Global Lab Automation For In Vitro Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

5.87 Billion

USD

9.58 Billion

2024

2032

USD

5.87 Billion

USD

9.58 Billion

2024

2032

| 2025 –2032 | |

| USD 5.87 Billion | |

| USD 9.58 Billion | |

|

|

|

|

Lab Automation for In-vitro Diagnostics Market Size

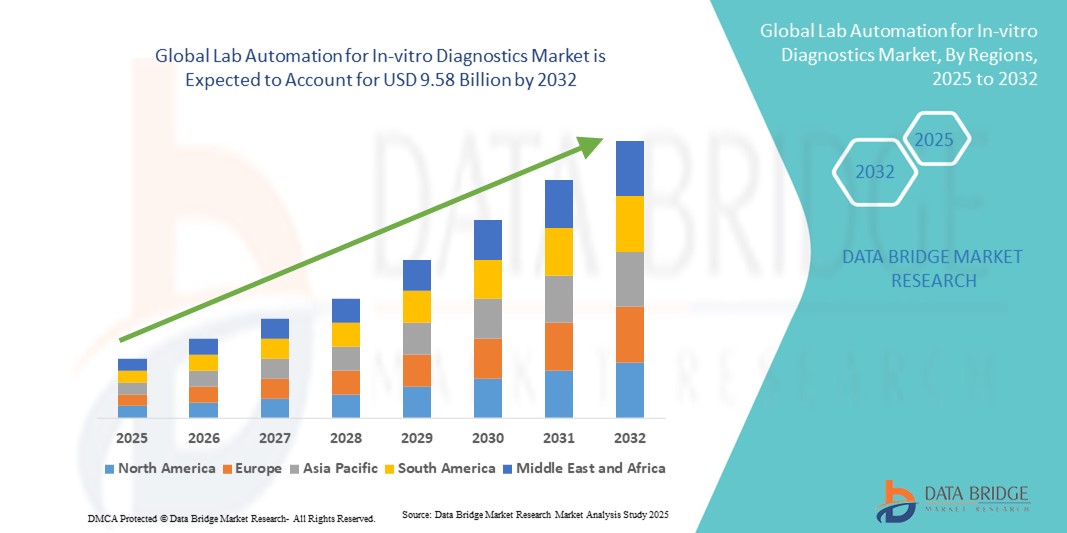

- The global lab automation for In-Vitro diagnostics market size was valued at USD 5.87 billion in 2024 and is expected to reach USD 9.58 billion by 2032, at a CAGR of 6.32% during the forecast period

- The market growth is largely driven by the increasing adoption of automated diagnostic systems and advancements in laboratory robotics, leading to improved efficiency, accuracy, and throughput in clinical testing

- Furthermore, rising demand for faster, reliable, and high-throughput diagnostic solutions across hospitals, diagnostic centers, and research laboratories is positioning lab automation as a critical component in modern healthcare. These factors collectively are accelerating the adoption of lab automation solutions, thereby significantly propelling the industry's growth

Lab Automation for In-vitro Diagnostics Market Analysis

- Lab automation for in-vitro diagnostics, providing automated solutions for sample handling, processing, and analysis, is becoming an essential component of modern clinical laboratories and research facilities due to enhanced accuracy, faster turnaround times, and seamless integration with laboratory information systems (LIS)

- The increasing demand for lab automation is primarily driven by the need for high-throughput testing, growing prevalence of chronic and infectious diseases, and the rising focus on reducing human error and operational costs in clinical diagnostics

- North America dominated the lab automation for in-vitro diagnostics market with the largest revenue share of 39.6% in 2024, characterized by early adoption of advanced laboratory technologies, high healthcare expenditure, and the presence of major industry players, with the U.S. witnessing significant growth in automated diagnostic installations across hospitals, reference labs, and research centers, propelled by innovations in robotic sample handling, AI-driven diagnostics, and integrated workflow solutions

- Asia-Pacific is expected to be the fastest-growing region in the lab automation market during the forecast period due to expanding healthcare infrastructure, increasing government initiatives for diagnostic efficiency, and rising demand for advanced clinical testing in emerging economies

- Automated liquid handler segment dominated the lab automation market with a market share of 42.6% in 2024, driven by its critical role in improving throughput, precision, and reproducibility across a wide range of clinical chemistry and immunoassay applications

Report Scope and Lab Automation for In-vitro Diagnostics Market Segmentation

|

Attributes |

Lab Automation for In-vitro Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lab Automation for In-vitro Diagnostics Market Trends

