Global Kids Wear Market

Market Size in USD Million

CAGR :

%

USD

212.50 Million

USD

365.11 Million

2025

2033

USD

212.50 Million

USD

365.11 Million

2025

2033

| 2026 –2033 | |

| USD 212.50 Million | |

| USD 365.11 Million | |

|

|

|

|

What is the Global Kids Wear Market Size and Growth Rate?

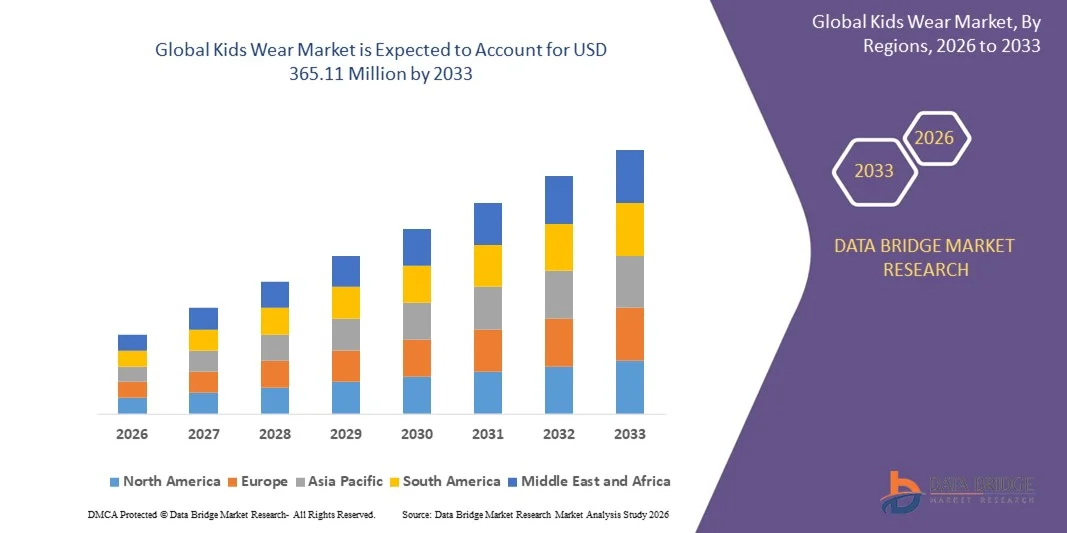

- The global kids wear market size was valued at USD 212.50 million in 2025 and is expected to reach USD 365.11 million by 2033, at a CAGR of7.00% during the forecast period

- Increasing preference for stylish, comfortable, and sustainable apparel, rising awareness among parents regarding premium and branded clothing, growing demand for online retail platforms and e-commerce channels, expansion of organized retail chains, and rising disposable income among middle-class families are some of the major factors likely to drive the growth of the kids wear market.

What are the Major Takeaways of Kids Wear Market?

- Growing popularity of eco-friendly fabrics, themed apparel, and fashionable designs among children is creating new opportunities for manufacturers and retailers, further boosting market growth

- Seasonal demand fluctuations, high competition among local and global brands, and challenges in supply chain management may act as restraints, potentially impacting market expansion

- North America dominated the kids wear market with a 31.13% revenue share in 2025, driven by increasing consumer spending, rising urbanization, and strong adoption of premium and casual kids apparel across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.25% from 2026 to 2033, driven by increasing urbanization, rising disposable incomes, growing online retail penetration, and rapid expansion of organized retail chains across China, India, Japan, South Korea, and Southeast Asia

- The Casual Wear segment dominated the market with a 45.2% share in 2025, owing to its versatility, comfort, and year-round usage across schools, playdates, and daily wear

Report Scope and Kids Wear Market Segmentation

|

Attributes |

Kids Wear Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Kids Wear Market?

Increasing Shift Toward Premium, Sustainable, and Digitally-Influenced Kids Apparel

- The Kids Wear market is witnessing strong adoption of sustainable fabrics, eco-friendly materials, and digitally designed clothing catering to style-conscious parents and children

- Manufacturers are introducing versatile apparel ranges, including mix-and-match outfits, themed clothing, and customizable designs that offer comfort, durability, and aesthetic appeal

- Growing demand for convenient shopping experiences, including online platforms, subscription boxes, and virtual fitting tools, is driving sales across retail and e-commerce channels

- For instance, companies such as Carter’s, GAP Kids, H&M Kids, and Zara Kids have enhanced their product lines with sustainable fabrics, trendy collections, and personalized online shopping experiences

- Increasing awareness among parents regarding fashion, comfort, and child safety is accelerating adoption of branded and eco-friendly kids wear

- As children’s fashion evolves, Kids Wears will remain essential for blending style, comfort, and sustainability in everyday apparel

What are the Key Drivers of Kids Wear Market?

