Global Lab On A Chip Technologies For Rapid Testing Market

Market Size in USD Billion

CAGR :

%

USD

4.20 Billion

USD

7.72 Billion

2024

2032

USD

4.20 Billion

USD

7.72 Billion

2024

2032

| 2025 –2032 | |

| USD 4.20 Billion | |

| USD 7.72 Billion | |

|

|

|

|

Lab-on-a-Chip Technologies for Rapid Testing Market Analysis

The global lab-on-a-chip (LOC) technologies for rapid testing market is experiencing significant growth due to the rising demand for efficient, portable diagnostic solutions in healthcare, food safety, and environmental monitoring. With cancer cases expected to reach 29.5 million by 2040 and a growing concern over food contamination affecting 1 in 10 people globally, the need for quick and accurate testing methods is more critical than ever. LOC technologies offer significant advantages, including the ability to deliver rapid results, reduce costs, and improve patient outcomes. Furthermore, increasing regulatory support for innovation in diagnostic technologies is fostering advancements in LOC, driving its adoption across multiple sectors and contributing to its market expansion.

Lab-on-a-Chip Technologies for Rapid Testing Market Size

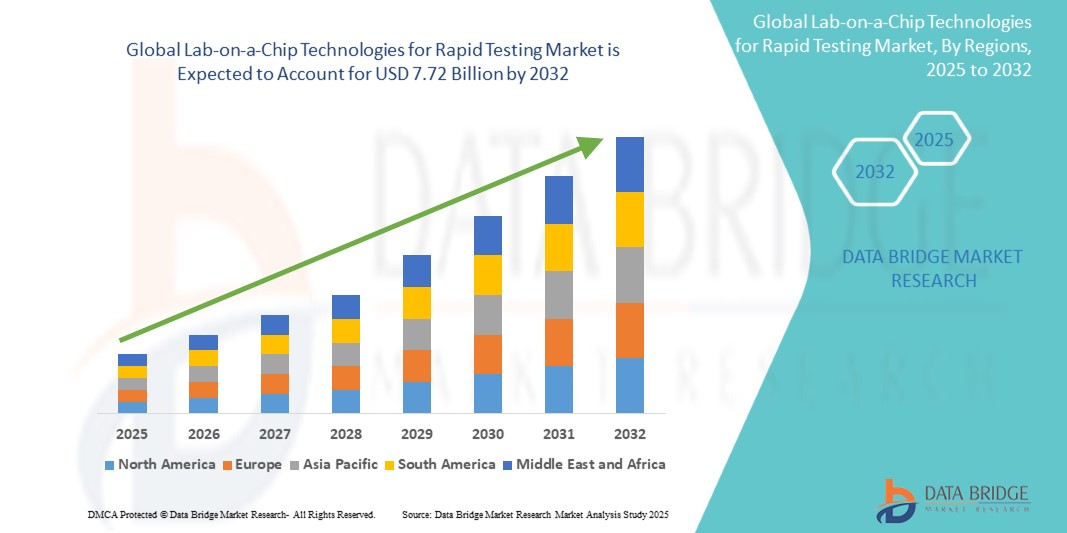

Global lab-on-a-chip technologies for rapid testing market size was valued at USD 4.20 billion in 2024 and is projected to reach USD 7.72 billion by 2032, with a CAGR of 7.9% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Lab-on-a-Chip Technologies for Rapid Testing Market Trends

“Miniaturization and Portability”

Miniaturization and portability is a significant trend in the Lab-on-a-Chip (LOC) Technologies for rapid testing market, characterized by the development of increasingly compact and portable devices. These smaller, more efficient LOC systems are designed for point-of-care (POC) testing, allowing for use in remote locations, at home, or in field environments. This trend is making rapid testing more accessible, as it eliminates the need for centralized laboratories and allows for on-site, real-time diagnostic results, enhancing the convenience and speed of healthcare services.

