers alike, contributing to robust market growth across regions.

Restraint/Challenge

Cybersecurity Risks and Infrastructure Limitations

- Despite its growing adoption, the IoT connectivity market faces significant challenges, particularly around cybersecurity vulnerabilities and infrastructure readiness. As IoT devices increasingly handle sensitive data and critical operations, they become prime targets for cyberattacks, data breaches, and system hijacking.

- High-profile incidents involving compromised IoT devices—such as smart cameras, routers, and industrial sensors—have highlighted the risks of poor security protocols. These concerns are especially pronounced in sectors like healthcare, where a breach could have life-threatening consequences.

- To address these issues, companies are investing in end-to-end encryption, multi-factor authentication, and secure firmware updates. For instance, Cisco and IBM emphasize their secure IoT platforms with built-in threat detection and real-time response capabilities, aiming to reassure enterprise clients and consumers alike.

- In addition to cybersecurity, limited connectivity infrastructure in rural or underdeveloped regions presents a barrier to full IoT deployment. Many IoT applications require stable, high-speed networks—something not yet universally available, particularly in emerging economies.

- Another restraint is the high cost of initial setup, particularly for industrial IoT systems requiring specialized sensors, edge devices, and backend integration. Small businesses and budget-conscious governments may delay adoption due to these upfront investments.

- Overcoming these challenges through international standards, public-private partnerships to improve infrastructure, and consumer education on IoT security best practices will be essential for unlocking the full potential of the global IoT connectivity market.

Global Internet of Things (IoT) Connectivity Market Scope

The market is segmented on the basis 0f component, deployment, connectivity and end use.

- By Component

On the basis of component, the IoT connectivity market is segmented into Platform and Solution and Services. The Platform and Solution segment dominated the market in 2024 with a 64% revenue share, owing to its foundational role in device-to-device and device-to-cloud communication. These platforms facilitate real-time monitoring, analytics, and centralized control, enabling enterprises to build scalable IoT ecosystems across various endpoints. The segment's strength lies in its flexibility, adaptability, and integration capabilities with emerging technologies like AI and edge computing.

The Services segment is projected to witness the fastest CAGR of 20.1% from 2025 to 2032, driven by the increasing demand for consulting, implementation, system integration, and managed services. As more businesses seek to optimize IoT performance and security, they turn to service providers to ensure reliable deployments and ongoing support, especially in complex, multi-vendor environments.

- By Deployment

Based on deployment, the market is divided into Cloud and On-premise solutions. The Cloud segment led the market in 2024 with around 70% of total revenue, supported by its cost efficiency, scalability, and real-time data management capabilities. Cloud deployments are widely adopted across industries for enabling remote monitoring, analytics, and device updates without the need for extensive infrastructure. Integration with machine learning, data lakes, and digital twins has made cloud the default choice for IoT innovation.

The On-premise segment is expected to experience the fastest CAGR of 21.4% from 2025 to 2032, especially in sectors where data sovereignty, security, and latency control are crucial. Defense, manufacturing, and healthcare institutions often opt for on-premise deployments to maintain full control over data infrastructure and ensure compliance with stringent regulatory frameworks.

- By Connectivity

On the basis of connectivity, the IoT connectivity market is segmented into Zigbee, Wi-Fi, Bluetooth, Z-Wave, and Others. The Wi-Fi segment dominated the market in 2024 with a 39.5% revenue share, primarily due to its widespread infrastructure, high-speed connectivity, and ability to support data-heavy IoT applications. Wi-Fi is commonly used in smart homes, retail, and industrial settings where continuous internet connectivity and wide coverage are essential.

The Zigbee segment is projected to grow at the fastest CAGR of 23.2% from 2025 to 2032, driven by its low-power mesh networking capabilities and rising adoption in smart home and building automation systems. Zigbee’s robustness and compatibility with various IoT devices make it a preferred choice for large-scale IoT deployments requiring reliable, energy-efficient connectivity across distributed devices.

- By End-use

The IoT connectivity market spans across various end-use industries including Consumer Electronics, Wearable Devices, Automotive & Transportation, BFSI, Healthcare, Retail, Building Automation, Oil & Gas, Agriculture, Aerospace & Defense, and Others. The Consumer Electronics segment held the largest market share in 2024 at approximately 26.8%, driven by the massive adoption of smart home devices, voice assistants, connected appliances, and entertainment systems. Enhanced user experience, remote control features, and integration with mobile ecosystems drive strong demand.