- Rising demand for eco-friendly, high-quality, and visually appealing apparel that combines style with durability

- For instance, in 2025, leading brands such as Carter’s, GAP Kids, H&M, Zara, and Mothercare expanded their sustainable collections and integrated digital tools for personalized shopping

- Growing penetration of e-commerce, mobile shopping apps, and online customization services is boosting global market reach

- Expansion of organized retail chains and international franchises is increasing brand visibility and consumer access

- Rising disposable income and growing focus on children’s fashion among middle-class families are fueling higher consumption

- Supported by marketing campaigns, influencer promotions, and collaborations with designers, the Kids Wear market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Kids Wear Market?

- High costs associated with premium and branded clothing limit adoption among price-sensitive families

- For instance, during 2024–2025, fluctuations in raw material costs, labor shortages, and supply chain disruptions increased product pricing for several global vendors

- Complex sizing variations, seasonal trends, and rapidly changing fashion preferences increase operational challenges for manufacturers and retailers

- Limited awareness about sustainable or eco-friendly apparel in emerging markets slows adoption

- Competition from unbranded local apparel, fast fashion, and second-hand clothing creates pricing pressure and reduces market differentiation

- To address these issues, companies are focusing on affordable sustainable lines, digital customization, targeted promotions, and omni-channel retail strategies to increase global adoption of Kids Wears

How is the Kids Wear Market Segmented?

The market is segmented on the basis of channel count, application, and vertical.

- By Product Type

On the basis of product type, the kids wear market is segmented into Formal, Casual, and Semi-Formal Wear. The Casual Wear segment dominated the market with a 45.2% share in 2025, owing to its versatility, comfort, and year-round usage across schools, playdates, and daily wear. Casual clothing such as t-shirts, shorts, dresses, and joggers is widely preferred by parents and children for its ease of movement and stylish appeal. Increasing urbanization, dual-income households, and lifestyle-oriented spending are further driving adoption.

The Formal Wear segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for school uniforms, festive wear, and party outfits. Manufacturers are introducing designer formal collections with innovative fabrics and eco-friendly materials to attract fashion-conscious parents, enhancing market expansion for premium offerings.

- By End-User

On the basis of end-user, the kids wear market is segmented into Boys and Girls. The Boys segment dominated the market with a 52.1% share in 2025, fueled by higher demand for casual, sports, and school apparel. Boys’ clothing trends emphasize comfort, durability, and functionality, which drives consistent purchases across urban and semi-urban regions.

The Girls segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing focus on trendy, fashionable, and colorful outfits. Rising disposable income, social media influence, and a growing appetite for branded and eco-friendly apparel among girls’ wear customers are propelling growth. Retailers and online platforms are offering customized collections, designer dresses, and festive apparel, further accelerating adoption in the segment.

- By Age Group

On the basis of age group, the kids wear market is segmented into Below 5 Years, 5–10 Years, and Above 10 Years. The 5–10 Years segment dominated the market with a 48.7% share in 2025, driven by strong demand for school uniforms, casual outfits, and age-specific playwear. Children in this age bracket are more active, and parents prioritize comfort, durability, and style in apparel purchases.

The Above 10 Years segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing influence of fashion trends, online shopping, and social media among pre-teens and teens. Brands are focusing on trendy collections, branded merchandise, and customization options to cater to evolving tastes and preferences, boosting market growth.

- By Distribution Channel

On the basis of distribution channel, the kids wear market is segmented into Offline and Online channels. The Offline segment dominated the market with a 55.3% share in 2025, driven by the presence of organized retail stores, departmental chains, and local specialty shops that offer tactile experience, try-on facilities, and immediate purchase convenience.

The Online segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising e-commerce penetration, mobile app adoption, and growing preference for doorstep delivery. Retailers and brands are investing in digital platforms, virtual fittings, and personalized shopping experiences to enhance customer engagement, further expanding online sales globally.

Which Region Holds the Largest Share of the Kids Wear Market?

- North America dominated the kids wear market with a 31.13% revenue share in 2025, driven by increasing consumer spending, rising urbanization, and strong adoption of premium and casual kids apparel across the U.S. and Canada

- High brand awareness, rapid expansion of organized retail, and increasing penetration of online retail platforms continue to fuel demand for Kids Wears across urban and semi-urban regions. Leading companies in North America are introducing innovative collections, sustainable fabrics, and technologically integrated e-commerce solutions, strengthening the region’s market leadership

- Continuous investments in marketing, R&D, and production capabilities further reinforce regional dominance, while high disposable income and evolving fashion trends continue to drive long-term market expansion

U.S. Kids Wear Market Insight

The U.S. is the largest contributor in North America, supported by growing demand for casual, formal, and semi-formal kids apparel across schools, social events, and online platforms. Rising awareness of sustainable and branded clothing, increasing digital commerce, and rapid adoption of e-retail apps intensify demand for Kids Wears. Presence of major fashion brands, startup clothing lines, and strong distribution networks further drives market growth, making the U.S. a critical hub for innovation and consumer adoption.

