Global It Asset Disposition Market

Market Size in USD Billion

CAGR :

%

USD

25.81 Billion

USD

48.41 Billion

2024

2032

USD

25.81 Billion

USD

48.41 Billion

2024

2032

| 2025 –2032 | |

| USD 25.81 Billion | |

| USD 48.41 Billion | |

|

|

|

|

IT Asset Disposition Market Size

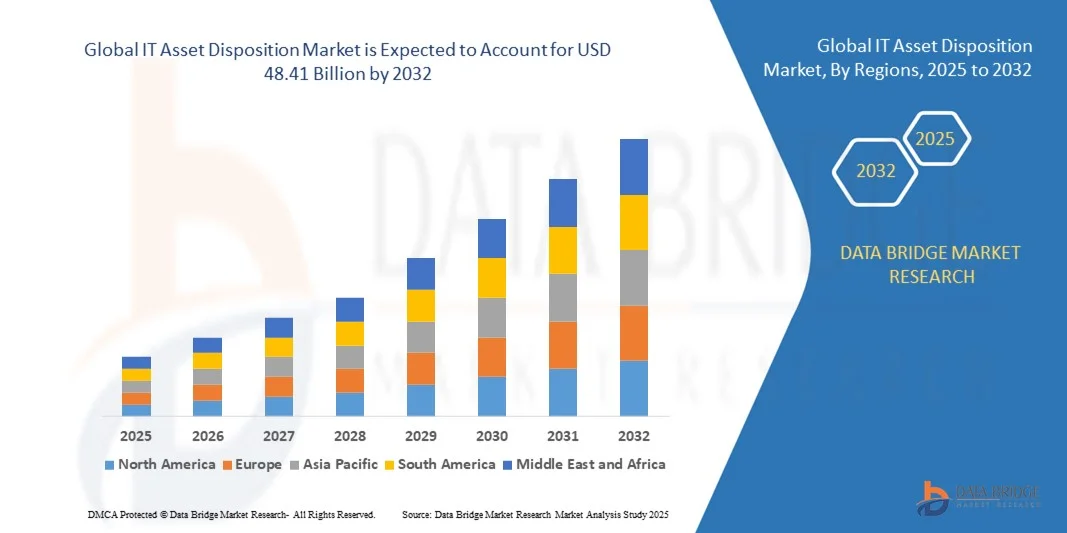

- The global IT asset disposition market size was valued at USD 25.81 billion in 2024 and is expected to reach USD 48.41 billion by 2032, at a CAGR of 8.18% during the forecast period

- The market growth is largely fuelled by the increasing need for secure data destruction, regulatory compliance, and sustainable disposal practices across enterprises and government organizations

- Rising adoption of cloud computing and the rapid turnover of IT hardware are also driving demand for professional ITAD services to manage retired assets efficiently and reduce environmental impact

IT Asset Disposition Market Analysis

- The market is witnessing heightened focus on certified and secure data erasure methods, ensuring compliance with data protection regulations such as GDPR, HIPAA, and CCPA

- Increasing partnerships between ITAD providers and enterprises are supporting end-to-end asset management solutions, including collection, refurbishment, recycling, and resale of IT equipment

- North America dominated the IT asset disposition market with the largest revenue share of 38.5% in 2024, driven by stringent data security regulations, growing e-waste concerns, and increased adoption of certified ITAD services among enterprises

- Asia-Pacific region is expected to witness the highest growth rate in the global IT asset disposition market, driven by urbanization, technological advancements, and the expansion of IT infrastructure across countries such as China, Japan, and Singapore. Increasing awareness of secure data disposal and sustainable recycling practices is further accelerating market adoption in the region

- The Data Destruction/Data Sanitization segment held the largest market revenue share in 2024, driven by increasing awareness of data security risks and strict regulatory compliance requirements. Organizations are increasingly relying on certified vendors to ensure secure and environmentally compliant disposal of sensitive IT assets, making this service highly preferred across industries

Report Scope and IT Asset Disposition Market Segmentation

|

Attributes |

IT Asset Disposition Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

IT Asset Disposition Market Trends

Rise of Secure and Environmentally Sustainable IT Asset Disposition Solutions

- The increasing focus on secure and environmentally sustainable IT asset disposition (ITAD) is transforming the market by enabling companies to safely retire, recycle, and dispose of end-of-life IT equipment. Proper disposal prevents data breaches and reduces environmental impact, supporting corporate governance and compliance requirements