Report Scope and Lab-on-a-Chip Technologies for Rapid Testing Market Segmentation

|

Attributes |

Lab-on-a-Chip Technologies for Rapid Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, and Rest of South America |

|

Key Market Players |

Thermo Fisher Scientific Inc. (U.S.), Agilent Technologies Inc. (U.S.), Danaher Corporation (U.S.), Siemens Healthineers AG (Germany), Abbott (U.S.), Bio-Rad Laboratories, Inc. (U.S.), PerkinElmer Inc. (U.S.), Illumina, Inc. (U.S.), F. Hoffmann-La Roche AG (Switzerland), BD (U.S.), Microsaic Systems Plc (U.K.), Fluidigm Corporation (U.S.), Cepheid Inc.(U.S.), Molecular Devices, LLC (U.S.), and LabSmith, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Lab-on-a-Chip Technologies for Rapid Testing Market Definition

Lab-on-a-chip (LOC) technologies for rapid testing refer to miniaturized devices that integrate multiple laboratory functions onto a single chip, enabling the rapid analysis of biological, chemical, or environmental samples. These technologies combine microfluidics, sensors, and other components to perform tests at the point of care or in-field environments, providing quick and accurate results. LOC systems are designed to be portable, cost-effective, and user-friendly, making them ideal for diagnostics, monitoring, and screening in healthcare, food safety, environmental testing, and other applications.

Lab-on-a-Chip Technologies for Rapid Testing Market Dynamics

Drivers

- Rising Demand for Point-of-Care Diagnostics

The rising demand for point-of-care (POC) diagnostics is a key driver for the adoption of Lab-on-a-Chip (LOC) technologies. With the growing need for quick, accurate, and accessible diagnostic testing, particularly in remote or resource-limited settings, LOC devices are becoming essential tools for on-site testing. These technologies offer rapid, real-time results, eliminating the need for patients to visit central laboratories and reducing diagnostic delays. This is particularly important in areas with limited access to healthcare infrastructure, where timely diagnostics can improve patient outcomes and reduce healthcare costs. Additionally, the shift toward preventive healthcare, as well as the rising prevalence of chronic diseases, is increasing the demand for POC testing for continuous monitoring of conditions such as diabetes, heart disease, and infectious diseases. As LOC systems become more affordable and portable, they are increasingly being used in a variety of healthcare settings, from clinics and hospitals to home care. For Instance, in April 2024, according to an article published by NCBI, in the United States, approximately 1 in 9 individuals reported having undergone at least one surgical procedure in the past year, with the highest prevalence observed among individuals aged 65 and older. This growing trend in surgical interventions, particularly among the aging population, is expected to act as a key driver for the global Lab-on-a-Chip Technologies for Rapid Testing market. As the need for surgical procedures rises, there will be an increased demand for precision instruments such as Lab-on-a-Chip Technologies for Rapid Testings to ensure successful surgical outcomes. This growing reliance on surgical instruments, especially for elderly patients who often require more procedures, highlights the importance of Lab-on-a-Chip Technologies for Rapid Testings in supporting the healthcare industry's evolving needs.

- Advancements in Microfluidics and Miniaturization

Advancements in microfluidics and miniaturization are significantly contributing to the growth of lab-on-a-chip (LOC) technologies by enhancing their efficiency, portability, and affordability. Microfluidics enables the precise manipulation of small volumes of fluids on a chip, making it possible to conduct complex diagnostic tests with minimal sample sizes, reducing costs, and increasing the speed of results. The miniaturization of these devices allows for the development of compact, portable LOC systems that can be used in a variety of settings, such as point-of-care facilities, remote areas, and even at home. Smaller, more efficient devices also lead to lower production costs, making them more affordable for healthcare providers and patients alike. These technological improvements enable LOC systems to be used across a wide range of applications, from disease diagnostics and genetic testing to environmental monitoring and food safety, thus expanding their market reach and driving growth. In July 2024, according to an article published by NCBI, The Electronic Pen Lab-on-a-Chip Technologies for Rapid Testing (EPNH) was designed to improve surgical precision, reduce operation time, and enhance patient outcomes by combining microergonomics, penization, and electronics. This innovation provides surgeons with a tool that minimizes hand strain and increases control during delicate procedures. The growing demand for such advanced, ergonomic tools in surgeries is expected to drive the global Lab-on-a-Chip Technologies for Rapid Testing market, as they improve both surgeon comfort and surgical efficiency, particularly in complex and minimally invasive procedures.

