Global Jerky Snacks Market

Market Size in USD Billion

CAGR :

%

USD

4.11 Billion

USD

7.38 Billion

2024

2032

USD

4.11 Billion

USD

7.38 Billion

2024

2032

| 2025 –2032 | |

| USD 4.11 Billion | |

| USD 7.38 Billion | |

|

|

|

|

Jerky Snacks Market Size

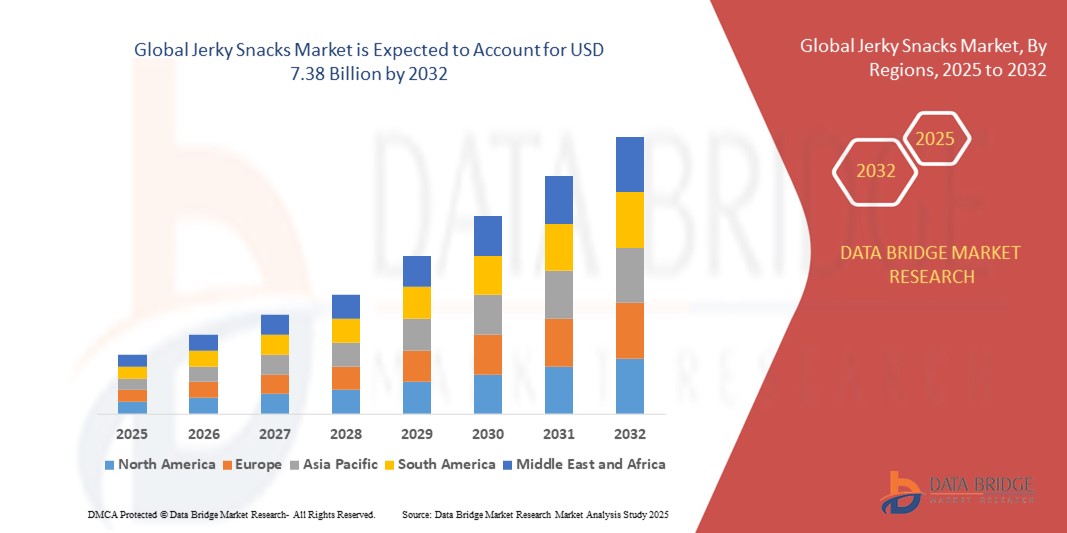

- The global jerky snacks market size was valued at USD 4.11 billion in 2024 and is expected to reach USD 7.38 billion by 2032, at a CAGR of 7.60% during the forecast period

- The market growth is largely fueled by increasing consumer preference for high-protein, on-the-go snack options and rising health consciousness across both developed and developing regions

- Furthermore, growing demand for clean-label, low-sugar, and functional foods is positioning jerky snacks as a favorable alternative to traditional processed snacks. These trends, combined with flavor innovation and expansion of plant-based offerings, are significantly driving market expansion

Jerky Snacks Market Analysis

- Jerky snacks are dried, seasoned meat or plant-based products consumed for their high protein content, portability, and long shelf life. Available in a variety of proteins such as beef, poultry, fish, and mushrooms, jerky products cater to a wide range of dietary preferences and lifestyles

- The rising popularity of protein-rich and low-carb diets such as keto and paleo, coupled with evolving snacking habits, is boosting demand for jerky products globally. Continuous product innovation, including new flavors, exotic proteins, and sustainable packaging, further supports the market's upward trajectory

- North America dominated the jerky snacks market with a share of 43.3% in 2024, due to high consumer preference for protein-rich, convenient snacks and a well-established meat snack culture

- Asia-Pacific is expected to be the fastest growing region in the jerky snacks market during the forecast period due to rapid urbanization, dietary diversification, and rising middle-class consumption

- Beef segment dominated the market with a market share of 51.2% in 2024, due to its long-standing dominance as a traditional jerky meat with strong consumer familiarity. Its high protein content, rich flavor, and widespread retail availability make it a preferred choice for mainstream buyers. Beef jerky is often seen as a portable, satisfying snack that meets both taste and nutrition needs, especially among fitness-conscious and outdoor consumers

Report Scope and Jerky Snacks Market Segmentation

|

Attributes |

Jerky Snacks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Jerky Snacks Market Trends

Expansion of Plant-Based and Alternative Protein Jerky Products

- The jerky snacks market is witnessing a notable shift towards plant-based and alternative protein formulations, responding to rising consumer interest in vegan, vegetarian, and flexitarian diets as well as sustainability concerns

