Global Isodecanol Market

Market Size in USD Billion

CAGR :

%

USD

4.92 Billion

USD

21.31 Billion

2024

2032

USD

4.92 Billion

USD

21.31 Billion

2024

2032

| 2025 –2032 | |

| USD 4.92 Billion | |

| USD 21.31 Billion | |

|

|

|

|

What is the Global Isodecanol Market Size and Growth Rate?

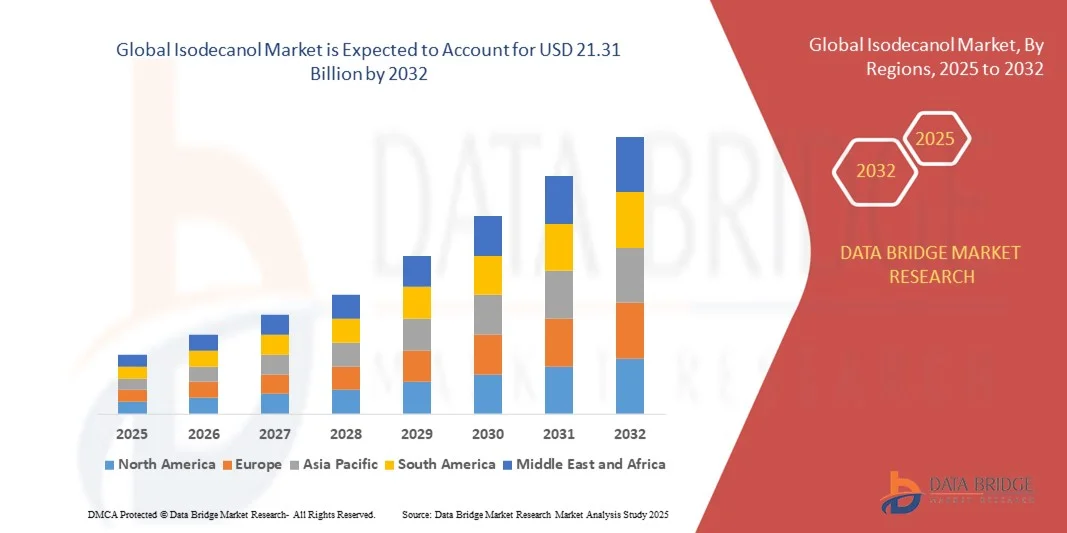

- The global Isodecanol market size was valued at USD 4.92 billion in 2024 and is expected to reach USD 21.31 billion by 2032, at a CAGR of 4.40% during the forecast period

- The growing usages of the product as a fragrance agent in perfumes, increasing applications of the product in synthesize derivatives, polymer additives, surfactant and others, growing number of initiatives by the government in the agriculture sector for enabling farmers to adopt new and advanced technology, prevalence of well-established distribution network are some of the major as well as important factors which will likely to accelerate the growth of the isodecanol market

What are the Major Takeaways of Isodecanol Market?

- Adoption of organic and inorganic growth strategies to increase sales and revenue which will further contribute by generating immense opportunities that will led to the growth of the isodecanol market in the above mentioned projected timeframe

- Limited availability of raw material for the composition of isodecanol which will likely to act as market restraint factor for the growth of the isodecanol

- Asia-Pacific dominated the Isodecanol market with the largest revenue share of 39.31% in 2024, driven by rapid urbanization, growing industrialization, and increasing adoption of high-performance chemicals across end-use industries

- The North America isodecanol market is poised to grow at the fastest CAGR of 9.24% during 2025–2032, driven by increasing industrial automation, rising demand for high-performance chemical intermediates, and technological advancements across end-use industries

- The 2-Octyldodecanol segment dominated the market with the largest revenue share of 38.6% in 2024, owing to its wide application in cosmetics, lubricants, and surfactants due to its excellent emollient properties and chemical stability

Report Scope and Isodecanol Market Segmentation

|

Attributes |

Isodecanol Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Isodecanol Market?

Growing Focus on Bio-Based and Sustainable Production

- A significant and accelerating trend in the global isodecanol market is the shift toward bio-based and sustainable production processes, driven by increasing environmental awareness and tightening global regulations. Manufacturers are focusing on using renewable raw materials such as bio-based feedstocks and adopting green chemistry principles to reduce carbon footprints and improve process efficiency

- For instance, Evonik Industries AG and BASF SE have been investing in the development of bio-based oxo alcohols, including Isodecanol, to minimize environmental impact while meeting growing industrial demand. These advancements are in line with the global shift toward sustainable chemical manufacturing

- Moreover, the integration of circular economy principles is gaining traction, with producers exploring recycling methods and waste valorization to optimize resource utilization. Companies are adopting low-emission technologies and renewable energy sources to enhance production efficiency and compliance with sustainability mandates

- The rising demand for eco-friendly plasticizers, lubricants, and surfactants—key applications of Isodecanol—is further propelling the adoption of greener production pathways. This is driven by consumer preference for sustainable end-products and industrial buyers’ increasing focus on environmental certifications

- Leading companies such as Shell Group and Arkema are actively investing in R&D for sustainable alcohol derivatives and renewable chemical manufacturing, positioning themselves as leaders in the transition toward a low-carbon chemical industry

- This growing emphasis on bio-based and sustainable Isodecanol production marks a pivotal shift in the market, aligning with global climate goals and reshaping long-term production strategies across the value chain

What are the Key Drivers of Isodecanol Market?

