Global Iot Monetization Market

Market Size in USD Billion

CAGR :

%

USD

1,045.38 Billion

USD

31,886.84 Billion

2024

2032

USD

1,045.38 Billion

USD

31,886.84 Billion

2024

2032

| 2025 –2032 | |

| USD 1,045.38 Billion | |

| USD 31,886.84 Billion | |

|

|

|

|

Internet of Things (IoT) Monetization Market Size

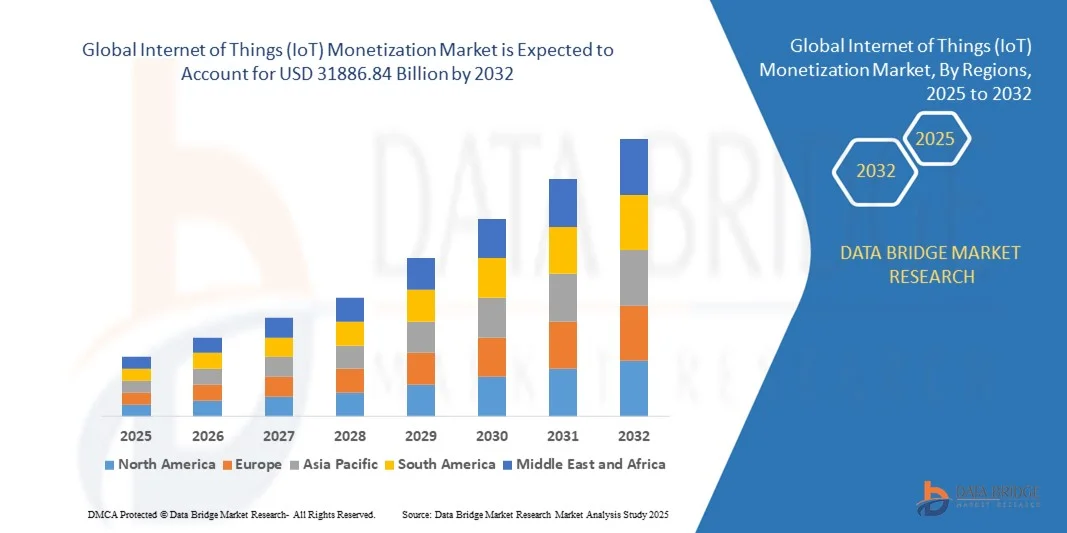

- The global internet of things (IoT) monetization market size was valued at USD 1045.38 billion in 2024 and is expected to reach USD 31886.84 billion by 2032, at a CAGR of 53.30% during the forecast period

- The market growth is largely fueled by the increasing adoption of Internet of Things devices across enterprises and industries, along with advancements in data analytics, artificial intelligence, and cloud computing, which enable effective monetization of IoT-generated data

- Furthermore, rising enterprise demand for actionable insights, predictive maintenance, and new revenue streams through IoT platforms is establishing IoT monetization as a strategic priority. These converging factors are accelerating the deployment of IoT monetization solutions, thereby significantly boosting the market’s growth

Internet of Things (IoT) Monetization Market Analysis

- Internet of Things monetization platforms allow enterprises to convert data generated from connected devices into actionable insights and revenue opportunities. These platforms integrate with cloud services, analytics tools, and enterprise IT systems, facilitating data-driven decision-making and operational optimization

- The escalating demand for Internet of Things monetization solutions is primarily driven by the widespread enterprise adoption of connected devices, growing focus on digital transformation, and increasing emphasis on operational efficiency and revenue optimization through data monetization strategies

- North America dominated the internet of things (IoT) monetization market with a share of 36.7% in 2024, due to rapid adoption of IoT devices across enterprises and increasing awareness of data-driven business models

- Asia-Pacific is expected to be the fastest growing region in the internet of things (IoT) monetization market during the forecast period due to increasing enterprise digitization, urbanization, and technological advancements in countries such as China, Japan, and India

- IT segment dominated the market with a market share of 35.5% in 2024, due to the critical role of IT departments in implementing, managing, and securing IoT monetization platforms. Organizations depend on IT to ensure seamless connectivity, integration with legacy systems, and robust cybersecurity, all essential for monetizing IoT data effectively. The growing need for centralized management and real-time monitoring of devices further reinforces IT’s pivotal role