- For instance, companies such as Jack Link's LLC and Chef’s Cut Real Jerky Co. are innovating with plant-based jerky lines made from ingredients such as mushrooms, soy, and pea protein that attract health-conscious and ethically minded consumers

- Increasing demand for clean-label, preservative-free, and organic jerky varieties is pushing manufacturers to reformulate traditional meat-based products with natural ingredients and reduced sodium levels

- Advancements in flavor innovation, incorporating ethnic and bold flavors, help broaden the customer base by appealing to adventurous eaters and younger demographics

- Packaging innovations focusing on sustainability, convenience, and resealability are improving product shelf life and consumer appeal, especially in e-commerce and retail environments

- The growing awareness of animal welfare and environmental impact is encouraging greater adoption of alternative protein jerky, positioning these products as mainstream snacks alongside traditional meat jerky

Jerky Snacks Market Dynamics

Driver

Growing Demand for On-The-Go Snacks

- The rising consumer preference for convenient, portable, and high-protein snack options is driving growth in the jerky snacks market, especially among busy professionals, fitness enthusiasts, and outdoor activity participants

- For instance, Frito-Lay North America (PepsiCo Inc.) has expanded its product portfolio with convenient single-serve jerky packs tailored for on-the-go consumption in places such as gyms, offices, and travel settings

- Increasing health awareness and shifting dietary preferences encourage consumers to choose jerky as a satisfying alternative to carbohydrate-heavy snacks such as chips and crackers

- Expansion of retail availability through supermarkets, convenience stores, and increasingly via online platforms is enhancing accessibility and visibility of jerky snacks globally

- The trend towards active lifestyles and clean eating supports premiumization in jerky offerings, with consumers willing to pay more for products perceived as healthier, higher in protein, and free from artificial additives

Restraint/Challenge

Price Sensitivity and High Production Costs for Premium Jerky

- The higher production costs associated with premium ingredients, clean-label formulations, and plant-based alternatives translate into elevated retail prices that may restrict market penetration among price-sensitive consumers

- For instance, some emerging plant-based jerky brands face challenges in achieving competitive pricing against traditional meat jerky products due to processing complexities and raw material costs

- Supply chain volatility, especially fluctuations in meat prices and availability of specialty plant proteins, adds to cost pressures and can affect profitability for manufacturers

- Consumer segments in developing regions may respond less favorably to premium-priced jerky products, limiting overall market growth and necessitating tailored pricing strategies

- Balancing quality, innovation, and affordability remains an ongoing challenge for brands aiming to expand mainstream adoption without compromising product integrity or margins

Jerky Snacks Market Scope

The market is segmented on the basis of product, flavor, packaging, distribution channel, and end user.

- By Product

On the basis of product, the jerky snacks market is segmented into beef, pork, poultry, fish, salmon, kangaroo, buffalo, alligator, soy, mushroom, trout, chicken, duck, and others. The beef segment dominated the largest market revenue share of 51.2% in 2024 due to its long-standing dominance as a traditional jerky meat with strong consumer familiarity. Its high protein content, rich flavor, and widespread retail availability make it a preferred choice for mainstream buyers. Beef jerky is often seen as a portable, satisfying snack that meets both taste and nutrition needs, especially among fitness-conscious and outdoor consumers. The segment is further supported by brand loyalty, with numerous legacy and premium brands offering diversified beef jerky product lines. The category benefits from established supply chains and processing infrastructure, keeping production costs competitive. In addition, beef jerky holds cultural significance in countries such as the U.S., where it is embedded in convenience and impulse-buy patterns. The strong performance of this segment is tied to both tradition and consistent product innovation.

The mushroom segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by growing consumer demand for plant-based, clean-label snack options. Mushroom jerky mimics the texture and umami richness of meat, offering a flavorful and health-conscious alternative for vegans, vegetarians, and flexitarians. Its natural antioxidants, fiber, and lower fat content make it particularly attractive to wellness-driven consumers. As environmental concerns about meat production intensify, mushrooms offer a sustainable protein source with lower ecological impact. Startups and health-food brands are actively investing in mushroom-based jerky, expanding availability through natural food retailers and e-commerce. The segment also benefits from positive perceptions surrounding functional foods, as mushrooms are associated with immune and cognitive health. Its rapid market penetration reflects shifting dietary preferences and the success of plant-based innovation across snacking categories.

