Global Laboratory Refrigerators And Ovens Market

Market Size in USD Billion

CAGR :

%

USD

1.69 Billion

USD

2.50 Billion

2024

2032

USD

1.69 Billion

USD

2.50 Billion

2024

2032

| 2025 –2032 | |

| USD 1.69 Billion | |

| USD 2.50 Billion | |

|

|

|

|

Laboratory Refrigerators and Ovens Market Size

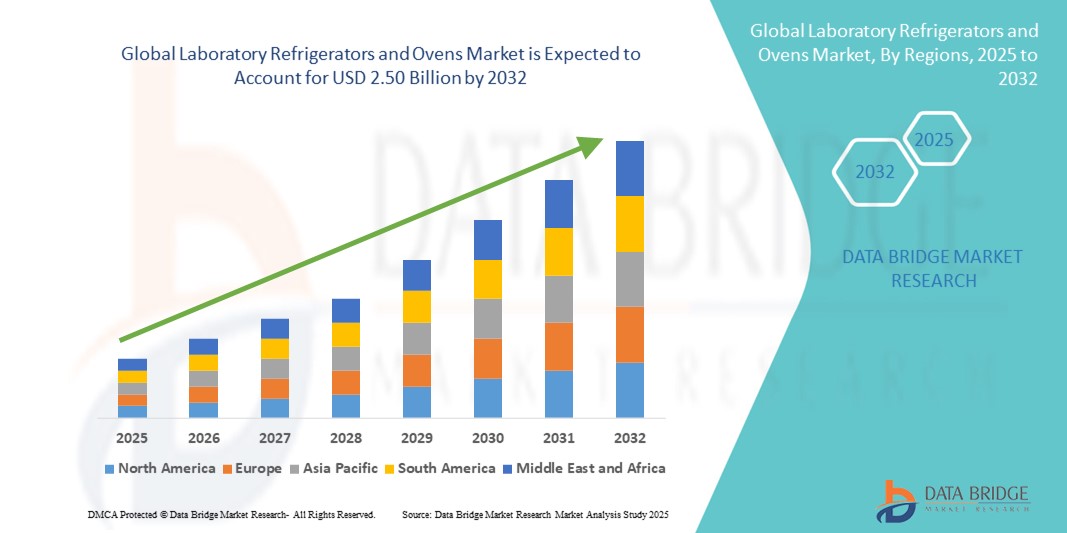

- The global laboratory refrigerators and ovens market size was valued at USD 1.69 billion in 2024 and is expected to reach USD 2.50 billion by 2032, at a CAGR of 5.00% during the forecast period

- This growth is driven by the increasing demand for precise temperature-controlled storage solutions in research and healthcare sectors, including pharmaceutical, biotechnology, and clinical laboratories

- Technological advancements, such as energy-efficient designs, smart connectivity, and enhanced safety features, are further propelling the adoption of laboratory refrigerators and ovens. The market is also influenced by stringent regulatory standards and the rising need for biobanking, personalized medicine, and vaccine storage

Laboratory Refrigerators and Ovens Market Analysis

- Laboratory refrigerators, freezers, and ovens, providing precise temperature-controlled storage and heating for samples, reagents, and materials, are increasingly essential in research, healthcare, and industrial laboratories due to their reliability, energy efficiency, and compliance with stringent safety standards

- The rising demand is primarily fueled by the growing adoption of advanced laboratory equipment in pharmaceutical, biotechnology, and clinical research sectors, along with the increasing need for biobanking, vaccine storage, and temperature-sensitive sample preservation

- North America dominated the laboratory refrigerators and ovens market with the largest revenue share of 39% in 2024, attributed to well-established healthcare infrastructure, high R&D investments, and the presence of major global equipment manufacturers

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to expanding research facilities, rising healthcare expenditure, and increasing adoption of modern laboratory technologies in emerging economies

- General Purpose Lab Refrigerator segment dominated the laboratory refrigerators market with a share of 45.6% in 2024, driven by its versatility, ease of use, and widespread adoption across hospitals, diagnostic centers, and research laboratories

Report Scope and Laboratory Refrigerators and Ovens Market Segmentation

|

Attributes |

Laboratory Refrigerators and Ovens Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Laboratory Refrigerators and Ovens Market Trends