The Healthcare sector is anticipated to witness the fastest CAGR of 25.3% from 2025 to 2032, fueled by increasing use of connected medical devices, telemedicine, and wearable health monitors. IoT connectivity plays a pivotal role in enabling real-time patient monitoring, early diagnostics, and health data management, while ensuring compliance with medical data privacy standards such as HIPAA. Other high-growth areas include Automotive & Transportation and Building Automation, leveraging IoT for safety, predictive maintenance, and energy optimization.

Global Internet of Things (IoT) Connectivity Market Regional Analysis

- North America dominated the global Internet of Things (IoT) connectivity market with the largest revenue share of 39.5% in 2024, driven by rapid technological advancements, strong infrastructure, and the widespread adoption of IoT-enabled devices across various industries including healthcare, manufacturing, and transportation.

- Businesses and consumers in the region place high value on real-time data analytics, automation, and operational efficiency, which are enabled through robust IoT connectivity solutions such as 5G, LPWAN, and satellite networks.

- This growth is further propelled by strong government initiatives for smart cities, high internet penetration, and increased investment in AI and cloud-based platforms, solidifying North America’s position as a leading hub for IoT innovation and deployment across both enterprise and consumer segments.

U.S. IoT Connectivity Market Insight

The U.S. IoT connectivity market captured the largest revenue share of 78% within North America in 2024, driven by the widespread deployment of smart infrastructure and growing investments in 5G and edge computing. Businesses across manufacturing, healthcare, logistics, and energy sectors are rapidly embracing IoT connectivity solutions to enhance operational efficiency and enable real-time data analytics. The rising adoption of connected vehicles, smart city initiatives, and industrial automation is further propelling demand. The presence of leading technology providers and a favorable regulatory environment also contribute significantly to the market's maturity.

Europe IoT Connectivity Market Insight

The Europe IoT connectivity market is projected to register a robust CAGR over the forecast period, supported by strong regulatory frameworks, including GDPR and smart energy directives. Increased adoption of smart grid technologies, connected mobility, and sustainable urban planning across major countries such as Germany, France, and the UK is driving the need for reliable and secure IoT connectivity. The region’s emphasis on privacy, data security, and interoperability is leading to the deployment of advanced communication protocols and cloud infrastructure, enhancing the performance and scalability of IoT networks across diverse applications.

U.K. IoT Connectivity Market Insight

The U.K. IoT connectivity market is expected to experience noteworthy growth in the coming years, driven by a surge in smart city developments, digital transformation initiatives, and robust public-private sector collaboration. Increasing demand for connected healthcare services, smart utility monitoring, and intelligent transportation systems is accelerating the deployment of LPWAN, NB-IoT, and 5G solutions. The country’s dynamic tech ecosystem and proactive government policies continue to create an enabling environment for scalable IoT infrastructure and services.

Germany IoT Connectivity Market Insight

Germany’s IoT connectivity market is poised for strong expansion, fueled by the country’s leadership in industrial automation (Industrie 4.0) and its advanced manufacturing landscape. The integration of IoT solutions into factory operations, logistics, and supply chain management is accelerating, creating a need for reliable, low-latency connectivity. Germany's focus on sustainability and digital transformation is also driving innovation in energy management and smart mobility. The strong presence of automotive and industrial IoT vendors further cements Germany’s strategic position in the European IoT ecosystem.

Asia-Pacific IoT Connectivity Market Insight

The Asia-Pacific IoT connectivity market is forecasted to grow at the fastest CAGR of 26% during the period of 2025 to 2032, driven by rapid urbanization, industrial digitization, and increasing internet penetration. Countries such as China, India, Japan, and South Korea are investing heavily in 5G infrastructure, smart cities, and IoT-enabled industries. The surge in connected devices, supported by favorable government initiatives and public funding, is enabling widespread adoption of IoT connectivity solutions across sectors like agriculture, transportation, and consumer electronics.

Japan IoT Connectivity Market Insight

Japan’s IoT connectivity market is witnessing accelerated growth, supported by the nation’s high-tech infrastructure, aging population, and focus on smart healthcare and robotics. The country's commitment to building Society 5.0—an integrated, super-smart society—is driving the adoption of advanced connectivity technologies such as 5G, AI, and edge computing. IoT connectivity is increasingly being used in elder care, disaster management systems, and precision manufacturing, with strong emphasis on reliability, efficiency, and minimal latency.