AI-Driven and Robotics-Enhanced Laboratory Automation

- A significant and accelerating trend in the global lab automation for in-vitro diagnostics market is the increasing integration of artificial intelligence (AI) and advanced robotics into laboratory workflows, enhancing efficiency, accuracy, and throughput

- For instance, automated liquid handling systems integrated with AI can optimize pipetting patterns and reduce reagent waste, enabling faster and more reliable sample processing across multiple assays

- AI integration enables predictive maintenance of equipment, anomaly detection, and workflow optimization, while robotics enhance repeatability and minimize human error. For instance, some automated analyzers use AI to prioritize urgent samples based on historical testing patterns

- The seamless integration of lab automation systems with laboratory information management systems (LIMS) and other digital platforms facilitates centralized monitoring, data analysis, and reporting, improving operational oversight

- This trend towards intelligent, connected, and high-throughput laboratory systems is fundamentally reshaping user expectations for diagnostics efficiency. Consequently, companies are developing AI-enabled robotic arms and automated storage systems capable of adaptive scheduling and real-time monitoring

- The demand for lab automation solutions featuring AI and robotics integration is growing rapidly across clinical, academic, and research laboratories as institutions prioritize speed, accuracy, and operational efficiency

Lab Automation for In-vitro Diagnostics Market Dynamics

Driver

Rising Need for High-Throughput, Accurate Diagnostics

- The increasing prevalence of chronic and infectious diseases, combined with the rising demand for faster and more accurate diagnostics, is a key driver for the adoption of lab automation systems

- For instance, in March 2024, a leading diagnostics company implemented AI-powered automated plate handlers to improve turnaround time for high-volume immunoassay testing, driving workflow efficiency

- Automated systems reduce human error, improve reproducibility, and increase sample throughput, offering a compelling advantage over manual laboratory processes

- Furthermore, the growing adoption of centralized laboratory networks and integrated healthcare facilities is making automated systems a necessity for maintaining consistent quality and scalability

- High demand for reliable, high-throughput testing, combined with growing investments in clinical diagnostics and research laboratories, is propelling the widespread deployment of automated liquid handlers, robotic arms, and analyzers

- Instance of robotic arms optimizing sample handling and automated storage systems enabling continuous workflow highlights the operational efficiency driving market adoption

Restraint/Challenge

High Cost and Regulatory Compliance Constraints

- The relatively high initial cost of advanced lab automation systems compared to traditional manual methods poses a challenge for market penetration, especially in smaller laboratories or emerging economies

- For instance, laboratories in developing regions may delay automation adoption due to budget constraints despite the long-term efficiency benefits

- Strict regulatory compliance requirements for clinical diagnostics, including validation, calibration, and quality control standards, can slow down the deployment of automated systems

- Addressing these challenges requires careful adherence to FDA, ISO, and other regional guidelines, ensuring accuracy, reproducibility, and patient safety

- While automation reduces long-term operational costs, the upfront investment in robotics, analyzers, and integration with LIMS remains a significant barrier for some end users

- Instance of smaller academic or research labs facing budgetary and regulatory hurdles highlights the need for cost-effective, compliant automation solutions to drive broader adoption

Lab Automation for In-vitro Diagnostics Market Scope

The market is segmented on the basis of equipment, application, and end user.

- By Equipment

On the basis of equipment, the lab automation for in-vitro diagnostics market is segmented into automated plate handler, automated liquid handler, robotic arm, automated storage and retrieval system, and analyser. The automated liquid handler segment dominated the market with the largest revenue share of 42.6% in 2024, driven by its ability to improve throughput, accuracy, and reproducibility across a wide range of diagnostic assays. Laboratories prioritize automated liquid handlers for their critical role in sample preparation, reducing human error, and supporting high-throughput workflows in both clinical chemistry and immunoassay applications. The segment’s widespread compatibility with various assay formats and integration with laboratory information management systems (LIMS) further reinforces its dominance. In addition, growing investments in diagnostic laboratories and the push for operational efficiency are increasing the adoption of liquid handling automation.

The robotic arm segment is anticipated to witness the fastest growth rate of 23.4% from 2025 to 2032, fueled by rising demand for fully automated sample handling and high-throughput testing. Robotic arms provide precise, programmable movements for sample transfer, plate handling, and integration with analyzers, minimizing manual intervention. Their adaptability allows deployment across diverse laboratory setups, including academic, clinical, and research environments. The growing integration of AI and machine learning to optimize robotic operations is further driving their adoption. In addition, the rising trend of laboratory consolidation and the demand for streamlined, end-to-end automation solutions are supporting the segment’s rapid growth.

