Global Laboratory Gas Generators Market

Market Size in USD Billion

CAGR :

%

USD

539.84 Billion

USD

1,561.68 Billion

2025

2033

USD

539.84 Billion

USD

1,561.68 Billion

2025

2033

| 2026 –2033 | |

| USD 539.84 Billion | |

| USD 1,561.68 Billion | |

|

|

|

|

Laboratory Gas Generators Market Size

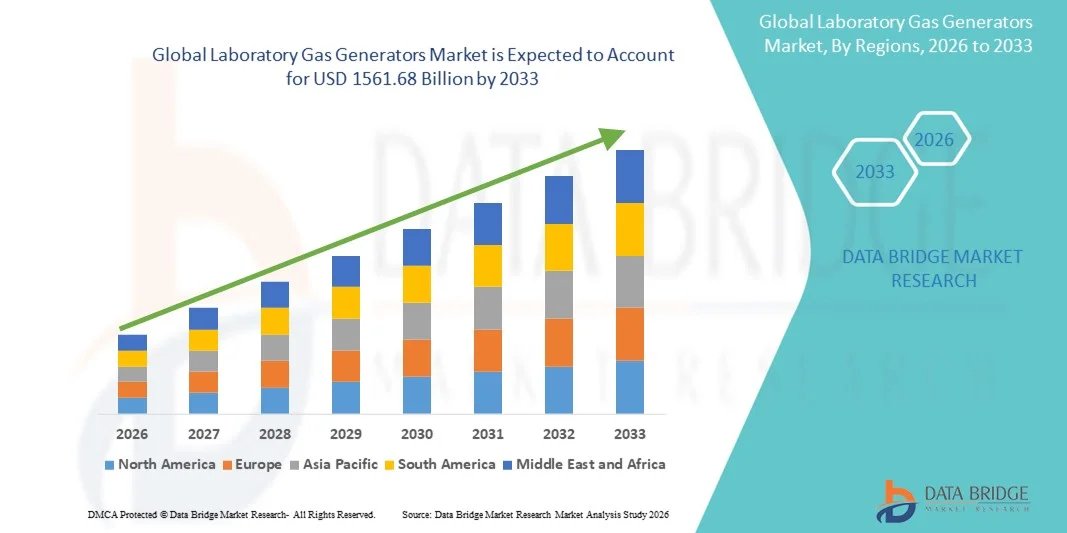

- The global laboratory gas generators market size was valued at USD 539.84 billion in 2025 and is expected to reach USD 1561.68 billion by 2033, at a CAGR of 14.20% during the forecast period

- The market growth is largely fueled by the increasing demand for high-purity gases in laboratories, research centers, and pharmaceutical applications, alongside technological advancements in gas generation systems that enhance reliability, safety, and cost efficiency

- Furthermore, the rising adoption of automated and continuous laboratory workflows, combined with the need for on-site gas production to reduce dependency on cylinder supply and transportation costs, is accelerating the uptake of Laboratory Gas Generators solutions, thereby significantly boosting the industry's growth

Laboratory Gas Generators Market Analysis

- Laboratory Gas Generators, providing on-site production of high-purity gases such as nitrogen, hydrogen, and zero air, are increasingly vital components of modern laboratories, research facilities, and pharmaceutical production units due to their reliability, cost efficiency, and continuous availability

- The escalating demand for Laboratory Gas Generators is primarily fueled by the growing need for uninterrupted gas supply in analytical instruments, rising R&D activities, and increasing focus on laboratory safety and operational efficiency

- North America dominated the laboratory gas generators market with the largest revenue share of approximately 39% in 2025, characterized by a strong presence of leading laboratory equipment manufacturers, advanced research infrastructure, and favorable regulations promoting in-house gas generation. The U.S. accounted for the majority of regional demand, driven by high adoption of automated laboratory workflows, well-established pharmaceutical and biotech sectors, and significant investments in laboratory efficiency and safety solutions

- Asia-Pacific is expected to be the fastest-growing region in the laboratory gas generators market during the forecast period, registering a high CAGR of around 12.8% from 2026 to 2033, driven by increasing R&D spending, expansion of pharmaceutical and biotechnology industries, growing adoption of advanced analytical instruments, and improving access to reliable laboratory infrastructure in countries such as China, India, and Japan

