Global Lactase Enzyme Market

Market Size in USD Million

CAGR :

%

USD

318.83 Million

USD

590.14 Million

2025

2033

USD

318.83 Million

USD

590.14 Million

2025

2033

| 2026 –2033 | |

| USD 318.83 Million | |

| USD 590.14 Million | |

|

|

|

|

Lactase Enzyme Market Size

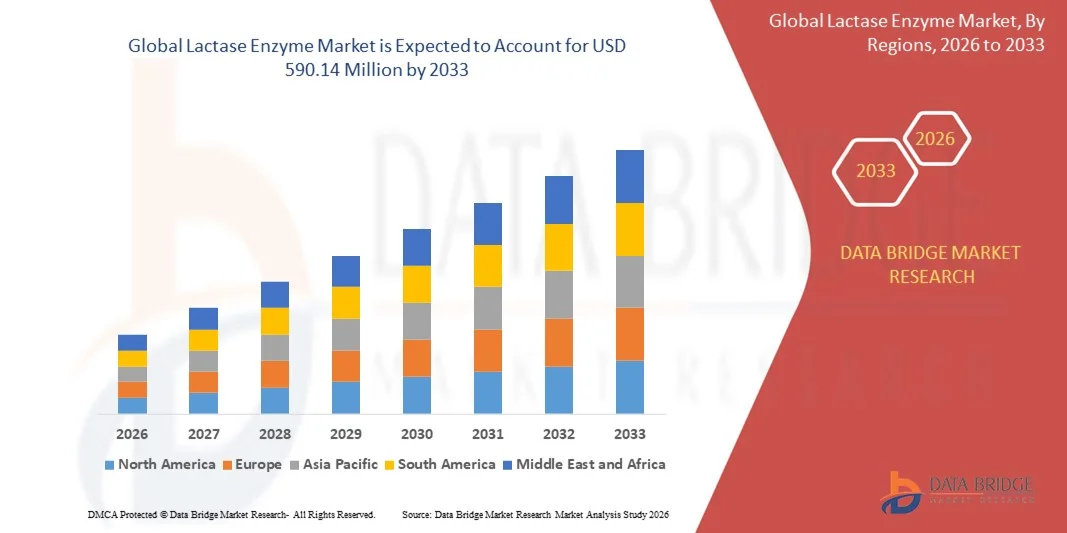

- The global lactase enzyme market size was valued at USD 318.83 million in 2025 and is expected to reach USD 590.14 million by 2033, at a CAGR of 8.0% during the forecast period

- The market growth is largely fueled by the rising prevalence of lactose intolerance and increasing consumer demand for lactose-free and functional dairy products, driving manufacturers to incorporate lactase enzymes into their production processes

- Furthermore, growing awareness of digestive health and nutritional benefits is encouraging the adoption of enzyme-treated products in dairy, dietary supplements, and functional beverages, thereby significantly boosting the demand for lactase enzymes

Lactase Enzyme Market Analysis

- Lactase enzymes, which break down lactose into digestible sugars, are becoming essential components in the production of lactose-free dairy products, functional beverages, and dietary supplements due to their role in improving digestibility, taste, and nutritional value

- The escalating demand for lactase enzymes is primarily fueled by increasing health-consciousness among consumers, rising consumption of dairy and fortified foods, and a growing preference for lactose-free alternatives in both developed and emerging markets

- North America dominated the lactase enzyme market with a share of 34.17% in 2025, due to growing consumer awareness of lactose intolerance, increasing demand for lactose-free dairy products, and the prevalence of advanced dairy processing technologies

- Asia-Pacific is expected to be the fastest growing region in the lactase enzyme market during the forecast period due to rising lactose intolerance awareness, urbanization, and increasing disposable incomes in countries such as China, Japan, and India

- Liquid segment dominated the market with a market share of 62.5% in 2025, due to its high solubility, rapid activity, and ease of incorporation into dairy processing lines, ensuring uniform lactose hydrolysis. Dairy manufacturers favor liquid lactase for large-scale production of milk, yogurt, and other beverages, as it minimizes processing time while maintaining product quality. The liquid form is also easier to dose accurately, reducing the risk of enzyme degradation during handling and storage. Its compatibility with automated dosing systems and continuous processing setups strengthens its dominance across commercial operations. Continuous innovations to improve stability and shelf life further support its leading position

Report Scope and Lactase Enzyme Market Segmentation

|

Attributes |

Lactase Enzyme Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lactase Enzyme Market Trends

Rising Adoption of Lactose-Free and Functional Dairy Products

- The increasing global prevalence of lactose intolerance and growing consumer preference for digestive-friendly products is driving the demand for lactase enzymes in dairy and functional food applications, as manufacturers aim to produce lactose-free milk, yogurt, and other products that cater to health-conscious consumers