Opportunities

- Rise of Personalized Medicine and Genomics

The rise of personalized medicine and genomic testing presents a significant opportunity for lab-on-a-chip (LOC) technologies to revolutionize healthcare. As personalized medicine focuses on tailoring treatments to individual genetic profiles, LOC devices can provide rapid, cost-effective, and precise diagnostics, enabling healthcare providers to assess a patient's genetic makeup and predict responses to specific treatments. These technologies enhance early disease detection by identifying genetic markers linked to various conditions, such as cancer, cardiovascular diseases, and inherited disorders. Furthermore, LOC systems enable quicker diagnostic results compared to traditional methods, which is crucial for timely interventions. The integration of genomic testing with LOC devices allows for efficient monitoring of biomarkers, improving personalized treatment plans and patient outcomes. As genomic research continues to expand, the demand for LOC technologies that offer fast, scalable, and accurate diagnostics will likely increase, opening up new opportunities in healthcare and improving disease management globally.

- Integration with Digital Health Platforms

The integration of lab-on-a-chip (LOC) systems with digital health platforms such as mobile apps and telemedicine services offers significant opportunities to improve healthcare accessibility and efficiency. By connecting LOC devices with digital platforms, healthcare providers can remotely monitor patients' health in real-time, enabling continuous, at-home testing and analysis. For instance, patients can use LOC systems to conduct tests and transmit results instantly to healthcare professionals via mobile apps or telemedicine platforms. This real-time data analysis allows for quicker decision-making, personalized treatment adjustments, and faster interventions, enhancing patient outcomes. Moreover, teleconsultations can be seamlessly integrated, allowing patients in remote or underserved areas to receive expert guidance without needing to visit a clinic. This integration also reduces healthcare costs by minimizing unnecessary in-person visits, streamlining the healthcare process, and ensuring more timely and efficient care delivery. Ultimately, it bridges the gap between patients and healthcare providers, improving overall healthcare systems' accessibility and responsiveness.

Restraints/Challenges

- High Development and Manufacturing Costs of Lab-on-a-Chip (LOC) Devices

High development and manufacturing costs represent a significant restraint in the growth of the Lab-on-a-Chip (LOC) technologies market. The advanced microfluidic components, sensors, and precision engineering required for LOC devices make their design and production complex and expensive. Additionally, integrating multiple laboratory functions onto a single chip requires sophisticated technology, high-quality materials, and rigorous quality control, all of which contribute to high production costs. For many companies, especially smaller or new entrants, these costs can be prohibitive, limiting their ability to scale up production or reduce prices. This financial barrier is particularly challenging in price-sensitive markets, where affordable healthcare solutions are essential. In low-resource settings, where budgets for diagnostic tools are often constrained, the high cost of LOC systems may prevent their adoption and restrict their potential for improving healthcare access and efficiency. Therefore, high development and manufacturing costs can hinder the widespread implementation of LOC technologies. The Titanium lab-on-a-chip technologies for rapid testing is priced at USD 165.26, as per IndiaMART InterMESH Ltd. This high cost reflects the advanced materials and precision involved, underscoring the "High Cost of Advanced Instruments" as a restraint for the global Lab-on-a-Chip Technologies for Rapid Testing market. Such premium pricing limits accessibility, especially in low-income regions and smaller healthcare facilities, where budget constraints hinder the adoption of these advanced tools, thereby slowing market growth.

- Regulatory and Standardization Challenges

Regulatory and standardization challenges are a significant hurdle for the lab-on-a-chip (LOC) technologies market. These devices, which integrate biological, chemical, and microfluidic components, require rigorous oversight to ensure quality, safety, and efficacy. However, the absence of a unified regulatory framework across regions complicates the approval process. Different countries and regions have varying requirements for medical devices, creating complexities for manufacturers who must comply with multiple, sometimes conflicting, standards. This lack of standardization leads to delays in product development, higher costs, and prolonged time-to-market. Additionally, inconsistent regulatory practices can result in inconsistent quality and performance standards, which may undermine trust in LOC technologies. As a result, manufacturers face the challenge of navigating diverse regulatory landscapes, which slows down the global adoption of LOC systems and limits their widespread use in healthcare settings. Effective standardization and clearer regulatory guidelines are crucial for the growth and scalability of LOC technologies. In April 2024, according to an article published by tmc.gov.in, instruments must hold a European CE marking or USFDA certification, be manufactured by companies with over 30 years of experience, and have a chromium content of at least 12% to ensure adequate corrosion resistance. These stringent requirements highlight the "Stringent Regulatory Standards" in the global Lab-on-a-Chip Technologies for Rapid Testing market. Such high standards increase manufacturing costs and extend approval timelines, posing challenges for smaller manufacturers and delaying market entry. This regulatory burden can hinder the adoption of advanced Lab-on-a-Chip Technologies for Rapid Testings, especially in regions with less stringent regulations, ultimately limiting market growth

