Global Jam Jelly And Preserves Market

Market Size in USD Billion

CAGR :

%

USD

295.10 Billion

USD

432.69 Billion

2024

2032

USD

295.10 Billion

USD

432.69 Billion

2024

2032

| 2025 –2032 | |

| USD 295.10 Billion | |

| USD 432.69 Billion | |

|

|

|

|

Jam, Jelly and Preserve Packaging Market Size

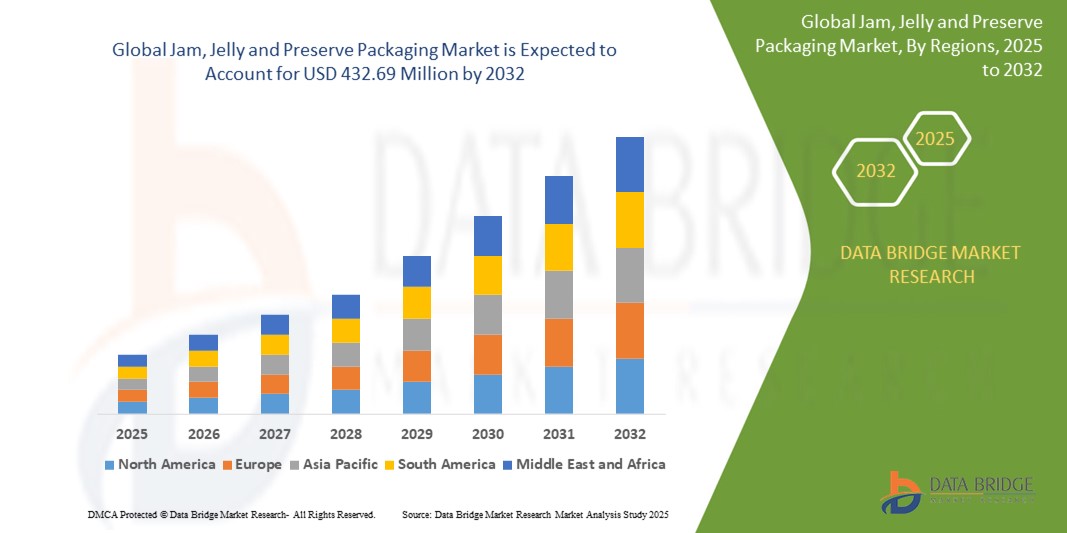

- The global jam, jelly and preserve packaging market size was valued at USD 295.1 million in 2024 and is expected to reach USD 432.69 million by 2032, at a CAGR of 4.9% during the forecast period

- This growth is driven by factors such as the rising demand for convenience foods, sustainable packaging, and premium product offerings.

Jam, Jelly and Preserve Packaging Market Analysis

- The jam, jelly, and preserve packaging market is experiencing a shift towards sustainable materials, with an increasing preference for recyclable and biodegradable options to meet environmental concerns and consumer demand for eco-friendly products

- There is a growing trend towards innovative packaging designs that enhance convenience and appeal, such as single-serve portions and resealable pouches, catering to the on-the-go consumption habits of modern consumers

- North America is expected to dominate the jam, jelly, and preserve packaging market due to a strong consumer base, premium product demand, and advanced distribution networks.

- Asia-Pacific is expected to be the fastest-growing region in the jam, jelly, and preserve packaging market during the forecast period due to rising disposable incomes, urbanization, and the adoption of Western dietary habits.

- The glass segment is expected to dominate the jam, jelly and preserve packaging market with the largest share of 50.5% in 2025 due to its ability to preserve the flavour, quality, and freshness of the product, while also being eco-friendly and recyclable, appealing to consumers who prefer sustainable packaging options. In addition, glass packaging enhances the premium perception of products, making it a preferred choice for high-end or organic brands. Its durability and ability to maintain product integrity during transport further solidify its position as the leading material for packaging preserves.

