Global Ivd In Cardiology And Neurology Market

Market Size in USD Billion

CAGR :

%

USD

18.45 Billion

USD

39.37 Billion

2024

2032

USD

18.45 Billion

USD

39.37 Billion

2024

2032

| 2025 –2032 | |

| USD 18.45 Billion | |

| USD 39.37 Billion | |

|

|

|

|

IVD In Cardiology and Neurology Market Size

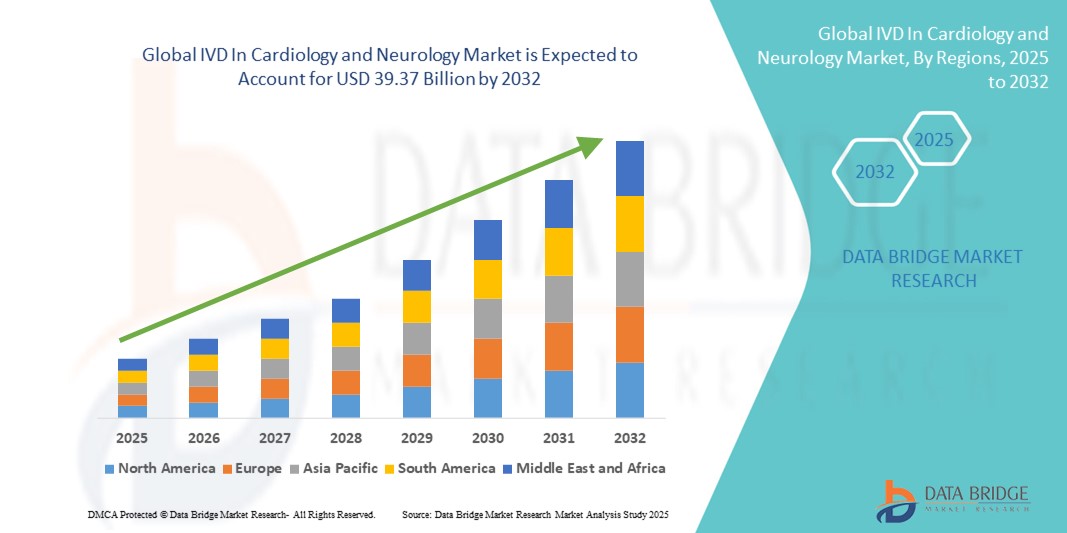

- The global IVD in cardiology and neurology market size was valued at USD 18.45 billion in 2024 and is expected to reach USD 39.37 billion by 2032, at a CAGR of 9.94% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress in precision diagnostics and personalized medicine, especially within cardiovascular and neurological care. The integration of in vitro diagnostics (IVD) with advanced imaging, genomic profiling, and biomarker-based detection is enabling earlier, more accurate diagnoses and better patient stratification, thereby driving clinical decision-making across both hospital and outpatient settings

- Furthermore, rising patient demand for proactive, minimally invasive diagnostic solutions and the increasing prevalence of chronic conditions—such as ischemic heart disease, arrhythmias, stroke, epilepsy, and neurodegenerative disorders—are establishing IVD tools as essential components in modern healthcare pathways. These converging factors are accelerating the uptake of IVD in Cardiology and Neurology solutions, thereby significantly boosting the industry's growth

IVD In Cardiology and Neurology Market Analysis

- In-vitro diagnostics (IVD) technologies, offering critical insights into the diagnosis and management of cardiovascular and neurological disorders, are becoming increasingly vital components of modern healthcare systems in both hospital and home-based settings due to their enhanced diagnostic accuracy, rapid turnaround time, and integration with digital health ecosystems

- The escalating demand for IVD in cardiology and neurology is primarily fueled by the rising prevalence of heart and brain-related disorders, the aging global population, increased awareness of early diagnosis, and growing adoption of personalized medicine

- North America dominated the IVD In cardiology and neurology market with the largest revenue share of 38.7% in 2024, characterized by the presence of advanced healthcare infrastructure, high healthcare spending, and strong market penetration of key diagnostic players. The U.S. witnessed substantial growth in the adoption of IVD technologies in cardiology and neurology, driven by rapid integration of AI-assisted diagnostic platforms and increased screening for chronic conditions

- Asia-Pacific is expected to be the fastest growing region in the IVD in cardiology and neurology market during the forecast period, with a projected CAGR of 9.8% from 2025 to 2032, driven by increasing urbanization, rising disposable incomes, government support for healthcare digitization, and a growing patient pool suffering from non-communicable diseases such as stroke and coronary artery disease

- The reagents & consumables segment dominated the IVD In cardiology and neurology market with the largest revenue share of 48.6% in 2024, driven by the high volume of diagnostic testing and the recurring nature of reagent usage in laboratories. These products are essential for both routine and specialized cardiac and neurological testing

Report Scope and IVD In Cardiology and Neurology Market Segmentation

|

Attributes |

IVD In Cardiology and Neurology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

