Global Isosorbide Market

Market Size in USD Million

CAGR :

%

USD

795.41 Million

USD

1,527.67 Million

2024

2032

USD

795.41 Million

USD

1,527.67 Million

2024

2032

| 2025 –2032 | |

| USD 795.41 Million | |

| USD 1,527.67 Million | |

|

|

|

|

Isosorbide Market Size

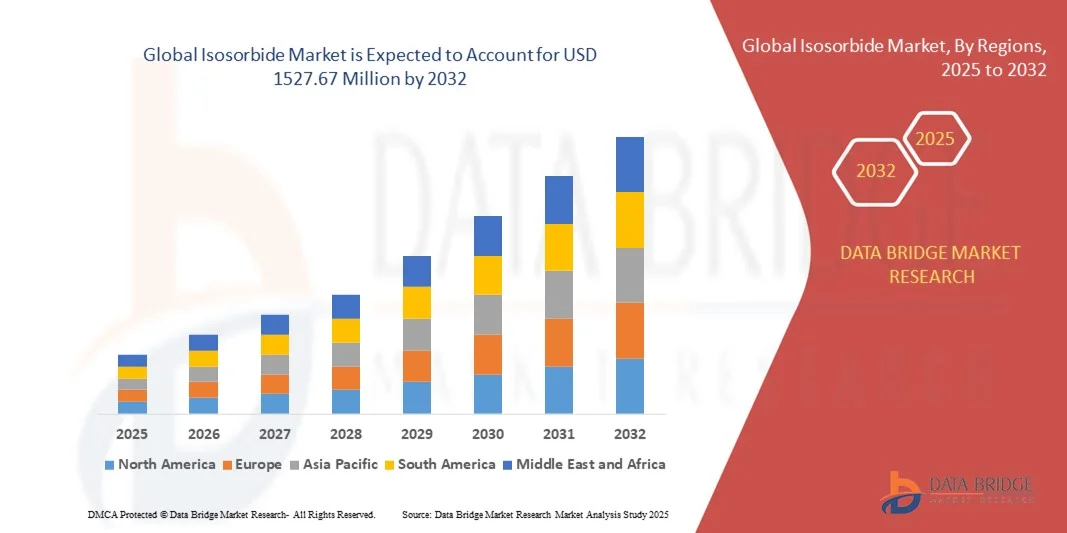

- The global isosorbide market size was valued at USD 795.41 million in 2024 and is expected to reach USD 1527.67 million by 2032, at a CAGR of 8.50% during the forecast period

- The market growth is largely fueled by the increasing adoption of sustainable and bio-based materials across industries, coupled with technological advancements in polymer synthesis and green chemistry, leading to wider utilization of isosorbide in packaging, polycarbonates, polyurethanes, and coatings

- Furthermore, rising demand for environmentally friendly, renewable, and high-performance alternatives to conventional petroleum-based chemicals is driving the adoption of isosorbide in multiple applications. These factors are accelerating its integration into industrial and consumer products, thereby significantly boosting market expansion

Isosorbide Market Analysis

- Isosorbide, a plant-derived monomer, is increasingly recognized as a versatile and eco-friendly building block for polymers, resins, and additives. Its properties, including biodegradability, thermal stability, and compatibility with diverse chemical processes, make it a preferred choice for manufacturers seeking sustainable solutions

- The escalating demand for bio-based polymers and sustainable chemicals is primarily fueled by stricter environmental regulations, consumer awareness of eco-friendly products, and the growing corporate focus on sustainability. This is driving innovation and investment in isosorbide-based materials across various sectors

- North America dominated the isosorbide market with a share of 40.5% in 2024, due to the growing adoption of sustainable polymers and biodegradable materials across industries

- Asia-Pacific is expected to be the fastest growing region in the isosorbide market during the forecast period due to rapid industrialization, urbanization, and the rising focus on sustainable materials in countries such as China, Japan, and India

- Oil- based isosorbide segment dominated the market with a market share of 45.8% in 2024, due to its extensive use in polymer synthesis and as a key intermediate in producing biodegradable plastics. Its compatibility with various chemical processes, high stability, and efficiency in producing high-performance materials make it the preferred choice for industrial applications. Manufacturers also favor oil-based Isosorbide for its consistent quality, scalability, and established supply chains, further reinforcing its market dominance

Report Scope and Isosorbide Market Segmentation

|

Attributes |

Isosorbide Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Isosorbide Market Trends