- By Flavor

On the basis of flavor, the jerky snacks market is segmented into original, teriyaki, peppered, and others. The original flavor segment held the largest market share in 2024, supported by its broad appeal, simple seasoning, and strong presence across retail shelves. Consumers often gravitate toward original jerky due to its familiar taste and minimal additives, which align with the clean-label trend. It serves as a foundational flavor that resonates with traditional buyers and those seeking an authentic, unaltered meat profile. Many first-time buyers also opt for the original variant as a safe introduction to jerky products. Legacy brands prioritize this flavor in core SKUs due to its consistent sales performance and versatility across proteins. Retailers continue to promote original-flavored jerky heavily, reinforcing its dominance in both mainstream and specialty outlets. The flavor’s enduring popularity stems from its balance of taste, tradition, and broad market reach.

The teriyaki flavor segment is expected to register the fastest CAGR from 2025 to 2032, driven by growing interest in globally inspired taste profiles and sweet-savory combinations. Teriyaki jerky combines soy sauce, sugar, and spices to deliver a flavor that appeals to adventurous and younger consumers seeking variety. The fusion of Asian culinary influence with snackable formats has created a strong demand for teriyaki products across both meat-based and plant-based jerky lines. It is especially popular in premium segments and multipack offerings that target snack enthusiasts. Brands are leveraging this flavor to differentiate their offerings and target urban markets with multicultural preferences. Its success also reflects the broader rise of global flavors in the packaged food industry. As flavor innovation continues to drive consumer experimentation, teriyaki jerky is well-positioned for sustained rapid growth.

- By Packaging

On the basis of packaging, the jerky snacks market is segmented into stand-up pouch, flat bottom pouch, and others. The stand-up pouch segment dominated the market revenue share in 2024 due to its high functionality, cost-efficiency, and widespread acceptance among manufacturers and consumers. This packaging format offers durability, lightweight properties, and excellent barrier protection, extending the product’s shelf life. Stand-up pouches are resealable, improving convenience for on-the-go snacking and minimizing food waste. Their vertical structure allows them to occupy less shelf space while maximizing visual appeal and brand visibility. Brands prefer this packaging for its customizability, supporting vivid graphics, window features, and sustainable material innovations. Consumers appreciate the practicality of these pouches, which combine portability with ease of storage. The segment’s dominance is reinforced by its compatibility with automation, reducing operational costs for producers.

The flat bottom pouch segment is projected to grow at the fastest rate from 2025 to 2032, propelled by its premium appearance, structural stability, and efficient shelf utilization. This packaging format, often seen in gourmet and organic product lines, allows brands to differentiate their offerings with a high-end look. The extra panels on flat bottom pouches provide more space for branding, nutritional information, and storytelling, enhancing consumer engagement. Retailers value their stability, as they stand well on shelves and are less prone to tipping, especially in bulk formats. Consumers perceive flat bottom pouches as more upscale and eco-friendly, aligning with rising expectations for design and sustainability. The format supports a wide range of materials, including recyclable and biodegradable films, further strengthening its appeal. As more artisanal and health-conscious brands enter the market, this packaging type is becoming a strategic tool for premium positioning.

- By Distribution Channel

On the basis of distribution channel, the jerky snacks market is segmented into hypermarkets, supermarkets, specialty stores, and others. The supermarkets segment held the largest revenue share in 2024 owing to its broad accessibility, extensive product assortment, and strong influence over consumer purchase behavior. Supermarkets serve as a one-stop destination where consumers can compare various brands, flavors, and formats of jerky snacks. These outlets often run price promotions, loyalty programs, and in-store displays that enhance product visibility and boost sales. Both private-label and branded jerky products perform well in supermarkets due to high foot traffic and convenience-oriented shoppers. The segment also benefits from the rising popularity of health aisles and protein snack sections, which feature jerky prominently. As supermarkets expand their premium and organic offerings, they continue to capture a growing share of jerky sales. Their established distribution networks and trust with consumers reinforce their position as the leading channel.

The specialty stores segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing consumer interest in niche, gourmet, and health-focused jerky options. Specialty stores offer curated selections that appeal to food-conscious buyers looking for high-quality ingredients, exotic proteins, or dietary-specific options such as keto, gluten-free, or vegan jerky. These stores allow smaller brands and startups to reach target audiences directly through premium merchandising and sampling opportunities. Customers often receive personalized recommendations and product education, enhancing brand trust and loyalty. Specialty stores also cater to ethically and environmentally minded consumers, offering sustainably sourced and small-batch jerky products. The rise of boutique food shops, health stores, and gourmet grocers reflects the growing demand for elevated snacking experiences. This channel aligns with the premiumization trend in snacking, supporting strong future growth.