- The growing demand for certified ITAD services in remote or distributed enterprise environments is accelerating the adoption of on-site data destruction and mobile collection platforms. These solutions are particularly effective where organizations need secure, compliant disposal of sensitive equipment across multiple locations

- The affordability, scalability, and ease of adoption of modern ITAD solutions are making them attractive for businesses of all sizes. Organizations benefit from minimized regulatory risks, streamlined asset management, and reduced environmental liabilities, promoting widespread adoption

- For instance, in 2023, several multinational corporations implemented certified ITAD programs to securely retire outdated servers and laptops, achieving compliance with global data protection regulations while reducing e-waste and improving sustainability metrics

- While secure and eco-friendly ITAD solutions are gaining traction, their impact depends on continued innovation, regulatory alignment, and workforce training. Vendors must focus on localized and scalable solutions to fully capitalize on the growing global demand

IT Asset Disposition Market Dynamics

Driver

Rising Data Security Concerns and Regulatory Compliance Requirements

- Growing awareness of data security risks and regulatory compliance obligations is pushing organizations to adopt certified ITAD solutions. Breaches arising from improperly disposed IT assets can lead to legal penalties, financial losses, and reputational damage, driving investment in secure disposal practices. In addition, enterprises are implementing multi-layered ITAD protocols to ensure end-to-end data destruction and maintain customer trust, strengthening overall cybersecurity posture

- Companies recognize the operational and financial risks associated with mishandled IT assets, including data leakage, environmental fines, and loss of recoverable value. This awareness is accelerating demand for advanced tracking, wiping, and recycling technologies. Organizations are also increasingly conducting internal audits and third-party verification to certify proper disposal, enhancing accountability and governance

- Government regulations, industry standards, and corporate governance frameworks promoting responsible e-waste management are boosting ITAD adoption. Organizations are increasingly leveraging third-party certified vendors to ensure compliance and secure end-of-life IT handling. The alignment with global standards such as ISO 14001 and R2 is encouraging enterprises to adopt structured, environmentally compliant ITAD programs

- For instance, in 2022, several North American banks and IT service providers upgraded their ITAD programs with on-site data destruction and certified recycling services, mitigating data breach risks and supporting sustainability initiatives. These initiatives also contributed to corporate ESG reporting and improved stakeholder confidence in environmentally responsible IT practices

- While data security and compliance are key drivers, integrating ITAD services with internal IT and asset management processes remains a challenge, requiring standardized practices and staff training. Enterprises must also invest in ongoing employee awareness and skill development to maintain compliance across geographically distributed locations

Restraint/Challenge

High Cost of Certified ITAD Services and Limited Access in Emerging Regions

- The premium pricing of certified ITAD services, including secure data destruction and environmentally compliant recycling, limits adoption among small and mid-sized enterprises. These services are often adopted primarily by large organizations with adequate IT budgets. Small businesses also face additional operational overhead to coordinate certified pickups and ensure adherence to regulatory mandates

- In emerging and remote regions, the scarcity of certified ITAD providers and trained personnel capable of performing secure disposal reduces accessibility. Organizations often rely on informal e-waste channels, which are less secure and environmentally responsible. This creates potential data breach risks and environmental liabilities that can affect local communities and regulatory compliance

- Supply chain and infrastructure challenges further restrict market penetration in developing regions, where consistent service availability and certified disposal facilities are not guaranteed. This limits adoption of compliant ITAD practices. Companies in these regions may struggle to manage logistics, track asset lifecycles, and verify proper disposal, slowing overall market growth

- For instance, in 2023, IT agencies in Sub-Saharan Africa reported that over 65% of small and medium enterprises lacked access to certified ITAD services due to high costs and limited provider availability. Many organizations resorted to informal e-waste handling, increasing both security and environmental risks, underscoring the need for affordable and scalable ITAD solutions

- While technology and service models continue to advance, addressing affordability, workforce training, and regional service gaps is critical. Vendors must focus on scalable, cost-effective solutions, mobile collection units, and educational programs to bridge market barriers, strengthen compliance, and enable sustainable growth globally

IT Asset Disposition Market Scope

The market is segmented on the basis of service, asset type, organization size, and end user.

