Global Irish Butter Market

Market Size in USD Million

CAGR :

%

USD

967.28 Million

USD

1,418.26 Million

2024

2032

USD

967.28 Million

USD

1,418.26 Million

2024

2032

| 2025 –2032 | |

| USD 967.28 Million | |

| USD 1,418.26 Million | |

|

|

|

|

What is the Global Irish Butter Market Size and Growth Rate?

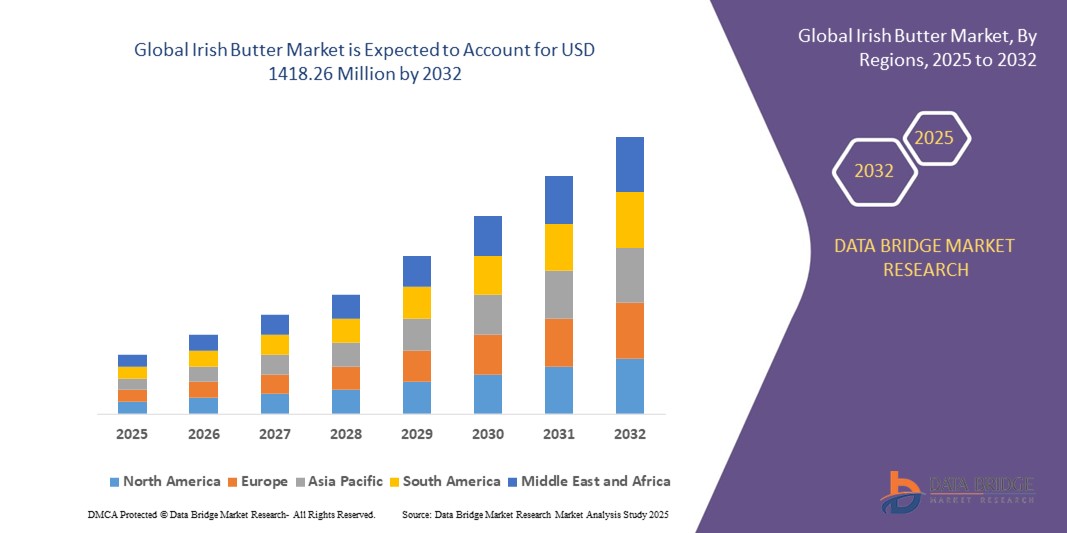

- The global irish butter market size was valued at USD 967.28 million in 2024 and is expected to reach USD 1418.26 million by 2032, at a CAGR of 4.90% during the forecast period

- The global Irish butter market is witnessing strong growth, driven by increasing consumer demand for premium, natural, and grass-fed dairy products. Renowned for its rich flavor and high quality, Irish butter is gaining popularity across both retail and foodservice sectors, particularly in North America and Europe

- The rise of health-conscious consumers and the growing trend toward clean-label and organic foods further bolster market expansion. However, challenges such as price volatility and competition from other premium butter brands exist. Despite this, the market benefits from Ireland’s strong dairy heritage and the global appeal of its butter

What are the Major Takeaways of Irish Butter Market?

- Irish Butters, offering electronic or digital access control for doors and gates, are increasingly vital components of modern home security and automation systems in both residential and commercial settings due to their enhanced convenience, remote access capabilities, and seamless integration with smart home ecosystems

- The escalating demand for Irish Butters is primarily fueled by the widespread adoption of smart home technologies, growing security concerns among consumers, and a rising preference for the convenience of keyless entry

- Europe dominated the Irish butter market with the largest revenue share of 42.3% in 2024, driven by a strong tradition of dairy consumption and the region’s reputation for premium quality dairy products

- North America is projected to grow at the fastest CAGR of 5.4% from 2025 to 2032, driven by increasing awareness of premium dairy imports and the rising popularity of European-style butter among consumers

- The salted butter segment dominated the market with the largest revenue share of 38.6% in 2024, driven by its widespread use in household cooking, baking, and food service applications

Report Scope and Irish Butter Market Segmentation

|

Attributes |

Irish Butter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Irish Butter Market?

Rising Demand for Premium and Organic Variants

- A significant and accelerating trend in the global Irish butter market is the surging demand for premium, organic, and grass-fed butter, driven by rising consumer health consciousness and preference for natural, minimally processed dairy products

- Irish butter, particularly grass-fed butter, is gaining popularity worldwide due to its superior flavor, higher nutritional value, and sustainable production practices compared to conventional alternatives

- For instance, Kerrygold (Ornua Co-operative Limited) has expanded its presence in the U.S. and European markets by emphasizing the premium quality of Irish grass-fed butter, which appeals to health-focused and gourmet consumers

- The growing popularity of clean-label and organic food products, supported by stricter food standards, is positioning Irish butter as a healthier and more authentic alternative to mass-produced butter

- This trend toward premiumization is reshaping consumer expectations in the dairy sector, making Irish butter a symbol of quality, heritage, and authenticity in global food markets

What are the Key Drivers of Irish Butter Market?