China IoT Connectivity Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, owing to aggressive smart city rollouts, widespread 5G deployment, and its dominant manufacturing ecosystem. As the world's largest IoT market by device volume, China is investing heavily in IoT infrastructure across sectors including transportation, energy, retail, and industrial automation. The government’s “New Infrastructure” policy, coupled with robust support for homegrown technology giants, is significantly bolstering the development and adoption of IoT connectivity solutions nationwide.

Global Internet of Things (IoT) Connectivity Market Share

The Internet of Things (IoT) Connectivity industry is primarily led by well-established companies, including:

- Renesas (Japan)

- Vodafone (U.K.)

- Linux Foundation (U.S.)

- Cisco Systems, Inc. (U.S.)

- IBM Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Amazon Web Services (AWS) (U.S.)

- Google (Alphabet Inc.) (U.S.)

- Intel Corporation (U.S.)

- Siemens AG (Germany)

- SAP SE (Germany)

- Oracle Corporation (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Qualcomm Technologies, Inc. (U.S.)

- Bosch.IO GmbH (Germany)

What are the Recent Developments in Global Internet of Things (IoT) Connectivity Market?

- In May 2023, Qualcomm Technologies Inc., a global leader in wireless technology, announced the launch of its Snapdragon X75 5G Modem-RF System, designed to optimize IoT connectivity across industries such as automotive, smart cities, and industrial IoT. The new system integrates AI capabilities to enhance signal performance and energy efficiency, reinforcing Qualcomm’s position as a critical enabler in the IoT connectivity landscape and accelerating the rollout of ultra-fast, low-latency connections worldwide.

- In April 2023, Cisco Systems, Inc. launched a comprehensive IoT Operations Dashboard as part of its industrial networking portfolio. The platform enables secure, real-time connectivity and device management for large-scale industrial deployments. Designed to streamline operational technology (OT) and IT convergence, the solution highlights Cisco’s focus on bridging connectivity gaps in smart manufacturing, energy, and utilities, while improving visibility and control across distributed environments.

- In March 2023, Huawei Technologies Co., Ltd. partnered with several telecom operators in Southeast Asia to deploy NB-IoT (Narrowband Internet of Things) infrastructure to support smart agriculture, utilities, and smart city projects. This collaboration aims to bring affordable and scalable connectivity to underserved regions, underscoring Huawei's commitment to advancing digital transformation through inclusive and energy-efficient IoT networks.

- In February 2023, Amazon Web Services (AWS) introduced AWS IoT FleetWise, a cloud-based service that enables automakers to collect, transform, and transfer vehicle data to the cloud in near real time. The service is aimed at improving vehicle safety, performance monitoring, and predictive maintenance. This development demonstrates AWS’s ongoing investment in connected mobility and its broader push to support scalable IoT connectivity solutions across transportation and mobility sectors.

- In January 2023, Ericsson unveiled its new IoT Accelerator Connect platform, designed to simplify and accelerate global cellular IoT connectivity for enterprises. By offering a plug-and-play solution with global reach across multiple mobile networks, the platform enables seamless integration and lifecycle management of IoT devices. This move reinforces Ericsson’s role in driving massive IoT adoption by reducing complexity and increasing interoperability across diverse markets and use cases.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL INTERNET OF THINGS (IOT) CONNECTIVITY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL INTERNET OF THINGS (IOT) CONNECTIVITY MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL INTERNET OF THINGS (IOT) CONNECTIVITY MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

5.2 PENETRATION AND GROWTH POSPECT MAPPING

5.3 COMPETITOR KEY PRICING STRATEGIES

5.4 TECHNOLOGY ANALYSIS

5.4.1 KEY TECHNOLOGIES

5.4.2 COMPLEMENTARY TECHNOLOGIES

5.4.3 ADJACENT TECHNOLOGIES

FIGURE 1 TECHNOLOGY MATRIX

Company Product/Service offered

5.5 COMPANY COMPETITIVE ANALYSIS

5.5.1 STRATEGIC DEVELOPMENT

5.5.2 TECHNOLOGY IMPLEMENTATION PROCESS

5.5.2.1. CHALLENGES

5.5.2.2. INHOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

5.5.3 TECHNOLOGY SPEND OF COMPANY

5.5.4 CUSTOMER BASE

5.5.5 SERVICE POSITIONING

5.5.6 CUSTOMER FEEDBACK/RATING (B2B OR B2C)

5.5.7 APPLICATION REACH

5.5.8 SERVICE PLATFORM MATRIX

FIGURE 2 COMPANY COMPARATIVE ANALYSIS

Parameters Company A

Market Share

Growth (%)

