Global Isobutyl Stearate Market

Market Size in USD Billion

CAGR :

%

USD

159.36 Billion

USD

232.59 Billion

2023

2031

USD

159.36 Billion

USD

232.59 Billion

2023

2031

| 2024 –2031 | |

| USD 159.36 Billion | |

| USD 232.59 Billion | |

|

|

|

|

Isobutyl Stearate Market Size

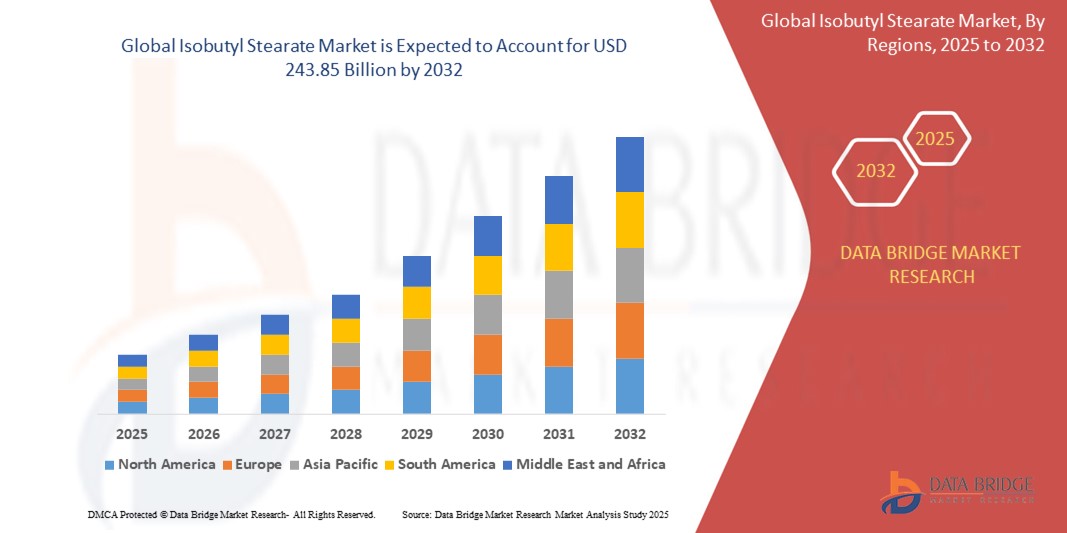

- The global isobutyl stearate market size was valued at USD 167.07 billion in 2024 and is expected to reach USD 243.85 billion by 2032, at a CAGR of 4.84% during the forecast period

- The market growth is primarily driven by increasing demand for eco-friendly and versatile chemical compounds in industries such as cosmetics, pharmaceuticals, and lubricants, fueled by advancements in formulation technologies and sustainable production methods

- Rising consumer preference for high-quality personal care products and the expanding industrial applications of isobutyl stearate in coatings, lubricants, and plastics processing are key factors accelerating market expansion

Isobutyl Stearate Market Analysis

- Isobutyl stearate, a versatile ester used as an emollient, lubricant, and solvent, is a critical component in various industries, including personal care, pharmaceuticals, and industrial applications, due to its excellent chemical stability, low toxicity, and compatibility with diverse formulation

- The growing demand for isobutyl stearate is driven by its widespread use in cosmetics for skin conditioning, in lubricants for metalworking, and in coatings for enhanced durability, alongside increasing consumer awareness of sustainable and biodegradable ingredients

- Asia-Pacific dominated the isobutyl stearate market with the largest revenue share of 42.5% in 2024, attributed to rapid industrialization, a booming cosmetics industry, and a strong manufacturing base in countries such as China, India, and Japan

- North America is expected to be the fastest-growing region during the forecast period, driven by increasing demand for high-quality personal care products, advancements in pharmaceutical formulations, and growing industrial applications

- The liquid segment dominated the largest market revenue share of 45% in 2023, driven by its versatility and ease of integration in formulations for cosmetics, lubricants, and coatings

Report Scope and Isobutyl Stearate Market Segmentation

|

Attributes |

Isobutyl Stearate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Isobutyl Stearate Market Trends

“Increasing Integration of Advanced Technologies”

