Global Iot Insurance Market

Market Size in USD Million

CAGR :

%

USD

27,500.00 Million

USD

299,813.95 Million

2022

2030

USD

27,500.00 Million

USD

299,813.95 Million

2022

2030

| 2023 –2030 | |

| USD 27,500.00 Million | |

| USD 299,813.95 Million | |

|

|

|

|

IoT Insurance Market Analysis and Size

IoT Insurance is a specialized branch of the insurance industry that utilizes IoT devices and data to provide enhanced risk assessment, policy pricing, and personalized coverage for various sectors such as automotive, healthcare, agriculture, home, and commercial properties. It leverages the data collected by IoT devices to monitor and manage risks, prevent losses, and improve operational efficiency.

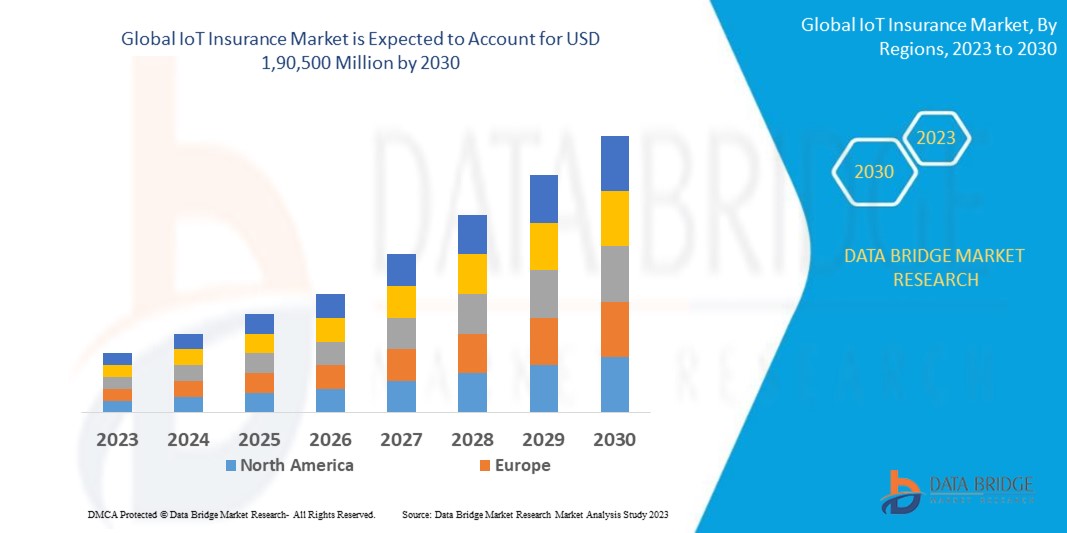

Data Bridge Market Research analyses that the global IoT insurance market which was USD 27,500 million in 2022, is expected to reach USD 1,90,500 million by 2030, and is expected to undergo a CAGR of 34.8% during the forecast period 2023-2030. This indicates the market value. “Health Insurance,” dominates the type segment of the global IoT insurance market due to their as enterprises have grasped the necessity of automated quality assurance in production processes, the demand for it has grown which is further anticipated to propel the growth of the industrial machine vision market. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

IoT Insurance Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 ( Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Type (Health Insurance, Property and Causality Insurance, Agricultural Insurance, Life Insurance, Others), End-User (Automotive and Transport, Travel, Healthcare, Home and Commercial Buildings, Business, Agriculture, Consumer Electronics) |

|

Countries Covered |

(U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) |

|

Market Players Covered |

Accenture plc (US), Allerin (US), Capgemini SE (US), Cognizant (US), Concirrus (US), Intel Corporation (US), International Business Machines Corporation (US), Microsoft Corporation (US), Sas Institute Inc. (US), Telit (US), Verisk Analytics Inc. (US) and Wipro Limited (US) |

|

Market Opportunities |

The introduction of Industry 4.0 is predicted to have a beneficial impact |

Market Definition

The global Internet of Things (IoT) insurance market refers to the market that encompasses insurance products and services specifically tailored for IoT devices and technologies. IoT refers to the network of interconnected physical devices, vehicles, buildings, and other objects embedded with sensors, software, and connectivity, enabling them to collect and exchange data.