- The gas chromatography segment dominated the market in 2025 with a revenue share of 38%, due to its extensive usage in chemical, pharmaceutical, food, and environmental laboratories

Report Scope and Laboratory Gas Generators Market Segmentation

|

Attributes |

Laboratory Gas Generators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Parker Hannifin Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Laboratory Gas Generators Market Trends

Rising Adoption of On-Demand Gas Generation Systems

- A major trend in the global laboratory gas generators market is the increasing adoption of on-demand gas generation systems, which offer laboratory-grade nitrogen, hydrogen, or zero-air without the need for high-pressure gas cylinders. This trend is being accelerated by the demand for safer, more reliable, and cost-effective gas supply in analytical laboratories, including pharmaceutical, food & beverage, and environmental testing labs

- For instance, in February 2024, Peak Scientific introduced an upgraded Genius XE Nitrogen Generator that provides continuous on-site nitrogen production for LC-MS systems, eliminating reliance on compressed gas cylinders. This launch highlights the growing preference for automated and cylinder-free gas generation solutions

- On-demand gas generators reduce operational risks associated with cylinder storage and handling while providing consistent gas quality. Laboratories benefit from uninterrupted workflows, reduced downtime, and lower overall maintenance costs

- The flexibility of installation and scalability for small to large laboratories is another key factor supporting adoption. Integration with analytical instruments and automated monitoring systems further enhances operational efficiency

- Regulatory compliance and adherence to safety standards are simplified with in-house generation The trend is particularly notable in regions with strict safety regulations, such as North America and Europe. Energy-efficient generators with low noise and compact footprints are gaining preference

- Industries such as biotechnology, clinical research, and petrochemicals are increasingly replacing traditional gas cylinders. Growing awareness of sustainability and reduced carbon footprint is driving preference for generators over cylinder-based gas supply

- Vendors are offering hybrid solutions combining on-demand generation with storage capacity to meet peak demand. Real-time monitoring and predictive maintenance features are emerging as standard expectations in new product designs

Laboratory Gas Generators Market Dynamics

Driver

Need for Cost-Effective and Reliable Gas Supply in Laboratories

- The rising demand for consistent, high-purity gas supply for laboratory applications is a significant driver of the Laboratory Gas Generators market. Laboratories require uninterrupted gas flow for critical analytical procedures such as chromatography, spectroscopy, and mass spectrometry

- For instance, in October 2023, Linde Gas launched its advanced H2-300 Hydrogen Generator for analytical instruments, enabling laboratories to reduce costs associated with cylinder refills while ensuring stable gas purity. This demonstrates how vendors are directly addressing laboratory operational efficiency and cost concerns

- The need to reduce operational risks and dependence on cylinder deliveries encourages adoption of on-site gas generation

- High-purity, zero-air, and ultra-high-purity gas options meet stringent analytical and research requirements

- Laboratories also benefit from reduced downtime and improved instrument lifespan through reliable gas supply. Cost savings from cylinder replacement, storage, and transport are significant over time

- The adoption of automation and remote monitoring enhances usability for laboratory staff. Environmental regulations and the drive for sustainability further favor in-house generation solutions

- Healthcare, food testing, and chemical industries increasingly prefer in-house generators for safety and compliance. The growing number of analytical laboratories and research centers globally supports sustained market growth

Restraint/Challenge

High Initial Cost and Maintenance Requirements

- The relatively high initial investment required for laboratory gas generators, compared to conventional gas cylinders, remains a key challenge for market growth. Laboratories with limited budgets may be hesitant to adopt new systems

- For instance, in May 2022, a report highlighted that smaller academic and research labs in India delayed generator adoption due to upfront costs despite the long-term benefits, emphasizing financial barriers in emerging regions

- Maintenance requirements, including filter replacement, membrane servicing, and periodic calibration, can add to operational complexity

- Inadequate technical expertise or trained personnel may hinder smooth adoption in some laboratories

- Certain generators have limitations in peak demand scenarios, necessitating hybrid systems or supplementary cylinders

- Power consumption and environmental conditions (temperature, humidity) can affect generator efficiency and lifespan

- Compatibility with diverse analytical instruments requires careful specification, which can limit flexibility

- Vendor service availability and support infrastructure may vary regionally, affecting adoption. Perceived complexity of installation and setup can delay decision-making in smaller labs

- While total cost of ownership is lower in the long term, initial investment perceptions can slow growth

- Addressing these challenges through financing options, training, and bundled maintenance services is crucial for wider market acceptance

Laboratory Gas Generators Market Scope

The market is segmented on the basis of product type, application, and end user.