- By Application

On the basis of application, the market is segmented into clinical chemistry and immunoassay. The clinical chemistry segment dominated the market with the largest revenue share in 2024, attributed to the high volume of routine diagnostic tests conducted in hospitals and clinical laboratories. Automation in clinical chemistry enables faster sample processing, improved assay consistency, and reduced turnaround times, which are critical for timely patient care. The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and liver dysfunction is fueling the demand for automated clinical chemistry testing. Laboratories prefer automation solutions for clinical chemistry due to the repetitive nature of the assays and the need for high accuracy and throughput.

The immunoassay segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising demand for sensitive and specific biomarker detection in diagnostics and research. Automated systems for immunoassays reduce manual errors, enhance reproducibility, and enable high-throughput screening of samples. Growing adoption of personalized medicine and biomarker-based testing is accelerating the need for immunoassay automation. Furthermore, integration with AI-enabled analyzers allows real-time optimization of assay conditions and faster reporting of results, making immunoassay automation an increasingly attractive solution for clinical and research laboratories.

- By End User

On the basis of end user, the market is segmented into academic, laboratory, and other end users. The laboratory segment dominated the market with the largest revenue share in 2024, driven by the extensive use of automated systems in hospital laboratories, reference labs, and diagnostic centers. Laboratories prioritize automation to improve throughput, minimize human error, and maintain compliance with regulatory standards. The increasing adoption of integrated workflow solutions and high-throughput equipment across clinical laboratories reinforces the segment’s dominance.

The academic segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising focus on research, biotechnology, and life sciences education. Academic and research institutions are increasingly implementing automated solutions such as robotic arms, automated plate handlers, and analyzers to conduct complex experiments, training, and high-throughput assays. Growing funding for research, coupled with the push for precision and efficiency in laboratory education, is driving the rapid adoption of lab automation in academic settings.

Lab Automation for In-vitro Diagnostics Market Regional Analysis

- North America dominated the lab automation for in-vitro diagnostics market with the largest revenue share of 39.6% in 2024, characterized by early adoption of advanced laboratory technologies, high healthcare expenditure, and the presence of major industry players

- Healthcare institutions and diagnostic laboratories in the region highly value the efficiency, accuracy, and high-throughput capabilities offered by automated systems, which streamline sample processing and testing workflows

- This widespread adoption is further supported by the presence of key market players, strong research and development activities, and increasing demand for integrated laboratory solutions, establishing lab automation as a preferred choice for clinical, academic, and research laboratories

U.S. Lab Automation for In-vitro Diagnostics Market Insight

The U.S. lab automation for in-vitro diagnostics market captured the largest revenue share of 82% in 2024 within North America, fueled by the rapid adoption of advanced laboratory technologies and increasing demand for high-throughput, accurate diagnostics. Healthcare institutions are prioritizing automation to improve workflow efficiency, reduce human error, and enhance patient care. The growing implementation of AI-enabled analyzers and robotic systems, alongside integration with laboratory information management systems (LIMS), further propels market expansion. Moreover, strong R&D initiatives and a robust presence of key industry players are significantly contributing to the market’s growth.

Europe Lab Automation for In-vitro Diagnostics Market Insight

The Europe lab automation for in-vitro diagnostics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising demand for accurate, high-throughput testing and stringent regulatory compliance in clinical laboratories. Increasing investments in healthcare infrastructure and adoption of automated analyzers and robotic arms are fostering market growth. European laboratories are also seeking efficiency, reproducibility, and cost savings, encouraging automation adoption across hospitals, research centers, and diagnostic facilities. The market growth is further supported by the region’s emphasis on digital healthcare transformation and integration of smart laboratory solutions.

U.K. Lab Automation for In-vitro Diagnostics Market Insight

The U.K. lab automation market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for precision diagnostics and streamlined laboratory workflows. The adoption of automated liquid handlers, analyzers, and robotic arms is increasing across hospitals and reference laboratories to enhance throughput and reduce human error. In addition, initiatives to modernize healthcare facilities and embrace digital lab solutions are stimulating market growth. The U.K.’s strong focus on clinical research and personalized medicine is also encouraging laboratories to invest in advanced automation technologies.