Global IoT Insurance Market

Drivers

- Risk Management and Loss Prevention

IoT insurance offers enhanced risk assessment and loss prevention capabilities. By utilizing real-time data from IoT devices, insurers can better understand and assess risks, allowing for more accurate underwriting and pricing. IoT-enabled risk mitigation measures, such as remote monitoring and predictive analytics, help prevent losses and reduce claim frequencies.

- Personalized Insurance Solutions

IoT insurance enables insurers to offer personalized coverage and pricing based on individual data and behavior. For instance, in auto insurance, usage-based policies can be tailored to an individual's driving habits, resulting in fairer premiums. Personalized insurance solutions drive customer satisfaction and retention.

Opportunity

- Market Expansion and Penetration

The global IoT insurance market offers opportunities for insurers to expand their customer base and penetrate new markets. As IoT adoption continues to grow across industries and regions, insurers can target specific sectors such as healthcare, agriculture, and manufacturing, where IoT devices are extensively used, and offer tailored insurance solutions.

Restraints/Challenges

- Data Security and Privacy Concerns

The widespread use of IoT devices and the collection of vast amounts of personal and sensitive data raise concerns about data security and privacy. Insurers must ensure robust data protection measures to prevent unauthorized access, breaches, and misuse of IoT generated data. Compliance with data protection regulations, such as GDPR (General Data Protection Regulation), adds complexity and cost to the IoT Insurance ecosystem.

- Complex Infrastructure and Integration:

IoT Insurance requires the integration of various technologies and systems, including IoT devices, data analytics platforms, and insurance software. Building and managing the necessary infrastructure can be complex and challenging. Ensuring compatibility, seamless data flow, and effective integration across different devices and platforms require significant investment and expertise.

Recent Developments

- In November 2022, IBM Corporation has announced a partnership with Ablera and Bulgaria to enhance ABACUS, a solution for insurance companies for pricing and rating processes powered by artificial intelligence, which brings next-level speed and accuracy to these processes, minimizing the error-prone, cumbersome manual efforts and allowing a more comprehensive range of users to work with the sophistication of applied mathematics

- In August 2022, Telit, a global leader in the Internet of Things (IoT), has announced the acquisition of group assets from Mobilogix acquisition adds comprehensive device engineering expertise and resources that focus on optimizing specifications for handoff to electronic manufacturing services, original device manufacturing, and the attainment of regulatory approvals and carrier certifications

Global IoT Insurance Market Scope and Market Size

The global IoT insurance market is segmented on the basis of type and end-user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Health Insurance

- Property and Causality Insurance

- Agricultural Insurance

- Life Insurance

- Others

End-User

- Automotive and Transport

- Travel, Healthcare

- Home and Commercial Buildings

- Business,

- Agriculture

- Consumer Electronics

Global IoT Insurance Market Regional Analysis/Insights

The global IoT insurance market is analysed and market size insights and trends are provided by country, type and end-user application as referenced above.

The countries covered in the industrial machine vision market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa

North America leads the industrial machine vision market due to the application of advanced technology in several industries. Furthermore, the occurrence of major key players will further boost the growth of the industrial machine vision market in the region during the forecast period 2023-2030.

Asia-Pacific is projected to observe significant amount of growth in the industrial machine vision market due to the sturdy occurrence of major manufacturing countries. Moreover, the rise in the number of new entrants is further anticipated to propel the growth of the industrial machine vision market in the region in the coming years.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global IoT Insurance Market Share Analysis

The global IoT insurance market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global IoT insurance market.

Some of the major players operating in the Global IoT insurance Market are:

- Accenture plc (US)

- Allerin (US)

- Capgemini SE (US)

- Cognizant (US)

- Concirrus (US)

- Intel Corporation (US)

- International Business Machines Corporation (US)

- Microsoft Corporation (US)

- Sas Institute Inc. (US)

- Telit (US)

- Verisk Analytics Inc. (US)

- Wipro Limited (US)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Iot Insurance Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Iot Insurance Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Iot Insurance Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.