Global Iron Ore Mining Market

Market Size in USD Billion

CAGR :

%

USD

3.26 Billion

USD

5.46 Billion

2024

2032

USD

3.26 Billion

USD

5.46 Billion

2024

2032

| 2025 –2032 | |

| USD 3.26 Billion | |

| USD 5.46 Billion | |

|

|

|

|

Iron Ore Mining Market Size

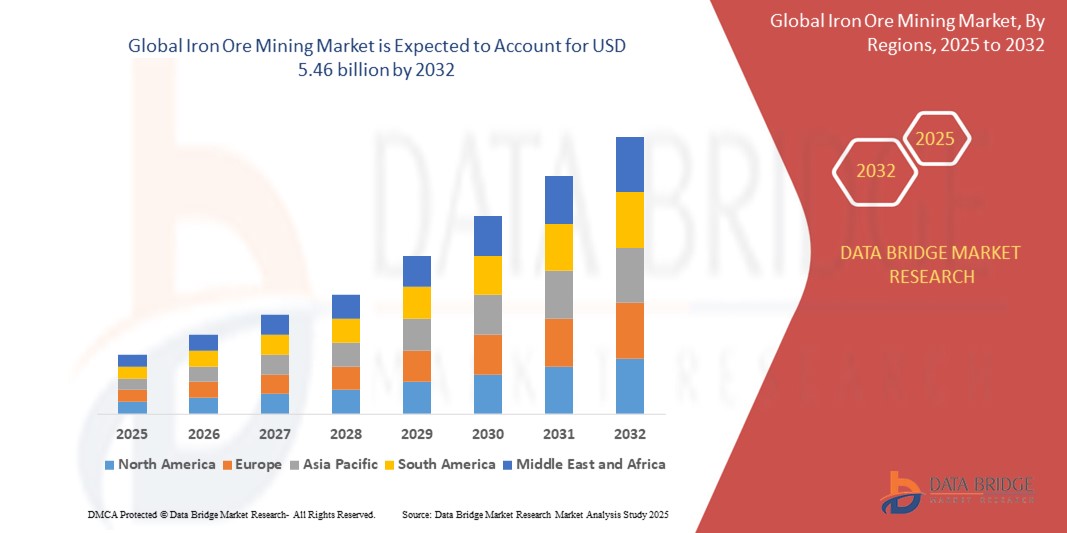

- The global iron ore mining market was valued at USD 3.26 billion in 2024 and is expected to reach USD 5.46 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.10%, primarily driven by the increased demand for steel production and infrastructure development for the Iron Ore Mining Market

- This growth is driven by factors such as rising industrialization, urbanization, and the growing construction and automotive sectors

Iron Ore Mining Market Analysis

- The iron ore mining market has shown steady growth and is expected to continue this trend over the coming years

- The demand for iron ore is closely linked to the increasing need for steel, which is vital for industries such as construction, automotive, and infrastructure development

- As industrialization grows globally, the need for iron ore rises, resulting in higher production levels and increased market activities

- The market participants are focusing on increasing their production capacities and improving the efficiency of their supply chains to keep up with the rising demand

- For instance, major iron ore-producing countries play a critical role in influencing global supply and demand, where the consumption patterns in these countries directly affect the market flow and market is driven by global industrialization, rising steel demand, and the efforts of market participants to enhance production and supply chain efficiency

Report Scope and Iron Ore Mining Market Segmentation

|

Attributes |

Iron Ore Mining Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Iron Ore Mining Market Trends

“Increasing Need for Steel Across Multiple Industries”

- The iron ore mining market is witnessing a steady increase in demand, mainly due to the growing need for steel across multiple industries such as construction and manufacturing

- Technological advancements in mining processes are helping companies improve efficiency and reduce operational costs, contributing to market growth

- Increased international trade in iron ore is facilitating better access to global markets, creating opportunities for growth in mining activities and production capabilities

- The demand for iron ore is driven by both economic growth and industrial expansion, pushing companies to focus on optimizing their production capacities and exploring new mining technologies

- For instance, innovations in automation and data analytics are helping mining companies improve ore extraction methods and manage their operations more effectively and thus market is driven by rising steel demand, technological innovations, and enhanced global trade opportunities

Iron Ore Mining Market Dynamics

Driver

“Increased Demand for Steel”

- One of the key drivers for the growth of the iron ore mining market is the increasing demand for steel, a vital material in industries such as construction, automotive, infrastructure development, and heavy machinery

- Steel production relies heavily on iron ore, which is the primary raw material used in the steelmaking process, making the demand for iron ore directly linked to the rising need for steel across various sectors

- As economies continue to industrialize and urbanize, the growing requirement for infrastructure, buildings, roads, and vehicles further fuels the demand for steel, driving the need for more iron ore

- For instance, in rapidly developing countries, large-scale infrastructure projects like highways, bridges, and residential complexes contribute to higher steel consumption, which directly impacts the demand for iron ore

- In addition, the automotive industry increasingly requires lightweight yet durable steel for vehicle manufacturing, which further increases the demand for iron ore, ensuring long-term market growth in the iron ore mining sector

Opportunity

“Technological Advancements in Mining”

- An emerging opportunity in the iron ore mining market is the continuous advancement of mining technologies that enhance productivity and sustainability

- Over time, technology has played a pivotal role in transforming the mining industry, enabling companies to improve efficiency, lower costs, and reduce environmental impact

- Automation, robotics, and artificial intelligence are being incorporated into mining operations to streamline processes, with autonomous trucks and drilling systems improving both productivity and safety

- For instance, the integration of big data and predictive analytics allows mining companies to optimize resource management, improve mining schedules, and predict equipment failures, which helps reduce downtime and increase overall efficiency