- The global isobutyl stearate market is experiencing a notable trend toward the integration of advanced manufacturing technologies, such as automated production processes and green chemistry innovations

- These technologies enable more efficient synthesis methods, such as transesterification of natural fats and oils, which improve yield, reduce production costs, and align with sustainability goals

- Advanced technologies facilitate the development of high-purity isobutyl stearate, particularly for cosmetic and pharmaceutical applications, meeting stringent quality standards

- For instance, companies are leveraging automated systems to optimize production for consistent quality in applications such as cosmetics, where isobutyl stearate is used as an emollient, and in lubricants, where precise formulations enhance performance

- This trend enhances the market's appeal by offering eco-friendly and biodegradable products, catering to consumer demand for sustainable solutions across industries such as personal care and industrial applications

- Data analytics and process optimization are also being employed to monitor raw material usage and streamline supply chains, ensuring cost-effectiveness and scalability

Isobutyl Stearate Market Dynamics

Driver

“Rising Demand for Sustainable and Bio-Based Products”

- Increasing consumer preference for eco-friendly and bio-based products is a key driver for the global isobutyl stearate market

- Isobutyl stearate, derived from natural sources such as stearic acid and isobutanol, is valued for its biodegradability, making it a preferred choice in cosmetics, personal care, and industrial applications

- Regulatory mandates in regions such as Europe and Asia-Pacific, promoting sustainable chemicals and reduced environmental impact, are boosting the adoption of isobutyl stearate

- The growth of the cosmetics and personal care industry, particularly in Asia-Pacific, drives demand for isobutyl stearate in products such as creams, lotions, and makeup due to its emollient and moisturizing properties

- Advancements in production technologies and the expansion of applications in textiles, pharmaceuticals, and lubricants further support market growth, especially in emerging economies with rising disposable incomes

Restraint/Challenge

“High Production Costs and Raw Material Price Volatility”

- The high initial investment required for advanced manufacturing technologies and equipment for producing isobutyl stearate can be a significant barrier, particularly for small-scale manufacturers in emerging markets

- The production process relies on raw materials such as stearic acid and isobutylene, which are subject to price fluctuations due to market dynamics, geopolitical issues, or supply chain disruptions, increasing overall costs

- Data security concerns are less prevalent in this market, but regulatory compliance with environmental and safety standards across different regions can complicate operations and raise cost

- The fragmented regulatory landscape, with varying standards for chemical production and usage in different countries, poses challenges for international manufacturers and limits market expansion.

- These factors may deter adoption in cost-sensitive regions and industries, potentially slowing market growth despite rising demand for sustainable products

Isobutyl Stearate market Scope

The market is segmented on the basis of type, application, form, grade, and end user.

- By Type

On the basis of type, the global isobutyl stearate market is segmented into liquid, powder, and adhesives. The liquid segment dominated the largest market revenue share of 45% in 2023, driven by its versatility and ease of integration in formulations for cosmetics, lubricants, and coatings. Its low viscosity and excellent solvency properties make it a preferred choice across multiple industries.

The adhesives segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand in industrial applications for enhanced adhesion properties and flexibility in automotive and packaging sectors. The rise in eco-friendly adhesive formulations further boosts adoption.

- By Application

On the basis of application, the global isobutyl stearate market is segmented into lubricants, cosmetics, inks, soaps, coatings, polishes, ointments, cable materials, artificial leather, rolled film, flavoring agent, solvent, and others. The cosmetics segment dominated the market with a revenue share of 42% in 2023, fueled by its widespread use as an emollient and thickener in creams, lotions, and makeup, driven by rising consumer demand for premium personal care products.

The lubricants segment is anticipated to experience the fastest growth rate from 2025 to 2032, propelled by increasing adoption in automotive and industrial applications for reducing friction and enhancing performance. Stringent environmental regulations promoting bio-based lubricants further accelerate market expansion.

- By Form

On the basis of form, the global isobutyl stearate market is segmented into oily liquid and waxy solid. The oily liquid segment accounted for the largest market revenue share of 62% in 2024, owing to its superior spreadability, compatibility with various formulations, and ease of handling in manufacturing processes for cosmetics, pharmaceuticals, and coatings.