- For instance, Danisco (a division of DuPont) has introduced advanced lactase enzyme solutions for large-scale dairy processing, enabling manufacturers to deliver high-quality lactose-free products with improved taste and digestibility, supporting wider adoption in retail and commercial applications

- The trend towards functional and fortified dairy products is encouraging the use of lactase enzymes to enhance nutritional value and improve consumer satisfaction, as products fortified with probiotics and enzymes gain traction in health-focused markets

- In addition, the growing innovation in enzyme formulations that offer higher stability, better thermal resistance, and suitability across various dairy matrices is promoting the integration of lactase enzymes in new product development

- The expansion of lactose-free options in dietary supplements, functional beverages, and infant nutrition further reinforces this trend, driving market growth by meeting specific consumer health requirements

- The rising consumer focus on digestive health and convenience in dairy consumption, coupled with technological advances in enzyme applications, is expected to sustain the adoption of lactase enzymes across global markets, establishing a strong foundation for market expansion

Lactase Enzyme Market Dynamics

Driver

Increasing Consumer Awareness of Digestive Health and Lactose Intolerance

- The rising awareness among consumers regarding lactose intolerance and digestive health issues is significantly propelling the demand for lactase enzymes, as more individuals seek lactose-free dairy and enzyme-treated food products to improve digestion and comfort

- For instance, Chr. Hansen Holding A/S has been actively promoting lactase enzyme applications in dairy products to help consumers with lactose intolerance enjoy milk, yogurt, and cheese without digestive discomfort, driving adoption across key markets

- Healthcare professionals and nutritionists recommending lactose-free and enzyme-fortified foods are encouraging consumers to choose products with lactase enzymes, which further boosts market penetration and acceptance

- The increasing emphasis on preventive healthcare and digestive wellness is leading food manufacturers to innovate and reformulate products with lactase enzymes, enhancing product offerings and capturing a broader audience

- Growing interest in functional foods that improve gut health and support nutritional well-being, such as lactose-free dairy and fortified beverages, is contributing to sustained demand for lactase enzymes across residential and commercial segments

Restraint/Challenge

High Cost and Stability Issues of Industrial Lactase Enzymes

- The relatively high production cost of industrial lactase enzymes compared to conventional processing methods is limiting adoption among small and medium-scale dairy manufacturers, creating a significant barrier to market expansion

- For instance, Novozymes’ premium lactase formulations, although highly effective, are priced higher than standard enzyme products, which can deter cost-sensitive customers from integrating these solutions

- Stability and activity loss during storage and processing conditions, such as high temperatures or varying pH levels, can reduce the efficiency of lactase enzymes, impacting product quality and limiting widespread utilization

- Ensuring consistent enzyme performance in diverse dairy matrices requires additional formulation and handling considerations, which may increase operational complexity for manufacturers

- Addressing these cost and stability challenges through innovation, improved formulation techniques, and scalable production methods is critical to enhancing market penetration and supporting sustained growth across different regions

Lactase Enzyme Market Scope

The market is segmented on the basis of type, form, and application.

- By Type

On the basis of type, the Lactase Enzyme market is segmented into neutral enzymes and fungal enzymes. The neutral enzymes segment dominated the market with the largest market revenue share in 2025, driven by its high efficacy in breaking down lactose across a wide pH range, making it suitable for diverse dairy processing applications. Food manufacturers often prefer neutral enzymes for their consistent performance in liquid milk, yogurt, and cheese production, which ensures better product quality and extended shelf life. The segment also benefits from ongoing research and development aimed at improving enzyme stability under varying temperature conditions, enhancing its adoption across commercial dairy operations. Neutral enzymes are widely compatible with existing industrial processing setups, reducing the need for additional modifications and operational costs. Their well-established track record and reliability in large-scale applications further strengthen their dominant position in the market.

The fungal enzymes segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for lactose-free products and the rising adoption in pharmaceutical and dietary supplement formulations. Fungal lactase enzymes are favored for their high thermal stability and suitability for acidic conditions, making them ideal for yogurt, fermented products, and enzyme supplements. For instance, DSM Food Specialties has introduced fungal lactase variants that enhance lactose hydrolysis efficiency in both liquid and dry dairy formulations. The ease of integration with novel food and beverage products and the growing consumer awareness regarding lactose intolerance are expected to drive significant market growth for fungal enzymes. Continuous innovations and the expanding range of functional applications provide additional opportunities for adoption in diverse industries.