Report Scope and Internet of Things (IoT) Monetization Market Segmentation

|

Attributes |

Internet of Things (IoT) Monetization Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Internet of Things (IoT) Monetization Market Trends

Increasing Adoption of Cloud-Based IoT Monetization Platforms

- The growing reliance on cloud-based IoT monetization platforms is reshaping how enterprises generate revenue from connected devices and services. These platforms provide the flexibility, scalability, and efficiency required to manage massive IoT ecosystems, enabling companies to expand offerings and improve customer engagement

- For instance, Ericsson’s IoT Accelerator platform leverages cloud infrastructure to enable telecom operators and enterprises to monetize connectivity and related IoT services. Similarly, Cisco’s IoT Control Center provides cloud-based monetization capabilities to manage devices and optimize revenue flows through subscription and usage-based billing models

- Cloud-based monetization models provide advanced features such as real-time analytics, automated billing, and dynamic pricing strategies that help organizations maximize profitability. By leveraging big data insights, enterprises can better align pricing models with customer usage behavior and operational efficiency

- The shift to cloud-based platforms also supports interoperability across diverse IoT devices and networks, allowing seamless management of millions of connected endpoints. This consolidated approach reduces complexity while enhancing the ability to scale rapidly across global markets

- These platforms also integrate AI and machine learning to drive predictive insights and optimize monetization strategies. Features such as demand forecasting and anomaly detection drive revenue opportunities and also ensure smarter pricing and operational resilience

- The adoption of cloud-powered monetization platforms is reshaping the competitive landscape, enabling enterprises across telecom, automotive, healthcare, and manufacturing sectors to innovate business models, ensure faster time-to-market, and secure recurring revenue streams through IoT services

Internet of Things (IoT) Monetization Market Dynamics

Driver

Rising Enterprise Focus on Data-Driven Revenue Generation

- Enterprises are increasingly recognizing the importance of monetizing IoT data and device connectivity as a key growth driver. With millions of devices producing real-time operational data, organizations are turning this information into new revenue models and improved service delivery

- For instance, Microsoft Azure IoT provides enterprises with tools to manage, analyze, and monetize IoT data efficiently. Companies such as IBM are also offering IoT platforms that integrate analytics and AI to unlock actionable insights and build new revenue streams for enterprises

- Businesses are leveraging IoT monetization to create customer-centric offerings such as usage-based pricing, subscription models, and predictive maintenance services. These models enhance customer satisfaction and ensure sustainable income generation by aligning costs with actual usage outcomes

- The rising integration of IoT monetization platforms into enterprise operations also supports cross-industry innovations. Telecom providers, for instance, are leveraging device connectivity for flexible billing models, while manufacturers are adopting pay-per-use frameworks to expand revenue opportunities

- The enterprise drive toward data-driven decision-making highlights IoT’s role in shaping the digital economy. By turning operational and customer data into measurable value, organizations are building resilient and scalable monetization models that are central to future digital business strategies

Restraint/Challenge

Data Security and Privacy Concerns

- The monetization of IoT ecosystems presents significant challenges related to cybersecurity and privacy, as constant data exchange among connected devices elevates risks of unauthorized access, manipulation, or misuse of sensitive information. These risks hinder trust and limit willingness among some enterprises to scale IoT monetization models

- For instance, high-profile cyberattacks on IoT devices, such as those targeting connected medical devices and smart infrastructure, have raised concerns around vulnerabilities in connected ecosystems. Companies are under mounting pressure to demonstrate strong security controls and compliance with global data protection regulations such as GDPR and HIPAA

- The complexity of IoT networks, which often involve multiple vendors and disparate systems, adds further risk as vulnerabilities can emerge at any integration point. This heightened risk requires constant monitoring, patching, and stringent authentication mechanisms that increase operational burdens

- Smaller enterprises entering IoT monetization markets often lack the resources and expertise needed to implement end-to-end security assurance. Gaps in encryption practices, access controls, and software updates make them more vulnerable to breaches and limit adoption in sensitive sectors

- Addressing these data privacy and security vulnerabilities through advanced encryption, trusted authentication methods, and regulatory compliance will be vital for ensuring customer confidence. Establishing transparent policies and enhancing consumer awareness will help overcome this challenge and accelerate market growth for IoT monetization platforms

Internet of Things (IoT) Monetization Market Scope

The market is segmented on the basis of application, component, organization size, business function, and deployment type.