Target Audience

Price Structure

Market Strategies

Customer Feedback

Service Positioning

Customer Feedback/Rating

Strategic Development

Acquisitions & its value (USD Million)

Application Reach

FIGURE 3 COMPANY SERVICE PLATFORM MATRIX

5.6 FUNDING DETAILS—INVESTOR DETAILS , REASON OF INVESTMENT FROM INVESTOR

5.7 USED CASES & ITS ANALYSIS

FIGURE 4 USED CASE ANALYSIS

Company Product/Service offered

6 GLOBAL INTERNET OF THINGS (IOT) CONNECTIVITY MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 PLATFORM

6.3 SERVICES

6.3.1 MANAGED

6.3.2 PROFESSIONAL

6.3.2.1. SUPPORT AND MAINTENANCE

6.3.2.2. TRAINING AND CONSULTING

6.3.2.3. DEPLOYMENT AND INTEGRATION

7 GLOBAL INTERNET OF THINGS (IOT) CONNECTIVITY MARKET, BY RANGE

7.1 OVERVIEW

7.2 LESS THAN 500KB

7.3 500 KB TO 1MB

7.4 1 MB TO 2MB

7.5 2 MB TO 5MB

7.6 5MB TO 10MB

7.7 10 MB TO 20MB

7.8 20 MB TO 50MB

7.9 50 MB TO 100MB

7.1 100 MB TO 200MB

7.11 200 MB TO 250MB

7.12 250 MB TO 350MB

7.13 350 MB 500MB

7.14 500 MB TO 1GB

7.15 1 GB TO 5GB

7.16 5GB TO 10GB

7.17 10 GB TO 20GB

8 GLOBAL INTERNET OF THINGS (IOT) CONNECTIVITY MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 SMES

8.3 LARGE ORGANIZATIONS

9 GLOBAL INTERNET OF THINGS (IOT) CONNECTIVITY MARKET, BY DEPLOYMENT

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISES

10 GLOBAL INTERNET OF THINGS (IOT) CONNECTIVITY MARKET, BY NETWORKING TECHNOLOGY

10.1 OVERVIEW

10.2 ZIGBEE

10.3 Z-WAVE

10.4 WI-FI

10.5 BLUETOOTH

10.6 RFID

10.7 OTHERS

11 GLOBAL INTERNET OF THINGS (IOT) CONNECTIVITY MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 BUILDING AND HOME AUTOMATION