Report Scope and Jam, Jelly and Preserve Packaging Market Segmentation

|

Attributes |

Jam, Jelly and Preserve Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Jam, Jelly and Preserve Packaging Market Trends

“Rise of Sustainable and Eco-Friendly Packaging”

- Consumers are increasingly opting for jams, jellies, and preserves packaged in materials that are recyclable, biodegradable, or made from post-consumer waste

- Glass jars and paper-based labels are gaining popularity as eco-conscious alternatives to traditional plastic containers, with brands such as Bonne Maman adopting fully recyclable glass packaging

- Companies are adopting plant-based inks and water-based adhesives to reduce their environmental impact and appeal to green-conscious shoppers

- Reusable and refillable packaging formats are emerging in specialty food stores and farmers' markets, offering customers a sustainable way to enjoy their favorite products

- For instance, The Jammery, a Canadian preserve company, encourages customers to return empty glass jars for reuse, promoting a closed-loop packaging system that supports waste reduction and eco-friendly practices

Jam, Jelly and Preserve Packaging Market Dynamics

Driver

“Growing Consumer Shift Toward Natural and Organic Products”

- Consumers are increasingly choosing natural, organic, and clean-label food products, which is driving demand for packaging that aligns with health and wellness trends

- Brands are shifting to packaging that reflects purity and quality, such as glass jars, compostable seals, and eco-friendly labels to match the image of organic offerings

- For instance, St. Dalfour uses glass packaging and minimal labeling to emphasize the natural quality of its preserves, while Crofter’s Organic features eco-friendly labeling and clean ingredients

- Transparent packaging is becoming more popular as it allows consumers to see the product inside, reinforcing trust and ensuring authenticity

- Packaging innovations are focusing on sustainability and health-conscious messaging, helping brands appeal to eco-aware buyers and differentiate themselves in a competitive market

Opportunity

“Rise of E-Commerce and Direct-to-Consumer Channels”

- The rise of e-commerce and direct-to-consumer platforms is increasing the need for packaging that ensures product safety, convenience, and shelf appeal during delivery

- Packaging is no longer just functional but also acts as a marketing tool, offering brands a chance to create memorable unboxing experiences and connect with consumers visually

- For instance, artisanal jam brands on platforms such as Etsy use personalized labels and sturdy, eco-friendly boxes to stand out and ensure safe delivery, while companies such as Harry & David use branded gift-style packaging for online gourmet preserve sales

- Lightweight, durable packaging materials are being adopted to reduce shipping damage and cost, while maintaining aesthetic value and consumer engagement

- Subscription-based models and online specialty stores are encouraging the use of innovative formats such as single-serve packs and tamper-evident seals, which enhance convenience and build consumer trust

Restraint/Challenge

“High Cost of Sustainable Packaging Solutions”

- One of the main challenges in the jam, jelly, and preserve packaging market is the high cost of switching to sustainable alternatives such as glass, compostable plastics, and paper-based packaging

- These materials, while environmentally friendly, often require higher production, transportation, and handling expenses, which can strain smaller producers

- For instance, local preserve makers at farmers’ markets may prefer plastic jars due to cost, while larger brands such as Bonne Maman can afford to use and promote premium glass packaging

- Inconsistent recycling and composting infrastructure across regions limit the practical benefits of eco-friendly materials, reducing their overall impact

- A lack of packaging standardization and rapidly changing regulations adds complexity and cost, making it harder for smaller brands to adopt sustainable solutions at scale

Jam, Jelly and Preserve Packaging Market Scope

The market is segmented on the basis of material and channel.

|

Segmentation |

Sub-Segmentation |

|

By Material |

|

|

By Channel |

|

In 2025, the glass is projected to dominate the market with a largest share in material segment

The glass segment is expected to dominate the jam, jelly and preserve packaging market with the largest share of 50.5% in 2025 due to its ability to preserve the flavour, quality, and freshness of the product, while also being eco-friendly and recyclable, appealing to consumers who prefer sustainable packaging options. In addition, glass packaging enhances the premium perception of products, making it a preferred choice for high-end or organic brands. Its durability and ability to maintain product integrity during transport further solidify its position as the leading material for packaging preserves.

The offline is expected to account for the largest share during the forecast period in channel market

In 2025, the offline segment is expected to dominate the market with the largest market share of 35.5% due to its established presence in physical retail spaces, offering consumers the convenience of immediate purchase, the ability to examine products first-hand, and the wide availability of various jam, jelly, and preserve brands in supermarkets and hypermarkets. In addition, offline retail stores provide a personalized shopping experience and promotional opportunities, which drive higher consumer foot traffic and impulse buys. The physical presence of these stores allows brands to create strong customer connections and foster brand loyalty, ensuring continued dominance in the market.