Smart and Energy-Efficient Laboratory Equipment Adoption

- A key and accelerating trend in the global laboratory refrigerators and ovens market is the adoption of smart, energy-efficient equipment with advanced temperature monitoring, remote control, and connectivity features. These innovations allow laboratories to optimize energy usage while maintaining precise environmental conditions for sensitive samples

- For instance, modern laboratory refrigerators from Thermo Fisher and Haier integrate IoT-based monitoring systems, enabling real-time temperature tracking, automatic alerts for deviations, and remote adjustments via mobile applications. Similarly, laboratory ovens from Memmert and Binder feature programmable controls and cloud-based data logging, offering enhanced operational efficiency

- Smart integration enables predictive maintenance, helping prevent equipment failures and ensuring sample safety. For instance, some ultra-low freezers now include AI-driven diagnostics that can anticipate component malfunctions, minimizing downtime and sample loss

- The integration of laboratory equipment with digital platforms allows centralized monitoring of multiple devices across research facilities. Through a single interface, lab managers can track storage conditions, manage multiple ovens and freezers, and generate automated compliance reports, improving operational productivity and regulatory adherence

- This trend towards intelligent, connected, and energy-efficient laboratory equipment is reshaping expectations for laboratory operations. Manufacturers such as Haier Biomedical and Thermo Fisher are expanding smart features in refrigerators, freezers, and ovens to meet evolving laboratory demands

- The demand for laboratory equipment with smart monitoring, energy efficiency, and remote control capabilities is rising rapidly, particularly in pharmaceutical, clinical, and biotech research sectors, as labs seek to enhance reliability, safety, and operational efficiency

Laboratory Refrigerators and Ovens Market Dynamics

Driver

Increasing Demand Due to Growing Research Activities and Healthcare Expansion

- The expanding pharmaceutical, biotechnology, and clinical research sectors, coupled with the rising need for proper sample storage and processing, are major drivers for the heightened demand for laboratory refrigerators and ovens

- For instance, in 2024, Thermo Fisher and Binder introduced advanced ultra-low freezers and programmable ovens for vaccine storage and biopharma research, addressing critical laboratory needs

- As laboratories handle temperature-sensitive materials such as biological samples, vaccines, and reagents, reliable storage and heating equipment becomes indispensable, providing a compelling upgrade over older, less precise equipment

- Furthermore, the growth of healthcare infrastructure, increasing number of diagnostic centers, and the rise in personalized medicine are making advanced laboratory equipment essential for operational efficiency and regulatory compliance

- Features such as remote temperature monitoring, automated logging, and alarm systems are key factors driving the adoption of laboratory refrigerators and ovens, particularly in high-volume research and clinical environments

Restraint/Challenge

High Costs and Regulatory Compliance Requirements

- The relatively high initial cost of advanced laboratory refrigerators, ultra-low freezers, and programmable ovens poses a challenge for small-scale laboratories and institutions in developing regions

- Compliance with stringent regulatory standards for sample storage, safety, and energy efficiency adds to operational complexity and costs. Manufacturers must ensure equipment meets ISO, FDA, and other regional requirements, which can delay adoption

- For instance, ultra-low freezers must maintain precise temperatures consistently while adhering to safety and energy efficiency norms, creating technical challenges for manufacturers and users asuch as

- While energy-efficient and smart laboratory equipment can reduce operational costs in the long term, the upfront investment remains a barrier, particularly for budget-conscious research facilities

- Overcoming these challenges through cost-effective models, modular designs, and enhanced support for regulatory compliance will be vital for sustained growth in the laboratory refrigerators and ovens market

Laboratory Refrigerators and Ovens Market Scope

The market is segmented on the basis of laboratory refrigerators, laboratory freezers, laboratory ovens, and distribution channels.

- By Laboratory Refrigerators

On the basis of type, the laboratory refrigerators market is segmented into general purpose lab refrigerator, explosion proof refrigerator, portable refrigerator, sub-zero refrigerator, and walk-in refrigerator. General Purpose Lab Refrigerator segment dominated the market with the largest revenue share of 45.6% in 2024, owing to its versatility and widespread use across hospitals, research laboratories, and diagnostic centers. These refrigerators provide stable and precise temperature control suitable for a wide variety of samples, reagents, and chemicals. Their compatibility with standard laboratory protocols and ease of installation makes them highly preferred. In addition, they are cost-effective compared to specialized refrigerators, making them suitable for both large and small laboratories. The segment benefits from consistent demand in clinical, educational, and biopharmaceutical settings. Growing investments in healthcare and research infrastructure further reinforce the dominance of this segment.