- By Application

On the basis of application, the IoT monetization market is segmented into Retail, Industrial, Automotive and Transportation, Agriculture, Energy, Building and Home Automation, Consumer Electronics, Healthcare, and Others. The Industrial segment dominated the largest market revenue share in 2024, driven by the rapid adoption of IoT technologies for process optimization, predictive maintenance, and operational efficiency. Enterprises in manufacturing and logistics increasingly leverage IoT monetization platforms to track assets, monitor equipment, and generate actionable insights, leading to cost savings and improved productivity. The market growth is further supported by government initiatives promoting smart factories and Industry 4.0 adoption. Integration with AI and analytics solutions enhances the value proposition of industrial IoT monetization, driving robust demand across multiple sub-sectors.

The Retail segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the rising use of connected devices, smart shelves, and customer analytics platforms. Retailers are adopting IoT monetization solutions to offer personalized experiences, optimize inventory, and enable dynamic pricing models. Increasing consumer preference for omnichannel shopping, combined with the need for real-time operational visibility, is accelerating adoption. Cloud-based IoT platforms allow seamless integration with existing retail management systems, enhancing scalability and ROI for retail enterprises.

- By Component

On the basis of component, the IoT monetization market is segmented into Solutions and Services. The Solutions segment dominated the largest market revenue share in 2024, driven by the demand for end-to-end platforms that enable data collection, device management, analytics, and monetization of IoT-generated data. Enterprises prioritize solutions that provide actionable insights, ensure secure data exchange, and allow flexible pricing or subscription models. Solution providers offering customizable and scalable platforms are preferred, as they allow integration with existing IT infrastructures and IoT ecosystems, enhancing operational efficiency and business agility.

The Services segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising demand for consulting, integration, and managed services to simplify IoT monetization deployment. Many organizations lack in-house expertise to manage complex IoT ecosystems, driving the adoption of professional services. Services such as implementation support, system integration, analytics setup, and ongoing maintenance are increasingly critical to ensure ROI from IoT initiatives.

- By Organization Size

On the basis of organization size, the IoT monetization market is segmented into Large Enterprises and Small and Medium-Sized Enterprises (SMEs). The Large Enterprises segment dominated the largest market revenue share in 2024, due to their extensive IoT deployments, sophisticated IT infrastructure, and higher investment capacity. Large organizations leverage IoT monetization to optimize operations, create new revenue streams, and improve customer experiences at scale. Strong focus on digital transformation and analytics-driven decision-making drives consistent adoption among global enterprises.

The SME segment is projected to witness the fastest growth from 2025 to 2032, driven by the increasing availability of affordable, scalable, and cloud-based IoT monetization solutions. SMEs are adopting IoT platforms to streamline operations, monitor assets, and implement flexible pricing strategies without heavy upfront investments. Growing awareness of the competitive advantages of data monetization and rising support from technology vendors is accelerating market penetration among smaller enterprises.

- By Business Function

On the basis of business function, the IoT monetization market is segmented into Marketing and Sales, IT, Finance, Supply Chain, and Operations. The IT segment dominated the largest market revenue share of 35.5% in 2024, driven by the critical role of IT departments in implementing, managing, and securing IoT monetization platforms. Organizations depend on IT to ensure seamless connectivity, integration with legacy systems, and robust cybersecurity, all essential for monetizing IoT data effectively. The growing need for centralized management and real-time monitoring of devices further reinforces IT’s pivotal role.

The Marketing and Sales segment is expected to witness the fastest growth from 2025 to 2032, fueled by the increasing use of IoT data to drive customer insights, personalized campaigns, and subscription-based revenue models. Businesses are leveraging IoT analytics to understand consumer behavior, optimize engagement, and introduce data-driven pricing strategies. The rise of connected devices and smart consumer ecosystems enhances opportunities for marketing and sales teams to monetize IoT-generated insights.