Germany Lab Automation for In-vitro Diagnostics Market Insight

The Germany lab automation market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of laboratory efficiency, accuracy, and regulatory compliance. Germany’s advanced healthcare infrastructure, emphasis on innovation, and investment in smart diagnostic systems promote the adoption of automated analyzers, robotic arms, and storage solutions. The integration of automation with laboratory information management systems (LIMS) and the demand for high-throughput sample processing are driving growth. Laboratories in Germany are also increasingly adopting eco-friendly and energy-efficient automation solutions in line with sustainability goals.

Asia-Pacific Lab Automation for In-vitro Diagnostics Market Insight

The Asia-Pacific lab automation market is poised to grow at the fastest CAGR of 25% during the forecast period of 2025 to 2032, driven by rising healthcare expenditure, expanding laboratory infrastructure, and technological advancements in countries such as China, Japan, and India. The region’s increasing focus on modernized diagnostics and government initiatives promoting digital healthcare are driving the adoption of automated liquid handlers, analyzers, and robotic arms. Furthermore, the availability of cost-effective automation solutions and the expansion of domestic manufacturers are making lab automation more accessible across clinical, academic, and research laboratories.

Japan Lab Automation for In-vitro Diagnostics Market Insight

The Japan lab automation market is gaining momentum due to the country’s advanced technological ecosystem, high healthcare standards, and demand for precision diagnostics. Japanese laboratories prioritize automation to improve throughput, reduce manual errors, and integrate with digital laboratory systems. The increasing adoption of AI-enabled analyzers and robotic arms for clinical chemistry and immunoassay applications is fueling growth. In addition, Japan’s aging population is driving the need for efficient, reliable, and easy-to-use laboratory solutions in both clinical and research settings.

India Lab Automation for In-vitro Diagnostics Market Insight

The India lab automation market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding healthcare infrastructure, growing middle class, and rising adoption of advanced diagnostic technologies. India is emerging as a key market for automated liquid handlers, analyzers, and robotic systems across hospitals, diagnostic centers, and research laboratories. Government initiatives supporting digital healthcare and smart laboratory setups, combined with cost-effective automation solutions, are key factors propelling the market in India.

Lab Automation for In-vitro Diagnostics Market Share

The Lab Automation for In-vitro Diagnostics industry is primarily led by well-established companies, including:

- Cognex Corporation (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- Danaher (U.S.)

- Siemens Healthineers AG (Germany)

- Agilent Technologies Inc. (U.S.)

- Abbott (U.S.)

- PerkinElmer (U.S.)

- Tecan Group Ltd (Switzerland)

- BD (U.S.)

- BIOMÉRIEUX (France)

- QIAGEN (Netherlands)

- Hologic, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Sysmex Corporation (Japan)

- Waters Corporation (U.S.)

- Beckman Coulter, Inc. (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Hitachi High-Tech Corporation (Japan)

What are the Recent Developments in Global Lab Automation for In-vitro Diagnostics Market?

- In September 2025, Beckman Coulter Diagnostics introduced the industry's first fully automated, high-throughput BD-Tau research use only immunoassay test, advancing neurodegenerative clinical research. This test is available for use on the DxI 9000 Immunoassay Analyzer and Access 2 Analyzer, facilitating efficient biomarker analysis in clinical studies

- In July 2025, Siemens Healthineers launched the fully automated CN-3000 and CN-6000 Hemostasis Systems, delivering advanced coagulation testing capabilities for laboratories of varying sizes. These systems offer a broad menu of routine and specialty coagulation assays, designed for seamless integration with Atellica Data Manager and Process Manager, enabling hands-free workflows and centralized oversight

- In May 2025, Thermo Fisher Scientific launched the Thermo Scientific CV2000 automated aliquoting liquid handler, enhancing laboratory efficiency through workflow automation. This second-generation platform can accurately dispense liquid volumes from 100-875 µL and process up to 1000 samples per hour, streamlining sample preparation in high-throughput environments

- In April 2025, PerkinElmer introduced its Plate Handling Robot, designed to automate the handling, transport, and processing of microplates in high-throughput laboratory workflows. This system enhances laboratory efficiency by reducing manual handling and increasing throughput in diagnostic and research applications

- In December 2023, Abbott's GLP Systems Track received FDA approval, providing laboratories and patients with faster results. This automation system enhances laboratory efficiency by streamlining sample tracking and processing, contributing to improved diagnostic turnaround times

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.