- The rising global demand for natural and organic dairy products is a key driver, with consumers increasingly associating Irish butter with quality and sustainability

- For instance, in March 2024, Ornua reported record sales of Kerrygold butter in the U.S., driven by consumer preference for grass-fed and non-GMO dairy options

- The growing trend of home baking and cooking post-pandemic has also increased butter consumption, with Irish butter favored for its rich flavor and versatility

- Export opportunities are expanding, particularly in North America, Europe, and Asia-Pacific, where consumers are willing to pay a premium for authentic Irish dairy

- Branding strategies that highlight Ireland’s pasture-based dairy system and environmental credentials are further boosting global demand for Irish butter

Which Factor is Challenging the Growth of the Irish Butter Market?

- Price sensitivity remains a key challenge, as Irish butter is often priced higher than conventional alternatives, limiting its adoption in some cost-conscious markets

- For instance, the price gap between Kerrygold and local butter brands in markets such as the U.S. and Asia can deter mass-market consumers from switching to premium Irish butter

- Competition from plant-based butter substitutes is another hurdle, as vegan and flexitarian consumers increasingly opt for dairy-free spreads, particularly in Europe and North America

- Export dependency poses risks, as fluctuations in international trade policies, tariffs, and supply chain disruptions can impact Irish butter exports

- Overcoming these challenges through competitive pricing, innovation in packaging and portion sizes, and diversification into dairy-free variants will be critical for sustaining growth

How is the Irish Butter Market Segmented?

The market is segmented on the basis of product type, packaging type, application, and distribution channel.

- By Product Type

On the basis of product type, the Irish butter market is segmented into salted butter, unsalted butter, grass-fed butter, organic butter, flavored butter, clarified butter, and others. The salted butter segment dominated the market with the largest revenue share of 38.6% in 2024, driven by its widespread use in household cooking, baking, and food service applications. Consumers often prefer salted butter for its longer shelf life and enhanced flavor, making it a staple in both domestic and international markets.

The organic butter segment is expected to register the fastest CAGR from 2025 to 2032, fueled by rising health-conscious consumer preferences, demand for chemical-free dairy, and premiumization trends. In addition, the strong global reputation of Irish dairy for purity and sustainability positions organic butter as an attractive product for export. Flavored butter and grass-fed varieties are also gaining momentum, particularly in gourmet and specialty retail channels.

- By Packaging Type

On the basis of packaging type, the Irish butter market is segmented into sticks, tubs, blocks, wrappers/parchment, bulk packaging, and others. The blocks segment held the largest market share of 41.2% in 2024, attributed to its extensive adoption in households, bakeries, and the food processing sector. Blocks offer convenience in portioning and storage, making them the preferred format for both domestic and industrial users.

The tubs segment is projected to experience the fastest CAGR from 2025 to 2032, supported by the rising demand for spreadable butter products and consumer convenience in urban households. Tubs also cater to flavored and organic butter products, aligning with premium consumption trends. Bulk packaging remains critical for food service and export, particularly for industrial applications. Increasing innovation in eco-friendly and sustainable packaging materials is expected to further boost the market appeal of tubs and wrappers in the coming years.

- By Application

On the basis of application, the Irish butter market is segmented into food service, industrial, and household. The household segment dominated the market with the largest revenue share of 45.7% in 2024, driven by the everyday use of butter in cooking, baking, and as a spread. The popularity of home cooking, growing health awareness, and premium butter consumption trends have further strengthened household demand.

The food service segment is expected to grow at the fastest CAGR from 2025 to 2032, owing to the rapid expansion of cafes, bakeries, and fine-dining establishments across Europe, North America, and Asia-Pacific. Irish butter, recognized globally for its rich taste and quality, is increasingly being used in gourmet menus and artisanal baked goods. The industrial segment continues to support large-scale bakery and confectionery manufacturing, but premium household consumption and rising food service innovation remain key growth accelerators.

- By Distribution Channel

On the basis of distribution channel, the Irish butter market is segmented into supermarkets/hypermarkets, convenience stores, specialty stores, online/e-commerce, and others. The supermarkets/hypermarkets segment dominated the market with the largest revenue share of 47.3% in 2024, owing to wide product availability, bulk purchasing, and the presence of multiple Irish butter brands in retail chains. Consumers prefer these outlets for their variety, discounts, and reliability in quality.