- By Deployment Type

On the basis of deployment type, the IoT monetization market is segmented into On-Premise and Cloud. The Cloud segment dominated the largest market revenue share in 2024, driven by scalability, lower upfront costs, and ease of deployment. Cloud-based IoT monetization platforms allow real-time data collection, advanced analytics, and seamless integration with multiple devices and applications. Organizations prefer cloud deployment to reduce infrastructure complexity, improve accessibility, and enable rapid expansion across global operations.

The On-Premise segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by organizations with strict data privacy, compliance, or regulatory requirements. On-premise deployment provides greater control over sensitive data, customization, and security protocols. Industries such as healthcare, finance, and critical infrastructure are increasingly investing in on-premise IoT monetization solutions to protect proprietary data while benefiting from monetization capabilities.

Internet of Things (IoT) Monetization Market Regional Analysis

- North America dominated the internet of things (IoT) monetization market with the largest revenue share of 36.7% in 2024, driven by rapid adoption of IoT devices across enterprises and increasing awareness of data-driven business models

- Organizations in the region highly value the ability to monetize IoT-generated data for operational efficiency, predictive maintenance, and new revenue streams

- This widespread adoption is further supported by strong IT infrastructure, high digital maturity, and a growing focus on analytics and cloud-based platforms, establishing IoT monetization as a key strategic initiative for businesses

U.S. Internet of Things (IoT) Monetization Market Insight

The U.S. Internet of Things (IoT) Monetization market captured the largest revenue share in North America in 2024, fueled by extensive enterprise Internet of Things deployments and the rapid shift towards Industry 4.0. Enterprises are increasingly leveraging Internet of Things (IoT) Monetization platforms to transform operational data into actionable insights and revenue opportunities. The growing adoption of cloud-based solutions, advanced analytics, and integration with artificial intelligence and machine learning is further driving market growth. Moreover, government initiatives supporting smart infrastructure and digital transformation, coupled with high information technology spending, are significantly contributing to market expansion.

Europe Internet of Things (IoT) Monetization Market Insight

The Europe Internet of Things (IoT) Monetization market is projected to expand at a substantial compound annual growth rate during the forecast period, primarily driven by stringent data management regulations and increasing investments in digital transformation. The rise in connected devices across manufacturing, retail, and energy sectors is fostering adoption of Internet of Things (IoT) Monetization solutions. European enterprises are focusing on operational efficiency, revenue optimization, and predictive analytics, boosting demand. The region’s digital maturity and strong enterprise information technology capabilities, combined with regulatory support, further reinforce market growth.

U.K. Internet of Things (IoT) Monetization Market Insight

The U.K. Internet of Things (IoT) Monetization market is anticipated to grow at a noteworthy compound annual growth rate during the forecast period, fueled by the adoption of cloud-based Internet of Things (IoT) Monetization platforms and increased enterprise digitization. Organizations are prioritizing real-time data insights, predictive analytics, and scalable monetization strategies. The country’s advanced information technology infrastructure and robust service ecosystem, along with government initiatives supporting Internet of Things (IoT) and smart city projects, are expected to sustain market growth.

Germany Internet of Things (IoT) Monetization Market Insight

The Germany Internet of Things (IoT) Monetization market is expected to expand at a considerable compound annual growth rate during the forecast period, driven by the integration of Internet of Things (IoT) platforms in industrial and manufacturing sectors. High awareness of data-driven decision-making and operational efficiency is encouraging enterprises to adopt monetization solutions. Germany’s focus on Industry 4.0, coupled with technological innovation and strong information technology infrastructure, is facilitating adoption across both large enterprises and small and medium-sized enterprises.

Asia-Pacific Internet of Things (IoT) Monetization Market Insight

The Asia-Pacific Internet of Things (IoT) Monetization market is poised to grow at the fastest compound annual growth rate during 2025 to 2032, driven by increasing enterprise digitization, urbanization, and technological advancements in countries such as China, Japan, and India. The region’s rising adoption of Internet of Things (IoT) platforms in manufacturing, retail, automotive, and smart city initiatives is accelerating market growth. Supportive government policies promoting digitalization and cloud adoption are driving enterprise interest in monetization solutions. Furthermore, Asia-Pacific’s growing technology services sector and affordability of Internet of Things (IoT) solutions are expanding access for small, medium, and large enterprises alike.