Jam, Jelly and Preserve Packaging Market Regional Analysis

“North America Holds the Largest Share in the Jam, Jelly and Preserve Packaging Market”

- North America is projected to account for 40.5% of the global jam, jelly, and preserve packaging market

- North America commands a leading share of the global market due to mature consumption patterns and strong brand presence across the U.S. and Canada

- Consumer preferences in the region have shifted toward organic, low-sugar, and artisanal spreads, which is driving demand for high-quality, sustainable packaging

- The region benefits from a well-established retail and e-commerce infrastructure, making distribution and accessibility of packaged products highly efficient

- Major players are focusing on innovations such as biodegradable jars, flexible pouches, and single-serve packs to align with eco-conscious consumer trends

“Asia-Pacific is Projected to Register the Highest CAGR in the Jam, Jelly and Preserve Packaging Market”

- Asia-Pacific is experiencing the fastest growth rate, driven by changing dietary habits and the growing influence of Western food culture, particularly in urban areas

- Rising disposable income and a younger, health-aware population are contributing to higher demand for packaged jam, jelly, and preserves

- Rapid expansion of modern retail formats and online grocery platforms in countries such as India, China, and Indonesia is boosting market accessibility

- Local manufacturers are increasingly adopting innovative packaging formats that reflect both affordability and visual appeal to capture regional market share

Jam, Jelly and Preserve Packaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Ajanta Bottle Pvt. Ltd. (India)

- Berlin Packaging LLC (U.S.)

- Bora Packaging Industries (India)

- Conagra Brands Inc. (U.S.)

- Festo SE and Co. KG (Germany)

- Futuristic Packaging Pvt. Ltd. (India)

- H.B. Fuller Co. (U.S.)

- Kanishka Technopack Industries (India)

- LD Packaging Co. Ltd. (China)

- Packaging for Retail Ltd. (U.K.)

- Packiro GmbH (Germany)

- Sanjeev Flexi Package Pvt. Ltd. (India)

- Scholle IPN Corp. (U.S.)

- SF PACKAGING CO. LTD. (China)

- Trivium Packaging B.V (Netherlands)

- TURNHERE (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL JAMS, JELLIES AND PRESERVES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL JAMS, JELLIES AND PRESERVES MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL JAMS, JELLIES AND PRESERVES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 FACTORS INFLUENCING PURCHASING DECISION