- By Service

On the basis of service, the global IT asset disposition (ITAD) market is segmented into De-Manufacturing and Recycling, Remarketing and Value Recovery, Data Destruction/Data Sanitization, Logistics Management and Reverse Logistics, and Others. The Data Destruction/Data Sanitization segment held the largest market revenue share in 2024, driven by increasing awareness of data security risks and strict regulatory compliance requirements. Organizations are increasingly relying on certified vendors to ensure secure and environmentally compliant disposal of sensitive IT assets, making this service highly preferred across industries.

The Remarketing and Value Recovery segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising adoption of cost-efficient solutions for recovering value from retired IT equipment. These services allow companies to resell refurbished assets, optimize returns on IT investments, and reduce electronic waste, making them particularly attractive for enterprises aiming to enhance sustainability and profitability.

- By Asset Type

On the basis of asset type, the ITAD market is segmented into Computers/Laptops, Servers, Mobile Devices, Storage Devices, and Peripherals. The Computers/Laptops segment held the largest revenue share in 2024, owing to their high volume in enterprise IT infrastructures and frequent replacement cycles. Secure disposal and refurbishment of these devices are critical to preventing data breaches and supporting regulatory compliance.

The Mobile Devices segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the proliferation of smartphones, tablets, and connected devices in enterprise environments. Companies are increasingly seeking secure and sustainable solutions to manage end-of-life mobile devices, including data wiping, recycling, and redeployment.

- By Organization Size

On the basis of organization size, the ITAD market is segmented into Small and Medium Enterprises (SMEs) and Large Enterprises. Large Enterprises held the largest market share in 2024, fueled by complex IT infrastructures, higher volumes of retired assets, and stringent compliance requirements. These organizations often engage certified ITAD vendors to manage secure disposal and value recovery.

The SME segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing awareness of data security, regulatory obligations, and cost-efficient IT asset management solutions. SMEs are gradually adopting ITAD services to mitigate risks and optimize returns from retired IT assets without large capital expenditures.

- By End User

On the basis of end user, the ITAD market is segmented into Banking, Financial Services, and Insurance (BFSI), IT & Telecom, Educational Institutions, Healthcare Industry, Media & Entertainment, Aerospace and Defense, Public Sector and Government Offices, Manufacturing, and Others. The BFSI segment held the largest revenue share in 2024, driven by the critical need for secure data destruction, regulatory compliance, and risk mitigation. Banks and financial institutions prioritize ITAD services to prevent data breaches and ensure secure management of sensitive customer information.

The IT & Telecom segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the high turnover of IT hardware, growing adoption of cloud services, and increasing focus on sustainable disposal practices. Telecom providers and IT companies are leveraging ITAD solutions to securely retire devices, recover value, and reduce environmental impact.

IT Asset Disposition Market Regional Analysis

- North America dominated the IT asset disposition market with the largest revenue share of 38.5% in 2024, driven by stringent data security regulations, growing e-waste concerns, and increased adoption of certified ITAD services among enterprises

- Organizations in the region prioritize secure disposal of end-of-life IT assets, leveraging advanced data destruction, recycling, and remarketing solutions to mitigate regulatory and operational risk

- This widespread adoption is further supported by high IT infrastructure penetration, robust corporate governance frameworks, and awareness regarding sustainable and compliant ITAD practices, establishing North America as a key market globally

U.S. IT Asset Disposition Market Insight

The U.S. ITAD market captured the largest revenue share in 2024 within North America, fueled by increasing digitalization, stringent federal and state-level data protection regulations, and rising corporate emphasis on responsible e-waste management. Enterprises are increasingly outsourcing ITAD services to certified providers to ensure secure data destruction, environmentally compliant recycling, and value recovery from retired assets. The growing adoption of cloud infrastructure and IoT devices further drives demand for secure and traceable IT asset disposal solutions.

Europe IT Asset Disposition Market Insight

The Europe ITAD market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by strict EU e-waste directives, GDPR compliance requirements, and heightened awareness regarding data security and environmental sustainability. Urbanization, technological adoption, and a strong corporate governance culture are fostering ITAD service uptake across SMEs and large enterprises. The region is witnessing growth in both on-site and off-site certified ITAD solutions across sectors such as BFSI, IT & telecom, and government institutions.