- By Form

On the basis of form, the Lactase Enzyme market is segmented into liquid and dry forms. The liquid segment dominated the market with the largest share of 62.5% in 2025, owing to its high solubility, rapid activity, and ease of incorporation into dairy processing lines, ensuring uniform lactose hydrolysis. Dairy manufacturers favor liquid lactase for large-scale production of milk, yogurt, and other beverages, as it minimizes processing time while maintaining product quality. The liquid form is also easier to dose accurately, reducing the risk of enzyme degradation during handling and storage. Its compatibility with automated dosing systems and continuous processing setups strengthens its dominance across commercial operations. Continuous innovations to improve stability and shelf life further support its leading position.

The dry segment is expected to witness the fastest CAGR from 2026 to 2033, driven by its convenience for storage, long shelf life, and suitability for powdered or solid formulations in both food and pharmaceutical applications. Dry lactase is particularly preferred for dietary supplements and infant formula production due to its controlled release properties and stability under varying temperature conditions. For instance, Novozymes has developed dry lactase powders that provide high enzymatic activity with minimal degradation, improving process efficiency. The expanding demand for portable and powdered lactose-free products enhances the growth potential for the dry enzyme form. Its versatility across multiple applications and ease of transport contribute to its rapid market adoption.

- By Application

On the basis of application, the Lactase Enzyme market is segmented into food and beverage, dietary supplements, and pharmaceuticals. The food and beverage segment dominated the market in 2025, driven by the growing consumer demand for lactose-free dairy products and functional beverages. Manufacturers leverage lactase enzymes to improve digestibility, enhance flavor, and extend shelf life in products such as milk, yogurt, and ice cream, which boosts consumer acceptance and market penetration. The segment benefits from continuous innovation in lactose-free formulations and the increasing focus on nutritional labeling and health-conscious products. Lactase enzymes in this application also contribute to operational efficiency in large-scale production, further cementing their dominance.

The dietary supplements segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising awareness of lactose intolerance and digestive health concerns. Consumers are increasingly adopting enzyme-based supplements to manage lactose digestion, driving demand for high-purity and clinically validated lactase formulations. For instance, Enzymedica offers lactase tablets specifically designed for effective lactose breakdown, catering to both adults and children. The expansion of e-commerce platforms and direct-to-consumer supplement distribution channels supports rapid market penetration. In addition, regulatory approvals and growing health-conscious trends in key markets provide strong growth opportunities for this application segment.

Lactase Enzyme Market Regional Analysis

- North America dominated the lactase enzyme market with the largest revenue share of 34.17% in 2025, driven by growing consumer awareness of lactose intolerance, increasing demand for lactose-free dairy products, and the prevalence of advanced dairy processing technologies

- Consumers in the region highly value the convenience, improved digestibility, and nutritional benefits offered by lactase-treated products in milk, yogurt, and functional beverages

- This widespread adoption is further supported by high disposable incomes, a health-conscious population, and the expanding presence of lactose-free and functional dairy brands, establishing lactase enzymes as a favored solution across both food manufacturing and dietary supplement sectors

U.S. Lactase Enzyme Market Insight

The U.S. lactase enzyme market captured the largest revenue share in 2025 within North America, fueled by rising lactose intolerance awareness and the increasing preference for dairy and functional foods with enhanced digestibility. Consumers are prioritizing lactose-free products and enzyme-based dietary supplements to improve digestive health. The growing trend of fortified and functional dairy products, combined with strong retail and e-commerce penetration, further drives market growth. In addition, the adoption of advanced dairy processing technologies that incorporate lactase enzymes ensures consistent product quality and shelf life, supporting continued expansion.

Europe Lactase Enzyme Market Insight

The Europe lactase enzyme market is projected to expand at a substantial CAGR during the forecast period, primarily driven by high prevalence of lactose intolerance, regulatory support for functional foods, and increasing demand for dairy alternatives. Urbanization, rising health awareness, and consumer preference for digestive-friendly products are fostering enzyme adoption. European consumers are also attracted to the nutritional benefits and enhanced digestibility offered by lactase-treated products. The region is witnessing significant growth across dairy, dietary supplements, and functional beverage applications, with both new product development and reformulations driving enzyme utilization.

U.K. Lactase Enzyme Market Insight

The U.K. lactase enzyme market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising popularity of lactose-free and functional dairy products and growing consumer health consciousness. Concerns regarding digestive health and lactose intolerance are encouraging both manufacturers and retailers to incorporate lactase enzymes into dairy and supplement formulations. The U.K.’s well-developed retail and e-commerce infrastructure, along with a trend toward personalized nutrition and wellness products, is expected to continue to stimulate market growth.

Germany Lactase Enzyme Market Insight

The Germany lactase enzyme market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of lactose intolerance and high adoption of functional and fortified dairy products. Germany’s focus on health, nutrition, and technological innovation in food processing promotes lactase enzyme usage, particularly in dairy and dietary supplements. The integration of enzymes into functional food formulations and beverages is becoming increasingly prevalent, with strong demand from both residential and commercial sectors.

