Global Laboratory Hoods And Enclosure Market

Market Size in USD Billion

CAGR :

%

USD

13.80 Billion

USD

24.99 Billion

2024

2032

USD

13.80 Billion

USD

24.99 Billion

2024

2032

| 2025 –2032 | |

| USD 13.80 Billion | |

| USD 24.99 Billion | |

|

|

|

|

Laboratory Hoods and Enclosure Market Size

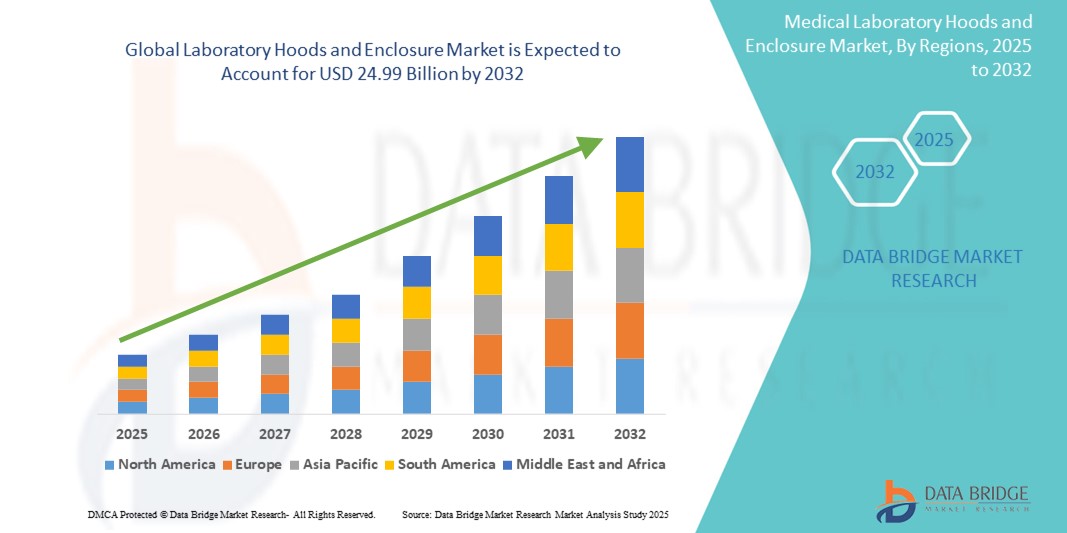

- The global laboratory hoods and enclosure market size was valued at USD 13.80 billion in 2024 and is expected to reach USD 24.99 billion by 2032, at a CAGR of 7.70% during the forecast period

- The market growth is largely fueled by the rising implementation of safety protocols and advancements in laboratory infrastructure across academic, pharmaceutical, and industrial research settings, leading to increased demand for high-performance containment systems

- Furthermore, increasing focus on worker safety, regulatory compliance, and environmental control is establishing laboratory hoods and enclosures as essential components of modern laboratory environments. These converging factors are accelerating the uptake of laboratory hoods and enclosure solutions, thereby significantly boosting the industry's growth

Laboratory Hoods and Enclosure Market Analysis

- Laboratory hoods and enclosures, providing controlled environments and effective containment for hazardous fumes, vapors, and particulates, are increasingly essential components in modern laboratories across academic, pharmaceutical, biotechnology, and industrial sectors. These systems are vital for ensuring operator safety, maintaining sample integrity, and meeting strict compliance standards

- The escalating demand for laboratory hoods and enclosures is primarily fueled by the growing emphasis on laboratory safety protocols, increased R&D activities in the life sciences sector, and rising adoption of advanced containment technologies in pharmaceutical and biotechnology research

- North America dominated the laboratory hoods and enclosure market with the largest revenue share of 45% in 2024, driven by the presence of leading manufacturers, high healthcare R&D spending, and stringent regulatory compliance. The U.S. has witnessed significant adoption of high-performance laboratory enclosures, particularly within academic research institutions, pharmaceutical labs, and clinical diagnostic centers