IVD In Cardiology and Neurology Market Trends

Growing Shift Toward Intelligent, Connected Diagnostic Solutions

- A significant and accelerating trend in the global IVD In cardiology and neurology market is the integration of intelligent technologies and digital platforms that enhance diagnostic accuracy and accessibility for healthcare providers and patients alike

- For instance, cloud-enabled IVD platforms are now facilitating real-time data sharing across hospitals and laboratories, leading to faster and more coordinated decision-making in the management of cardiovascular and neurological diseases

- Advancements in intelligent diagnostics enable systems to learn patient-specific patterns, optimize test recommendations, and deliver early alerts for conditions like stroke, myocardial infarction, or dementia, thereby enabling timely interventions

- The integration of IVD technologies with hospital information systems and mobile health applications is streamlining operations—allowing clinicians to remotely access diagnostic insights and manage patient data with greater ease and precision

- This digital convergence is driving increased adoption of IVD solutions across primary care clinics, specialty hospitals, and even home-testing environments—especially in regions with growing demand for decentralized healthcare

- The shift toward personalized and predictive diagnostics continues to attract investment and R&D in the IVD In Cardiology and Neurology space, with major companies focusing on enhancing automation, connectivity, and diagnostic efficiency across both developed and emerging markets

IVD In Cardiology and Neurology Market Dynamics

Driver

Growing Need Due to Rising Disease Burden and Digital Diagnostics Adoption

- The increasing prevalence of cardiovascular and neurological disorders, combined with the shift toward digitized diagnostic systems, is significantly driving demand for IVD (In Vitro Diagnostics) solutions in these therapeutic areas

- According to the World Health Organization, cardiovascular diseases (CVDs) account for over 17.9 million deaths annually, making them the leading cause of mortality worldwide. Advanced IVD solutions, such as high-sensitivity cardiac troponin tests, are increasingly being adopted for early diagnosis of myocardial infarction, enabling timely intervention and reducing mortality rates. Similarly, in neurology, biomarker-based IVD tests for Alzheimer’s disease, such as amyloid-beta and tau protein assays, are gaining traction for early detection and disease monitoring, reflecting a major shift toward digitized and precision diagnostics

- As healthcare providers and patients become more aware of the importance of early disease detection and monitoring, IVD technologies offer enhanced capabilities such as high-throughput testing, biomarker-based diagnosis, and remote monitoring—offering critical improvements over conventional methods

- In addition, the growing use of connected diagnostic tools and demand for precision medicine are making IVD platforms indispensable in the management of cardiac and neurological conditions, with increasing integration into hospital networks and home-care settings

- The convenience of point-of-care testing, the availability of personalized diagnostic insights, and the rise in decentralized healthcare systems are further propelling the adoption of IVD in both acute care and outpatient environments. Government programs promoting preventive healthcare and the expansion of telemedicine are also accelerating market growth

Restraint/Challenge

Data Privacy and High Implementation Costs

- Concerns surrounding the security and privacy of patient data, especially with the digitization and networking of IVD platforms, remain a key challenge for widespread adoption. As systems connect to the cloud and integrate with hospital IT infrastructure, risks of unauthorized access and breaches increase

- For instance, cybersecurity lapses in healthcare IoT platforms have raised red flags regarding the protection of sensitive diagnostic data

- To overcome this, companies must implement stringent cybersecurity protocols, including encrypted data transmission, secure user authentication, and compliance with data protection regulations such as HIPAA and GDPR. Firms such as Roche and Abbott are leading efforts by embedding advanced cybersecurity layers within their IVD ecosystems

- Moreover, the high initial cost associated with implementing sophisticated IVD systems—especially those leveraging molecular diagnostics or AI-based decision support—can be a major barrier in low- and middle-income economies. Many providers still struggle with the capital required for equipment, staff training, and digital infrastructure

- Affordability-focused innovations and strategic collaborations between public and private sectors will be essential to expand access to advanced diagnostics and maintain sustained market growth globally

IVD In Cardiology and Neurology Market Scope

The market is segmented on the basis of product type, technology, and end user.

- By Product Type

On the basis of product type, the IVD in cardiology and neurology market is segmented into instruments, reagents & consumables, and software & services. The reagents & consumables segment dominated the market with the largest revenue share of 48.6% in 2024, driven by the high volume of diagnostic testing and the recurring nature of reagent usage in laboratories. These products are essential for both routine and specialized cardiac and neurological testing.

The software & services segment is expected to witness the fastest CAGR of 8.9% from 2025 to 2032, owing to the increasing adoption of digital health solutions, cloud-based analytics, and AI-driven diagnostics.

- By Technology

On the basis of technology, the IVD in cardiology and neurology market is segmented into immunoassays, molecular diagnostics, haematology, and others. The immunoassays segment held the largest revenue share of 37.2% in 2024, due to its extensive use in detecting key biomarkers like troponins and brain natriuretic peptides (BNP), which are critical in early diagnosis and disease monitoring.