- By Product Type

On the basis of product type, the Global Tissue Testing Market is segmented into hydrogen gas generators, nitrogen gas generators, oxygen gas generators, zero air gas generators, purge gas generators, and others. The nitrogen gas generators segment dominated the market, holding approximately 36% of the global revenue in 2025, primarily due to its essential role in laboratory testing applications such as gas chromatography, LC-MS, and spectroscopy. Nitrogen generators provide a stable, high-purity gas supply, eliminating dependency on cylinders and enhancing laboratory safety and efficiency. Their adoption is particularly strong in pharmaceutical and biotechnology laboratories where precise, consistent results are critical. The segment is supported by widespread integration with automated analytical instruments, lower operational costs, and minimal maintenance requirements. Technological improvements, such as energy-efficient and scalable generator models, have further strengthened market penetration. North America and Europe are leading regions due to advanced laboratory infrastructure and high analytical instrument usage. In addition, manufacturers are offering compact, space-saving designs suitable for both small and large labs. The rising regulatory focus on quality control, coupled with increasing demand from research institutions and contract laboratories, reinforces dominance. Vendor initiatives for service support, long-term reliability, and sustainability features also contribute to the continued preference for nitrogen generators.

The hydrogen gas generators segment is expected to witness the fastest CAGR of 12.5% from 2026 to 2033, driven by growing demand for high-purity hydrogen in analytical applications requiring sensitive detection, such as LC-MS. Hydrogen generators offer superior performance in terms of reduced background noise, improved detector sensitivity, and minimized operational hazards compared to cylinder-based systems. For instance, in 2024, Peak Scientific launched the Genius XE Hydrogen Generator specifically optimized for LC-MS applications, enabling safer and more efficient laboratory workflows. Adoption is increasing in pharmaceutical R&D, environmental testing, and petrochemical labs where precision and safety are critical. Compact designs, low noise, and minimal footprint further support their growing popularity. Asia-Pacific is emerging as a high-growth region due to expanding laboratory infrastructure and rising analytical testing demand. Integration with automated instruments and instrument control systems allows on-demand hydrogen supply, reducing downtime. In addition, the segment is supported by the increasing need for green and sustainable laboratory operations. Manufacturers are also offering generators with advanced monitoring features to enhance reliability and efficiency. Rising awareness about cylinder-free operations and reduced operational costs further propels growth, establishing hydrogen generators as the fastest-growing segment in product type.

- By Application

On the basis of application, the market is segmented into gas chromatography, LC-MS, gas analysers, spectroscopy, and others. The gas chromatography segment dominated the market in 2025 with a revenue share of 38%, due to its extensive usage in chemical, pharmaceutical, food, and environmental laboratories. Gas chromatography instruments require high-purity carrier gases such as nitrogen, hydrogen, and zero-air, which drives the adoption of gas generators. The segment benefits from the need for accurate, reproducible results, especially in regulatory compliance testing. High-throughput laboratories, including contract research organizations, prefer integrated gas generator solutions for cost efficiency and operational reliability. North America and Europe are key markets because of advanced analytical infrastructure and well-established laboratory networks. The segment’s dominance is reinforced by continuous technological innovations in gas generators, such as energy-efficient designs, reduced footprint, and automated operation. Compatibility with multiple instruments, low maintenance requirements, and safety features also contribute to strong adoption. In addition, growing awareness regarding laboratory sustainability and the avoidance of high-pressure cylinders further supports growth. Vendors are continuously innovating with scalable systems to cater to diverse laboratory sizes and requirements.