Increasing Use of Bio-Based Polymers

- The global isosorbide market is experiencing rapid growth due to the rising adoption of bio-based polymers across multiple industrial applications. Derived from renewable sources such as sorbitol obtained from corn and other biomass, isosorbide is being heavily utilized as a sustainable monomer in polymer synthesis, aligning with the global transition toward low-carbon and environmentally friendly materials

- For instance, Mitsubishi Chemical Group Corporation has commercialized bio-based polyethylene terephthalate (PEIT) and polybutylene succinate (PBS) using isosorbide as a key component to enhance durability and transparency. The company’s focus on renewable inputs underscores the growing industrial shift toward bio-based chemistry replacing fossil-derived polymers in packaging and engineering plastics

- The increasing environmental awareness among consumers and industries has propelled the demand for isosorbide-based bioplastics offering lower carbon footprints and superior mechanical properties. These bio-based alternatives are gaining acceptance in coatings, resins, and packaging films where sustainability and high performance are required simultaneously

- In addition, advancements in green chemistry and catalysis have improved the polymerization characteristics of isosorbide, enabling its broader adoption in polyesters and polycarbonates. Technological progress in processing methods is enhancing compatibility with existing resin manufacturing, facilitating scalability for large-volume industrial applications

- Manufacturers are exploring the integration of isosorbide into emerging biopolymer formulations that deliver improved heat resistance and optical clarity. This approach supports the development of advanced materials suitable for automotive interiors, electronic components, and sustainable packaging sectors targeting reduced environmental impact

- The increasing use of bio-based polymers in global industries signals a pivotal transformation within the materials sector. With ongoing innovation and regulatory encouragement for renewable sources, isosorbide-based polymers are expected to form a critical foundation for next-generation sustainable plastics, driving long-term demand across multiple industrial domains

Isosorbide Market Dynamics

Driver

Demand for Eco-Friendly Chemical Alternatives

- The growing global emphasis on reducing dependency on petrochemical-based materials is fueling demand for eco-friendly chemical alternatives such as isosorbide. Manufacturers and end-users across polymer, pharmaceutical, and coating industries are shifting toward bio-based compounds that align with environmental sustainability benchmarks and carbon reduction targets

- For instance, Roquette Frères has scaled up production of its bio-based isosorbide under the brand POLYSORB in response to rising demand across resin and polymer sectors. The company’s investments in renewable feedstock processing highlight the expanding role of eco-efficient raw materials in shaping modern industrial ecosystems

- Isosorbide is gaining traction as a substitute for bisphenol-A (BPA) and other petro-derived intermediates due to its biodegradable, non-toxic nature and capacity to enhance polymer stability. Its renewable origin offers manufacturers an environmentally compliant solution to address strict regulations regarding volatile organic compounds and waste emissions

- In addition, the adoption of bio-based raw materials is being driven by corporate sustainability commitments and government incentives promoting circular economy developments. Various regions are encouraging industrial adoption of renewable chemicals to minimize reliance on fossil fuels while supporting innovation in green production methods

- With industries increasingly aligning sustainability objectives with business performance, isosorbide serves as a strategic material bridging functionality and ecological responsibility. Its growing incorporation into eco-friendly formulations ensures that demand for renewable chemical alternatives will continue to accelerate in the foreseeable future

Restraint/Challenge

High Production Costs

- Despite strong potential, the widespread commercialization of isosorbide remains constrained by relatively high production costs compared to conventional petrochemical substitutes. The process of converting sorbitol into isosorbide through catalytic dehydration involves significant energy input and requires advanced catalysts and purification systems, elevating overall manufacturing expenses

- For instance, companies such as SK Chemicals and Roquette Frères face considerable challenges in managing operational costs associated with large-scale manufacturing while maintaining consistent purity levels of isosorbide for industrial-grade applications. This cost disparity limits its use in price-sensitive markets despite strong environmental advantages

- Limited economies of scale and dependence on agricultural feedstocks contribute to fluctuating input costs influenced by crop yields and regional pricing variations. These factors collectively increase production volatility, making it difficult for producers to achieve cost parity with petroleum-based intermediates

- In addition, the implementation of advanced manufacturing technologies and quality control mechanisms demands continuous investment in process optimization. Small and mid-tier manufacturers often find it difficult to sustain high margins while meeting industrial performance expectations for bio-based polymers and resins

- Addressing the challenge of high production costs will require collaborative efforts across technology developers, feedstock suppliers, and downstream manufacturers. Continuous process innovation, catalyst optimization, and government-supported bioeconomy initiatives will be key to improving cost efficiency, thereby strengthening global competitiveness and adoption of isosorbide-based materials

Isosorbide Market Scope

The market is segmented on the basis of product type, application, and end use.