11.3 SMART ENERGY AND UTILITY

11.4 SMART MANUFACTURING

11.5 SMART GRID

11.6 SMART RETAIL

11.7 SMART TRANSPORTATION

11.8 OTHERS

12 GLOBAL INTERNET OF THINGS (IOT) CONNECTIVITY MARKET, BY END USER

12.1 OVERVIEW

12.2 BFSI

12.2.1 BY SOLUTIONS

12.2.1.1. PLATFORM

12.2.1.2. SERVICES

12.2.1.2.1. MANAGED

12.2.1.2.2. PROFESSIONAL

12.2.1.2.2.1 SUPPORT AND MAINTENANCE

12.2.1.2.2.2 TRAINING AND CONSULTING

12.2.1.2.2.3 DEPLOYMENT AND INTEGRATION

12.3 FLEET TELEMATICS

12.3.1 BY SOLUTIONS

12.3.1.1. PLATFORM

12.3.1.2. SERVICES

12.3.1.2.1. MANAGED

12.3.1.2.2. PROFESSIONAL

12.3.1.2.2.1 SUPPORT AND MAINTENANCE

12.3.1.2.2.2 TRAINING AND CONSULTING

12.3.1.2.2.3 DEPLOYMENT AND INTEGRATION

12.4 SOLAR

12.4.1 BY SOLUTIONS

12.4.1.1. PLATFORM

12.4.1.2. SERVICES

12.4.1.2.1. MANAGED

12.4.1.2.2. PROFESSIONAL

12.4.1.2.2.1 SUPPORT AND MAINTENANCE

12.4.1.2.2.2 TRAINING AND CONSULTING

12.4.1.2.2.3 DEPLOYMENT AND INTEGRATION

12.5 MANUFACTURING

12.5.1 BY SOLUTIONS

12.5.1.1. PLATFORM

12.5.1.2. SERVICES

12.5.1.2.1. MANAGED

12.5.1.2.2. PROFESSIONAL

12.5.1.2.2.1 SUPPORT AND MAINTENANCE

12.5.1.2.2.2 TRAINING AND CONSULTING

12.5.1.2.2.3 DEPLOYMENT AND INTEGRATION

12.6 AUTOMOTIVE

12.6.1 BY SOLUTIONS

12.6.1.1. PLATFORM

12.6.1.2. SERVICES

12.6.1.2.1. MANAGED

12.6.1.2.2. PROFESSIONAL

12.6.1.2.2.1 SUPPORT AND MAINTENANCE

12.6.1.2.2.2 TRAINING AND CONSULTING

12.6.1.2.2.3 DEPLOYMENT AND INTEGRATION

12.7 RETAIL AND E-COMMERCE

12.7.1 BY SOLUTIONS

12.7.1.1. PLATFORM

12.7.1.2. SERVICES

12.7.1.2.1. MANAGED

12.7.1.2.2. PROFESSIONAL

12.7.1.2.2.1 SUPPORT AND MAINTENANCE

12.7.1.2.2.2 TRAINING AND CONSULTING

12.7.1.2.2.3 DEPLOYMENT AND INTEGRATION

12.8 TRANSPORTATION AND LOGISTICS

12.8.1 BY SOLUTIONS

12.8.1.1. PLATFORM

12.8.1.2. SERVICES

12.8.1.2.1. MANAGED

12.8.1.2.2. PROFESSIONAL

12.8.1.2.2.1 SUPPORT AND MAINTENANCE

12.8.1.2.2.2 TRAINING AND CONSULTING

12.8.1.2.2.3 DEPLOYMENT AND INTEGRATION

12.9 HEALTHCARE AND PHARMACEUTICALS

12.9.1 BY SOLUTIONS

12.9.1.1. PLATFORM

12.9.1.2. SERVICES

12.9.1.2.1. MANAGED

12.9.1.2.2. PROFESSIONAL

12.9.1.2.2.1 SUPPORT AND MAINTENANCE

12.9.1.2.2.2 TRAINING AND CONSULTING

12.9.1.2.2.3 DEPLOYMENT AND INTEGRATION

12.1 ENERGY AND UTILITIES

12.10.1 BY SOLUTIONS

12.10.1.1. PLATFORM

12.10.1.2. SERVICES

12.10.1.2.1. MANAGED

12.10.1.2.2. PROFESSIONAL

12.10.1.2.2.1 SUPPORT AND MAINTENANCE

12.10.1.2.2.2 TRAINING AND CONSULTING