The molecular diagnostics segment is projected to grow at the highest CAGR of 10.4% during the forecast period, driven by technological advancements such as PCR and NGS, and the increasing demand for precision diagnostics.

- By End User

On the basis of end user, the IVD in cardiology and neurology market is segmented into hospitals, clinical laboratories, and others. The hospital segment accounted for the largest revenue share of 53.1% in 2024, supported by the growing burden of cardiovascular and neurological conditions and the integration of IVD platforms into hospital settings for real-time patient monitoring and care delivery.

The clinical laboratories segment is expected to witness the fastest CAGR of 9.7% from 2025 to 2032, attributed to increasing outsourcing trends, cost-efficiency, and the proliferation of private diagnostic labs across developed and emerging markets.

IVD In Cardiology and Neurology Market Regional Analysis

- North America dominated the IVD in cardiology and neurology market with the largest revenue share of 38.7% in 2024, driven by rising incidences of cardiovascular and neurological diseases

- A mature healthcare infrastructure, and high adoption of innovative diagnostic technologies

- The region’s growth is further propelled by favorable reimbursement frameworks, strong research investments, and the presence of leading market players like Abbott, Thermo Fisher, and Quest Diagnostics that continuously introduce advanced IVD solutions

U.S. IVD in Cardiology and Neurology Market Insight

The U.S. IVD in cardiology and neurology market accounted for the largest revenue share of 81% in 2024 within North America, fueled by increasing demand for early diagnostics, widespread access to healthcare services, and the growing implementation of precision medicine. Rising healthcare expenditure and the adoption of molecular diagnostics in neurology and cardiology are also key contributors to market expansion.

Europe IVD in Cardiology and Neurology Market Insight

The Europe IVD in cardiology and neurology market is projected to expand at a notable CAGR during 2025 to 2032, driven by the increasing prevalence of chronic conditions, government initiatives supporting early disease detection, and improved laboratory infrastructure. Countries like Germany, France, and the U.K. are leading the charge in adopting automation in clinical diagnostics, further boosting market potential.

U.K. IVD in Cardiology and Neurology Market Insight

The U.K. IVD in cardiology and neurology market is expected to grow significantly due to rising healthcare digitalization, growing public-private partnerships, and investments in genomic and biomarker testing. The NHS's efforts to improve diagnostic accuracy for neurological disorders and stroke prevention initiatives contribute to long-term market growth.

Germany IVD in Cardiology and Neurology Market Insight

The Germany IVD in cardiology and neurology market is poised to grow at a steady CAGR, attributed to the strong focus on research and innovation, high penetration of advanced IVD systems, and a robust regulatory landscape. Demand for precise diagnostic tools in stroke and heart disease management is creating favorable opportunities for local and global players alike.

Asia-Pacific IVD in Cardiology and Neurology Market Insight

The Asia-Pacific IVD in cardiology and neurology market is expected to grow at the fastest CAGR of 9.8% from 2025 to 2032, driven by increasing healthcare spending, improving healthcare access in countries like India, China, and Japan, and growing awareness about early diagnosis. Government-led health reforms and strategic expansions by multinational companies are key growth enablers in this region.

Japan IVD in Cardiology and Neurology Market Insight

The Japan IVD in cardiology and neurology market is witnessing strong growth due to an aging population with a high burden of chronic conditions, advancements in point-of-care testing, and the integration of AI in diagnostics. The country’s commitment to innovation and digitized health records supports precision diagnostics and research in cardiology and neurology.

China IVD in Cardiology and Neurology Market Insight

The China IVD in cardiology and neurology market held the largest revenue share in Asia-Pacific in 2024, supported by the rapidly expanding middle class, urbanization, and large-scale digital health initiatives. The government’s push toward domestic biotech manufacturing and AI-driven diagnostics positions China as a central hub in the regional IVD space.

IVD In Cardiology and Neurology Market Share

The IVD In Cardiology and Neurology industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Sysmex Corporation (Japan)

- Siemens Healthineers AG (Germany)

- Quest Diagnostics Incorporated (U.S.)

- Abbott (U.S.)

- BD (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Beckman Coulter, Inc. (U.S.)

Latest Developments in Global IVD In Cardiology and Neurology Market

- In July 2022, Thermo Fisher Scientific, a global leader in scientific solutions, unveiled the Applied Biosystems Taq Path Respiratory Viral Select Panel. This panel is a molecular assay kit that has received CE-IVD marking. It is designed to detect five prevalent viruses, including those responsible for common colds, bronchiolitis, croup, influenza-like illnesses, and pneumonia

- In July 2025, Thermo Fisher Scientific, a global leader in scientific solutions, secured FDA approval for its Oncomine Dx Express Test run on the Ion Torrent Genexus Dx Integrated Sequencer. The test is authorized as a companion diagnostic (CDx) for ZEGFROVY (sunvozertinib) and for tumor profiling, enabling next‑generation sequencing (NGS) results in as little as 24 hours, and bringing precision oncology tools into decentralized clinical settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.