- Asia-Pacific is expected to be the fastest growing region with 9.4% CAGR in the laboratory hoods and enclosure market during the forecast period, owing to rapid industrialization, growing investment in healthcare infrastructure, and government support for expanding biotechnology research facilities in countries such as China, India, and South Korea

- The benchtop segment dominated the laboratory hoods and enclosure market, with a market revenue share of 61.5% in 2024, driven by its widespread adoption in fixed laboratory infrastructure, offering efficient airflow and reliable containment control

Report Scope and Laboratory Hoods and Enclosure Market Segmentation

|

Attributes |

Laboratory Hoods and Enclosure Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Laboratory Hoods and Enclosure Market Trends

“Enhanced Convenience Through Automation and Digital Monitoring Integration”

- A significant and accelerating trend in the global Laboratory Hoods and Enclosure market is the growing integration of automation and digital monitoring technologies. These innovations enhance operational efficiency, real-time safety monitoring, and workflow management in research and clinical laboratory settings

- For instance, modern fume hoods and biosafety cabinets now come equipped with programmable airflow systems and smart sensors that adjust ventilation based on chemical concentration or personnel proximity, reducing energy consumption and improving laboratory safety

- Automated sash positioning and digital readouts for airflow, filter status, and system diagnostics offer users greater convenience and ensure compliance with stringent regulatory standards such as OSHA, ANSI, and NSF

- The integration of Laboratory Information Management Systems (LIMS) and cloud-based monitoring platforms with laboratory enclosures facilitates centralized data tracking, maintenance scheduling, and performance analytics, all of which streamline lab operations

- This trend toward more intelligent and responsive laboratory environments is reshaping expectations around lab safety and operational control. Manufacturers such as Thermo Fisher Scientific and AirClean Systems are responding with next-gen systems that incorporate intuitive touch controls, self-cleaning capabilities, and real-time alert systems

- The demand for digitally enabled, automated laboratory hoods and enclosures is growing rapidly across pharmaceutical, biotech, and academic sectors, as laboratories prioritize safety, sustainability, and user-centric innovation in their infrastructure investments

Laboratory Hoods and Enclosure Market Dynamics

Driver

“Growing Need Due to Rising Laboratory Safety Standards and Research Expansion”

- The increasing emphasis on laboratory safety regulations and expanding pharmaceutical and biotechnological research activities are significant drivers behind the growing demand for laboratory hoods and enclosure systems

- For instance, in April 2024, Thermo Fisher Scientific announced the development of next-generation ductless fume hoods integrated with real-time air quality sensors and energy-efficient filtration systems. These innovations aim to improve lab worker safety while minimizing environmental impact—reflecting the market’s shift toward smarter, more sustainable containment solutions

- As research facilities, academic institutions, and diagnostic labs expand globally, there is a rising need for advanced enclosures that provide superior protection against chemical exposure, biological agents, and hazardous materials. Products such as biosafety cabinets, laminar flow hoods, and clean benches are increasingly favored over conventional containment methods

- The growing use of highly sensitive assays and cross-contamination-sensitive protocols in genomics, oncology, and pharmaceutical R&D is also driving the adoption of specialized hoods with HEPA/ULPA filters and airflow monitoring systems

- In addition, the trend toward modular laboratory setups and decentralized research units supports demand for portable, customizable enclosures that can be tailored to diverse experimental environments. This, in turn, boosts the overall growth of the Laboratory Hoods and Enclosure Market

Restraint/Challenge

“High Initial Costs and Maintenance Complexities”

- The relatively high capital investment required for advanced laboratory hoods and enclosure systems—particularly those with integrated digital controls, energy-saving motors, and multi-stage filtration—remains a major challenge for smaller labs and facilities in low-resource settings.