- The rising demand for Isodecanol in surfactants, lubricants, and plasticizers industries is a major driver of market growth. Its versatility in applications ranging from detergents and coatings to cosmetics and adhesives is fueling widespread adoption across end-use sectors

- For instance, in April 2024, BASF SE expanded its oxo-alcohol production capacity to meet growing global demand for surfactant intermediates, including Isodecanol, used in personal care and industrial applications. Such strategic expansions by leading players highlight the strong market outlook

- The increasing shift toward high-performance lubricants and specialty chemicals is also boosting Isodecanol consumption, as it enhances viscosity, stability, and biodegradability in formulations. Its use in producing eco-friendly plasticizers provides an additional advantage amid tightening environmental regulations

- Furthermore, the growth of personal care and cosmetic industries, particularly in emerging economies, is driving the need for Isodecanol as a key ingredient in emollients and surfactants, offering moisturizing and conditioning benefits

- The global trend of industrial modernization and urbanization, coupled with the increasing use of advanced coatings and materials, continues to push the demand for Isodecanol in paints, coatings, and adhesive formulations

- Overall, the combination of industrial diversification, technological advancement, and sustainability-driven innovation positions Isodecanol as a critical material supporting future-oriented growth across multiple industries

Which Factor is Challenging the Growth of the Isodecanol Market?

- The fluctuating prices of raw materials used in Isodecanol production, particularly oxo intermediates and petrochemical feedstocks, pose a major challenge to market stability. Since Isodecanol production relies heavily on propylene and syngas, price volatility directly impacts manufacturing costs and profit margins

- For instance, periodic supply chain disruptions and crude oil price fluctuations have created instability in input availability, leading to production slowdowns and delayed deliveries across regions

- In addition, the stringent environmental regulations governing petrochemical processes are pushing companies to adopt cleaner technologies, often requiring substantial capital investments that may limit participation from smaller manufacturers

- The transition toward bio-based production, while beneficial long-term, faces challenges such as high initial costs, limited technology availability, and scalability constraints, which slow down mass adoption

- Moreover, competition from substitute alcohols and other oxo chemicals offering similar performance characteristics at lower costs creates further pricing pressure in the global market

- Overcoming these challenges through strategic sourcing, renewable feedstock development, and collaborative innovation will be critical for manufacturers to maintain competitiveness and ensure the sustainable growth of the Isodecanol market in the coming years

How is the Isodecanol Market Segmented?

The market is segmented on the basis of product, function, end use industry, and application.

- By Product

On the basis of product, the Isodecanol market is segmented into 2-Butyloctsanol, 2-Hexyldecanol, 2-Octyldodecanol, 2-Decyltetradenol, 2-Dodecylhexadecaynol, and Others. The 2-Octyldodecanol segment dominated the market with the largest revenue share of 38.6% in 2024, owing to its wide application in cosmetics, lubricants, and surfactants due to its excellent emollient properties and chemical stability. It is highly valued for improving texture, viscosity, and spreadability in formulations.

The 2-Hexyldecanol segment is anticipated to witness the fastest growth during 2025–2032, driven by its increasing use in specialty chemical synthesis and performance additives. Its compatibility with both aqueous and non-aqueous systems enhances its demand in industrial and personal care applications. The growing adoption of bio-based and multifunctional alcohols will continue to strengthen the position of higher molecular weight isodecanol derivatives across diverse end-use sectors.

- By Function

On the basis of function, the Isodecanol market is segmented into Additive, Lubricant, and Fragrance. The Additive segment held the largest revenue share of 45.3% in 2024, driven by the extensive use of isodecanol as a plasticizer, dispersant, and wetting agent in coatings, polymers, and agrochemical formulations. Its ability to enhance flow, improve solubility, and provide chemical stability makes it a preferred choice across multiple industries.

The Lubricant segment is expected to register the fastest CAGR from 2025 to 2032, propelled by rising demand in metalworking fluids, automotive lubricants, and synthetic esters. Isodecanol’s superior oxidative stability and low volatility contribute to enhanced performance and energy efficiency. Increasing industrialization and the shift toward high-performance synthetic lubricants will continue to fuel this segment’s growth in the coming years.

- By End Use Industry

On the basis of end use industry, the Isodecanol market is segmented into Chemical, Material, Cosmetic, Agriculture, and Others. The Chemical segment dominated the market with a revenue share of 41.7% in 2024, supported by its widespread use as an intermediate in producing surfactants, plasticizers, and solvents. Chemical manufacturers rely on isodecanol for its versatility and high compatibility with both polar and non-polar compounds.