The waxy solid segment is expected to witness significant growth from 2025 to 2032, driven by its use as a thickener and stabilizer in personal care products and as a lubricant in industrial applications such as artificial leather and cable materials. Its stability in demanding environments supports its growing adoption.

- By Grade

On the basis of grade, the global isobutyl stearate market is segmented into technical grade (40-60%) and cosmetic/pharma grade (<99%). The cosmetic/pharma grade segment held the largest market revenue share of 58% in 2024, driven by its high purity and safety standards required for applications in personal care and pharmaceutical formulations, such as ointments and creams.

The technical grade segment is projected to grow rapidly from 2025 to 2032, fueled by its cost-effectiveness and increasing use in industrial applications such as lubricants, coatings, and plastics, particularly in emerging markets with expanding manufacturing sectors.

- By End User

On the basis of end user, the global isobutyl stearate market is segmented into pharmaceuticals and healthcare, personal care, metal working, plastic processing, textile and apparel, rubber, industrial, electrical and electronics, packaging, automotive, and others. The personal care segment dominated the market with a revenue share of 60% in 2024, driven by the rising demand for natural and bio-based ingredients in cosmetics and skincare products, particularly in emerging markets.

The automotive segment is anticipated to witness the fastest growth rate of 8.2% from 2025 to 2032, driven by increasing use of isobutyl stearate in lubricants and coatings for enhanced performance and sustainability. The expansion of the automotive industry in emerging markets further supports this growth.

Isobutyl Stearate Market Regional Analysis

- Asia-Pacific dominated the isobutyl stearate market with the largest revenue share of 42.5% in 2024, attributed to rapid industrialization, a booming cosmetics industry, and a strong manufacturing base in countries such as China, India, and Japan

- Consumers prioritize isobutyl stearate for its emollient, lubricating, and solvent properties, enhancing product performance in personal care, industrial, and textile applications across diverse climatic condition

- Growth is supported by advancements in eco-friendly manufacturing processes, such as transesterification of natural fats, and increasing adoption in both industrial and consumer product segments

U.S. Isobutyl Stearate Market Insight

The U.S. isobutyl stearate market is expected to witness significant growth, fueled by strong demand in the personal care and textile industries, alongside growing awareness of its eco-friendly and biodegradable benefits. The trend toward sustainable product formulations and increasing regulations promoting bio-based chemicals further boost market expansion. The integration of isobutyl stearate in cosmetics and industrial lubricants complements both OEM and aftermarket sales, creating a robust market ecosystem.

Europe Isobutyl Stearate Market Insight

The Europe isobutyl stearate market is expected to witness significant growth, supported by regulatory emphasis on sustainable and bio-based chemicals. Consumers seek isobutyl stearate for its emollient and lubricating properties, which improve product texture and performance in cosmetics and industrial applications. Growth is prominent in both new formulations and retrofit applications, with countries such as Germany and France showing significant uptake due to rising environmental concerns and industrial demand.

U.K. Isobutyl Stearate Market Insight

The U.K. market for isobutyl stearate is expected to witness rapid growth, driven by demand for enhanced product performance in personal care and textile applications in urban and suburban settings. Increased interest in sustainable ingredients and rising awareness of isobutyl stearate’s eco-friendly benefits encourage adoption. Evolving regulations promoting bio-based chemicals influence consumer choices, balancing performance with environmental compliance.

Germany Isobutyl Stearate Market Insight

Germany is expected to witness rapid growth in the isobutyl stearate market, attributed to its advanced manufacturing sector and high consumer focus on sustainability and product efficiency. German industries prefer technologically advanced isobutyl stearate formulations that enhance performance in cosmetics, lubricants, and textiles while contributing to environmental goals. The integration of these products in premium industrial and consumer goods supports sustained market growth.

Asia-Pacific Isobutyl Stearate Market Insight

The Asia-Pacific region dominates the global isobutyl stearate market and is expected to maintain its lead, driven by expanding cosmetics, pharmaceutical, and textile industries in countries such as China, India, and Japan. Increasing awareness of isobutyl stearate’s emollient, lubricating, and eco-friendly properties boosts demand. Government initiatives promoting sustainable chemicals and bio-based products further encourage the use of advanced isobutyl stearate formulations.