- For instance, outfitting a lab with Class II biosafety cabinets or ductless hoods with carbon filtration can significantly increase setup costs, especially when factoring in the need for HVAC integration or routine maintenance

- Maintenance requirements such as filter replacement, airflow calibration, and system validation also contribute to ongoing operational expenses and can strain budgets for educational or government institutions

- Furthermore, the lack of standardized compliance protocols across regions leads to complexity in regulatory approvals, slowing procurement cycles

- To mitigate these challenges, manufacturers are focusing on offering cost-effective product lines, streamlined maintenance solutions, and rental or lease-based models, making advanced Laboratory Hoods and Enclosure solutions more accessible to a broader range of end users

Laboratory Hoods and Enclosure Market Scope

The market is segmented on the basis of product, modularity, material, and end user.

• By Product

On the basis of product, the laboratory hoods and enclosure market is segmented into ventilated balance enclosures (VBEs), biological safety cabinets, laminar flow cabinets, enclosures, hoods, and others. The biological safety cabinets segment accounted for the largest market share of 34.2% in 2024, driven by their critical role in ensuring personnel and product protection in microbiological and biomedical laboratories.

The laminar flow cabinets segment is expected to witness the fastest CAGR of 9.8% from 2025 to 2032, due to their growing use in sterile and cleanroom applications, especially within pharma and electronics sectors.

• By Modularity

On the basis of modularity, the laboratory hoods and enclosure market is segmented into benchtop and portable. The benchtop segment dominated with a market share of 61.5% in 2024, owing to their widespread adoption in fixed laboratory infrastructure, offering efficient airflow and containment control.

The portable segment is projected to register the highest CAGR of 10.3% during the forecast period, attributed to increasing demand for mobile lab solutions and flexible, on-demand laboratory setups.

• By Material

On the basis of material, the laboratory hoods and enclosure market is segmented into PVC, stainless steel, and others. The stainless steel segment held the largest revenue share of 57.6% in 2024, thanks to its superior durability, chemical resistance, and compliance with stringent laboratory safety standards.

The PVC segment is expected to grow at the fastest CAGR of 9.5% from 2025 to 2032, driven by cost-efficiency and lightweight benefits, particularly in academic and research labs.

• By End User

On the basis of end user, the laboratory hoods and enclosure market is segmented into pharmaceutical companies, research institutes, academic centers, and others. The pharmaceutical companies segment captured the largest market share of 42.9% in 2024, driven by increasing drug development activities, regulatory compliance requirements, and a growing focus on biosafety.

The research institutes segment is expected to witness the fastest CAGR of 10.7% during 2025–2032, propelled by expanding biomedical research initiatives, grant funding, and innovation in life sciences and biotechnology.

Laboratory Hoods and Enclosure Market Regional Analysis

- North America dominated the laboratory hoods and enclosure market with the largest revenue share of 45% in 2024, driven by a growing demand for advanced laboratory infrastructure, increased R&D investments, and stringent safety regulations in laboratories

- The region’s strong presence of pharmaceutical giants and research institutions is accelerating the adoption of laboratory hoods and enclosures across academic, clinical, and commercial labs

- The market growth is further supported by high healthcare spending, rapid technological innovation, and government-backed biosafety initiatives

U.S. Laboratory Hoods and Enclosure Market Insight

The U.S. laboratory hoods and enclosure market accounted for 81.05% of the North American market share in 2024, reflecting its leadership in biotech research and stringent safety compliance in laboratory environments. A robust presence of manufacturers, growing academic-industry collaboration, and federal funding for biomedical research are key growth drivers. Ongoing innovation in energy-efficient and ergonomic hood designs is expected to further fuel market expansion in the U.S.

Europe Laboratory Hoods and Enclosure Market Insight

The Europe laboratory hoods and enclosure market held a market share of 28% in 2024, driven by increased adoption of sustainable laboratory practices and enhanced regulatory oversight for lab safety and environmental protection. The market is witnessing rising demand across pharmaceutical companies and university labs due to the need for controlled workspaces and advanced filtration systems. Government initiatives supporting pharmaceutical innovation and safety-compliant infrastructure are positively influencing market growth.

U.K. Laboratory Hoods and Enclosure Market Insight

The U.K. laboratory hoods and enclosure market contributed 22% to the European market in 2024, underpinned by its strong pharmaceutical base and government-led R&D initiatives such as the UKRI. Increased demand for modular laboratory designs and mobile enclosures in clinical trials and biotech startups is creating significant growth opportunities.