The Cosmetic segment is projected to grow at the fastest rate during 2025–2032, driven by increasing demand for natural-feel emollients in skincare and personal care formulations. Its non-greasy texture, mildness, and high oxidative stability make it ideal for creams, lotions, and lipsticks. Growing consumer awareness toward sustainable and bio-derived cosmetic ingredients will further accelerate its adoption in the global personal care industry.

- By Application

On the basis of application, the Isodecanol market is segmented into Surfactant, Synthesize Derivatives, Metal Processing, Polymer Additives, Lubricant Esters, and Others. The Surfactant segment held the largest market revenue share of 39.9% in 2024, owing to the extensive utilization of isodecanol in manufacturing non-ionic surfactants, detergents, and emulsifiers. Its ability to improve solubility and reduce surface tension makes it indispensable in cleaning, textile, and agrochemical formulations.

The Lubricant Esters segment is expected to exhibit the fastest CAGR from 2025 to 2032, fueled by its increasing application in high-performance lubricants for automotive and industrial machinery. The superior film-forming ability and thermal stability of isodecanol-based esters enhance lubrication efficiency and durability. Rising demand for energy-efficient and eco-friendly lubricant solutions will continue to drive the growth of this segment globally.

Which Region Holds the Largest Share of the Isodecanol Market?

- Asia-Pacific dominated the Isodecanol market with the largest revenue share of 39.31% in 2024, driven by rapid urbanization, growing industrialization, and increasing adoption of high-performance chemicals across end-use industries

- Consumers and industries in the region highly value the performance, versatility, and cost-efficiency offered by Isodecanols, especially in cosmetics, lubricants, surfactants, and chemical intermediates

- This widespread adoption is further supported by expanding manufacturing hubs, favorable government policies, and the rising demand for eco-friendly and multifunctional chemical products, establishing Isodecanols as a preferred solution across residential, commercial, and industrial sectors

China Isodecanol Market Insight

The China isodecanol market accounted for the largest market revenue share in APAC in 2024, driven by increasing industrial output, growing middle-class consumption, and rising demand in personal care, chemical, and lubricant applications. The country’s emphasis on smart manufacturing, coupled with the availability of domestic and imported Isodecanol grades, further boosts market growth. Strong investments in chemical processing plants and R&D also support the region’s leadership in the global Isodecanol market.

Japan Isodecanol Market Insight

The Japan isodecanol market is gaining traction due to high technological adoption, urbanization, and increasing consumer awareness regarding quality chemicals. Japan’s emphasis on advanced industrial processes, eco-friendly formulations, and premium cosmetic products is fueling demand for specialty Isodecanols. The integration of Isodecanols in high-value applications such as lubricants, surfactants, and polymer additives is further enhancing market expansion.

Which Region is the Fastest Growing Region in the Isodecanol Market?

The North America isodecanol market is poised to grow at the fastest CAGR of 9.24% during 2025–2032, driven by increasing industrial automation, rising demand for high-performance chemical intermediates, and technological advancements across end-use industries. The region’s growing inclination toward sustainable formulations and specialty chemical solutions is accelerating adoption.

U.S. Isodecanol Market Insight

The U.S. isodecanol market captured the largest revenue share within North America in 2024, fueled by demand from cosmetics, polymer additives, and lubricant applications. The adoption of high-performance specialty chemicals, coupled with advancements in manufacturing and regulatory support for eco-friendly chemicals, is driving market growth.

Canada Isodecanol Market Insight

The Canadian market is witnessing steady growth due to increasing investments in chemical manufacturing and rising demand for Isodecanols in personal care and industrial applications. The country’s emphasis on innovation and quality standards ensures the integration of high-purity and multifunctional Isodecanols across diverse sectors, contributing to the region’s rapid growth.

Which are the Top Companies in Isodecanol Market?

The Isodecanol industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Sasol (South Africa)

- Evonik Industries AG (Germany)

- JARCHEM INDUSTRIES INC. (U.S.)

- New Japan Chemical Co., Ltd. (Japan)

- KOKYU ALCOHOL KOGYO CO., LTD. (Japan)

- by KISCO LTD. (South Korea)

- Jigs Chemical Ltd. (India)

- KH Neochem Co., Ltd. (Japan)

- Exxon Mobil Corporation (U.S.)

- RAG-Stiftung (Germany)

- Shell group of companies (U.K./Netherlands)

- Triveni Interchem Private Limited (Group Of Triveni Chemicals) (India)

- Hallstar. (U.S.)

- Arkema (France)

- Oxiteno (Brazil)

- NAN YA PLASTICS CORPORATION (Taiwan)

- Suzhou Fanhua Chemical Co., Ltd. (China)

- Spectrum Chemical Manufacturing Corp. (U.S.)

- Merck KGaA (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Isodecanol Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Isodecanol Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Isodecanol Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.