The Sub-Zero Refrigerator segment is expected to witness the fastest growth during the forecast period, driven by the rising need for ultra-low temperature storage of vaccines, biological samples, and reagents. These refrigerators are essential for research-intensive applications in biotechnology, pharmaceuticals, and clinical laboratories. Advancements in energy-efficient compressors, IoT-based monitoring, and remote temperature alerts enhance their adoption. Increasing global focus on vaccine storage and cold chain management also fuels market growth. Emerging economies investing in laboratory infrastructure are such asly to accelerate the demand. The ability to maintain precise low temperatures for sensitive materials gives this segment a significant growth advantage.

- By Laboratory Freezers

On the basis of type, the laboratory freezers market is segmented into general purpose lab freezer, explosion proof freezer, and ultra low temperature freezer (ult freezer). The ULT Freezer segment dominated the market with a revenue share of 42.3% in 2024, driven by its critical role in cryogenic storage of vaccines, biological samples, and RNA/DNA materials. These freezers are indispensable in pharmaceutical R&D, clinical trials, and biobanking applications. Increasing regulatory standards and the need for reliable sample preservation solutions in hospitals and research institutes further support its adoption. Technological advancements in energy-efficient compressors and smart monitoring systems also enhance usability. The segment’s dominance is reinforced by high adoption rates in North America and Europe. In addition, the growing demand for biopharma research and personalized medicine sustains long-term market growth.

The explosion proof freezer segment is anticipated to witness the fastest growth during the forecast period, driven by rising awareness of laboratory safety regulations and the need for safe storage of volatile chemicals. These freezers minimize the risk of fire or chemical reactions in hazardous laboratory environments. Increasing investments in chemical and pharmaceutical R&D facilities globally are boosting adoption. Technological innovations in safety and monitoring features further contribute to growth. The segment is gaining traction in emerging economies where chemical and biotech labs are expanding rapidly. Explosion proof freezers ensure compliance with strict safety standards, making them a preferred choice for high-risk laboratories.

- By Laboratory Ovens

On the basis of type, the laboratory ovens market is segmented into general purpose lab ovens and vacuum ovens. The general purpose lab oven segment dominated the market with a share of 46.0% in 2024, due to their broad applicability in drying, sterilization, and sample preparation. They are widely used in research laboratories, universities, and industrial labs for routine processes. These ovens are cost-effective, reliable, and easy to operate, making them highly preferred in standard laboratory workflows. The segment benefits from strong demand in North America and Europe, supported by established research and healthcare infrastructure. Compatibility with multiple laboratory procedures further reinforces its dominance. Consistent technological improvements in energy efficiency and temperature uniformity also enhance their market presence.

The vacuum oven segment is expected to witness the fastest growth during the forecast period, driven by its increasing adoption in pharmaceutical, chemical, and biotechnology industries for processes requiring low-pressure heating. These ovens prevent degradation of heat-sensitive materials, ensuring precise experimental results. Rising R&D investments, expanding laboratories, and the need for advanced sample processing techniques accelerate demand. Advanced features such as programmable controls, smart monitoring, and data logging further enhance market growth. The segment’s rapid adoption is particularly notable in emerging economies investing in modern laboratory infrastructure. Increasing emphasis on precise and safe laboratory operations supports its continued growth globally.

- By Distribution Channel

On the basis of distribution, the market is segmented into hospital pharmacies, retail pharmacies, and online stores. The Hospital Pharmacies segment dominated the market with the largest revenue share of 41.2% in 2024, due to the high demand for laboratory refrigerators, freezers, and ovens to store temperature-sensitive drugs, vaccines, and biological samples in clinical and diagnostic environments. Hospitals require reliable and compliant equipment to ensure patient safety and regulatory adherence. The segment is supported by large-scale healthcare infrastructure and rising hospital investments in developed regions. Its dominance is reinforced by continuous demand in clinical trials, research, and pharmaceutical storage.

The Online Stores segment is expected to witness the fastest growth during the forecast period, driven by increasing e-commerce adoption and the convenience of direct procurement for laboratories. Online platforms provide access to advanced laboratory equipment, smart monitoring features, and competitive pricing. This channel is particularly appealing to small- and medium-scale laboratories in emerging markets. Growing digital penetration and preference for hassle-free ordering contribute to its rapid adoption. The ability to compare products and access global brands further accelerates growth.