12.10.1.2.2.3 DEPLOYMENT AND INTEGRATION

12.11 GOVERNMENT

12.11.1 BY SOLUTIONS

12.11.1.1. PLATFORM

12.11.1.2. SERVICES

12.11.1.2.1. MANAGED

12.11.1.2.2. PROFESSIONAL

12.11.1.2.2.1 SUPPORT AND MAINTENANCE

12.11.1.2.2.2 TRAINING AND CONSULTING

12.11.1.2.2.3 DEPLOYMENT AND INTEGRATION

12.12 DEFENSE AND AEROSPACE

12.12.1 BY SOLUTIONS

12.12.1.1. PLATFORM

12.12.1.2. SERVICES

12.12.1.2.1. MANAGED

12.12.1.2.2. PROFESSIONAL

12.12.1.2.2.1 SUPPORT AND MAINTENANCE

12.12.1.2.2.2 TRAINING AND CONSULTING

12.12.1.2.2.3 DEPLOYMENT AND INTEGRATION

12.13 OTHERS

13 GLOBAL INTERNET OF THINGS (IOT) CONNECTIVITY MARKET, BY COUNTRY

13.1 GLOBAL INTERNET OF THINGS (IOT) CONNECTIVITY MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 EUROPE

13.3.1 GERMANY

13.3.2 FRANCE

13.3.3 U.K.

13.3.4 ITALY

13.3.5 SPAIN

13.3.6 RUSSIA

13.3.7 TURKEY

13.3.8 BELGIUM

13.3.9 NETHERLANDS

13.3.10 SWITZERLAND

13.3.11 REST OF EUROPE

13.4 ASIA PACIFIC

13.4.1 JAPAN

13.4.2 CHINA

13.4.3 SOUTH KOREA

13.4.4 INDIA

13.4.5 AUSTRALIA

13.4.6 SINGAPORE

13.4.7 THAILAND

13.4.8 MALAYSIA

13.4.9 INDONESIA

13.4.10 PHILIPPINES

13.4.11 REST OF ASIA PACIFIC

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SOUTH AFRICA

13.6.2 EGYPT

13.6.3 SAUDI ARABIA

13.6.4 U.A.E

13.6.5 ISRAEL

13.6.6 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL INTERNET OF THINGS (IOT) CONNECTIVITY MARKET,COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL INTERNET OF THINGS (IOT) CONNECTIVITY MARKET, SWOT AND DBMR ANALYSIS

16 GLOBAL INTERNET OF THINGS (IOT) CONNECTIVITY MARKET, COMPANY PROFILE

16.1 AERIS COMMUNICATIONS

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 GEOGRAPHIC PRESENCE

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 KORE WIRELESS

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 GEOGRAPHIC PRESENCE

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 ESEYE

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 GEOGRAPHIC PRESENCE

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 HOLOGRAM

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 GEOGRAPHIC PRESENCE

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 WIRELESS LOGIC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 GEOGRAPHIC PRESENCE

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 1NCE PTE LTD.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 GEOGRAPHIC PRESENCE