- Furthermore, innovations in ore beneficiation technologies allow miners to extract higher-quality iron ore from lower-grade deposits, which boosts profitability while supporting more environmentally sustainable practices, like water recycling and dust suppression technologies, which reduce the environmental impact of mining activities

Restraint/Challenge

“Environmental Concerns and Regulations”

- One of the major challenges in the iron ore mining market is the growing environmental concerns associated with mining operations, which lead to significant ecological damage, such as deforestation, habitat destruction, water contamination, and air pollution

- As awareness of climate change and sustainability rises globally, mining companies face increasing pressure to adopt environmentally friendly practices to mitigate these impacts, requiring them to integrate new technologies and strategies for sustainable mining

- Governments worldwide are imposing stricter regulations on mining, requiring companies to meet environmental standards that can result in higher compliance costs, such as implementing waste management systems, monitoring air quality, and adhering to emissions standards

- For instance, companies like Rio Tinto and Vale have faced increasing scrutiny and legal action over their environmental practices, with Vale’s involvement in the 2019 Brumadinho dam disaster highlighting the severe consequences of environmental mismanagement

- The social impacts of mining, such as displacement of local communities and disruption of agricultural activities, have led to resistance from local populations and environmental groups, with protests and legal challenges becoming more common against large-scale mining projects

Iron Ore Mining Market Scope

The market is segmented on the basis of type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By End User |

|

Iron Ore Mining Market Regional Analysis

“Asia Pacific is the Dominant Region in the Iron Ore Mining Market”

- The Asia-Pacific region remains the dominant force in the global iron ore mining market, primarily due to China's massive consumption and demand for iron ore

- China, as the largest global consumer and importer of iron ore, accounts for over 60% of global imports, significantly shaping global production, pricing, and trade trends

- China’s steel industry, which supports construction, automotive, and manufacturing, heavily relies on iron ore, with demand continuing to rise as urbanization and infrastructure development accelerate

- Other countries in the region, such as Japan and South Korea, also contribute to the demand, as they possess strong industrial sectors that require a steady supply of iron ore

- Australia, one of the top producers and exporters of iron ore, plays a critical role in meeting Asia-Pacific’s demand, further cementing the region's dominance in the global iron ore mining market

“North America is Projected to Register the Highest Growth Rate”

- North America has emerged as the fastest-growing region in the global iron ore mining market, driven by factors like investments in mining technology, rising industrial activities, and increased infrastructure development

- The U.S., with its focus on economic recovery and infrastructure development, has seen a notable rise in steel demand, directly impacting the need for iron ore to meet manufacturing and construction requirements

- Major industrial sectors such as construction, automotive, and machinery manufacturing are increasingly demanding steel, which in turn fuels the need for iron ore to support these industries

- The U.S. government’s infrastructure spending on projects such as roadways, bridges, and energy initiatives is expected to continue driving steel production, increasing the demand for iron ore

- Canada’s large iron ore reserves and the region’s adoption of advanced mining technologies, like automation, AI, and sustainable practices, have helped boost mining efficiency and production capacity, further strengthening North America's position in the iron ore market

Iron Ore Mining Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BHP (Australia)

- Rio Tinto (U.K.)

- Northern Iron & Machine (U.S.)

- Shree Minerals Ltd. (Australia)

- Mount Gibson Iron (Australia)

- Vale (Brazil)

- ArcelorMittal (Luxembourg)

- NIPPON STEEL CORPORATION

- (Japan)

- POSCO (South Korea)

- Tata Steel (U.K.)

- Great Panther Mining Limited (Canada)

- Atlas Iron Works (U.S.)

- Iron Ore Company of Canada. (Canada)

- Kudremukh Iron Ore Company (India)

- Cleveland-Cliffs Inc. (U.S.)

- GFG Alliance (U.K.)

- Eurasian Resources Group (Luxembourg)

- JSW (India)

- Mineral Resources (Australia)

- Exxaro. (South Africa)

Latest Developments in Global Iron Ore Mining Market

- In March 2024, Ursa Space Systems launched a new product offering weekly volumetric measurements of iron ore stockpiles at key global locations. This product, using radar satellite imagery, provides critical insights into market trends, helping traders better understand supply-demand dynamics and make more informed decisions

- In 2027, Kazakhstan plans to launch the Lomonosovske iron ore project with 74 million tons of iron ore concentrate reserves. Located in the Kostanay region, this project aims to supply high-grade raw materials for the green steel sector, contributing to decarbonization efforts. Despite challenges with financing and excavation, the project is poised to play a key role in the growing demand for high-grade iron ore concentrate in global markets

- In July 2021, Vedanta Zinc International launched a new iron ore product line at its Black Mountain Mine (BMM) in South Africa. The project aims to produce high-grade iron ore and dense media separation products, supporting the steel and coal industries. The initiative is expected to enhance the competitiveness and sustainability of BMM operations, contributing to local economic development and providing new employment opportunities in the region

- In January 2024, Tata Steel’s Noamundi Iron Mine marked its 100th anniversary of sustainable mining. The mine, located in Jharkhand, India, has been a key player in producing high-quality iron ore, contributing to Tata Steel’s long-standing commitment to environmental sustainability and community development. This milestone highlights the successful integration of responsible mining practices with continuous technological advancements over the years

- In 2011, ArcelorMittal formally commenced commercial iron ore production in Liberia. This marks a significant milestone in the country’s economic recovery following civil war, with ArcelorMittal contributing to infrastructure development, including roads, railways, and educational facilities. The project reflects the company’s commitment to responsible business practices, sustainable mining, and enhancing local economic opportunities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Iron Ore Mining Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Iron Ore Mining Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Iron Ore Mining Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.