Laboratory Refrigerators and Ovens Market Regional Analysis

- North America dominated the laboratory refrigerators and ovens market with the largest revenue share of 39% in 2024, attributed to well-established healthcare infrastructure, high R&D investments, and the presence of major global equipment manufacturers

- Laboratories in the region increasingly rely on precise temperature-controlled storage and heating solutions for biological samples, vaccines, reagents, and chemicals, making laboratory refrigerators, freezers, and ovens indispensable

- The dominance is further supported by significant R&D investments, high healthcare expenditure, and the presence of leading global manufacturers of laboratory equipment

U.S. Laboratory Refrigerators and Ovens Market Insight

The U.S. laboratory refrigerators and ovens market captured the largest revenue share of 82% in North America in 2024, driven by the country’s well-established healthcare and research infrastructure. Increasing demand for temperature-sensitive storage solutions for vaccines, reagents, and biological samples is fueling adoption. The prevalence of pharmaceutical R&D, clinical diagnostics, and biobanking facilities further supports market growth. In addition, technological advancements, such as IoT-enabled monitoring, energy-efficient refrigeration, and smart ovens, are enhancing operational efficiency and reliability. High awareness of laboratory safety and regulatory compliance also reinforces the preference for advanced laboratory equipment. The expanding trend of homegrown research labs and private diagnostic centers further propels market expansion in the U.S.

Europe Laboratory Refrigerators and Ovens Market Insight

The Europe laboratory refrigerators and ovens market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent regulatory standards and increasing investments in healthcare and research infrastructure. Rising urbanization and demand for technologically advanced laboratory equipment are fostering adoption. European laboratories increasingly require energy-efficient and precise temperature-controlled solutions for research and clinical applications. The market growth is supported by both new laboratory constructions and modernization of existing facilities. Sustainability initiatives and eco-conscious designs are also influencing purchasing decisions. Across residential, commercial, and institutional laboratories, reliable storage and heating solutions are becoming essential for daily operations.

U.K. Laboratory Refrigerators and Ovens Market Insight

The U.K. laboratory refrigerators and ovens market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country’s focus on life sciences research, clinical diagnostics, and pharmaceutical manufacturing. The demand for advanced laboratory equipment is fueled by the need for precise temperature control, sample preservation, and regulatory compliance. Modern research laboratories increasingly integrate smart monitoring and automated logging systems for efficiency and safety. In addition, rising investments in R&D and expansion of diagnostic centers support market adoption. The robust e-commerce and distribution infrastructure in the U.K. further facilitates access to high-quality laboratory equipment. Growing awareness of laboratory safety standards encourages the use of reliable refrigerators, freezers, and ovens across institutions.

Germany Laboratory Refrigerators and Ovens Market Insight

The Germany laboratory refrigerators and ovens market is expected to expand at a considerable CAGR during the forecast period, driven by high awareness of laboratory safety, precision research, and energy efficiency. Germany’s well-developed healthcare and research infrastructure, combined with a strong focus on innovation, supports adoption of advanced refrigerators, ultra-low freezers, and laboratory ovens. Eco-friendly designs and compliance with local regulatory standards further enhance market acceptance. Integration with smart monitoring systems allows for centralized control and real-time alerts in research facilities. Rising investments in pharmaceutical, biotechnology, and academic research sectors are fueling demand. Germany’s focus on sustainability and energy-efficient laboratory equipment continues to shape market growth.

Asia-Pacific Laboratory Refrigerators and Ovens Market Insight

The Asia-Pacific laboratory refrigerators and ovens market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by increasing urbanization, rising healthcare expenditure, and expanding R&D activities in countries such as China, Japan, and India. Governments are promoting digitalization and modern laboratory infrastructure, boosting the adoption of advanced refrigerators, freezers, and ovens. The region’s growing life sciences, pharmaceutical, and biotechnology sectors create strong demand for precise temperature-controlled storage and heating solutions. In addition, the emergence of APAC as a manufacturing hub for laboratory equipment enhances affordability and accessibility. Rising adoption of smart monitoring, energy-efficient designs, and IoT-enabled features further accelerates market growth.