5.3 INDUTRY TRENDS AND FUTURE PERSPECTIVES

5.4 SHOPPING BEHAVIOUR AND DYNAMICS

5.4.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.4.2 RESEARCH

5.4.3 IMPULSIVE

5.4.4 ADVERTISEMENT

5.4.4.1. TTELEVISION ADVERTISEMENT

5.4.4.2. OONLINE ADVERTISEMENT

5.4.4.3. IIN-STORE ADVERTISEMENT

5.4.4.4. OOUTDOOR ADVERTISEMENT

5.5 PRIVATE LABEL VS BRAND ANALYSIS

5.6 PROMOTIONAL ACTIVITIES

5.7 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

5.8 NEW PRODUCT LAUNCH STRATEGY

5.8.1 NUMBER OF NEW PRODUCT LAUNCH

5.8.1.1. LLINE EXTENSTION

5.8.1.2. NNEW PACKAGING

5.8.1.3. RRE-LAUNCHED

5.8.1.4. NNEW FORMULATION

5.9 CONSUMER LEVEL TRENDS

5.1 MEETING CONSUMER REQUIREMENT

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 GLOBAL JAMS, JELLIES AND PRESERVES MARKET, BY TYPE

11.1 OVERVIEW

11.2 JAMS

11.2.1 JAMS, BY FLAVOR

11.2.1.1. MIX FRUIT

11.2.1.2. SINGLE FRUIT

11.2.1.2.1. BLACKBERRY

11.2.1.2.2. BLUEBERRY

11.2.1.2.3. STRAWBERRY

11.2.1.2.4. BLACK CURRENT

11.2.1.2.5. APRICOT

11.2.1.2.6. GRAPE

11.2.1.2.7. CRANBERRY

11.2.1.2.8. RASPBERRY

11.2.1.2.9. APPLE

11.2.1.2.10. ORANGE

11.2.1.2.11. PLUMS

11.2.1.2.12. LEMON

11.2.1.2.13. PEACHES

11.2.1.2.14. PINEAPPLE

11.2.1.2.15. GUAVA

11.2.1.2.16. BANANA

11.2.1.2.17. KIWI

11.2.1.2.18. OTHERS

11.3 JELLY

11.3.1 JELLY, BY FLAVOR

11.3.1.1. MIX FRUIT

11.3.1.2. SINGLE FRUIT

11.3.1.2.1. BLACKBERRY

11.3.1.2.2. BLUEBERRY

11.3.1.2.3. STRAWBERRY

11.3.1.2.4. BLACK CURRENT

11.3.1.2.5. APRICOT

11.3.1.2.6. GRAPE

11.3.1.2.7. CRANBERRY

11.3.1.2.8. RASPBERRY

11.3.1.2.9. APPLE

11.3.1.2.10. ORANGE

11.3.1.2.11. PLUMS

11.3.1.2.12. LEMON

11.3.1.2.13. PEACHES

11.3.1.2.14. PINEAPPLE

11.3.1.2.15. GUAVA

11.3.1.2.16. BANANA

11.3.1.2.17. KIWI

11.3.1.2.18. OTHERS

11.4 PRESERVES

11.4.1 PRESERVES, BY FLAVOR

11.4.1.1. MIX FRUIT

11.4.1.2. SINGLE FRUIT

11.4.1.2.1. BLACKBERRY

11.4.1.2.2. BLUEBERRY

11.4.1.2.3. STRAWBERRY

11.4.1.2.4. BLACK CURRENT

11.4.1.2.5. APRICOT

11.4.1.2.6. GRAPE

11.4.1.2.7. CRANBERRY

11.4.1.2.8. RASPBERRY

11.4.1.2.9. APPLE

11.4.1.2.10. ORANGE

11.4.1.2.11. PLUMS

11.4.1.2.12. LEMON

11.4.1.2.13. PEACHES

11.4.1.2.14. PINEAPPLE

11.4.1.2.15. GUAVA

11.4.1.2.16. BANANA

11.4.1.2.17. KIWI

11.4.1.2.18. OTHERS

12 GLOBAL JAMS, JELLIES AND PRESERVES MARKET, BY FLAVOR

12.1 OVERVIEW

12.2 MIX FRUIT

12.3 SINGLE FRUIT

12.3.1 BLACKBERRY

12.3.2 BLUEBERRY

12.3.3 STRAWBERRY

12.3.4 BLACK CURRENT

12.3.5 APRICOT

12.3.6 GRAPE

12.3.7 CRANBERRY

12.3.8 RASPBERRY

12.3.9 APPLE

12.3.10 ORANGE

12.3.11 PLUMS

12.3.12 LEMON

12.3.13 PEACHES

12.3.14 PINEAPPLE

12.3.15 GUAVA

12.3.16 BANANA

12.3.17 KIWI

12.3.18 OTHERS

13 GLOBAL JAMS, JELLIES AND PRESERVES MARKET, BY COLORIE CONTENT

13.1 OVERVIEW

13.2 REGULAR/WITH CALORIE

13.3 LOW CAORIE

13.4 CALORIE FREE

14 GLOBAL JAMS, JELLIES AND PRESERVES MARKET, BY CATEGORY

14.1 OVERVIEW

14.2 CONVENTIONAL

14.3 ORGANIC

15 GLOBAL JAMS, JELLIES AND PRESERVES MARKET, BY NATURE