The online/e-commerce segment is projected to grow at the fastest CAGR from 2025 to 2032, supported by the rising trend of digital grocery shopping, subscription-based dairy delivery, and global consumer access to premium Irish butter. Specialty stores also contribute significantly by catering to niche demands for organic, grass-fed, and flavored butter. Meanwhile, convenience stores maintain steady sales in urban and semi-urban areas, appealing to on-the-go consumers. The shift toward digital-first strategies among leading dairy brands will accelerate online sales penetration.

Which Region Holds the Largest Share of the Irish Butter Market?

- Europe dominated the Irish butter market with the largest revenue share of 42.3% in 2024, driven by a strong tradition of dairy consumption and the region’s reputation for premium quality dairy products

- Consumers in Europe highly value the authenticity, natural production methods, and sustainability credentials of Irish Butter, making it a staple in both households and foodservice sectors

- The region’s dominance is further reinforced by the European Union’s supportive dairy policies, strong retail networks, and growing demand for organic and grass-fed butter varieties, positioning Irish Butter as a premium choice across major markets

U.K. Irish Butter Market Insight

The U.K. Irish butter market is witnessing robust growth, fueled by consumer preference for premium, natural dairy products and the increasing adoption of Irish-origin butter in retail and hospitality channels. Despite trade challenges post-Brexit, the U.K.’s reliance on Irish imports ensures steady demand. The growing trend of home baking and premium food consumption further boosts the Irish Butter market in the country.

Germany Irish Butter Market Insight

Germany remains one of the key importers of Irish Butter, supported by its large bakery and confectionery industry. Rising demand for sustainable, traceable, and organic dairy products aligns well with Ireland’s grass-fed butter offerings. The integration of Irish Butter in processed foods, combined with strong retail visibility, is expected to support market growth in Germany.

Which Region is the Fastest Growing Region in the Irish Butter Market?

North America is projected to grow at the fastest CAGR of 5.4% from 2025 to 2032, driven by increasing awareness of premium dairy imports and the rising popularity of European-style butter among consumers. U.S. and Canadian markets are experiencing a shift toward natural, grass-fed, and artisanal dairy options, with Irish Butter brands gaining prominence in retail and foodservice. The region’s growth is also supported by rising disposable incomes, strong e-commerce platforms, and consumer preference for authentic international food products.

U.S. Irish Butter Market Insight

The U.S. accounts for the largest share in North America, with rapid adoption of Irish Butter fueled by its association with natural, premium quality. Consumers are incorporating it in home baking, cooking, and health-focused diets such as keto. Robust distribution partnerships with major retail chains such as Whole Foods and Trader Joe’s have strengthened Irish Butter’s visibility and penetration across the U.S.

Canada Irish Butter Market Insight

Canada is emerging as a growing market for Irish Butter, supported by consumer demand for premium European dairy and the expansion of gourmet and specialty food retail stores. The increasing adoption of Western dietary trends and rising health awareness about grass-fed dairy are further fueling growth in the Canadian market.

Which are the Top Companies in Irish Butter Market?

The irish butter industry is primarily led by well-established companies, including:

- Ornua Co-operative Limited (Ireland)

- Glenstal Foods (Ireland)

- Dairygold Co-Operative Society Limited (Ireland)

- Glanbia Ireland (Ireland)

- The Little Milk Company (Ireland)

- Arrabawn Co-operative Society (Ireland)

- Aurivo Co-operative Society Ltd (Ireland)

- Carbery Group (Ireland)

- Tipperary Co-operative Creamery Ltd. (Ireland)

- Lakeland Dairies Co-operative Society Ltd. (Ireland)

- Wexford Milk Producers (Ireland)

- North Cork Creameries (Ireland)

- Kerry Group Plc (Ireland)

- Clona Dairy Products Ltd. (Ireland)

- Coolhull Farm (Ireland)

- Bandon Co-op (Ireland)

- Drinagh Co-operative Ltd. (Ireland)

What are the Recent Developments in Global Irish Butter Market?

- In March 2024, Ór-Real Irish Butter expanded its product portfolio by launching two new options, a smaller 227g pack and an unsalted variant, to cater to rising consumer demand. The smaller packs offer greater convenience, particularly for baking needs, thereby strengthening the brand’s market appeal

- In October 2023, Kerrygold enhanced its product range with the introduction of the Kerrygold Butter Stick, featuring 25g marks for precise usage. This innovation is designed to meet the needs of chefs and bakers, further reinforcing the brand’s strong presence in the dairy market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.