Japan Laboratory Refrigerators and Ovens Market Insight

The Japan laboratory refrigerators and ovens market is gaining momentum due to the country’s high-tech culture, focus on research and development, and increasing need for efficient laboratory operations. Japanese laboratories prioritize precise temperature control, automation, and integration with smart monitoring systems for sample safety. Growing investments in pharmaceutical, clinical, and academic research sectors drive demand for ultra-low freezers, laboratory ovens, and general-purpose refrigerators. In addition, an aging population increases the need for efficient laboratory diagnostics. The adoption of advanced laboratory equipment, energy-efficient designs, and compliance with stringent safety standards contribute to steady market growth in Japan.

India Laboratory Refrigerators and Ovens Market Insight

The India laboratory refrigerators and ovens market accounted for the largest market revenue share in Asia-Pacific in 2024, fueled by rapid urbanization, expanding healthcare infrastructure, and increasing R&D activities. India is witnessing growing adoption of laboratory refrigerators, freezers, and ovens across hospitals, diagnostic centers, and research laboratories. Government initiatives for smart cities and laboratory modernization further drive the demand. Affordable equipment options, supported by domestic manufacturers and increasing digital penetration, are enhancing accessibility. The rise in pharmaceutical manufacturing, clinical trials, and educational research facilities contributes to strong market growth. Increasing awareness regarding laboratory safety and sample preservation standards further strengthens adoption across the country.

Laboratory Refrigerators and Ovens Market Share

The laboratory refrigerators and ovens industry is primarily led by well-established companies, including:

- Avantor, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Memmert GmbH + Co. KG (Germany)

- So-Low Environmental Equipment Co. (U.S.)

- Liebherr-Hausgeräte GmbH (Germany)

- Darwin Chambers Company, LLC (U.S.)

- Hettich AG (Switzerland)

- Haier Biomedical (China)

- Cole-Parmer Instrument Company (U.S.)

- Eppendorf SE (Germany)

- Helmer Scientific (U.S.)

- Chart Industries, Inc. (U.S.)

- Labcold Ltd. (U.K.)

- NuAire, Inc. (U.S.)

- Marvel Refrigeration (U.S.)

- Philipp Kirsch GmbH (Germany)

- Sheldon Manufacturing, Inc. (U.S.)

- Worthington Industries (U.S.)

- Carbolite Gero Limited (U.K.)

- Azbil Telstar S.L. (Spain)

What are the Recent Developments in Global Laboratory Refrigerators and Ovens Market?

- In August 2023, Thermo Fisher Scientific, a global leader in serving science, launched its new TSV Series of laboratory refrigerators and freezers specifically manufactured in India. This launch focused on providing advanced cold storage solutions to support the country's growing life science, pharmaceutical, and healthcare sectors. The new series aims to offer enhanced energy efficiency and reliable performance for sensitive sample storage

- In November 2022, Avantor, which acquired VWR, announced the launch of new drying ovens as part of its VWR VENTI-Line Prime series. These forced convection ovens are designed for a variety of laboratory tasks including drying, tempering, and sterilizing. The new models feature an adjustable ventilation system, a wide temperature range, and an APT.line pre-heating chamber technology for homogeneous temperature distribution, catering to the need for precision and reliability in modern laboratories

- In June 2021, B Medical Systems, a global leader in the vaccine cold chain industry, announced a partnership with Dr. Reddy's Laboratories to provide cold chain solutions for the pan-India rollout of Sputnik V vaccines. This collaboration involved installing specialized medical-grade vaccine freezers capable of maintaining the required temperature of -18°C or below, a critical step for a successful vaccine campaign

- In March 2021, Helmer Scientific announced the launch of its new line of GX Solutions Laboratory and Plasma Freezers. Powered by OptiCool technology, these freezers are optimized for temperature performance, noise reduction, and energy efficiency. They are designed for the storage of vaccines, medications, blood therapies, and samples, and utilize low Global Warming Potential (GWP) natural refrigerants

- In March 2021, BioLife Solutions, Inc., a company specializing in bioproduction tools and services for cell and gene therapies, signed a definitive merger agreement to acquire Stirling Ultracold. This acquisition expands BioLife Solutions' product portfolio by adding Stirling's ultra-low temperature (ULT) freezers, which utilize a proprietary Stirling engine and have been at the forefront of COVID-19 vaccination efforts. The deal creates a complete cold chain infrastructure for personalized medicine

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.