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Lab-on-a-Chip Technologies for Rapid Testing Market Scope

The market is segmented on the basis of product type, technology, device type, sample type, application, end-user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Consumables

- Instruments

- Software

Technology

- Microfluidics

- Lab-on-a-Disc

- Digital Microfluidics

- Optical LOC

- Electrochemical LOC

Device Type

- Standalone Devices

- Integrated Devices

- Portable Devices

- Wearable Devices

Sample Type

- Blood Samples

- Urine Samples

- Saliva Samples

- Tissue Samples

- Environmental Samples

- Food Samples

Application

- Healthcare and Diagnostics

- Environmental Testing

- Food Safety

- Biotechnology and Pharmaceuticals

- Others

End-User

- Hospitals and Diagnostic Centers

- Research Laboratories

- Biotech and Pharmaceutical Companies

- Regulatory Agencies

- Others

Distribution Channel

- Direct Sales

- Online Sales

- Distributors and Retailers

Lab-on-a-Chip Technologies for Rapid Testing Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, product type, technology, device type, sample type, application, end-user, and distribution channel as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

North America is expected to dominate the market due to its advanced healthcare infrastructure, which supports the widespread implementation of cutting-edge diagnostic technologies. The region's strong focus on research and development, coupled with substantial government funding for medical diagnostics, fosters innovation and accelerates the adoption of rapid testing solutions.

Asia-Pacific is expected to be the fastest growing due to significant increases in healthcare investments, which are driving improvements in infrastructure and access to advanced medical technologies. The rising demand for affordable diagnostics, particularly in emerging economies where healthcare systems are evolving, is a major factor in this growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Lab-on-a-Chip Technologies for Rapid Testing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Lab-on-a-Chip Technologies for Rapid Testing Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (U.S.)

- Agilent Technologies Inc. (U.S.)

- Danaher Corporation (U.S.)

- Siemens Healthineers AG (Germany)

- Abbott (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- PerkinElmer Inc. (U.S.)

- Illumina, Inc. (U.S.)

- F. Hoffmann-La Roche AG (Switzerland)

- BD (U.S.)

- Microsaic Systems Plc (U.K.)

- Fluidigm Corporation (U.S.)

- Cepheid Inc.(U.S.)

- Molecular Devices, LLC (U.S.)

- LabSmith, Inc. (U.S.)

Latest Developments in Lab-on-a-Chip Technologies for Rapid Testing Market

- In November 2023, Surtex Instruments introduced its "Infinex" series at MEDICA 2023, offering microsurgery instruments designed to give surgeons exceptional control and precision, even in the most intricate procedures. This innovation will help the company strengthen its position in the surgical instruments market by meeting the growing demand for high-performance tools, which are crucial for complex surgeries. The launch is expected to enhance Surtex's reputation for quality and precision, attracting more healthcare professionals and expanding its market share in the global Lab-on-a-Chip Technologies for Rapid Testing industry.

- In October 2020, Katena Products has acquired Micro-Select Instruments, a manufacturer of ophthalmic instruments such as forceps, Lab-on-a-Chip Technologies for Rapid Testings, and speculums. This acquisition strengthens Katena’s instrument manufacturing capabilities and expands its product portfolio, enhancing its position in the ophthalmic surgical market. The move is expected to broaden Katena’s reach and offer a more comprehensive range of high-quality instruments to healthcare professionals, driving further growth in the global Lab-on-a-Chip Technologies for Rapid Testing market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.