The LC-MS segment is projected to register the fastest CAGR of 13.2% from 2026 to 2033, driven by increasing adoption of mass spectrometry in proteomics, metabolomics, and pharmaceutical research. LC-MS instruments require high-purity gases for optimal performance, making gas generators crucial. For instance, in 2023, Agilent Technologies launched a new on-site gas generation system compatible with its LC-MS platforms, improving workflow efficiency and safety. Increasing R&D investments, expansion of clinical testing laboratories, and rising demand for rapid and accurate diagnostics fuel growth. Asia-Pacific is emerging as a high-growth region due to the expansion of pharmaceutical and biotechnology industries. Compact designs, integration with automated workflows, and low maintenance requirements further contribute to adoption. The growing focus on analytical accuracy, regulatory compliance, and green laboratory operations strengthens the segment’s growth. Vendors are introducing user-friendly monitoring interfaces and remote diagnostics to improve convenience. Adoption is also driven by the need to replace traditional cylinder-based gas systems, enhancing laboratory safety. Rising government initiatives supporting laboratory modernization and advanced diagnostics support this segment’s rapid growth.

- By End User

On the basis of end user, the market is segmented into chemical/petrochemical companies, pharmaceutical and biotechnology companies, environmental companies, food and beverage companies, and others. The pharmaceutical and biotechnology segment dominated the market in 2025 with a share of 40%, fueled by stringent quality control requirements, continuous R&D activities, and the adoption of high-precision analytical instruments. Gas generators are critical for supporting sensitive laboratory workflows, ensuring reliability, consistency, and safety. The segment benefits from regulatory pressures requiring precise testing, as well as high-throughput laboratory environments. North America and Europe are key markets due to advanced healthcare and R&D infrastructure. Continuous improvements in gas generator technology, including compact and energy-efficient systems, are driving adoption. Integration with automated workflows in pharmaceutical and biotech labs further strengthens dominance. In addition, the need for sustainable and cylinder-free laboratory operations supports ongoing preference. Rising adoption of contract research organizations and expansion of pharmaceutical R&D activities globally also contributes to market growth. Vendor support, service reliability, and global distribution networks further enhance segment dominance.

The environmental companies segment is expected to witness the fastest CAGR of 12.8% from 2026 to 2033, driven by rising demand for air, water, and soil testing to meet environmental compliance standards. Gas generators provide a safe and reliable alternative to cylinder-based gases, enabling continuous monitoring and testing. For instance, in 2022, Horiba launched an integrated gas generation system for environmental labs to support air quality testing workflows efficiently. Increasing government regulations on emissions, expanding environmental testing infrastructure, and growing analytical requirements in emerging economies such as China, India, and Brazil are driving growth. Compact and low-maintenance designs, energy efficiency, and safe operations further contribute to adoption. The segment is benefiting from rising investments in environmental monitoring programs, global awareness of pollution control, and the need for accurate and reproducible results. Vendor initiatives to provide scalable and user-friendly systems for environmental labs further enhance adoption.

Laboratory Gas Generators Market Regional Analysis

- North America dominated the laboratory gas generators market with the largest revenue share of approximately 39% in 2025

- Driven by a strong presence of leading laboratory equipment manufacturers, advanced research infrastructure, and favorable regulations promoting in-house gas generation

- High adoption of automated laboratory workflows, well-established pharmaceutical and biotechnology sectors, and significant investments in laboratory efficiency and safety solutions further supported the market growth

U.S. Laboratory Gas Generators Market Insight

The U.S. laboratory gas generators market accounted for the majority of North America’s demand, capturing nearly 82% of the regional revenue in 2025. Growth is fueled by widespread adoption of laboratory automation, high utilization of analytical instruments such as GC, LC-MS, and spectroscopy, and increasing investments in research and development within pharmaceutical, biotechnology, and chemical industries. In addition, robust government initiatives and strict regulatory standards for laboratory safety and efficiency are further propelling market expansion.

Europe Laboratory Gas Generators Market Insight

The Europe laboratory gas generators market is projected to expand at a notable CAGR throughout the forecast period, supported by advanced laboratory infrastructure, stringent safety and quality regulations, and growing adoption of in-house gas generation in research institutions and pharmaceutical companies. Countries like Germany, France, and the U.K. are investing in laboratory modernization, increasing the demand for reliable and low-maintenance gas generators.