- By Product Type

On the basis of product type, the Isosorbide market is segmented into oil-based Isosorbide, water-based Isosorbide, and silicone-based Isosorbide. The oil-based Isosorbide segment dominated the market with the largest revenue share of 45.8% in 2024, driven by its extensive use in polymer synthesis and as a key intermediate in producing biodegradable plastics. Its compatibility with various chemical processes, high stability, and efficiency in producing high-performance materials make it the preferred choice for industrial applications. Manufacturers also favor oil-based Isosorbide for its consistent quality, scalability, and established supply chains, further reinforcing its market dominance.

The silicone-based Isosorbide segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in high-performance coatings, adhesives, and specialty silicone polymers. Its unique chemical properties, including thermal stability, flexibility, and resistance to degradation, make it increasingly attractive for advanced material applications. Growing demand from electronics, automotive, and personal care sectors, combined with rising interest in eco-friendly silicone alternatives, is expected to accelerate segment growth.

- By Application

On the basis of application, the Isosorbide market is segmented into Polyethylene Isosorbide Terephthalate (PEIT), polycarbonate, polyesters Isosorbide succinate, polyurethane, Isosorbide diesters, and others. The PEIT segment dominated the market in 2024, driven by its growing use in high-performance packaging, particularly for beverages and food products, due to its excellent barrier properties and biodegradability. Manufacturers increasingly prefer PEIT for sustainable packaging solutions, aligning with global environmental regulations and consumer demand for eco-friendly alternatives. Its mechanical strength, thermal stability, and compatibility with existing production lines make it a key driver of Isosorbide demand.

The polycarbonate segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by rising applications in lightweight and durable engineering plastics for automotive, electronics, and construction industries. Polycarbonate production with Isosorbide offers improved transparency, heat resistance, and environmental benefits, boosting adoption. Innovations in manufacturing processes and increasing demand for sustainable alternatives to conventional bisphenol-A-based polycarbonates are expected to fuel robust growth in this segment.

- By End Use

On the basis of end use, the Isosorbide market is segmented into resins and polymers, additives, and others. The resins and polymers segment dominated the market with the largest revenue share in 2024, due to its extensive application in producing biodegradable plastics, coatings, and packaging materials. The ability of Isosorbide-based resins to improve thermal, mechanical, and barrier properties has strengthened their adoption across multiple industries. Growing environmental awareness and regulatory mandates for sustainable materials have further reinforced demand for resins and polymers, making it the backbone of the Isosorbide market.

The additives segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its increasing use in enhancing polymer performance, including UV resistance, plasticization, and mechanical reinforcement. Additives derived from Isosorbide are gaining traction due to their non-toxic nature, biodegradability, and compatibility with various polymer matrices. Rising demand from packaging, automotive, and electronics sectors, coupled with the shift toward eco-friendly chemical solutions, is expected to propel segment growth in the coming years.

Isosorbide Market Regional Analysis

- North America dominated the isosorbide market with the largest revenue share of 40.5% in 2024, driven by the growing adoption of sustainable polymers and biodegradable materials across industries

- Manufacturers in the region are increasingly leveraging Isosorbide as a key intermediate for eco-friendly plastics, coatings, and resins

- The market growth is further supported by strong R&D activities, favorable regulatory policies promoting green chemistry, and the presence of well-established chemical production hubs

U.S. Isosorbide Market Insight

The U.S. Isosorbide market captured the largest revenue share North America in 2024, fueled by increasing focus on sustainable polymers and high-performance materials. Rising demand from the packaging, automotive, and personal care industries, coupled with government incentives for green chemical production, is propelling market growth. Companies are investing in advanced Isosorbide derivatives to produce biodegradable plastics, polyesters, and polycarbonates, aligning with the growing environmental consciousness among consumers and industrial stakeholders.

Europe Isosorbide Market Insight

The Europe Isosorbide market is projected to expand at a significant CAGR during the forecast period, driven by stringent environmental regulations and growing adoption of bio-based polymers. Countries such as Germany, France, and Italy are emphasizing sustainable production practices and replacing conventional plastics with eco-friendly alternatives. The increase in urbanization, focus on circular economy initiatives, and rising R&D investments are accelerating Isosorbide adoption across packaging, coatings, and polymer manufacturing applications.