U.K. IT Asset Disposition Market Insight

The U.K. ITAD market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing regulatory compliance demands, rising IT infrastructure investments, and corporate focus on secure and sustainable disposal of end-of-life IT assets. Organizations are adopting standardized ITAD practices, including data sanitization, remarketing, and recycling programs, to ensure risk mitigation and adherence to environmental mandates.

Germany IT Asset Disposition Market Insight

The Germany ITAD market is expected to witness the fastest growth rate from 2025 to 2032, driven by strong industrial and technological infrastructure, growing awareness of e-waste management, and emphasis on data protection. Certified ITAD services are being increasingly adopted in enterprises to securely handle decommissioned IT equipment while recovering value through resale or recycling. Integration of ITAD processes with broader IT asset management frameworks is also becoming prevalent in Germany.

Asia-Pacific IT Asset Disposition Market Insight

The Asia-Pacific ITAD market is expected to witness the fastest growth rate from 2025 to 2032, propelled by rapid digitalization, increasing enterprise IT infrastructure, and growing concerns around data security and e-waste disposal in countries such as China, Japan, and India. Government initiatives promoting sustainable e-waste management, along with the expansion of certified ITAD service providers, are enhancing accessibility and affordability of ITAD solutions in the region.

Japan IT Asset Disposition Market Insight

The Japan ITAD market is expected to witness the fastest growth rate from 2025 to 2032 due to advanced technological adoption, regulatory frameworks emphasizing data protection, and rising corporate awareness regarding sustainable IT asset disposal. Organizations increasingly rely on certified ITAD providers to ensure secure data destruction, environmentally compliant recycling, and recovery of asset value from retired IT equipment.

China IT Asset Disposition Market Insight

The China ITAD market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, expanding enterprise IT infrastructure, and increasing government emphasis on secure and environmentally responsible e-waste disposal. The growth is further fueled by affordable ITAD services, rising awareness among SMEs and large enterprises, and strong domestic ITAD service providers offering comprehensive solutions across sectors such as BFSI, IT & telecom, and manufacturing.

IT Asset Disposition Market Share

The IT Asset Disposition industry is primarily led by well-established companies, including:

- Hewlett Packard Enterprise Development LP (U.S.)

- IBM Corporation (U.S.)

- Iron Mountain Incorporated (U.S.)

- Apto Solution, Inc. (U.S.)

- TBS Industries Inc. (U.S.)

- ITRenew Inc. (U.S.)

- TES (Singapore) Pte Ltd. (Singapore)

- Lifespan International Inc. (U.S.)

- Ingram Micro, Inc. (U.S.)

- Arrow Electronics, Inc. (U.S.)

- Dell Inc. (U.S.)

- SIMS Recycling Solutions, Inc. (U.K.)

Latest Developments in Global IT Asset Disposition Market

- In February 2025, CompuCom Systems, Inc., announced a strategic partnership with Verkada to enhance business security solutions through advanced cloud-based technology. The collaboration combines CompuCom’s IT service expertise with Verkada’s physical security systems, enabling organizations to implement data-driven security strategies. By integrating intelligent analytics and streamlined infrastructure, the initiative aims to improve operational efficiency, safeguard assets, and deliver smarter, more responsive protection, positively impacting the enterprise security solutions market

- In September 2024, Iron Mountain acquired IT asset disposition (ITAD) firm Wisetek to strengthen its end-of-life IT asset management capabilities. This acquisition allows Iron Mountain to expand service offerings, providing secure, sustainable, and technologically advanced IT lifecycle solutions. The move enhances the company’s market position, supports regulatory compliance, and drives innovation in secure IT asset disposal, boosting confidence among enterprises in handling sensitive IT equipment

- In January 2024, Sims Lifecycle Services, Inc. partnered with MOLG, a U.S.-based digital and automation tools provider, to automate the repurposing of Open Compute Project (OCP) data center materials. The collaboration addresses the growing need for efficiency in reverse data center supply chains by combining technical expertise and scalable operations. The initiative supports sustainability, reduces operational costs, and promotes efficient reuse of IT assets, positively influencing the global ITAD and data center recycling market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.