15.1 OVERVIEW

15.2 GMO

15.3 NON-GMO

16 GLOBAL JAMS, JELLIES AND PRESERVES MARKET, BY BRAND

16.1 OVERVIEW

16.2 BRANDED

16.3 PRIVATE LABEL

17 GLOBAL JAMS, JELLIES AND PRESERVES MARKET, BY END USERS

17.1 OVERVIEW

17.2 HOUSEHOLD/RETAIL

17.3 FOOD SERVICE INDUSTRY

17.3.1 FOOD SERVICE INDUSTRY, BY TYPE

17.3.1.1. HOTELS

17.3.1.2. RESTAURANTS

17.3.1.3. CAFES

17.3.1.4. CANTEENS

17.3.1.5. GHOST KITCHEN

17.3.1.6. OTEHRS

18 GLOBAL JAMS, JELLIES AND PRESERVES MARKET, BY PACKAGING TYPE

18.1 OVERVIEW

18.2 SACHETS

18.3 DIP POTS

18.4 POUCHES

18.5 JARS

18.5.1 PLASTC

18.5.2 GLASS

18.6 BOTTLES

18.6.1 PLASTC

18.6.2 GLASS

18.6.2.1. OTHERS

19 GLOBAL JAMS, JELLIES AND PRESERVES MARKET, BY DISTRIBUTION CHANNEL

19.1 OVERVIEW

19.2 STORE-BASED RETAILING

19.2.1 CCONVENIENCE STORES

19.2.2 SSUPERMARKETS/HYPERMARKETS

19.2.3 SSPECIALTY STORES

19.2.4 GGROCERY STORES

19.2.5 WWHOLESALERS

19.2.6 OOTHERS

19.3 NON-STORE RETAILING

19.3.1 EE-COMMERCE RETAILER

19.3.2 COMPANY WEBSITE

20 GLOBAL JAMS, JELLIES AND PRESERVES MARKET, COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: GLOBAL

20.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

20.3 COMPANY SHARE ANALYSIS: EUROPE

20.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

20.5 MERGERS & ACQUISITIONS

20.6 NEW PRODUCT DEVELOPMENT & APPROVALS

20.7 EXPANSIONS & PARTNERSHIP

20.8 REGULATORY CHANGES

21 GLOBAL JAMS, JELLIES AND PRESERVES MARKET, BY GEOGRAPHY

21.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

21.2 NORTH AMERICA

21.2.1 U.S.

21.2.2 CANADA

21.2.3 MEXICO

21.3 EUROPE

21.3.1 GERMANY

21.3.2 U.K.

21.3.3 ITALY

21.3.4 FRANCE

21.3.5 SPAIN

21.3.6 SWITZERLAND

21.3.7 NETHERLANDS

21.3.8 BELGIUM

21.3.9 RUSSIA

21.3.10 DENMARK

21.3.11 SWEDEN

21.3.12 POLAND

21.3.13 TURKEY

21.3.14 REST OF EUROPE

21.4 ASIA-PACIFIC

21.4.1 JAPAN

21.4.2 CHINA

21.4.3 SOUTH KOREA

21.4.4 INDIA

21.4.5 AUSTRALIA

21.4.6 SINGAPORE

21.4.7 THAILAND

21.4.8 INDONESIA

21.4.9 MALAYSIA

21.4.10 PHILIPPINES

21.4.11 NEW ZEALAND

21.4.12 VIETNAM

21.4.13 REST OF ASIA-PACIFIC

21.5 SOUTH AMERICA

21.5.1 BRAZIL

21.5.2 ARGENTINA

21.5.3 REST OF SOUTH AMERICA

21.6 MIDDLE EAST AND AFRICA

21.6.1 SOUTH AFRICA

21.6.2 UAE

21.6.3 SAUDI ARABIA

21.6.4 OMAN

21.6.5 QATAR

21.6.6 KUWAIT

21.6.7 REST OF MIDDLE EAST AND AFRICA

22 GLOBAL JAMS, JELLIES AND PRESERVES MARKET, SWOT & DBMR ANALYSIS

23 GLOBAL JAMS, JELLIES AND PRESERVES MARKET, COMPANY PROFILE

23.1 KRAFT FOODS

23.1.1 COMPANY OVERVIEW

23.1.2 REVENUE ANALYSIS

23.1.3 GEOGRAPHICAL PRESENCE

23.1.4 PRODUCT PORTFOLIO

23.1.5 RECENT DEVELOPMENTS

23.2 MURPHY ORCHARDS

23.2.1 COMPANY OVERVIEW

23.2.2 REVENUE ANALYSIS

23.2.3 GEOGRAPHICAL PRESENCE

23.2.4 PRODUCT PORTFOLIO

23.2.5 RECENT DEVELOPMENTS

23.3 BAXTER & SONS

23.3.1 COMPANY OVERVIEW

23.3.2 REVENUE ANALYSIS

23.3.3 GEOGRAPHICAL PRESENCE

23.3.4 PRODUCT PORTFOLIO

23.3.5 RECENT DEVELOPMENTS

23.4 NAKODAS

23.4.1 COMPANY OVERVIEW