Germany Isosorbide Market Insight

The Germany Isosorbide market is expected to grow at a considerable CAGR, fueled by rising awareness of sustainable materials and the demand for high-performance, bio-based polymers. Germany’s strong chemical industry infrastructure, coupled with innovation in green technologies, promotes the adoption of Isosorbide across industrial and commercial applications. Increasing integration of Isosorbide in polyesters, polycarbonates, and additives aligns with local consumer and regulatory expectations for environmentally friendly materials.

Asia-Pacific Isosorbide Market Insight

The Asia-Pacific Isosorbide market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid industrialization, urbanization, and the rising focus on sustainable materials in countries such as China, Japan, and India. The region’s manufacturing capabilities, cost-effective production, and government initiatives supporting green chemicals are boosting Isosorbide adoption. Furthermore, the growing awareness of biodegradable polymers and increasing R&D investments in sustainable chemistry are driving strong demand from packaging, automotive, and electronics sectors.

China Isosorbide Market Insight

The China Isosorbide market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid industrial growth, urbanization, and government policies promoting bio-based materials. China is emerging as a major hub for the production and export of Isosorbide and its derivatives. Strong domestic chemical manufacturers, coupled with the rising adoption of sustainable polymers in packaging, automotive, and electronics, are key factors propelling market growth.

Japan Isosorbide Market Insight

The Japan Isosorbide market is gaining momentum due to the country’s focus on high-performance and eco-friendly materials. Rising industrial applications in polyesters, polycarbonates, and specialty polymers, combined with strong technological infrastructure and R&D initiatives, are driving market growth. In addition, Japan’s aging population and demand for sustainable, safe, and high-quality products in consumer goods and packaging are expected to further enhance Isosorbide adoption in both residential and commercial sectors.

Isosorbide Market Share

The isosorbide industry is primarily led by well-established companies, including:

- ADM (U.S.)

- Roquette Frères (France)

- Mitsubishi Chemical Corporation (Japan)

- Novaphene (U.S.)

- Par Pharmaceutical (U.S.)

- Merck KGaA (Germany)

- TCI Chemicals (India) Pvt. Ltd. (India)

- Thermo Fisher Scientific (U.S.)

- SK Chemicals (South Korea)

- Jinan Hongbaifeng Industry & Trade Co., Ltd (China)

- BOC Sciences (U.S.)

- BioCrick BioTech (India)

- FINETECH INDUSTRY LIMITED (China)

- abcr GmbH (Germany)

- Vitas M Chemical Limited (U.K.)

- Oakwood Products, Inc. (U.S.)

- ApexBio Technology (U.S.)

- Targetmol (China)

Latest Developments in Global Isosorbide Market

- In April 2024, Endo, Inc. announced the successful conclusion of its purchase of almost all of Endo International Plc's assets, in accordance with EIP's reorganization plan. This strategy is now implemented, and EIP's operating assets have emerged from Chapter 11 restructuring with reduced debt and resolved pre-bankruptcy legal issues. This development reflects strategic consolidation in the pharmaceutical sector and may influence the supply and innovation of materials, including isosorbide derivatives for medical applications

- In February 2024, Mitsubishi Chemical Group integrated its plant-derived bioengineering plastic, DURABIO™, into the handle of Sunstar Group’s Ora2 Premium Smooth Fit Toothbrush. This marks the first use of DURABIO™ in a toothbrush and the first domestic toothbrush to receive biomass plastic mark certification. Being derived from plant-based isosorbide, DURABIO™ offers high transparency, scratch resistance, and optical quality, highlighting the growing adoption of sustainable materials in consumer products and boosting the market for eco-friendly alternatives

- In January 2024, Roquette’s POLYSORB® isosorbide received the International Sustainability and Carbon Certification (ISCC) PLUS. This certification reinforces Roquette’s commitment to sustainability across its value chain. POLYSORB® isosorbide provides a versatile, eco-friendly alternative to conventional materials and enhances performance while minimizing environmental impact, driving its adoption in packaging, polycarbonates, polyurethanes, plasticizers, and paints and coatings

- In May 2023, Mitsubishi Chemical Group developed a new grade of DURABIO™ with higher biomass content. This advancement improves the sustainability profile of DURABIO™ by increasing its renewable plant-based material proportion. The new grade is expected to expand applications across automotive, electronics, and consumer goods, strengthening market adoption of isosorbide-based bioengineering plastics as eco-friendly alternatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Isosorbide Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Isosorbide Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Isosorbide Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.