Germany Laboratory Hoods and Enclosure Market Insight

The Germany laboratory hoods and enclosure market accounted for 26% of the European market in 2024, supported by a thriving life sciences sector and high manufacturing standards. The country’s focus on innovation, energy-efficient designs, and cleanroom compliance is promoting increased installation across pharmaceutical and research facilities.

Asia-Pacific Laboratory Hoods and Enclosure Market Insight

The Asia-Pacific laboratory hoods and enclosure market is projected to grow at the fastest CAGR of 9.4% from 2025 to 2032, driven by expanding pharmaceutical manufacturing and R&D investments in countries such as China, India, and Japan. Growing government support for research infrastructure, increased academic research funding, and the rise of contract research organizations (CROs) are enhancing market penetration.

Japan Laboratory Hoods and Enclosure Market Insight

The Japan laboratory hoods and enclosure market accounted for 21% of the Asia-Pacific market in 2024, driven by its innovation-driven research landscape, increasing university collaborations, and focus on environmental sustainability in lab operations. The market is further bolstered by demand for precision-engineered lab equipment and retrofitting of aging lab facilities with updated safety systems.

China Laboratory Hoods and Enclosure Market Insight

The China laboratory hoods and enclosure market held the largest share of 43% in the Asia-Pacific laboratory hoods and enclosure market in 2024, driven by rapid industrialization, robust domestic manufacturing, and government-backed initiatives to modernize research and academic infrastructure. The country’s growing investment in biomedical R&D and smart laboratory integration is expected to sustain long-term growth in the sector.

Laboratory Hoods and Enclosure Market Share

The laboratory hoods and enclosure industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- WALDNER Holding GmbH & Co. KG (Germany)

- Köttermann GmbH (Germany)

- Shimadzu Rika Corporation (Japan)

- Yamato Scientific co., ltd. (Japan)

- NuAire, Inc. (U.S.)

- Sentry Air Systems, Inc. (U.S.)

- Sheldon Laboratory Systems (U.S.)

- Bigneat Ltd. (U.K.)

- Royston LLC. (U.S.)

- Hamilton Lab Solutions (U.S.)

- AirClean Systems, Inc. (U.S.)

- Mott Manufacturing Ltd. & Mott Manufacturing LLC. (U.S.)

Latest Developments in Global Laboratory Hoods and Enclosure Market

- In May 2024, Thermo Fisher Scientific Inc. announced the launch of its next-generation energy-efficient biological safety cabinets under the Heracell series, designed to meet increasing demand from academic and pharmaceutical labs. These new cabinets offer advanced HEPA filtration, ergonomic controls, and digital monitoring systems, aligning with sustainability initiatives and safety compliance in laboratory environments

- In April 2024, WALDNER Holding GmbH & Co. KG introduced a modular laboratory fume hood system called ScienLab, engineered for flexible integration in both existing and new laboratory infrastructures. The launch focuses on providing enhanced airflow control, reduced energy consumption, and compatibility with evolving research needs, particularly in pharmaceutical and chemical labs

- In March 2024, AirClean Systems, Inc. unveiled its updated PCR Workstation Enclosures at the Pittcon Conference & Expo. These new models feature built-in UV sterilization, touchscreen interfaces, and HEPA filtration to ensure contamination-free environments in life sciences and molecular biology research. This marks a key step in supporting genomic workflows and sample integrity

- In February 2024, Yamato Scientific Co., Ltd. announced the development of a new series of laminar flow cabinets designed for low-noise operation and enhanced visibility in cleanroom applications. This innovation supports the increasing demand from electronics and medical device industries, where particulate control is critical

- In January 2024, Mott Manufacturing Ltd. partnered with a leading North American research institute to supply customized ventilated balance enclosures (VBEs) that ensure operator safety during high-precision weighing operations involving hazardous materials. The partnership reflects the growing demand for tailored containment solutions in high-risk research environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.