Japan Internet of Things (IoT) Monetization Market Insight

The Japan Internet of Things (IoT) Monetization market is gaining momentum due to rapid digitization, high technological adoption, and focus on operational efficiency. Enterprises are adopting Internet of Things (IoT) Monetization solutions to optimize manufacturing, logistics, and service operations. Integration with artificial intelligence and analytics platforms, along with the rise of connected devices in smart factories and offices, is boosting market adoption. Japan’s aging workforce and the push for automation and data-driven decision-making are expected to further drive demand.

China Internet of Things (IoT) Monetization Market Insight

The China Internet of Things (IoT) Monetization market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid industrial digitization, a large enterprise base, and government initiatives supporting smart manufacturing. The country’s strong technology ecosystem and increasing investments in cloud and artificial intelligence-enabled Internet of Things (IoT) platforms are key growth drivers. Enterprises are leveraging Internet of Things (IoT) Monetization to generate new revenue streams, improve operational efficiency, and implement predictive analytics. The growth of smart cities and digital infrastructure, alongside increasing awareness of data monetization strategies, continues to propel the market in China.

Internet of Things (IoT) Monetization Market Share

The internet of things (IoT) monetization industry is primarily led by well-established companies, including:

- Cisco Systems, Inc. (U.S.)

- PTC (U.S.)

- IBM (U.S.)

- SAP (Germany)

- Amdocs (U.S.)

- Aria Systems, Inc. (U.S.)

- Intel Corporation (U.S.)

- Oracle (U.S.)

- Google (U.S.)

- Microsoft (U.S.)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Tata Consultancy Services Limited (India)

- Nokia (Finland)

- Infosys Limited (India)

- Thales Group (France)

- CSG Systems International, Inc. (U.S.)

- SAMSUNG (South Korea)

- PortaOne, Inc. (Canada)

- Netcracker (U.S.)

- Magnaquest Technologies Ltd. (India)

- JeraSoft (U.K.)

Latest Developments in Global Internet of Things (IoT) Monetization Market

- In July 2025, Vodafone Spain announced the launch of its own Internet of Things (IoT) platform, aiming to develop new smart services for businesses and public administrations. The platform will enable the creation of intelligent applications in areas such as urban management, logistics, telecare, and water cycle management. Vodafone's extensive IoT network, with over 9.3 million connected devices, positions the company to consolidate its leadership in the IoT monetization market, accelerating adoption of smart services and data-driven solutions across enterprises

- In March 2025, Siemens unveiled significant advancements in industrial artificial intelligence, software-defined automation, and digital twin technology. These innovations are designed to drive digital transformation and sustainability across industries. Siemens introduced its first industrial foundation model to optimize engineering and automation processes. Collaborations with partners such as Audi, Accenture, NVIDIA, Microsoft, and AWS aim to accelerate the adoption of AI-driven IoT monetization solutions in manufacturing, enhancing operational efficiency and revenue generation

- In January 2025, Siemens showcased its industrial artificial intelligence and digital twin technologies at CES 2025, highlighting how these innovations enable unprecedented flexibility, optimization, and continuous improvement across industries. The integration of data, AI, and software-defined automation is expected to transform manufacturing processes, creating new opportunities for IoT monetization through predictive analytics and enhanced operational insights

- In November 2024, Deloitte emphasized the transformative impact of artificial intelligence on the consumer device ecosystem. The integration of AI with edge computing is enhancing user experiences through intelligent, personalized digital tools. Advanced chip technology, efficient large language models, and neural processing units are enabling on-device AI, reshaping interactions with mobile handsets, PCs, and other smart devices and driving new monetization avenues for IoT platforms

- In August 2024, Samsung and IBM announced a partnership to integrate Samsung Knox's mobile security features with IBM's QRadar Suite. This collaboration provides enterprises with centralized visibility into mobile device vulnerabilities and on-device threat intelligence. The integrated solution is expected to enhance risk mitigation for mobile endpoints, strengthening security in IoT deployments and supporting safer, monetizable data exchanges across enterprise networks

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.