Japan Isobutyl Stearate Market Insight

Japan’s isobutyl stearate market is expected to witness rapid growth due to strong consumer preference for high-quality, sustainable isobutyl stearate formulations that enhance product performance and environmental compliance. The presence of major manufacturers and the integration of isobutyl stearate in cosmetics and industrial applications accelerate market penetration. Rising interest in sustainable aftermarket products also contributes to growth.

China Isobutyl Stearate Market Insight

China holds the largest share of the Asia-Pacific isobutyl stearate market, propelled by rapid urbanization, rising consumer demand for personal care and textile products, and increasing need for eco-friendly industrial solutions. The country’s growing middle class and focus on sustainable manufacturing support the adoption of advanced isobutyl stearate formulations. Strong domestic production capabilities and competitive pricing enhance market accessibility.

Isobutyl Stearate Market Share

The isobutyl stearate industry is primarily led by well-established companies, including:

- Emery Oleochemicals (U.S.)

- Oleon NV (Belgium)

- A&A Fratelli Parodi S.p.A (Italy)

- Industrial Quimica Lasem S.A.U. (Spain)

- DAYANG CHEM (HANGZHOU) CO., LTD (China)

- MOSSELMAN. (Belgium)

- Dow (U.S.)

- 3M (U.S.)

- Huntsman International LLC. (U.S.)

- Ashland (U.S.)

- Fine Organic Industries Limited (India)

- Merck KGaA, Darmstadt (Germany)

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Eastman Chemical Company (U.S.)

- Exxon Mobil Corporation. (U.S.)

- Nouryon (Netherlands)

What are the Recent Developments in Global Isobutyl Stearate Market?

- In January 2024, Ataman Chemicals introduced a new line of bio-based Isobutyl Stearate, crafted to serve the evolving needs of the cosmetics and personal care industries. Derived from renewable sources, this innovative ester delivers superior emollient properties, making it ideal for skincare formulations that prioritize both performance and sustainability. The launch reflects Ataman’s commitment to eco-conscious chemistry and responds to increasing consumer demand for natural, skin-friendly ingredients that align with clean beauty trends

- In March 2023, Emery Oleochemicals expanded its Isobutyl Stearate production capacity in Europe, a strategic decision aimed at meeting the rising demand from the automotive and lubricants sectors. Known for its excellent lubricating properties and biodegradability, Isobutyl Stearate plays a vital role in high-performance formulations. This move not only strengthens Emery’s foothold in the global esters market but also aligns with the industry's shift toward sustainable, high-efficiency lubricant solutions

- In December 2022, Oleon NV partnered with a prominent cosmetic brand to co-develop a high-purity Isobutyl Stearate formulation tailored for premium skincare applications. This collaboration harnessed Oleon’s deep expertise in bio-based esters to deliver lightweight, non-greasy moisturizers that align with the growing demand for clean beauty solutions. The initiative reflects a shared commitment to sustainability and innovation in personal care, offering consumers high-performance products with a natural touch

- In October 2022, A&A Fratelli Parodi Spa acquired a minority stake in an Asia-based Isobutyl Stearate manufacturer, marking a strategic move to broaden its geographic footprint and reinforce its supply chain capabilities. This investment is designed to support the company’s growth in the personal care and pharmaceutical sectors, particularly within the fast-expanding Asia-Pacific market. By securing regional production capacity, A&A Fratelli Parodi aims to meet increasing demand for bio-based esters and enhance responsiveness to local market needs

- In June 2022, Merck KGaA launched an advanced grade of Isobutyl Stearate tailored for pharmaceutical applications, with a focus on enhancing solubility and bioavailability in drug delivery systems. This high-purity ester supports the development of complex formulations by serving as a reliable excipient, aligning with the pharmaceutical industry's demand for efficient, stable, and biocompatible ingredients. The product reflects Merck’s ongoing commitment to innovation in specialty chemicals and its role in advancing formulation science

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Isobutyl Stearate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Isobutyl Stearate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Isobutyl Stearate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.