- By End User

On the basis of end user, the jerky snacks market is segmented into residential and commercial. The residential segment accounted for the largest revenue share in 2024, supported by rising demand for convenient, protein-rich snacks for home and personal consumption. Households increasingly incorporate jerky into everyday diets as a healthy alternative to sugary or carb-heavy snacks. Busy lifestyles, fitness goals, and remote working trends have contributed to increased at-home snacking, where shelf-stable items such as jerky are preferred. The segment also benefits from the proliferation of e-commerce platforms, which offer direct access to a wide variety of jerky options. Subscription models and DTC brands are gaining traction, allowing consumers to personalize flavor profiles and delivery frequency. Parents and individuals seeking clean-label, portion-controlled options also favor jerky for lunchboxes and quick energy boosts. The combination of health appeal, convenience, and broad availability continues to drive residential segment dominance.

The commercial segment is projected to register the fastest CAGR from 2025 to 2032, fueled by rising demand in vending machines, office pantries, travel hubs, and institutional catering. Jerky’s long shelf life, minimal handling, and compact packaging make it an ideal choice for commercial foodservice and retail applications. Businesses are increasingly including high-protein snacks in wellness programs, breakroom assortments, and in-flight offerings to meet evolving dietary preferences. The hospitality sector is also leveraging gourmet jerky as part of minibar selections and welcome kits, enhancing guest experiences. Convenience stores and gas stations continue to expand their jerky offerings to cater to travelers and shift workers. The segment also includes fitness centers and campus stores, where jerky aligns with active lifestyles and sports nutrition. As commercial spaces modernize their snack assortments, jerky is becoming a staple in high-protein, on-the-go formats.

Jerky Snacks Market Regional Analysis

- North America dominated the jerky snacks market with the largest revenue share of 43.3% in 2024, driven by high consumer preference for protein-rich, convenient snacks and a well-established meat snack culture

- Consumers in the region prioritize high-protein, low-carb snacks that align with active and health-conscious lifestyles, especially among gym-goers and outdoor enthusiasts

- The growing demand for clean-label and functional snacks, along with the popularity of keto and paleo diets, has fueled jerky consumption across various age groups

U.S. Jerky Snacks Market Insight

The U.S. jerky snacks market captured the largest revenue share in 2024 within North America, driven by the country’s strong retail infrastructure, high protein consumption, and innovative product offerings. The market benefits from a large base of consumers seeking on-the-go snacking options that support fitness and dietary goals. The presence of both legacy brands and emerging startups has created a dynamic competitive landscape, leading to expanded flavor profiles, exotic proteins, and plant-based variants. In addition, growing e-commerce penetration and DTC models are increasing accessibility and brand engagement.

Europe Jerky Snacks Market Insight

The Europe jerky snacks market is projected to grow at a notable CAGR throughout the forecast period, supported by increasing health awareness and rising demand for natural, high-protein snacks. European consumers are gradually shifting away from sugary and processed snacks toward clean-label, low-sugar alternatives such as jerky. The region’s growing interest in fitness and sustainable consumption is also contributing to the popularity of plant-based jerky options. As convenience foods gain traction, jerky is being integrated into meal kits, lunchbox options, and sports nutrition channels.

U.K. Jerky Snacks Market Insight

The U.K. jerky snacks market is expected to grow at a strong CAGR during the forecast period, fueled by the growing appetite for protein snacks and clean-eating trends. British consumers are showing increasing interest in beef and alternative protein jerky as healthier substitutes for traditional crisps and confections. Retailers are expanding their healthy snacking aisles, and specialty stores are highlighting niche jerky brands with sustainable sourcing and artisan appeal. Rising gym memberships and outdoor activity trends are further boosting demand for high-protein portable snacks.

Germany Jerky Snacks Market Insight

The Germany jerky snacks market is anticipated to expand steadily over the forecast period, driven by rising consumer focus on nutrition, functionality, and convenience. German consumers increasingly prefer snacks that provide satiety and energy, particularly during work hours or travel. The market is witnessing a gradual but steady uptake in both traditional and plant-based jerky formats. Demand for organic, preservative-free products aligns well with German preferences for clean-label foods. Growth is also supported by wider product availability in supermarkets, fitness centers, and online platforms.