Asia-Pacific Lactase Enzyme Market Insight

The Asia-Pacific lactase enzyme market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising lactose intolerance awareness, urbanization, and increasing disposable incomes in countries such as China, Japan, and India. The growing demand for dairy products, functional beverages, and enzyme-based dietary supplements is fueling enzyme adoption. Furthermore, government initiatives promoting nutrition and health, alongside expanding manufacturing capabilities for enzyme production, are improving accessibility and affordability, contributing to rapid market growth across the region.

Japan Lactase Enzyme Market Insight

The Japan lactase enzyme market is gaining momentum due to high consumer awareness of digestive health, rapid urbanization, and increasing demand for functional foods and dairy alternatives. Japanese consumers place strong emphasis on nutritional quality and convenience, encouraging the adoption of lactase-treated products. The integration of lactase enzymes in functional beverages, yogurt, and supplements is driving growth, with product innovations tailored for an aging population further supporting demand.

China Lactase Enzyme Market Insight

The China lactase enzyme market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rising lactose intolerance awareness, an expanding middle class, and strong demand for dairy and functional foods. China is one of the largest markets for enzyme-treated dairy products, and lactase enzymes are increasingly used in milk, yogurt, and dietary supplements. The push for functional nutrition, rapid urbanization, and the availability of cost-effective enzyme solutions from domestic manufacturers are key factors propelling the market in China.

Lactase Enzyme Market Share

The lactase enzyme industry is primarily led by well-established companies, including:

- Chr. Hansen Holding A/S (Denmark)

- Kerry Inc. (U.S.)

- Novozymes (Denmark)

- Merck KGaA (Germany)

- DSM (Netherlands)

- Amano Enzyme Inc (Japan)

- Season (China)

- Advanced Enzymes Technologies (India)

- ENMEX (U.S.)

- Antozyme Biotech Pvt Ltd (India)

- Nature Bioscience Pvt. Ltd (India)

- Aumgene Biosciences (India)

- Creative Enzymes (U.S.)

- Biolaxi Corporation (India)

- Novact Corporation (U.S.)

- Enzymes Bioscience Private Limited (India)

- Mitushi Biopharma (India)

- Infinita Biotech Private Limited (India)

Latest Developments in Global Lactase Enzyme Market

- In August 2025, Chr. Hansen announced the launch of a next-generation lactase enzyme formulation optimized for both liquid and powdered dairy products. This innovation is expected to significantly enhance production efficiency for dairy manufacturers by providing enzymes with higher stability, improved activity, and greater versatility across various applications. The development is projected to lower production costs, expand the availability of lactose-free products, and strengthen the adoption of enzyme-based solutions in both emerging and mature markets, enabling producers to cater to the growing consumer demand for digestive-friendly dairy options

- In January 2025, the European Commission approved the use of lactase enzymes in the production of infant formula, allowing manufacturers to offer lactose-free options to a wider audience. This regulatory approval is anticipated to drive substantial growth in the infant nutrition segment, as companies can now formulate products that cater to lactose-intolerant infants and young children. The endorsement also encourages innovation in enzyme applications, supporting the expansion of lactose-free product portfolios and increasing market penetration in Europe and globally

- In October 2024, Novozymes secured a significant investment of €200 million to expand its production capacity for industrial lactase enzymes. This strategic investment is expected to reinforce the company’s leadership in the market, ensuring it can meet the escalating global demand for lactose-free products. By increasing manufacturing capabilities, Novozymes is positioned to supply large-scale dairy producers efficiently, promote the adoption of enzyme-based solutions, and strengthen its competitive advantage in the growing lactose-free dairy sector

- In May 2024, Danisco, a division of DuPont, entered into a strategic partnership with Fonterra, the world’s largest dairy cooperative, to co-develop and commercialize lactose-free dairy ingredients. This collaboration is anticipated to accelerate market growth by combining advanced research and development expertise with extensive distribution networks. The partnership enables both companies to address increasing consumer demand for high-quality lactose-free products, expand their market reach globally, and foster innovation in functional dairy formulations

- In February 2023, DuPont Nutrition & Biosciences introduced LactoGuard Ultra, a new lactase enzyme designed to deliver enhanced performance across multiple dairy applications. The product is expected to help manufacturers produce lactose-free milk, yogurt, and other dairy products with improved taste, texture, and digestibility. This launch supports the broader adoption of enzyme-treated dairy products, enhances consumer satisfaction, and strengthens DuPont’s position in the global lactase enzyme market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Lactase Enzyme Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Lactase Enzyme Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Lactase Enzyme Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.