23.4.2 REVENUE ANALYSIS

23.4.3 GEOGRAPHICAL PRESENCE

23.4.4 PRODUCT PORTFOLIO

23.4.5 RECENT DEVELOPMENTS

23.5 DUERR

23.5.1 COMPANY OVERVIEW

23.5.2 REVENUE ANALYSIS

23.5.3 GEOGRAPHICAL PRESENCE

23.5.4 PRODUCT PORTFOLIO

23.5.5 RECENT DEVELOPMENTS

23.6 KEWPIE CORPORATION

23.6.1 COMPANY OVERVIEW

23.6.2 REVENUE ANALYSIS

23.6.3 GEOGRAPHICAL PRESENCE

23.6.4 PRODUCT PORTFOLIO

23.6.5 RECENT DEVELOPMENTS

23.7 B&G FOODS

23.7.1 COMPANY OVERVIEW

23.7.2 REVENUE ANALYSIS

23.7.3 GEOGRAPHICAL PRESENCE

23.7.4 PRODUCT PORTFOLIO

23.7.5 RECENT DEVELOPMENTS

23.8 HEROMEA

23.8.1 COMPANY OVERVIEW

23.8.2 REVENUE ANALYSIS

23.8.3 GEOGRAPHICAL PRESENCE

23.8.4 PRODUCT PORTFOLIO

23.8.5 RECENT DEVELOPMENTS

23.9 BRISCOE’S JELLIES

23.9.1 COMPANY OVERVIEW

23.9.2 REVENUE ANALYSIS

23.9.3 GEOGRAPHICAL PRESENCE

23.9.4 PRODUCT PORTFOLIO

23.9.5 RECENT DEVELOPMENTS

23.1 BRASWELL'S

23.10.1 COMPANY OVERVIEW

23.10.2 REVENUE ANALYSIS

23.10.3 GEOGRAPHICAL PRESENCE

23.10.4 PRODUCT PORTFOLIO

23.10.5 RECENT DEVELOPMENTS

23.11 UNILEVER

23.11.1 COMPANY OVERVIEW

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 GEOGRAPHICAL PRESENCE

23.11.5 RECENT DEVELOPMENTS

23.12 THE JAM HORSE

23.12.1 COMPANY OVERVIEW

23.12.2 REVENUE ANALYSIS

23.12.3 PRODUCT PORTFOLIO

23.12.4 GEOGRAPHICAL PRESENCE

23.12.5 RECENT DEVELOPMENTS

23.13 THE NASHVILLE JAM

23.13.1 COMPANY OVERVIEW

23.13.2 REVENUE ANALYSIS

23.13.3 GEOGRAPHICAL PRESENCE

23.13.4 PRODUCT PORTFOLIO

23.13.5 RECENT DEVELOPMENTS

23.14 HAGO LIMITED

23.14.1 COMPANY OVERVIEW

23.14.2 REVENUE ANALYSIS

23.14.3 GEOGRAPHICAL PRESENCE

23.14.4 PRODUCT PORTFOLIO

23.14.5 RECENT DEVELOPMENTS

23.15 STUTE FOODS

23.15.1 COMPANY OVERVIEW

23.15.2 REVENUE ANALYSIS

23.15.3 GEOGRAPHICAL PRESENCE

23.15.4 PRODUCT PORTFOLIO

23.15.5 RECENT DEVELOPMENTS

23.16 NORFOLK PRESERVES

23.16.1 COMPANY OVERVIEW

23.16.2 REVENUE ANALYSIS

23.16.3 GEOGRAPHICAL PRESENCE

23.16.4 PRODUCT PORTFOLIO

23.16.5 RECENT DEVELOPMENTS

23.17 HARTLEY’S FRUIT

23.17.1 COMPANY OVERVIEW

23.17.2 REVENUE ANALYSIS

23.17.3 GEOGRAPHICAL PRESENCE

23.17.4 PRODUCT PORTFOLIO

23.17.5 RECENT DEVELOPMENTS

23.18 AHOTA

23.18.1 COMPANY OVERVIEW

23.18.2 REVENUE ANALYSIS

23.18.3 GEOGRAPHICAL PRESENCE

23.18.4 PRODUCT PORTFOLIO

23.18.5 RECENT DEVELOPMENTS

23.19 SOUTHRIDGE JAM CO.

23.19.1 COMPANY OVERVIEW

23.19.2 REVENUE ANALYSIS

23.19.3 GEOGRAPHICAL PRESENCE

23.19.4 PRODUCT PORTFOLIO

23.19.5 RECENT DEVELOPMENTS

23.2 BONNE MAMAN

23.20.1 COMPANY OVERVIEW

23.20.2 REVENUE ANALYSIS

23.20.3 GEOGRAPHICAL PRESENCE

23.20.4 PRODUCT PORTFOLIO

23.20.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

24 RELATED REPORTS

25 CONCLUSION

26 QUESTIONNAIRE

Global Jam Jelly And Preserves Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Jam Jelly And Preserves Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Jam Jelly And Preserves Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.