16.6.4 PRODUCT PORTFOLIO

16.6.5 RECENT DEVELOPMENTS

16.7 AT&T

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 GEOGRAPHIC PRESENCE

16.7.4 PRODUCT PORTFOLIO

16.7.5 RECENT DEVELOPMENTS

16.8 VERIZON

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 GEOGRAPHIC PRESENCE

16.8.4 PRODUCT PORTFOLIO

16.8.5 RECENT DEVELOPMENTS

16.9 CISCO SYSTEMS INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 GEOGRAPHIC PRESENCE

16.9.4 PRODUCT PORTFOLIO

16.9.5 RECENT DEVELOPMENTS

16.1 HUAWEI TECHNOLOGIES CO. LTD.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 GEOGRAPHIC PRESENCE

16.10.4 PRODUCT PORTFOLIO

16.10.5 RECENT DEVELOPMENTS

16.11 AT&T INTELLECTUAL PROPERTY

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 GEOGRAPHIC PRESENCE

16.11.4 PRODUCT PORTFOLIO

16.11.5 RECENT DEVELOPMENTS

16.12 TELEFONICA SA

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 GEOGRAPHIC PRESENCE

16.12.4 PRODUCT PORTFOLIO

16.12.5 RECENT DEVELOPMENTS

16.13 TELEFONAKTIEBOLAGET LM ERICSSON

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 GEOGRAPHIC PRESENCE

16.13.4 PRODUCT PORTFOLIO

16.13.5 RECENT DEVELOPMENTS

16.14 VODAFONE GROUP PLC

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 GEOGRAPHIC PRESENCE

16.14.4 PRODUCT PORTFOLIO

16.14.5 RECENT DEVELOPMENTS

16.15 ORANGE S.A.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 GEOGRAPHIC PRESENCE

16.15.4 PRODUCT PORTFOLIO

16.15.5 RECENT DEVELOPMENTS

16.16 VERIZON

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 GEOGRAPHIC PRESENCE

16.16.4 PRODUCT PORTFOLIO

16.16.5 RECENT DEVELOPMENTS

16.17 SIERRA WIRELESS

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 GEOGRAPHIC PRESENCE

16.17.4 PRODUCT PORTFOLIO

16.17.5 RECENT DEVELOPMENTS

16.18 HOLOGRAM INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 GEOGRAPHIC PRESENCE

16.18.4 PRODUCT PORTFOLIO

16.18.5 RECENT DEVELOPMENTS

16.19 TELIT

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 GEOGRAPHIC PRESENCE

16.19.4 PRODUCT PORTFOLIO

16.19.5 RECENT DEVELOPMENTS

16.2 AERIS

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 GEOGRAPHIC PRESENCE

16.20.4 PRODUCT PORTFOLIO

16.20.5 RECENT DEVELOPMENTS

16.21 EMNIFY GMBH

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 GEOGRAPHIC PRESENCE

16.21.4 PRODUCT PORTFOLIO

16.21.5 RECENT DEVELOPMENTS

16.22 MOECO IOT INC.

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 GEOGRAPHIC PRESENCE

16.22.4 PRODUCT PORTFOLIO

16.22.5 RECENT DEVELOPMENTS

16.23 SIGFOX

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 GEOGRAPHIC PRESENCE

16.23.4 PRODUCT PORTFOLIO

16.23.5 RECENT DEVELOPMENTS

16.24 ARM LTD.

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 GEOGRAPHIC PRESENCE

16.24.4 PRODUCT PORTFOLIO

16.24.5 RECENT DEVELOPMENTS

16.25 LANTRONIX

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 GEOGRAPHIC PRESENCE

16.25.4 PRODUCT PORTFOLIO

16.25.5 RECENT DEVELOPMENTS

16.26 ACTILITY

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 GEOGRAPHIC PRESENCE

16.26.4 PRODUCT PORTFOLIO

16.26.5 RECENT DEVELOPMENTS

16.27 SOFTDEL

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 GEOGRAPHIC PRESENCE

16.27.4 PRODUCT PORTFOLIO

16.27.5 RECENT DEVELOPMENTS

16.28 ASL HOLDINGS

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 GEOGRAPHIC PRESENCE

16.28.4 PRODUCT PORTFOLIO

16.28.5 RECENT DEVELOPMENTS

16.29 ASL HOLDINGS

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 GEOGRAPHIC PRESENCE

16.29.4 PRODUCT PORTFOLIO

16.29.5 RECENT DEVELOPMENTS

16.3 FLOLIVE

16.30.1 COMPANY SNAPSHOT

16.30.2 REVENUE ANALYSIS

16.30.3 GEOGRAPHIC PRESENCE

16.30.4 PRODUCT PORTFOLIO

16.30.5 RECENT DEVELOPMENTS

16.31 ZIPIT WIRELESS, INC.

16.31.1 COMPANY SNAPSHOT

16.31.2 REVENUE ANALYSIS

16.31.3 GEOGRAPHIC PRESENCE

16.31.4 PRODUCT PORTFOLIO

16.31.5 RECENT DEVELOPMENTS

16.32 MAVOCO AG

16.32.1 COMPANY SNAPSHOT

16.32.2 REVENUE ANALYSIS

16.32.3 GEOGRAPHIC PRESENCE

16.32.4 PRODUCT PORTFOLIO

16.32.5 RECENT DEVELOPMENTS

16.33 APTILO NETWORKS

16.33.1 COMPANY SNAPSHOT

16.33.2 REVENUE ANALYSIS

16.33.3 GEOGRAPHIC PRESENCE

16.33.4 PRODUCT PORTFOLIO

16.33.5 RECENT DEVELOPMENTS

16.34 PELION

16.34.1 COMPANY SNAPSHOT

16.34.2 REVENUE ANALYSIS

16.34.3 GEOGRAPHIC PRESENCE

16.34.4 PRODUCT PORTFOLIO

16.34.5 RECENT DEVELOPMENTS

16.35 CRADLEPOINT

16.35.1 COMPANY SNAPSHOT

16.35.2 REVENUE ANALYSIS

16.35.3 GEOGRAPHIC PRESENCE

16.35.4 PRODUCT PORTFOLIO

16.35.5 RECENT DEVELOPMENTS

16.36 NABTO

16.36.1 COMPANY SNAPSHOT

16.36.2 REVENUE ANALYSIS

16.36.3 GEOGRAPHIC PRESENCE

16.36.4 PRODUCT PORTFOLIO

16.36.5 RECENT DEVELOPMENTS

16.37 TE CONNECTIVITY

16.37.1 COMPANY SNAPSHOT

16.37.2 REVENUE ANALYSIS

16.37.3 GEOGRAPHIC PRESENCE

16.37.4 PRODUCT PORTFOLIO

16.37.5 RECENT DEVELOPMENTS

16.38 OSF DIGITAL

16.38.1 COMPANY SNAPSHOT

16.38.2 REVENUE ANALYSIS

16.38.3 GEOGRAPHIC PRESENCE

16.38.4 PRODUCT PORTFOLIO

16.38.5 RECENT DEVELOPMENTS

17 CONCLUSION

18 QUESTIONNAIRE

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.