Asia-Pacific Jerky Snacks Market Insight

The Asia-Pacific jerky snacks market is expected to grow at the fastest CAGR during the forecast period of 2025 to 2032, supported by rapid urbanization, dietary diversification, and rising middle-class consumption. Consumers in countries such as China, Japan, South Korea, and India are becoming more receptive to Western-style protein snacks, including jerky. Expansion of retail chains and increasing exposure to international food trends through social media are accelerating adoption. The rise of fitness culture and demand for portable, protein-rich snacks are also driving regional market growth.

Japan Jerky Snacks Market Insight

The Japan jerky snacks market is gaining momentum due to the country's increasing demand for functional, savory snacks with high nutritional value. Japanese consumers value convenience and quality, leading to the popularity of both seafood-based jerky and premium meat products. Growing awareness around protein intake and health consciousness is pushing consumers toward low-fat, low-sugar options such as jerky. The market is also experiencing product innovation in packaging and flavor, catering to consumers seeking balanced and culturally appealing snacks.

China Jerky Snacks Market Insight

The China jerky snacks market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by increasing disposable incomes, changing dietary preferences, and exposure to global food products. Jerky is gaining traction across urban and semi-urban regions as a high-protein, shelf-stable snack that appeals to younger and working populations. Domestic brands are investing heavily in flavor innovation, local protein sources, and e-commerce distribution to reach a broader audience. The growing acceptance of meat and plant-based jerky across supermarkets, convenience stores, and online platforms is further propelling the market.

Jerky Snacks Market Share

The jerky snacks industry is primarily led by well-established companies, including:

- LINKS SNACKS, INC. (U.S.)

- Old Trapper Smoked Products (U.S.)

- Oberto Snacks Inc. (U.S.)

- THE HERSHEY COMPANY (U.S.)

- General Mills Inc. (U.S.)

- Chef's Cut Real Jerky Co. (U.S.)

- Frito-Lay North America, Inc. (a subsidiary of PepsiCo) (U.S.)

- Tillamook Country Smoker (U.S.)

- Conagra Brands, Inc. (U.S.)

- The Meatsnacks Group Ltd (U.K.)

Latest Developments in Global Jerky Snacks Market

- In September 2024, Jack Link’s introduced a limited-edition beef jerky flavor, Red Light Green Light, inspired by the popular Netflix series Squid Game. Featuring sweet and spicy Korean Ssamjang flavors, the launch strategically capitalized on pop culture trends to boost brand visibility and consumer engagement. This cross-promotional product appealed to fans of the series and also helped expand the brand’s reach among younger demographics, reinforcing the role of entertainment-driven product innovation in driving demand within the jerky snacks market

- In April 2023, Doki Foods, a Delhi-based startup, aims to become India's first meat snack brand by launching chicken chips and buffalo jerky in diverse flavors. Co-founders Bharat Kaushish and Bharat Dhody started the venture inspired by a fitness phase and a craving for high-protein snacks. Despite facing challenges such as a defrosted emu and initial product struggles, Doki gained popularity, especially among the fitness community. The company prioritizes quality, using the leanest cuts of buffalo meat and free-range chicken, committing to ethical practices and sustainability. Doki plans to expand its meat snacks range, including more indulgent options such as pork crackling

- In February 2021, Werner Gourmet Meat Snacks Inc. unveils a refreshed look for their complete Snack Line, aligning it with the successful rebranding of their meat snacks introduced in May 2019. The Snack Line includes gummy candy, roasted nuts, proprietary trail mixes, and more. Lauded for its effectiveness, the new packaging mirrors the vibrant teal background of the meat snacks, showcasing a badge-shaped design. Following positive industry feedback, Werner Snacks will start shipping with the new packaging in the first quarter of 2021, hitting retail shelves in the second quarter

- In September 2021, In a significant stride towards market expansion, Baja Jerky has forged strategic partnerships with major distributors KeHE, UNFI, Eby-Brown, and SYSCO. This collaboration extends Baja Jerky's reach into new markets, including the Central and East Coast regions, amplifying its visibility within the meat snacks category. Distributors such as KeHE and UNFI facilitate national presence, while Eby-Brown focuses on the convenience market in WV, PA, and MD. SYSCO, as the largest broadline food distributor, enhances Baja Jerky's standing in the restaurant and hospitality sector. This expansion bolsters Baja Jerky's nationwide accessibility and also underscores its commitment to transparency and quality in the meat snack market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Jerky Snacks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Jerky Snacks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Jerky Snacks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.