Canada Kids Wear Market Insight

Canada contributes significantly to regional growth, driven by expanding retail networks, rising demand for eco-friendly and organic kids apparel, and increasing e-commerce adoption. Parents are increasingly seeking durable, comfortable, and fashionable clothing for children, supporting market expansion. Government initiatives promoting sustainable textiles, coupled with urban population growth and rising disposable income, further reinforce the market. Educational institutions and daycare centers also drive bulk purchases of formal and casual uniforms, sustaining steady growth.

Asia-Pacific Kids Wear Market

Asia-Pacific is projected to register the fastest CAGR of 8.25% from 2026 to 2033, driven by increasing urbanization, rising disposable incomes, growing online retail penetration, and rapid expansion of organized retail chains across China, India, Japan, South Korea, and Southeast Asia. Growing population of children, increasing fashion consciousness among parents, and the rise of e-commerce platforms are key factors accelerating market demand. Brands are focusing on localized designs, affordable pricing, and seasonal collections to capture market share, while emerging economies are witnessing strong growth in premium and casual kids apparel segments.

China Kids Wear Market Insight

China is the largest contributor to Asia-Pacific due to a rising middle-class population, growing fashion consciousness, and strong retail infrastructure. Demand for casual, formal, and semi-formal kids clothing is increasing rapidly, supported by online sales channels and domestic fashion brands. Expansion of organized retail stores, coupled with digital marketing initiatives, boosts consumer adoption and drives overall market growth.

Japan Kids Wear Market Insight

Japan shows steady growth supported by high disposable income, strong retail infrastructure, and increasing demand for premium and eco-friendly kids apparel. Rising interest in designer clothing, seasonal collections, and formal wear for school and social occasions drives market adoption. E-commerce and online retail platforms are increasingly influencing purchasing decisions, supporting growth in both urban and suburban areas.

India Kids Wear Market Insight

India is emerging as a major growth hub, driven by rapid urbanization, rising disposable incomes, and a growing middle-class population. Increasing awareness of branded, casual, and formal kids wear, combined with the expansion of online retail platforms, fuels adoption. Government initiatives supporting textile manufacturing and startups in apparel further enhance market penetration, while seasonal festivals and school uniform requirements sustain consistent demand.

South Korea Kids Wear Market Insight

South Korea contributes significantly due to high fashion awareness among parents, rising disposable income, and increasing online retail penetration. Demand for trendy casual wear, formal outfits, and semi-formal apparel is growing across urban regions. Brands focusing on quality, comfort, and eco-friendly materials, coupled with strong digital marketing campaigns, are driving adoption. E-commerce platforms and social media influence further support rapid market growth.

Which are the Top Companies in Kids Wear Market?

The kids wear industry is primarily led by well-established companies, including:

- Carter’s, Inc. (U.S.)

- The Children's Place, Inc. (U.S.)

- Nike, Inc. (U.S.)

- Gianni Versace S.r.l. (Italy)

- Industria de Diseño Textil, S.A. (Inditex) (Spain)

- Hennes & Mauritz AB (Sweden)

- Mothercare plc (U.K.)

- Cotton On Group (Australia)

- Burberry (U.K.)

- Gerber Childrenswear LLC (U.S.)

What are the Recent Developments in Global Kids Wear Market?

- In October 2022, H&M launched its new collection “Imagine That”, marking the first independent kidswear range from its Innovation Stories initiative. The collection is made from recycled bottles and a cactus-derived leather alternative, emphasizing sustainability and eco-conscious fashion trends for children. This launch strengthens H&M’s commitment to innovative and environmentally friendly kids apparel

- In October 2022, Les Petits, a luxury fashion brand, unveiled an exclusive new range of kids apparel under its in-house brands Rang and Stella Rossa. The Rang collection focuses on ethnic wear, while Stella Rossa offers party wear for special occasions, catering to diverse children’s fashion needs. This launch reinforces the brand’s presence in premium kidswear

- In October 2022, Starrior, a children’s clothing brand, introduced its first eco-friendly, high-quality kidswear collection, including t-shirts, sweatshirts, shorts, sweatpants, hats, and everyday wear in sizes from Newborn to Youth XL. The collection highlights sustainability and versatility for young consumers, enhancing Starrior’s market positioning

- In July 2022, Abercrombie Kids, part of Abercrombie & Fitch Co., launched its new 2022 denim collection for kids, featuring updated options for fit and sizing. The collection caters to comfort, style, and contemporary fashion preferences for children, strengthening brand loyalty among young consumers

- In January 2022, Michael Kors, in collaboration with Children Worldwide Fashion (CWF), launched a line of children’s apparel and accessories for boys and girls. The collection focuses on premium, stylish, and functional clothing, expanding Michael Kors’ footprint in the global kidswear market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.