U.K. Laboratory Gas Generators Market Insight

The U.K. laboratory gas generators market is expected to witness steady growth during the forecast period, driven by increasing R&D activities in the pharmaceutical and biotechnology sectors, expanding laboratory automation, and the rising need for safe, cost-efficient, and reliable gas generation systems. Government support for scientific research and laboratory safety initiatives is further boosting adoption.

Germany Laboratory Gas Generators Market Insight

The Germany laboratory gas generators market is projected to grow at a considerable CAGR due to well-established pharmaceutical and chemical industries, growing focus on laboratory safety standards, and increasing adoption of high-purity gas generation technologies. Strong R&D activities and the presence of global laboratory equipment manufacturers also contribute to market expansion.

Asia-Pacific Laboratory Gas Generators Market Insight

The Asia-Pacific laboratory gas generators market is expected to grow at the fastest CAGR of around 12.8% from 2026 to 2033, driven by increasing R&D spending, the expansion of pharmaceutical and biotechnology industries, growing adoption of advanced analytical instruments, and improving access to reliable laboratory infrastructure. Countries such as China, India, and Japan are key contributors to this rapid growth.

Japan Laboratory Gas Generators Market Insight

The Japan laboratory gas generators market is witnessing strong momentum, supported by advanced laboratory infrastructure, high demand for high-purity gases, and increasing adoption of automated laboratory systems. The country’s focus on research efficiency and safety in laboratories is further driving market growth.

China Laboratory Gas Generators Market Insight

The China Laboratory Gas Generators m laboratory gas generators market accounted for the largest revenue share in Asia-Pacific in 2025, due to rapid industrialization, expanding pharmaceutical and chemical sectors, growing R&D investments, and increasing adoption of automated laboratory equipment. Availability of cost-effective gas generation solutions and strong domestic manufacturers are key factors propelling market growth.

Laboratory Gas Generators Market Share

The Laboratory Gas Generators industry is primarily led by well-established companies, including:

• Parker Hannifin Corporation (U.S.)

• Peak Scientific Instruments (U.K.)

• LNI Swissgas (Switzerland)

• Matheson Tri-Gas (U.S.)

• Praxair Technology (U.S.)

• Air Products and Chemicals (U.S.)

• Messer Group (Germany)

• Generon IGS (U.S.)

• GCE Group (Sweden)

• Hitachi Industrial Equipment Systems (Japan)

• Cole-Parmer (U.S.)

• RIX Industries (U.S.)

• Inmatec GmbH (Germany)

• Nupor Technologies (China)

• Edwards Vacuum (U.K.)

• MG Industries (U.S.)

• Cryogenic Gases (Canada)

• Air Liquide (France)

• ELGA LabWater (U.K.)

• CryoTech Systems (India)

Latest Developments in Global Laboratory Gas Generators Market

- In May 2025, at the American Society for Mass Spectrometry (ASMS) Conference, PEAK Scientific unveiled its new Intura Series of laboratory gas generators, including hydrogen, nitrogen, and zero-air generators. The Intura platform features a compact footprint, enhanced filtration technology, and reduced power consumption, catering to modern high-throughput analytical laboratories.

- In March 2024, PEAK Scientific, a leading manufacturer of laboratory gas generators, announced the launch of the Horizen 24 Nitrogen Generator, designed specifically for single-quadrupole LC-MS systems. The system delivers up to 55% lower energy consumption and significantly reduced heat output, helping laboratories lower operating costs while meeting sustainability goals

- In November 2023, PEAK Scientific introduced its Eco-Series Nitrogen Generator platform, focused on laboratories seeking energy-efficient and environmentally responsible gas supply solutions. The launch addressed growing demand for sustainable laboratory infrastructure, particularly in pharmaceutical and academic research laboratories

- In June 2022, Claind, a global provider of on-site gas generation systems, expanded its production capabilities by opening a new manufacturing facility in Suzhou, China. This expansion was aimed at increasing output of high-purity nitrogen generators to support rising demand from analytical laboratories across Asia-Pacific and global export markets

- In September 2021, F-DGSi (part of the F-DGS Group) announced advancements to its H2CAL hydrogen generator range, integrating improved safety controls and digital monitoring features. These upgrades were aimed at chromatography laboratories requiring continuous, high-purity hydrogen supply with enhanced operational safety

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.